Harry S. Dent Jr.'s Blog, page 177

October 27, 2014

China and India Changing the Global Marketplace

China is looking at investing in infrastructure in India. That’s the best idea I’ve heard in a long time.

China has overinvested — like 12 to 15 years of future urban migration out — with 27% of home vacancies in cities. India has underinvested in everything. The roads are terrible, electricity is nearly non-existent in rural areas and it’s shoddy at best in urban sectors. Water and sewer services are not up to snuff and there are slums everywhere.

This means the Indian population on the whole has to work much harder than emerging world competitors like China or Malaysia. I’ve always said that if the Indian government just made much larger investments in infrastructure… it would attract strong foreign investment and its development would accelerate at a faster pace just like China did.

India Becomes A Major PlayerIndia looks like the next big thing to me and will likely be the first foreign country we advise to invest in after the next crash ahead, likely by late 2016 to early 2017. Much of the rest of the emerging world is too linked to commodity exports and won’t see a sustainable turnaround until that 30-year commodity cycle bottoms between 2020 and 2023.

India has a population of 1.271 billion, close to China’s at 1.395 billion. That’s 17.4% of the world’s population, but it’s growing at a much faster pace than China…

By 2050, India will be larger than China in population and China is already on the road to a shrinking workforce followed soon by declining population.

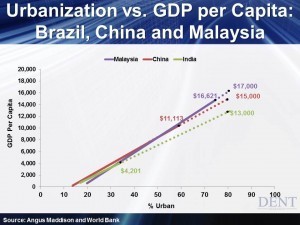

The biggest driving factor in emerging countries is the rate and slope of urbanization vs. GDP per capita. India has a slope nearly as high as China and Malaysia, the two strongest in the emerging world.

India is only 33% urban and will not mature to 80% for at least another 50 years. China is at 56% and will likely slow dramatically over the next decade after so much overbuilding and the highest rate of urban migration in history in the past 15 years. The following chart summarizes the urbanization trends and projections for three major emerging countries at different stages.

India’s workforce growth, the key demographic indicator for emerging countries, will grow rapidly into 2050 followed by a plateau moving into 2060 and then it’ll only slowly decline. Urbanization will continue to grow until at least 2070. Combining urbanization and demographic trends, I see India continuing to grow into the mid- to late 2060s before it slows down.

China’s workforce growth already peaked back in 2012. Malaysia will peak around 2040 demographically with their urbanization peaking well before that.

But here’s perhaps the most interesting trend. The major BRICS (Brazil, Russia, India, China and South Africa) are talking about an international bank to help finance their growth and political issues like the IMF for the world. China is talking about investing in India. Why not Southeast Asia that has much potential for urbanization and modernization as well?

Combine China, India and Southeast Asia and it’s close to 50% of the world’s population in one giant and connected emerging region… That is formidable.

The Asian Union (AU) is likely the next big thing as well, but India more so, especially now that it has the first progressive and capitalistic leader in its history with newly elected Narendra Modi… and he’s already meeting with the U.S. and China.

While the European Union faces more pressure, demographic slowing, high debt, banking and trade imbalances; I could see an AU emerging increasingly over the coming years. And it just makes sense for China to invest in India and Southeast Asia, now that it has overinvested in its own country.

It makes sense for the wealthiest western nations to invest in Asian emerging countries that are experiencing the highest growth. Japan and the East Asian “tigers” should do so as well seeing as they’re faced with stagnating growth and deteriorating infrastructures and yet… they have much higher wealth to invest.

I’ve stressed for many years that investors from developed countries will get higher returns by investing in the emerging world after this winter season and great reset.

We’ll keep monitoring India as the first emerging country and we’ll likely recommend it for longer term investments after the next big crash well before the winter season finally ends between 2020 and 2022. I cover this topic in more depth in this November’s issue of Boom & Bust.

Harry

Ahead of the Curve with Adam O’DellWe’re most certainly still in a choppy, cyclical market environment…

A Smart Well-Hedged Portfolio

We’re most certainly still in a choppy, cyclical market environment – experiencing the wild swings I told Boom & Bust subscribers to brace for in their issue of 5 Day Forecast. This market-oriented alert goes out every Monday morning and prepares investors for the week ahead. It’s complimentary with your subscription to Boom & Bust.

The good news is our Boom & Bust portfolio is holding up just fine. I dive into the specifics of how our portfolio has weathered the last month in our November issue of Boom & Bust – make sure to sign up here to begin receiving our must-read research.

Simply put: the Boom & Bust portfolio is well-hedged!

Not only do we have bearish plays that made good gains during the sell-off… we also have unique long-stock plays that are doing well by taking advantage of trends outside the equities market – particularly, falling interest rates and weak commodity prices.

And since our portfolio’s well-balanced nature is proving effective, we don’t need to make knee-jerk reactions – or major adjustments to our positions – amidst this volatility.

Let’s take a look at these themes as we go around the global markets in 10 seconds…

Global stock markets rose sharply and in unison last week. Short-term, the prior three weeks of selling became overdone, setting up the perfect conditions for a dead cat bounce. Whether the rally will have legs through year-end, and to new highs, is still unknown. Equity markets are still in recovery mode, so be cautious. Still, it’s good to see that U.S. stocks (SPY), which rose 4.2% last week, are outperforming Chinese (FXI) and emerging-market (EEM) stocks, which gained only 1% and 0.75%, respectively. That means the most recent trade recommendation added to the Boom & Bust portfolio – a trade we’re calling “All About the U.S.” – gained value last week.Bond prices pulled back just a little after a good five-week run higher. The one exception was junk bonds (JNK), which gained 1.1% last week alongside the return of the equity bulls.Commodity markets were lower across the board. Natural gas (UNG) suffered the sharpest drop, losing 4.3%. After making a low on January 10, UNG shot 44% higher into February 28. But now, that entire gain has been erased as natural gas is trading at its lowest price all year.Looking Ahead…

I can’t share with you the specific contents of the Boom & Bust portfolio, but here’s what I’m telling subscribers:

“We’ll do best by sitting on our hands through this choppy, volatile environment. We’re in “no man’s land” right now, with no clear trend, but a lot of sharp moves back and forth. Investors notoriously get “chopped up” in these environments when they try to time each twist and turn.

I’d rather keep a close eye on our portfolio’s net performance, to ensure our hedges are doing what they’re supposed to, and waiting for a clear trend to show itself before making drastic changes.”

Adam

October 24, 2014

Drowning in the Stock Market

Before I question the wisdom of the “Oracle of Omaha,” let me start with a few important caveats.

Warren Buffett is the second-richest person in the U.S. which has way more billionaires than any other country.He is the classic modern-day manifestation of the original Graham-Dodd value investment approach that first emerged in the mid-1920s and is still a relevant and successful model today — as Buffett has so demonstrated… and last but not least…He’s just a damn likeable, down-to-earth, non-pretentious guy that eats burgers and barbecue but still seems healthy at his age.Today he is America’s everyman’s economist — something he never really intended to do. I blame this on Becky Quick at CNBC. She got him on the show talking and people loved him so much that now you hear him everywhere….

Buffett used to start any discussion on stocks with something like: “I have no idea whether the stock market is going to be up or down at any point in the future… I don’t take the economy and the markets into account. I just buy really good companies that have long-term potential when they are at good valuations.”

Reality CheckI think he’s making a strategic mistake by commenting more on the economy rather than stock selection — and worse — becoming a cheerleader for the U.S. economy. He’s basically been telling people that the government is largely doing the right thing and things will be alright as America is still a great country.

Well, you know my view: The government is doing the worst thing possible and is killing the golden goose of free-market capitalism… or “corrupting” it as David Stockman, our keynote speaker for our recent IES conference calls it.

But my main difference with Buffett is more critical: Things are NOT going to be alright.

Such an over-extension of the already greatest bubble in modern history can only lead to either a greater financial crisis and depression, or worse, a multi-decade “coma economy” like we witnessed in Japan.

I’m not going to go into all the reasons why this is the case at this moment, as you’re familiar with my take on this subject. I’m simply going to bring some reality into the midst of the largest bubble in history.

These major bubbles and great resets or depressions to follow only come once in a lifetime so most of us never saw a major bubble or depression before. Even Buffett at age 84 was only a child in the Great Depression.

I often comment in my speeches that if you had bought blue chip stocks like the Dow in 1929 and retired, you would have been dead before you broke even. The Dow peaked in 1929, suffered an 89% loss at worse, and didn’t reach those levels again until 1953… 24 years later.

We all know that almost no one would hold stocks through that big a rout, so they would have never broke even no matter how long they lived.

Warren was saying on CNBC earlier this month that he doesn’t see how you could go wrong if you buy a really solid company with products that everyday people use. That would be a true statement most of the time — but NOT today!

AT&T was a really solid company with affordable products everyone uses and a dominant market position during and after the last great bubble. This stock peaked in 1929 at $51 and fell 81% into 1932… it didn’t even regain its high until 31 years later.

General Motors peaked in late 1928 at $395 and fell to $4 in 1932, down 91%. It was still down 67% in 1938 and didn’t hit new highs until 1950. GM was vying with Ford for leadership in the hottest new consumer industry of the day, and it ultimately became the greatest company in the world by the mid-1960s.

But you would have been underwater for 22 years.

Sears & Roebuck was the greatest retailer of its time, and even more so into the 1960s. It topped in late 1927 at $48 and fell as low as $2.50. That’s a whopping 95% drop! It briefly hit a new high in 1946, but then fell back and didn’t hit a sustainable new high until 1950.

This is not the time to listen to Warren.

By the way, he’s also investing in a retail car dealership company just when baby boom spending on autos is due to peak at age 53 this year. The echo boom won’t return us to similar sales levels until around 2043 to 2045.

This isn’t the time to buy stocks or to make any investment during the greatest bubble in modern history.

If there are great long-term companies you like, wait a few years. Our long-term cycles are the worst they’ve been since the early 1930s. Once they’re down by 50% to 60% or more, take a second look.

Harry

October 23, 2014

The Global Economy and GDP

Nations are doing their best to export as much as possible, which allows them to grow their GDP well beyond what would be supported by domestic demand…particularly, China and Germany.

And Treasury Secretary Jack Lew is mad at them. He told Congress in his semi-annual report on international exchange rates that they aren’t playing fair.

Cry me a river.

He should’ve labeled his speech “The Case of the Sour Grapes,” because if the roles were reversed he’d be crowing about U.S. exports and how other nations need to open their borders for more trade with us. Here’s a (non-) news flash — global demand is slow. It’s been that way for six years. It will continue this way for another 5 to 8 years. There’s not much that Lew or anyone else can do about it, which is obvious from the utter failure of most policies enacted since the downturn.

So countries are doing everything to protect themselves, even at the expense of… well, everyone else. Instead of pointing fingers, he should be asking a very important question: “What are nations with slow domestic demand supposed to do?”

Less Than ZeroThis is a conundrum that faces just about every nation on the planet. The typical answers from economic textbooks and pundits have already been tried. Lower interest rates so that debt is cheaper. How much below zero can you go?

Remind consumers that with no interest on savings, they are better off spending the money. No one has to tell us that we aren’t making any returns on safe savings, but the money is not meant for spending, it’s earmarked for the future (think retirement and education). The crux of the problem is that as populations age, they face the same issue — older consumers have a greater need for saving and paying down debt, which are not activities that stimulate growth.

So if you cannot get your own people to buy your stuff, should you force austerity on the nation, which is the painful process of deleveraging and cutting wages and benefits, or try to get other countries to buy your stuff? Is that really a choice? The first option is political suicide.

In their quest for growth, countries pursue greater export strategies, which almost always begin and end with one thing — a cheaper currency. If a nation can push down the value of its money, then it can either lower the prices of its goods and services to foreign buyers, or it can leave prices the same and receive more of its own currency for each transaction.

A third option is to do a little of both. No matter how it plays out, all of this leads to increased GDP for the exporting country, which was the point in the first place. Sure, the domestic citizens can’t afford as many imports as before because they cost more, but hey, if domestic buyers turn more to domestic goods at the same time that exports rise, well, that’s an even better outcome.

Not Everyone Is a WinnerThe problem in this scenario is that every country can’t pursue the strategy, because in the end there would be no benefit. If global demand is slowing and countries are pursuing greater exports, then some countries will “win” and some will “lose.”

In a world where the U.S. dollar is dominant, countries like Japan keep trying to devalue their own currency against the U.S. dollar. If Japan is successful, then their exporters will earn more yen per dollar of sales in the U.S. (or per euro of sales in the euro zone), which will lead to Japanese GDP growth. It is true that the Japanese people will pay more for imported items such as energy, which leaves them with rising inflation and a lower standard of living, but you know what? At least GDP is moving in the right direction.

Given the state of the Japanese economy and those of the countries that make up the euro zone, it’s hard to see where this situation will turn around anytime soon. Expect the U.S. dollar to remain strong, and even gain ground in the months ahead as other countries do their best to export as much stuff as possible.

Rodney

October 22, 2014

How Much is That Hot Rod in the Window?

Having bad credit doesn’t mean you won’t get a car loan. But you probably won’t be buying the car of your dreams.

Living in Florida requires a lot of patience. A common cause of frustration is the endless stream of retirees that rush to the Sunshine State, only to make moving slowly into an art form once they’ve arrived. Whether it’s on the road or in line at a store, getting stuck behind a person who has all day to do nothing, including getting to their destination or finishing their transaction, can send you over the edge.

But there is a great time to be stuck behind retirees — when they take their classic cars on the road. It’s common to see cars from the 30’s and 40’s, along with the normal parade of hot rods from the ‘50s and muscle cars from the ‘60s. There is also another place we like to see retirees — turning in their daily driver cars at used car lots.

The cliché about a 10-year-old car with very low miles because it was driven by a little old lady who only took it to church is more than a sales pitch down here, it’s often the truth. This gives Floridians a great supply of low mileage cars. As more boomers join the ranks of retirees, it only makes sense that these cream-puff used vehicles will keep hitting local car lots.

That’s good news for consumers, but not so good news for new car dealers. Unfortunately for this group, the bad news starts long before retirement…

Buying Your Dream WheelsAccording to our research on consumer spending patterns, the highest rate of spending on new cars occurs around age 54. This makes sense because if the average kid is born to 28-year-old parents, then that child leaves the house when his parents are right around 50. This gives a 54-year-old more discretionary income to buy the car of his or her dreams. This might not be the last car purchase of the consumer’s life, but so far it has been the most expensive. After that consumers are either closing in on or have already reached retirement, and might lean toward more affordable vehicles, and will keep them longer.

From our immigration-adjusted birth index we know that the peak year of births for boomers was 1961. That group turns 54 in 2015, which indicates lower car sales to the boomers in the following years. As boomers turn this corner, car makers will have to find new markets to keep their volume up. Chances are this will be a tough sell.

As boomers slow their auto purchases, it would be logical to turn to the next largest generation, millennials. This group experienced a surge in births in 1990, which led to a flood of young people reaching adulthood in the late 2000s. With our continued weak economy and an over-supply of labor, millennials are not finding a hospitable job market.

No Job, No CarWhile college graduates are still finding employment, 44% are in positions that don’t require a degree, so they are under-employed. To go along with having a job that doesn’t require college, these workers are earning less than their better-positioned peers. In short, the young generation is struggling to make ends meet, which puts a crimp in their spending on big purchases.

This situation is exasperated by the growing use of car-sharing programs and ride services such as Uber, which lessen the need for urban dwellers to have a car at all. If the young generation is not earning as they expected, and have less of a need to own a vehicle outright anyway, what is it that will drive them onto car lots in the years to come?

Bad Credit? You’re Approved!Luckily, the car industry seems to have figured this out. Instead of foregoing sales or lowering revenue targets, the auto industry has chosen to lend more money to people with bad credit, and extend the terms over a longer period of time. In the first half of 2014, 31% of car loans were to people with poor credit, while 25% of all car loans in the first quarter of 2014 were six to seven years in duration.

This pulled the average car loan to 5 ½ years, which is a record. Add to this mix the exceptionally low interest rates courtesy of the Federal Reserve, and you have a perfect recipe for an asset bubble that will eventually pop.

So far in 2014 auto sales have been strong, reaching over 17 million units on an annualized pace before dropping back a bit in September. These are heady times for auto manufacturers, but based on demographic trends, they should be preparing for leaner sales ahead.

Rodney

What Deleveraging?

The best way to delever is to immediately pay off any existing debt, right? So, how can the global economy do that?

There’s a great new study out from Geneva Reports on the World Economy 16 (ICMB — International Center for Monetary and Banking Studies) called Deleveraging? What Deleveraging?

This prestigious group of economists is saying the same thing we’ve been saying and they’re backing it up with the most comprehensive and global analysis we’ve seen yet.

Economists, who want to pretend that things are okay, and that things are getting better, often state that we’ve seen a period of deleveraging and now consumers, corporations and banks are in much better shape.

Here’s the FactsThe truth is that the private sector in the U.S. has deleveraged a little — from $40.9 trillion from 2008 down to $38.2 trillion… that’s 10% less. But since then our total government debt has gone up 53%. From $13.5 to $20.6 trillion.

Foreign debt has risen from $1.5 to $3.1 trillion…

We’ve subtracted $2.8 trillion, but added $8.6 trillion of debt. That’s not deleveraging.

We now have private and government debt of $61.9 trillion vs. $56.1 trillion in 2008. We have more debt, not less… $5.8 trillion more.

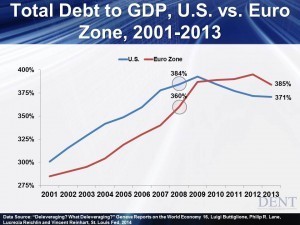

As a percent of GDP it has gone down a little as the chart below shows for both the U.S. and the euro zone.

Please note that in the two major developed regions of the world total debt has gone sideways, even as a percentage of GDP. This is also true for the entire developed world as well. This isn’t fair.

An unprecedented government stimulus has artificially inflated the GDP to higher levels.

I’ve circled where the GDP peaked before falling for the U.S. and for the euro zone. When GDP falls rapidly, as it did in mid-2009, it temporarily distorts debt to GDP ratios.

In the U.S., we started around 384% total debt in comparison to the GDP and now we’re at 371%. We’re a tiny bit better off by this measure at 3% lower. If you measure that from 360% in 2008 in the euro zone, total debt is actually about 7% higher than at the beginning of the financial crisis.

The Great DepressionIf we go back to 1929 when the last debt and financial bubble peaked, the total debt ratio was about 180% of GDP. Government debt was only about 30% with private debt at 150%.

Here’s the clincher… private debt fell from that 150% of GDP to 50% between 1930 and 1945. Let me point out one thing — that is deleveraging. Private debt at 67% as a percentage of GDP disappeared!

Government debt went up massively, initially due to the depression and to deficits.

The big kick came with World War II. Government debt went from 30% to 115% as a percentage of GDP. If you do the math, that’s up 283%. That’s more than we’re likely to see in the deep financial crisis ahead.

The key here is that private debt can deleverage massively. What if our private debt, peaking at $42 trillion, deleverages by even 50% vs. the 67% in the last winter season?

That would mean that $21 trillion of debt would disappear! Now you see it, now you don’t.

Debt is like magic with money created out of thin air by the fractional reserve system.

When money disappears from writing down or canceling debts, you get deflation: less money chasing the same goods.

The U.S. government has printed about $4 trillion dollars in the last six years. Which is bigger: adding $4 trillion or $21 trillion disappearing? That’s how you get deflation despite money printing.

The Real DealI’m going to cover this topic in much more depth in the November issue of The Leading Edge. I will include some new charts from this Geneva report along with some updated charts from our research.

It’s not just debt that’ll disappear in a deep crisis ahead; it’ll be even more in financial assets: stocks, real estate and commodities, etc. Financial assets do bubble even more than debt and it creates more money in the chase.

When the bubble bursts, those assets deflate rapidly and destroy the money and wealth that consumers, and businesses, were planning on using in their future.

In this last time central banks reflated most financial assets but the next time they won’t have the public’s confidence to do so again. People will lose faith in the concept that a financial crisis and debt bubble can be remedied by simply filling in the crater with free money…

We all know you don’t get something for nothing.

When I add up all of the debt and financial assets that could deflate I come to the conclusion that there simply is no way the government can print enough money to fill in the next, and even bigger, crater that is coming.

Prepare your portfolio for deflation, not inflation.

Now is not the time to listen to the gold bugs, even though many are as astute as we are in looking at the debt, leverage and financial reality. They just haven’t thought through what happens when the bubble deleverages.

History clearly shows that deflation follows, not inflation.

Harry

October 18, 2014

Fast Tracking Your Money

You can hear commentary around the room centering on market collapse, global markets, and demographic trends. When Harry Dent or Rodney Johnson walk into the room, they are surrounded and bombarded with questions about investments, asset protection and if you have enough for retirement.

After two days of listening to some of the savviest financial experts, you can feel the confidence in the room. You see that people are already planning how their financial decisions will change when they get home and sit down to look over their portfolios, investments and retirement packages.

Yesterday wrapped up with two strong workshops by Don Hosmer of Royale Energy and Chris Gaffney of Everbank. Yes, both of these gentlemen made presentations earlier in the day, but during their workshops they moved away from their initial broad presentation and honed in on financial specifics.

Hosmer gave some pretty fascinating information regarding 3-D Seismic Prospects and the profitable future in Alaska on the North Slope. The slides were impressive. Gaffney then stepped to the podium and brought the second day of the Irrational Economic Summit to a close with an insightful presentation on how rising interest rates affect the global recovery. He wrapped up with some definitively targeted advice on how to safeguard your profits.

I hope these updates have brought you some useful information and that, next year, you’ll join us to get the real time value of our summits. In the meantime, take a moment to register for On-Demand access to this year’s event and gain immediate access to every moment of these three days on any device, at anytime and anywhere. When you do, not only will you get to see what was said on the first two days, but you’ll also hear what’s going on today…

With the sun shining brightly and the sand on the beach feeling soft, the Irrational Economic Summit began the morning with an extremely sharp knife…

Joe Wirbick, President of Sequinox literally pulled out a very sharp and useful Swiss Army Knife in his presentation. Just like the real knife, his had several tools he could pull out of it. You can’t use them to cut a rope or tighten a screw… but you can use them to apply to your retirement package or to help you avoid market loss.

Shortly after, there came a fiery presentation by Jeff Opdyke of the Sovereign Society. He’s known for his no-holds-barred comments regarding the real state of our economy and his view on the numbers behind poverty, government benefits and unemployment. His broad view on global investments was very illuminating. It’s about looking at the mundane details that no one looks at that prove the most valuable.

Following protection mode, John Del Vecchio CFA, Portfolio Manager, Ranger Alternative Management LP, wanted to help everyone by giving specific red flags to watch for when dealing with someone who is taking your money for investments. His initial question: “Are you getting fleeced?” caught everyone’s attention. So are YOU getting fleeced?

When you see it via our On-Demand exclusive URL, you will lean forward and pay close attention as well, just like everyone in the audience did today. So don’t delay in registering for access because you have a little less than 72 hours and counting until this opportunity closes. And once it has, it goes straight into our vault and will not be available again.

Charles Biderman, CEO of TrimTabs, stepped up to the podium next. I must say, if you haven’t been lucky enough to see him speak, you’ve missed something truly great. The crowd was in the palm of his hand. He’s the funny uncle at family dinner that tells it like it is, like it or not. Yet his humor veiled some pretty harsh truths about our economy and the people that are running it.

I’m being told I have to wrap this up for today so we can get it out to you. And I still have so many people I’m looking forward to hearing this afternoon. But I do promise, I’ll put together a great flashback for Monday and cover more than a few of today’s presentations and my favorite highlights of the past three days.

October 17, 2014

Of Diseases and Dollars

Should you invest in pharmaceutical companies that combat contagious diseases? Is the euro holding its own against the dollar? We’ve got your answers right here.

It’s day two at the Irrational Economic Summit at the Loews Hotel in Miami. The weather is phenomenal, Dent Research Network members enjoyed an early breakfast and Q&A with David Stockman and the stage is set for a full day of presentations.

First, I promised to tell you about Stockman’s presentation and the panel discussion he did with Harry and Rodney yesterday. It was fascinating. Stockman detailed why Russia is no threat to the global markets and why it has a second-rate economy. He described China as an unstable house of cards that will fall apart… perhaps not tomorrow, but it will collapse.

I wish I had the space to tell you everything here, but I don’t. Still, you can hear every word Stockman said and the questions he answered from at least 10 attendees by registering for On-Demand access at the top of our page. When you do, you will receive exclusive and unlimited access to every valuable piece of information presented at IES… which you can watch from any device at any time, from anywhere. This offer does have a deadline, so don’t delay.

Our own Adam O’Dell, of Cycle 9 Alert, set the benchmark for the day by opening up the presentations. He detailed a three-pronged approach to investing and the essence of trend-following… and then he shocked the audience with his view of the soon-to-be safest place for you and your money.

Then as Adam left the stage, a man in a hazmat suit walked on…

Can you imagine the reaction in the room? Sharp intakes of breath swept from one side to the other. And that’s how Alan Hall of the Socionomics Institute began his presentation. His slides delved into history and the occurrences of disease outbreaks and their correlation with the stock market.

He too offered a statement that shocked everyone into silence. Two, in fact. One was that bear markets happen during epidemics. Did you know that? Then he went on to make some pretty fantastic correlations between social mood, market activity, diseases… and terrorist activities! And the charts he showed leave little room for argument.

It’s so frustrating not to be able to pass on all the information we’re listening to here at the summit. And even with these updates, it’s just overwhelming. I’m typing as fast as I can but the rest you’ll have to get via On-Demand access, which you can register for at the top of the page. Keep in mind that you’ll also have access to the speakers slide presentations and that’s a pretty sweet perk.

Todd Ryden, CEO of FNEX stepped up next and while Alan was a pretty hard act to follow, Todd’s presentation was impressive. His pointed remarks regarding why our market isn’t sustainable and the harsh economic times the demographic sector of 18-34 year olds are facing was nothing if not grim.

When he was done, Ryden passed the microphone to Chris Gaffney, CEO of Everbank who focused on the one thing everyone here is interested in: protecting their money. He spoke of the pitfalls found in the euro zone and the three key points that central banks are attempting to fix (and manipulate).

And that was all before lunch!

The afternoon presentations included Barry Potekin, VP of Rutsen Meier Belmont Group, Gordon Chang, author of The Coming Collapse of China and then Don Hosmer, President of Royale Energy. But seeing as I’m writing this while trying to grab a bite to eat, I’ll fill you in on the rest tomorrow, as well as on a number of fantastic workshops that are already filled to capacity.

Be sure to tune in tomorrow for more on what’s going on here at the Irrational Economic Summit.

Your conference insider,

Liza Flores

P.S. The deadline for registering for access to On-Demand is Monday, October 20 at midnight. After that, it will never be accessible again. So don’t delay..click on the banner at the top of the page.

The Buck Stops Here

Remember when you went to your first music concert? You felt the excitement of the crowd and then that rush of energy when the star takes the stage.

That’s exactly how it felt in the hours before the 2nd annual Irrational Economic Summit opened its doors earlier today. And to see the hundreds of attendees gathered here at the Loews Hotel in Miami, preparing to get the latest strategies from renowned economists and the experts from Dent Research (our stars), is simply… impressive.

From the chatter at registration, attendees have come from all over the U.S. and the world! And once the lights were dimmed, there wasn’t an empty seat in the house. (In fact, I had to ask the hotel for an extra chair that I could sit on.)

Still, we know that not everyone could make the trip and for those not with us in Miami: We’ll miss you. But we feel that the information being shared over the next three days is important, so we’re making On-Demand access available. Register now so you can experience summit in the comfort of your own home or office, from any device, at any time. As soon as we have your go-ahead, you’ll receive access to an exclusive URL that will allow you to watch every moment of these three days.

And from the crowd’s reaction, this is something you don’t want to miss. They really welcomed Harry when Rodney presented him and what he had to say about our economy will come as a shock to some…

When it comes to demographics and the bubble our economy is in, it’s very simple. As Harry said earlier:

“The Fed cannot continue fueling this bubble because when it bursts it will do so violently.”

Scanning the crowd in the room, there were nods of agreement and note taking.

Now, the thing to understand is that when Harry takes the stage, he has a commanding presence and his connection with the audience is immediate. It’s like having him sit down in your living room. He speaks right to you and to the concerns all of us have when it comes to our money.

So when Harry explained why the next several years look so grim, everyone in the room began nodding.

Speaking about money, that was the topic of Rodney’s interesting presentation on the dollar. Contrary to popular opinion, the U.S. dollar is gaining in strength and it will continue to do so. And Rodney knows why. As he said, when you take a closer look at the manipulation of central banks in the euro zone, it’s no surprise that they are in the deep economic crisis they are in today.

The sharing Rodney and Harry did in the initial part of today’s conference was eye-opening. They covered everything from…

The triggers that will unleash the next crash.Where to next for the housing market.What’s really tying the Fed’s hands in this economy.Why knowing the definition of a reserve currency is important.The trade of the decade you should make now.And so much more. This is stuff you need to hear, and from the lively discussions during the coffee break, I’d say the attendees couldn’t agree more.

As I was wrapping up your issue for today, David Stockman was getting ready for his presentation. I’ll give you more details on what he said tomorrow, so watch out for that.

Even with these updates throughout this week, there is just too much information to pass along in a timely manner. I’ll do what I can though. The rest you’ll have to get via On-Demand access, which you can register for at the banner at the top of our page.

I’ll start off tomorrow’s update with the undoubtedly phenomenal presentation David Stockman is about to make.

Until tomorrow… wish you were all here.

Your conference insider,

Liza Flores

October 16, 2014

Complimentary Survival Gear

We’re offering complimentary survival gear and it consists of forecasting tools, tips on how to protect your investments and information on how to secure your retirement.

We are finally pulling back the curtain on the 2nd annual Irrational Economic Summit at the Loews Hotel in Miami. It’s taken a lot of preparation but everything has come together and we’re so excited to begin three days of presentations by an extraordinary lineup of speakers.

Our economy’s decline over this past year has been so concerning to us that we felt the conference couldn’t come soon enough. In the past month alone, it’s gotten even worse. In just a few weeks, the Dow Jones Industrial Average lost all of its 2014 gains. Economic gloom continues to pervade global markets, especially in Europe. We have been warning you about this Great Reset for more than a year now. Everyone who reads our newsletters knows that Harry and Rodney’s forecast of a massive correction can no longer be ignored.

We’re watching the geopolitical cycle revving up so powerfully that we’re expecting some major events to take place in the coming months and we want to make sure you’re prepared.

This year’s Irrational Economic Summit is committed to providing you with the information you’ll need to safeguard your investment accounts, your savings and your future retirement. We’re here to give you the tools and strategies you’ll need for the catastrophe that’s just around the corner…

We’re so committed to sharing this critical information — even if you can’t be there with us in person, for whatever reason, you can take advantage of our first ever On Demand package. This allows you not only to watch the summit’s speakers and their presentations but it also provides you with an indispensable archive of every moment, so you can watch in the comfort of your own home or office at your convenience.

Sign up for our On Demand package as soon as possible. As soon as we have your details, you’ll receive an exclusive URL address, username and password and you’re set to sit back and absorb some of the most powerful information you’ll ever hear at the click of a mouse.

So, what have you got to look forward to?

Well, more than I have space to tell you about here. Rodney Johnson will kick off tomorrow’s events at 1 p.m. He’ll introduce everyone to our impressive lineup of speakers and then call Harry onto the stage.

Harry will give you the latest updates to his forecast, including details of the six triggers he expects will set off the next great crash.

After that, Rodney will take the microphone again and give you very important information about the U.S. dollar. Rodney’s forecast for our currency goes against everything the traditional media is saying and what you hear will give you more than a few things to think about.

Next up will be David Stockman, who both Harry and Rodney admire. Not only is he our keynote speaker this year, but he’s a renowned economist and author of The Great Deformation. His views on the Fed’s decision making (or lack thereof) regarding the bubble our economy is in today will be very revealing. I’m looking forward to meeting him myself.

Then we’ll wrap up day one with a panel discussion between Harry, Rodney and David. You will not want to miss one second. But if you do, remember you can always access the On Demand package by registering here.

In fact, through the On Demand package you’ll be able to experience the energy and the buzz of the conference. Sadly, the only thing you won’t be able to experience is Miami’s Cuban coffee! (Don’t forget to register before the deadline tonight.)

We’re all going to be privy to some uncommonly valuable information in the coming days… we’ve brought together some of the greatest economists and strategists out there. And they will be sharing their expertise with you.

That’s why, every day for the next week, I’ll be providing on-the-ground updates to make sure you don’t miss a thing.

For those attending in person, I’m excited to see you there. Be sure to come over and say hello whenever you get a chance. And let me know how you’re enjoying the conference. For those watching via LIVE Stream, you should also stay in touch. You can tweet me @economymarkets and use the hashtag #IES.

Until tomorrow, then…

Your conference insider,

Liza Flores