Purchasing Power and the Holidays

‘Tis the season of traditions…

And… predictable spending patterns!

I’m not a big fan of our materialistic, consumer culture… but I do see predictable, seasonal spending patterns for what they are: great investment opportunities.

Earlier this week, I shared with Cycle 9 Alert subscribers some interesting stats that describe the predictability of the prime holiday shopping season from the perspectives of the retailer, the consumer and the investor:

• Retailers earn an outsized share of their revenue — between 20% and 40% — in November and December alone.

• Consumers spend, on average, 12% more in the fourth quarter (Oct — Dec) than in the first quarter (Jan — March).

• Investors who focused on consumer discretionary stocks in September, October or November — and held them for three months — have enjoyed better-than-average odds of success, generating gains 77% of the time.

And this year, in particular, consumers are expected to have more excess cash than in recent years (and it’s likely burning a hole their pockets).

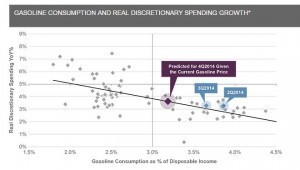

Check out this chart from Guggenheim Partners, which shows that our consumers spend less money on gas… they, predictably, spend more money on discretionary items.

Now, click here to see the investment recommendation poised to capitalize on this trend.

There’s still time to get into this opportunity. And if it pays off quickly, it might just put some extra holiday-shopping bucks in your pocket!

Happy Thanksgiving!

Adam