Monthly Portfolio Update

It's time for my monthly portfolio allocation update. I shifted some things around a little more since last month and put more cash to work. My overall portfolio allocation approach is to remain broadly diversified across a wide range of asset classes, effectively creating an "all weather" portfolio that should do well in any investing environment (the goal to achieve lower risk and higher return) and consistent with my Financial Fortress methodology.

First here's an overview of the major indices:

S&P 500 - 10 Year

S&P 500 - 10 Year Dow Jones Industrial Average - 10 Year

Dow Jones Industrial Average - 10 Year NASDAQ - 10 Year

NASDAQ - 10 YearAll three major US stock market indices continue to grind higher and with volatility compression over the past few weeks, seem poised to either break up or down given an appropriate market catalyst. A lot of the people I follow seem to think a downside move is becoming more and more likely, even if it's just a "normal" bull market correction of 10% or so. Time will tell, but it's best to be prepared and remain fully invested with hedges, and broadly diversified as I describe below.

Here's a chart of 30 year Treasury yields:

30 Year Treasury Yields - Last 6 Months

30 Year Treasury Yields - Last 6 MonthsDespite the recent uptick as a result of the robust employment report on Friday, the trend has been toward lower long term bond yields. The bond market appears to be expecting slower growth in the future, which will ultimately put downward pressure on prices and inflation. Should this trend continue, that could be the catalyst for a stock market selloff. Ironically, interest rate sensitive growth stocks should do relatively better in a low interest rate environment, versus cyclical/value stocks, which have rallied recently due to the economic recovery and would perform relatively worse in a softer economic growth environment. Indeed, much of the market action over the past six months has been shifting between growth and value names, depending on where the economic data has trended. This trend will also continue as we continue to see how the economic data unfolds in the coming weeks and months.

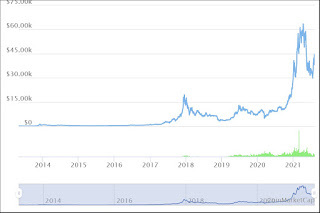

Here's the chart of Bitcoin:

Bitcoin Since Inception

Bitcoin Since InceptionThe Bitcoin chart shows a clear recovery from the recent dip to around $29K - $30K and while it has some ways to go to reclaim the recent all time high, from what I have learned from on chain analysts I follow, the available supply on exchanges is shrinking just as demand for coins is increasing. The main demand for coins is global adoption as an alternative investment and to a lesser extent for payments, especially in countries that have experienced hyperinflation in their local currencies. Short term supply and demand imbalances will be a recurring feature as will the volatile bull and bear cycles of Bitcoin, but the long term potential for appreciation in this asset class is unparalleled, particularly given the adoption trend which many have compared to other technologies including the internet itself. Also, Bitcoin has proven itself over the past 10 years despite major draw downs, that it can appreciate an average of 200% per year, so this benefits long term holders (vs traders who can easily get wiped out on the volatile short term movements).

Here's the portfolio breakdown for this month:

Cash - 1.6%Stocks - 18.7% US Large Cap - 8.2% (66% I manage myself in a hedged trading portfolio and remainder is actively managed fund in retirement account)US Mid Cap - 2.8% (100% actively managed fund in retirement account)US Small Cap - 2.6% (100% actively managed fund in retirement account)International - 5.1% (100% actively managed funds in retirement account)Commodities - 5.5% (100% actively managed fund in retirement account)Bonds - 12.8% (62% actively managed fund in retirement account and remainder is mostly Schwab TIPS ETF (SCHP) with some long term treasuries (TLT) for an equity hedge)Real Estate - 21.9% (26% actively managed fund in retirement account and remainder is investment property I manage myself)Private Equity - 11.8% (includes numerous small Seed Invest and Republic investments - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, fintech, cybersecurity, eSports, etc.)Bitcoin - 17.5% (mix of direct Bitcoin ownership, MicroStrategy and GBTC - recently added a small Etherium position and continuing to dollar cost average small amounts twice a month into ETH and BTC in my Coinbase account)Gold / Silver / Other Alt - 6.7% (gold/ silver is 50% physical coins and 50% miner ETF's GDX and GDXJ (I like the miners because they pay a dividend and they also are a leveraged way to play gold since they tend to move up faster than the gold price, of course the opposite is true as well) - gold has been beaten down lately but is expected to recover as inflation and money printing continue for the foreseeable future; also hold some small positions in VIX (UVXY) and dollar (UUP) as short-term equity portfolio hedges)Other - 3.5%I continue to be concerned by elevated stock market risk as the overall averages grind higher, so I have tried to keep stock exposure moderate, even though performance has actually been quite good recently. I also added a few hedges to my equity trading portfolio in case of a market correction, which many believe is long overdue. As mentioned above, those hedges include bullish long bond ETF (TLT), leveraged VIX ETF (UVXY) and bullish dollar ETF (UUP), since all three of these would rise in the event of a stock market correction. Cash position is kept relatively low due to inflation and to "put the money to work." Since last month, I shifted a little more money to private equity (startup investments) including a cybersecurity company on Republic and an eSports startup on Seed Invest. The recent rally in Bitcoin has helped the overall portfolio quite a bit and if it continues, could pose a rebalancing dilemma over the next several months, but that's a good problem to have.I'm continuing to closely monitor the market situation for opportunities, but feel pretty good about my overall allocation right now. I'm expecting continued market volatility for the rest of this year and like most observers, I'm expecting a stock market correction at some point of 10% or so, which would be healthy given extended valuations and also a great opportunity to cash in hedges and buy the dip in stocks.

Hopefully reviewing this allocation helps you understand how I operationalize my macro strategy views and Financial Fortress approach in a practical way.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.