Nick Reichert's Blog, page 16

April 26, 2020

Solid Dividend Plays for Inflation or Deflation

There is currently much speculation about whether we will witness a deflationary period followed by inflation as the post-COVID-19 recession / depression unfolds. With all the monetary and fiscal stimulus being put forth by the Federal Reserve and the US government, we could very well see tremendous inflation down the road. Either way, investing in solid dividend yielding stocks can be a great way to ensure a steady source of income and provide superior returns in either environment.

There is currently much speculation about whether we will witness a deflationary period followed by inflation as the post-COVID-19 recession / depression unfolds. With all the monetary and fiscal stimulus being put forth by the Federal Reserve and the US government, we could very well see tremendous inflation down the road. Either way, investing in solid dividend yielding stocks can be a great way to ensure a steady source of income and provide superior returns in either environment. The simple math is that the more dollars there are in circulation, the less each one is worth. Global demand for dollars, the safest currency in the world, has continued to be very strong in this downturn which has resulted in the dollar appreciating recently, oddly enough. Still, the dollar is worth between 30% and 40% less (depending on who you believe) than it was back in 1985 due to inflation. So the long term effects of inflation on the value of cash are still very much in play. See chart below:

Here's a longer term view of the growth of the money supply since 1960. The money supply growth has spiked significantly recently due to the Federal Reserve's historically unprecedented actions:

I have written about dividend stocks as a passive income strategy a few times and have screened some great names previously. If you're interested, here are links to my previous posts:

Passive Income: 4 Dividend StocksBuilding a Strong Dividend PortfolioMore Dividend Investing Ideas

I recently updated the screener to focus on those stocks that have a 50-year or longer history of increasing dividends, with a payout ratio of 80% or less (for safety of dividend) and without regard to industry or market capitalization.

Here are the top 6 stocks that screened and also seem poised to continue to do well in the current economic environment:

3M (MMM) / 4.07% yield / 70.5% payout ratio Coca Cola (KO) / 3.64% yield / 80% payout ratioProcter & Gamble (PG) / 2.65% yield / 63.7% payout ratioTarget (TGT) / 2.54% yield / 39.8% payout ratioColgate-Palmolive (CL) / 2.47% yield / 60.7% payout ratioJohnson & Johnson (JNJ) / 2.44% yield / 51.8% payout ratioIn addition to collecting the dividend, if you own enough shares, another strategy to increase cash flow is to sell covered call options. Best case is the options expire out of the money and you get to keep the premium. Worst case, is you have to sell your shares at the contract price and then use the money to either repurchase the same shares or move funds to a different stock on your target list. If you sell calls that are sufficiently out of the money, your chances of profit can be very high (80% - 90%). You should make sure you are comfortable holding the stock you buy for the long term, since price decreases may occur which will enhance your chances of a profitable option trade, but will result in losses in the underlying stock.

Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on April 26, 2020 11:59

April 12, 2020

COVID-19 Credit Card and Debt Relief Resources

Most banks and credit card issuers are now offering at least temporary (2-3 month) relief to consumers impacted by COVID-19 in the following areas:

Most banks and credit card issuers are now offering at least temporary (2-3 month) relief to consumers impacted by COVID-19 in the following areas:Deferral of minimum credit card payments for up to three months (interest still being charged, however)Deferral of mortgage and auto loan payments for up to three months (again, interest still being charged and in most cases, the term of the loan is extended for up to an additional three months)Waiver of late payment penalties / feesNo reporting of late payments to credit bureausWaiver of ATM, overdraft, safe deposit box, low balance and other banking feesEach financial institution is unique, some are more on top of this than others and most require some sort of online application or a phone call to opt-in to these programs.

Here's a great article in Forbes that has a lot of information about the various financial institutions and what they are offering with links to their websites. The credit bureau, Experian also has some great resource links on their COVID-19 resource page. I would recommend you check your financial institutions to see what they offer and if you are impacted, be sure to apply for the relief available. If you are unaffected by COVID-19 and are not otherwise in a hardship situation, most of the financial institutions will require that you continue to make your scheduled payments as usual.

You may also be able to get some relief from your auto insurance company on premiums since you are most likely not driving as much during the quarantine - all of the major insurance companies have a program now to rebate back some of the monthly insurance premium to policyholders and payment deferrals for those who are impacted by COVID-19.

Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on April 12, 2020 13:18

April 5, 2020

WFH and the Monthly Budget

During a time of crisis, there is so much that is beyond our control. That's why it's best to focus on the things you can control and your monthly spending is certainly one of those things.

During a time of crisis, there is so much that is beyond our control. That's why it's best to focus on the things you can control and your monthly spending is certainly one of those things. I wanted to focus on some of the positives I have been seeing with our monthly household budget after three weeks of working from home and getting ready for a fourth. This is by no means a complete list, but certainly an opportunity to put more cash away until we can see more clearly what the post-pandemic depression / recession / recovery will look like. I'm starting to see more toilet paper and paper towels at the grocery store lately, so that's at least a positive sign. Funny story about toilet paper that I didn't realize is that most of the toilet paper is consumed in the workplace (obviously, since that's where we normally spend most of our day), so another explanation for the household TP shortage in addition to hoarding behavior!

Consistent with my overall conservative nature, I'm not looking to make any investing moves right now, even though many are advocating for "buy the dip," etc. - I'm just staying the course with the Financial Fortress and building up cash reserves with some of the savings areas listed below. In addition, all portfolio investment income (net rental income, dividends, interest) is being saved as well right now.Credit cards - saving a lot here because we aren't traveling, shopping or eating out as much; I did have one larger bill recently, because I had to pay for appraisals for refinancing my properties, but I got a little cash back that covered these after closing Food - after spending a couple hundred dollars on a pantry refresh several weeks ago, we are pretty good in the non-perishable food right now; generally this budget has gone up since we are eating more meals at home mostly from grocery stores, but also some takeout to support our favorite local restaurants; also a bit of DoorDash which is a little expensive, but very convenient; offsetting that, I calculate I am saving between $100 - $200 per month by not eating lunch out every day as I would normally in the office plus the restaurant savings mentioned above; also cooking your own meals is a lot healthier!Gas - big savings due to lower gas prices and no commuting / limited driving (I try to shop for groceries once a week now to limit my time out of the house in crowded places) - at least $100 / monthMortgage - just finished refinancing the house, dropping rate from 4% to 3.5% and lowered my monthly payment, which will help a lot (previously refinanced in October from 4.5% to 4%)Internet - Cox waived data caps for April and May, so I don't have to worry about overages while the kids and I am working from home, which is nice (so monthly cost remains flat)Amazon - Haven't gone crazy here, just buying necessities - most recently, printer ink and some cloth face masks so I would say spending is about flatDry Cleaning - Saving about $40 - $50 per month on dry cleaning since I'm not going into the officeGym Membership - Currently not being charged while they are closed, saving about $40 / month; walking at least 10K+ steps every day instead and thinking about other ways to exercise at homeHopefully, you are able to see some of the same types of savings in your household budget and are able to save a little more each month.

Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on April 05, 2020 15:06

March 29, 2020

How Well Has The Financial Fortress Performed?

I thought in this time of great uncertainty, it would be good to check in to see how the Financial Fortress has been performing. I have literally been preparing for this since the Great Recession in 2006, in the belief that our financial cycles would continue to be extreme, just as we are seeing today. I checked my net worth and so far it has taken a hit of about 10% overall, which is better than I would have expected. I believe when this crisis passes, I will be well-positioned for some great upside gains and I have sufficiently controlled my downside risk with the Financial Fortress, even if things get worse before they get better.

I thought in this time of great uncertainty, it would be good to check in to see how the Financial Fortress has been performing. I have literally been preparing for this since the Great Recession in 2006, in the belief that our financial cycles would continue to be extreme, just as we are seeing today. I checked my net worth and so far it has taken a hit of about 10% overall, which is better than I would have expected. I believe when this crisis passes, I will be well-positioned for some great upside gains and I have sufficiently controlled my downside risk with the Financial Fortress, even if things get worse before they get better.I have a broadly diversified portfolio as follows (% of total investment portfolio reflected):

401(k) (32%) - invested 100% in lowest risk (in-retirement) life-cycle fund option, which is almost 60% high quality bondsReal Estate Investment Property (26%) - watching tenant's ability to pay rent, but can avail myself of new government programs for deferment of agency-backed mortgage payments if necessary that will allow me to withstand the downturn, provide much needed housing and avoid losing the property; also, if things get really bad I can move into the investment property and sell my primary residence to dramatically lower my cost of living (that's what I call my "Plan B," which hopefully isn't necessary)Dividend Portfolio (12%) - value has been hammered, but all companies are dividend aristocrats and no cuts on the horizon yet, continuing to provide passive income on a monthly / quarterly basis which is being put into a money market fund4-Week US Treasury Bills (8%) - not paying much interest now and might go a little negative on next rollover, but very safeIRA (7%) - took a bit of a hit because 80%+ equity funds (mix of SPY, QQQ and a low cost Vanguard blended stock/bond ETF - VASGX), however just holding on to that long term for growth potentialCash in the bank (5%) - no yield, but safePrivate equity investment (3%) - still waiting on a marketable product, but big outside investors are stepping up which is good news, so too early to write-offGold / Silver (3%) - doing great and just holding physical coins locked up at the bank safe deposit boxRoyalties (2%) - continuing to pay quarterly providing passive income stream and non-correlated to financial marketsCrypto (1%) - 100% Bitcoin, continuing to dollar cost average in each month; up and down but not a big concentration and I believe tremendous upside in the future with all the "helicopter money" literally flying around

I'm not panic selling, and I don't feel any need at this time to "buy the dip" or make any other sudden moves in the portfolio. I will simply continue to contribute 13% of my income to the 401(k), do my annual IRA contribution about mid-year (a "back door" Roth contribution) and build up my cash reserves from reduced spending on "non-necessities" and passive income sources. I have been able to further improve my monthly cash flow by refinancing both my investment property and primary residence, saving literally hundreds of dollars a month that can go to additional savings.

As I mentioned in last week's post, with the right setup it's possible to survive and thrive in the current crisis and it's not too late to build your own Financial Fortress.

I'm reminded of a quote shared with me by my Grandfather, who lived through the Great Depression and it's called "Don't Quit." I'm not sure who the author is, but I have dropped it in below. I find it very inspirational when times are tough as they are now.

Please stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on March 29, 2020 16:03

March 21, 2020

Surviving and Thriving During the COVID-19 Pandemic

Well, I made it through my first week working at home. I think it has been good for the family to be together during this difficult time, even though the kids are not liking distance learning, are bored and don't like our new opportunistic diet (depends on what's at the store). I haven't dug into the canned food yet in the pantry and hopefully won't have to unless we can't leave the house at all or stores are completely out of food. So far, that doesn't seem to be the case. I also keep a few "go bags" with three days of supplies in the garage in case we have to leave the house, but again hopefully, I never need to use those.

Well, I made it through my first week working at home. I think it has been good for the family to be together during this difficult time, even though the kids are not liking distance learning, are bored and don't like our new opportunistic diet (depends on what's at the store). I haven't dug into the canned food yet in the pantry and hopefully won't have to unless we can't leave the house at all or stores are completely out of food. So far, that doesn't seem to be the case. I also keep a few "go bags" with three days of supplies in the garage in case we have to leave the house, but again hopefully, I never need to use those. I'm fortunate to be able to work from home, with only my desktop, internet connection, house phone, cell phone and yellow notepad as my main tools. I have to say, having between 8 and 12 conference calls a day plus doing work online is very draining, especially since there are plenty of mini-crises at work in the midst of the bigger COVID-19 crisis. At the end of the workday, I always make sure to go for a nice long walk by myself to get some exercise and reset my mind. I still try to make sure I get 10,000 steps a day, even though I can't go to the gym. I'm finding it's really hard to work efficiently remotely when you are used to walking down to someone's office to talk about things, but we are all slowly getting used to it. Still, it's amazing what we can do now with technology and I do think many companies will look very differently at working from home after this crisis. They will also take disaster preparedness more seriously. Also many companies that support WFH will no doubt continue to grow in value.

Went to Trader Joe's today and waited in line for about an hour to go in the store, but was pleasantly surprised to see the aisles fully stocked. The joy of seeing meat, eggs, bread and frozen foods on the shelves was hard to describe. Also Smart & Final was pretty well restocked as well. After securing food for next week, it was time to come home, walk the dog and then work on the blog. A typical weekend day on lock down.

On the bright side, gas is cheap and the line at Costco gas is short. Also mortgage rates are really low and I was able to refinance my home and this will put more money in our bank account soon, which will be very helpful. I also recently paid off a lot of debt, so I'm in good shape financially with an adequate emergency fund. I feel like having built a Financial Fortress for my family since the Great Recession has really helped me deal with the new recession we are now facing with a real sense of calm. Yes, many of my stock investments have lost value, but they are a small portion of my overall portfolio and I have no need to sell. Plus, they all pay dividends and are strong companies, unlikely to cut their dividends, so I continue to "clip coupons" every quarter. The yields on quality companies' stocks that pay dividends are also significantly better than on government bonds currently.

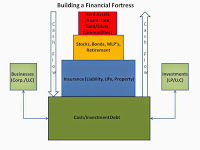

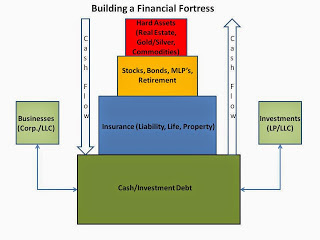

Below is a graphic of the Financial Fortress:

I believe it's never too late to begin Building a Financial Fortress, even now. As you can see, it starts with a strong base of Cash (and investment debt, like mortgages on income property). Insurance is the next level, making sure you have adequate coverage for liability, life and property. Next comes stocks, bonds, and retirement accounts. The top level is hard assets including real estate, gold/silver and commodities. The key is positive cash flow in all of your investments and lots of passive income so you can continue to build your base of cash. Especially in times like these, having multiple streams of income and plenty of cash in an emergency fund is critical. This is not only for peace of mind, if an unexpected big expense comes up or if you lose your job, but more importantly to take advantage of the many investing opportunities that will undoubtedly arise in the wake of the current crisis. It's also good to have a plan if you lose your job (where will you live, how will you reduce your monthly living expenses, etc.). With this in place, you can pretty much weather any storm.

Please stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on March 21, 2020 23:08

March 8, 2020

Disaster Preparation

I have experienced a couple of major disasters in my life - two hurricanes when I lived in Hawaii in 1982 (Iwa) and again in 1992 (Iniki). Unfortunately, my family was not well prepared for both of those events and the aftermath was a real struggle, especially Iniki which was a Category 5 storm and knocked out power on Kauai for months. The community was very resilient, however and everyone helped each other to recover, sharing food and other resources. I remember we had a generator and we let our neighbor use it to power his refrigerator at night to keep his perishable food fresh. Honestly, once all the perishable food was gone, if it wasn't for the military passing out MRE's, there were some days that we might not have eaten very much.

I have experienced a couple of major disasters in my life - two hurricanes when I lived in Hawaii in 1982 (Iwa) and again in 1992 (Iniki). Unfortunately, my family was not well prepared for both of those events and the aftermath was a real struggle, especially Iniki which was a Category 5 storm and knocked out power on Kauai for months. The community was very resilient, however and everyone helped each other to recover, sharing food and other resources. I remember we had a generator and we let our neighbor use it to power his refrigerator at night to keep his perishable food fresh. Honestly, once all the perishable food was gone, if it wasn't for the military passing out MRE's, there were some days that we might not have eaten very much.After the 2011 Tsunami that hit Japan, I purchased two Red Cross 3-day survival back packs for my family and I keep them in the garage. I bought two more recently (I found some cheaper ones on Amazon), so now I have four, one for each person in the family and if we need to leave the house in the event of a disaster, we have those ready to go. The backpacks include things like food, water, first aid supplies, toiletries, gloves, tools and other basics. I also got mini survival kits for the cars, just in case.

The similarities to the COVID-19 pandemic to other disasters I have experienced are stunning. Especially the runs on toilet paper, water and other essentials at grocery stores. I have never seen Costco run out of toilet paper, paper towels and water! While we all can hope for the best, I think it's important to be prepared and not be cavalier about this. A probable scenario that we are seeing in some of the hardest-hit areas of the world is a general quarantine that lasts two to three weeks (the presumed incubation period of the COVID-19 virus). In that event, it's best to have at least enough non-perishable food and basic supplies in your home to last two to three weeks, in case you need to stay home for an extended period of time. Other than that, it seems like the usual precautions for cold and flu season are also very important, including hand washing, not touching your face, staying home when you are sick, covering your mouth when you sneeze, keeping household surfaces clean and sanitary, etc.

The CDC Website is a great source of information on the COVID-19 situation and it's highly recommended. There is a lot of hysteria and "fake news" about this right now.

The financial markets have reacted with extreme volatility in the face of the COVID-19 situation and the uncertainty of the impact it will ultimately have on the US economy. I have not been too worried about my portfolio lately, because I have built a financial fortress for myself since the Great Recession and I've broadly diversified my investments across many non-correlated asset classes, I'm also very conservative in my 401(k), I have been reducing personal indebtedness, I have remained disciplined in my strategy and I have been building plenty of cash reserves. In last week's post I talked about why it's important to resist the urge to panic sell, but it's a lot easier to remain calm if you have a fortress portfolio.

Perhaps one of the "gifts" of the recent market dislocation, in addition to lower prices for good stocks and improved dividend yields for some of my favorite stocks, the rally in 10-year treasuries and corresponding yield decline has made it a great time to refinance real properties! When life gives you lemons, make lemonade!

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on March 08, 2020 15:17

February 29, 2020

Resisting the Urge to Panic Sell

The markets have been on a wild ride recently, with many major indexes now down over 10+ percent so far this year. The selling has gotten downright ugly, some even say ridiculous and yet it was bound to happen as the market has been on a steady upward climb for the better part of the last ten years. All it took was the "black swan" of a viral pandemic to trigger the sell signal.

The markets have been on a wild ride recently, with many major indexes now down over 10+ percent so far this year. The selling has gotten downright ugly, some even say ridiculous and yet it was bound to happen as the market has been on a steady upward climb for the better part of the last ten years. All it took was the "black swan" of a viral pandemic to trigger the sell signal. Here's how the Dow Jones Industrial Average has fared over the past 10 years:

Dow Jones Industrial Average - 10 Year Performance

Dow Jones Industrial Average - 10 Year PerformanceHere's how the S&P 500 has fared over the past 10 years:

S&P 500 - 10 Year Performance

S&P 500 - 10 Year PerformanceWhat's an investor to do in a market environment such as this? Buy the dip? Sell everything? Do nothing? The answer, as always, is "it depends." Probably the best thing you can do is have your portfolio balanced in a way that matches up to your risk tolerance. That way, when extreme market volatility hits, you can do nothing and relax a bit more knowing you are in alignment with your appetite for risk and you can handle these temporary "paper" losses.

People who are less risk tolerant will be more conservative in their investments and will take less of a hit when the market drops, but also miss out on some upside when the market goes up. Alternatively, the more risk-tolerant will be okay with temporary declines in value, even if significant, since they are willing to be patient for the greater upside potential when the market does turn around. Whether you are risk averse or risk tolerant, it's a good idea to have a variety of investments in your portfolio and not have 100% of your wealth tied up in the stock market (unless you're Warren Buffett). For the risk averse, holding a portion of your portfolio in government bonds, cash / short term investments and similar types of investments is critical for that "peace of mind."

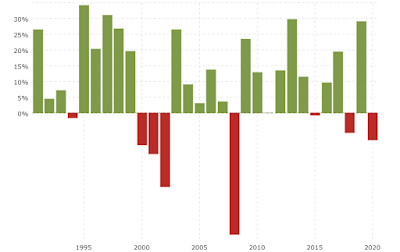

When you look at market history, most years are positive and years where there is a loss are somewhat rare. This favors the long-term or "buy and hold" investor, provided you have a long time horizon.

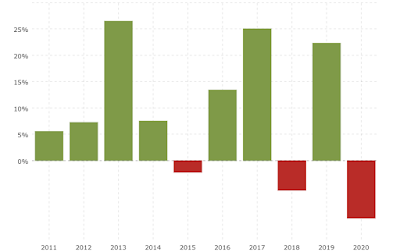

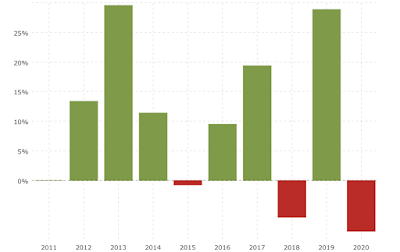

Take a look at the 30 year performance of the S&P 500:

S&P 500 - 30 Year PerformanceSure there were some down years, especially 2008 (Great Recession) which took a 38% hit, but when you look at it, there were 7 down years and 22 up years (2020 is still early and could be green or red, who knows). In other words, 76% of the time, over the long term, you are going to be making money in the stock market and you are only losing money 24% of the time. As such, if you simply held on during the "red" years, you would be sitting on a nice gain over that period of time. That's why it's important to resist the urge to panic sell.

S&P 500 - 30 Year PerformanceSure there were some down years, especially 2008 (Great Recession) which took a 38% hit, but when you look at it, there were 7 down years and 22 up years (2020 is still early and could be green or red, who knows). In other words, 76% of the time, over the long term, you are going to be making money in the stock market and you are only losing money 24% of the time. As such, if you simply held on during the "red" years, you would be sitting on a nice gain over that period of time. That's why it's important to resist the urge to panic sell. It's a lot easier to do this when you have minimal debt, adequate cash on hand for emergencies and for investing opportunities, strong cash flow from your investments and a variety of different investments such that some will perform well in any market environment. That type of strategic approach brings peace of mind to the investor, regardless of your appetite for risk. That's why it's important to have a strategy and to stick with it, rather than reacting to market ups and downs. For example, maybe you invest a portion of your monthly salary or annual bonus in a portfolio of dividend stocks. Maybe you also contribute to a 401(k) every month and an IRA once a year. Keep doing that consistently year in and year out, don't try to time the market and market ups and downs will not matter.

Perhaps one of the "gifts" of the recent market dislocation, in addition to lower prices for good stocks and improved dividend yields for some of my favorite stocks, the rally in 10-year treasuries and corresponding yield decline has made it a great time to refinance real properties! When life gives you lemons, make lemonade!

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 29, 2020 22:55

February 23, 2020

Annual Warren Buffett Letter to Shareholders - Key Takeaways

In what has become an annual tradition, the Berkshire Hathaway letter to shareholders from the Chairman, Warren Buffett, was published yesterday in conjunction with the Company's annual report for 2019.

In what has become an annual tradition, the Berkshire Hathaway letter to shareholders from the Chairman, Warren Buffett, was published yesterday in conjunction with the Company's annual report for 2019.The letter is always an interesting read, since he often talks not only about the past, but also the future and where he sees investing opportunities. It gives small investors a glimpse into the "Wizard of Omaha's" portfolio and where he is allocating capital. The Company has investments in a dizzying array of US companies, many in basic industries such as transportation, banking, energy, insurance, services and now even tech (Apple!). Many people mimic his holdings or simply buy the stock outright (the "B" shares currently trade at about $230 and so are somewhat more accessible to average investors than the "A" shares which trade over $343,000 per share).

This year, with the Company's stock lagging the major benchmark indices, you would think he would have some explaining to do. Also, some investors are frustrated by the lack of dividends paid by the company, the relatively limited amount of stock buybacks and the lack of major new acquisitions. The result is a large pile of cash: $125B in cash and short term investments.

Instead, he makes a pretty convincing case for "retained earnings" and how the compounding effects that can be achieved in allocating capital in a disciplined way to growing profitable, strong businesses provides the best long-term growth. Indeed, this growth is far better than paying out large dividends or buying back shares indiscriminately. The Company's ten largest public company holdings (which include Apple, Bank of America, Coca Cola and American Express) paid out dividends of $3.8B to Berkshire Hathaway. What's more interesting is that Berkshire Hathaway's share of those same companies' retained earnings (reinvested in their respective businesses) was $8.3B or 2.2x the amount paid out in dividends.

He also talked a lot (as he has in past years) about the superior attributes of the insurance business and the ability to capitalize on the collection and accumulation of premiums in advance of incurring losses ("float") to leverage investment returns, while carefully managing the risks inherent in the insurance business. The utility business is also notable in that like the rest of the Company, the earnings are plowed back into the business rather than paid out as dividends (which is very common in the utility industry). What's more notable and impressive is the big commitment to alternative energy in this reinvestment program, which should excite many investors.

While there can be no guarantee that earnings retained in the business and reinvested will result in a superior return and the annual results can swing wildly from year to year, he strongly believes in this approach to building wealth and maximizing long term returns. He has talked about the "American Tailwind" in last year's letter and how the US economy continues to generate strong innovation and long-term business growth relative to other parts of the world.

Warren Buffett holds 99% of his net worth in Berkshire Hathaway stock. This is pretty incredible in a day and age where corporate leaders are actively selling off their shares in an effort to "diversify" their holdings - especially those "internet unicorns." As it relates to his faith in the Company and it's management team even after he is gone, here's a direct quote from the letter that I found very interesting and should make anyone comfortable in holding Berkshire stock long term:

"Today, my will specifically directs its executors – as well as the trustees who will succeed them in administering my estate after the will is closed – not to sell any Berkshire shares. My will also absolves both the executors and the trustees from liability for maintaining what obviously will be an extreme concentration of assets.

The will goes on to instruct the executors – and, in time, the trustees – to each year convert a portion of my A shares into B shares and then distribute the Bs to various foundations. Those foundations will be required to deploy their grants promptly. In all, I estimate that it will take 12 to 15 years for the entirety of the Berkshire shares I hold at my death to move into the market.

Absent my will’s directive that all my Berkshire shares should be held until their scheduled distribution dates, the “safe” course for both my executors and trustees would be to sell the Berkshire shares under their temporary control and reinvest the proceeds in U.S. Treasury bonds with maturities matching the scheduled dates for distributions. That strategy would leave the fiduciaries immune from both public criticism and the possibility of personal liability for failure to act in accordance with the “prudent man” standard.

I myself feel comfortable that Berkshire shares will provide a safe and rewarding investment during the disposal period. There is always a chance – unlikely, but not negligible – that events will prove me wrong. I believe, however, that there is a high probability that my directive will deliver substantially greater resources to society than would result from a conventional course of action.

Key to my “Berkshire-only” instructions is my faith in the future judgment and fidelity of Berkshire directors. They will regularly be tested by Wall Streeters bearing fees. At many companies, these super-salesmen might win. I do not, however, expect that to happen at Berkshire."What I find fascinating is that he is not interested in any sort of diversification or "flight to safety," since he sees the continued growth potential of the business Berkshire Hathaway has built well into the future and which will provide even greater resources to the charitable organizations that will ultimately benefit from these shares. He is even willing to indemnify the trustees of his estate of all liability for holding only Berkshire Hathaway. That's a strong statement.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 23, 2020 09:55

Annual Warren Buffett Letter to Shareholders - Key Takeways

In what has become an annual tradition, the Berkshire Hathaway letter to shareholders from the Chairman, Warren Buffett, was published yesterday in conjunction with the Company's annual report for 2019.

In what has become an annual tradition, the Berkshire Hathaway letter to shareholders from the Chairman, Warren Buffett, was published yesterday in conjunction with the Company's annual report for 2019.The letter is always an interesting read, since he often talks not only about the past, but also the future and where he sees investing opportunities. It gives small investors a glimpse into the "Wizard of Omaha's" portfolio and where he is allocating capital. The Company has investments in a dizzying array of US companies, many in basic industries such as transportation, banking, energy, insurance, services and now even tech (Apple!). Many people mimic his holdings or simply buy the stock outright (the "B" shares currently trade at about $230 and so are somewhat more accessible to average investors than the "A" shares which trade over $343,000 per share).

This year, with the Company's stock lagging the major benchmark indices, you would think he would have some explaining to do. Also, some investors are frustrated by the lack of dividends paid by the company, the relatively limited amount of stock buybacks and the lack of major new acquisitions. The result is a large pile of cash: $125B in cash and short term investments.

Instead, he makes a pretty convincing case for "retained earnings" and how the compounding effects that can be achieved in allocating capital in a disciplined way to growing profitable, strong businesses provides the best long-term growth. Indeed, this growth is far better than paying out large dividends or buying back shares indiscriminately. The Company's ten largest public company holdings (which include Apple, Bank of America, Coca Cola and American Express) paid out dividends of $3.8B to Berkshire Hathaway. What's more interesting is that Berkshire Hathaway's share of those same companies' retained earnings (reinvested in their respective businesses) was $8.3B or 2.2x the amount paid out in dividends.

He also talked a lot (as he has in past years) about the superior attributes of the insurance business and the ability to capitalize on the collection and accumulation of premiums in advance of incurring losses ("float") to leverage investment returns, while carefully managing the risks inherent in the insurance business. The utility business is also notable in that like the rest of the Company, the earnings are plowed back into the business rather than paid out as dividends (which is very common in the utility industry). What's more notable and impressive is the big commitment to alternative energy in this reinvestment program, which should excite many investors.

While there can be no guarantee that earnings retained in the business and reinvested will result in a superior return and the annual results can swing wildly from year to year, he strongly believes in this approach to building wealth and maximizing long term returns. He has talked about the "American Tailwind" in last year's letter and how the US economy continues to generate strong innovation and long-term business growth relative to other parts of the world.

Warren Buffett holds 99% of his net worth in Berkshire Hathaway stock. This is pretty incredible in a day and age where corporate leaders are actively selling off their shares in an effort to "diversify" their holdings - especially those "internet unicorns." As it relates to his faith in the Company and it's management team even after he is gone, here's a direct quote from the letter that I found very interesting and should make anyone comfortable in holding Berkshire stock long term:

"Today, my will specifically directs its executors – as well as the trustees who will succeed them in administering my estate after the will is closed – not to sell any Berkshire shares. My will also absolves both the executors and the trustees from liability for maintaining what obviously will be an extreme concentration of assets.

The will goes on to instruct the executors – and, in time, the trustees – to each year convert a portion of my A shares into B shares and then distribute the Bs to various foundations. Those foundations will be required to deploy their grants promptly. In all, I estimate that it will take 12 to 15 years for the entirety of the Berkshire shares I hold at my death to move into the market.

Absent my will’s directive that all my Berkshire shares should be held until their scheduled distribution dates, the “safe” course for both my executors and trustees would be to sell the Berkshire shares under their temporary control and reinvest the proceeds in U.S. Treasury bonds with maturities matching the scheduled dates for distributions. That strategy would leave the fiduciaries immune from both public criticism and the possibility of personal liability for failure to act in accordance with the “prudent man” standard.

I myself feel comfortable that Berkshire shares will provide a safe and rewarding investment during the disposal period. There is always a chance – unlikely, but not negligible – that events will prove me wrong. I believe, however, that there is a high probability that my directive will deliver substantially greater resources to society than would result from a conventional course of action.

Key to my “Berkshire-only” instructions is my faith in the future judgment and fidelity of Berkshire directors. They will regularly be tested by Wall Streeters bearing fees. At many companies, these super-salesmen might win. I do not, however, expect that to happen at Berkshire."What I find fascinating is that he is not interested in any sort of diversification or "flight to safety," since he sees the continued growth potential of the business Berkshire Hathaway has built well into the future and which will provide even greater resources to the charitable organizations that will ultimately benefit from these shares. He is even willing to indemnify the trustees of his estate of all liability for holding only Berkshire Hathaway. That's a strong statement.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 23, 2020 09:55

February 8, 2020

It's Refinancing Time Again!

If you haven't been following the mortgage market, now is again an excellent time to refinance.

If you haven't been following the mortgage market, now is again an excellent time to refinance. The Current 30-year mortgage rate is 3.51% for January, again near the lowest levels we have seen in 50 years, as shown in the chart below:

A combination of stock market volatility and concerns about the Wuhan Coronavirus have resulted in a big rally in the 10-Year Treasures last week, which has quickly driven rates down.

I recently kicked off a refinancing of an investment property, which was at a 4.5% rate and I was able to get it down to 3.99% with no points and no cash out of pocket, 30-year fixed. I used Loan Depot, who I have so far been pretty happy with, but I have worked with my loan officer in the past at different lenders and she is amazingly fast, has excellent knowledge and great customer service. One of the nice things about refinancing this way is you can increase your monthly positive cash flow right away with a lower mortgage payment (the combination of the lower rate and new 30 year amortization can significantly increase monthly positive cash flow, especially if your rate is high and your mortgage has been outstanding for several years). If you're interested in getting started in real estate investing, you might be interested in my book, Building a Financial Fortress: Getting Started in Real Estate Investing.

It's amazing how the technology has changed the loan application process. I remember the days of having to locate and either mail or fax pages and pages of documents. It used to take days to pull together all the things required for a loan application. Now everything can be uploaded electronically to a portal in minutes. With a simple, intuitive "to do" list and with most statements available online, it's pretty easy. The whole process of applying and getting documents is so much faster than it was even 5 years ago.

It's still not easy to qualify for a loan. You need to have excellent credit to start with and show plenty of income and assets. It's really important to watch your credit score and keep vigilant about identity theft which could potentially ruin your credit. Check out my recent post on this topic if you're interested in learning more about protecting your identity.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 08, 2020 21:50