Nick Reichert's Blog, page 15

July 5, 2020

Here Comes Earnings Season

With continuing challenges to control COVID-19 in many parts of the country, earnings season arrives with plenty of uncertainty. Many analysts continue to predict large year over year drops in earnings for most of the S&P 500 companies. The mega-cap FAANG tech stocks are generally expected to continue to do well in the current environment but beyond that, it's anyone's guess. The real question is will the markets trade flat, drop or move into rally mode? Without a really great catalyst like another huge stimulus bill from Congress or more action from the Federal Reserve, in the absence of great earnings numbers, my best guess is the market overall moves sideways into the Fall possibly setting up for a rally in the winter as the economy shows more signs of recovery. If that's the case, it's probably a great environment for buying quality companies and selling calls, since there should be minimal downside for the stock price thanks to the Federal Reserve's "easy money" policy (plenty of volatility of course but should track flat to the market) and you can keep more of your call premiums without getting exercised.

With continuing challenges to control COVID-19 in many parts of the country, earnings season arrives with plenty of uncertainty. Many analysts continue to predict large year over year drops in earnings for most of the S&P 500 companies. The mega-cap FAANG tech stocks are generally expected to continue to do well in the current environment but beyond that, it's anyone's guess. The real question is will the markets trade flat, drop or move into rally mode? Without a really great catalyst like another huge stimulus bill from Congress or more action from the Federal Reserve, in the absence of great earnings numbers, my best guess is the market overall moves sideways into the Fall possibly setting up for a rally in the winter as the economy shows more signs of recovery. If that's the case, it's probably a great environment for buying quality companies and selling calls, since there should be minimal downside for the stock price thanks to the Federal Reserve's "easy money" policy (plenty of volatility of course but should track flat to the market) and you can keep more of your call premiums without getting exercised. One recent addition to my portfolio was Netflix (NFLX). This Company continues to benefit from the stay at home trend and is also well situated for the long, slow recovery. I picked up some shares last week in advance of earnings on 7/16 and immediately sold slightly out of the money calls with a very nice premium and the same day the stock hit the exercise price. Either way, it will be a nice profit whether the stock stays up there and I get exercised or drops after earnings and I get to keep the stock and premium and sell more calls. Netflix is not a bad stock to hold in your portfolio long term. I am also holding Lululemon (LULU) and Lennar (LEN); both companies are leaders in their industries, have great long term upside and have solid call premiums in the meantime.

I have tried to stay away from the very speculative stocks for this strategy like the airlines, cruise ships, companies on the verge of or in bankruptcy, etc. Many of those trades may look attractive, but you always have to think of the worst case scenario especially if you are using any margin to invest. My simple rule is don't buy anything you wouldn't mind holding in your portfolio for a very long time - companies with a good secular growth story, industry leaders, strong balance sheets, etc. From my recent experience, I think the Invesco QQQ Series Trust (QQQ) (one of the best diversified ways I have found to invest in the FAANG stocks and also other great companies in the top 100 Nasdaq by market cap) and Abbvie (ABBV) (a growing pharma company with a great dividend - currently 4.77% yield) continue to look good in light of the current environment, have upside potential and also pay a dividend - these two have been particularly good for the covered call strategy over the last couple of months.

Another earnings season idea that looks interesting is Boeing (BA). This is a company that has seen it's ups and downs this past year both internally (737 Max) and externally (COVID-19 impact on airline industry). Boeing's business includes not only commercial aviation, but defense, space and security systems which gives it some diversification. It currently trades at $181, about $60 below the average of the 52 week high and low prices, so would appear to have some upside with a little good news. Earnings is scheduled for 7/22 and the 7/24 calls for $185 (slightly out of the money) are a whopping $11.35, which means for owning 100 shares you could collect $1,135 in call premium and potentially make another $400 if the stock goes above the strike price at expiration. Worst case, you keep the $1,135 and sell more calls for the following weeks - with the stock's recent volatility premiums should continue to be attractive.

Of course, you will need to do your own homework and invest where you feel comfortable. What I have provided above is simply my strategy and I'm not recommending any particular stock or strategy. Stay safe, healthy and positive. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on July 05, 2020 12:39

June 28, 2020

New Dividend Screen

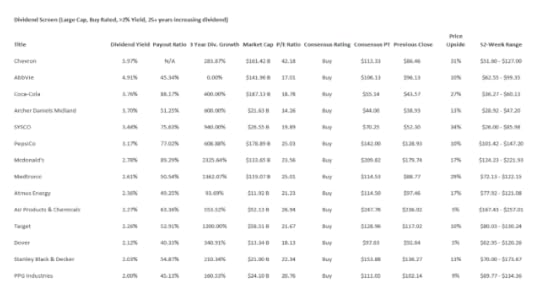

I recently completed a new stock screen to identify some potential dividend stocks to add to my portfolio in the coming months. You can find my last post on the topic here. The new screen filtered for large cap ($10B-$200B market cap) stocks with a consensus "buy" rating, yielding 2% or more and with a 25+ year track record of dividend growth. Many of the usual suspects continue to show up, consistent with past screens I have done, including my perennial favorite AbbVie (ABBV) with a 4.91% yield and great future dividend raise prospects, having recently acquired Allergan and further expanding the product pipeline.

I recently completed a new stock screen to identify some potential dividend stocks to add to my portfolio in the coming months. You can find my last post on the topic here. The new screen filtered for large cap ($10B-$200B market cap) stocks with a consensus "buy" rating, yielding 2% or more and with a 25+ year track record of dividend growth. Many of the usual suspects continue to show up, consistent with past screens I have done, including my perennial favorite AbbVie (ABBV) with a 4.91% yield and great future dividend raise prospects, having recently acquired Allergan and further expanding the product pipeline. Other great companies show up on this screen, including Chevron, Coca-Cola, McDonald's and Target. I also included a percentage calculation of upside from previous close to the analysts' consensus price target in the table. Some notable companies with a high degree of potential stock price upside include Sysco (SYY - 34%), Chevron (CVX - 31%), Medtronic (MDT - 29%) and Coca Cola (27%). All of these stocks will depend upon the continued reopening of the US economy in order to achieve these upside targets and they may continue get buffeted around with the volatility and daily COVID-19 news in the meantime. In the long run, however, these stocks should do fine and the analysts would seem to agree. Stanley Black and Decker (SWK) stands to gain from an uptick in home improvement due to people staying at home and also increasing demand for new and existing homes due to very low interest rates.

I also ran the same screen for mega cap stocks (over $200B market cap) and it only returned two companies which should be familiar: Proctor and Gamble - 2.93% yield (PG) and Johnson and Johnson - 2.74% yield (JNJ). Both companies have been resilient during the current difficult economic times, with PG stock price up 5% over the past year and JNJ down 1% over the past year.

I continue to favor a conservative stock investing strategy heavily focused on strong, stable dividend yield for cash flow. I also like to sell call options for additional yield, with a bias toward large heavily-traded index funds like SPY and QQQ, but I will also look at solid individual stocks, where the call premiums are good and I don't mind holding for some time. Some recently acquired stocks include Lululemon (LULU) and Lennar (LEN), both leaders in their respective industries and poised to do well as the economy recovers. AbbVie has also been a profitable stock for selling calls, with high premiums and pretty consistent upward movement in the stock, although it often moves into the money, resulting in an exercise of the underlying option and having to repurchase shares. As long as your call strike price is above your cost basis, however, you will not lose money, which is one of the things I find most attractive about selling call options. I outline the strategy in more detail in my previous post here.

Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on June 28, 2020 15:10

June 20, 2020

Investing For a Long, Slow Recovery

With recent events unfolding, including increasing COVID-19 cases as the country reopens, some slowing of states' reopening in response to major spikes in cases, store re-closures (for example, Apple's announcement on Friday), delays in the cruise industry resuming operations, etc., it's looking like the recovery will be slow and bumpy. Economic news has been mixed, with retail sales growing faster than expected and a good jobs report a couple weeks ago, followed by reports of more cases and higher weekly unemployment claims than anticipated last week. While many economists agree the worst is behind us in terms of the unemployment and other major impacts of the almost three month shutdown of the economy due to COVID-19, there is less agreement about the future path of recovery.

With recent events unfolding, including increasing COVID-19 cases as the country reopens, some slowing of states' reopening in response to major spikes in cases, store re-closures (for example, Apple's announcement on Friday), delays in the cruise industry resuming operations, etc., it's looking like the recovery will be slow and bumpy. Economic news has been mixed, with retail sales growing faster than expected and a good jobs report a couple weeks ago, followed by reports of more cases and higher weekly unemployment claims than anticipated last week. While many economists agree the worst is behind us in terms of the unemployment and other major impacts of the almost three month shutdown of the economy due to COVID-19, there is less agreement about the future path of recovery. What seems most likely from what I have read is a long, slow recovery that looks almost like a Nike whoosh symbol. It could take a year or even longer to fully recover and we may still at that point have elevated unemployment since some jobs simply may not come back as entire industries restructure their operations. The US Federal Reserve has provided a tremendous amount of liquidity and market support, creating a "floor" under asset prices unlike anything we have seen in history. However the stock market continues to be very volatile, rising and falling rapidly depending on the news flow from day to day.

There are some sectors of the economy benefiting from this environment, most notably are the technology stocks and in particular the larger "FAANG" stocks, which have outperformed the rest of the market pretty much since the crisis began. Many of these companies have great balance sheets, plenty of cash and cash flow, solid growth business models and have benefited greatly from the "Work From Home" experience and will continue to benefit as the economy recovers. An easy way to invest in this trend is to buy the QQQ ETF, which represents the Nasdaq 100, the top 100 stocks in the Nasdaq index (non financial) by market cap. QQQ also pays a 0.66% dividend yield.

Another trend seems to be pharmaceutical companies, which can benefit from the search for a COVID-19 vaccine, but also from healthcare trends in general especially as pent-up demand for elective procedures kicks in as COVID-19 subsides. These stocks, which tend to pay higher dividends are also more "defensive" in a volatile market. One of my favorite pharma stocks is Abbvie (ABBV). Abbvie recently completed an acquisition of Allergan which helps broaden its product line and provides even more future cash flow from existing drugs. The current dividend yield is 4.88%, which is among the best out there and the stock has been steadily rising since the completion of the merger. In the current zero interest rate environment, that's an excellent yield with very little downside and a lot of upside to the stock (analysts' average price target is $101 and recently trading at $96.50).

Since it's pretty obvious that COVID-19 will be with us for some time, stocks like Clorox (CLX - 2.04% dividend yield) that help us keep our homes, offices and other places we frequent clean and virus-free, are likely to continue to do well at least for the next year or two. Also, with people spending more time at home and not taking vacations where will they spend that extra money? Some analysts think Lowes (LOW - 1.64% dividend yield) and Home Depot (HD - 2.43% dividend yield) will benefit from a home improvement trend. Being deemed "essential" during the nationwide shutdown, these companies stayed open and continue to build on their key strengths of size and scale. They also benefit from a robust housing market - see below.

One surprising recent trend is the strength of the housing market, likely due to super low interest rates and a desire by some people to relocate from cities to suburban areas due to COVID-19 and recent civil unrest. This is also helped by being able to work from home, with many companies being very flexible about this - a trend that may continue after the pandemic. A beneficiary of this trend is Lennar (LEN - 0.83% dividend yield), one of the largest home builders in the nation and has recently traded lower since it's recent (but very good) earnings announcement. Average analyst price target is almost $71 and stock closed at $59.90 on Friday.

Any stock that pays a safe, high dividend is good in this low-interest rate environment as part of your portfolio, but some are better than others as noted in my recent post here.

Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on June 20, 2020 22:23

June 14, 2020

Life Insurance

Most financial gurus recommend that you buy a cheap term life insurance policy in an amount sufficient to cover your family's needs in the event you pass away. The premiums are generally way lower than whole or permanent life insurance, at least initially, but they do go up as you age and the policy typically expires when you are around retirement age. The term policy expiration date is usually well before you are likely to pass away, so the chance of your beneficiaries receiving the death benefit is low.

Most financial gurus recommend that you buy a cheap term life insurance policy in an amount sufficient to cover your family's needs in the event you pass away. The premiums are generally way lower than whole or permanent life insurance, at least initially, but they do go up as you age and the policy typically expires when you are around retirement age. The term policy expiration date is usually well before you are likely to pass away, so the chance of your beneficiaries receiving the death benefit is low. The financial guru mantra is "pay less and invest the rest." While that sounds great, doing well with that strategy assumes that you actually do save and invest the difference between the whole life and term life policy, and that you are somewhat successful in that effort such that you earn a greater after-tax return than the cash surrender value that will build up in your whole life policy over time. As a practical matter, that is very difficult to do, especially if you are in a high tax bracket and you could be missing out on a great retirement and estate planning tool.

Here's a brief summary of each type of insurance:

Term Life:Low initial cost / cheaper than whole life, but premium does go up as you get olderBuy basic coverage that you need"Pay less and invest the rest"Whole Life:Level premium (never goes up), but significantly more expensive than term life Part of premium goes to cover insurance cost and part of it builds up "cash surrender value"Can access cash surrender value tax free, if needed, for any reason through policy loans or "partial surrender"Policy dividends (earnings from the insurance company's general account attributable to your policy) can increase cash surrender value and / or increase death benefit and are tax-freeUnlike 401(k) and IRA accounts, there is no minimum required distribution - if you don't need the money you can just let it continue to grow and as mentioned above you can take funds out tax-free (when using a policy loan), so great for retirement planningContinuing coverage until you pass (no expiration, "permanent")Great wealth transfer idea, since proceeds are tax free to beneficiaries and you can't outlive permanent life insuranceI have a term life policy with Northwestern Mutual that is convertible into whole life at any time up to age 60, with no need for a physical. The annual premium has been growing steadily, which prompted me to look at it the last few years. I decided to exercise that conversion option this year to take advantage of the benefits of whole life as an investment diversification strategy and also for the estate planning and tax benefits outlined above. The first few years aren't great in terms of cash surrender value growth, but after that it grows quite nicely according to the illustration provided. The process was very simple and now I'm happy to have permanent life insurance coverage not only to protect my family now but in the future as a great generational wealth transfer tool. I believe it's important to maintain life insurance outside of your work's group term life policy. In the event you lose your job, you should have "portable" coverage, which is why I have maintained the convertible term life policy for many years.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. Stay safe, healthy and positive.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on June 14, 2020 14:35

June 7, 2020

A New Bull Market?

In the last couple of weeks, there have been several confirming data points that the stock market rally from the March lows might be for real, as much as people hate to admit it (especially stock market "Bears"). The most recent positive proof was the May jobs report last week Friday, which showed the most job growth in history (+2.5M) compared to expectations of significant losses (-7.5M). While the unemployment rate is still very high at 13.3% (might be revised up to 16.3% based on some data errors), positive news is positive news. All around the US, there are more and more signs of the positive effects of the economy reopening, people going back to work and business conditions improving, albeit at a much lower pace initially due to social distancing protocols. With California and now New York reopening, this positive momentum is set to continue. Professional sports including the NBA are preparing to come back. Airlines and cruise ship companies are reporting increased bookings. Restaurants and retail establishments are reopening - Mall REITs last week soared almost 50%, with some individual REIT's almost doubling in value and still well off of their highs pre-COVID-19. These include names like Simon Property Group (SPG), Washington Prime Group (WPG) and Pennsylvania Realty Trust (PEI). The bond market last week seemed to also acknowledge the recovery by pushing yields up on longer dated bonds (caused by selling bonds), which would make sense if investors were beginning to rotate some money back into the stock market. Below is a chart of the 30-year treasury bond:

In the last couple of weeks, there have been several confirming data points that the stock market rally from the March lows might be for real, as much as people hate to admit it (especially stock market "Bears"). The most recent positive proof was the May jobs report last week Friday, which showed the most job growth in history (+2.5M) compared to expectations of significant losses (-7.5M). While the unemployment rate is still very high at 13.3% (might be revised up to 16.3% based on some data errors), positive news is positive news. All around the US, there are more and more signs of the positive effects of the economy reopening, people going back to work and business conditions improving, albeit at a much lower pace initially due to social distancing protocols. With California and now New York reopening, this positive momentum is set to continue. Professional sports including the NBA are preparing to come back. Airlines and cruise ship companies are reporting increased bookings. Restaurants and retail establishments are reopening - Mall REITs last week soared almost 50%, with some individual REIT's almost doubling in value and still well off of their highs pre-COVID-19. These include names like Simon Property Group (SPG), Washington Prime Group (WPG) and Pennsylvania Realty Trust (PEI). The bond market last week seemed to also acknowledge the recovery by pushing yields up on longer dated bonds (caused by selling bonds), which would make sense if investors were beginning to rotate some money back into the stock market. Below is a chart of the 30-year treasury bond:

We all know the backdrop of the unprecedented amount of fiscal and monetary stimulus that has been unleashed to fight off the massive and equally unprecedented unemployment and decline in business conditions since the start of the COVID-19 pandemic in early March. Could this be the shortest (and worst) recession on record followed by the shortest (and best) recovery on record? Or was the data we saw last week a "head fake" and will this continue to be a long and protracted recession (with a "U" shaped recovery versus the so-called "V" shaped recovery)? Only time will tell for sure.

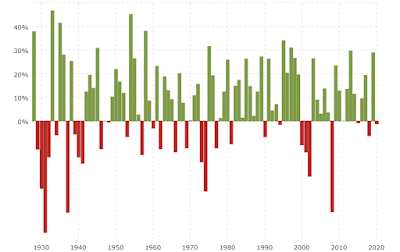

In the meantime, it seems best to stay the course with whatever your investing strategy has been, which hopefully includes an allocation to stocks. If you have held on to your stocks through the COVID-19 crisis, much of the losses suffered since March have recovered and you might even be looking to add selectively as cash is available. My stock portfolio strategy is focused on safety / cash flow and is heavy on solid dividend paying stocks. I have recently started selling slightly out of the money call options on highly-liquid and broadly diversified index funds that I own (SPY, QQQ) to generate additional cash flow- see my recent post A Simple Option Trade. I'm still a big believer in broad diversification across multiple asset classes (the Financial Fortress) including real estate, precious metals, stocks, cash and alternative assets (such as royalties and Bitcoin) to weather any storm. However, it's important to also have some cash set aside not only for emergencies, but also to take advantage of opportunities as they arise. It seems that there are definitely some opportunities in the stock market and as the rally continues a focus on of the more beat-up sectors such as retail, restaurants, travel and leisure, small cap stocks, etc. might make sense as part of the "reopening rally" theme. One thing is for sure, historically there is a lot more positive return years in the stock market than negative - about 75% of the time the outcome is positive and 25% it's negative (see chart below):

S&P 500 Historical Annual Returns

S&P 500 Historical Annual ReturnsI hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. Stay safe, healthy and positive.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on June 07, 2020 12:03

May 30, 2020

The Final Frontier?

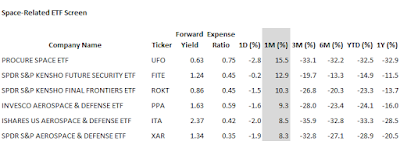

I really enjoyed watching today's SpaceX launch of two astronauts on a mission to the International Space Station. I have to admit, I was a little nervous, since I still have vivid memories of the Space Shuttle Challenger's (1986) and Columbia's (2003) failed missions. Especially since we have had such a rough year so far in 2020. But as it turned out, the launch went as planned and the astronauts are on their way to the ISS. With this launch, a new era of America's space program begins as well, with a private / public partnership hopefully making space travel safer and less costly. Missions to the moon and Mars seem to be well within our reach now. It's a very exciting development indeed. In thinking about the opportunity that commercial space flight offers, I did a little research into ETF's that can give you exposure to this emerging growth area. Not surprisingly, many of the stocks tracked by these ETF's are in the aerospace and defense industry and are mostly industrial companies, which is important to keep in mind when looking at your overall portfolio diversification. See below for the screener results:

I really enjoyed watching today's SpaceX launch of two astronauts on a mission to the International Space Station. I have to admit, I was a little nervous, since I still have vivid memories of the Space Shuttle Challenger's (1986) and Columbia's (2003) failed missions. Especially since we have had such a rough year so far in 2020. But as it turned out, the launch went as planned and the astronauts are on their way to the ISS. With this launch, a new era of America's space program begins as well, with a private / public partnership hopefully making space travel safer and less costly. Missions to the moon and Mars seem to be well within our reach now. It's a very exciting development indeed. In thinking about the opportunity that commercial space flight offers, I did a little research into ETF's that can give you exposure to this emerging growth area. Not surprisingly, many of the stocks tracked by these ETF's are in the aerospace and defense industry and are mostly industrial companies, which is important to keep in mind when looking at your overall portfolio diversification. See below for the screener results:

While all of these ETF's have performed poorly looking back 3/6/12 months, over the past month, they have seen some life as the stock market has rallied. The best performer has been the Procure Space ETF, with a one month return of 15.5%. It also has the highest expense ratio of the group at 0.75 and the lowest dividend yield of the group at 0.61%, both of which aren't great. However, if the superior return can be sustained maybe that's not such a big deal. The ticker symbol for this ETF is appropriately "UFO."

Here are the top holdings of UFO:

Virgin Galactic, DISH Network, Garmin and Sirius XM Holdings might be familiar names, but here's a summary of the top three companies, which might not be that familiar to you:ORBCOMM, Inc. engages in the provision of network connectivity, devices, device management, and web reporting applications. Its products are designed to track, monitor, control and enhance security for a variety of assets, such as heavy equipment; fixed asset monitoring; government and homeland security; and in industries for manufacturing, warehousing, and supply chain management. It operates through the following geographical segments: United States, South America, Japan, Europe, and Other. The company was founded on April 4, 2001 and is headquartered in Rochelle Park, NJ.Maxar Technologies, Inc. provides space technology solutions, delivering unmatched end-to-end capabilities in satellites, robotics, Earth imagery, geospatial data, analytics and insights. Its segments include Space Systems, Imagery and Services. The company was founded on February 3, 1969 and is headquartered in Westminster, CO.Trimble, Inc. engages in the provision of positioning technology solutions. It operates through the following segments: Buildings and Infrastructure, Geospatial, Resources and Utilities, and Transportation. The Buildings and Infrastructure segment serves architects, engineers, contractors, owners, and operators. The Geospatial segment offers solutions for the customers working in surveying, engineering, and government. The Resources and Utilities segment caters customers working in agriculture, forestry, and utilities. The Transportation segment covers long-haul trucking, field service management, rail, and construction logistics industries. The company was founded in 1978 by Charles Robert Trimble and is headquartered in Sunnyvale, CA.Unfortunately, SpaceX is still a private company owned by Elon Musk so until he decides to take it public like Tesla, you'll have to find other ways to invest in the Space Economy. Hopefully this ETF list gives you some ideas.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. Stay safe, healthy and positive.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on May 30, 2020 19:29

May 23, 2020

A Simple Option Trade

I recently discovered a simple, high probability option trade that so far I have really liked. If you have read my past posts, you will know my journey with Robinhood option trading and the crazy ups and downs of buying calls and puts and also more complex strategies like straddles, strangles and iron condors. Like most people who try these strategies, my results weren't very good and resulted in mostly losses. I'm not sure experience really helps, since you are pretty much relying on luck when you enter most of these trades. That's why I compared it to gambling in my post entitled Free Trades May Cost More Than You Think.

I recently discovered a simple, high probability option trade that so far I have really liked. If you have read my past posts, you will know my journey with Robinhood option trading and the crazy ups and downs of buying calls and puts and also more complex strategies like straddles, strangles and iron condors. Like most people who try these strategies, my results weren't very good and resulted in mostly losses. I'm not sure experience really helps, since you are pretty much relying on luck when you enter most of these trades. That's why I compared it to gambling in my post entitled Free Trades May Cost More Than You Think. Staying with the gambling analogy, there is another strategy where you are more like the "house" with the odds in your favor and this is selling covered calls. Selling a covered call is basically selling the right for someone to buy shares of a stock you own at a set price that expires at a certain time. The buyer pays a premium to you for this right in cash. The calls are "covered" because you own enough of the underlying shares to sell, should the contract expire "in the money" and the shares are purchased. You can also sell calls "naked" or not covered, but I don't recommend that at all.

Say you want to own a dividend paying stock like Coke, which currently yields about 3.6% and has a strong likelihood of being able to continue to maintain that dividend, even in the current recession. While that's a nice dividend, you'd like to make a little more. Coke currently trades at $45.11 per share, so you can buy 100 shares for $4,511. You will earn $162 a year in dividends - passive income without you having to lift a finger.

You can also sell a covered call on Coke with a $47 strike price, expiring in about two weeks on June 5 for $0.18 per share (one contract is 100 shares so you would get $18 of premium for selling the call). If Coke is trading below $47 on June 5 (86% chance of this happening according to Robinhood option quote), you keep the premium and nothing happens to your shares. Another way to look at this is there is a 14% chance that the option expires in the money and you have to sell your shares. If you did that every two weeks, you could make an extra $468 per year, almost 3x the dividend! There are calls that have a higher probability of profit, but you get a lower premium since they are lower risk. For example, you could sell a call with a $49 strike price and same expiration date, but you would only get $11 for that one and a 93% chance of profit. If you can get 90%+ probability of profit and a premium you are happy with, then it's likely a good trade.

If the stock is trading above the strike price on the expiration date, then you will get "exercised," which means your shares will be sold for $47 per share at that time. You still get to keep the premium of $18 plus you will get the proceeds from the sale of shares ($4,700) and have a gain on the sale of your shares of $189 ($4,700 - $4,511), so you would have made a total of $207 ($18 + $189) and you still have your original investment money. As long as you don't sell calls with strike prices below your cost basis, you will make money in the unlikely event the option is exercised. If you sell your shares for a loss and buy them back right away, you could lose the ability to deduct the loss on your tax return (called "wash sale rules") so that's something to be aware of and to talk to your CPA about.

I like this strategy for earning extra cash flow on stocks I want to keep long term. If you keep the duration of the option short - like only one or two weeks, you'll have a higher probability of keeping the premium but of course will earn less of a premium. The only "loss" you incur if you are exercised is the opportunity cost of being able to sell your shares for a higher price (the difference between the market price and the strike price at expiration). In a declining market, this is a great way to make extra money above your dividends. In a rising market, while there's a higher chance of getting exercised, you have the option to repurchase your shares (albeit at a higher price) or buy something else and repeat the process.

At certain times, like around earnings, stocks become more volatile and option premiums can be higher than they are normally, but so can the risk of exercise so you have to use judgment when selling calls into earnings. There's a great covered call screening tool at Barchart.com. You can study the different trades to see which ones have the best return probability. Of course, there's a chance you buy a stock and the price drops significantly, which could be a problem if you aren't willing to hold it, but at least you would keep the premium. Hertz was high on this list a week or so ago and now they are in bankruptcy and the stock is down significantly, so you do need to be careful and do your research on stocks that pop up on screeners like this. I prefer to invest in solid, conservative dividend yielding stocks so the call premiums may not be that great, but overall it's less risky.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. Stay safe, healthy and positive.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on May 23, 2020 19:10

May 16, 2020

Top 25 ETF's Last Week

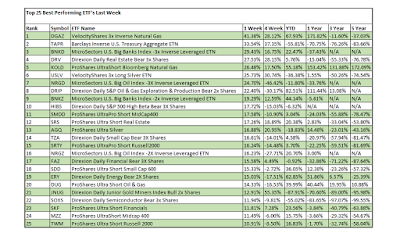

I did a quick scan of the top performing ETF's last week (Top 25) and wanted to share this information with you - not necessarily as recommended investments, since many of these are inverse and / or highly leveraged, carry a considerable amount of risk and are generally speculative in nature (i.e., "trading" vs "investing"). Instead, I thought it would be interesting to see the themes and trends that are emerging in the markets. In particular, what sectors have been performing poorly (as demonstrated by the out-performance of the inverse ETF's that track the underlying indices). 3x Inverse Natural Gas is top of the list (DGAZ) with a 41% return last week, followed by Inverse US Treasury ETN (TAPR) with a 34% return, US Big Banks Index 3x Inverse Leveraged ETN (BNKD) with a 29% return, the Real Estate Bear 3x (DRV) with a 28% return and again a Natural Gas Short (KOLD) with a 26% return, rounds out the top 5.

I did a quick scan of the top performing ETF's last week (Top 25) and wanted to share this information with you - not necessarily as recommended investments, since many of these are inverse and / or highly leveraged, carry a considerable amount of risk and are generally speculative in nature (i.e., "trading" vs "investing"). Instead, I thought it would be interesting to see the themes and trends that are emerging in the markets. In particular, what sectors have been performing poorly (as demonstrated by the out-performance of the inverse ETF's that track the underlying indices). 3x Inverse Natural Gas is top of the list (DGAZ) with a 41% return last week, followed by Inverse US Treasury ETN (TAPR) with a 34% return, US Big Banks Index 3x Inverse Leveraged ETN (BNKD) with a 29% return, the Real Estate Bear 3x (DRV) with a 28% return and again a Natural Gas Short (KOLD) with a 26% return, rounds out the top 5. Here's the Top 25 ETF list for last week:

What's not surprising to see is long silver and gold funds (3 funds or 12%), short oil and gas funds (7 funds or 28%) and short banks (4 funds or 16%). Precious metals have been performing well with all the government stimulus and monetary easing recently and fears of deflation followed by major inflation. Also, the recession's impact on the economy and dramatically reduced demand for energy and the impact of very low interest rates and the economic disruption on financial services companies are also well understood. There are 7 funds (28%) that short various stock market indices, which is also not too surprising given the recent stock market volatility and popularity of "shorting the index." One semiconductor short and one US Treasury short round out the mix and again, not too surprising given recent market action in the wake of the COVID-19 pandemic and onset of a recession.

What is surprising is that there are two real estate short funds on the list (8% of the total). Typically in a recession, real estate is considered a defensive play, but in this recession due to massive impact the pandemic has had on almost every type of real estate asset, there are expectations that real estate values will plummet more broadly and perhaps worse than during the Great Recession.

Lodging / Resorts (YTD Return -45.81%) Many hotels have closed due to lack of travel resulting from the pandemic. As the country reopens and travel slowly resumes, social distancing measures will make the process very slow and some hotels may never reopen or if they do, it could be years before they are profitable. It's hard to imagine business travel will quickly return to normal due to the cost and difficulty of travel (many companies have been forced to cut back expenses in the wake of the recession) and also the ability to conduct remote video conferences to accomplish the same tasks. Even leisure travel could take some time to come back (no doubt some travelers will be lured by low prices).

Retail (YTD Return -41.16%) For retail, tenants are going out of business and those that remain (other than the "essential businesses" like hardware stores, grocery stores, etc. who have been doing quite well recently) will struggle to pay their rent. There have also been many high-profile retail bankruptcies recently, most recently J. Crew, Neiman Marcus and JC Penney and many more retailers are in jeopardy. All of these bankruptcies mean lots of empty spaces at shopping centers and malls, which will make it very hard for property owners to cover their expenses including paying the mortgage.

Office (YTD Return -22.63%) In the office sector, there are similar issues with tenants who are going out of business and / or are struggling to pay rent. What's more important, however, is the longer term trend that many companies may have much of their workforce work from home if not all of the time at least part of the time. Indeed, many tech companies such as Google, Twitter, Amazon, Facebook, Microsoft, Slack and Zillow have already allowed an extended period of time for employees to work from home, some until the end of 2020 and for Twitter, "permanently." If this trend continues, it could dramatically reduce demand for office space in the future which could again put pressure on property owners being able to cover expenses.

Residential (YTD Return -18.05%) Even residential real estate is facing challenges with tenants still paying rent, but struggling and without a rebound in job growth or continued government assistance in the form of unemployment benefits and stimulus checks, paying the rent will only get more difficult over time. Landlords will not be able to evict for many months due to recent eviction moratorium legislation at the federal, state and local levels. Landlords could face a large number of non-paying tenants building up over time. However, it's clear that the residential space is performing the best right now.

For more information on real estate sector performance check out NAREIT's website here.

Legendary investor Carl Icahn is "short commercial real estate" and says he hasn't seen this good of a risk/reward opportunity in many years. This is a little scary, since many investors view real estate and the relatively high, steady yields produced as safe. Indeed, many sellers of commercial mortgage fund products tout their relative safety and yield compared to US Treasuries, which clearly is not the case in this recession. Mortgage REITs are down -47.61% year to date, with home financing (-49.1%) performing slightly worse than commercial financing (-44.3%)

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. Stay safe, healthy and positive.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on May 16, 2020 22:47

May 9, 2020

Bitcoin - Volatile, But Still a Great Idea

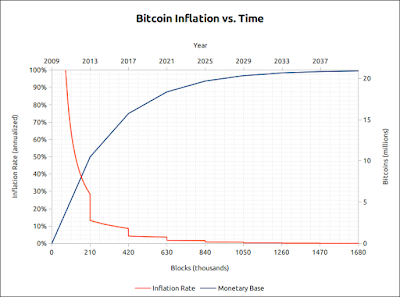

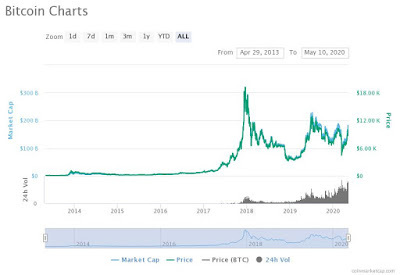

As Bitcoin continues to grow in popularity, and especially as it has garnered more attention with the upcoming halving on May 12, the investment thesis continues to be strong for this digital asset. The halving is when the reward for Bitcoin miners will be cut in half on that date (as it does about every four years), which basically reduces the amount of Bitcoin going into circulation, which should in theory increase the value of Bitcoin over time assuming demand remains the same or increases. By maintaining scarcity in its algorithm, Bitcoin avoids the problem that fiat currencies face when more money is put in circulation, resulting in inflation or a long term decline in the purchasing power of the currency.

Below is a chart of the value of the US dollar from January 1985 through April 2020. As you can see, depending on who you believe, the dollar now buys somewhere between 60% and 70% of what it did in 1985, due to the effects of inflation.

The main reasons for investing in Bitcoin include:Store of value that may even be superior to gold due to Bitcoin's liquidity compared to gold, especially physical gold which is difficult to buy / sell, handle and storePrivacy and ease of completing payments and transfers, even for large amounts, without an intermediary like a bankHedge against dollar and other fiat currency depreciation which will be inevitable result of recent monetary actions taken to combat the COVID-19 economic downturn (Fed has implemented many programs that simply amount to accelerated money printing)Programmed scarcity (halvings) will continue to drive value up as long as demand remains constantHas outperformed many, if not most, other investments since it's inception at +6,300%

I still think the best approach is to keep your Bitcoin investments small and dollar cost average over time - maybe $100 to $200 per month or a little more if you can afford it. If you invest consistently, you can take advantage of price decreases, since Bitcoin is very volatile and can experience significant price drops in a short period of time. The key is to continue to accumulate over time and don't sell - this is truly a long term buy and hold investment.

I have invested in the so-called "alt coins" in the past, including Litecoin, Ethereum, Ripple and others but I believe Bitcoin with the largest market capitalization ($160Bn) is the best bet for long term adoption and ultimate success as an investment and medium of exchange. As such, I have limited my cryptocurrency investing to only Bitcoin starting about a year ago.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. Stay safe, healthy and positive.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on May 09, 2020 20:27

May 3, 2020

File Cleaning For Spring

Once a year, usually when I'm finished filing my taxes as I have done recently, I go through my home office file cabinets and perform a "Spring File Cleaning." This has several benefits, including:

Once a year, usually when I'm finished filing my taxes as I have done recently, I go through my home office file cabinets and perform a "Spring File Cleaning." This has several benefits, including:Helps create room to file bills for the new year and makes the file drawers easier to open and closeAllows me to archive last year's stuff in case I need it for some reason laterAllows me to check to make sure I have all my critical documents in orderCan trigger financial reminders and "to do's" that would otherwise get overlookedIt's a really good process and I highly recommend it. I used to keep several years of records in the garage, which was causing a lot of clutter. IRS rules only require you to keep three years in case of audit, subject to some exceptions of course (states may differ from the IRS requirement, for example California is 4 years). I do keep copies of all my actual tax returns going back many years prior to 2017 "just in case," since they don't take up too much space (two boxes). Also, as I discuss below, since 2017 I have been archiving my tax returns electronically, but I do keep paper copies of supporting documents in storage. For the cleaning process, I usually just get a banker's box and go through all the old bills / statements individually and drop them into the box more or less in alphabetic order since that's how my filing cabinet is setup. I am now down to just a few small boxes in the garage, which is great! In going through the filing cabinets, here's how I usually approach it:

Keep statements and bills for the current year (2020) and archive everything else except as discussed belowMake sure you keep a copy of the current insurance declaration page for all policies including homeowner's, personal umbrella liability, personal articles, rental property and auto (for auto, make sure you keep the second insurance card they send you in case the one in your car is lost); if you refinance your properties, you'll need to have the insurance declaration pages handyMake sure you keep your most recent property tax appraisal for your home and rental properties along with the most recent tax bills; this triggered me to think about looking at property values in my area post-COVID19 to see if I should appeal my property's value like I did back in 2008 in the Great RecessionMake sure you have a copy of your most recent IRA statement; this can help remind you to plan for your current year contribution and possibly to review your investment mixIf you have one or more Homeowner's Associations at your properties, make sure you keep a copy of the current annual budget and audit (if you sell or refinance your property it helps to have these handy)Keep your most recent life insurance policy premium payment and invoiceFor memberships, keep the last bill where you paid the annual fee (i.e. Costco, AAA, etc.)I have been trying to go with more paperless billing on all my accounts, so the amount of paper in my file cabinet is a lot less than it used to be many years agoFor the past three years, I have kept copies of my filed tax returns electronically in a iCloud folder and I no longer print paper copies (except for the filing instructions and authorizations to file electronically which have to be manually signed)Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on May 03, 2020 11:21