Nick Reichert's Blog, page 9

November 14, 2021

Portfolio Allocation Update (November 2021)

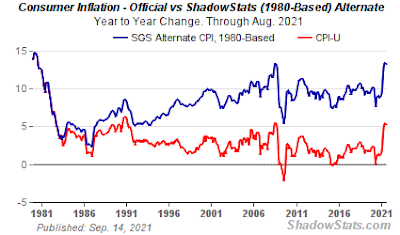

Last week was another eventful week in markets. Probably the biggest news was the surprisingly high CPI inflation print at 6.2%, the highest in 30+ years. This sent investors running for cover, sending gold / silver into a rally, bonds sold off and stocks were mixed but down for the week. Ironically, a very poor Michigan Consumer Sentiment reading, which itself would be negative for markets, encouraged some hope in investors that the Federal Reserve might delay interest rate hikes to avoid the economy slipping into a recession. It seems clear that inflation is not transitory and will be with us for some time, so investors must prepare for this reality. Whether we can continue to see the economy grow amid elevated inflation or fall into stagflation will depend on the actions taken by the Federal Reserve (tapering and rates) and the amount of government spending (infrastructure bill, Build Back Better, etc.). Either way, you will need to pay close attention to your investment portfolio allocation to make sure you are staying ahead of inflation.

Last week was another eventful week in markets. Probably the biggest news was the surprisingly high CPI inflation print at 6.2%, the highest in 30+ years. This sent investors running for cover, sending gold / silver into a rally, bonds sold off and stocks were mixed but down for the week. Ironically, a very poor Michigan Consumer Sentiment reading, which itself would be negative for markets, encouraged some hope in investors that the Federal Reserve might delay interest rate hikes to avoid the economy slipping into a recession. It seems clear that inflation is not transitory and will be with us for some time, so investors must prepare for this reality. Whether we can continue to see the economy grow amid elevated inflation or fall into stagflation will depend on the actions taken by the Federal Reserve (tapering and rates) and the amount of government spending (infrastructure bill, Build Back Better, etc.). Either way, you will need to pay close attention to your investment portfolio allocation to make sure you are staying ahead of inflation.Here's the portfolio breakdown for this month:

Cash - 5.9% (basically just my emergency fund plus a little extra)Stocks - 20.8% US Large Cap - 7.1% (61% I manage myself in a trading portfolio and remainder is actively managed fund in retirement account)US Mid Cap - 2.7% (100% actively managed fund in retirement account)US Small Cap - 2.5% (100% actively managed fund in retirement account)International - 8.5% (100% actively managed funds in retirement account, including developed and emerging markets) - added some this month as I exited the rest of my bond portfolioCommodities - exited this month to lock in gains and moved most of it to a Bitcoin IRA, the rest was invested in art and private equityBonds - exited all positions this month, including TIPS (locked in a small profit and moved to cash)Real Estate - 24.8% (37% actively managed fund in retirement account and remainder is investment property I manage myself) - added more this month as I exited the rest of my bond fund in the retirement portfolioPrivate Equity - 13.6% (includes numerous small Seed Invest and Republic investments and a few direct investments - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, proptech, fintech, blockchain, energy, cybersecurity, eSports, cannabis, etc.)Bitcoin - 23.2% (mix of direct Bitcoin ownership including a new Bitcoin IRA, some GBTC and MicroStrategy; continuing to add to small Etherium position and dollar cost averaging small amounts twice a month into ETH and BTC in my Coinbase account); I also have a small position in the the Proshares Bitcoin Futures ETF (BITO) in my trading portfolio which I sell calls against for cash flow.Gold / Silver / Other Alt - 9.8% (gold/ silver is 50% physical coins and 50% miner ETF's GDX and GDXJ (I like the miners because they pay a dividend and they also are a leveraged way to play gold since they tend to move up faster than the gold price, of course the opposite is true as well) - gold has started to rally in the last week or so and I think is still one of the most under-valued sectors right now; I also hold a small position in Metalla (MTA), a gold royalty company that should also have a leveraged return in any precious metals rally. I made several additions to my new Masterworks account to invest in art this month (there were several interesting IPO's this month which look to have great upside and sold out rather quickly) - see my review of Masterworks here)Other - 1.9%This month, I added more exposure to small private equity deals and the new Masterworks investment as well as Bitcoin through rolling over an existing IRA to a Bitcoin IRA. Fees were a bit high to do the IRA rollover (5% setup plus 2% trading fee), but the setup was easy, the coins are securely stored offline and they maintain $100M in insurance. Over the long run this should outperform the commodity fund I had at Vanguard, which has had a nice run over the past year up about 50%. Bitcoin IRA also offers a lending program where you can earn 2% by lending your Bitcoin, which will offset the account maintenance fees which are slightly less than 1% annually and allow you to add to your coins over time. I did consider counterparty risk and after researching Genesis Global Trading (world's largest digital asset lender), I felt pretty comfortable in proceeding with that option. If you are interested in other coins, they do have seven coins available currently including Bitcoin, Etherium, Cardano, Chainlink, Stellar, Litecoin and Bitcoin Cash and plan to add more in the future. I focus my investing on Bitcoin and to a lesser degree Etherium and avoid speculating much in the "altcoins."I continue to keep a broad diversification across asset classes and favor hard assets like Bitcoin, gold/silver, real estate, and art especially in the current inflationary environment. I like the potential upside that private equity offers relative to the public stock market, which is generally overvalued in my opinion (although if you look closely you can always find undervalued stocks which is the primary focus of my trading portfolio now). Cash is a little higher than last month. Overall portfolio grew 2.2% since last month.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

October 31, 2021

Investing in the Metaverse

There has been a lot of buzz in the last week about the "metaverse," the virtual reality future of the internet that was accelerated with Facebook's recent rebranding to "Meta" announced last week and their $10B investment commitment. There is no universal definition of the metaverse, but it seems like a natural evolution of the internet as gaming, social media, commerce and digital assets (NFT's/cryptocurrency) continue to merge and evolve into robust online communities. While Facebook (FB) is an obvious investment play into this emerging area, I wanted to look into other investment ideas. As always, do your own research and make your own investment decisions based on what's best for your portfolio, timeframe and risk tolerance.

There has been a lot of buzz in the last week about the "metaverse," the virtual reality future of the internet that was accelerated with Facebook's recent rebranding to "Meta" announced last week and their $10B investment commitment. There is no universal definition of the metaverse, but it seems like a natural evolution of the internet as gaming, social media, commerce and digital assets (NFT's/cryptocurrency) continue to merge and evolve into robust online communities. While Facebook (FB) is an obvious investment play into this emerging area, I wanted to look into other investment ideas. As always, do your own research and make your own investment decisions based on what's best for your portfolio, timeframe and risk tolerance.Stocks

Roundhill Ball Metaverse ETF (META) - this ETF includes stocks related to the metaverse theme, most of which you will recognize. It hasn't really performed that well since it launched back in June, most likely due to the up and down performance of tech so far this year, but maybe the future will look better for this ETF. It has seen a pickup in volume and inflows after the Facebook announcement last week, as discussed .

Top 10 Holdings include:

NVIDIARobloxFacebookMicrosoftSnapUnity SoftwareAutodeskAmazonTencentSea Ltd.I think Roblox (RBLX) is generally regarded as a pure metaverse play and might be worth considering for a stand-alone investment. Judging by the amount of time my son spends playing it (and the amount of money he spends on "Robucks," the currency you use to buy in game virtual items), it has quite the appeal and is very "sticky." Indeed, Roblox has live events like concerts and digital item "drops" that are highly anticipated and very well attended. Roblox is scheduled to report earnings on 11/8 and that might be an opportunity to buy on weakness if the stock sells off after earnings. The quarterly results for the past few quarters show remarkably strong free cash flow (almost $200M in the June quarter, a 58% increase from the prior quarter). This was quite surprising to me, especially given the history of losses and earnings disappointments.

Snap recently had disappointing earnings and was beaten down pretty bad and I bought some on the dip. Didn't realize it was a metaverse stock, though. Should recover nicely given enough time and especially if the metaverse momentum picks up.

Crypto

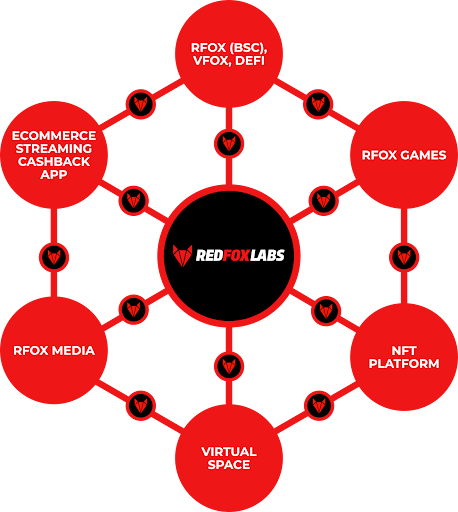

There are also a few crypto projects that are deep into the metaverse including RedFox (RFOX). They are involved in gaming, shopping, finance and media as shown in the graphic below.

Here's the company description from their website:

RedFOX Labs was founded in 2018 with the purpose to be Southeast Asia's first digital venture builder and internet-technology company to improve the mass adoption of crypto and blockchain as well as other new and emerging technology.

We identify and replicate successful pure-play business models for the local markets within the fastest growing sectors across several industries.

Our core focus is to open the true business potential of the digital economy for high demand products and services such as e-Commerce, e-Media (video live streaming app), Esports and gaming, e-Travel, and ride-hailing/logistics.

Through our fast-growing and advancing ecosystem as an internet-technology company for digital economy development, we are becoming one of the leading, go-to decentralized mobile applications (dApp) in Southeast Asia.

Investing in the RFOX coin is not for the faint of heart. Take a look at the price action since inception below. It's currently making a parabolic move, no doubt resulting from last week's Facebook announcement and investors looking to get metaverse exposure. As I was writing this, the price went from $0.18 to $0.20 in just a few minutes.

On Twitter, this project is quoted a lot as a good metaverse play. There are other coins that you can invest in including Decentraland (MANA), an Etherium token that powers the Decentraland virtual reality platform. MANA can be used to pay for virtual plots of land in Decentraland as well as in-world good and services.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

October 16, 2021

Monthly Portfolio Update (October 2021)

It's time for my monthly portfolio allocation update. Here's a quick overview of recent market activity:

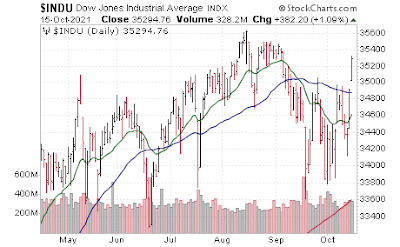

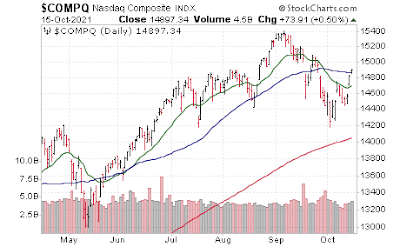

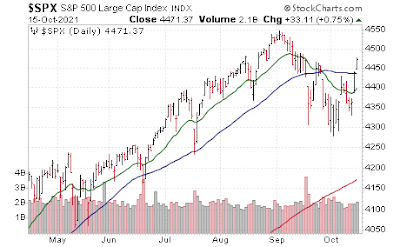

It's time for my monthly portfolio allocation update. Here's a quick overview of recent market activity:All three major indices (Dow Jones, Nasdaq and S&P 500) have broken their upward trend in September and seem to be headed downward, albeit with some very big bounces including the last few days of this week. Many believe that the market trend has changed and so there will continue to be volatility and bounces but the overall trend will be lower for the rest of the year. Others believe a new rally into year end is at hand, driven by strong earnings and receding COVID cases, but complicated by inflation, unemployment / job openings mismatch and supply chain issues.

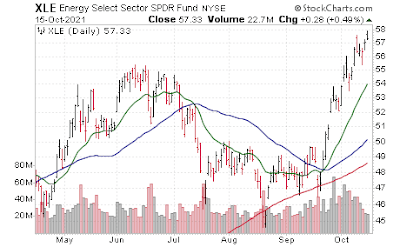

Certain sectors, like energy have been on fire and have gone parabolic (seems like XLE is due for a pullback soon):

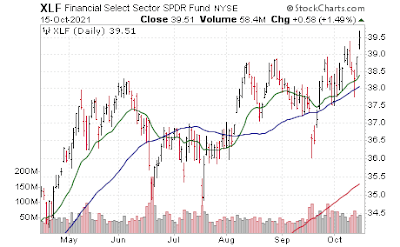

Financials also had a strong and fairly consistent upward trend, supported by a steepening yield curve (strong bank earnings this week seem likely to continue to provide a catalyst for more gains in this sector if supported by yield curve):

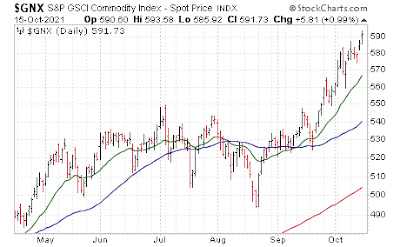

Of course, commodities have turned in a very strong performance recently thanks to inflation:

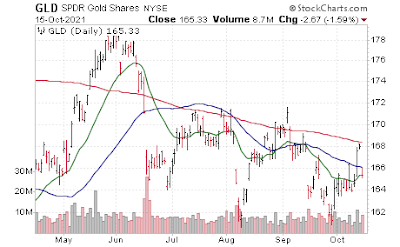

Gold is still struggling to break out of its downtrend and return to previous all time highs; could that be around the corner?:

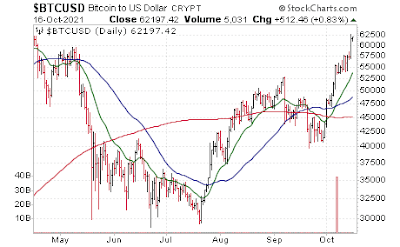

The big story of the week is the Bitcoin rally to break above $60K and getting very close to prior all time highs; SEC approval of new bitcoin futures ETF's expected to start trading next week, as well as continuing interest as an inflation hedge and substitute to gold may be driving some of the rally (institutions vs individuals):

Here's the portfolio breakdown for this month:

Cash - 5.3%Stocks - 20.2% US Large Cap - 6.5% (59% I manage myself in a hedged trading portfolio and remainder is actively managed fund in retirement account)US Mid Cap - 2.6% (100% actively managed fund in retirement account)US Small Cap - 2.5% (100% actively managed fund in retirement account)International - 8.6% (100% actively managed funds in retirement account, including developed and emerging markets) - I transferred half of my bond portfolio into an international index fund because I'm worried about rising bond yields / falling prices due to inflation; international stocks, particularly some of the larger China stocks, have been beaten down lately and seems to offer good valueCommodities - 6.8% (15% actively managed myself and 85% actively managed fund in retirement account)Bonds - 7.6% (48% actively managed fund in retirement account and remainder is Schwab TIPS ETF (SCHP))Real Estate - 21.1% (26% actively managed fund in retirement account and remainder is investment property I manage myself)Private Equity - 12.7% (includes numerous small Seed Invest and Republic investments - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, fintech, blockchain, energy, cybersecurity, eSports, etc.)Bitcoin - 16.8% (mix of direct Bitcoin ownership, some GBTC and MicroStrategy; sold majority of GBTC position - recently added a small Etherium position and continuing to dollar cost average small amounts twice a month into ETH and BTC in my Coinbase account)Gold / Silver / Other Alt - 7.8% (gold/ silver is 50% physical coins and 50% miner ETF's GDX and GDXJ (I like the miners because they pay a dividend and they also are a leveraged way to play gold since they tend to move up faster than the gold price, of course the opposite is true as well) - gold has been beaten down lately but is expected to recover as inflation and money printing continue for the foreseeable future; also hold a small position in VIX (UVXY) as short-term equity portfolio hedge and recently opened a Masterworks account to invest in art - see my review of Masterworks here)Other - 1.9%This month, I added a little more exposure to small private equity deals and the new Masterworks investment and sold GBTC to fund these investments and raise some cash, which kept my overall Bitcoin allocation about the same after factoring in recent appreciation. Continue to keep a broad diversification across asset classes and favor hard assets (Bitcoin, gold/silver, real estate), private equity and inflation protected bonds. Cash is a little higher than last month for new investments. Overall portfolio grew 6% since last month, mostly driven by Bitcoin and commodities.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

October 9, 2021

Masterworks.io Review

As an investor that favors hard or tangible investments, I'm always looking for new alternative assets for portfolio diversification. Quite a while ago, I was introduced to Masterworks.io, but only recently did a bit more research and finally made my first investment in artwork. This post is a general overview of the site, pros and cons and my overall take on the product.

As an investor that favors hard or tangible investments, I'm always looking for new alternative assets for portfolio diversification. Quite a while ago, I was introduced to Masterworks.io, but only recently did a bit more research and finally made my first investment in artwork. This post is a general overview of the site, pros and cons and my overall take on the product.Overview

Masterworks.io is a site that allows you to make fractional investments in fine art. They research the art market, have developed relationships with major auction houses and have built a database tracking a massive amount of historical sales data. Using this data, they have developed a selection process whereby they are able to vet through art offered for sale to them and select the pieces that are expected to have the best long term investor returns through the use of algorithms. Each piece of art they acquire is held by an entity that is registered with the US Securities and Exchange Commission and shares are sold to investors representing fractional interests in the work. They also maintain a secondary exchange where you can sell your shares to other investors if for some reason you need the cash. Otherwise, you would just hold your investment for 3-10 years until it is ultimately sold. They only end up buying about 2% of the art they are offered in about 1% of the artist markets they have analyzed (the ones they believe have the best returns based on their data analysis). The amount of historical price data they have is impressive - they have a proprietary data set that spans 70+ years of data and 60,000 datasets. They boast a 16% average annual rate of return on all their artwork, after deducting fees, which is pretty impressive. Fees are 1.5% annually (collected in additional shares issued to Masterworks vs cash) and a 20% fee upon sale.

Benefits

There are several benefits to investing in fine art through Masterworks:

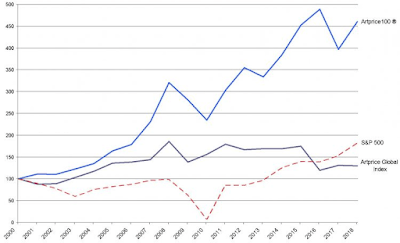

Each piece is carefully vetted and unique and therefore scarce, which improves chances for strong returnsAdditionally, over time the works of popular (deceased) artists find their way into museums and off the market, thereby increasing scarcity of the artist's work over timeCan potentially be a hedge against inflation Diversification of portfolioLow correlation to other asset classes (see chart below - top performing artists as represented by the Artprice 100 have far outpaced S&P 500 historically)Anyone can invest (no need to be an accredited investor) and low initial offering price of $20 per share for each work of artWorks of art valued in the millions or tens of millions that would not ordinarily be available to small individual investors can be invested inArt is protected and insured

Disadvantages

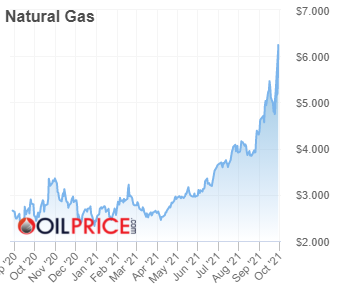

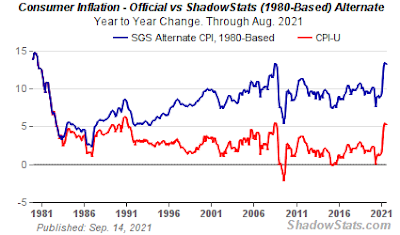

There are also some disadvantages to this investment:Counterparty risk (i.e., Masterworks.io continues to stay in business, adequately safeguards the works of art, has appropriate due diligence prior to purchase of works of art including careful authentication and also knows when to sell)Secondary market may be illiquid and pricing in the event of the need to sell may not be very favorableRequires "patient money" since this is a very long term investment and ideally shouldn't be "traded"Fees are pretty substantial, however the 20% back-end fee does align Masterworks' interests with the shareholdersOverall TakeSales process is very smooth; you make an appointment to talk to an agent who walks you through the investment process and answers any questions you might haveWebsite is intuitive and very easy to navigateInvestment thesis and investment deal sheet are well written and very straightforwardFunding investment and closing were easy (link bank account using Plaid)I plan to continue to build my Masterworks portfolio over time by adding some other artists and works. Eventually I plan to target about 2%-5% or so of my portfolio in this asset class. It should perform well in the coming years, especially if we experience above average levels of inflation, which may be a lot higher than the official numbers as I have discussed before (see chart below).

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

September 27, 2021

Energy Rally Ideas

There is a growing realization that energy (oil and gas) could be a great fourth quarter 2021 investment thesis for several reasons:Major and growing supply constraints due to "green" / "ESG" / "carbon footprint" public policy worldwideOil and gas stocks have been shunned by investors for some time in favor of renewable energy stocksEconomic growth in the wake of the pandemic, driving demandNo way that renewable energy can replace fossil fuels for a very long timeShort term bottlenecks driving prices up due to supply chain issues in the wake of the pandemic and hurricanesInflationIn short, a classic situation of supply shortages meeting growing demand plus inflation provide an excellent backdrop for investing in energy stocks.

There is a growing realization that energy (oil and gas) could be a great fourth quarter 2021 investment thesis for several reasons:Major and growing supply constraints due to "green" / "ESG" / "carbon footprint" public policy worldwideOil and gas stocks have been shunned by investors for some time in favor of renewable energy stocksEconomic growth in the wake of the pandemic, driving demandNo way that renewable energy can replace fossil fuels for a very long timeShort term bottlenecks driving prices up due to supply chain issues in the wake of the pandemic and hurricanesInflationIn short, a classic situation of supply shortages meeting growing demand plus inflation provide an excellent backdrop for investing in energy stocks.

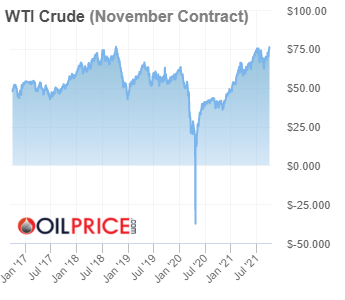

Indeed, from negative oil prices last year for WTI (<-$25/barrel!), we have come a long way recently approaching $80/barrel and with $90-$100 per barrel in sight.

Some stocks on my watchlist for investing in this trend include the following ideas:Chevron (CVX) - 5.21% dividend yieldExxon Mobil (XOM) - 5.87% dividend yieldEnergy Select SPDR ETF (XLE) - 4.1% dividend yieldPioneer Natural Resources (PXD) - 1.33% dividend yieldOther ways to play the space include US Oil Fund (USO) for direct exposure to the commodity (no dividend yield, however, which is a nice bonus with the ETF's and operating companies).

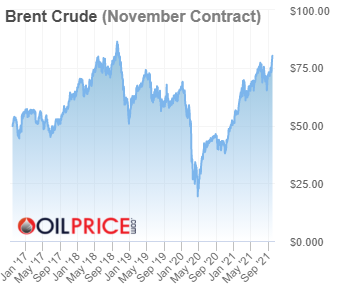

Natural gas has recently gone parabolic as shown in the chart below. While it can continue to move higher, especially with colder weather on the way and supply shortages, a pullback seems more likely in the near term back to the trendline (just below $5) - this looks a lot like lumber's recent parabolic move upward, which was followed by a collapse. Personally, I would probably stay away from this one until it corrects.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

September 19, 2021

Monthly Portfolio Update (September 2021)

It's time for my monthly portfolio allocation update. Rather than provide a broad market overview (indeed, both the stock and bond markets have seen a lot of selling action lately), I thought I would focus on a couple of key themes that seem to be driving recent market volatility.

It's time for my monthly portfolio allocation update. Rather than provide a broad market overview (indeed, both the stock and bond markets have seen a lot of selling action lately), I thought I would focus on a couple of key themes that seem to be driving recent market volatility. What matters most in investors' minds today seems to be weak(er) economic growth coupled with strong inflation trends. This is also known as "Stagflation," an unhappy situation where the economy (GDP) is not growing, while prices continue to rise. Even the official data would suggest we are heading in that direction and alternate data (shown below) would suggest things are considerably worse (much higher actual inflation and lower growth). This situation amplifies investor nervousness on a number of subjects including: an abnormally long "win" streak of all time highs in the stock market, persistent negative real yields on bonds, weak stock market seasonality, a potential looming real estate debt crisis in China (Evergrande), the US debt ceiling and potential default, US Federal budget and taxation uncertainty, ongoing COVID concerns, etc. Many market participants think the odds of a significant stock market correction are growing, while some analysts are still expecting volatility with more upside through the remainder of the year as the US economic recovery (led by a resilient consumer) continues. Indeed, the market seems to have mostly been "climbing a wall of worry" for the last few months. The next few months through the end of the year will certainly be interesting to watch.

Here's the portfolio breakdown for this month:

Cash - 3%Stocks - 18.2% US Large Cap - 7.8% (64% I manage myself in a hedged trading portfolio and remainder is actively managed fund in retirement account)US Mid Cap - 2.8% (100% actively managed fund in retirement account)US Small Cap - 2.6% (100% actively managed fund in retirement account)International - 5% (100% actively managed funds in retirement account)Commodities - 6.7% (16% actively managed myself and 84% actively managed fund in retirement account)Bonds - 12% (65% actively managed fund in retirement account and remainder is Schwab TIPS ETF (SCHP))Real Estate - 22% (26% actively managed fund in retirement account and remainder is investment property I manage myself)Private Equity - 12.9% (includes numerous small Seed Invest and Republic investments - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, fintech, cybersecurity, eSports, etc.)Bitcoin - 17.2% (mix of direct Bitcoin ownership, MicroStrategy and GBTC - recently added a small Etherium position and continuing to dollar cost average small amounts twice a month into ETH and BTC in my Coinbase account)Gold / Silver / Other Alt - 6% (gold/ silver is 50% physical coins and 50% miner ETF's GDX and GDXJ (I like the miners because they pay a dividend and they also are a leveraged way to play gold since they tend to move up faster than the gold price, of course the opposite is true as well) - gold has been beaten down lately but is expected to recover as inflation and money printing continue for the foreseeable future; also hold a small position in VIX (UVXY) as short-term equity portfolio hedge)Other - 2.1%Not many changes in the overall portfolio allocation since last month. I added a little more exposure to commodities (inflation hedge) and continued to invest in small private equity deals for growth. Continue to keep a broad diversification across asset classes and favor hard assets (Bitcoin, gold/silver, real estate) and inflation protected bonds. Keeping cash as low as practical. Overall portfolio grew 1.3% since last month, which is terrific considering the amount of recent market volatility and would suggest that the broad diversification is working as expected.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

August 29, 2021

Market Outlook for Coming Week

For this week's post, I thought it would be good to give a market overview in light of the Federal Reserve Chairman's comments last week on starting to taper bond purchases later this year and continuing to hold interest rates low. This ignited a strong stock market rally on Friday after a volatile last couple of weeks, presumably lifting some of the uncertainty about the Fed's path forward. The question now is which way will the market go. A difficult question to answer, especially since September is typically not a great month for the stock market. On the flip side, the ongoing economic recovery, strong corporate earnings and favorable monetary / fiscal environment are positives. Perhaps the biggest positive is the continued "easy money" environment supported by the Fed. Some market watchers see economic weakness on the horizon based on some of the recent mixed economic data and a slowdown would obviously be bullish for bonds and not so bullish for the stock market. There is however, a big difference between a recession and moderating growth in 2022 and we could be seeing the latter, which would still bode well for the stock market for the remainder of the year and next.

For this week's post, I thought it would be good to give a market overview in light of the Federal Reserve Chairman's comments last week on starting to taper bond purchases later this year and continuing to hold interest rates low. This ignited a strong stock market rally on Friday after a volatile last couple of weeks, presumably lifting some of the uncertainty about the Fed's path forward. The question now is which way will the market go. A difficult question to answer, especially since September is typically not a great month for the stock market. On the flip side, the ongoing economic recovery, strong corporate earnings and favorable monetary / fiscal environment are positives. Perhaps the biggest positive is the continued "easy money" environment supported by the Fed. Some market watchers see economic weakness on the horizon based on some of the recent mixed economic data and a slowdown would obviously be bullish for bonds and not so bullish for the stock market. There is however, a big difference between a recession and moderating growth in 2022 and we could be seeing the latter, which would still bode well for the stock market for the remainder of the year and next.Starting with the S&P 500, the linear trend continues to be up and there doesn't seem to be much in the way of keeping that going in the near term. Of course, there may be pull-backs and the market is due for a correction at some point, but predicting the exact timing is very difficult.

Much like the S&P 500, the NASDAQ linear trend is strong and upward. Again, not much in the way here.

Dow Jones Industrial Average momentum and linear trend continue to be strong as well, very much like the other two indices. Again, hard to see anything stopping this in the near term given the current environment.

The VIX continues to be at very low levels, suggesting that fear is low with investors. I think this is probably the best hedge against market uncertainty (better than bonds, which seem to be heading toward higher rates, not lower) in the current environment and it probably makes sense to own a small position at these levels just in case something happens to the broader market. I prefer UVXY a leveraged ETF, for that purpose.

Dollar is struggling now (was in an upward trend but Fed comments hit pretty hard last week). It will be interesting to see if the dollar moves higher or if it rolls over and heads back down into the 80's. The latter would be extremely bullish for commodities, including gold and silver.

Gold is trying to rally but has been stuck in a more or less sideways pattern since last summer. Many analysts believe that gold is poised to move up in light of the Fed's comments (presumably on dollar weakness) and the recent dramatic recovery from a deep sell-off. Gold is expected to move toward all time highs over the remainder of the year if it can overcome a few key technical levels. The long term outlook for gold is very good with global money printing, but patience may be required in the near term. Still worth at least a 5% or 10% portfolio allocation as a buy and hold, especially at these levels. I like the miners the best because they have sold off more, tend to outperform on the upside and also pay a dividend (GDX, GDXJ).

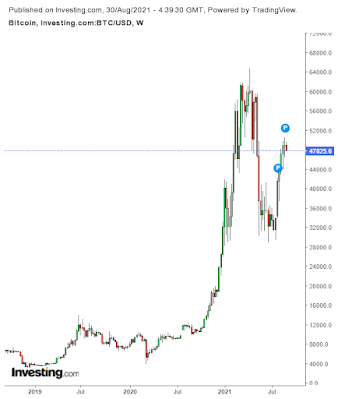

Bitcoin continues to mount an impressive rally from the recent 50% "crash" from all time highs. Some analysts believe that Bitcoin could hit $51K or $52K and then it will drop all the way down to the $15K - $20K range before consolidating and moving up again. If that's the case, I would definitely be a buyer at those levels. Others have said that it will continue to move up and once it breaks through the former all time high, $100K could be the next target level before the end of the year. Only time will tell, but the best approach is to buy on the dips and dollar cost average on a regular basis. See my post last week on Bitcoin investing rationale for more info.

In summary, perhaps your best protection over market uncertainty is keeping a broadly diversified portfolio since it's so difficult to beat the program traders and it's much easier for an individual investor to maintain a buy and hold portfolio. See my recent post here for my last portfolio allocation update. Beyond having a broadly diversified portfolio, it makes sense to stay fully invested in the stock market consistent with your portfolio allocation target and employ hedging where it makes sense just in case. For example in my trading portfolio I use two main hedging strategies: I sell call options on the stocks I own for cash flow and to hedge downside moves and I also own UVXY shares (roughly 9% of the total portfolio).I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

August 22, 2021

Why Invest in Bitcoin?

I have written many past posts about Bitcoin in particular and cryptocurrency in general, covering how Bitcoin fits into an overall asset allocation strategy, different ways of getting exposure to Bitcoin and have also recommended weightings in my monthly portfolio updates. For this post, I thought it would be good to go back to basics and focus on Bitcoin and why it's something that everyone should have a "non-zero" allocation to.

First of all, what is Bitcoin? Bitcoin is the first peer to peer digital payment system ever created. It is entirely decentralized. There are thousands of exact copies of the Bitcoin ledger stored on computers all over the world. These are called "nodes" and are used to validate authenticity of bitcoin transactions - if any node were to go down there are many many more that have the same information, thereby making the blockchain extremely resilient. Transactions are validated by miners, who use high powered processors and compete to solve complex math equations. If successful, a miner will write the next block of the Bitcoin ledger (a copy to be retained on all nodes for future reference) and will earn a block reward (newly issued Bitcoins). Once written, the block is immutable and unchangeable and so are all the blocks that were written previously. Also, anyone can see it since the blockchain is public, so while the identity of the parties to a Bitcoin transaction are not visible, the address of their wallets is and other aspects of the transaction such as the amount of Bitcoin being transferred are public. Perhaps one of the most notable aspects of Bitcoin is the ability to balance privacy with transparency in this way.

The amount of Bitcoin processing power is called hash rate. The higher the hash rate, the more difficult it is to attack the system in order to compromise the ledger and create fake transactions - the so-called "50% Attack." This was recently done with a smaller coin (Bitcoin SV). At current hash rate levels (which have been growing on an annual basis roughly in line with the price of Bitcoin at about 200%), it would be virtually impossible to harness the computing power necessary to overwhelm the network. As the network grows, so does the hash rate. Hash rate did dip when China recently shut down all mining operations in their country, but it quickly recovered as miners relocated to more friendly countries including the US. Helping this along (and part of the game theory embedded in the Bitcoin code), when hash rate drops, the difficulty of mining new blocks also drops, making it more lucrative for existing miners to solve the equations faster and thereby earn more Bitcoin. When hash rate recovers, the difficulty increases.

Because of Bitcoin's decentralization, it is "trustless" and does not require an intermediary such as a bank or other entity to complete a transaction. Similar to physical gold and silver, it can be "self-custodied" by holding the coins in a hardware wallet (basically a USB flash drive) as opposed to on an exchange like Coinbase. Storing Bitcoin on a hardware wallet requires you to know the keys, or a series of random words that will allow you to recover your account. If those keys are lost, then your Bitcoin is lost forever, so it's important to save them in a safe place.

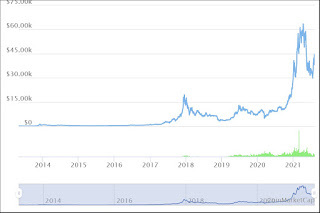

Bitcoin is a scarce digital asset: there will only ever be 21 million Bitcoins in existence. Currently, there are 18.8 million bitcoins in existence and the remaining 2.2 million will be mined over the next 30 years or so, until all coins have been issued. Every four years, there is a "halving" event, which reduces the miner's reward by half (currently 6.25 coins per block). At today's price of about $50K per coin, a miner makes $312,500 each time they successfully write a block, so Bitcoin mining while extremely difficult and capital intensive (requiring hundreds if not thousands of processors in most large operations and plenty of cheap electricity), can be lucrative. Indeed, investing in Bitcoin miners and related companies has become popular.

Bitcoin is and has been for some time the largest cryptocurrency by market capitalization, currently at $946 Billion. Etherium is currently number two at about $392 Billion. Because of Etherium's popularity in the decentralized finance (DeFi) and nonfungible token (NFT) worlds, it has seen strong demand, even though the protocol is very different from Bitcoin. For example, it is more centralized (a core group of developers can make changes to the protocol), has no maximum supply and is moving to a less rigorous but less energy intensive method of validating transactions called proof of stake versus the proof of work method that Bitcoin uses. It is generally believed by the Bitcoin community that proof of work is superior to proof of stake for securing the network.

The investment thesis for Bitcoin is fairly straightforward. As a scarce digital asset, it is similar in many ways to gold or silver. Unlike gold, it is "compact" and a significant amount of value can be stored in a very small space (on a hardware wallet the size of a USB flash drive). Also unlike gold, it can be transferred easily to whoever you want, without the need of a third party intermediary. To me, these are significant improvements over gold. But as a digital asset, there's more that Bitcoin can do.

Bitcoin also has the capability of being the "base layer" of a new monetary system, with second and third layers built on top of it that can handle more transactions and faster processing speeds at a fraction of the cost - rivaling Visa or Mastercard payment networks. One of the complaints with the Bitcoin base layer currently is that it takes 10 minutes to write a new block and each block is limited to 1 Megabyte of data. These limitations are eliminated with second layer protocols such as the Lightning Network (which sets out to do much of what Etherium has sought to do). Etherium sought out to solve those speed and volume issues on the base layer, but as time has gone on it's clear that this is very difficult to do without sacrificing security, which is the main reason why Bitcoin was architected the way it was. I think Etherium and the 10,000 or so other "Alt Coins" have their function and place, but they are very different from Bitcoin.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

August 8, 2021

Monthly Portfolio Update

It's time for my monthly portfolio allocation update. I shifted some things around a little more since last month and put more cash to work. My overall portfolio allocation approach is to remain broadly diversified across a wide range of asset classes, effectively creating an "all weather" portfolio that should do well in any investing environment (the goal to achieve lower risk and higher return) and consistent with my Financial Fortress methodology.

First here's an overview of the major indices:

S&P 500 - 10 Year

S&P 500 - 10 Year Dow Jones Industrial Average - 10 Year

Dow Jones Industrial Average - 10 Year NASDAQ - 10 Year

NASDAQ - 10 YearAll three major US stock market indices continue to grind higher and with volatility compression over the past few weeks, seem poised to either break up or down given an appropriate market catalyst. A lot of the people I follow seem to think a downside move is becoming more and more likely, even if it's just a "normal" bull market correction of 10% or so. Time will tell, but it's best to be prepared and remain fully invested with hedges, and broadly diversified as I describe below.

Here's a chart of 30 year Treasury yields:

30 Year Treasury Yields - Last 6 Months

30 Year Treasury Yields - Last 6 MonthsDespite the recent uptick as a result of the robust employment report on Friday, the trend has been toward lower long term bond yields. The bond market appears to be expecting slower growth in the future, which will ultimately put downward pressure on prices and inflation. Should this trend continue, that could be the catalyst for a stock market selloff. Ironically, interest rate sensitive growth stocks should do relatively better in a low interest rate environment, versus cyclical/value stocks, which have rallied recently due to the economic recovery and would perform relatively worse in a softer economic growth environment. Indeed, much of the market action over the past six months has been shifting between growth and value names, depending on where the economic data has trended. This trend will also continue as we continue to see how the economic data unfolds in the coming weeks and months.

Here's the chart of Bitcoin:

Bitcoin Since Inception

Bitcoin Since InceptionThe Bitcoin chart shows a clear recovery from the recent dip to around $29K - $30K and while it has some ways to go to reclaim the recent all time high, from what I have learned from on chain analysts I follow, the available supply on exchanges is shrinking just as demand for coins is increasing. The main demand for coins is global adoption as an alternative investment and to a lesser extent for payments, especially in countries that have experienced hyperinflation in their local currencies. Short term supply and demand imbalances will be a recurring feature as will the volatile bull and bear cycles of Bitcoin, but the long term potential for appreciation in this asset class is unparalleled, particularly given the adoption trend which many have compared to other technologies including the internet itself. Also, Bitcoin has proven itself over the past 10 years despite major draw downs, that it can appreciate an average of 200% per year, so this benefits long term holders (vs traders who can easily get wiped out on the volatile short term movements).

Here's the portfolio breakdown for this month:

Cash - 1.6%Stocks - 18.7% US Large Cap - 8.2% (66% I manage myself in a hedged trading portfolio and remainder is actively managed fund in retirement account)US Mid Cap - 2.8% (100% actively managed fund in retirement account)US Small Cap - 2.6% (100% actively managed fund in retirement account)International - 5.1% (100% actively managed funds in retirement account)Commodities - 5.5% (100% actively managed fund in retirement account)Bonds - 12.8% (62% actively managed fund in retirement account and remainder is mostly Schwab TIPS ETF (SCHP) with some long term treasuries (TLT) for an equity hedge)Real Estate - 21.9% (26% actively managed fund in retirement account and remainder is investment property I manage myself)Private Equity - 11.8% (includes numerous small Seed Invest and Republic investments - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, fintech, cybersecurity, eSports, etc.)Bitcoin - 17.5% (mix of direct Bitcoin ownership, MicroStrategy and GBTC - recently added a small Etherium position and continuing to dollar cost average small amounts twice a month into ETH and BTC in my Coinbase account)Gold / Silver / Other Alt - 6.7% (gold/ silver is 50% physical coins and 50% miner ETF's GDX and GDXJ (I like the miners because they pay a dividend and they also are a leveraged way to play gold since they tend to move up faster than the gold price, of course the opposite is true as well) - gold has been beaten down lately but is expected to recover as inflation and money printing continue for the foreseeable future; also hold some small positions in VIX (UVXY) and dollar (UUP) as short-term equity portfolio hedges)Other - 3.5%I continue to be concerned by elevated stock market risk as the overall averages grind higher, so I have tried to keep stock exposure moderate, even though performance has actually been quite good recently. I also added a few hedges to my equity trading portfolio in case of a market correction, which many believe is long overdue. As mentioned above, those hedges include bullish long bond ETF (TLT), leveraged VIX ETF (UVXY) and bullish dollar ETF (UUP), since all three of these would rise in the event of a stock market correction. Cash position is kept relatively low due to inflation and to "put the money to work." Since last month, I shifted a little more money to private equity (startup investments) including a cybersecurity company on Republic and an eSports startup on Seed Invest. The recent rally in Bitcoin has helped the overall portfolio quite a bit and if it continues, could pose a rebalancing dilemma over the next several months, but that's a good problem to have.I'm continuing to closely monitor the market situation for opportunities, but feel pretty good about my overall allocation right now. I'm expecting continued market volatility for the rest of this year and like most observers, I'm expecting a stock market correction at some point of 10% or so, which would be healthy given extended valuations and also a great opportunity to cash in hedges and buy the dip in stocks.

Hopefully reviewing this allocation helps you understand how I operationalize my macro strategy views and Financial Fortress approach in a practical way.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

July 18, 2021

Coinbase Review

I started using Coinbase to buy Bitcoin back in 2017. Since that time, the platform has added lots of new features and I have been trying out many of them. I thought it would be good to give a review of what I like and what I don't like about the new Coinbase platform. Overall, I would say I have been happy with it, especially the newer features they have added since I first started using it. In this post, I'll walk through each of the current features of the current platform.

I started using Coinbase to buy Bitcoin back in 2017. Since that time, the platform has added lots of new features and I have been trying out many of them. I thought it would be good to give a review of what I like and what I don't like about the new Coinbase platform. Overall, I would say I have been happy with it, especially the newer features they have added since I first started using it. In this post, I'll walk through each of the current features of the current platform. 1) Free Coins - One of the things I like is when they offer new coins and you can learn about them and earn a few coins for watching videos and answering questions. Although you may not end up investing in the new coins (I usually just convert the ones I receive as rewards into Bitcoin), you learn a lot about how decentralized finance is evolving which is helpful to have a broader understanding of the crypto industry.

2) Buying Crypto - If you are buying a large amount of crypto, it probably makes sense for you to use Coinbase Pro to purchase the coins and then transfer them back into Coinbase for no fee afterward. The fee structure is slightly lower on Coinbase Pro and it gets lower the more you buy. For example a typical small buy of Bitcoin on Coinbase (say $250) would incur a 1.5% fee. On Coinbase Pro, that fee would be 0.5% up to $10K and is reduced at different levels as you buy more over a 30 day period. One disadvantage of Coinbase Pro is you can't do recurring buys like you can on Coinbase, which is really nice for dollar cost averaging and also simplifying your investing. I like how you can easily transfer coins between your Coinbase and Coinbase Pro wallets instantly and for no cost. I don't like how they put a hold on the ability to transfer your coins for several days in Coinbase Pro after doing a cash funding transfer, but I'm assuming that's due to banking laws. Both platforms offer a wide array of coins to buy and sell, although some coins are not available for trading, like Binance Coin, Binance USD, Ripple, VeChain, Tron, Monero and Theta. That might be a good thing, however, since each of those have heightened regulatory risk. However Dogecoin of course is available, although not something that I would invest in personally. I am mostly focused on Bitcoin and to a lesser extent Etherium as far as crypto investing goes. Check out my recent post here for more on Bitcoin investing and broader crypto strategy.

3) Staking Etherium - Coinbase now allows you to stake your Etherium (Etherium 2) which is still held in your wallet and earns interest currently at 5%, although it was 6% when they first rolled it out. I believe you can earn higher staking rewards on other platforms, but security and peace of mind are important considerations for me so I decided to use Coinbase for that. I currently buy a small amount twice a month and stake it. Staking fees are likely to decline in the future as more investors choose to stake their Etherium, which you will have to watch. Also, there's no clear timeframe as to when the ETH2 will be unlocked and available to trade - could be a year or two, but if you are a long term HODLer, that shouldn't matter much.

4) USDC Interest - Coinbase currently pays 0.15% interest on USDC deposits, but that is slated to increase to 4% soon, which will be very attractive compared to other alternative, including savings and money market accounts. There are other exchanges that pay much higher rates of interest on USDC, but again security and peace of mind are top on my list so I'm willing to take a lower yield to ensure that my assets are safe. Coinbase being a very large, well capitalized public company arguably has some of the best security protocols in the industry. There is some regulatory risk brewing for stable coins generally, but I think the ones that are 100% backed by US treasury securities / cash and are reviewed / attested monthly like USDC should have little concern. Regardless, additional regulation in this space would be a welcome development considering the high growth rate and large amount of assets being accumulated in stablecoins.

5) Other Interest Earning Crypto - In addition to USDC, Coinbase currently offers interest on the following coins:

Cosmos - 5%Tezos - 4.63%Algorand - 4%Dai - 2%While you do take some risk of your principal in buying these coins, if you have done the research and think they have long term potential as part of your investment portfolio, then the interest earned on them is a nice bonus. Dai is a stablecoin similar to USDC and is designed to always equal a value of $1, but unlike USDC is not backed by US dollar assets, but is instead backed by collateral on the Maker platform and so there is some risk that if the Dai credit system were modified or shut down you would have to convert Dai to Etherium.6) Debit Card - Coinbase's new debit card is a great product. You can choose which crypto you want to use to fund transactions, but I find USDC is the best because there is no fee (or tax implications) when you buy and sell USDC. You can also choose which crypto you want to earn rewards in - 1% BTC or 4% XLM (Stellar). I chose the XLM option because I can just convert XLM to BTC when the balance builds up enough. I deposit a set amount every two weeks of USDC into Coinbase and I use the debit card for many of my recurring subscriptions and also for purchases on Amazon, DoorDash, etc. It also helps me to budget for those things because I have a set amount each month. I was using the Crypto.com card for quite some time, but while the rewards were good, the CRO token has plummeted in value and so the CRO you have to stake in order to earn your reward level also plummeted in value as well. For some reason they also stopped acknowledging Costco gas so I wasn't earning rewards on that anymore (and it happened with a couple of other vendors too), but this isn't an issue with the Coinbase card.

7) Borrowing - I have not tried this feature yet, but I think it has a lot of potential. Coinbase allows you to borrow up to $100K backed by Bitcoin (you would have to lock $250K of Bitcoin to do the maximum loan) and they currently charge 8% interest. The minimum loan is $10K. Because it's fully collateralized the loan process is very simple and you can get cash quickly. This is really a great feature if you need some cash quickly for any reason and you don't want to have to sell your Bitcoin and incur a tax liability in the process. As Bitcoin's value appreciates in the future, this could be a great way for holders to have financial flexibility, possibly even as a retirement strategy - since loans are not taxable. Of course the loan will eventually have to be paid off someday, but that could potentially happen in the estate settlement process.

If you haven't already started investing in Crypto and want to get started, I have been recommending opening an account with Coinbase. If you click the link, you'll get my invitation and we both get $10 in Bitcoin when you open your account with at least $100!I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.