Nick Reichert's Blog, page 10

July 12, 2021

Monthly Portfolio Allocation

It's once again time for my monthly portfolio allocation update. I shifted some things around since last month and put more cash to work since the last update. My overall portfolio allocation approach is to remain broadly diversified across a wide range of asset classes, effectively creating an "all weather" portfolio that should do well in any investing environment (the goal to achieve lower risk and higher return) and consistent with my Financial Fortress methodology.

It's once again time for my monthly portfolio allocation update. I shifted some things around since last month and put more cash to work since the last update. My overall portfolio allocation approach is to remain broadly diversified across a wide range of asset classes, effectively creating an "all weather" portfolio that should do well in any investing environment (the goal to achieve lower risk and higher return) and consistent with my Financial Fortress methodology. Here's the breakdown for this month:

Cash - 0.8%Stocks - 23.6% US Large Cap - 10.3% (60% actively managed in a trading portfolio and remainder is passively managed in retirement account)US Mid Cap - 3.2% (100% passively managed in retirement account)US Small Cap - 4% (75% passively managed in retirement account and 25% actively managed in a non-trading portfolio)International - 6.1% (100% passively managed in retirement account)Commodities - 6.4% (100% passively managed in retirement account)Bonds - 9.2% (100% passively managed in retirement account)Real Estate - 24.9% (26% passively managed in retirement account and remainder is actively managed investment property)Private Equity - 13.5% (includes Seed Invest and Republic investments - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, fintech, etc.)Bitcoin - 12.5% (mix of direct Bitcoin ownership, MicroStrategy and GBTC)Gold / Silver / Other Alt - 6.7% (50% physical coins and 50% miner ETF's GDX and GDXJ)Other - 2.4%I'm very mindful of elevated stock and bond prices and risk, so I have tried to keep that exposure somewhat limited, even though performance has actually been quite good recently. Cash position was reduced to "put the money to work," but I plan to increase cash position a bit more next month to have a bit more liquidity. Since last month, I shifted more money to private equity (startup investments), Bitcoin (accumulation of more coins at current low prices) and also paid off my car loan.Thanks to used car inflation, my car appreciated 20% since I bought it about a month ago - ironically my best performing investment. I know that won't be the case long term, but at least I don't have a car payment anymore, which should help me save a bit more each month.

I'm continuing to closely monitor the market situation for opportunities, but feel pretty good about my overall allocation right now. I could probably increase my commodity exposure a little and as mentioned previously, increase cash a bit, but otherwise not much to do at this time. I'm expecting continued market volatility for the rest of this year and like most observers, I'm expecting a stock market correction at some point of 10% to 20%, which would be healthy given extended valuations and a great buying opportunity.

Hopefully reviewing this allocation helps you understand how I operationalize my macro strategy views and Financial Fortress approach in a practical way.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

July 4, 2021

Trading Volatility

Stock market volatility is measured by the VIX index, sometimes called the "fear gauge."

Stock market volatility is measured by the VIX index, sometimes called the "fear gauge."

The Cboe Volatility Index (VIX) is a real-time index that represents the market's expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants.

The index is more commonly known by its ticker symbol and is often referred to simply as "the VIX." It was created by the Chicago Board Options Exchange (CBOE) and is maintained by Cboe Global Markets. It is an important index in the world of trading and investment because it provides a quantifiable measure of market risk and investors' sentiments.

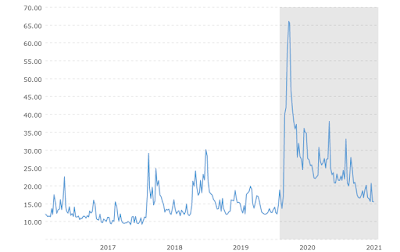

The VIX has looked like an interesting trade recently for several reasons:

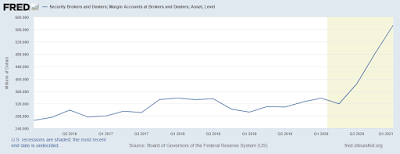

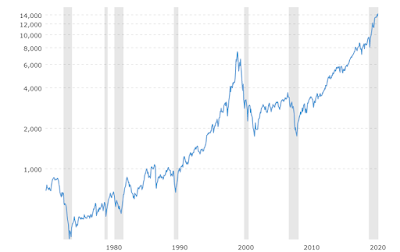

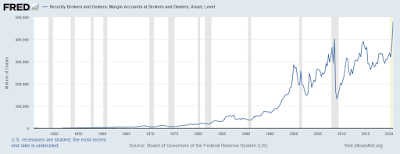

Although still elevated relative to the period prior to COVID, VIX has declined significantly since March of last year when it spiked above 65, while the stock market has continued to rally (currently at about 15) - see first chart belowStocks continue to reach all time highs - S&P 500 has recently started going parabolic, which is not sustainable from a technical standpoint (pullback to trendline will happen eventually - SPY closed at $433.72 on Friday; 50 day simple moving average is $420 (-3%), 100 day simple moving average is $408 (-6%) and 200 day simple moving average is $383 (-12%), which gives you some idea of the downside support levels) - see second chart belowStock market margin exposure extremely elevated, something I have written about before as a concern if there is any sort of market sell-off, this can exacerbate the downward selling pressure - see third chart belowThere are plenty of potential catalysts to derail the stock market rally, at least temporarily, including rising bond yields in response to inflation concerns as noted by ForbesYou can go long volatility by purchasing volatility ETF's - one thing is for sure, volatility will spike again, it's just a matter of time

VIX - 5 Years

VIX - 5 Years S&P 500 - 5 Years

S&P 500 - 5 Years Broker Margin Accounts - 5 Years

Broker Margin Accounts - 5 YearsThere are several ways to invest in volatility. The largest and most popular ETF is VXX which tracks the VIX without leverage. One ETF I like is UVXY, which is designed to replicate 1.5x the performance of the VIX on a daily basis. Once you own UVXY, you can also choose to sell calls on it (as long as your strike price is at or above your cost basis so you don't lose money on your initial investment). This allows you to earn some additional cash flow and is a great way to capitalize on investor interest in gaining exposure to volatility, given the current market setup. The premiums tend to be high on this ETF due to the underlying volatility of UVXY, so a great cash flow opportunity.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

June 27, 2021

Interesting Long / Short Trade

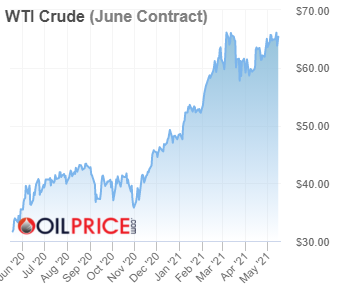

In doing my weekly review of markets and listening to podcasts, I came across an interesting trade setup, given the current market environment that seems to favor higher and more persistent inflation than perhaps what some market participants believe. There are those, of course, that believe the inflation we are currently seeing is transitory and you only need to look at several key commodities that have fallen off their recent parabolic highs (i.e., copper and lumber), although they continue to remain at elevated levels relative to last year - lumber is still up 83% over last year's price, copper is still up 49% from a year ago. Oil is the one notable exception to the trend, its price continuing to rise steadily this year from last year's lows, the chart showing a very bullish trend:

In doing my weekly review of markets and listening to podcasts, I came across an interesting trade setup, given the current market environment that seems to favor higher and more persistent inflation than perhaps what some market participants believe. There are those, of course, that believe the inflation we are currently seeing is transitory and you only need to look at several key commodities that have fallen off their recent parabolic highs (i.e., copper and lumber), although they continue to remain at elevated levels relative to last year - lumber is still up 83% over last year's price, copper is still up 49% from a year ago. Oil is the one notable exception to the trend, its price continuing to rise steadily this year from last year's lows, the chart showing a very bullish trend:

Brent Crude

Brent CrudeIndeed, some analysts are predicting $100 / barrel oil by next year, last seen in 2014. This would certainly contribute to inflation.

Meanwhile, gold continues to consolidate around $1,800 / ounce and looks like it's ready to move higher (will require dollar weakness and low real interest rates to really get moving - assuming no change to current fiscal and monetary policy trends, this seems a probable outcome):

Gold

GoldAt the same time, major stock market indices continue to make all time highs. Inflationary periods historically tend to favor commodities ("hard" assets) over financial assets like stocks and bonds:

S&P 500

S&P 500 NASDAQ

NASDAQ DJIA

DJIASo the trade idea is to buy long dated puts on NASDAQ (QQQ) and S&P500 (SPY) and maybe even DJIA (DIA) and buy long-dated calls on USO and GDX/GDXJ. If inflation indeed continues to hang around as many expect, it could prove to be a catalyst for a stock market sell off (many think at least a small 10% or so stock market correction is overdue anyway, which could provide an opportunity to take early profits on the puts). Gold and oil should benefit from these inflationary forces. Gold miner indices GDX / GDXJ are a great way to make a leveraged bet on gold. USO is a good way to bet on oil but you can also invest in energy ETF's like XLE. If you are strong in your long-term conviction for gold and oil and you have the capital, it might make more sense to just buy XLE, USO, GDX and GDXJ directly and hold and possibly hedge your equity positions by buying UVXY or a similar ETF. Otherwise, if you have limited capital, buying puts and calls might be a better choice.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

June 13, 2021

Portfolio Update

This week, it's time for my monthly portfolio update and a look at how I have diversified my holdings broadly across a number of asset classes with some commentary. It wasn't a great month with the overall portfolio declining 3.8%. Most of that was driven by weakness in Bitcoin and some of the high growth tech stocks I own in my trading portfolio, although both have started to recover the last few days. The broader stock investments in my 401(k) performed well, posting a 3.7% increase from last month which helped offset losses elsewhere.

This week, it's time for my monthly portfolio update and a look at how I have diversified my holdings broadly across a number of asset classes with some commentary. It wasn't a great month with the overall portfolio declining 3.8%. Most of that was driven by weakness in Bitcoin and some of the high growth tech stocks I own in my trading portfolio, although both have started to recover the last few days. The broader stock investments in my 401(k) performed well, posting a 3.7% increase from last month which helped offset losses elsewhere. With a buy and hold mindset, particularly for Bitcoin, I don't mind the frequently wild short term fluctuations and actually do like to see the lack of correlation between broader stock holdings and Bitcoin, which helps my overall portfolio diversification strategy. Last week I reviewed the top 20 cryptocurrencies if you're interested - my top picks continue to be Bitcoin, Etherium and Litecoin. I continue to favor a heavier portfolio mix of hard assets including real estate, Bitcoin, gold/silver and commodities in the current fiscal and monetary environment. There are many good arguments on both sides of the inflation / deflation question from many very smart people and I still think it makes sense to prepare for either situation rather than trying to make a directional bet on one or the other. Indeed, we could see inflation followed by deflation (i.e., both scenarios could unfold in the next few years).

One thing is for sure: It's important to review your portfolio and make adjustments where appropriate as things change - not trading, but rather actively managing your asset allocation. Passively investing in index funds is no longer a guaranteed way to make money given current market dynamics.

Here's the breakdown:

Cash - 11.6% (moved out of TIPS into cash to see what happens with interest rates, especially with Fed meeting next week and recent action in 10 year Treasuries - TIPS were selling off last week as longer dated bonds rallied)US Large Cap - 10.2%US Mid Cap - 3.0%US Small Cap - 3.0%International - 6.2% (split evenly between emerging and developed markets)Commodities - 6.4% (these performed well - up 1.6% over last month)Bonds - 9.1%Real Estate - 24.5% (has been a particularly strong performer recently)Private Equity - 10.8% (added a couple new investments this month on SeedInvest and continuing to build a portfolio of small early stage investments focused on artificial intelligence, genomics and fintech)Bitcoin - 10.9% (includes direct Bitcoin holdings mostly, plus Grayscale Bitcoin Trust and Microstrategy - during the month I sold some stocks and increased direct Bitcoin holdings, buying the most recent dip)Other - 4.1% (includes physical gold and silver and royalties) I try to keep a disciplined approach on my asset targets and trade in and out of positions only as necessary. I also try to be patient with unrealized losses and don't allow those to dictate my strategy. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

June 6, 2021

Top 20 Crypto Rankings Update

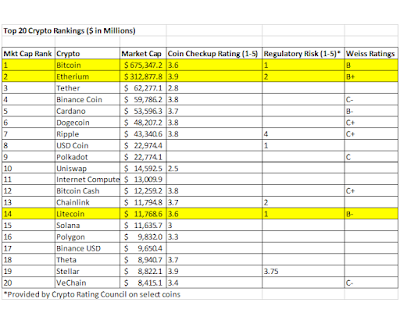

For this week's post, I have updated my Top 20 Crypto Rankings, since it has been a while since the last update back in November 2020 and a lot has changed in the space since then. I was able to get Coin Checkup ratings on most of the coins, Weiss Ratings on about half and I discovered a new rating of securities regulatory risk published by the Crypto Rating Council on some select coins that I thought was interesting. A higher score on a scale of 1 to 5 reflects greater securities regulation risk.

For this week's post, I have updated my Top 20 Crypto Rankings, since it has been a while since the last update back in November 2020 and a lot has changed in the space since then. I was able to get Coin Checkup ratings on most of the coins, Weiss Ratings on about half and I discovered a new rating of securities regulatory risk published by the Crypto Rating Council on some select coins that I thought was interesting. A higher score on a scale of 1 to 5 reflects greater securities regulation risk. Overall, Bitcoin and Etherium continue to be the dominant coins as they were in the last update. Bitcoin's market cap has increased by $339.1 Billion or 100% since the last update six months ago and Etherium's market cap has increased by $249.8 Billion or 396% since the last update. This is pretty incredible considering the recent massive (50%) market correction and all the related negative press around it. The cryptocurrency market is rapidly changing and adoption is growing, with new developments literally every week and so it's quite a challenge to keep up with it all. One of my favorite YouTube channels for updates in the space is Blockworks and I recommend you check it out if you're interested, especially the weekly show On The Margin, which is always informative and entertaining. Also big news this week was the Bitcoin Conference in Miami and while there were some shenanigans, the overall content, tone and guest speakers were incredible, the news about El Salvator planning to make Bitcoin a recognized currency was huge and I believe there is a lot to be excited about for the future of Bitcoin and cryptocurrency space generally.

My top three picks in the cryptocurrency space are Bitcoin, Etherium and Litecoin based on the scores above and also the outlook for these coins.

I think Bitcoin is a superior store of value asset or "sound money." Bitcoin has proven itself as having the most mature protocol in terms of technical development, stability and network security, which is what you want when you are storing your money. The volatility in price takes a little getting used to, but it is expected that over time that will settle down as adoption increases and price discovery continues. The nice thing about Bitcoin is the supply is immutably fixed, so the only variable to watch is demand and that is expected to grow over time as investors see the superior qualities of Bitcoin compared to other digital and non-digital assets, especially as a non-correlated diversification strategy. In particular, as I have written about previously, the ability to store and move large amounts of Bitcoin for very low cost is clearly superior to gold or silver, although I still advocate for having gold and silver in a diversified portfolio along with Bitcoin. While Bitcoin transaction processing speeds can be relatively slow, there are new "layer two" technologies (such as Lightning) that are much faster. These are being developed to sit on top of the Bitcoin blockchain and can do many of the same things that the Etherium protocols can do in terms of fast processing of financial transactions using smart contracts. This will be an area to watch closely.

Etherium has tremendous potential as a platform for enabling all sorts of financial transactions using smart contracts, including the ability to lend / borrow and earn interest (DeFi), NFT transactions and many other use cases. It also seems to be growing quicker than Bitcoin and so has potentially more appreciation upside in that regard. One downside is that the protocol is centrally controlled vs decentralized like Bitcoin and also the protocol is still being developed and so is less stable and potentially subject to manipulation. A new version is being rolled out in the next year or two that leverages "proof of stake" to process transactions - faster than "proof of work" and potentially less secure, but also pays interest if you "stake" your Etherium to support the network. There is also the debate over "proof of stake" versus "proof of work" and which one is better. Despite all this, adoption continues to grow exponentially, so it definitely bears watching.

Litecoin represents one of the "original" coins that has a protocol very similar to Bitcoin (proof of work) with much faster processing speeds that I think is under-appreciated by the market.

While it's very difficult to pick "winners" in this space and it's clear that most of the coins currently in circulation will not survive over the long haul, the history of the internet has taught us that the first movers have a tremendous advantage, since for anyone to unseat the first mover requires a 10x+ improvement in functionality as well as widespread adoption to be successful. As such, the largest market cap players like Bitcoin and Etherium seem best positioned for future success under that thinking.

Personally, I'm staying away from other popular altcoins like Dogecoin and the like. While there's clearly money to be made speculating, a serious investor needs to look at where the long term value will be created.

However, there's also a strategy around investing a small amount in each of the top 20 smaller-cap cryptos (excluding Bitcoin and Etherium, which would presumably have the highest allocation in your portfolio and stable coins, which track the dollar and won't appreciate). This strategy could pay off much in the way that investing in startups does. While many of the 10,296 (as of this writing according to Coinmarketcap) coins will fail, some will succeed and those that do could pay off quite well with exponential returns.

What's most important is that you develop a strategy of diversification across multiple asset classes (Financial Fortress), which includes stocks, bonds, real estate, commodities, private equity, and alternative assets including gold/silver and cryptocurrencies.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

May 31, 2021

Avoiding Leverage

With interest rates near all time lows, investors are not only enticed out of cash and bonds into riskier assets like stocks, commodities and crypto, they can also be tempted to borrow money for those investments to magnify returns. Whether using a brokerage margin account (my broker currently charges between 6.575% - 8.325% depending how much you borrow), home equity loan (I have seen 3% - 5% if you have good credit), or personal loan (6% - 36%, depending on your credit), there are many ways that people can borrow money for investing. While the returns can be infinite using borrowed money and also sizable, especially if the asset you invest in goes up dramatically (crypto such as Bitcoin or Etherium, or meme stocks such as AMC or GME come to mind), the downside can also be pretty bad since losses are also magnified. Of course, repayment of the loan will eventually have to happen and without a source of repayment funds other than the investment, it's critical for that asset to at least increase at the rate of interest you are paying, or you will face losses.

With interest rates near all time lows, investors are not only enticed out of cash and bonds into riskier assets like stocks, commodities and crypto, they can also be tempted to borrow money for those investments to magnify returns. Whether using a brokerage margin account (my broker currently charges between 6.575% - 8.325% depending how much you borrow), home equity loan (I have seen 3% - 5% if you have good credit), or personal loan (6% - 36%, depending on your credit), there are many ways that people can borrow money for investing. While the returns can be infinite using borrowed money and also sizable, especially if the asset you invest in goes up dramatically (crypto such as Bitcoin or Etherium, or meme stocks such as AMC or GME come to mind), the downside can also be pretty bad since losses are also magnified. Of course, repayment of the loan will eventually have to happen and without a source of repayment funds other than the investment, it's critical for that asset to at least increase at the rate of interest you are paying, or you will face losses.Other than real estate, I'm not a big advocate of borrowing to invest, especially with the incredible recent volatility in markets. In particular, if you are investing in crypto like Bitcoin or Etherium, it's best to use excess cash, buy the dips and hold for the long term. This helps you avoid getting ruined in one of the deep market corrections that can happen to these assets (indeed, we just had a 50% correction recently). It seems that many crypto speculators who use 100x leverage regularly get wiped out, whether they are long or short, due to the volatility. Why risk all that when you can just buy and hold?

The downside to using a brokerage margin account is that stocks can drop dramatically in a downturn and the brokerage can change their margin limits on individual stocks during periods of market volatility, the combination of which could quickly result in a margin call and either having to come up with cash or having to sell your stocks at a loss. Even professional investors can blow themselves up with leverage - look no further than the $30 Billion Archegos debacle.

Another form of leverage is stock options. Buying call options or selling put credit spreads are common ways to speculate on the upside of an individual stock, however you can easily lose your entire investment if a stock trades lower than the strike price prior to expiration. In my personal experience with these types of investments, this has happened way more often than I expected - possible market manipulation? I prefer to take the other side of the trade, selling call options on stock I already own. This strategy capitalizes on the demand for call options and allows you to collect premium while having a fair chance of earning the full premium at expiration and keeping your stock. This is like being the "house" at a casino - let everyone else gamble with options and go for the sure thing. Worst case, you get exercised and get cash for your stock - as long as your call strike price is above your cost basis, you'll never lose money. Of course, the stock you own may drop to a level where selling calls may not make sense, but at least with owning stock you simply wait for the value to recover. Many technology stocks that had very attractive valuations and call premiums a few months ago have suffered this fate, with the recent rotation of the stock market out of growth and into value. Like all seasons, this season too shall pass and better days will lie ahead for growth stocks, so if you are holding shares (versus options) in good companies, you have the staying power to wait for the ultimate recovery.

No matter how tempting it might be, avoiding leverage in investing to me is as fundamental as diversification. Believe me, I have learned the hard way many times and (other than real estate where it makes a lot of sense) I avoid leverage at all costs, even if I'm "missing out" on a great opportunity. That takes a great deal of discipline, but staying disciplined in your investing approach will ultimately allow you to achieve your goals in the long run and sleep better at night.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

May 23, 2021

Buy the Bitcoin Dip?

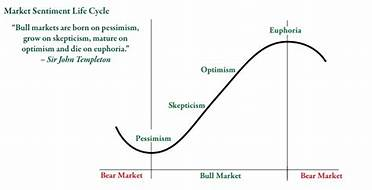

With the recent decline in Bitcoin from a peak of $64,899 down to $32,959 as of this writing (a 49% decrease), is this the beginning of the end of Bitcoin or a tremendous buying opportunity? I think it's a buying opportunity. Bitcoin has had drawdowns of this magnitude before in bull markets and it's fairly normal for this asset. Furthermore, we are not anywhere near the peak of this market cycle based on my research and past bull market behavior. While there will definitely be a sell-off after Bitcoin reaches its new cycle high (there are many estimates ranging from $100K to $500K), the bottom that is established after the "blow off top" should be significantly higher than where it is trading now, based on past history. New investors to the space, however, are certainly alarmed by this and will feel a strong urge to sell especially if using borrowed funds. I don't recommend using leverage at all in crypto, stocks or gold - only use cash you can afford to put away for a while. My own observation is that there seems to be a lot of leverage (futures) chasing Bitcoin on the way up and down in this market cycle, which seems to have increased the volatility. However, if your strategy is to simply buy the dips and hold onto it for the long term (even better to put it in a hardware wallet offline and "out of sight, out of mind"), you should be very happy. Despite all the ups and downs, Bitcoin has returned on average a 200% annual return for the past 10 years. Given Bitcoin's verifiable scarcity (21 million coins maximum), supply is immutably fixed forever. Demand will fluctuate with the market and adoption of it as an investment, store of value and potentially a medium of exchange. Over the long run, as adoption grows, the demand will follow and the price will inevitably rise. Any market will follow a life cycle and Bitcoin is no exception, as shown in the chart below:

With the recent decline in Bitcoin from a peak of $64,899 down to $32,959 as of this writing (a 49% decrease), is this the beginning of the end of Bitcoin or a tremendous buying opportunity? I think it's a buying opportunity. Bitcoin has had drawdowns of this magnitude before in bull markets and it's fairly normal for this asset. Furthermore, we are not anywhere near the peak of this market cycle based on my research and past bull market behavior. While there will definitely be a sell-off after Bitcoin reaches its new cycle high (there are many estimates ranging from $100K to $500K), the bottom that is established after the "blow off top" should be significantly higher than where it is trading now, based on past history. New investors to the space, however, are certainly alarmed by this and will feel a strong urge to sell especially if using borrowed funds. I don't recommend using leverage at all in crypto, stocks or gold - only use cash you can afford to put away for a while. My own observation is that there seems to be a lot of leverage (futures) chasing Bitcoin on the way up and down in this market cycle, which seems to have increased the volatility. However, if your strategy is to simply buy the dips and hold onto it for the long term (even better to put it in a hardware wallet offline and "out of sight, out of mind"), you should be very happy. Despite all the ups and downs, Bitcoin has returned on average a 200% annual return for the past 10 years. Given Bitcoin's verifiable scarcity (21 million coins maximum), supply is immutably fixed forever. Demand will fluctuate with the market and adoption of it as an investment, store of value and potentially a medium of exchange. Over the long run, as adoption grows, the demand will follow and the price will inevitably rise. Any market will follow a life cycle and Bitcoin is no exception, as shown in the chart below:

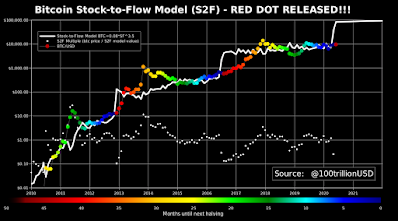

I think the market for Bitcoin has moved quickly to pessimism, but we are still in a bull market as discussed previously, which is a pretty good setup. If you are a long term investor, the market cycles mean less to you because you are holding on for the long term. If you invest regularly and hold in almost any market (gold/silver, stocks, real estate, etc.) you will most certainly make a good return over time. Bitcoin offers something different than almost any market and the closest comparison is to gold. Bitcoin has many advantages over gold, not the least of which is the ability to easily and for relatively low cost store and transfer vast amounts of wealth that would be impractical with gold. One Bitcoin chart I like to follow is the so-called "stock to flow" model. It's an incredibly accurate predictor of the price of Bitcoin. While the price can be very volatile and fluctuates above and below the flow line, it always comes back to it. Every four years the next Bitcoin bull market kicks off with a "halving" when the reward for Bitcoin miners to process blocks successfully is cut in half, thereby reducing the new supply that is coming on the market from miners. Eventually, say in 50 years, all the new Bitcoin will have been mined when the issued supply reaches 21 million coins and miners will be rewarded only through fees for transferring Bitcoin (which by then should be fairly lucrative assuming broad global adoption). The stock to flow model predicts a price of $100,000 for Bitcoin this year. With recent price action, it's certainly not difficult to see why many new investors find that hard to believe, while the more seasoned Bitcoin investors are still "buying the dips."

I think the market for Bitcoin has moved quickly to pessimism, but we are still in a bull market as discussed previously, which is a pretty good setup. If you are a long term investor, the market cycles mean less to you because you are holding on for the long term. If you invest regularly and hold in almost any market (gold/silver, stocks, real estate, etc.) you will most certainly make a good return over time. Bitcoin offers something different than almost any market and the closest comparison is to gold. Bitcoin has many advantages over gold, not the least of which is the ability to easily and for relatively low cost store and transfer vast amounts of wealth that would be impractical with gold. One Bitcoin chart I like to follow is the so-called "stock to flow" model. It's an incredibly accurate predictor of the price of Bitcoin. While the price can be very volatile and fluctuates above and below the flow line, it always comes back to it. Every four years the next Bitcoin bull market kicks off with a "halving" when the reward for Bitcoin miners to process blocks successfully is cut in half, thereby reducing the new supply that is coming on the market from miners. Eventually, say in 50 years, all the new Bitcoin will have been mined when the issued supply reaches 21 million coins and miners will be rewarded only through fees for transferring Bitcoin (which by then should be fairly lucrative assuming broad global adoption). The stock to flow model predicts a price of $100,000 for Bitcoin this year. With recent price action, it's certainly not difficult to see why many new investors find that hard to believe, while the more seasoned Bitcoin investors are still "buying the dips."

One thing to note is that over time and amid all the huge swings, the price of Bitcoin has risen steadily, giving rise to the 200% average annual rate of return and Bitcoin almost always ends the year higher than it started. True, that sometimes Bitcoin trades sideways for a while in between bull markets, but there's no question about its historical performance. Now, some may say "the easy money has been made" in this asset and that you can look forward to lower returns going forward. With an immutably fixed supply and so many demand drivers, here are several reasons why I don't agree with this:Global currency debasement (money printing) is unlikely to stop given extremely high debt levels and need to continue to stimulate economic growth; this will continue to inflate all assets and Bitcoin is a theoretically perfect hedge to this activity, with an immutably fixed supply and superior features as discussed previously to other similar assets like gold and silverInstitutional adoption of Bitcoin in investment portfolios continues to growCorporate adoption of Bitcoin as part of Treasury function continues to growCrypto ecosystem is in early stages of development and continues to build on the base of Bitcoin and while some projects like Etherium are interesting and maybe worth a speculative allocation, cannot compete with Bitcoin's decentralization, stability and securityBitcoin is the largest network by market capitalization, has the most mature technology, enjoys the "first mover" advantage and has a powerful network effect (Metcalf's Law)Traditional financial services companies including banks are realizing they need to get on board or be disrupted by cryptoIndividuals, especially the younger generations, are demanding crypto for investing, earning returns and for transactingSome have also said that if the government bans Bitcoin, then what? It's interesting to note that China has "banned" Bitcoin many times in the past (and recently), but a decentralized global monetary protocol is impossible to ban. You may be able to control the on and off ramps back into fiat currency, but the technology that holds and transfers the value is beyond the control of any one person or government and continues to work 24 hours a day seven days a week. In the end, governments will want to collect their taxes on trading and transactions, so it's in their best interest to welcome Bitcoin and other crypto assets into the financial system to 1) be able to regulate the activity and 2) collect tax revenue. Regulation and paying taxes is nothing new - same holds true if you invest in stocks, bonds, gold/silver, real estate or anything else. Frankly, I think the industry could benefit from some regulation particularly around scams, pumping and dumping activities on social media and the like (mostly around the so called "alt coins"). What about illegal activity? Well fiat currency has been used for a lot more illegal activity than Bitcoin historically and the combination of regulation and the open, transparent blockchain, use for illegal activity should be able to be curtailed as much as it has been for fiat currency (i.e., not much).

Another common complaint is that Bitcoin doesn't adapt to new use cases like the other crypto assets and as such will get "left behind" as the rest of the industry evolves. I view that more as a feature than a flaw since we are talking about your hard earned money. Who wants to put money into something that can change at a whim of one person or a few at the top? Bitcoin is really good at one thing and that's keeping your money safe from currency devaluation over the long term and being able to store it and move it as necessary. In time, you'll be able to borrow against Bitcoin much like real estate and you can use that money for whatever your needs are without having to sell and incur a tax liability. That day could come in the next 10 years, I think.

All of these negative narratives can be categorized as "Fear, Uncertainty and Doubt" or FUD for short. They have all come up before in the past decade since Bitcoin's inception and they will continue in the future. The crypto boat has sailed and many investors, including the younger generation of investors, understand it and are embracing it. This will continue to drive adoption and innovation in the space. Many traditional financial services businesses including banks will be massively disrupted by the changes happening here and the smart ones will change their business models and work with regulators to embrace the change or risk being left behind. Probably the best examples of this type of adaptation are seeing traditional automakers like Ford and GM fully commit to building electric vehicles - they have seen the success of Tesla and the writing on the wall from investors interested in ESG, governments looking to reduce carbon emissions and ultimately what their customers are demanding.

Finally, as I wrote about in my post last week here, while there are opportunities in gold and silver to invest with some potential upside, the stock market is clearly over valued and seems likely to correct in the next few weeks or months - the higher it goes, the more likely (and possibly more significant) the correction, especially with unprecedented amounts of margin debt outstanding. Rather than piling in to the stock market, why not buy Bitcoin when everyone else is selling it? In summary, while the short term price action can be disconcerting, when Bitcoin dips, I think it's an opportunity to buy and hold for the long term. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

May 16, 2021

Macro View and Ideas for Coming Weeks

After reviewing the market action last week and watching some good market commentary on YouTube (see my twitter feed for some of the recommended videos I posted), my overall portfolio positioning as discussed last week here is still pretty solid and poised to weather the ups and downs as the markets cycle between risk on and risk off, inflation and deflation, etc. While Bitcoin and other crypto has been struggling lately, I am still bullish for the long term outlook on this asset class and feel better about reducing my allocation last week and shifting some money to gold, silver and TIPS. For my stock trading portfolio, I'm making a few moves next week to capture some areas of the market that I think look poised for growth and exit some positions that look less attractive, which I'll talk about later in this post.

After reviewing the market action last week and watching some good market commentary on YouTube (see my twitter feed for some of the recommended videos I posted), my overall portfolio positioning as discussed last week here is still pretty solid and poised to weather the ups and downs as the markets cycle between risk on and risk off, inflation and deflation, etc. While Bitcoin and other crypto has been struggling lately, I am still bullish for the long term outlook on this asset class and feel better about reducing my allocation last week and shifting some money to gold, silver and TIPS. For my stock trading portfolio, I'm making a few moves next week to capture some areas of the market that I think look poised for growth and exit some positions that look less attractive, which I'll talk about later in this post. In my opinion, the biggest macro theme in the coming weeks, other than inflation, is how over-extended the US stock market is starting to look. The S&P 500 continues to post all time highs and the chart is starting to look parabolic - a troubling development, as shown in the chart below:

S&P 500 - 10 Year Chart

S&P 500 - 10 Year ChartThe market action last week (three days of sell offs followed by two strong days of rallies, but overall down for the week) indicates investors are nervous. The Nasdaq chart looks similar, although has faced a bit more weakness lately than the S&P 500 but still near all time highs and this chart is also looking parabolic:

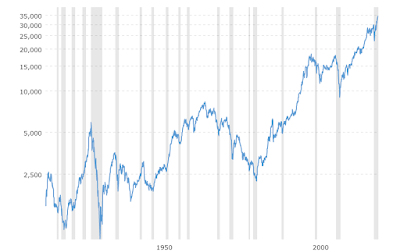

Nasdaq - 10 Year Chart

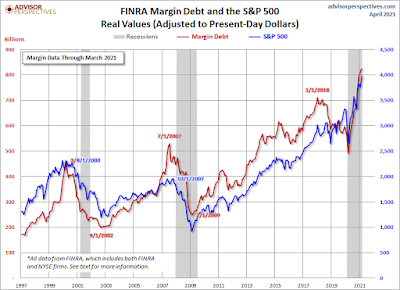

Nasdaq - 10 Year ChartIt's pretty obvious to most investors that US markets are over-extended and are at risk of a near term correction, maybe as much as 20% or 30%. This is not because of any sort of economic slowdown (indeed, the economy is doing quite well and is expected to do so for the next year or two - but that's already priced-in). Instead, it could be driven by over-valuation of US stocks, selling to take profits and the huge amount of margin debt currently outstanding, which has spiked tremendously since last year as shown below:

With this amount of margin debt, any significant downturn in the market could cascade into a massive amount of selling as margin calls are triggered and liquidations are forced. For long term investors, these ups and downs are less of a concern as long as you are diversified and positioned well (Financial Fortress), but it's certainly a concern for traders who are trying to make money on short term positions and preferring to front-run this correction by selling early in order to have cash to buy at the bottom of any correction.

For my trading portfolio, I added a couple of hedges recently, buying long term puts for SPY and QQQ to protect in the event of a significant downturn. These aren't huge positions and I view them more as cheap insurance than a trade, although if there is a significant downturn there's an opportunity to sell to generate cash to use to buy "bargain" stocks. I'm planning to add to those hedges a small position in UVXY which is a leveraged VIX ETF that is at or near all time lows and could spike significantly if market selling / volatility rises and therefore has tremendous upside in the event of a significant market correction. Again, I view this more as cheap insurance than a trade but if markets do really go into a significant downturn, these hedges will perform quite well.

I'm also planning to sell positions in Chevron (CVX), MGM (MGM), Sklz (SKLZ) and Qualcomm (QCOM) and buying Junior Gold Miners ETF (GDXJ) and Alibaba (BABA). I think oil prices might not have as much more to run in the near term and are going to hit a lot of resistance at current price levels, especially as the world continues to struggle to recover from COVID. Of course, the tech names have struggled recently as cyclical and value stocks have been more in favor with investors, so best to exit those now with only minor losses (and also collected some good call premiums while I held them).

See oil chart below:

I think gold is undervalued relative to stocks and bonds as I have mentioned in previous posts. A moderating interest rate environment, with continued signs of inflation have helped to wake up gold and silver recently. The junior miners tend to be a bit more volatile than the larger miners (GDX), but much more upside potential if gold is ready to break out, which seems to be the setup. See gold chart below:

I think gold is undervalued relative to stocks and bonds as I have mentioned in previous posts. A moderating interest rate environment, with continued signs of inflation have helped to wake up gold and silver recently. The junior miners tend to be a bit more volatile than the larger miners (GDX), but much more upside potential if gold is ready to break out, which seems to be the setup. See gold chart below:

Alibaba, a very well known Chinese internet behemoth, is significantly below its 52 week high of $319 and seems like a great bargain at around $210, particularly if investors move their money out of the US (due to a market correction or for diversification) and into emerging markets such as China for better returns. I can also sell calls on this for income with pretty good premiums, if desired. I'm also increasing my cash position slightly to about 9% of my trading portfolio to be ready to take advantage of other opportunities.

My overall outlook for US stocks is cautious for the next several weeks as recent volatility shows that the markets are unsettled and a big move down seems more likely than a big move up. Having a diversified portfolio is the best defense for a small investor but taking advantage of market opportunities with "little bets" with a small trading portfolio is a good way to learn more about the markets, generate cash flow and build your portfolio. Above all, it's important for you to do your research and ultimately make your own decisions about what you want to invest in.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

May 9, 2021

Portfolio Weighting Update

As I mentioned last week, for this week's post I will provide a timely update on my current portfolio diversification strategy, which I have broadened out more since last month. Overall performance was good and showed growth over last month, which is good since some components went up and some went down but overall everything moving in the right direction.

As I mentioned last week, for this week's post I will provide a timely update on my current portfolio diversification strategy, which I have broadened out more since last month. Overall performance was good and showed growth over last month, which is good since some components went up and some went down but overall everything moving in the right direction.Here's the breakdown as of May 9:

Cash - 2.1%US Large Cap - 12.0%US Mid Cap - 2.8%US Small Cap - 2.8%International (split half in emerging markets and half developed) - 5.8%Commodities - 6.1%Bonds (TIPS and actively managed bond funds about half and half) - 13.7%Real Estate - 22.6%Private Equity - 10.1%Crypto (principally Bitcoin) - 12.5%Alternatives (principally gold and silver) - 9.2%Commentary on changes since last month:As I mentioned in last week's post, I shifted some money out of equities back into bonds after considering the potential for a deflationary situation in the medium to longer term, extended stock market valuations (particularly in the US) and also to add more diversity. One of the active bond managers has some short positions on currently, so they are making money in the current environment and aren't solely long bonds which is very helpful. Also, the Vanguard Short Term Treasury Inflation Protected Securities Fund (VTIP) is a good way to get some passive TIPS exposure and yield without a lot of volatility, while protecting against inflation and is far superior to buying four week TBills that currently yield zero.

I shifted some of my positioning in Bitcoin (GBTC) to TIPS (VTIP), gold (GDX), silver (PSLV), Etherium (ETHE) and a small amount to a diversified mix of large cap cryptos (GDLC) based on trying to achieve more diversification and also the value proposition. I believe gold and silver are undervalued at current levels given everything else happening in other asset classes in response to the macro environment. Gold miners are highly levered to increases in gold prices which is why I chose GDX plus it pays a dividend and from my research I think the best physical silver fund to own is PSLV. As it turned out, both gold and silver performed well and broke out of some key levels last week and look to continue that trend. Also, Etherium has outperformed Bitcoin lately but I think both are good long term holds based on macro environment and adoption trends. Investing in the Grayscale funds makes it much easier to diversify your portfolio across different asset classes in a brokerage account and I don't have to worry about the safety of the coins. Until ETF's are approved in the US (SEC will revisit again in June), they are the only show in town.

I also diversified my international positions between emerging markets and developed markets. Even though emerging markets may outperform in the future, I felt the diversification was a good idea and indeed as the pandemic subsides the developed markets should see good recovery similar to what we are now seeing in the US.

I kept my real estate position the same, since it has performed well and looks to continue to do so for the foreseeable future due to the favorable macro environment, providing both current income and capital appreciation.

I added a couple of new private equity positions on Seed Invest and Republic, but I typically limit those to $1,000 to limit risk. I'm particularly interested in DeFi projects and also Artificial Intelligence applications, which I think will be very impactful disruptive technologies.

As far as overall performance since last month, equities (in particular real estate) and commodities performed well, while crypto lagged. I expect in the long run that crypto will continue to outperform most other asset classes which is why I have devoted a 12.5% portfolio allocation to it, which for me is pretty comfortable. Some institutions like Morgan Stanley are limiting Bitcoin exposure to only their wealthiest clients and even then are further limiting exposure to 2.5% of their net worth, which I feel is overly conservative. Fortunately, as I have discussed in a prior post, there are many ways for anyone to get exposure to Bitcoin and other cryptocurrencies, regardless of your net worth. Staying diversified helps ensure you get the benefit of upside without getting crushed if one particular part of your portfolio performs poorly and in the world of extreme volatility we live in, that's always a possibility!

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

May 2, 2021

The Recovery Is Here - Now What?

Last week showed just how great corporate earnings were, with a vast majority of the S&P 500 beating estimates significantly so far this earnings season. The "low base effect" of being for the most part completely shut down last year for most companies contributed greatly to year over year growth, but analysts still got it wrong. The stock market reaction in many cases was muted and many companies who otherwise reported excellent results and outlook sold off. This will no doubt create some near term buying opportunities for great companies including Microsoft and Apple. At the same time, the bond market sell off abated somewhat and rates stabilized (for example 10 year most recently at around 1.625%). Could the markets be telling us that while we will see stellar near term growth and higher than normal inflation, the outlook for future growth - 2023 and beyond is anemic, possibly deflationary? Will we see continued strong growth for years to come with higher than normal inflation? Or will we see weak or no growth and inflation (stagflation)? The first scenario seems like the market signal, versus the other two. With the stock market continuing to make all time highs, one concern weighing on investors' minds is the large amount of margin debt that has been taken on (an all time high), as shown in the chart below:

Last week showed just how great corporate earnings were, with a vast majority of the S&P 500 beating estimates significantly so far this earnings season. The "low base effect" of being for the most part completely shut down last year for most companies contributed greatly to year over year growth, but analysts still got it wrong. The stock market reaction in many cases was muted and many companies who otherwise reported excellent results and outlook sold off. This will no doubt create some near term buying opportunities for great companies including Microsoft and Apple. At the same time, the bond market sell off abated somewhat and rates stabilized (for example 10 year most recently at around 1.625%). Could the markets be telling us that while we will see stellar near term growth and higher than normal inflation, the outlook for future growth - 2023 and beyond is anemic, possibly deflationary? Will we see continued strong growth for years to come with higher than normal inflation? Or will we see weak or no growth and inflation (stagflation)? The first scenario seems like the market signal, versus the other two. With the stock market continuing to make all time highs, one concern weighing on investors' minds is the large amount of margin debt that has been taken on (an all time high), as shown in the chart below:

Growing margin debt is a significant area of concern because a sharp stock market sell-off could quickly cascade into a major downturn as a result of all this leverage, as brokerages issue margin calls, curtail margin lending and investors are forced to sell their stocks. Ultra-low interest rates, strong stock market performance and very few other options for investors have all fed this borrowing binge. Indeed, we have seen that recently in the Bitcoin options markets, with leveraged traders both long and short getting crushed at various times as the Bitcoin price rallied and fell, and as long term unlevered investors sat calmly on the sidelines HODLing. Typically, the stock market peak has lagged the peak in margin debt by a few months. The real question is when will we see the peak in margin debt and how long after that before the market peaks and goes into the next correction cycle? A second and more important question is how bad will the correction be? I have seen some investors such as Jim Rickards project as much as an 80% correction. I sure hope he's wrong about that!

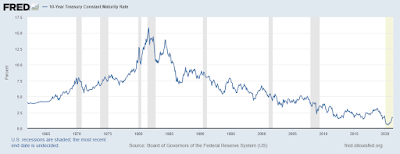

The 10 year treasury yield is sending its own signal about rising inflation expectations, after having bottomed at 0.55% last year in July, then rising to 1.65% at the end of April:

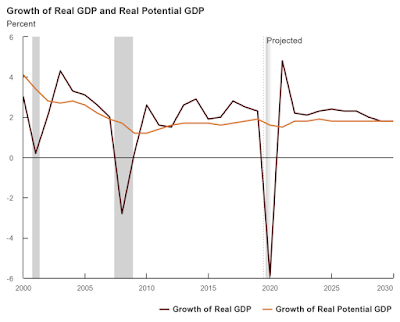

While this is a significant short term increase of 110 bps in a period of 9 months, it's not particularly rapid in historical context and we are still very close to all time lows for this important benchmark rate. For example, in July 1979 the rate was 9.01% and by April 1980 it had risen to 10.76%, a 175 bps increase in 9 months. We know in hindsight that period coincided with serious and pervasive inflation, which is why the rates were so much higher and now we are starting from a much lower level, having been through a period of very modest inflation. If the bond market is processing all available information correctly, it is not seeing economic growth (the main driver of long term inflation) continuing at the current pace for very long and indeed, falling to perhaps lower than pre-pandemic levels. Indeed, the CBO projection shows GDP trending back to about 2% over the next several years, as shown in the chart below. The Conference Board projects 6% GDP growth in 2021 and 3.5% GDP growth in 2022 after posting -3.5% in 2020. The huge amount of fiscal and monetary stimulus that was deployed last year and earlier this year (and more to come) is clearly driving the economic recovery. All of this designed to "prime the pump." But what happens when the stimulus effects burn off? Will the pump run on its own? Will we return to 2% growth or will it be even lower?

After thinking this through, while there is definitely a short term threat of inflation, longer term it's not totally clear to me that we don't face an equivalent risk of deflation as stimulus wears off, supply chains normalize and technological innovation continues to increase efficiency and puts pressure on the labor market (both in terms of overall demand and also labor rates). One of the long term consequences of the COVID-19 pandemic is the acceleration of corporate investments in technology to streamline process and leverage artificial intelligence and automation, which ultimately results in substitution of technology for labor. As such, many jobs cut during the pandemic recession just won't be coming back. If high unemployment is persistent, that will be a significant drag on economic growth. At the same time, new jobs are forming rapidly as technology innovates, but there will be fewer of those and they will require different education and skills. Either way, the Fed will have no choice but to keep short term rates low until labor markets recover and this could take quite some time. This means cash will continue to offer no return and thus forcing investors into stocks, commodities, bonds and other assets.

How does all this uncertainty translate into an investing strategy? As Ray Dalio has said, probably the best way for an individual investor to approach this environment is to be broadly diversified across many asset categories. For the average investor, it's very difficult to trade in and out of positions and try to "front run" the market, which can shift daily if not by the hour. This philosophy fits well with my concept of a Financial Fortress, which builds on a solid foundation of liquidity and focuses on broad asset class diversification.

Over the past year or so, my view of the liquidity foundation of the Financial Fortress has changed in that cash no longer provides any return and is unlikely to for the foreseeable future. I used to have a lot of my cash in US Treasury Bills, which I shifted to other assets recently. This turned out to be a good move since last week the US Treasury sold 4 week bills for zero yield for the first time ever. As such, after keeping enough cash on hand for short term needs, the rest of the cash is now invested in short term Treasury Inflation Protected Securities (31%), gold (15%) silver (16%), Bitcoin (32%) and a mix of large cap cryptocurrencies (6%). In the long run, it's my belief that these investments represent "sound money" and will outperform cash held in a bank account significantly. Whether inflation is a modest 2% or much higher, these investments should perform well over the longer term. In particular, I think gold and silver are relatively undervalued right now based on everything going on with fiscal and monetary stimulus. Bitcoin while extremely volatile still has a long way to go on its adoption path, is immutably sound money and has already demonstrated an incredibly asymmetrical investment opportunity over the past 10 years. I think other cryptocurrencies such as Etherium and some of the other "alt coins" also warrant consideration as well due to their utility in the rapidly growing NFT and Decentralized Finance spaces. Indeed, Coinbase will soon offer staking of Etherium with a 6% yield, which doesn't require you to hand over your coins to a third party and you can still achieve an attractive alternative to bank yields (of course you still have the risk of holding the cryptocurrency but if you are not leveraged, have a long term hold strategy and can stomach short term price fluctuations it shouldn't be an issue). DeFi could seriously challenge traditional banking in the coming years.

I have also reconsidered my "zero bonds" thesis and now think it makes sense to at least have some allocation to actively managed bond funds as a hedge against longer term deflation risks. I'll have a complete update on my portfolio allocation in the next week or two that will reflect that change as well as other fine-tuning to broaden and improve overall portfolio diversification.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.