Investing in the Metaverse

There has been a lot of buzz in the last week about the "metaverse," the virtual reality future of the internet that was accelerated with Facebook's recent rebranding to "Meta" announced last week and their $10B investment commitment. There is no universal definition of the metaverse, but it seems like a natural evolution of the internet as gaming, social media, commerce and digital assets (NFT's/cryptocurrency) continue to merge and evolve into robust online communities. While Facebook (FB) is an obvious investment play into this emerging area, I wanted to look into other investment ideas. As always, do your own research and make your own investment decisions based on what's best for your portfolio, timeframe and risk tolerance.

There has been a lot of buzz in the last week about the "metaverse," the virtual reality future of the internet that was accelerated with Facebook's recent rebranding to "Meta" announced last week and their $10B investment commitment. There is no universal definition of the metaverse, but it seems like a natural evolution of the internet as gaming, social media, commerce and digital assets (NFT's/cryptocurrency) continue to merge and evolve into robust online communities. While Facebook (FB) is an obvious investment play into this emerging area, I wanted to look into other investment ideas. As always, do your own research and make your own investment decisions based on what's best for your portfolio, timeframe and risk tolerance.Stocks

Roundhill Ball Metaverse ETF (META) - this ETF includes stocks related to the metaverse theme, most of which you will recognize. It hasn't really performed that well since it launched back in June, most likely due to the up and down performance of tech so far this year, but maybe the future will look better for this ETF. It has seen a pickup in volume and inflows after the Facebook announcement last week, as discussed .

Top 10 Holdings include:

NVIDIARobloxFacebookMicrosoftSnapUnity SoftwareAutodeskAmazonTencentSea Ltd.I think Roblox (RBLX) is generally regarded as a pure metaverse play and might be worth considering for a stand-alone investment. Judging by the amount of time my son spends playing it (and the amount of money he spends on "Robucks," the currency you use to buy in game virtual items), it has quite the appeal and is very "sticky." Indeed, Roblox has live events like concerts and digital item "drops" that are highly anticipated and very well attended. Roblox is scheduled to report earnings on 11/8 and that might be an opportunity to buy on weakness if the stock sells off after earnings. The quarterly results for the past few quarters show remarkably strong free cash flow (almost $200M in the June quarter, a 58% increase from the prior quarter). This was quite surprising to me, especially given the history of losses and earnings disappointments.

Snap recently had disappointing earnings and was beaten down pretty bad and I bought some on the dip. Didn't realize it was a metaverse stock, though. Should recover nicely given enough time and especially if the metaverse momentum picks up.

Crypto

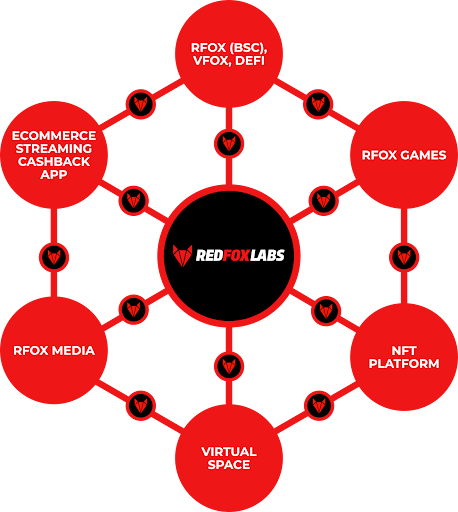

There are also a few crypto projects that are deep into the metaverse including RedFox (RFOX). They are involved in gaming, shopping, finance and media as shown in the graphic below.

Here's the company description from their website:

RedFOX Labs was founded in 2018 with the purpose to be Southeast Asia's first digital venture builder and internet-technology company to improve the mass adoption of crypto and blockchain as well as other new and emerging technology.

We identify and replicate successful pure-play business models for the local markets within the fastest growing sectors across several industries.

Our core focus is to open the true business potential of the digital economy for high demand products and services such as e-Commerce, e-Media (video live streaming app), Esports and gaming, e-Travel, and ride-hailing/logistics.

Through our fast-growing and advancing ecosystem as an internet-technology company for digital economy development, we are becoming one of the leading, go-to decentralized mobile applications (dApp) in Southeast Asia.

Investing in the RFOX coin is not for the faint of heart. Take a look at the price action since inception below. It's currently making a parabolic move, no doubt resulting from last week's Facebook announcement and investors looking to get metaverse exposure. As I was writing this, the price went from $0.18 to $0.20 in just a few minutes.

On Twitter, this project is quoted a lot as a good metaverse play. There are other coins that you can invest in including Decentraland (MANA), an Etherium token that powers the Decentraland virtual reality platform. MANA can be used to pay for virtual plots of land in Decentraland as well as in-world good and services.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.