Connie R. Clay's Blog, page 6

March 19, 2017

How to Make a Tough Decision

“The choice is yours. You hold the tiller. You can steer the course you choose in the direction or where you want to be-today, tomorrow, or in a distant time to come.”

W. Clement Stone

Daily, we are faced with tough decisions. Do I take the promotion? Should I stay put in my job for the salary and benefits? Do I need to leave an organization or continue to pay my dues for the connections? Maybe you’re faced with a tough decision at this season in your life. Here are some things to consider:

1. What would you do if you only had one year to live?

When you consider how you will spend time and resources, consider if you would spend the last year of your life on a particular project, with a particular friend at a particular job.

2. What would you tell a friend to do?

When it comes to our friends and loved ones, we offer our best advice. So as you consider what is best for you, step back and think what you would tell a friend. Would you advise a friend to stay put in a relationship or pursue a relationship? Would you advise a friend to invest in a startup business? Once you’ve thoroughly considered what you would tell a friend, apply that same reasoning to your situation.

3. Visualize each outcome.

Think about the best result for each choice.

Which one fills you with joy? Now think about what could go wrong with each choice. Which one carries the most risk?

4. Determine how each choice aligns with your goals.

Whether you have written them down or they live in your head, you have goals. How does each of your choices align with your goals? Does one choice get you closer to your goals or farther from them?

5. Consider whether each choice will create or disrupt harmony.

How will each choice impact your daily life? Will there be more to do? Will you need to get up earlier? Just because a choice will be disruptive does not make it a bad choice, but consider this factor when making a decision.

As you filter your choice, through the five points made above, take time. It’s rare that you will need to make a major decision in a short period. If you’re making a decision that will have a long term impact, spend the time to consider all your options.

What factors do you consider when making a tough decision?

March 12, 2017

3 Reasons to Quit

“Winners never quit, and quitters never win”. How many times have you heard that? Do you believe it? I don’t. You can quit and still win. You can refuse to quit and lose. How do you know when it’s time to quit?

1. It was never your idea in the first place. Are you working on a doctorate because everyone in your family has one and that’s what you’re expecting to do? Maybe you and your husband are happy with one child, but your mother “expects” two or three more grands. What are you working on or working towards that you really don’t want? Give yourself permission to let it go.

2. You’re not good at it. Most of us do two or three things exceptionally well. If we spend precious time and resources on the things that we find really hard to do, there is no physical or mental energy left for what we were designed to do. I am good enough at math to balance my checkbook. I don’t do my own tax returns. I stay in my lane. What are you struggling with right now? Why do you continue to struggle? Who do you know who could do a better job than you and in less time? Go ahead and delegate that task to someone who is gifted in that area.

3. The timing is not right. There are seasons in life. Seasons when we’re busy and seasons when things are a bit calmer. If you’re in an exceptionally busy season, you might need to let some minor projects go. For several years, I’ve wanted to speak fluent French. For a year, I practiced French with an app for 30 minutes just about every day. I also took an in person class. According to the app, I was 20% fluent in French after investing hundreds of hours. I concluded that I would table French for a while. Maybe I need a tutor. It was obvious that the time was not right for me to become fluent in French. What about you? Is the timing a little off on something you’re doing?

Don’t ever tell yourself that you can’t quit. Examine your reasons for starting or continuing a particular venture. Are the reasons still valid? Consider the worst thing that would happen if you quit. It’s not so bad is it? Does the idea of quitting give you a huge sense of relief? Winners know when to quit.

March 3, 2017

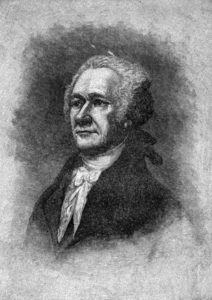

Success Lessons from Alexander Hamilton

For months, the hottest ticket on Broadway was for Hamilton, An American Musical. The hip-hop production about the controversial Alexander Hamilton won numerous awards and ignited an interest in the gentleman whose picture appears on the American $10 bill. The musical is based on the 700 page biography of Alexander Hamilton written by Ron Chernow. Whether or not you plan to read the book, you can take some success lessons from one of American’s most interesting founding fathers.

1. Get a mentor.

Hamilton immigrated to what would become the United States as an orphaned teenager. He eventually became George Washington’s chief assistant during the Revolutionary War. Hamilton was appointed the new nation’s first treasury secretary, and he was also Washington’s chief policy adviser. Washington was a father figure, adviser and friend to Hamilton for over 20 years. It is unlikely that Hamilton would have accomplished so much without the influence and guidance of George Washington.

2. Turn back to God.

When Hamilton was a student at Kings College, which is now Columbia University, he was known as a devout Christian who was seen saying his prayers before beginning his day. Although Hamilton was a member of Trinity Church and had a family pew, he stopped attending church and left the religious education of his children to his wife. However, the conversations that he had with friends, family and clergy during the last several hours of his life indicate that he returned to the faith in the last few years of his life. Also, in the final letters that he wrote he discussed his Christian faith.

3. Excel in more than one area.

Hamilton was brilliant. He considered studying medicine but decided to become an attorney. After completing his service as treasury secretary, he returned to practicing law. However, Hamilton also became a general in the army and was the head of his political party. Additionally, he started a bank and a newspaper.

4. Admit your mistakes.

Hamilton had an adulterous affair that lasted several months. When he was about to be publicly exposed, he wrote and published a short book providing details of the incident. While this method of admitting a mistake is questionable, the historical record suggests that Hamilton’s wife, family and in-laws forgave his indiscretion.

5. Marry someone who complements you and who understands you.

Hamilton and his wife were married for over 20 years and had eight children before his death. Eliza Hamilton was content to raise the children and manage the household while Hamilton fought a war, built the nation’s financial system and ran a thriving law practice. Eliza understood Hamilton’s zeal to prove himself on American soil, and she provided the support and nurturing that he needed.

6. Honor your parents.

Hamilton’s father abandoned the family when Hamilton was 10 years old. However, Hamilton maintained contact with his father for the next 30 years. Hamilton repeatedly invited his father to come to the states and live with him, and Hamilton mailed his father a stipend until the older man’s death.

7. Open your heart to the less fortunate

Once Hamilton was established in the states, he and his wife supported widows and orphans, often taking children into their home. Hamilton was an active participant in the anti-slavery movement.

Hamilton’s life indicates that he knew and practiced Godly principles such as honoring his father and caring for widows and orphans. Examine your life. Are you leaving a rich heritage of goodness and kindness that your descendants can respect and repeat?

February 25, 2017

How to Get Back on Track with Your Goals

Most of us have lofty goals at the beginning of the year, but most people quit by the end of February. Making changes is tough and finding time is difficult. With a couple of small shifts, you can restart your goals and actually achieve them this year.

1. Whittle your goals down to three. From the three, choose the one that will have the greatest impact on your life, and focus on accomplishing that goal.

2. Make your goal a priority. What gets scheduled gets done. If your goal is to exercise five days a week, get your calendar out and schedule your workouts. If your goal is to drink seven glasses of water a day, set a timer on your phone for every two hours. When the timer goes off, go chug that glass of water. Execution is easier and more likely to occur if you schedule the tasks in advance.

3. Make your goal SMART. Making a goal SMART will greatly increase your chances of achieving it.

S-Specific-You won’t make progress if your goal is vague. Telling yourself that you’re going to “eat better” is too general. Setting a goal of eating five veggies a day is specific. If you want to learn a second language, saying, “I’m going to practice French” is too vague. If you state, I’m going to practice French for 15 minutes a day, five days a week, using the Duolingo app, that’s making your goal specific.

M-Measurable-Anyone should be able to easily measure your progress. Deciding to “save some money” is not measurable. Stating that you will save $100 every payday is something that is easily measured. Either you did or you didn’t. Saying, I’m going to “exercise more” is hard to measure. Saying, “I will exercise for 30 minutes a day, five days a week”, can be measured.

A-Attainable-Your goals should require you to work and stretch, but they should also be attainable. I’m under 5’tall, so a goal to play in the NBA would not be attainable for me. However, learning to play golf is an attainable goal for me.

R-Relevant-Your goals should be relevant to your life. If the women in your office are all training to run a half marathon, but you’re content to exercise in your family room with DVDs, the half marathon training goals are not relevant to you at this point. Choose another wellness goal that interests you. The thought of completing your goal should make you feel accomplished and happy.

T-Time Bound-You must give yourself a realistic deadline. For instance, if you want to earn a degree or a certificate, assess what needs to be done and set a deadline. It should be an aggressive deadline, but something that you can do if you push yourself. It’s a thrill to finish a goal before your deadline, but it’s okay to adjust the deadline to give yourself more time. Life happens.

Consider your goals in light of what you just read. Which one is the most important? What can you schedule right now to get you closer to achieving your life altering goal? Make the goal SMART. Implement these changes, and you will see progress.

February 18, 2017

How to Win When You Lose

Have you ever kept a compost bucket in your kitchen? You place egg shells, coffee grounds, tea bags, and other kitchen waste into a container with a lid that fits tightly. Compost is slimy, smelly and messy. But when you mix it together and give it a few days in that dark pot, it becomes a rich fertilizer for your plants. However, if you were to simply toss those egg shells, coffee grounds and tea bags in the trash, they would be nothing more than waste. By composting, you give your rubbish an opportunity to nourish another living thing.

Do you ever make a mistake and try to quickly forget it and move on? If you treat a mistake like the ingredients in a compost bucket, you can mix it with other experiences and reap fertile soil. In fertile soil, you can plant new seed and reap a harvest from the original mistake and other experiences. Can you really benefit from a mistake? How do you win from what seems like a loss?

1. Admit that you failed. Whether it was a relationship, a bad business decision or overspending. To admit that you failed is to focus on what you did, not on what someone did to you.

2. Revisit the signs that you were headed in the wrong direction. Did a friend or loved one warn you? Did you have a funny feeling in your gut?

3. Decide what you will do differently the next time. This situation or something similar will happen again. What will you do differently?

4. Determine what you learned. Did you learn that you have a weakness for a certain type of person? Did you learn that you’re afraid to say no?

5. Forgive yourself. No one gets through life without making serious mistakes.

6. Use your mistake to help someone else. Who in your sphere of influence could benefit from what you’ve learned? You don’t have to share all the details, but you can help someone else avoid the mistake that you made.

7. Acknowledge that if you repeat the same “mistake” over and over again, it’s not a mistake, it’s a decision. If you don’t like the decisions you keep making, pray about it and seek wise counsel.

What is the most important lesson you’ve learned from a mistake?

February 12, 2017

How to Create Margin in Your Life

Money management experts advise us to live on 90% of our income and to save 10%. Time management experts tell us to only schedule 65% of our day. These principles seem reasonable enough. Not only do we need margin in our finances and time, we need emotional margin. We shouldn’t take on every single project or involve ourselves in every single problem. When we have no emotional margin, small annoyances will seem like crises because we have no mental room or energy. So, how do we stop overspending, over-scheduling, and over committing emotionally? Consider these tips:

1. To instantly create margin in your budget, take out enough cash every pay day to pay for groceries, gas, meals out and incidentals. Whether it’s $150 or $300, when you know that the cash has to last for two weeks, you will spend less. After two or three pay periods, you will find that you have a cushion in your checking account. Leave it there. When an unexpected expense comes up, you will have the margin to handle it.

2. To stop over-scheduling yourself, pause before you commit. If someone asks you to serve on a committee, tell the person you need to think about it or check your calendar. Before you click “buy now” for a conference or an online class, figure out what you’re going to stop doing so that you can add this activity to your schedule. Once you get into this habit, you’ll find yourself having extra time to rest, exercise and work on projects that are important to you.

3. How do you stop getting too involved emotionally? You don’t have to adopt a problem to assist with it. For example, if your coworker is in an emotionally abusive relationship, you can listen to her and help her find resources, but you don’t have to listen to her problems over lunch five days a week. Save your emotional energy for close friends, family and the projects that you know are in your zone of interest and expertise.

Allowing space between where you are and your limits will help you to stay financially and emotionally healthy, and having margin allows you to be available to your loved ones.

What do you need to do to create margin in your life?

January 29, 2017

Your Clutter Is Keeping You Stuck

Do you dread paying bills and balancing your checkbook? Does the site of your closet irk you? Do you have unfinished business with a former employer, ex-spouse or relative? If so, you probably have clutter in your life. All clutter is emotional, although there may be physical evidence of it. Clutter is indecision. Clutter is fear. It’s unfinished business. It’s not just too much stuff in your physical environment. Clutter rents space in your head-for free. Clutter keeps you from doing what’s really important to you. Clutter keeps you stuck. Here’s how to tackle the mess that is keeping you in neutral.

1. Financial clutter. Whether you have enough money or too little money, your clutter is keeping you from having more. It’s hard to make an effort to learn about stocks and bonds when you’re too overwhelmed to balance your checkbook. How do you clear financial clutter? You decide to face it. Acknowledge that it is a privilege and not a burden to have money to manage. Start by setting aside at least an hour a week to address the problem. Shred old receipts and statements. Close bank accounts that you don’t use. Decide how you will use credit cards and be deliberate in your approach. For instance, if you no longer shop at a certain store, cancel their credit card. If a friend or relative owes you money and has no intention of paying you back, deal with it. You have three options, attempt to negotiate a settlement with the person, pursue legal remedies or release the person from the debt. Once you discard your financial clutter, you are free to use your mental energy to think of ways to earn more money and to use the money you have wisely.

2. Physical clutter. Do you spend several minutes every day looking for stuff? Are your drawers crammed full? Physical clutter is an evidence of indecision and fear. You can’t decide between two pairs of shoes, so you buy both. You bought 12 books last year and never decided to read one. You’re afraid to give away the purse that you hate because it might come in handy one day. You can hire a professional organizer to help you to declutter, and there are dozens of books on the topic. About a year ago, I heard about a New York Times bestseller called The Life-Changing Magic of Tidying Up. I couldn’t believe that millions of people were buying a book that taught them how to clean up? I read an excerpt from the book and was so inspired that I gathered three boxes of things that I didn’t want and donated them to Goodwill. I finally listened to the audio book and bought the companion illustrated guide, Spark Joy. Now, I am working through the program. I love the process, and I’m rediscovering my home. As the author of these books says, tidying up (decluttering) forces you to confront yourself. You are confronting the indecision that caused the clutter and the fear that maintains the clutter. Donating things that you don’t need is generous. As you clear your physical space of things that you don’t want, you make room for what you do want. For instance, if you’re single and believing God for a spouse, shouldn’t you make room for the wonderful person who is coming your way?

3. Emotional clutter. Do you constantly relive arguments and snide remarks? Do you ever begin a sentence with, “and another thing”? Why are you hanging on to junk? When you think about something that someone did or said that you didn’t like, you choose to suffer over and over again. Let it go. Decide that you are going to forgive the person. Even if the person does the same thing every day. You can’t control what people do and say, but you can control how you react to it. React with grace. React with forgiveness. You get to choose what you think about. Think about all the beauty that God has created. Oceans, mountains, lions, babies. Think about all that you have to be grateful for. If you’re dwelling on old hurts, there’s no room for joy, peace and new relationships.

Where will you begin your decluttering campaign?

January 7, 2017

17 Smart Money Moves

How does your money look? Robust? Anemic? Somewhere in between? If you’ve decided to improve your financial outlook for 2017, here are several strategies to help you. Choose two or three of these tips depending on where you are with your money and where you want to be. Once you choose a strategy, schedule the implementation. For instance, if you decide that you are going to take a class about managing retirement accounts, give yourself a deadline for registering for the class.

1. Fast unnecessary spending for 21 days. This exercise will make it clear to you where you can cut back. Read The 21 Day Financial Fast by Washington Post columnist, Michelle Singletary.

2. Calculate your net worth. Determine the cash value of your assets. Subtract the amount of debt that you have. That’s your net worth. If you don’t like the number, choose one of the strategies in this post to address it.

3. If your money is a complete mess, and you don’t know where to begin, consider enrolling in Dave Ramsey’s Financial Peace University. This comprehensive nine-week class will teach you basic money management, how to get out of debt, what you need to know about insurance, and how to allocate your retirement assets.

4. Establish an emergency fund. Something will come up this year. Set aside at least $500 for the unexpected car repair or medical bill. Set up an online savings account. Deposit $5 to open the account. Fund this account with your tax refund and any unexpected money you receive. You can also decide to set aside $25 every pay day until you reach $500.

5. Investigate your options to save for retirement. Whether or not you plan to retire in the traditional sense of the word, there may come a time when you are no longer able to produce income. That time could come when you’re 40 or when you’re 80. Prepare for that time. Many employers will match your retirement contributions. If you are not contributing enough to get the employer match, you might as well be burning that money.

6. Set up a fun account. Want to go on a cruise when prices are cheap in January 2018? Find out how much it will cost and start depositing money into a special account every month.

7. Help someone else. Visit www.WorldVision.org. Here you can make a onetime donation, sponsor a child on a monthly basis or make a micro-loan to a small business owner.

8. Practice gratitude. Every morning, think of three things that you are grateful for.

9. Set a spending limit. Decide that before you spend more than $25, $100, or $500 on a non-emergency basis, you will prayerfully consider the expense for 24 hours.

10. Consider your need for life insurance. If someone else is dependent on you for income, you probably need life insurance. Term life insurance is best for most people. Determine if your employer, college alumni association or fraternal group offers a group policy.

11. Prepare a will and advance directives. Having an attorney prepare these documents will cost about $500.

12. Cut back on meals and beverages outside of home. If you are spending $30 a week on meals and beverages on the go, that’s $1,560 a year! This is money that you could allocate for emergency savings or your fun account.

13. Define wealth on your terms. Does it mean having all your needs met and being able to serve others? Does it mean having a net worth of $10,000,000?

14. Schedule time for money management (paying bills and balancing your checkbook). Make sure this is a time when you are alert and you won’t be distracted.

15. Schedule time for wealth building. Reading books, reading blogs, taking classes, reviewing your investment accounts.

16. Up your retirement contributions by 1%. While you will barely miss this amount now, it will pay you back later with interest.

17. Mimic the financial behavior of Jews. Jews as a whole are wealthier by percentage than the general population. Want to know why? Read Thou Shall Prosper: Ten Commandments for Making Money by Rabbi Daniel Lapin.

What will you do today to be a good steward of your money this year?

December 13, 2016

How to Increase Your Productivity

Do you ever wonder how some people seem to find time to work full time, care for their families and write books, start businesses, and or volunteer in the community? Those folks have the same 24 hours that you do. Billionaire investor Warren Buffet has told interviewers that he says “no” far more often than he says yes. Here are a few productivity practices that will help you rein in your to-do list and have time for the things that matter to you.

1. Plan your day in advance. Take a few minutes in the evening and decide the three most important things that you must do the following day. Schedule those tasks on your calendar. If possible, complete the tasks on schedule or ahead of schedule.

2. Create urgency. When you’re about to leave work for the weekend or for a vacation, you’re suddenly about to turbo charge your productivity. Use this same idea to complete tasks. Set a timer. If you know you should be able to complete a task in 60 minutes, set a timer. By creating a deadline for yourself, you will work more quickly and efficiently.

3. Say no. There are literally thousands of things clamoring for your attention. There are real and virtual groups, books, TV shows, movies, and shopping centers. You have something that you want to do, but you can’t seem to get it done. You must start saying no to the people, places and things that don’t get you any closer to accomplishing your goal. And you must say no to yourself. No to watching 2-3 hours of TV a night. No to trolling on social media for several hours a week.

4. Bunch similar tasks. For instance, try only checking email twice a day. If you need to create blog posts, create two or three in one sitting. In other words, get into the zone for a task and then knock out similar tasks.

5. Ask a better question. Instead of asking, “Why can’t I ever find time to write/exercise/manage my money?” Ask yourself, when will I write/exercise/manage my money this week. Don’t say that you don’t have time. You have time for the things that are important. Critically consider what you are saying yes to.

Try one or all of these tips to increase your productivity. What productivity hacks do you use that aren’t mentioned here?

November 5, 2016

You Should Talk to Strangers

As a child, you were repeatedly told not to talk to strangers. While this was good advice when you were a child, avoiding people who are different or “strange” will leave you uninformed and isolated as an adult. You can choose to only have superficial conversations with coworkers, service workers, and acquaintances, or you can decide to ask questions, listen and maybe change your thinking.

During my two weeks in Southern Africa, my assumptions about people were continually challenged.

Before my trip, I thought that any white person in South Africa, over 40 years of age must have agreed with apartheid and benefited from it. However, my 52 year old white tour guide, “Tom” told me that his mother secretly prepared correspondence for the African National Congress that opposed apartheid. Tom told me that he was drafted into the army. He said he was forced to commit acts in Angola and in Soweto that haunt him to this day. Once he left the army, he attempted to spend time in Great Britain but was denied a visa because the issuing official assumed Tom was a “racist __________”.

And then there was the 60-year-old white taxi driver, “Shawn” whose marriage crumbled because his wife supported apartheid and he didn’t. So much for my assumptions.

Once I returned to the States, I had lunch with a white friend. She wanted to know if it would be safe to take her children to South Africa. Her assumptions about white South Africans were similar to mine before the trip. I assured her that there were many white South Africans who were opposed to apartheid and who supported the move to democracy.

During my few days in Lesotho, I was forced to question my presumption that the Western way was the right way. There are only four commercial flights into Lesotho every day. I mentioned to my daughter that it would make more sense to consolidate the four flights into two larger flights. My daughter commented that with four flights, the personnel at the airport have full time jobs. Perhaps in terms of a corporate bottom line, two flights would be better, but for the few dozen people who work at that airport, four flights make more cents.

While in Africa, I frequently heard the term, “African time,” which simply means that you don’t have to rush through life. There were a few mornings when my daughter and I were not ready to leave when our drivers arrived. I appreciated it when our tour guides and hosts said, “take your time and finish your breakfast.” For me “African time” means receiving grace. It is something that we should all extend to others.

Here are some reasons you should venture outside of your circle and talk to people who are different from you:

1. What you believe about people could be inaccurate.

2. Your vision of the world is limited by your assumptions. Have the courage to examine your beliefs about how things should operate.

3. The Lord is global. His love extends to every corner of the earth. Shouldn’t yours? How can you love a neighbor that you won’t talk to?

You don’t have to travel across the globe to get a different view of the world. Who will you have a conversation with this week?