Nick Reichert's Blog, page 11

April 25, 2021

Bitcoin Investing and Broader Crypto Strategy

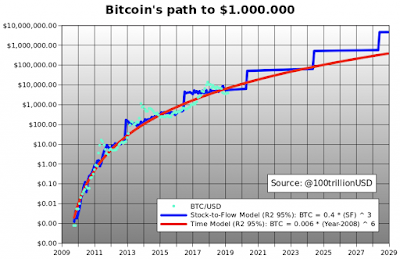

I have been doing a lot of research lately into cryptocurrencies, particularly in light of recent choppy price action and calls from a large majority institutions that Bitcoin in particular is in a "bubble." While my contrarian attitude continues to push me to go a different direction from the crowd anyway, from what I have learned, we are still very much in a bull market across a number of indicators and the long term trajectory, particularly of Bitcoin, continues to be very positive as it has been for the past ten years.

I have been doing a lot of research lately into cryptocurrencies, particularly in light of recent choppy price action and calls from a large majority institutions that Bitcoin in particular is in a "bubble." While my contrarian attitude continues to push me to go a different direction from the crowd anyway, from what I have learned, we are still very much in a bull market across a number of indicators and the long term trajectory, particularly of Bitcoin, continues to be very positive as it has been for the past ten years.

Global demand for a reliable store of value, fueled by declining value of fiat currencies due to pandemic induced monetary and fiscal policies that are inherently inflationary, will continue to meet immutably fixed supply. As such, I still believe the crypto investment thesis is intact. Buying and holding (with cash and avoiding leverage) continues to be the best long-term investment strategy for all assets, and particularly crypto due to the unusually good risk/reward characteristics for this asset class.

The first part of this post is about ways to hold your Bitcoin and how I have classified them in terms of risk / reward. The second part is about a broader crypto investment strategy, since there are really a tremendous number of innovations in the space and many ways to participate in what will no doubt be transformational change in how we handle our finances in the years ahead.

Bitcoin Investing / HODLing

Ways to invest in Bitcoin, ranked from highest to lowest in terms of risk / reward:

1) Buy and self-custody in offline wallet (I ended up buying the Trezor Model T along with a Cryptotag Zeus stainless steel private key storage device for some of my Bitcoin - so far I have been very happy with both; I do recommend you buy direct from Trezor to make sure you get full customer support)Benefits: you control your private keys and keeping your crypto in cold storage ensures you are never exposed to an exchange hack loss of your coinsCosts: you will have to invest $200 - $300 for the hardware wallet and key storage device; if you lose your private keys your Bitcoin is gone forever with no possible way to recover; you also miss out on potential profits from staking your coin on an exchange (that has counterparty risk, however, as noted below)2) Online wallet with a secure, reputable exchange (like Coinbase, Crypto.com, Kraken, etc.)Benefits: very convenient to buy/sell/transfer; no need to worry about loss of private keys since they are kept by the exchange and account recovery is possible if you lose your credentials/phone/app temporarilyCosts: exchanges charge fees either overtly and/or with a "spread" to the actual market value of the coin you are buying, so shopping around for the best fees especially if you are buying large amounts or frequently makes sense; risk of an exchange hack and loss of your coins (most of the major exchanges have dramatically improved their security over time to make hacking very difficult but it has happened before and will happen again)3) Buying into a Grayscale trust (GBTC, ETHE)Benefits: if you have a large amount of money to invest in a brokerage account, this is by far the easiest way to invest; no need to worry about security, regulatory oversight and audits since they have all three and the confidence of large institutional investors who also don't want the risk and hassle of self-custody; both trusts currently trade at a discount to underlying coins, which I think represents a nice upside opportunityCosts: you do have similar risks to coins on exchanges (risk of hack) although large trusts like Grayscale take even more extreme measures to ensure security including storing bits of private keys in multiple undisclosed locations; management fees come off the top of your returns which are fine in an up-market but can hurt in a down market (Grayscale currently charges 2%-3% for their funds but that is expected to come down when they convert to ETF's, when ETF's are approved in the US - in the meantime they are basically the only show in town) 4) Buying Microstrategy (MSTR)Benefits: you get exposure to Bitcoin with no management fees and are able to buy shares in brokerage accounts (IRA, etc.) where you might not be able to get direct exposure via GBTCCosts: like any other technology stock, MSTR can get beaten down with the rest of the tech sector in market selloffs and also faces other risks unrelated to its balance sheet Bitcoin holdings as an operating business5) Staking with a secure, online exchangeBenefits: you can earn interest on your coins while you hold them, increasing your position over timeCosts: you do face counterparty risk in the event that something happens to the exchange that you are handing your coins over to (bad investment decisions, insider fraud/theft, hack, etc.) and there is no insurance for loss, so you have to weigh the risk of loss with the reward - smaller balances that are staked are less of a concern than very large balances which may be better to keep in an online or even better, offline walletThoughts on Broader Crypto StrategyThere is a tremendous amount of activity in the broader crypto space, with new developments literally every week. It's very hard to keep up with all of it. There is a lot of activity in DeFi or decentralized finance, which has evolved to decentralized exchanges where crypto assets can be pooled and pledged as collateral for loans and loaned/staked in exchange for interest payments, using smart contracts.

This is a particularly interesting development in that you are no longer required to sell your crypto in order to monetize for fiat currency, since you can pledge your crypto assets as collateral and borrow in stablecoins (coins that are indexed to the US dollar) and use those for whatever the need is - your loan funds immediately and without dealing with a third party like a bank or having to fill out a loan application. The higher your collateral level, the lower the interest rate. Of course there is a risk in the event of a crypto market crash that you could could get a margin call, so it's best to only borrow relatively small amounts in comparison to your asset base to ensure you don't get liquidated and of course you'll eventually have to pay the loan back.

Similarly, individuals interested in lending their crypto can do so and collect interest on the balance in the same currency. These lending arrangements are also collateralized and if the crypto drops to a certain level, the collateral is returned to the lender, otherwise the lender just collects interest and ultimately gets the crypto back when the loan is paid off (which can also be paid off before maturity).

Another interesting development in stablecoin demand is they have emerged as a great way for companies to settle international payments quickly and without the need for intermediaries who are very slow to process transfers (some can take days) and charge significant fees. This may be another big reason why there has been so much growth in stablecoins recently.

We have also heard a lot recently about Non-Fungible Tokens or NFT's as a potential revolutionary change in the way creators can transfer and monetize their digital works of art. Payment for NFTs is generally facilitated by using Etherium. See my recent post on the subject here.

What much of the DeFi and NFT spaces have in common is they are built on the Etherium platform, which I believe will mean growth in the demand for the Etherium tokens over time as a means of settling transactions on these different applications. As such, I think investing in Etherium makes a lot of sense as a complement to Bitcoin, which I see as primarily engineered as a store of value asset not unlike gold or silver as a defense against inflation, but much easier to store and secure due to being digital vs physical.

One of the more obvious ways to make broader investments in the crypto space is to either invest directly in crypto exchanges like Coinbase (COIN), Bitcoin miners like Riot Blockchain (RIOT) or Crypto ETF's like Amplify Transformational Data Sharing ETF, Siren Nasdaq NexGen Economy ETF or First Trust Indxx Innovative Transaction & Process ETF. These ETF's have broader exposure to the crypto space and companies operating in the space vs investing directly in cryptocurrencies like the Grayscale funds.

I think following a broad diversification strategy across asset classes in accordance with the Financial Fortress model is critical and also within asset categories (such as crypto) it also makes sense to be diversified across direct crypto investments as well as companies involved in the space. Possibly the highest rewards (and risk) would be private equity investments in the crypto space, but I haven't seen any that small individual investors can take advantage of on Seedinvest or StartEngine, maybe because there is plenty of capital available from high net worth individuals directly these days but hopefully in the future there will be more opportunities for smaller investors. However, I did find one deal that was interesting on Republic for a company called Linen that might be worth looking into. Full disclosure, I have investments in many of the stocks and funds mentioned in this post.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

April 11, 2021

Portfolio Allocation Update

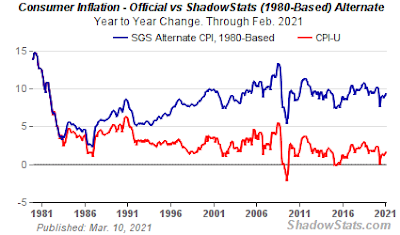

Time again for my monthly update on portfolio allocation. Over the past month, I decided to shift away from TIPS and more into Bitcoin, increasing my overall allocation to Bitcoin and reducing my bond allocation to zero. I decided to do this largely based on my ten year time horizon and desire to hedge against what I believe will be higher than normal inflation in the coming years and continued low or negative real interest rates. I'm thinking inflation could be at least 3% to 5% in the US for a sustained period of time, but definitely more than 2% and hyperinflation is not in my base case. I'm currently reading When Money Dies by Adam Ferguson and it's a pretty scary tale of what happened in the early 1920's with hyperinflation in Germany, Austria and Hungary - all I can say is I hope policymakers have learned their lessons from history. I don't think TIPS will provide the best protection in this environment since I believe CPI understates the real rate of inflation due to calculation methodology changes over the years (not to mention excluding critical day to day items like food and gas).

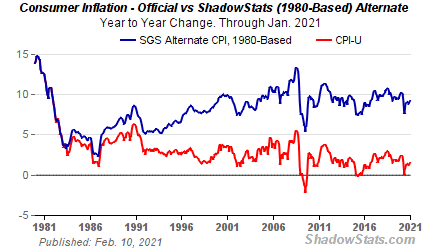

Time again for my monthly update on portfolio allocation. Over the past month, I decided to shift away from TIPS and more into Bitcoin, increasing my overall allocation to Bitcoin and reducing my bond allocation to zero. I decided to do this largely based on my ten year time horizon and desire to hedge against what I believe will be higher than normal inflation in the coming years and continued low or negative real interest rates. I'm thinking inflation could be at least 3% to 5% in the US for a sustained period of time, but definitely more than 2% and hyperinflation is not in my base case. I'm currently reading When Money Dies by Adam Ferguson and it's a pretty scary tale of what happened in the early 1920's with hyperinflation in Germany, Austria and Hungary - all I can say is I hope policymakers have learned their lessons from history. I don't think TIPS will provide the best protection in this environment since I believe CPI understates the real rate of inflation due to calculation methodology changes over the years (not to mention excluding critical day to day items like food and gas). Here's a ShadowStats chart I have shared previously that shows actual inflation could be closer to 10%:

The bigger issue in my mind for TIPS is the risk of yield curve management, where shorter dated securities including 0-5 year TIPS can be sold by the Fed in order to buy longer dated maturities to drive down long term interest rates. This can depress prices of the shorter dated bonds and result in losses, a situation which could persist for some time - possibly years depending on inflation behavior, economic growth, unemployment and policy constraints. This can be a problem for TIP holders, especially with very low yields (around 0.76% currently for VTIP). We don't have to experience hyperinflation to do a lot of damage to cash and fixed income holdings in this environment. Some day, of course, when real interest rates are positive and interest rates are higher, it may make sense to move some money back into cash and bonds but for now, that part of the market doesn't seem like a good place to be and many respected investors appear to share that view.

Here's the latest allocation:

Cash - 2.0%US Large Cap Stocks - 16.5%US Mid Cap Stocks - 5.5%US Small Cap Stocks - 5.6%Emerging Markets - 5.3%Commodities - 5.5%Real Estate - 22.1%Private Equity - 10.2%Bitcoin - 23.2%Other (Gold/Silver/Royalties) - 4.1%I have been reading lately that some analysts believe hard assets are relatively undervalued in this environment (vs financial assets such as stocks), including real estate, precious metals and collectibles. While I don't have any collectibles in my portfolio (see my post last week on NFT's), I do have a healthy allocation to real estate and precious metals. I do believe that gold and silver look attractive at current levels. My equity portfolio includes some direct exposure to gold miners as well as cyclical, tech and natural resources companies. I still believe, consistent with the Financial Fortress methodology, that broad diversification is critical to protect your portfolio over the long term, especially since it's very difficult to predict what will be "working" as markets shift through their cycles (i.e., growth vs value) and as macro conditions evolve.Future Bitcoin price predictions range widely, but I feel pretty comfortable that the price will continue to appreciate over the next 10 years at a rate that will substantially exceed inflation and therefore will provide a good store of value. The short-term volatility is expected to go down over time as Bitcoin gains more institutional adoption and acceptance / use continues to grow. My Bitcoin holdings are primarily Grayscale Bitcoin Trust (GBTC), Bitcoin held in a Crypto.com account and Microstrategy (MSTR). If you're interested, I recently did a post here on ways to invest in Bitcoin. There are currently several applications pending with the US Securities and Exchange Commission for Bitcoin ETF's, but so far none have been approved in the US. There are a couple of popular ETF's approved in Canada. Also, GBTC's sponsor has said they intend to convert to an ETF (they are a currently organized as a closed end fund) as soon as practical. When/if these ETF's are available, this will give investors more options to own Bitcoin. Although hard-core Bitcoiners say you should self-custody (not your keys, not your Bitcoin), some people may not want to deal with the potential risk of loss of Bitcoin that is in self-custody. The main value proposition for a fund or ETF is convenience (in a brokerage account) as well as peace of mind, since they have robust security, regulatory oversight, audits, etc. That especially appeals to institutional investors who may not have the expertise or risk appetite for self custody.

Last week, I watched an interesting interview with Mark Cuban, billionaire owner of the Dallas Mavericks and regular on Shark Tank. He has developed a deep understanding of the blockchain space and while he is bullish on Bitcoin for its store of value thesis, he's more interested in Etherium as an enabler of smart contract transactions across the blockchain and particularly with respect to NFT's, an area he has already made several investments. He also has a bit more of a "real world" perspective of how most people will respond to crypto adoption, which is somewhat refreshing. That got me thinking that maybe a small allocation toward Etherium (1% - 2%) might make sense in a broadly diversified portfolio. The argument against Etherium is that it is still very much a "work in progress" as a protocol and therefore is more speculative than Bitcoin at this stage of its evolution. The investment thesis would be that continued growth in demand such as NFT's (which require Etherium for payment settlement and the to support the underlying smart contracts that allow creators to collect royalties in perpetuity) would drive corresponding demand for Etherium and which would therefore result in rising prices over time, perhaps at times even better performance than Bitcoin.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

April 4, 2021

NFT's - I'm Cautiously Optimistic

Non Fungible Tokens (NFT's) are original digital collectibles or works of art that are stored on a blockchain. Already, there have been many famous NFT's, including the recent sale at auction of the digital artist Beeple's "5000 Days" for over $69 Million. Because the artwork was transferred to an NFT, it is a digitally secure "original" and while it can be copied online and printed out or reused many times over, there is only one original, it's authenticity and ownership secured by the blockchain.

Non Fungible Tokens (NFT's) are original digital collectibles or works of art that are stored on a blockchain. Already, there have been many famous NFT's, including the recent sale at auction of the digital artist Beeple's "5000 Days" for over $69 Million. Because the artwork was transferred to an NFT, it is a digitally secure "original" and while it can be copied online and printed out or reused many times over, there is only one original, it's authenticity and ownership secured by the blockchain. What's more interesting about NFT's is that all sorts of digital artwork creators can take advantage of this not only as another way to create and distribute their work directly to fans, but also to more efficiently monetize their work and ensure they receive royalties both at the point of original sale and in the future. Because smart contracts are used, they can be programmed to share a percentage of each resale of the original work of art with the creator as the piece changes hands in the future (presumably for more money) - this is revolutionary and cannot be replicated in the real world. For this reason, I think most NFT's will probably benefit the artist more than the buyer and can also allow more artists to reach a global audience than ever before with their work. From the buyer's perspective, but there could be some limited edition pieces that go up significantly in value - either due to viral popularity of a previously unknown artist and / or after the passing of the artist. It's possible, however, for the owner of the NFT to find ways to monetize the value of their digital art piece other than selling it in the future - possibly charging a fee for showing the piece in a digital museum or using it as collateral for a loan. Clearly, not everything being offered for sale today will have value in the future, so if you are interested in investing in NFT's it will pay to be cautious.

Many artists and creators are getting into the game. A couple of weeks ago, Time Magazine auctioned off some of its most iconic covers as NFT's, including "Is God Dead?" and "Is Truth Dead?" and a new cover based on the other two "Is Fiat Dead?" These covers sold for between 70 and 80 ETH ($140K to $160K based on recent price). More recently, musical artists Snoop Dogg and Boy George have created and are offering limited edition NFT's for sale on Crypto.com's new NFT site. Crypto.com's approach is to offer "drops" for a limited time and then limited quantities of each NFT. Purchasing an NFT requires you to buy cryptocurrency to complete the transaction. Typically this has been Etherium, but with Crypto.com they leverage their own CRO coin on their site. The rise of NFT's will obviously increase the demand for the cryptocurrencies used to purchase the items, which should help increase the value of the cryptocurrencies used over time, especially if supply is limited similar to Bitcoin. I still prefer Bitcoin as an investment and store of value vs the other cryptocurrencies, although it's not easy to be a long term holder - see my post from last week on dealing with fear, uncertainty and doubt.

Collectibles, including rare works of art can be a lucrative investment but you have to really understand the market for the items you buy. Some collectible items that are only represented physically like coins, stamps, baseball cards and the like could some day have digital counterparts but that's one I have a hard time getting my head around. It's one thing to have a song, video clip or piece of digital art (or all three combined in some cases) natively created in a digital format and put on an NFT. Indeed, this is what all the current generation of NFT's are. It's a whole other thing to create a digital representation of a physical thing for a peer to peer transaction, without involving a third party such as an escrow agent. However, in terms of documenting change of ownership of a physical thing without an intermediary including setting and enforcing contractual requirements, the blockchain does have huge potential. The applications for this are truly immense (think about buying and selling homes or cars, for example).

In terms of the Financial Fortress, collectibles do have a place in a portfolio, although I would recommend a small percentage at least to start with. Maybe 1-2%. As you gain confidence in the process and the assets you are interested in accumulating, a higher allocation may be warranted. With Bitcoin, I started with a small 1-2% allocation and have raised it steadily as my confidence in the asset has grown while still making sure I'm maintaining my overall portfolio diversity. The same could be true of NFT's, although I have yet to invest in any.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

March 28, 2021

Dealing with Bitcoin FUD

If you are like me and have devoted a significant portfolio allocation to Bitcoin, it's relatively easy to fall prey to the "FUD" or Fear, Uncertainty and Doubt that is often spread by the media directed at Bitcoin. It comes and goes in waves and usually peaks after a big run-up in the price of Bitcoin. As a long term investor, it's important to do your own research, your own thinking and stick to your strategy - whatever works best for you. I have found that Bitcoin requires a significant amount of research to understand how it works, but having done that research I still learn more every day and I continue to be committed to having a "nonzero" position in it.

If you are like me and have devoted a significant portfolio allocation to Bitcoin, it's relatively easy to fall prey to the "FUD" or Fear, Uncertainty and Doubt that is often spread by the media directed at Bitcoin. It comes and goes in waves and usually peaks after a big run-up in the price of Bitcoin. As a long term investor, it's important to do your own research, your own thinking and stick to your strategy - whatever works best for you. I have found that Bitcoin requires a significant amount of research to understand how it works, but having done that research I still learn more every day and I continue to be committed to having a "nonzero" position in it. Here are some of the most common types of Bitcoin FUD:

Governments will "outlaw" It's a "bubble"It's a Ponzi schemeSomething better will come alongThere's nothing of tangible value (unlike gold or silver)It will crash 90% It is used for illicit / criminal activityWhenever something is new, it's difficult for most people to see the potential. This could be said of many inventions in the past, such as electricity or the automobile or more recently, the internet. I recently watched a video clip of Bill Gates on the David Letterman show in 1995 explaining the internet and what it does and Letterman was cracking lots of jokes about it. I believe the current status of Bitcoin is much like the early internet days and you have similar camps of believers and naysayers, both are equally convinced they are "right."When you think about Bitcoin, its most obvious use case is as a commodity similar to gold, where it can be used as a store of value. In fact, that's exactly what Bitcoin was engineered to be: programmatically safe, sound money that cannot be debased. Where Bitcoin is superior to gold is in how it can be stored and transferred digitally at very low cost compared to gold. Indeed, it is impractical to store and transfer large amounts of physical gold. Bitcoin is already recognized in the United States as a commodity and many investors believe that as long as the government is able to maintain regulatory control over Bitcoin and get their tax revenue from the sale of Bitcoin (approving Bitcoin Exchange Traded Funds in the US will go a long way toward these objectives), Bitcoin should have a path forward in the US.

Banning Bitcoin would be silly and a few countries that have tried like India and Nigeria have had to walk that back because ultimately it puts your country at a disadvantage to the rest of the world that is adopting Bitcoin. It's also practically very difficult to do with a decentralized digital asset. Also, with a $1Trillion market cap, an outright ban on Bitcoin would be an unconstitutional taking of property and would be extremely unpopular. There is a whole industry and ecosystem growing up around Bitcoin and that means jobs, many of which we can't even conceive of today. That's important for economic growth and governments will hopefully soon realize that is the case.

The more intriguing use case for Bitcoin is the concept of using it as a "base layer" of a new digital decentralized financial network. Many people are familiar with Etherium, another digital currency that supports "smart contracts" using blockchain technology and that allows for all sorts of financial innovation. However, the Etherium protocol, although popular, is still a work in progress technically while Bitcoin is essentially a completed project. What I have learned recently is that there are entrepreneurs who are developing similar smart contract protocols that can work on top of the Bitcoin network, leveraging its large computing base and extremely strong security. An example of this is Stacks.co. This next generation of financial technology can bring the best of both worlds together allowing for low cost, rapid and secure "smart" financial transactions without the need for an intermediary and leveraging the Bitcoin protocol for settlement and payment. I think this is probably the most compelling use case for Bitcoin and one that could dwarf the demand driven by investors and corporate treasuries as an alternative asset.

Ray Dalio, an investor I have a lot of respect for, created a stir last week by suggesting that it's probable that Bitcoin could be outlawed in the US and other countries (indeed, as noted above that has already been happening). While that is indeed a possibility (gold ownership was outlawed in the US for many years), I think this only happens if Bitcoin becomes a threat to the demand for US Treasury debt. The government needs to be able to issue a lot of Treasury debt to fund operations and ongoing stimulus programs and the Federal Reserve doesn't want to be the only one buying all those bonds for obvious reasons (i.e. monetary inflation through monetization of the debt). I think that only happens in a hyperinflationary scenario in the US, which seems very unlikely. The Federal Reserve, even if they are late to the game, cannot allow inflation to get out of hand although they can let it "run hot" for a while which should do plenty of damage to cash and bond holdings. Stocks, especially cyclicals, will continue to see a boost in this environment since investors have no other good investment alternatives (gold and silver have done nothing, which is why investor demand for Bitcoin as an alternative asset class has been so strong).

Also, as Cathy Wood, another great investor I follow says, there are very powerful deflationary forces at work in the world today due to technological innovations. Indeed, you really don't have strong inflation without wage inflation and until the unemployment rate is extremely low, you won't see wage pressures. My own observation from the COVID19 pandemic and recession is that many of the jobs that were lost may never come back since companies have rapidly accelerated adoption of technology to replace labor, which means that wage inflation may have a tough time taking hold. If we see any signs of deflation, investors will run right back into Treasuries, which was what we saw during the Great Recession and also more recently last year and whenever an economic downturn happens. That would solve the Treasury demand problem and many investors (as they have been until very recently) might still be willing to accept zero or slightly negative real rates of return in exchange for "safety."

The volatility of Bitcoin is expected to settle down as it gains adoption and over the long haul, should approach a more "normal" rate of appreciation commensurate with inflation. In the meantime, the network effect will be a major driver of the price of Bitcoin, since greater use as an alternative investment, more use cases and a fixed supply will continue to drive the price up. The nature of the network effect is that there is a massive advantage to the first mover (in this case Bitcoin, which is the first global monetary network) and the only way you are disrupted is if something comes out that is 10x better. While that's a possibility, the first-mover advantage is huge as we have seen with the likes of Amazon, Google, Facebook, Netflix, and Apple. If you are going to own Bitcoin, you have to be willing to hold regardless of the price action, whether up or down, with a time horizon of at least 10 years I believe. Bitcoin will continue to be volatile in the near term, that much is certain.

A Ponzi scheme usually has a sponsor who is making money at the top by taking in investments, keeping most of the money for personal use or funding the occasional redemption and paying out a small amount to investors as a "return." Bernie Madoff was running such a scheme - the largest in US history - and was able to do it for years by showing great results to his investors, and it all fell apart when the stock market crashed during the Great Recession. The Ponzi falls apart when new investors stop coming in and the operator is unable to pay interest or redemptions to existing investors. Based on this definition, Bitcoin can't be labelled a Ponzi scheme because as a decentralized platform there is no central sponsor who is enriching themselves at the expense of new investors and there's certainly no faking the price of Bitcoin since it is actively quoted and traded 24 hours a day, 7 days a week.

As far as criminal activity, ironically Bitcoin is probably the worst way for criminals to transact because the blockchain is open and everyone can see it. This actually makes it easier for law enforcement to "follow the money." Historically dollars (especially paper bank notes in suitcases) have been used for way more illegal activity than Bitcoin has.

In conclusion, while there is plenty of FUD out there, when you look at the facts there's not much reason to be concerned if you have a long-term buy and hold approach to Bitcoin. Your percentage allocation should be in accordance with your comfort level and I certainly am not recommending going "all in," as some have done. It still makes sense to have a diversified portfolio consistent with a strong Financial Fortress, since not all assets are always "working" at the same time. The outlook for cash and bonds with ongoing monetary and fiscal stimulus not just in the US but globally, suggests that a higher allocation to alternatives such as Bitcoin make sense in the current environment. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

March 21, 2021

Gold and Silver Update

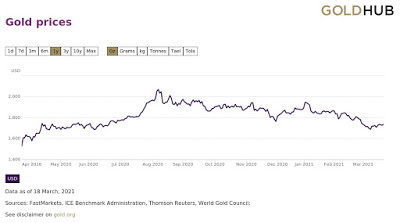

Gold has been in a down trend since hitting a high back in August 2020 at $2,038 per ounce and has mostly been trading sideways in a range between $1,750 and $1,850 per ounce over the past six months (see long term chart below). Recent volatility in the bond market with long term interest rates spiking has caused more downward pressure on gold, hitting a low of $1,685 on March 8, from which it has bounced back up to around $1,739. Many investors believe gold has been consolidating since August and will eventually begin a steady move up, driven by massive fiscal and monetary stimulus in the US which is expected to cause inflation (and possibly a rotation from stocks and bonds into commodities). As I have written about before, a Financial Fortress comprised of a diversified portfolio should include an allocation to precious metals, including gold and silver.

Gold has been in a down trend since hitting a high back in August 2020 at $2,038 per ounce and has mostly been trading sideways in a range between $1,750 and $1,850 per ounce over the past six months (see long term chart below). Recent volatility in the bond market with long term interest rates spiking has caused more downward pressure on gold, hitting a low of $1,685 on March 8, from which it has bounced back up to around $1,739. Many investors believe gold has been consolidating since August and will eventually begin a steady move up, driven by massive fiscal and monetary stimulus in the US which is expected to cause inflation (and possibly a rotation from stocks and bonds into commodities). As I have written about before, a Financial Fortress comprised of a diversified portfolio should include an allocation to precious metals, including gold and silver.

As I discussed in my book Investing in Gold and Silver, there are many ways to invest in gold and silver. The most popular way is to simply buy coins and bars and securely store them. Lately this has become a challenge, especially for silver, with the #silversqueeze movement which has been encouraging individual investors to buy as much physical silver as possible to expose perceived manipulation of the "paper" silver market (futures contracts being sold with no physical backing). You can find silver coins, but they have a hefty premium to the spot price of silver - a quick survey of EBay had many monster boxes available in the $17K range (each monster box includes 500 one ounce US liberty silver coins, implying a physical price of $34 per ounce while the spot price is about $26 - a 30% premium to spot). Having physical possession of gold and silver is comforting to some investors and for many it is the only way they want to hold precious metals. Storage and security can become a problem depending on how large your holdings are, however.

Alternatively, you can invest directly in common stock of gold miners such as Barrick Gold (GOLD) or Wheaton Precious Metals (WHT). If you are looking for diversification across several of the larger miners, you may be interested in investing in ETF's such as the Van Eck Gold Miner's Index Fund (GDX) or if you want exposure to the smaller "junior" miners, you can invest in the Van Eck Junior Gold Miner's Index Fund (GDXJ). There is also "paper" ownership of physical gold and silver through one of the ETF's like Sprott Physical Silver Trust (PSLV) or the SPDR Gold Shares ETF (GLD). These ETF's buy and hold physical gold and silver in vaults - the value of the ETF shares reflects the value of the stored gold and silver, less storage and administrative costs.

I recently learned of a new way to invest in metals that I hadn't heard about before. There are some companies that are formed to invest in metals royalties. These companies own the rights to the claims and get paid a set amount or percentage for gold, silver and other metals that are extracted from the claim. They have none of the cost risk that miners often face and so are a leveraged way to invest in metals since they are very sensitive to an increase in price of the underlying metals and of course, production levels (more gold at higher prices equals higher royalty payments). One such company is Metalla Royalty and Streaming, Ltd. (MTA), which engages in the acquisition and management of precious metal royalties, streams, and similar production-based interests. It focuses on precious metals such as gold and silver. The company was founded on May 11, 1983 and is headquartered in Vancouver, Canada. While this stock has performed poorly so far this year (down 28%), when gold prices turn around it could see some significant upside due to the leverage discussed previously and may be worth a look in a diversified portfolio as part of precious metals allocation.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

March 14, 2021

Investing Gameplan

After doing a quick portfolio review (results below), I thought it would be a good time to go over my investing game plan for the next several weeks. With a broadly diversified portfolio and a strategy that doesn't involve a lot of trading in and out of positions (the Financial Fortress), I'll be the first to admit my approach is pretty boring. However, boring over the long haul should be way more profitable than active trading!

After doing a quick portfolio review (results below), I thought it would be a good time to go over my investing game plan for the next several weeks. With a broadly diversified portfolio and a strategy that doesn't involve a lot of trading in and out of positions (the Financial Fortress), I'll be the first to admit my approach is pretty boring. However, boring over the long haul should be way more profitable than active trading!

Here's my current portfolio breakdown:

Cash - 1.5% Stocks - 34% Mixed Portfolio of Long Stock Positions and Covered Calls - 10% (cash flow strategy) - see below for a breakdown of current holdingsUS Large Cap - 7% US Mid Cap - 5%US Small Cap - 6%Emerging Markets - 6%Commodities - 6%Bonds - 12.5% (0-5 year TIPS - invested in Vanguard Short-Term Treasury Inflation Protected Securities Fund - VTIP)Real Estate - 22% (rental property 75%; REIT portfolio 25%)Private Equity - 10% (angel investments - posted about this quite some time ago if you are interested - here's the link)Bitcoin - 10% (allocation has grown from 6%-8% target due to small additions and recent price appreciation, but goal is to continue to stay overweight and accumulate through dollar cost averaging over time); if you're interested in different ways to invest in Bitcoin check out my recent post here.Other Alternatives - 4% (mostly physical gold and silver held in a vault and some music royalties)My game plan is to continue to invest small amounts in Bitcoin each month - currently $300 per month is automatic directly into a Bitcoin wallet (Crypto.com). Additional Bitcoin investments are allocated to the Grayscale Bitcoin Trust (GBTC). Additional Bitcoin investment is dependent on success of cash flow from selling call options in my trading portfolio. I try to keep a set overall amount in that portfolio and invest excess cash flow in Bitcoin. In case you're interested, these are the stocks I currently hold in that portfolio (I tried to build a balance of a few solid tech names, commodities, retail and some industrials that will benefit from the economic recovery and rotation into cyclical stocks):3M CoBarrick Gold CorpBeyond Meat Inc.Boeing Co.C3 AI Inc.Facebook Inc.Gap, Inc.General Electric Co.Palantir Technologies Inc.Qualcomm Inc.Rio Tinto PLCTarget Corp.I have a few stocks on my watchlist, including Visa, Eaton and General Motors.I don't plan to make any more big portfolio moves at this point, since I feel like everything is well diversified and well situated for the next several years. Other than continuing 401(k) and IRA contributions with a goal to max out again this year, I also plan to continue to deploy small amounts to private equity deals - in particular where the minimum investment is around $1,000 and the deal is focused on Artificial Intelligence, an area I have been very interested in and I believe has a lot of upside.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

March 7, 2021

The Dividend Dilemma

I recently saw a quote come across in social media that went something like "If your only source of income is a paycheck, you are one step away from being broke." Certainly, the pandemic and recession last year, causing so many people to join the ranks of the unemployed and now dependent on government payments (unemployment benefits, stimulus checks), was and still is a stark reminder of this. I have written about the benefits of passive income for a while and one component of passive income is having a portfolio of dividend paying stocks. For today's post, I set out to answer the question: "If you wanted to keep things simple and get reliable dividend income, what is the one thing (presumably an ETF) that you would invest in for the long haul?" While doing the research, I came up with a few good ideas that I will share below.

I recently saw a quote come across in social media that went something like "If your only source of income is a paycheck, you are one step away from being broke." Certainly, the pandemic and recession last year, causing so many people to join the ranks of the unemployed and now dependent on government payments (unemployment benefits, stimulus checks), was and still is a stark reminder of this. I have written about the benefits of passive income for a while and one component of passive income is having a portfolio of dividend paying stocks. For today's post, I set out to answer the question: "If you wanted to keep things simple and get reliable dividend income, what is the one thing (presumably an ETF) that you would invest in for the long haul?" While doing the research, I came up with a few good ideas that I will share below. I also came across an article on Seeking Alpha that I shared on my Twitter feed called "Confessions of a Recovering Income Investor" that highlighted the tax burden associated with dividend income (even qualified dividends, although taxed at a lower rate, are still taxed). If your strategy is to use the dividends to buy more stocks and grow the portfolio (or if you plan on spending the money you earn), you quickly learn that when it's time to pay the tax bill, you may not have the money! This forces you to set aside some portion of your income for the tax man, cutting into the benefit of having the passive income. As such, sometimes it may make sense to forego some dividends for higher growth stocks that pay a lower yield to get the best, long term and most tax efficient returns (majority of tax paid when you sell). That would be a contrarian move in today's market that is running away from growth / tech stocks toward cyclicals like industrial and financial stocks - buy FAANG on the dip?

Anyway, back to the focus of today's post. Some key considerations for a dividend ETF are 1) the yield, 2) the expense ratio (it's very important for this to be as low as possible, especially if you are looking at a long term hold) 3) the relative risk and level of diversification (for example if the fund is invested 50% in energy and that sector crashes, so does your investment in the ETF - if you have "diamond hands" that's not a problem, but the temptation to sell will be strong if / when that happens) and 4) the types of stocks that are included in the top holdings and how those relate to your macro views and personal preferences. While there are many international dividend ETF's and many that pay high yields, the expense ratios are high and I focused more on US ETF's for this research. As Warren Buffett says "Don't bet against the US."

Here are a few of the ETF's that seemed to rise to the top of the lists after a survey of Motley Fool, The Street, ETF.com, Nerd Wallet and Investors' Business Daily:

Vanguard High Dividend Yield Index ETF (VYM) - expense ratio 0.06%, yield 3.09%; The Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that are characterized by high dividend yield. The Fund attempts to replicate the FTSE High Dividend Yield Index by investing substantially all of its assets in the stocks that make up the Index.iShares Core Dividend Growth ETF (DGRO) - expense ratio 0.08%, yield 2.26%; The Fund seeks to track the investment results of an index composed of U.S. equities with a history of consistently growing dividends. The Underlying Index may include large-, mid- or small-capitalization companies, and components primarily include consumer staples, industrials and information technology companies.Schwab US Dividend Equity ETF (SCHD) - expense ratio 0.06%, yield 3.09%; The Fund seeks to track the total return of the Dow Jones U.S. Dividend 100 Index. The Index is designed to measure the stock performance of high dividend yielding U.S. companies with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios.SPDR Portfolio S&P 500 High Dividend ETF (SPYD) - expense ratio 0.07%, yield 4.74%; The Fund seeks to provide investment results that correspond generally to the total return performance of S&P 500 High Dividend Index. The Fund invests at least 80% of its assets in the securities comprising the Index, designed to measure the performance of 80 high dividend-yielding companies within the S&P 500 Index.Vanguard Dividend Appreciation ETF (VIG) - expense ratio 0.06%, yield 1.63%; The Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that have a record of increasing dividends over time. The Fund attempts to replicate the Nasdaq US Dividend Achievers Select Index by investing its assets in the stocks that make up the Index.Of these five, the Schwab fund looks like it has a lot of recent inflows and overall good current and long term return, low expenses and a reasonable risk profile. It is also well situated for the "reflation trade" since its two largest sector holdings are financials and industrials - 44% of the portfolio. My only concerns about this fund are 1) concentration in financials (26% of portfolio), 2) largest holdings include Exxon (5%) and Altria (4%) - Exxon while doing well recently with the spike in oil prices is in secular decline, owning Altria is an issue if you don't like big tobacco and both stocks are not favored by the ESG crowd. If you can get past those issues, this is a pretty good ETF to own right now and for the long term but be prepared when there is a rotation out of cyclicals into growth again as the share value could take a big hit.If you are looking for a bit more diversity, the Vanguard Dividend Appreciation ETF looks better, although the yield is not as good, but expenses are low; the low yield should be offset by dividend and share price growth upside - top holdings include Microsoft, Walmart, Johnson & Johnson, Proctor & Gamble, United Health Group, Walt Disney, Home Depot, Visa, Comcast and Abbott Labs. I actually like this one better for tax efficiency, diversification and growth potential.

The Vanguard High Dividend Yield Index ETF lands somewhere in the middle with a similar yield and expense ratio to the Schwab fund, but more exposure to financials; top holdings include: Johnson & Johnson, JPMorgan Chase, Proctor & Gamble, Bank of America, Intel, Verizon, Comcast, AT&T, Pfizer and Walmart.

In conclusion, as with most ETF's, there are many to choose from but for long term dividend investors choosing one dividend ETF can be a simple, diversified solution to create passive income.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

February 28, 2021

Confirmation of Portfolio Realignment

After shrinking my portfolio's bond exposure last week to about 12.5% (short term Treasury Inflation Protected Securities exposure via the VTIP ETF), I received more confirming evidence this week that the move out of longer term, non-inflation adjusted bonds was a sound strategic shift.

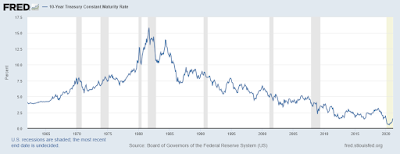

After shrinking my portfolio's bond exposure last week to about 12.5% (short term Treasury Inflation Protected Securities exposure via the VTIP ETF), I received more confirming evidence this week that the move out of longer term, non-inflation adjusted bonds was a sound strategic shift. Bond yields have declined steadily since peaking in 1981 (at that time the 10 year Treasury bond was yielding almost 16%!) and hit a low in 2020 of about 0.6%, a rate decline of about 96%. Rates have been rising recently as high as 1.5% and seem certain to head higher as the economy recovers and in particular if investors anticipate higher inflation. What's got investors spooked is how rapidly the rates have been rising recently. Here's the long term chart of the 10 year bond yield:

Here are a few more data points:

Mohamed El-Erian in an interview said rising Treasury yields are flashing a warning sign and are rising for the "wrong reason" - not because of the economic recovery but because of inflation fears.In another interview, Martin Malone (chief economic advisor at Alphabook) said we could see interest rates on the 10-year as high as 3% by the middle of 2021. He attributes this to "super monetary" and "super fiscal" policies that will continue, unabated.And finally, on Wall Street Week last week, former Treasury Secretary Larry Summers thinks we are "headed for the worst inflation risk in 40 years." He is concerned that there is not a balance between the risks of inflation and deflation or an awareness of the economic growth already underway and how the additional fiscal monetary and fiscal stimulus could "overheat" the economy.This from Warren Buffett's annual letter to shareholders (published on Saturday):

"And bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.

Some insurers, as well as other bond investors, may try to juice the pathetic returns now available by shifting their purchases to obligations backed by shaky borrowers. Risky loans, however, are not the answer to inadequate interest rates. Three decades ago, the once-mighty savings and loan industry destroyed itself, partly by ignoring that maxim."

All of these data points would suggest that bonds are not a great investment right now, which is particularly concerning for many investors, including retirees and those who are nearing retirement who typically rely heavily on bonds for retirement income and "safety." Indeed, real yields have been about negative 1% for the last couple of years and are now approaching zero with the recent rise in rates. If inflation rises rapidly, rates will be playing "catch up" for years. Also, the government can't afford for rates to rise significantly, since the cost to service the almost $28 Trillion national debt will be too great. This means it's very likely that rates will be "capped" (similar to what was done in the 1940's) while inflation is allowed to "run," resulting in a big hit to bondholders with potentially large and rising negative real yields. The bonds will get repaid, so there will be no default, but the decline in the inflation-adjusted value will result in a potentially significant loss of purchasing power. Lyn Alden has a nice overview of this historical context in this podcast.

Ironically, the volatility and risk of rapidly rising interest rates makes bonds one of the riskiest asset classes right now, while Bitcoin with its well documented volatility might actually be a less risky asset in the coming inflationary environment. Bitcoin has many other features, including ease of transfer, very strong security and a verifiable fixed supply and has been called my many well-respected investors as an alternative to gold. Gold and silver have been languishing of late, but that situation seems like it will change soon as well. Even though Bitcoin has stolen some of their thunder, gold and silver are still great hard assets / inflation hedges and an important part of the Financial Fortress. If you're interested in getting started in investing in gold and silver, check out my book here.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

February 21, 2021

Portfolio Allocation Alert

As I discussed in last week's post, inflation seems to be posing more of an issue in investors' minds over the past several weeks. Inflation is manifesting itself in many ways, including a rather rapidly steepening yield curve (higher market-driven long term interest rates with short term rates pegged close to zero by the Fed), increases in commodity prices like copper and oil, and fears that continued fiscal stimulus coupled with huge pent-up demand for "the way things were" (travel and leisure will likely benefit the most from this trend) will ultimately lead to significant inflation in the coming years. If unchecked by the Fed, high inflation could become a big problem for investors who aren't positioned properly.

As I discussed in last week's post, inflation seems to be posing more of an issue in investors' minds over the past several weeks. Inflation is manifesting itself in many ways, including a rather rapidly steepening yield curve (higher market-driven long term interest rates with short term rates pegged close to zero by the Fed), increases in commodity prices like copper and oil, and fears that continued fiscal stimulus coupled with huge pent-up demand for "the way things were" (travel and leisure will likely benefit the most from this trend) will ultimately lead to significant inflation in the coming years. If unchecked by the Fed, high inflation could become a big problem for investors who aren't positioned properly. Not everyone agrees with what is happening - some are saying the steepening yield curve is merely "normalizing," while others are taking the relatively rapid rise as a sign of higher than expected inflation on the horizon. That coupled with the Fed's limited ability to combat inflation by raising interest rates due to the huge amount of public (and private) debt is even more concerning. There is also some disagreement about how higher interest rates and inflation will impact the attractiveness of stocks. It seems to me that interest rates will have to rise a lot to where there is a sufficiently positive real return (and inflation expectations will also need to be confirmed with reality), before investors will be willing to move a significant amount of money out of stocks into bonds. Many investors believe that stocks are a good place to be if there is inflation, especially companies that have pricing power and relatively fixed costs, those that benefit from low short term rates and high long term rates like banks, cyclical stocks and also those that are involved in the production of commodities. High tech growth companies, however, may suffer significant value decline in a high interest rate environment due to the effect on discounted future cash flows (higher interest rates in the future mean lower value in today's dollars assuming the cash flows are held constant).

If you step back and think about it, higher inflation does seem like a natural consequence of what is happening all around us. Due to the pandemic and being stuck at home, for example, the demand for bicycles, appliances and furniture has increased significantly. With supply chains disrupted, manufacturers are having a hard time filling orders, but ultimately prices will rise as rising raw materials and labor costs work their way through the system due to the significant demand. A recent trip to the furniture store confirmed that for me - no negotiating prices / "big sales" and you might have to wait a couple of months to get what you want. Copper has been particularly interesting to me since it is a key component in electric vehicles as well as house construction, both of which have seen unprecedented demand recently and which has likely been a big driver in the recent rise of copper prices.

I have also learned that since copper prices have been so low for so long (about 10 years), there has been no incentive to develop new sources, so supply of copper is somewhat limited, while demand is increasing. This is true of many other commodities, including the so called "rare earth metals" needed for electric vehicles and defense production, uranium, iron ore and many others. Some observers believe we are at the beginning of a 10 year "commodity super cycle" due the confluence of limited supply and strong demand stoked by the "return to normal" post-pandemic phase and massive government fiscal stimulus.

After reflecting on all this, I decided to restructure my portfolio to significantly reduce exposure to bonds and more broadly diversify across the remaining asset classes including adding exposure to commodities, increasing exposure to emerging market stocks, real estate and bitcoin, while keeping a good amount of short term TIPS for emergencies and opportunities. I will wait to move back into longer term bonds until I can see there is a positive real yield that makes sense - otherwise the long term bond rally seems set to continue to unwind in the coming months and years as rates continue to rise and values fall.

Here's the new portfolio allocation after last week's adjustments which still reflects broad diversification, but a move away from long term bonds:

Cash - 14% (mostly held in 4-week US treasury bills, but due to very low and declining yields, shifting over to Vanguard Treasury Inflation Protected Securities ETF (VTIP) for better yield at about 1.2% and low volatility; after that move cash will be about 1.5%)Stocks - 35% Mixed Portfolio of Long Stock Positions and Covered Calls - 11% (cash flow strategy)US Large Cap - 6% US Mid Cap - 6%US Small Cap - 6%Emerging Markets - 6%Commodities - 6%Bonds - 0% (will be 12.5% when the shift to VTIP (5 years or less duration) discussed above is complete; will review higher allocation to longer maturities after interest rates normalize in the future)Real Estate - 22% (rental property 75%; REIT portfolio 25%)Private Equity - 10% (angel investments - posted about this quite some time ago if you are interested - here's the link)Bitcoin - 10% (allocation has grown from 6%-8% target due to small additions and recent price appreciation, but goal is to continue to stay overweight and accumulate through dollar cost averaging over time); if you're interested in different ways to invest in Bitcoin check out my recent post here.Other Alternatives - 3% (mostly physical gold and silver held in a vault and some music royalties)This is intended to be a buy and hold, multi-year strategy. Before investing, make sure you do your own research, consider what others have to say and make your own decisions. Also make sure to look at your overall portfolio diversification regularly.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

February 14, 2021

10 Inflation Defense Ideas For Your Portfolio

Continuing on a theme from last week, I have researched some more investments that would perform well in the event we see a big uptick in inflation in the coming months and lasting for the next few years.

Continuing on a theme from last week, I have researched some more investments that would perform well in the event we see a big uptick in inflation in the coming months and lasting for the next few years. Inflation would be generally bad for stocks, since a lot of the recent increase in stock valuations has been driven by extraordinarily low interest rates and inflation will drive longer-term rates up. Essentially, bonds are not a good investment with such low rates and negative real yields, so investors for the most part have been forced to sell bonds and move into riskier assets like stocks for better returns, creating a virtuous cycle and strong stock market rally for the last 11 months, with a few minor pull backs.

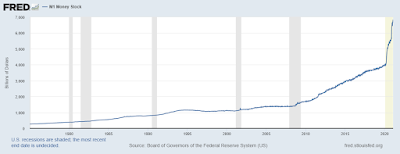

With persistent inflation however, bond yields would eventually climb to a level that would attract more investors away from stocks and looking for "safety." Some have said that could happen when the 10 year Treasury approaches 2.5% or 3%, (assuming no Fed intervention) which would also put a damper on economic activity, including housing and autos which have been leading the recovery so far. In past periods of high inflation (i.e., the 1970's), the stock market traded flat, while commodities performed really well. As I have written previously, we have seen an unprecedented growth in the money supply due to the Fed cutting rates and buying bonds - about $5.7 Trillion committed. The money supply curve has gone parabolic (see chart below).

We have also seen unprecedented monetary stimulus from the Federal government ($4.8 Trillion committed between Legislative and Executive actions so far) with more on the way ($1.9 Trillion current proposal which seems likely to pass largely in the form it was proposed and infrastructure proposal promised to follow). Here's an interesting summary I found on the total amount of COVID support outstanding - it's staggering. Both of these forces seem likely to result in a very strong economic recovery, which will ultimately lead to higher inflation. Once inflation gets started, it will be difficult to get the "genie back in the bottle" without hurting the economy with higher interest rates. Interest rates are headed up (chart below shows the 10-year Treasury yield, an important benchmark that impacts housing and commercial loans), with the recent increase likely due to inflation expectations - currently at 1.16%. This is still low by historical standards and so not a concern yet, but we'll have to see how the next few months plays out.

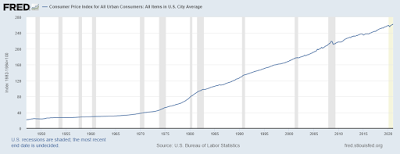

Inflation as expressed by the Consumer Price Index continues to look tame as shown in the chart below, showing a 1.4% increase in January 2021 vs a year ago, but of course the long term perspective is that purchasing power of the dollar is eroding steadily over time. You can also see the big increase in inflation during the 1970's on this chart where the price index doubled from 40 to 80 or 100%:

If you invest in 10 year Treasuries at 1.16%, you are earning a negative 0.24% real rate of return after inflation. That's troubling enough. However as I have written before, there are many issues with how the Consumer Price Index is calculated, particularly that it excludes housing, food and energy costs (due to their volatility), but as everyone knows all have been increasing steadily recently. Also, the way the index is calculated has changed over time and has not been consistent. The real rate of inflation could be closer to 10%, as shown in the chart below. That really changes the math of the real inflation-adjusted return on Treasuries - a negative 8.84% real rate of return. No wonder Bitcoin is so popular.

Here's my list of 10 ideas for inflation defense (you can spread across all ten equally weighted or pick and choose which ones make the most sense for your portfolio):BlackRock Resources & Commodities Strategy Trust (BCX) - actively managed commodity closed-end fund that invests primarily in common stocks of miners, chemical companies, oil companies and other basic materials companies; 6.13% distribution yield and currently trades at a small discount to net asset valueFreeport-McMoRan (FCX) - copper and gold miner; pays a dividend but very small yieldSPDR Gold Trust (GLD) - no yield, just exposure to physical goldBarrick Gold (GOLD) - gold miner; 1.38% yield and Warren Buffet likes themSprott Physical Silver Trust (PSLV) - no yield, just exposure to physical silver and said to be better than SLVRio Tinto (RIO) - diversified mining company (Iron Ore, Aluminum, Copper/Diamonds - includes gold, silver, molybednum, Energy/Minerals - includes uranium, borates, salt, titanium dioxide and coal); 4.61% yieldProShares UltraShort 20+ Year Treasury ETF (TBT) - 0.3% yield, this is a 2x inverse long term US Treasury ETF; if interest rates on longer-dated treasuries continue to climb with inflation expectations/reality, the fund's value will increaseVanguard US REIT Fund (VNQ) - diversified ETF representing market-cap weighted index of entire US REIT market - real estate has historically benefited from inflation since financing costs are generally fixed for extended periods of time, operating cost controls are generally very good and rent income tends to move up with inflation; 3.89% yieldVanguard Short-Term Inflation-Protected Securities ETF (VTIP) - tracks an index of Treasury Inflation Protected Securities with 5 years or less remaining to maturity; 1.19% yieldVanguard FTSE Emerging Markets Fund (VWO) - tracks a market cap weighted index of emerging market stocks - weak dollar resulting from inflation will be a boon for emerging markets; 1.77% yield

I may make some of these moves, but not for a few months until I can see a bit more confirming evidence that inflation is indeed on the move. This is intended to be a buy and hold, multi-year strategy. I think we will have pretty good confirmation of where inflation is headed by this summer. Before investing, make sure you do your own research, consider what others have to say and make your own decisions. Also make sure to look at your overall portfolio diversification regularly.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.