Nick Reichert's Blog, page 7

May 22, 2022

May 15, 2022

Building a Financial Fortress - Episode 17 - Monthly Portfolio Review - ...

May 8, 2022

Building a Financial Fortress - Episode 16 - Bitcoin Estate Plan - 5/7/22

May 1, 2022

Building a Financial Fortress - Episode 15 - Bitcoin vs Real Estate - 4/...

April 24, 2022

Building a Financial Fortress - Episode 14 - Bitcoin FUD - 4/23/22

April 17, 2022

Building a Financial Fortress - Episode 13 - Monthly Portfolio Review - ...

April 10, 2022

2022 Bitcoin Conference Highlights

For this week's post, I wanted to highlight some of the more significant announcements that happened at the 2022 Bitcoin Conference held in Miami this week. While there were a lot of great keynote speeches, I think these six announcements were in my opinion some of the most significant. For each, I have highlighted the importance as well as some of the key takeaways. Hope you find this useful!

For this week's post, I wanted to highlight some of the more significant announcements that happened at the 2022 Bitcoin Conference held in Miami this week. While there were a lot of great keynote speeches, I think these six announcements were in my opinion some of the most significant. For each, I have highlighted the importance as well as some of the key takeaways. Hope you find this useful! Importance: Expanding use of the Bitcoin lighting network (a layer two protocol that works on top of the Bitcoin network to handle fast, private, virtually no cost payment transfers that are final settled on the Bitcoin network)

Key Takeaways:

Payment networks have not innovated since 1949 (Diners' Club was the original payment network)Current payment networks are costly to merchants (due to fees) and typically take time to final settle in bank accountsPartnerships with Shopify, NCR, and Blackhawk to integrate Lightning payments announcedCustomers who use this option can instantly transfer funds to merchant to pay for anything and merchant avoids the typical 3% fee charged by payment networks and also gets cash finalityPayments can be transferred globally on the "rails" of the Bitcoin network without needing to hold Bitcoin - dollars (or any other fiat currency) are converted from customer to Bitcoin, transferred to merchant and converted back to dollars (or any other fiat currency) on the other end instantlyMy view:Merchants will likely drive adoption due to economics of reducing merchant fees and improving bottom lineCustomers who don't want to go into debt and are indifferent about "reward" programs will embrace - i.e., debit card usersCustomers who like the option of paying off their credit card balance over time (i.e., borrowing) and earning points or rewards will not likely be as interested in this payment option2) Robinhood enabling on chain and lightning withdrawals

Importance: Expanded adoption of Bitcoin with ability to move coins from Robinhood wallet to other wallets and also expanded use of lighting network when payments are enabled

Key Takeaways:

Robinhood has 22.5 million verified users and 13 million active usersBitcoin is the number one recurring asset buy in 2022 for RobinhoodOver two million users now have ability to send and receive Bitcoins on their Robinhood walletPlan to bring lighting network payments to Robinhood in the near term due to speed, low cost and low carbon footprint3) Pro Bitcoin legislation in three countries (Samson Mow)

Importance: Nation-state adoption of Bitcoin either as legal tender or with tax-preferred status is key to driving overall global adoption

Key Takeaways:

Joel Bomgar, the president of Próspera, an “economic development hub” located in Honduras, said that bitcoin acts as legal tender thereMiguel Filipe Machado de Albuquerque, the president of Portugal’s Madeira region, announced that bitcoin investors will pay no personal income taxes thereIndira Kempis, a senator in Mexico, announced that she plans to propose regulation there to recognize bitcoin as legal tenderSamson Mow (former Chief Strategy Officer at Blockstream) has stepped down and is forming a new company to focus on Bitcoin Nation State adoptionEl Salvador announced last year that they would move forward with and have since4) Cash App lightning integration "Pay Me with Bitcoin"

Importance: Expanded adoption of Bitcoin and lightning network

Key Takeaways:

Cash App has 36 million monthly active users7 million users have access to a Cash App debit cardCash App generated $4.57 Billion in Bitcoin revenue in 2020 and $1.96 Billion in Bitcoin revenue in the fourth quarter of 2021Cash App has already added lightning payments but will now allow lightning receipts, so will be fully functional on lightning networkCash App will also allow you to deposit your paycheck and convert all or a portion to Bitcoin as well as rounding off your debit / credit card payments and depositing the "change" into Bitcoin"We believe that bitcoin is the world's best digital, sound money period," Suter said. "We believe that Bitcoin is for the people and that in America, Cash App is the financial app for the people.""To make Bitcoin even more universally accessible, we're announcing Lightning receives,” said Suter. "In the coming months, you'll be able to receive bitcoin over the Lightning Network with no block confirmations needed."5) Senator Lummis forthcoming Bitcoin bill

Importance: Favorable US regulatory treatment for Bitcoin is essential for continued institutional investment adoption (price support) as well as innovation such as lightning network and other layer two protocols. Also Central Bank Digital Currencies such as the one adopted by China are very intrusive and can be used for surveillance, so government position on this in US is very important to watch.

Key Takeaways:

U.S. Senator Cynthia Lummis offered details on a bipartisan bill, The Responsible Financial Innovation Act, that she hopes will establish favorable Bitcoin regulation."It's truly a legislative framework that we hope will provide the sandbox for innovation to occur but also put some regulatory parameters, so you all know the rules of the road," Lummis explained. "It includes privacy components, consumer protection components, taxation components…There becomes an obvious burden as nation states recognize the success of Bitcoin and attempt to apply existing regulations to govern its use or create new laws to do so. In the U.S., Lummis shared that she sees legislators becoming increasingly open to the idea of passing favorable rules catered to Bitcoin that would foster innovation in the country.Lummis alleviated the concerns of many in the crowd as she explained that, “If there is a digital product that is direct to consumer, it would be a stablecoin, as opposed to a CBDC direct to consumer. I think that's a much more American way of adopting this technology as backed by the U.S. dollar."My view is that there are more and more "single issue voters" in the Bitcoin space that have become quite vocal and politicians are taking notice all across the country and indeed the world6) Trezor straight to Bitcoin cold storage with Swan

Importance: Easier support for dollar cost averaging Bitcoin purchases and direct transfer to cold storage

Key Takeways:

Trezor Suite app has integrated new Swan API to allow for recurring Bitcoin purchasesThese can be setup to deposit directly into cold storage Bitcoin wallet addressSaves time from typically having to buy on the exchange and then transfer to cold storage wallet, also saves the network feeGreat for people like me who dollar cost average and hodl in cold storage wallet (see my recent post on quick start to Bitcoin self custody).Not financial advice, only for information and entertainment, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.Always remember: freedom, health and positivity!

Please also check out my new Podcast now on YouTube here.

April 3, 2022

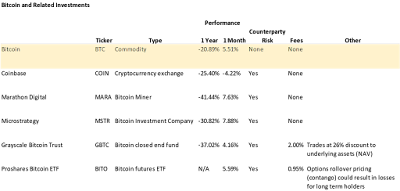

Bitcoin and Related Investments Performance

For this week's post, I wanted to cover the relative performance of Bitcoin and a few popular Bitcoin-related investments over a one year timeframe and a shorter (one month) timeframe. Many of these investments I have written about previously in past posts. My overall thesis is that investing in Bitcoin directly in a self-custody hardware wallet is the best way to invest in Bitcoin. While you may get slightly higher returns from some of the Bitcoin-related investments, such as investing in Bitcoin miners, crypto exchanges and ETF's, you will face counterparty risk in all cases and management fees in cases of ETF's/Funds as well as other issues.

For this week's post, I wanted to cover the relative performance of Bitcoin and a few popular Bitcoin-related investments over a one year timeframe and a shorter (one month) timeframe. Many of these investments I have written about previously in past posts. My overall thesis is that investing in Bitcoin directly in a self-custody hardware wallet is the best way to invest in Bitcoin. While you may get slightly higher returns from some of the Bitcoin-related investments, such as investing in Bitcoin miners, crypto exchanges and ETF's, you will face counterparty risk in all cases and management fees in cases of ETF's/Funds as well as other issues. What I mean by counterparty risk really relates to two factors: 1) the risk that the custodian of your account in which you hold your securities fails to perform (for example if the government asks that your account be frozen like we saw recently in Canada due to the trucker protests or is hacked) or 2) in the case of operating companies, the risk that the company you are invested in has some kind of operating problem that diminishes its value, independent of the market price of Bitcoin.

Management fees are usually charged by ETF's (in the case of GBTC and BITO) and can be significant. One advantage of owning MSTR, for example, is that it is basically a leveraged Bitcoin investment fund that doesn't charge a fee and uses the positive cash flow of its software business to continue to build its Bitcoin holdings. As such, in many ways given the choice between the three, MSTR might be the better choice for low (no) fees.

In the table below, I outlined some of the most popular Bitcoin-related investments to review performance and other factors (this is not an exhaustive list and also not a recommendation to invest in any of these):

As you can see, for the past year every Bitcoin-related investment listed above underperformed Bitcoin. For the past month, some investments outperformed Bitcoin as to be expected (for example, MSTR, MARA) since these are leveraged plays, but you only get about 200 Bps of outperformance relative to Bitcoin, at least for this period. Of course performance could be quite different over a longer period of time. The question you have to ask yourself is whether the added risks outlined above are worth the potential reward. What's surprising is that GBTC actually underperformed in both periods badly. That may have to do with the significant discount to net asset value that it trades at, which has been persistent - currently at 26%. Some feel like that it's advantageous to buy GBTC because you are getting more asset for your money with the discount. Many people expect this situation to reverse when / if GBTC is approved by the SEC as an ETF, but you could be waiting a long time for that to happen as the SEC continues to resist approving any physical Bitcoin ETF's. COIN also underperformed both timeframes but that's probably a lot to do with general selling in technology stocks over the past year or so. It's also getting pressure from low or no fee exchanges like Strike who offer similar services at a lower price. Also, BITO performed slightly better but it's not a great investment for long term holders due to pricing differences between spot and futures which can result in losses when futures prices are higher than spot prices (a technical term called "contango").

Maybe you can only invest in a brokerage account and so you are limited to what your broker offers. In that case, you may not have any choice but to get exposure to Bitcoin through Bitcoin-related investments. I remember a year or two ago, the only investment option I had in my Roth IRA at JP Morgan was MSTR. At the time, you couldn't invest in GBTC although that changed recently. Same was true at Morgan Stanley (they would sell GBTC but not let you buy it). Now there are several other options offered by brokers due to customer demand, but all are custodial and have the limitations discussed above. Not only that, but many brokerages will limit Bitcoin investments to only their highest net worth customers and even then, limit the percentage of your portfolio invested in Bitcoin to a very small percentage.

As I mentioned above, I feel like the approach to buy, hold and self-custody Bitcoin is the safest way to build wealth in the current economic and political environment. For more information on how to do this yourself, check out my post from last week and also my related podcast episode.Not financial advice, only for information and entertainment, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my new Podcast now on YouTube here.

March 27, 2022

Quick Start to Bitcoin Self Custody

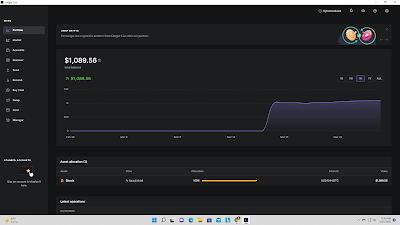

This week, I wanted to outline step by step the process for setting up a cold storage hardware wallet and also setting up a low cost way to buy Bitcoin that can be transferred on a regular basis to your hardware wallet. As I have written before, self-custody is one of the greatest features of Bitcoin and everyone who is comfortable enough to do it should try to have some if not all of their Bitcoin held in this way. Recent world events (Canada Trucker supporters bank accounts being frozen, freezing of Russia's foreign currency reserves) certainly support the notion that self-custody of your assets is the only way to ensure they are not confiscated without due process. I don't have any sponsorships and you don't need to feel like you have to use the specific products I recommend, but being an accountant and not liking to spend a lot of money, I was mostly going for low cost and simple use in mapping this out. If you're interested and prefer an audio walk through, I also included this same content in my weekly Building a Financial Fortress podcast this week located here.

This week, I wanted to outline step by step the process for setting up a cold storage hardware wallet and also setting up a low cost way to buy Bitcoin that can be transferred on a regular basis to your hardware wallet. As I have written before, self-custody is one of the greatest features of Bitcoin and everyone who is comfortable enough to do it should try to have some if not all of their Bitcoin held in this way. Recent world events (Canada Trucker supporters bank accounts being frozen, freezing of Russia's foreign currency reserves) certainly support the notion that self-custody of your assets is the only way to ensure they are not confiscated without due process. I don't have any sponsorships and you don't need to feel like you have to use the specific products I recommend, but being an accountant and not liking to spend a lot of money, I was mostly going for low cost and simple use in mapping this out. If you're interested and prefer an audio walk through, I also included this same content in my weekly Building a Financial Fortress podcast this week located here. Ledger Nano S Hardware Wallet Setup

I looked on Amazon for the cheapest hardware wallet and found a Ledger Nano S for $59 on Prime and got it in a couple of days. I already completed the setup for this wallet and this is my second one (previously setup a Trezor Model T hardware wallet). I found that the process was overall very easy and simple to follow, but of course it helped to have had some experience with it. Here is the step by step instructions:

Make sure you have the following:Ledger Nano S with supplied micro USB cableComputer with at least Windows 8.1 (64-bit), macOS 10.10, or Linux with internet connectionThe Ledger Live application downloaded and installed on your computerSet up as a new deviceConnect the Ledger Nano S to your computer using the supplied USB cable. Your device should display "Welcome to Ledger Nano S." You should contact Ledger if the device immediately asks you for a PIN code, as it may not be safe to use.Press the left or right button to navigate through on screen instructionsPress both buttons at the same time to choose the options "Set up as new device"Choose your PIN codePress both buttons when "Choose PIN code" is displayed on the device (choose a unique code that you can easily remember)Press the right or left button to choose the first digit of your PIN codePress both buttons to enter / accept a digitRepeat the process until you've entered 4 to 8 digits (8 digits is recommended for optimal security)Select the checkmark icon and press both buttons to confirm the PIN code. Use the backspace icon to erase a digit.Confirm your PIN code by entering it once moreWrite down your recovery phraseYour 24-word recovery phrase will now be displayed one word at a time on the Ledger Nano S screen. The recovery phrase is the only backup of your private keys and will be displayed only once.Take the blank Recovery sheet supplied in the box and a penWrite down the first word (Word #1) on the Recovery sheet. Verify that you have copied it correctly in position 1.Press the right button to move to the second word (Word #2). Write it in position 2 on the Recovery sheet. Verify that you've copied it correctly. Repeat the process until the twenty-fourth word (Word #24).Press both buttons to "Confirm your recovery phrase" when completeSelect the requested words by navigating with the left or right button. Validate each word by pressing both buttons. Repeat this step for each requested word.Your device will display "Processing" and then "Your device is now ready" once you've successfully completed the setup process.Press both buttons to access the "Dashboard." The Dashboard is where you can access the apps and settings on your device.Some security tips:Anyone with access to your recovery phrase could take your assets, so store it securelyLedger does not keep a backup of your 24 wordsNever use a device with a supplied recovery phrase or PIN codeWhen in doubt contact Ledger SupportCongratulations, your device is successfully setup. The next step is to install apps from the Ledger Live app and add an account (we will install the Bitcoin app and wallet account). Follow the prompts in the Ledger Live app to complete this step and once done you will be ready to send and receive Bitcoin!Below is a screen shot of the Ledger Live app. You can see the menu on the left side where you can send or receive coins, setup new wallet accounts and even buy coins:

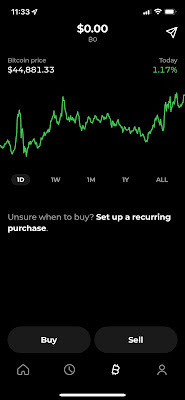

Strike Account Setup, Buy and Send Bitcoin to Hardware Wallet

Next we need to setup your Strike app on your phone. Strike is a Bitcoin and payment app that facilitates global payments at zero cost by using the Bitcoin Lighting network. You can buy Bitcoin on the app at market prices for zero fees. This can add up over time. For example, Coinbase charges a 1.5% fee for each purchase so why not stack more Bitcoin over time versus paying the fee? Also, I have checked the market prices between Coinbase and Strike and they are very close which means you aren't paying any more of a "spread" to actual market prices by using Strike. I also like the user interface which is very simple and clean. Here's a screenshot below:

Download Strike app on your phoneClick on the far right icon and add a payment method - I'd recommend a checking account and complete the setup promptsYou'll notice on that same screen that you can also setup direct deposit of all or a portion of your paycheck to Strike and you can "pay yourself in Bitcoin" if you want by coupling that with a recurring Bitcoin purchaseNext, click "Deposit" on the same screen and you'll have to enter an amount. Note that for bank accounts the limit per deposit is $1,000 but there is no fee charged.Then go to the second icon from the right and there you can buy (or sell) one time or setup a recurring purchase hourly, daily, weekly or monthly.For now, just buy a small amount - say $50 - $100; once you complete your purchase you will have Bitcoin in your Strike walletNext, click on the arrow icon in the upper right corner of the same screen.Open your Ledger Live app on your computer and make sure your hardware wallet is connected and logged in. On the left side menu select "Receive" and a Bitcoin address should show up on your app and on the device. I like to check both to make sure they match before sending. Then you select the QR code option and the app will display the code for the address.Take your phone with the Strike scan window open, scan the QR code and it should copy into Strike. I also like to check the address one more time in Strike before I send just to make sure it matches.Then hit send. You should see the transaction show up unconfirmed in your Ledger Live app in a minute or two and it may take up to 10 minutes for the network to confirm the transaction. I usually wait to close everything out until I have at least one confirmation.As far as amounts to transfer, assuming you bought $100, you may want to do your first transfer with a small amount like $10 or $20 until you are comfortable that it "works." That's what I did at first, but now I can confidently send any amount between my wallets at any time. Note the Bitcoin network fees will be quite high as a percentage of the transfer for very small amounts, but they are relatively tiny for larger amounts being transferred.The best strategy is to setup a recurring buy and then periodically (more frequently with larger recurring purchases and less frequently with smaller purchases) send the coins to your hardware wallet for cold storage - as mentioned above, Strike has many options for periodic purchase to help dollar cost average your Bitcoin buys and given Bitcoin's volatility, this is the best way to accumulate coins for the long term investorI have written several posts on the subject of Bitcoin in my blog, but if you're just getting started the best one is Why Invest in Bitcoin. I also have an episode of my podcast dedicated to that here.As always, do you own research and consult with your financial advisors before making any investment decisions. This is not investment advice.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

March 20, 2022

Monthly Portfolio Review - March 2022

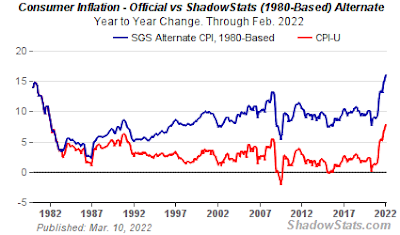

Another wild month in the markets! Bitcoin showing some upside recently and helping out my portfolio overall in addition to the recent stock market rally. Gold, silver and commodities (especially oil) continue to look strong in the face of a 40-year high inflation print of 7.9% from the BLS this month and continued upward pressure from the fallout of economic sanctions against Russia. With the inflation report (all monthly numbers are annualized), the devil is in the details, with energy +25.6%, used cars and trucks +41.2% and new vehicles +12.4%; oddly, shelter is only +4.7%, which seems low given we are still seeing rent and home price appreciation in high double digits, at least where I live. My regular readers will know I don't have a lot of faith in the official statistics, since the method of calculation has changed over the years and I often refer to the alterative measure published by Shadowstats (see chart below), which would indicate inflation is likely well above 15%.

Another wild month in the markets! Bitcoin showing some upside recently and helping out my portfolio overall in addition to the recent stock market rally. Gold, silver and commodities (especially oil) continue to look strong in the face of a 40-year high inflation print of 7.9% from the BLS this month and continued upward pressure from the fallout of economic sanctions against Russia. With the inflation report (all monthly numbers are annualized), the devil is in the details, with energy +25.6%, used cars and trucks +41.2% and new vehicles +12.4%; oddly, shelter is only +4.7%, which seems low given we are still seeing rent and home price appreciation in high double digits, at least where I live. My regular readers will know I don't have a lot of faith in the official statistics, since the method of calculation has changed over the years and I often refer to the alterative measure published by Shadowstats (see chart below), which would indicate inflation is likely well above 15%.

Cash - 6.6% (sold some equity, gold/silver and bitcoin ETF's in trading portfolio this month to bolster cash position due to market volatility and to hedge risk, since I believe we are still in a bear market with Federal Reserve set to continue raising interest rates as the economy slows, which will not be good for stocks - especially growth / tech stocks)Stocks - 15.2% US Large Cap - 2.6% (100% actively managed fund in 401(k))US Mid Cap - 2.4% (100% actively managed fund in 401(k))US Small Cap - 2.4% (100% actively managed fund in 401(k))International - 7.9% (100% actively managed funds in 401(k), including developed and emerging markets)Commodities - 0.3% (small position in URNM uranium producer ETF; I like the upside potential due to increasing demand for green energy and high oil prices, which are favorable longer term for nuclear energy; also industry dynamics for higher demand are improving with plant shutdowns being delayed and new plants coming online; this ETF also has a nice dividend yield of 5.87%)Bonds - 0.1% (adding back a small position in 401(k) through dollar cost averaging to take advantage of rising interest rates)Real Estate - 29.2% (32% actively managed fund in 401(k) and remainder is investment property I manage myself)Private Equity - 16.3% (includes numerous small Seed Invest, AngelList and Republic investments and a few direct investments in startups - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, proptech, fintech, blockchain, energy, cybersecurity, eSports, cannabis, etc.)Bitcoin - 22% (mix of direct Bitcoin ownership mostly self-custodied in cold storage and also including Bitcoin IRA and some GBTC; have a small staked Etherium position and dollar cost averaging small amounts twice a month into BTC in my Coinbase account, which gets moved to cold storage monthly); Bitcoin has posted about a 7% return this month, which has helped further reverse a terrible January, but my time horizon is 10+ years so I don't get too worried about short term price fluctuations and I'm always looking to buy at attractive entry points to add to my position in addition to dollar cost averaging - stay humble and stack! I also am rolling my Roth IRA that was previously in MicroStrategy stock (Chase has very limited Bitcoin investment options) into an Unchained Capital self-custody Bitcoin IRA. I may do a review on this in a future post, but so far the process has been very smooth.Gold / Silver / Other Alt - 8.2% (gold/ silver is 100% physical coins. This category also includes a Masterworks account to invest in fractional interests in fine art, which is now a little over half of this category - see my review of Masterworks here)Other - 2%Despite the market madness, my portfolio is up 2% this month, which I'm pretty happy with although most of that performance came in the past week. Other than the aforementioned cash raise, I made very few changes to the portfolio this month. I feel it is well positioned to benefit from the current inflationary environment and although I have a low stock exposure overall at 15%, I see that also could perform well to the extent active managers moving into stocks that have pricing power and benefit from inflation and higher interest rates. As always, do you own research and consult with your financial advisors before making any investment decisions. This is not investment advice.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!