Nick Reichert's Blog, page 18

November 2, 2019

Managing Spending on Kids' Stuff

If you have kids, you know that things will always come up with them that require a payment of one sort or another: summer camps, sports uniforms, clothing, school supplies, holiday / birthday gifts, educational support, etc. The list can be endless. Tracking all of this activity can be a nightmare and can make following a budget very difficult, especially if you have more than one child. In our house, we have a "kid card," a credit card in my wife's name, that is solely dedicated to paying for kids' necessities. Each month we pay off the balance in full so we don't have interest charges and we have an overall monthly budget for the kid card activity that we manage to.

If you have kids, you know that things will always come up with them that require a payment of one sort or another: summer camps, sports uniforms, clothing, school supplies, holiday / birthday gifts, educational support, etc. The list can be endless. Tracking all of this activity can be a nightmare and can make following a budget very difficult, especially if you have more than one child. In our house, we have a "kid card," a credit card in my wife's name, that is solely dedicated to paying for kids' necessities. Each month we pay off the balance in full so we don't have interest charges and we have an overall monthly budget for the kid card activity that we manage to. For example, each child has a clothing budget for the school year and if they want to use some of that budget by purchasing their own clothes online, they can use the kid card for that. Or for example, when my oldest wanted to sign up for a community college class, college applications / testing, etc., we put those costs on the kid card. The kid card has come in handy not only for the increasing amount of online purchasing that happens in our family, but also as a great way to control and manage the budget. By reviewing the statement each month, we can ensure there are no "surprises," since the kids have to tell us before they use the card. A shared card kept in a safe place in the house is much easier to manage than, for example, giving each child their own card to use. Our kids have actually taken well to this and are very careful in keeping to their budget since they don't want to lose access to the card.

In selecting a credit card to use, the best ones are usually those with I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 02, 2019 11:17

October 27, 2019

Buying or Leasing a New Car

If you are thinking about buying a car, there are several things you need to know about the finances before you do. This post should help give you some insight from my experience over the years in buying cars.

If you are thinking about buying a car, there are several things you need to know about the finances before you do. This post should help give you some insight from my experience over the years in buying cars.1) Cash is Not King. Contrary to popular belief, assuming you have the cash available, it's not necessarily always cheaper to buy a car for cash from a dealer. They actually want you to use their financing and many times are more willing to give you a lower price or other incentives if you do so.

2) Information is Power. There are plenty of online sources to check pricing these days to avoid getting ripped off, unlike the "old days" of car buying when you were at a disadvantage trying to figure out whether you are getting a good deal or not (staring at the discount off the "sticker price"). I like Kelley Blue Book or Truecar.

3) Timing is Key. Timing is everything when buying a car. The best time to buy a car is usually around the end of the month and also after the next year's models have come out (which makes the prior year models less desirable and often with incentives in order to sell them). The best time to buy a car is probably late December since many companies' accounting years end in December and they are highly motivated to get the sales recorded.

4) Use Depreciation to Your Advantage. I like to buy previously owned cars, since they are often like new (only a few years old with low mileage) and they cost significantly less than buying a new car, saving you a lot of money. Most new cars depreciate in value rapidly and buying a used car leverages this fact to your advantage. This is particularly true if you are in the market for an electric vehicle.

5) Understand the Numbers. In my experience, I have found the best thing to do is finance the car with the dealer and then pay the loan off right away if you are planning to own the car for several years. Paying the loan off quickly can also improve your credit score. Also, many people don't understand the interest rate that is charged on the car loan and other loan terms. If you have good credit and the car dealer is anxious to sell you the car, they can often offer very low annual percentage rates as low as 1% to 4%. How are they able to do this? Well, first of all many auto manufacturers own their own finance companies and they provide low-cost financing to support their dealer network and ultimately sales. Since you have to make a substantial down payment and the loan is secured by the car, and most importantly you have good credit, there's not as much risk taken by the financing company to make a loan with that interest rate. After all, it's designed to entice you into buying the car since it makes the payment more affordable.

Also, many times finance companies / dealers will try to make the monthly payment even more affordable by stretching the repayment term out from 3 to 5 years or even longer. If your plan is to pay off the loan quickly, the interest rate and the term don't matter as much and that might help you get a lower price or other incentives on the car. Just make sure that the initial payment (until you pay off the car loan) doesn't break your budget if you do go with a higher rate and shorter loan term.

Leasing a car can also make sense for you, depending on your situation. The best thing about leasing is that you don't have to bring much cash upfront to get the car (usually less than the down payment that would be required on a loan, for example) and the monthly payment can be lower. The downside of a lease is that your payment assumes a certain amount of annual miles you drive and if you have "overage" when you return the car, you have to pay for that. You also get charged for any damage or excessive wear and tear on the car when you return it. Oftentimes, the dealer will use that "return bill" as a bargaining chip to get you to lease a new car from them at the end of your current lease, which is another potential downside. If you like getting a new car every three years or so and don't mind having a car payment all the time, then leasing might be best for you, as long as you don't lease in order to get a vehicle that you can't afford to buy outright and so long as you understand the financial impact of leasing versus buying (more on that below). Also, if you are self-employed, leasing a car for your business might make sense as a business tax deduction, but always check with your CPA first.

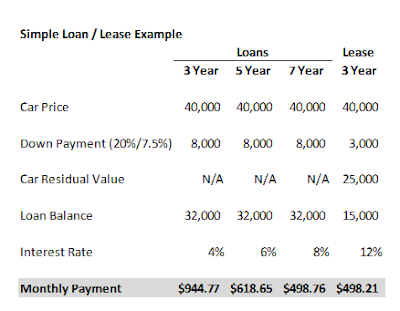

Here's how the numbers look (see table below with a simple example). You'll see that you actually pay a much higher interest rate on a lease, but the monthly payment is lower because you give back the low-mileage car at the end of the lease - the residual value of the vehicle effectively reduces the amount you are financing. Note the lower loan balance that's assumed ($40,000 car price less $25,000 residual value equals "loan" amount of $15,000). Typically the lease includes a rent charge in addition to the vehicle depreciation, but for simplicity I have combined the two into one amount of $15,000 for this example. The down payment of $3,000 is really just a prepayment of the lease and can be any convenient amount the dealer wants to charge. This is frequently discounted in order to entice you into leasing the car, depending on how motivated the dealer is to move the car off their lot.

A few take-aways on loans: Longer loan terms can carry higher interest rates, but overall you get a lower monthly payment since you have more time to pay the loan off. Down payments can also vary depending on the situation, but for simplicity I just assumed 20% below except for the lease situation described previously. Also, it's important to note that this example does not include taxes, title, registration, license, dealer fees and other up-front payments required when buying a car. It's also important to remember that most likely your insurance will go up when buying a new car and that needs to be budgeted as well.

As you can see, the highest monthly payment is for a 3 year loan and the lowest monthly payment is for a 3 year lease. Even with the 3 year loan at 4%, you will still pay over $2,000 in interest over the life of the loan, which is why paying off early is always a good idea if you can do it. Sometimes you can pay off in "chunks" like when you get your annual bonus or when you get your tax refund. Also, in the lease example, you will pay almost $3,000 in interest over the life of the lease (50% more than the loan example). This is significant and not well understood by consumers, since both the car buyer and the dealer focus only on the monthly payment and not on the "cost of money." Unlike a loan, you cannot prepay a lease, although you may be able to "buy out" of it before the end of the term for a fee or possibly the dealer may let you out if you lease a new vehicle. That's also important to consider when deciding whether to lease or buy.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on October 27, 2019 12:50

October 19, 2019

Recession Preparation Checklist

Many more people are talking about a coming recession as the current expansion becomes one of the longest in history (see chart below courtesy of www.macrotrends.net). Business cycles are nothing new and certainly we can expect a recession to come eventually, but no one can accurately predict when it will arrive or how long it will last. Indeed, some have even said they expect the next recession to be relatively mild and short-lived (we can all hope), but there is no way to know that for sure. The longer the current expansion lasts and as more data that shows economic weakness comes in, however, the likelihood of a recession in the near future grows.

Many more people are talking about a coming recession as the current expansion becomes one of the longest in history (see chart below courtesy of www.macrotrends.net). Business cycles are nothing new and certainly we can expect a recession to come eventually, but no one can accurately predict when it will arrive or how long it will last. Indeed, some have even said they expect the next recession to be relatively mild and short-lived (we can all hope), but there is no way to know that for sure. The longer the current expansion lasts and as more data that shows economic weakness comes in, however, the likelihood of a recession in the near future grows. S&P 500 Historical, With Recessions Shown

S&P 500 Historical, With Recessions ShownWhat, then, to do to prepare for a recession? I put together the checklist below based on my experience from the Great Recession and lessons learned from that experience. You may have your own priorities that are different, but this can serve as a good guide to "get your house in order" to weather the storm and perhaps most importantly, take advantage of the opportunities that will undoubtedly pop up in the wake of the next recession.

Budget - Start by reviewing your household budget - is there anything you can cut back on or eliminate to generate a little more cash flow each month (maybe one less coffee at Starbucks each week, find a cheaper gym membership or lose one or two video / music subscriptions)? Every little bit counts. $100 saved a month turns into $1,200 in a year.Credit Cards / Loans - If you have credit cards or other personal loans with balances, don't hesitate to dig into your savings to pay them off and funnel the extra cash flow from the payments back into your savings; if money is tight, consider a consolidation loan with a peer to peer lender such as Prosper with a lower rate to pay off the high rate cardsCash Back - As you continue to use credit cards moving forward, make sure you are getting the maximum cash back on every purchase (forget points, cash is better - I currently have a 2% cash back debit card I use instead of credit cards that pays me in MCO cryptocurrency which I can sell for dollars or convert into Bitcoin) and of course, pay off the balance each monthRetirement Investments - Look at your retirement portfolio - are you sufficiently diversified with a mix of asset classes? Consider moving to a more defensive stance (more bonds and fixed income, less stocks)Non-Retirement Investments - Look at your investment portfolio - if you invest in dividend stocks, make sure they have a high likelihood of maintaining or even growing their payout through a recession (I like stocks that have payment histories of 25 years or more with steady increases to the dividend); buy and hold and don't panic if values drop during the recession - consider adding to your positions strategically when the time is rightInterest - Maximize your cash interest income by shopping around for the best rate as interest rates continue to fall - TreasuryDirect is still a very good option but so are online banks and brokeragesMortgage - Refinance your mortgage to take advantage of lower interest rates and lower your monthly payment, if it makes sense for you; I was able to refinance recently and lowered my monthly payment by 10%Dry Powder - Keep some cash "dry powder" on the side for investing opportunities that present themselves in the wake of the recession, including stocks, real estate and other assets Insurance - Check your insurance policies and see if you can lower your rates by switching to a different company or maybe you can lower your rates with your current company by increasing your deductiblesCar Loan - See if you can refinance your car to get a lower payment, since interest rates have dropped recentlyMajor Purchases - Minimize major purchases over the next six to twelve months (cars, recreational vehicles, homes, vacations, etc.); these can all take a toll on your monthly cash flow - especially moving to a new home with all the "hidden" costs that you never realize like having to buy new appliances, restocking cleaning supplies and other basic household items, new furniture, movers, utility deposits / connection fees, etc., etc.Phones - It can be a hassle, but you can look into switching your cell phone plan with your current provider to something less costly or possibly switching to a new provider that saves you money each month; also a great way to save money is not to upgrade your IPhone right away; I have an 8 and rather than upgrading to an 11, I can get an XR for a lot less; but I'm waiting until my lease is up to get the best deal.Side Hustle - If you have a side hustle or two, keep them going for extra cash flow as long as they don't impact your current job; the best ones are the ones that don't take a lot of time and pay while you sleep - see my post on passive income ideas hereJob - Now is not an ideal time to get a new job in my opinion, as typically the new hires are high on the layoff list when a recession hits; instead, do what you can to expand opportunities for yourself at your current employer and develop your leadership skillsStay Positive - Always remember that it can feel pretty bad during a recession and things may seem bleak at times, but there is always a recovery and new opportunities so it's really important to stay positive and look to the future and not dwell too much on the past or the present.I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on October 19, 2019 11:38

October 12, 2019

Top 20 Crypto Ranking Update (October 2019)

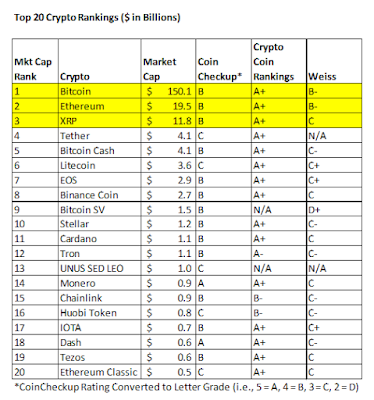

It's been almost six months since my last update on Crypto Rankings. A lot has happened in the space during this time, including most notably an increase in Bitcoin's market cap from $142.4B to $150.1B, up 5%. Ethereum's market cap declined to $19.5B from $26.6B, a decrease of 27% and XRP's market cap declined to $11.8B from $16.3B, a decrease of 28%. Bitcoin continues to show strength at the top of the ratings chart with steady market cap growth, while all other so-called "altcoins" continue to struggle. Indeed, Bitcoin's market cap is almost 8 times that of Ethereum and almost 13 times larger than XRP. Ethereum was recently designated a "commodity" by the CFTB, along with Bitcoin and other cryptocurrencies. While this ruling limits trading as a security, which many had been hoping for as a catalyst for broader investor adoption of crypto and value growth, the ruling serves to further solidify Ethereum as the number two cryptocurrency next to Bitcoin and also clarifies the rules that will govern the cryptocurrency market in the US.

There continues to be very few published cryptocurrency rating systems in the market, a big reason why I started doing these updates quite some time ago. Rency no longer publishes ratings (site looks like it went out of business), but there is a new rating site called Crypto Coin Rankings that I referenced in the table below, along with industry stalwarts Coin Checkup and Weiss, which continue to put out coin ratings. While Crypto Coin Rankings seems to suffer from "grade inflation," it's still a worthy data point to consider.

Based on the overall rankings and market cap, it seems like the top three (Bitcoin, Ethereum and XRP) should continue to garner interest from investors. Ethereum and XRP could represent good value plays now based on their recent market cap decline and growth outlook. Indeed, Ethereum and XRP both have good commercial utility (Etherium with "smart contracts" while XRP has garnered interest from financial institutions).

If you are interested in investing in cryptocurrency, I really like Crypto.com. See my post here on their app and how they are innovating the crypto space in many different ways. As I have written many times before, I don't recommend you put everything into crypto, but it certainly makes sense to buy a small amount monthly to dollar cost average and just hold for the long term. I have been doing that with Bitcoin for quite some time and have been very pleased with the result. If you are interested in reading more about developing a crypto investing strategy, please read my post here.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on October 12, 2019 15:12

October 5, 2019

Music Royalty Investing Update

Some time ago I wrote about investing in music royalties on the Royalty Exchange site. I thought now would be a good time to review how the returns have been on my investments in music royalties and also look at some of the new features on Royalty Exchange that they have implemented recently.

Some time ago I wrote about investing in music royalties on the Royalty Exchange site. I thought now would be a good time to review how the returns have been on my investments in music royalties and also look at some of the new features on Royalty Exchange that they have implemented recently.I originally invested a total of $38,400 in three royalty streams almost exactly one year ago. Two of the streams were 10-year duration and one was "life of rights," meaning you continue to receive royalties for the entire legal term (life of author plus 70 years). Over the past year, I have collected a total of $2,850 on these royalties and (based on last quarter's payment), I'm anticipating the current September quarter payment will be about $520, bringing the total payments for the year to $3,370. While that seems okay, unless the payments increase over time, I'm unlikely to recover my entire investment over a 10 year period at the rate I'm going, incurring a loss of about $4,700 if everything stays the same. Of course, quarterly royalty payments vary significantly and mine are no exception, from a high of $1,144 to a low of $429. International payments lag by a few months versus domestic, so that can also play a factor in the volatility. It's very difficult to extrapolate future royalty payments, especially if the songs are newer. Songs that have been out for a while are much easier to predict since they have a longer royalty history.

As you can see, the difficult thing to predict is how songs will perform in the future when investing in music royalties. For example, if one of the songs you own the rights to is used in a television show / series or movie, that will perhaps significantly increase the payment stream (and value) of the royalty. Also, if the artist wins a grammy or produces a new album, that frequently increases interest in the "back catalog" of older songs that you may own the rights to. Similarly, if you have some royalties that are relatively new songs that are played a lot on radio, as those songs transition to streaming, the payments can increase over time depending on their popularity. Production of music videos and remixes of songs can also increase the popularity of songs and the royalty payments over time. Also, growth in international demand is a factor that can increase the value over time, especially with R&B and hip hop music which has a lot of international popularity. Of course, as mentioned earlier, those payments lag, so the increasing popularity may not show up right away in the dollars you receive. These are all the unknowns of investing in music royalties. As a general rule, most royalty streams that I have looked at show a slowly decaying rate of payment over a long period of time, unless something occurs to increase the artist's popularity or there is some other activity like tv / movie use. That's also why people like investing in "name brand" grammy-winning artists such as Drake, where you can be fairly confident that the songs will get plenty of plays over time. As such, even though music royalties are uncorrelated to stock and bond markets, there is still a fair degree of risk that you could be overpaying for the royalty asset, depending on what happens over time to the popularity of the artist and songs that you own the rights to.

Royalty Exchange has always held auctions for music catalogs and that feature continues to work the same way as it has in the past, with bidders entering the auction and bidding up the value of the royalty until the end of the auction. The winner pays a $500 fee to the exchange plus the final sale price of the royalty stream, signs some forms and starts collecting the royalties. Royalty Exchange handles the administration of the royalty payments and they have an online portal to monitor your activity.

A new feature recently launched is a separate catalog of select older auctions that have been relisted for sale, with the owner's permission. This allows the owner to set a "buy it now price" and also allows interested investors to submit offers. One of my royalties was included on this and I have already received two "low ball" offers. This seems like a good opportunity to find some values depending on how motivated the seller is to exit the investment. Even if you are able to get a lower price than what the original buyer paid for the stream, the volatility and general declining nature of the payment stream may still pose some risk, so you have to do your research in looking at the payment history critically and also evaluating the popularity of the artist and songs in the catalog.

Investing in music royalties is still an interesting alternative investment strategy for those looking to diversify away from stocks and bonds, but is not without risk and potential investors should definitely do their homework before buying these. Having said that, there is certainly the opportunity to make good steady cash flow from these investments over time, especially with a "life of rights" royalty.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on October 05, 2019 11:44

September 28, 2019

Investing is Learning

As I have become a more active investor in the stock market this year, I have come to realize that investing can really help you understand business better, with broad application across not only your personal investing activities but also your career. As an investor, you learn what drives the different businesses you are investing in and how they operate within the broader context of the economy. You also learn how these companies deal with both internal and external challenges, such as maintaining margins / profits, competitors, or the US-China trade war / tariffs. All companies have to deal with these issues in one way or another and so this helps bring focus to different strategies that you might even be able to use in your day to day work.

As I have become a more active investor in the stock market this year, I have come to realize that investing can really help you understand business better, with broad application across not only your personal investing activities but also your career. As an investor, you learn what drives the different businesses you are investing in and how they operate within the broader context of the economy. You also learn how these companies deal with both internal and external challenges, such as maintaining margins / profits, competitors, or the US-China trade war / tariffs. All companies have to deal with these issues in one way or another and so this helps bring focus to different strategies that you might even be able to use in your day to day work.This learning can be accomplished by reading articles written about the company, analyst information (Zack's has great free analysis), the investing community's thoughts (such as StockTwits), earnings releases and especially listening in on earnings conference calls, which contain a lot of information about a company, its recent performance and near term prospects. It's especially interesting to see what questions the analyst community has and how the management team responds to them. As it relates to your career for example, if you are in the retail business, there's nothing like listening in to a conference call from a retailer that you may be competing with directly or indirectly to learn more about how they are succeeding (or not succeeding) and what they are doing to manage their business. I also like to read general market websites such as Yahoo Finance, Marketwatch or Seeking Alpha and I also subscribe to select newsletters from those sites to get a daily feed of market information that I'm interested in, including information about stocks that I own or that I'm following. As I have written about before, I really like Robin Hood's app and find it really easy to use to do research and also buy and sell stocks and options. As a result of my research habits, I have found that I can apply much of what I have learned as an investor in my work and in my other investing activities.

In short, investing is learning. Of course, if you do well and make wise investments, you get paid well for your learning and if your investment doesn't work out, you get an extra, perhaps more costly lesson. Maybe you learn not to take such a big position next time, hedging a bit more, sitting out or maybe just doing a bit more research before taking an investment position. Losses happen in investing, but as long as you are learning and applying what you learned the next time and getting the added bonus of accelerating your career development, that's the important thing.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on September 28, 2019 10:58

September 21, 2019

Preparing for Opportunities

With all the talk in the media lately about recession fears, I have been thinking that rather than focus energy and attention on worrying about the coming recession, it's better instead to focus on the future, after the recession hits. How will you be prepared to take advantage of the many investing opportunities that will present themselves when asset prices are lower? Wouldn't you rather be a buyer and not a seller in that environment? If your investment portfolio is properly built and diversified, you should be able to ride out the recession without having to make any major changes. More importantly, you should make sure you have enough cash not only for an emergency fund in case of job loss, but to take advantage of great investing opportunities that will surely arise.

With all the talk in the media lately about recession fears, I have been thinking that rather than focus energy and attention on worrying about the coming recession, it's better instead to focus on the future, after the recession hits. How will you be prepared to take advantage of the many investing opportunities that will present themselves when asset prices are lower? Wouldn't you rather be a buyer and not a seller in that environment? If your investment portfolio is properly built and diversified, you should be able to ride out the recession without having to make any major changes. More importantly, you should make sure you have enough cash not only for an emergency fund in case of job loss, but to take advantage of great investing opportunities that will surely arise. During the Great Recession, I saw many incredible real estate investing opportunities, for example, only to find that I didn't have the cash to take advantage of them. Of course, as I explained in my book on getting started in real estate investing, I opted to cash out my IRA (which had already taken a big hit) to generate the necessary funds. I'm glad I did that, since the after-tax cash on cash returns were well above 100% and that helped build the foundation of my portfolio I have today. This time around, I plan to have enough cash readily available so that I can quickly take advantage of deals as they present themselves. While the Great Recession was notable in that real estate value declines were significant and were caused primarily by very loose lending standards, those standards have been tightened significantly since that time. I'm going through a refinancing process right now and it's quite incredible how difficult it is for someone with good credit and a steady income to get a loan these days.

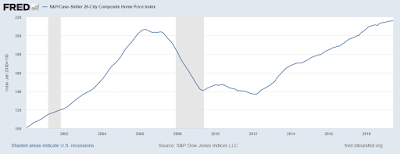

Also, while real estate prices have recovered and there may be pockets in the US where bubbles are forming, overall it seems that real estate values have not risen too dramatically from the last peak (see chart below). I know this also because when I got the appraisal for my refinancing, my house was valued at exactly what I paid for it back in 2006. Therefore, the real estate deals available in the next recession might not be as good as the Great Recession, but there will still be opportunities in real estate worth looking at and even small one or two bedroom condos (which have a relatively low up front cost to buy) could once again present a great investing opportunity.

Other areas of opportunity would include stocks. In a recession, we could see declines of 20% to 30% (or more) in the value of high quality stocks. Especially for dividend paying stocks, whose yields will rise as their prices drop, this would present a great opportunity to buy some passive income generating assets at a great value. Of course, I have suggested that you might not wait in the current low (and going lower) interest rate environment to start building a portfolio of solid dividend paying stocks to earn a higher rate of return. I just did a quick search on Bankrate, and the top 5 money market fund yields currently range from 1.85% to 2.2%. The current yield on the SPY ETF is 1.84% for comparison, but there are many quality names that pay 3% to 6% dividend yields currently. A recession can provide the opportunity to significantly increase your holdings of the same quality stocks. Check out my post on building a strong portfolio of dividend paying stocks here.

Chart courtesy of macrotrends.netIn looking at the S&P 500 chart above (up about 50% from last peak) in comparison to the housing price index (up about 5% from last peak), clearly there has been a lot more appreciation in stocks and therefore perhaps the best buying opportunities in the next recession will be found in the stock market. Only time will tell.

Chart courtesy of macrotrends.netIn looking at the S&P 500 chart above (up about 50% from last peak) in comparison to the housing price index (up about 5% from last peak), clearly there has been a lot more appreciation in stocks and therefore perhaps the best buying opportunities in the next recession will be found in the stock market. Only time will tell.I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on September 21, 2019 09:54

September 14, 2019

Next Week Investing Outlook (9/16)

There will be a lot of news for investors to digest next week, including earnings releases from several companies such as FedEx and Adobe (Tuesday after hours) as earnings season winds down, as well as the results of the Federal Reserve meeting and announcement about the Federal Funds Rate on Wednesday morning. Another potentially interesting piece of information for investors will be credit card charge-off reports that will be issued by major card issuers such as Bank of America, Citigroup, Capital One, Discover and JPMorgan, which may give a good indication of how the American consumer is doing and might give some insight into how much longer we have before we can expect an economic recession. The stronger retailers such as Target, WalMart, Home Depot and Lowes posted very strong results in their most recent quarter, indicating the consumer is doing well.

There will be a lot of news for investors to digest next week, including earnings releases from several companies such as FedEx and Adobe (Tuesday after hours) as earnings season winds down, as well as the results of the Federal Reserve meeting and announcement about the Federal Funds Rate on Wednesday morning. Another potentially interesting piece of information for investors will be credit card charge-off reports that will be issued by major card issuers such as Bank of America, Citigroup, Capital One, Discover and JPMorgan, which may give a good indication of how the American consumer is doing and might give some insight into how much longer we have before we can expect an economic recession. The stronger retailers such as Target, WalMart, Home Depot and Lowes posted very strong results in their most recent quarter, indicating the consumer is doing well.Major stock indexes have been moving positively and ended last week on a positive note (Dow was up 1.6%, S&P 500 and Nasdaq both up 0.9% for the week), suggesting that new all time highs could be coming, although there's also a chance that investors will be disappointed in the Federal Reserve's actions / messaging next week and markets could drop. Markets are currently anticipating an 80% chance of a 25 basis point cut and a 20% chance of no cut.

Chart courtesy of www.macrotrends.net

Chart courtesy of www.macrotrends.netWhat does all this mean for the average investor? If there's a rate cut, the interest you earn on your cash in the bank will be reduced and depending on how much the cut is, the market could react positively, but it will depend on what is said about future rate cuts if the cut is only 25 basis points. A 50 basis point cut would be totally unexpected and would likely ignite a huge rally in stocks, as would any announcement of a "early trade deal" with China.

As I have said in previous posts, although there is risk that the value of your stocks will drop short term, if you invest in good dividend stocks for the long term, you can enjoy a yield that will be much higher than cash held in a bank account (or even Treasury bills), given the low interest rate environment we are heading into. Bonds have rallied recently from their recent lows, but the rates are still well below the 3% to 5% yields that can be found in many quality dividend stocks. Obviously, if there's no rate cut, you will continue to earn the same interest from your bank savings account, but look for a big sell-off in the stock market which could be an opportunity to pick up some good dividend paying stocks when the dust settles. See this post for some suggestions for building a high quality dividend stock portfolio.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on September 14, 2019 12:22

September 7, 2019

Crypto.Com - A Leading Innovator in the Space

If you haven't heard of it, Crypto.com is a big financial innovator in the crypto space. Based in Hong Kong (incorporated in the Cayman Islands), Crypto.com is first and foremost a cryptocurrency wallet. They have also launched two cryptocurrencies of their own: MCO and CRO.

Crypto.com has also launched a Visa debit card program (recently available in the US). By "staking" or setting aside a set amount of MCO coins in your crypto wallet for six months, you can order a visa debit card that can earn up to 5% back from purchases in the form of additional MCO coins. The "red card" pays 2% back with an MCO stake of 50 coins (about $160 at current price), while the "green card" pays 3% back with a stake of 500 MCO coins (about $1,600 at current price). There are also other cards (up to a "black card" that pays 5%), but I only mention the ones that are a bit more attainable. I have a red card myself - it's a very cool looking and feeling metal card that also supports contactless payment. They have a "free" card that doesn't require an MCO stake that pays 1%. If you choose to sell your MCO stake, the red card payment drops to 1% as well, so in order to continue to earn 2% with your red card you have to keep the MCO stake in place. The card can be funded from a cryptocurrency wallet by selling any supported cryptocurrency into your local currency or they also have a fiat wallet linked to a bank account that you can transfer funds into and from there, you can either invest in cryptocurrency or use the funds to "reload" the debit card. They also have some cool perks for Spotify subscribers with a 100% MCO rebate for the monthly subscription fee (red card and higher), among other perks. Higher level cards have rebates for Netflix, Expedia and AirBnB.

But that's not where the innovation ends. They also have a "crypto earn" program where you can set aside some of your crypto for a "flexible," one month or three month period of time to earn interest on supported digital assets (paid in the same currency as the investment). This also requires an MCO stake to participate in. For example, with a 50 MCO stake, you can set aside Bitcoin and earn 6% interest (simple interest calculated daily and paid weekly) in the three month term, 4% for the one month term and 2% for the flexible term. If you like to "HODL" your bitcoin, this is a nice option to earn some extra money on your coins which I haven't seen anywhere else.

Crypto.com also has other reward programs similar to the card cashback program, including CRO rewards for using the app for payments (i.e., purchasing gift cards or sending payments to friends in CRO), referral fees for new users ($50 in MCO) and also referral fees for new merchants that accept the company's currencies.

In summary, Crypto.com is a real innovator in the cryptocurrency space and is launching a number of interesting initiatives that might be worth looking into whether you have cryptocurrency or not and regardless of what wallet you are currently using. If you're curious about investing in crypto, check out this post I wrote a while ago introducing the rationale for it. You might also be interested in this post which talks about setting up a simple strategy for investing in crypto.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on September 07, 2019 11:44

August 31, 2019

Are You Prepared for the Next Recession?

With fears of a coming recession in the US on many people's minds these days (longest expansion in US history - see chart below), I thought it would be good to look back to the last recession for ideas on how we might be better prepared for the next one. Of course, we all hope that the next recession is not as severe, but you can never tell for sure and should always be prepared for the worst. The level of volatility in stock and bond markets would suggest the next recession could be as bad as the Great Recession or possibly even worse. The other thing to remember is that the business cycle is just that - a cycle. After the recession, there is always a recovery and sometimes being patient with good long term investments is the best strategy instead of selling everything. Timing the market is also virtually impossible for most investors. Being patient is hard, however, especially with today's constant media barrage and easy access to check the balances in your accounts on your phone or online.

With fears of a coming recession in the US on many people's minds these days (longest expansion in US history - see chart below), I thought it would be good to look back to the last recession for ideas on how we might be better prepared for the next one. Of course, we all hope that the next recession is not as severe, but you can never tell for sure and should always be prepared for the worst. The level of volatility in stock and bond markets would suggest the next recession could be as bad as the Great Recession or possibly even worse. The other thing to remember is that the business cycle is just that - a cycle. After the recession, there is always a recovery and sometimes being patient with good long term investments is the best strategy instead of selling everything. Timing the market is also virtually impossible for most investors. Being patient is hard, however, especially with today's constant media barrage and easy access to check the balances in your accounts on your phone or online.

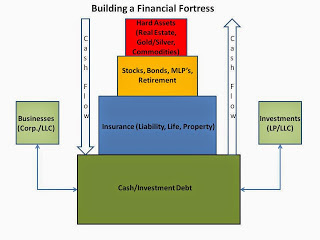

In my book, Building a Financial Fortress: Lessons Learned From the Great Recession which I wrote during the Great Recession, when it seemed like the entire financial system was collapsing, I laid out my basic philosophy of the Financial Fortress. The essence of the Financial Fortress is that as savers and investors, we need to first have a strong defense before we can have a strong offense. As volatility in the markets continues to worsen each year and seem to become exponentially worse with each recession / recovery, preservation of capital is paramount but so is finding opportunities to leverage what you have in order to grow your wealth.

In my book, I outline various investing strategies, asset types and their behavior and other related topics that help support building your Fortress, most of which I have tried at one time or another to test my theories. During the recession, I was successful in capitalizing on the dramatic real estate downturn by buying a few condos that I held for some time and eventually sold for a nice profit. I also capitalized on volatility in silver (which again seems to be on the move lately - SLV), borrowing some money at a very low interest rate to buy, hold and ultimately sell silver coins for a tidy profit.

Being able to recognize opportunities in the midst of the chaos and developing and implementing a plan to take advantage of those opportunities is key, but only the "base" of your Fortress is strong. The base is cash and cash equivalents and may include investment debt (so long as that debt is covered by the cash flow of the investment it was used to purchase, such as a rental property). The chart below outlines the Financial Fortress graphically:

During the Great Recession and in the many years since that time, I have learned that the keys to success include:Financial Education - read books, research investing strategies and take classes to improve your financial educationContrarian Thinking - don't "follow the herd" or financial advisers; make your own decisionsFlexibility - as Bruce Lee once said "Take things as they are. Punch when you have to punch. Kick when you have to kick."Don't Quit - if you put your mind to something and really want to do it, you'll find a way to get it done.

During the Great Recession and in the many years since that time, I have learned that the keys to success include:Financial Education - read books, research investing strategies and take classes to improve your financial educationContrarian Thinking - don't "follow the herd" or financial advisers; make your own decisionsFlexibility - as Bruce Lee once said "Take things as they are. Punch when you have to punch. Kick when you have to kick."Don't Quit - if you put your mind to something and really want to do it, you'll find a way to get it done.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress this year. If you're interested, I wrote a post on 20 Things You Can Do to Weather the Next Big Financial Crisis, which is also featured in my book.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on August 31, 2019 12:17