Nick Reichert's Blog, page 13

November 29, 2020

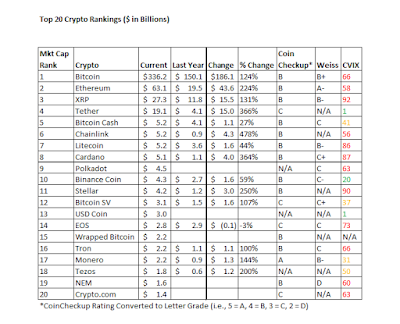

Top 20 Crypto Rankings Update

It's been about a year since I updated my Top 20 Crypto Rankings and with all the news lately about Bitcoin's impressive rise and subsequent sell-off, I thought now might be a good time to look back on how the Top 20 coins from last year have performed and what has changed.

It's been about a year since I updated my Top 20 Crypto Rankings and with all the news lately about Bitcoin's impressive rise and subsequent sell-off, I thought now might be a good time to look back on how the Top 20 coins from last year have performed and what has changed. First of all, five new coins have been added to the Top 20 (Polkadot, USD Coin, Wrapped Bitcoin, NEM and Crypto.com coin) and five coins have fallen out of the Top 20 (UNUS SED LEO, Huobi Token, IOTA, Dash and Ethereum Classic). I believe investors need to be really careful with the so-called "Alt Coins" since they can see their market cap disappear overnight, which is why I have chosen to focus only on Bitcoin. For example, the Crypto.com coin (CRO) was a top 10 coin not too long ago and now is barely holding the #20 spot. By the same token (no pun intended), some of the Alt Coins have seen tremendous growth. The best performing coin over the past year with a +478% increase was Chainlink. The worst performing coin over the past year was EOS at -3%. The average increase of the coins that were on the list last year is +174%. The top 5 coins remained the same: Bitcoin (+124%), Ethereum (+224%), XRP (+131%), Tether (+366%) and Bitcoin Cash (+27%).

For this year's update, I kept the Coin Checkup and Weiss rankings (if available) and added the "CVIX" rating. The CVIX reflects monthly price fluctuations within the 10% range, so a higher number represents higher volatility/risk and a lower number represents a lower volatility/risk. The CVIX can be found on crypto-rating.com if you're interested in more information. The table below is sorted by current market cap and includes the rankings as discussed above:

I have been reading recently about more companies using Bitcoin in their Treasury function to park excess funds instead of cash or US Treasuries. This is a very striking development. Most notably, Microstrategy ($400M) and Square ($50M) have made relatively large investments in bitcoin under the theory that with current Fed policy, low interest rates and "money printing" its a safer bet than holding cash. This along with more ways for individuals to own bitcoin has resulted in a broadening of the ownership base and hopefully more patient "buy and hold" type investors, although the speculators will continue to be attracted to bitcoin and other alt coins with the sudden price moves and huge volatility.

A Morgan Stanley strategist recently came out recommending Bitcoin as one alternative investment in addition to gold that would be a good hedge against the stock market and money printing activity. He was recommending 5% portfolio allocation to alternatives which presumably could include a mix of Bitcoin and gold. This is also good news for long-term Bitcoin owners, since institutional demand will help provide support and drive the price of Bitcoin up further in the long run.

As part of a diversified portfolio, I have seen recommendations of as much as 20%, but I continue to recommend a more conservative position of between 2% and 5% for Bitcoin simply due to the incredible volatility and uncertainties inherent in any new asset class including future government regulation and the effect that speculators can have at least in the short term. Considering there will only ever be 21M Bitcoins, it certainly makes sense in at least one or two!

If you are interested in investing in cryptocurrency, I really like Crypto.com. See my post here on their app and how they are innovating the crypto space in many different ways. As I have written many times before, I don't recommend you put everything into crypto, but it certainly makes sense to buy a small amount monthly to dollar cost average and just hold for the long term. I have been doing that with Bitcoin for quite some time and have been very pleased with the result. If you are interested in reading more about developing a crypto investing strategy, please read my post here.

The Financial Fortress approach would ensure that you are broadly diversified across asset classes and your alternative asset portfolio should not be a large component of your overall financial picture, so even if you suffered heavy losses (which shouldn't happen if you are managing risk appropriately), the impact to your net worth should be minimal. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

November 22, 2020

Risk On?

Last week again proved to be another week of good news / bad news, especially on the COVID front. First there was the great news of another highly effective vaccine, this time by Moderna followed by the bad news of continued exponential growth in COVID cases across the US and the world. Unemployment numbers last week weren't great (showing the first monthly increase in quite some time) and raising some concerns about a "double dip" recession, although housing continues to impress with continued price growth, short supply and strong demand driven by low interest rates, suburban migration and first time homebuyers. Also, homebuilder confidence is extremely high.

Last week again proved to be another week of good news / bad news, especially on the COVID front. First there was the great news of another highly effective vaccine, this time by Moderna followed by the bad news of continued exponential growth in COVID cases across the US and the world. Unemployment numbers last week weren't great (showing the first monthly increase in quite some time) and raising some concerns about a "double dip" recession, although housing continues to impress with continued price growth, short supply and strong demand driven by low interest rates, suburban migration and first time homebuyers. Also, homebuilder confidence is extremely high. Indeed, the housing recovery has been a strong driver of the overall economy, not only favoring homebuilders, mortgage originators and other companies directly involved in residential real estate, but also retailers like Home Depot, Lowe's and Target all reporting strong earnings last week, but each with a different market reaction. All are essential retailers with a focus on the home, but there are some concerns (at least in the case of Lowe's and Home Depot) that the gains they have experienced during the pandemic may not be sustainable, while Target seems to be able to grow both online and in their physical stores and investors seem to believe that Target has the right formula for continued success post-pandemic. While some companies did quite well last week, the overall market sank, with all the major indices ending down on Friday.

With the dueling forces of short-term pessimism and longer term optimism, it's certainly difficult to decide what the best strategy is to navigate this turbulent market. Typically the period from Thanksgiving through New Year is strong for the stock market and this year should be no different, with potentially more more catalysts than normal including recovery in some industries, low interest rates, COVID vaccines on the way, election resolution and the hope for more fiscal stimulus to support pandemic recovery. That's a lot of tailwinds! Of course, the pandemic itself continues to be a strong headwind in the short term with many states rolling back reopening in response to case hikes, which seems to cause investors to flip between growth and value stocks on a daily basis. See my post last week for more of my thoughts on this topic.

On balance, it seems like a good time to be fully invested in the market with a bias toward long positions and buying quality companies on pull-backs. I like selling call options to collect the premium while holding the stocks - either way you make money on your holdings as long as you can patiently hold long-term to weather short-term dips. The market rally seems more likely than not to continue to broaden, especially favoring small caps and the beaten-down cyclical stocks, but I believe growth stocks will also continue to have a place in the portfolio, especially in a low interest rate environment and since they seem to do well in any economy.

Here's what I am currently holding:

Apple (AAPL)Beyond Meat (BYND)Draft Kings (DKNG)Etsy (ETSY)Facebook (FB)Microsoft (MSFT)Square (SQ)I'm also looking to add Roku (ROKU) and Overstock (OSTK) positions next week.The Financial Fortress approach would ensure that you are broadly diversified across asset classes and your stock trading portfolio should not be a large component of your overall financial picture, so even if you suffered heavy losses (which shouldn't happen if you are managing risk appropriately), the impact to your net worth should be minimal. The diversification in your stock trading portfolio need not include other asset classes like bonds or real estate, unless you don't have exposure to those areas in other parts of your Financial Fortress. I'm not recommending any particular stock or strategy. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

November 15, 2020

Growth Vs Value

Many in the financial community are talking about a massive shift from growth stocks (like the companies that have done well during the pandemic such as the FAANG stocks) to value stocks, or the companies that have been beaten down most of the year and have suffered during the pandemic (the so-called "reopening plays" like travel including airlines, leisure including cruise lines and movie theaters, physical retail, restaurants, hospitality, commercial real estate, etc.). I don't think it's a good idea to chase one or the other, but rather take a balanced approach.

Many in the financial community are talking about a massive shift from growth stocks (like the companies that have done well during the pandemic such as the FAANG stocks) to value stocks, or the companies that have been beaten down most of the year and have suffered during the pandemic (the so-called "reopening plays" like travel including airlines, leisure including cruise lines and movie theaters, physical retail, restaurants, hospitality, commercial real estate, etc.). I don't think it's a good idea to chase one or the other, but rather take a balanced approach. This growth vs value notion shifted into high gear with the announcement last week of the first COVID vaccine from Pfizer/BioNTech that is 90% effective in preventing infection, a very significant medical breakthrough. This, coupled with an apparently "divided government" election result in the US, with the Senate likely to retain a Republican majority, a reduced Democratic majority in the House of Representatives and a Democratic President (thereby reducing the risk of dramatic changes to the status quo), were powerful positive catalysts for the stock market last week. More good news on unemployment and company earnings helped further boost the stock market last week, continuing a rally that started just before the presidential election. The market has whipsawed a few times over the past couple of weeks, moving from fear to optimism about COVID as the number of cases continue to grow exponentially across the country, with no end in sight. There have also been notable shifts back and forth between value and growth. This will likely continue to fuel the market volatility that we have seen for months now.

Many professional investors recommend diversified portfolios to weather any storm and also recommend a "barbell" approach, which includes some growth stocks and some value stocks in your portfolio to take advantage of whichever direction the market wants to move from week to week or month to month. What seems most likely is that the market continues to anticipate future economic recovery and with the introduction of additional fiscal stimulus (which is more of a question of when not if and how much), this should set the economic recovery on a more solid foundation. The low interest rate environment looks like it will persist for a couple of years based on recent Fed comments and so there are really few good alternatives to the stock market for your investable cash, other than perhaps Bitcoin or gold.

While there may be a rotation going on, you can't ignore the long term growth story of companies like Amazon, Apple, Facebook, Netflix, Google and Microsoft and so they still deserve a place in anyone's portfolio, especially if they become "oversold." If you can't afford the shares, consider buying fractional shares of each stock, which many brokerages offer or better yet simply buy an ETF like QQQ that focuses on the Nasdaq 100, which would give you plenty of exposure to these names and many other quality non-financial companies. If you are prepared to hold long term, the return of QQQ is likely to be much higher than the market in general. Still, if you are interested in capturing the rotation without having to pick winners and losers, another idea is to simply buy an S&P 500 ETF like SPY. Although selling in the tech stocks tends to drag the S&P 500 down, buying in value names will have the opposite effect and at some point, when the broader market is in balance and rallying together you could see some nice gains. Also, small cap stocks seem to be poised for a breakout to the upside as the economy recovers and these stocks tend to out perform other stocks during recoveries - the Russell 2000 ETF IWM is a good way to participate in this upside.

Once you own these ETF's you can make some extra money by selling covered calls on them, which especially for SPY and IWM will likely be bid up if the rally continues. You can get some nice cash flow in this strategy, although the shares will get called away upon expiration if the market continues to rally. However, this allows you to either buy again or buy something else. If the calls expire out of the money, you keep the premium and can sell more while you wait for share growth. Selling covered calls has been one of my favorite and most profitable option strategies.

The Financial Fortress approach would ensure that you are broadly diversified across asset classes and your stock trading portfolio should not be a large component of your overall financial picture, so even if you suffered heavy losses (which shouldn't happen if you are managing risk appropriately), the impact to your net worth should be minimal. The diversification in your stock trading portfolio need not include other asset classes like bonds or real estate, unless you don't have exposure to those areas in other parts of your Financial Fortress. I'm not recommending any particular stock or strategy.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

November 8, 2020

Safety and Diversification

When thinking about portfolio performance and the desire to seek safe, predictable returns what is really safe? Bank accounts including the so called "high yield" savings accounts pay virtually no interest (0.4% to 0.7% in November according to BankRate and Nerd Wallet) and the same is true for other safe and liquid investments like bank CD's, short term US Treasury ETF's and the like. Currently, it looks like we will have very low interest rates for at least the next few years, based on what the US Federal Reserve (and indeed other global central banks') policy has been. This makes holding cash or cash equivalent investments very difficult to do with such low returns, especially when other investments like stocks are generally performing better. It's truly very tempting to move into riskier assets.

When thinking about portfolio performance and the desire to seek safe, predictable returns what is really safe? Bank accounts including the so called "high yield" savings accounts pay virtually no interest (0.4% to 0.7% in November according to BankRate and Nerd Wallet) and the same is true for other safe and liquid investments like bank CD's, short term US Treasury ETF's and the like. Currently, it looks like we will have very low interest rates for at least the next few years, based on what the US Federal Reserve (and indeed other global central banks') policy has been. This makes holding cash or cash equivalent investments very difficult to do with such low returns, especially when other investments like stocks are generally performing better. It's truly very tempting to move into riskier assets. For example, the S&P 500 has returned 8.6% so far this year, although the Dow Jones Industrial average is -0.75% year to date after a recent rally. Year to date return for the Nasdaq, however, is 32.6%. These disparate returns are mostly due to the wide difference between how technology stocks have performed this year in the COVID 19 pandemic vs other industries and indeed, has been a cause for concern by analysts who have been calling it a "tech bubble" not unlike what we have seen in the past like say around 2004. I'm not sure I totally agree with that, since today's big tech companies are actually quite profitable (unlike the companies in the "Dot.Com" era that were all losing money) and we are talking about earnings multiples today versus sales multiples and other weird nonfinancial metrics in 2004. Also, with 10-Year Treasury yields at very low levels at between 0.7% and 0.8% currently, bonds aren't a great alternative to cash. One could argue that bonds are possibly riskier than stocks if we begin to see inflation, which will cause the value of 10 year bonds at such low rates to plummet if interest rates were to rise significantly.

In fact, if you are looking for yield, you can earn more in an S&P 500 ETF (SPY, for example, boasting a current dividend yield of 1.62%) than you can in a short term (1-3 year) government treasury bond ETF (VGSH, for example, which currently yields 1.37%). Certainly, SPY provides more long-term upside, inflation protection and a yield that's likely to grow as companies typically raise their dividends over time. On the flip side of that argument, you can also suffer a stock market crash like we experienced back in March that could quickly obliterate the value of SPY and which would take a long time to recoup, while an ETF like VGSH would likely go up in value in that scenario, and would certainly preserve your principal. In the end, it's probably not a choice of either SPY or VGSH, but rather having good diversification so that part of your portfolio is in the highly liquid, risk-free end of the spectrum and part of your portfolio is in the higher risk/higher reward end of the spectrum.

As for whether you should pick individual stocks / bonds or just invest in ETF's, the ETF's certainly work if you don't have time or desire to do the research and actively manage your account. They also have a very low cost, which is a huge factor in influencing long term returns. Also, investing in ETF's ensures that you enjoy market-average performance, which isn't a bad thing since most individual investors (not to mention professionals) have a hard time beating the averages anyway. Perhaps its best to allocate a portion of your portfolio to passive index funds and a smaller portion to active investing (again, if you have the time and desire to do so).

Broad diversification is very important for long term returns and the dual objective of wealth preservation and growth. Further, I believe diversification is key to surviving the volatile markets we have experienced over the past several years and seem likely to continue for the foreseeable future. This is what I have called Building a Financial Fortress. Here's my current portfolio allocation:

Stocks - 32%Cash and equivalents - 22%Real Estate - 21%Bonds - 19%Alternatives - 6%Within the stock portfolio, I actively manage about 30% and the rest is passively managed through ETF's. This works well for me, but might not be appropriate for all investors. Alternatives include small positions in gold/silver, Bitcoin, royalty assets and a whole life insurance policy.The Financial Fortress approach would ensure that you are broadly diversified across asset classes and your stock trading portfolio should not be a large component of your overall financial picture, so even if you suffered heavy losses (which shouldn't happen if you are managing risk appropriately), the impact to your net worth should be minimal. The diversification in your stock trading portfolio need not include other asset classes like bonds or real estate, unless you don't have exposure to those areas in other parts of your Financial Fortress. I'm not recommending any particular stock or strategy. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

November 1, 2020

Another Busy and Volatile Week Ahead for Investors

With the US Presidential election overshadowing everything next week, there will be plenty of other news that investors will also have to pay attention to, including more earnings reports (some of the more notable companies reporting next week include Estee Lauder, Skyworks, Humana, Clorox, PayPal, Eaton, Emerson Electric, Qualcomm, TMobile and Roku), the Fed meeting, unemployment numbers and new COVID developments, among other things. Like last week, where pretty good economic data and corporate earnings were swamped by election and COVID jitters, next week is likely to be more of the same. Indeed, the major averages like the S&P500 (SPY) are testing key technical support levels (see red lines in the chart below - the first level of about 3200 is close to being broken and the next level of strong support looks like about 3000). SPY is showing strong signs of further downside risk - perhaps as much as 8% from Friday's close if it drops down to the next level of support (second red line in the chart below).

With the US Presidential election overshadowing everything next week, there will be plenty of other news that investors will also have to pay attention to, including more earnings reports (some of the more notable companies reporting next week include Estee Lauder, Skyworks, Humana, Clorox, PayPal, Eaton, Emerson Electric, Qualcomm, TMobile and Roku), the Fed meeting, unemployment numbers and new COVID developments, among other things. Like last week, where pretty good economic data and corporate earnings were swamped by election and COVID jitters, next week is likely to be more of the same. Indeed, the major averages like the S&P500 (SPY) are testing key technical support levels (see red lines in the chart below - the first level of about 3200 is close to being broken and the next level of strong support looks like about 3000). SPY is showing strong signs of further downside risk - perhaps as much as 8% from Friday's close if it drops down to the next level of support (second red line in the chart below).

Should the election outcome not be clear on Tuesday, the volatility could continue for weeks or even up to 30 days. Also, the market will likely be set to open down on Monday with the announcement that the UK will go to a nationwide COVID lockdown for one month, following similar actions in France and Germany earlier. What's an investor to do?

Well of course, it's best not to panic. If you own good companies, all this turmoil will eventually pass and investors will begin to focus on the fundamentals again. Trying to time the market is a loser's game. If you want to speculate in market volatility and short-term downside, I like ProShares Ultra VIX Short-Term Futures ETF (UVXY), a 1.5x leveraged VIX ETF. I think it's best not too get to aggressive with something like this, keep your position small and focus on short-term trades, especially since the longer term trend has been down since the March market lows - indeed it has already gone up over 24% in the past week, so unless the market has a big downward break (which as discussed previously is certainly a possibility), further upside to UVXY could be limited.

Diversification continues to be a central theme that I hear from the professionals. What's interesting about last week however, is that investors were selling bonds and stocks at the same time, which is odd since typically they are inversely correlated. Possibly this is because government spending is expected to increase next year with fiscal stimulus, which will put upward pressure on interest rates, so why hold bonds now when rates are set to go up and you can buy later for a better yield? It could also just be investors wanting to move to cash to await the election results next week for safety and to take advantage of any opportunities the market presents to "buy the dip."

If you have built a Financial Fortress for yourself, you are already broadly diversified in a range of different asset classes and also have ample cash for emergencies. As such, your stock portfolio should continue to be fully invested in quality companies with good long term prospects. Many are saying the FAANG stocks should be avoided now, but they continue to have great earnings and growth stories and recent interest in government regulation of those companies could actually work out in their favor by stifling upstart competitors. Also outright company breakups are rare, but in that unlikely event could unlock tremendous shareholder value. It seems too early to write off the FAANG story as similar to the Tech Bubble of 2000. The big difference is these companies are making money and most actually trade at a reasonable multiple of those earnings given their growth prospects.

The Financial Fortress approach would ensure that you are broadly diversified across asset classes and your stock trading portfolio should not be a large component of your overall financial picture, so even if you suffer heavy losses (which shouldn't happen if you are managing risk appropriately), the impact to your net worth should be minimal. The diversification in your stock trading portfolio need not include other asset classes like bonds or real estate, unless you don't have exposure to those areas in other parts of your Financial Fortress. I'm not recommending any particular stock or strategy. Stay safe, healthy and positive.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

October 25, 2020

Top 11 Trading Lessons

With the last big week of earnings season ahead and plenty of news expected, not to mention the many other things weighing on investors minds, next week promises plenty of volatility. For stock traders, this is actually a great setup and gives them opportunities to make more money than possible in a market that has little to no volatility. So while volatility can be nerve racking for a long term investor, for a trader it's a opportunity to profit. Of course, it's also an opportunity to lose money if you don't know what you are doing.

With the last big week of earnings season ahead and plenty of news expected, not to mention the many other things weighing on investors minds, next week promises plenty of volatility. For stock traders, this is actually a great setup and gives them opportunities to make more money than possible in a market that has little to no volatility. So while volatility can be nerve racking for a long term investor, for a trader it's a opportunity to profit. Of course, it's also an opportunity to lose money if you don't know what you are doing. Trading stocks is really about taking calculated risks and managing your risk. I wanted to use this post to talk about some lessons I have learned over the past few years trading stocks and options that I think might be helpful to some newer traders. These lessons have been painful and costly, but I feel like they have been very valuable and have made me a better investor. I'm generally a pretty risk averse investor, so my approach to trading stocks and options, while certainly aggressive, has a definite tilt toward my inherent conservatism. This approach may not work for everyone and as usual, I'm not recommending any particular approach - you'll have to figure out what works for you.

Here's a rundown of my top 11 trading lessons learned:

Portfolio Size - Keep trading portfolio allocation modest relative to overall portfolio size (Financial Fortress) - It's important that when you are trading, you want to make sure you isolate the money you are using from other life savings and asset "buckets" to insulate yourself from trading losses, should your risk management strategies failPosition Size - Keep individual position sizes small relative to your trading portfolio - 2-3% for individual options positions and 10-12% for stock positionsCompany Size - Stick with the large cap stocks - the markets for these stocks are generally more liquid than smaller cap names and bid/ask spreads are generally tighter which means it's easier to buy and sell positions and to get better pricing; also if you do suffer a temporary setback in a particular trade, you can always hold the stock until it recovers especially if the long-term trend has been positive (this does require some patience, of course)Margin - Don't use excessive leverage - if using margin, keep the percentage low to avoid triggering a margin call in the event your portfolio value drops (I like to target 30% or less since most brokers will let you margin at most 70% depending on the stocks in your portfolio); when trading options, always use cashEarnings Season - Unless you are "long" in the stock or option or are selling covered calls (to capture the elevated premium and you don't mind continuing to own the stock post-earnings), avoid earnings week trading of calls and puts (especially the ones that expire that week or the week after) - that's basically gambling and while you can make 10x sometimes, you can lose everything and in my experience, that's what happens most of the time - the sellers of those calls and puts are banking on itRisk Management - Remember that options trading is a zero sum game - there is one winner and one loser in every trade - try not to be the loser by focusing on risk managementRisk Management II - Understand your break-even point for each trade and the maximum loss you are willing to take - sell when you hit that point to keep your losses small (remember that with options, the price goes to zero at expiration if they are "out of the money," so selling early for a loss may be better than waiting for a miracle)Risk Management III - If a trade is not working, close it out - don't wait and hope for a rebound, your money can be better deployed somewhere elseDon't Sell too Soon - If a trade is working, let it continue to work and set a reasonable profit target to exitTrades that Work - My favorite trades that have most consistently worked: selling covered calls on "household name" stocks (I found a great free webinar on Barchart here that you might be interested in that does a good job of explaining this strategy), and also buying long-term call options (3-6 months out) and taking small profits along the way - 10% to 30%Trades that Don't Work - My least favorite trades that have not worked: selling short term put and call credit spreads - these are difficult to risk manage if the stock moves in the wrong direction, since there's not much time to recover and they are costly to exit and mitigate losses; to make money on these trades, you have to be right about 80% of the time, which is not easy to do; longer term put credit spreads can work, but generally the further out they are, the lower the premium relative to the risk of loss you take, which is not appealingThe Financial Fortress approach would ensure that you are broadly diversified across asset classes and your stock trading portfolio should not be a large component of your overall financial picture, so even if you suffered heavy losses (which shouldn't happen if you are managing risk appropriately), the impact to your net worth should be minimal. The diversification in your stock trading portfolio need not include other asset classes like bonds or real estate, unless you don't have exposure to those areas in other parts of your Financial Fortress. I'm not recommending any particular stock or strategy. Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.To see all my books on investing and leadership, click here.

October 18, 2020

Managing Through the Uncertainty

Over the past week, the stock market seemed like it wanted to break out, especially with some positive news from generally better than expected bank earnings. However, the market's performance was muted, with uncertainty about rising COVID cases in Europe and the US, setbacks in vaccine / therapy development reported by Eli Lilly (vaccine study paused due to safety concerns), Johnson & Johnson (vaccine study paused due to safety concerns) and Gilead (Remdesivir may not improve COVID survival rate), proposed regulation of "big tech," the US presidential election and the nature / timing / amount of fiscal stimulus all serving to tamp down the bulls with all three major stock market indices up only slightly for the week. Some other potential negative news was China looking at approving its own technology protection law (restricts sensitive exports vital to national security), which could make doing business more difficult for all technology companies in China, including those with foreign investors.

Over the past week, the stock market seemed like it wanted to break out, especially with some positive news from generally better than expected bank earnings. However, the market's performance was muted, with uncertainty about rising COVID cases in Europe and the US, setbacks in vaccine / therapy development reported by Eli Lilly (vaccine study paused due to safety concerns), Johnson & Johnson (vaccine study paused due to safety concerns) and Gilead (Remdesivir may not improve COVID survival rate), proposed regulation of "big tech," the US presidential election and the nature / timing / amount of fiscal stimulus all serving to tamp down the bulls with all three major stock market indices up only slightly for the week. Some other potential negative news was China looking at approving its own technology protection law (restricts sensitive exports vital to national security), which could make doing business more difficult for all technology companies in China, including those with foreign investors. Positive news included Apple's announcement of its new iPhone product line, but as usual the stock sold off after the announcement. Apple reports earnings the week after next (on 10/29) and could see a run up to earnings after last week's sell off, so that one is worth watching. Retailers got a boost from the "new Black Friday" Amazon Prime Day and similar events held last week by other big box retailers (Wal Mart, Target, Best Buy) and also a positive retail sales report on Friday. While goods seem to be leading the recovery, services (including food service and drinking establishments not to mention travel and leisure) which account for 2/3 of the US economy are still firmly in a recession, which is the cautionary note coming out of the otherwise positive report. In other positive news, General Motors (GM) announced that it will be deploying fully autonomous vehicles in San Francisco, which follows news that Google's Waymo launched a fully autonomous service in Phoenix. GM is also launching an electric version of its iconic Hummer truck, which will certainly get some attention. Up until now, the autonomous vehicles were required to have human "co pilots." This is a significant development, particularly as Tesla (TSLA - also slated to report earnings next week on 10/21) has talked about a "robot taxi fleet" program where Tesla owners could rent their car to the program when not in use and earn extra money. That program, if launched, could be a game changer since estimates are owners could earn up to $30K a year from leasing their car to this program.

For now, it seems like volatility will continue at least until early November and the election results are known. Some analysts think there will be as much as a 10% dip if the election is contested, but polling and betting oddsmakers currently show that will be unlikely. Many believe there will be a relief rally once the election results are final. As always, trying to time those events will be difficult so it's best to remain broadly diversified and appropriately invested in the market. I'm still bullish, but I am increasing my overall cash position to wait out the election and its aftermath, given all the volatility in the past several weeks and the related uncertainties discussed earlier. I'm mostly looking at smaller bullish earnings option plays for select companies reporting in the next four to six weeks. My favorites are the big box retailers (especially in light of the aforementioned retail sales report, early kickoff to the holiday shopping season and continued strength in housing), such as Home Depot (HD), Lowes (LOW), Target (TGT), Wal Mart (WMT) and specialty retailers Lululemon (LULU) and Ulta Beauty (ULTA). I also like Fed Ex (FDX), which looks to continue to do very well in the post-pandemic world and especially as the holidays approach and which will certainly see the highest ever online purchasing due to COVID. Similarly, McDonald's (MCD) seems like a good play for affordability and safety (drive through / delivery) in the midst of the pandemic / recession and also it's great marketing, recently partnering with celebrities to drive sales.

Diversification, managing leverage and position sizing are critical. Borrowing too much on margin or taking too large a position in any one stock / option could wreck your portfolio. A good rule of thumb I have learned is limiting to no more than 2% of your portfolio in any one position for pure option trades (buying or selling puts or calls). For stocks, it's good to limit yourself to 10% - 15% of your total portfolio in any one stock, unless it's a very low volatility cash flow / dividend play, in which case a higher percentage may be okay.

The Financial Fortress approach would ensure that you are broadly diversified across asset classes and your stock trading portfolio should not be a large component of your overall financial picture, so even if you suffered heavy losses (which shouldn't happen if you are managing risk appropriately), the impact to your net worth should be minimal. The diversification in your stock trading portfolio need not include other asset classes like bonds or real estate, unless you don't have exposure to those areas in other parts of your Financial Fortress. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage positions in the stocks mentioned above. Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.To see all my books on investing and leadership, click here.

October 11, 2020

Earnings Season Kicks Off - A Look Ahead

Next week earnings season kicks off again with most of the big banks reporting. Two banks that are favorites of some analysts are Morgan Stanley (MS) and JP Morgan Chase (JPM) for different reasons. Morgan Stanley continues to establish itself as a wealth manager (a better business with steady, growing cash flows and less dependence on interest rates and ability of borrowers to repay loans), most recently with its acquisition of Eaton Vance. JP Morgan is expected to have good investment banking results, good results from mortgage refinancing and possibly better than expected loan loss reserves compared to last quarter. The outcome of next week will certainly set the tone for the next few weeks. Although expectations are low, some improvement over the last quarter is to be expected. While stimulus talks are on again and off again, the stock market seems to be adjusting to the reality that it's coming, it just might not be until early next year. And assuming a Democratic sweep, which polls and betting odds seem to indicate, the fiscal stimulus when it does arrive, is likely to be substantial. Plenty of economic data continues to point to a slow and steady economic recovery, however the there continues to be broad governmental support for additional fiscal stimulus to ensure the recovery stays on track and to help the many people who are still unemployed and the small businesses who continue to struggle. Other items of note next week include Apple's (AAPL) reveal of the next generation of IPhones, which should generate some investor interest. Zoom (ZM) has a two day analyst event which should provide some new insights into its business and future prospects. Finally, stimulus talks will continue which could add some volatility into the mix.

Next week earnings season kicks off again with most of the big banks reporting. Two banks that are favorites of some analysts are Morgan Stanley (MS) and JP Morgan Chase (JPM) for different reasons. Morgan Stanley continues to establish itself as a wealth manager (a better business with steady, growing cash flows and less dependence on interest rates and ability of borrowers to repay loans), most recently with its acquisition of Eaton Vance. JP Morgan is expected to have good investment banking results, good results from mortgage refinancing and possibly better than expected loan loss reserves compared to last quarter. The outcome of next week will certainly set the tone for the next few weeks. Although expectations are low, some improvement over the last quarter is to be expected. While stimulus talks are on again and off again, the stock market seems to be adjusting to the reality that it's coming, it just might not be until early next year. And assuming a Democratic sweep, which polls and betting odds seem to indicate, the fiscal stimulus when it does arrive, is likely to be substantial. Plenty of economic data continues to point to a slow and steady economic recovery, however the there continues to be broad governmental support for additional fiscal stimulus to ensure the recovery stays on track and to help the many people who are still unemployed and the small businesses who continue to struggle. Other items of note next week include Apple's (AAPL) reveal of the next generation of IPhones, which should generate some investor interest. Zoom (ZM) has a two day analyst event which should provide some new insights into its business and future prospects. Finally, stimulus talks will continue which could add some volatility into the mix.For next week, I'm looking at selling covered calls "at the money" with a 10/16 expiration for a few stocks that have great recent and longer-term upward momentum, excellent business prospects (post-pandemic "winners") and strong top analyst support. They are Peloton (PTON), Etsy (ETSY), Twilio (TWLO) and Fuel Cell (FCEL). Fuel Cell in particular has recently gotten an upgrade from JP Morgan, a recent Department of Energy contract, and stands to benefit from the global push to develop alternative fuel hydrogen vehicles, particularly for heavy trucks.

Longer term, I think the focus on cyclical / industrial stocks will continue and I like chemicals, basic materials, transportation stocks (railroads in particular) and industrials like 3M (MMM).

As the recovery slowly grinds on and the stock market rally continues, there will be many investment choices, but it's important to do your research and look for the companies that stand to benefit the most from the recovering economy and are not "over-priced." Often, you will get conflicting opinions from the Wall Street analysts, "talking heads" on TV and your own research. It's important to digest all that information and make your own decisions.

Diversification, managing leverage and position sizing are critical. Borrowing too much on margin or taking too large a position in any one stock / option could wreck your portfolio. A good rule of thumb I have learned is limiting to no more than 2% of your portfolio in any one position for pure option trades (buying or selling puts or calls). For stocks, it's good to limit yourself to 10% - 15% of your total portfolio in any one stock, unless it's a very low volatility cash flow / dividend play, in which case a higher percentage may be okay.

The Financial Fortress approach would ensure that you are broadly diversified across asset classes and your stock trading portfolio should not be a large component of your overall financial picture, so even if you suffered heavy losses (which shouldn't happen if you are managing risk appropriately), the impact to your net worth should be minimal. The diversification in your stock trading portfolio need not include other asset classes like bonds or real estate, unless you don't have exposure to those areas in other parts of your Financial Fortress. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage positions in the stocks mentioned above. Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.To see all my books on investing and leadership, click here.

October 4, 2020

More Volatility Ahead

When I wrote my post last week about the potential for a lot of stock market volatility in the month of October, I didn't expect it to happen in the same week. Of course, one thing missing from my list of investor concerns was the President of the United States contracting COVID and being hospitalized. Now that's what you call a "Black Swan" event and even though there was some encouraging economic data on Friday and stimulus talks are continuing (although new stimulus legislation is still highly unlikely before the election), the market sold off significantly. This theme could very well carry into next week with more ups and downs ahead. Between the President's health status, news of more COVID cases in the mid-west and New York City shutting down again due to COVID, investors will certainly be on edge next week, despite the slowly improving economy and hopes for more stimulus from Congress.

When I wrote my post last week about the potential for a lot of stock market volatility in the month of October, I didn't expect it to happen in the same week. Of course, one thing missing from my list of investor concerns was the President of the United States contracting COVID and being hospitalized. Now that's what you call a "Black Swan" event and even though there was some encouraging economic data on Friday and stimulus talks are continuing (although new stimulus legislation is still highly unlikely before the election), the market sold off significantly. This theme could very well carry into next week with more ups and downs ahead. Between the President's health status, news of more COVID cases in the mid-west and New York City shutting down again due to COVID, investors will certainly be on edge next week, despite the slowly improving economy and hopes for more stimulus from Congress. I still think a short-term bearish and long-term bullish positioning is the best way to profitably navigate this market. Three long-term plays that I like right now are Nikola (NKLA), Terex (TEX) and DraftKings (DKNG).

I think the selling in NKLA is overdone right now and the company still has a great business model and very savvy investors behind it. As long as the OEM partnerships (including GM) and the pre-orders remain intact, the company still has plenty of potential to succeed in a very large market opportunity to replace diesel long haul trucks with fuel cell / battery electric trucks and launch a new fully electric pickup truck. Although loss of the CEO Trevor Milton was a shock, I think in the long run it will benefit the company to move away from some of the "noise" and focus on execution of the business plan.

TEX makes materials handling and high reach equipment and there was a recent article in Barron's about them that is a good read. They are a relatively cheap, small cap play on the nascent economic recovery for a number of reasons, not the least of which is recovery in basic materials industries (and associated demand for mining equipment) and replacement cycles for high reach equipment used by rental operators and other companies, as well as the Company's good execution through the pandemic period.

DKNG has been a great stock to own, although I liked it better in the $30's, it has the potential to be a $100 stock. Their dominant position in the legal sports betting market in the US and potential for more states to open up as a solution to budget woes is the long term driver of their growth. The restart of professional and college sports has been a tremendous boost to the stock, causing it to more than double from recent lows. As sports continue to figure out how to navigate the post-COVID world, the opportunity for growth in online gambling will continue. The company is also one of the only pure plays in online gambling, which is particularly advantageous without the need for physical locations and has certainly helped drive the high valuation unlike many of it's competitors such as Penn National Gaming (PENN).

As for short plays, selling a short-term call credit spread or buying a short-term put on SPY or QQQ will work or also buying a leveraged VIX ETF like UVXY. Underneath the stock market index declines, select individual stocks (such as cyclicals like industrial / materials companies, banks and even airlines) have been doing well in the past few days, while the broader market, driven by technology stocks has sold off in the midst of the volatility. This is due to investors continuing to shift from technology to cyclical stocks as the economy recovers and to seek out greater value, which has been a big theme recently. Technology stocks still present great long term growth potential, but their valuations for the most part have gone up so much since the March lows, that investors are more willing to sell those companies to find better upside (or to simply raise cash if volatility is too high).

Every market provides an opportunity for profit, but the key is to stay informed and do your research.

Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage positions in the stocks mentioned above. Stay safe, healthy and positive.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

September 27, 2020

Stock Market Outlook in the Coming Weeks

The next several weeks promise plenty of news and market volatility, with numerous issues / uncertainties on investors' minds including:US Presidential election outcome Lack of a new stimulus bill out of Congress (highly unlikely prior to the election, even though some lawmakers are still holding out hope of a deal - this also seems even more unlikely given the Democratic uproar over the President's Supreme Court nominee, the confirmation of which is to be completed before the election)Course of the COVID-19 pandemic as we move into the winter in the US and as other countries in the world begin to see a resurgence and some countries are forced to take lockdown measures againPersistently high unemployment (rate of improvement has slowed over the past several weeks)Sluggish economic recovery Continued flow of IPO's (9 next week) which causes investors to sell other stocks (mostly tech stocks) to buy, which can drive down the market if selling is concentrated in the FAANG group as we have seen with the recent market pull-backSome analysts are predicting more volatility in the coming weeks and perhaps some further declines in the major stock market indices as stocks sell off due to the numerous uncertainties. However, once we are past the election and more fiscal stimulus is available, the markets are expected to stabilize and continue to march higher with the economic recovery, perhaps led by sectors that have lagged in the most recent runup including "traditional" cyclical stocks such as industrial / material companies. The S&P 500 (SPY) shows a very noticeable break from the rising trend since the March lows (see chart below). This could be an indication that a further decline can be expected before the selling is done, possibly as much as another 10% to 20% downside, according to some analysts. Considering how much and how quickly the markets have recovered from the March lows, that would not be surprising.

The next several weeks promise plenty of news and market volatility, with numerous issues / uncertainties on investors' minds including:US Presidential election outcome Lack of a new stimulus bill out of Congress (highly unlikely prior to the election, even though some lawmakers are still holding out hope of a deal - this also seems even more unlikely given the Democratic uproar over the President's Supreme Court nominee, the confirmation of which is to be completed before the election)Course of the COVID-19 pandemic as we move into the winter in the US and as other countries in the world begin to see a resurgence and some countries are forced to take lockdown measures againPersistently high unemployment (rate of improvement has slowed over the past several weeks)Sluggish economic recovery Continued flow of IPO's (9 next week) which causes investors to sell other stocks (mostly tech stocks) to buy, which can drive down the market if selling is concentrated in the FAANG group as we have seen with the recent market pull-backSome analysts are predicting more volatility in the coming weeks and perhaps some further declines in the major stock market indices as stocks sell off due to the numerous uncertainties. However, once we are past the election and more fiscal stimulus is available, the markets are expected to stabilize and continue to march higher with the economic recovery, perhaps led by sectors that have lagged in the most recent runup including "traditional" cyclical stocks such as industrial / material companies. The S&P 500 (SPY) shows a very noticeable break from the rising trend since the March lows (see chart below). This could be an indication that a further decline can be expected before the selling is done, possibly as much as another 10% to 20% downside, according to some analysts. Considering how much and how quickly the markets have recovered from the March lows, that would not be surprising.

Similarly, the NASDAQ (QQQ) shows a similar pattern and faces similar downside risks, as shown below:

It may be wise to hold some cash to take advantage of the bigger dip if and when it comes. Individual stocks poised to benefit the most from the economic recovery should be held with a time horizon of at least four months (January) to allow for election and fiscal stimulus resolution, not to mention possibly a COVID-19 vaccine and more data on how the recovery is doing. Investors may even be able to look forward to a "Santa Claus Rally." As mentioned above, "traditional" cyclical stocks seem poised to benefit from a rotation and better performance as the economy recovers, since they have not seen the same post-March rally as technology stocks.

It may also make some sense to make some small short-term bets in further declines in the indices either by buying puts or selling call credit spreads over the next four weeks or so.

Another great idea for capitalizing on the coming volatility, which is expected to spike significantly during the month of October (historically a month that has extremely high volatility) is an exchange traded fund that tracks 1.5x the VIX index, the ProShares Ultra VIX Short-Term Futures ETF (UVXY). As you can see, the VIX recently started to trend back up slightly but has been on a general downtrend from March as you would expect due to the recovery in the market.

In summary, a short-term bearish and long-term bullish strategy appears to be the best way to approach the current stock market environment over the next few months. There are several ways to play this as discussed above.

Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage positions in the stocks mentioned above. Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.