Nick Reichert's Blog, page 12

February 7, 2021

Inflation-Dividend Mini-Portfolio

One of the many dilemmas facing investors lately is the prospect of little to no yield on cash. I just got my 1099 for tax time from TreasuryDirect and realized that the four week Treasury Bills I have invested in for most of the past 12 months have been yielding 0.07% and have recently started to dip further. While that's better than what the bank is paying, I'm looking to move that money into a higher-yielding but still relatively safe product - the Vanguard Short Term Inflation-Protected Securities Index Fund (VTIP) where the yield is 1.19% and you are protected from inflation. I also have about 6% of my portfolio allocated to Bitcoin as I said I was planning to do in an earlier post and I also have another 4% in precious metals and other alternative assets. I continue to maintain broad diversification across a wide range of assets, which seems to be the best way to approach these tumultuous times. I was watching an interview recently with Ray Dalio, the legendary macro investor, and that's exactly his advice for the average investor.

One of the many dilemmas facing investors lately is the prospect of little to no yield on cash. I just got my 1099 for tax time from TreasuryDirect and realized that the four week Treasury Bills I have invested in for most of the past 12 months have been yielding 0.07% and have recently started to dip further. While that's better than what the bank is paying, I'm looking to move that money into a higher-yielding but still relatively safe product - the Vanguard Short Term Inflation-Protected Securities Index Fund (VTIP) where the yield is 1.19% and you are protected from inflation. I also have about 6% of my portfolio allocated to Bitcoin as I said I was planning to do in an earlier post and I also have another 4% in precious metals and other alternative assets. I continue to maintain broad diversification across a wide range of assets, which seems to be the best way to approach these tumultuous times. I was watching an interview recently with Ray Dalio, the legendary macro investor, and that's exactly his advice for the average investor. Here's my current portfolio allocation after the Bitcoin move:

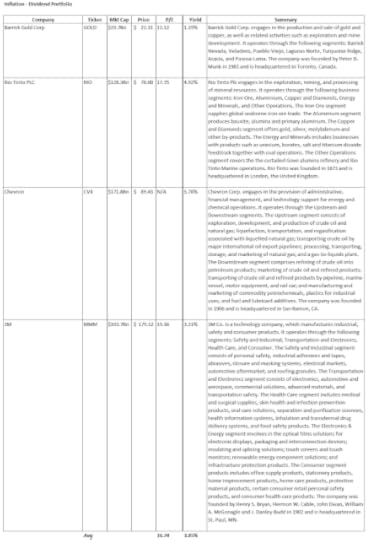

Cash / Equivalents - 16.6%US Stocks - 22.9%Private Equity - 10.6%International Stocks - 5.9%Bonds - 16.8%Real Estate - 16.8%Bitcoin - 6.1%Precious Metals, Other - 4.3%Low yields on most cash-equivalent instruments (with the exception of TIPS) will not keep up with inflation, which seems set to increase with the unprecedented monetary and fiscal stimulus that has become a global phenomenon in the wake of the COVID pandemic as I have discussed previously. A diversified portfolio should include some exposure to stocks and I wanted to find some stocks that are still relatively fairly valued, large capitalization, pay a good dividend yield and have good commodity upside in the event inflation really starts to spike. After screening several stocks, I came up with the list below that I call the Inflation-Dividend Mini-Portfolio. This portfolio gives you an average yield of 3.85% if equally weighted, which is significantly better than even the long end of the Treasury curve and the average price earnings ratio is 16.74 which is well below the average of the S&P 500 of 39.57.

This portfolio gives exposure to gold and copper (Barrick Gold), basic materials (Rio Tinto), oil (Chevron) and industrial manufacturing (3M). All of these areas look to grow significantly as the economy recovers, will benefit from the "value rotation" and could really take off if there is meaningful inflation in the coming years, all while paying a nice dividend yield. The table below summarizes the market cap, recent price, price earnings ratio and dividend yield as well as a brief summary of the business.

Before investing, make sure you do your own research, consider what others have to say and make your own decisions. Also make sure to look at your overall portfolio diversification regularly.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

January 31, 2021

Silver Short Rumors

Last week, the short-busting activity of the subreddit WallStreetBets crowd dominated the financial news, with stocks like Gamestop, AMC and other companies with high short interest (in some cases much more than the total float of shares outstanding, which added more fuel to the short squeeze). This activity appears to have had some ripple effects throughout the broader stock market, with some observers thinking that the short squeeze forced hedge funds holding the short positions to liquidate their long positions to cover, driving down prices of some of the more popular stocks and driving down the overall stock market averages in the process. This has also become a social movement for equality, not unlike other populist movements of the recent past (Occupy Wall Street), except this movement packs a punch because it involves the loss of real money by those institutions on the other side of the crowd. This movement has garnered a lot of attention, from lawmakers, regulators, media and celebrities and seems likely to have far-reaching consequences. At a minimum, institutions will need to be careful about taking short positions in companies and broadcasting their rationale to the media. Individual investors will have to be careful about their entry point into shorted stocks when the rally "fades" and they could be stuck waiting a long time for the stock values to return to their parabolic peaks.

Last week, the short-busting activity of the subreddit WallStreetBets crowd dominated the financial news, with stocks like Gamestop, AMC and other companies with high short interest (in some cases much more than the total float of shares outstanding, which added more fuel to the short squeeze). This activity appears to have had some ripple effects throughout the broader stock market, with some observers thinking that the short squeeze forced hedge funds holding the short positions to liquidate their long positions to cover, driving down prices of some of the more popular stocks and driving down the overall stock market averages in the process. This has also become a social movement for equality, not unlike other populist movements of the recent past (Occupy Wall Street), except this movement packs a punch because it involves the loss of real money by those institutions on the other side of the crowd. This movement has garnered a lot of attention, from lawmakers, regulators, media and celebrities and seems likely to have far-reaching consequences. At a minimum, institutions will need to be careful about taking short positions in companies and broadcasting their rationale to the media. Individual investors will have to be careful about their entry point into shorted stocks when the rally "fades" and they could be stuck waiting a long time for the stock values to return to their parabolic peaks. The next target appears to be the silver market, a market that has been historically notorious for institutional manipulation / shorting activity and which is rumored to have much more short positions than physical silver in existence, which would definitely be an enormous speculation opportunity. Many think if that's successful, gold will be next.

The silver market is about $1.4 Trillion and the gold market is about $11.7 Trillion. Bitcoin has a market cap of about $600B by comparison (and is also rumored to now be heavily shorted after the recent parabolic move to $40K, from which is has sold off down to about $30K). Last week I wrote about how I now recommend a higher allocation of your portfolio to Bitcoin (see my post here) and if anything, the events of last week have only confirmed the thesis of holding Bitcoin for the long haul due to its decentralized nature. The market caps of Gamestop, AMC and the companies that have been shorted recently are much smaller and therefore technically "easier" targets for crowdsourced short-busting activity and that's the argument for why the WSB crowd will not be able to impact these large commodity markets. However, if indeed the amount of "paper" silver far exceeds the amount of physical silver backing it up, as some have suggested, then a large group of individual investors buying physical silver and ETF shares in concert could conceivably cause a short squeeze and a parabolic move in the price of silver. Indeed, there are already signs this is happening with physical dealers running out of inventory over the weekend and unusual volume and price action in the ETF's.

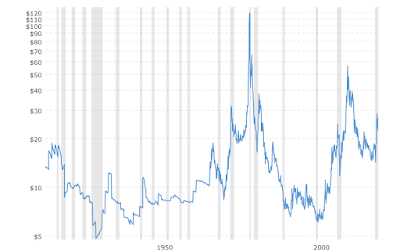

Silver has done well over the past 12 months (from a low of $14 in March 2020 to $27 recently), but some would say it should now be much higher given all the global financial turmoil caused by the pandemic and the resulting huge increase in the money supply, not to mention the industrial demand that is coming from the technology and electric vehicle markets as the economy recovers and unprecedented product demand continues.

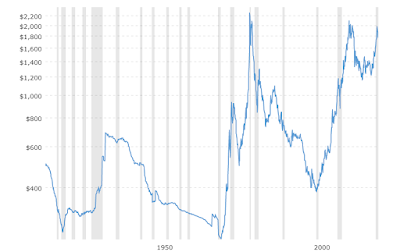

Silver is currently nowhere near recent peak despite the macro trends mentioned above. Here's the long-term silver chart (note where the prices peaked at over $100 and $50 only to fall precipitously thereafter):

100 Year Silver Price

100 Year Silver PriceAgain, it's easy to understand how massive shorting following parabolic upward price moves has been standard operating procedure for institutions for years. It's a fairly straightforward strategy and seems to "work." If you are an individual long term investor, you just need to be careful at what level you buy at and hold your position for the long term. If you have been waiting to open a position in silver, now might be a good time to do that ahead of what could be another parabolic move to the upside. Even if the crowd is only able to make the short players more cautious, the price of silver should "normalize" at a higher level commensurate with the macro environment, which would still be a positive for long term investors. I recently learned about the Sprott Physical Silver Trust (PSLV), which might be a good alternative to the iShares Silver Trust (SLV) since it has a lower share price and so is a little more affordable for individual investors. Also, the shares are more easily redeemable for physical silver (if desired) by individual investors than SLV.

If you're interested in learning more about investing in gold and silver, check out my book here.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here. Stay safe, healthy and positive.

January 24, 2021

Increasing Bitcoin Allocation

Over the past few months as I have continued my Bitcoin research, I have decided to increase my recommended allocation from 2-3% to 5-6% of a diversified portfolio. I post relevant videos and other content on my Twitter @NickReichert if you're interested in following and I also post links to my recent blog posts there as well.

Over the past few months as I have continued my Bitcoin research, I have decided to increase my recommended allocation from 2-3% to 5-6% of a diversified portfolio. I post relevant videos and other content on my Twitter @NickReichert if you're interested in following and I also post links to my recent blog posts there as well. This recommended allocation increase is driven by the following:Excellent recent performance of Bitcoin (300% increase over past 12 months) and great long term growth potential as discussed in more detail belowGrowing adoption as the first global, decentralized monetary networkMonetary and fiscal stimulus measures that governments around the world are taking in response to the COVID pandemic to "print money" that will continue for the foreseeable future. Below is a long-term logarithmic chart that shows the steady, yet volatile, growth of Bitcoin market cap, price and volume. I like to look at the log charts because they are more helpful in visualizing the long term trend and smooth out a lot of the short term volatility, which shouldn't matter to a buy and hold investor:

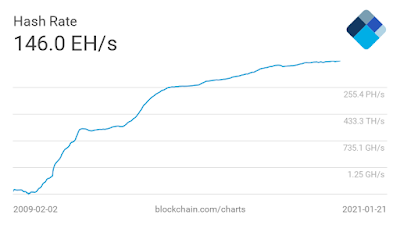

Below is another key long-term logarithmic chart of Bitcoin's hash rate, or the computational power and mining speed of the cryptocurrency. This is a good indicator of transaction volume as well as protocol acceptance:

Below I have summarized some of the reasons for investing in Bitcoin for the long haul that I have gleaned from my research:

Limited supply (only 21 Million coins will ever exist)Largest market cap by far in the crypto space ($600+ Billion), and like other internet social networks and businesses (i.e., Google, Facebook, Amazon, Netflix, etc.), first mover advantage is very importantPlenty of opportunity for growth in the future - global gold market cap estimates range from $6 - $8 Trillion, by comparison and in many ways, Bitcoin is superior to gold as discussed belowMost developed, mature network of all the crypto currencies and yet still early enough in its adoption to have plenty of upside Steady growth in trading and transaction volume over time as shown in the charts aboveSecure, trustless (verification is built into the software / blockchain), which is very appealing especially with widespread hacking of computer systems recently; if you hold your bitcoin on a crypto exchange like Coinbase or Crypto.com or in a fund like GBTC, you do need to consider the security of the exchange or fund and similar to bank accounts you may want to enable dual factor authentication, but you don't have to worry about the security of the Bitcoin blockchainEasy and low-cost to store and transfer (as compared to precious metals, for instance), without need for an intermediary Growing investment acceptance by institutional investors as well as retail investorsExpanding use cases, including PayPal plan to support payment transactions by converting in and out of fiat as well as supporting crypto investing on its platform; adoption as alternative to gold / precious metals and short term cash investmentsBeginning to see use in Corporate Treasury function instead of cash / cash equivalents (Microstrategy, Square)Price is totally dependent on demand since supply is fixed (unlike fiat currency) and many catalysts for demand to steadily grow over timeFuture demand seems assured with global monetary and fiscal policies in the wake of the COVID pandemic likely to cause all fiat currencies to experience inflation at an accelerated rate (even "normal" inflation causes devaluation to occur by default over time)Total addressable market is enormous (global currency / investment market)Government intervention is a risk, but the more broadly Bitcoin is adopted the less likely there will be an outright ban or other extreme action and more likely that there will be controls over use as a payment method (similar to fiat); I believe the government will be more interested in collecting taxes on crypto sales and limiting criminal use than anything else - since the blockchain is a public ledger, it's actually much more auditable by the authorities than cash in suitcasesAs I wrote last week, I'm looking to increase my exposure to Bitcoin in the coming weeks to get closer to the 5%-6% portfolio target and I'm leaning toward GBTC, versus buying more coins directly in my Crypto.com wallet. I'm hoping a lower-cost ETF will be available in the near future, but until then I think GBTC is probably the best option. Most of my Bitcoin at Crypto.com is staked, so I earn a 6.5% interest rate for a three month term and since I'm a long term investor and don't plan to sell any, that suits me well. I also increased my monthly Bitcoin purchase this month from $200 to $300.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

January 17, 2021

Looking Ahead - 1/18

The beginning of the year has brought with it much of the stock market volatility we have been seeing for many months now. The major indices had been rallying to all time highs and then fell last week after the announcement of President-elect Biden's fiscal stimulus plan (perhaps a "sell the news" event or simply concern that it will go smoothly through Congress in substantially current form). There may also be growing unease over the COVID-19 pandemic and the disorganized, slow rollout of vaccines which could hamper economic recovery a bit longer than expected. I should also mention more grim unemployment figures were reported with the weekly jobless claims rising to a level not seen since the last virus spike in August.

The beginning of the year has brought with it much of the stock market volatility we have been seeing for many months now. The major indices had been rallying to all time highs and then fell last week after the announcement of President-elect Biden's fiscal stimulus plan (perhaps a "sell the news" event or simply concern that it will go smoothly through Congress in substantially current form). There may also be growing unease over the COVID-19 pandemic and the disorganized, slow rollout of vaccines which could hamper economic recovery a bit longer than expected. I should also mention more grim unemployment figures were reported with the weekly jobless claims rising to a level not seen since the last virus spike in August. Most investors seem to be expecting earnings season to be a blowout due to low expectations (less about strong year over year growth), so over the next several weeks after the presidential inauguration, the implementation of further stimulus legislation and as earnings season continues to roll along, there could be some upside catalysts to the stock market. Indeed, individual stocks have performing well in some key cyclical areas (real estate, utilities, oil, banks, autos, for example) while technology has been lagging and materials / industrials have been mixed. Some bank stocks have run up quite a bit and then have seen sell-offs (some significant) after reporting earnings last week as investors took profits (JPM, C and WFC), despite reporting good to great earnings. Most banks are expected to outperform this year due to the steepening of the yield curve, which allows banks to borrow money at low rates and lend it out at higher rates.

Hopefully borrower solvency isn't an issue for the banks and they find themselves unable or unwilling to lend or having to set aside larger loan loss reserves. Time will tell. While these have been great trades lately, I find it hard to get excited about banks and energy for the long haul since both seem on a steady long-term downward trajectory for different reasons. For banks, its simply disruptive, innovative competition both in the form of fintech and crypto (and acknowledged by at least one CEO - Jamie Dimon of JPM). For energy, it's the inevitable rise of alternative energy driven by consumer demand, government mandates and a growing realization that global warming is real, not to mention the incredible investor demand for all things ESG.

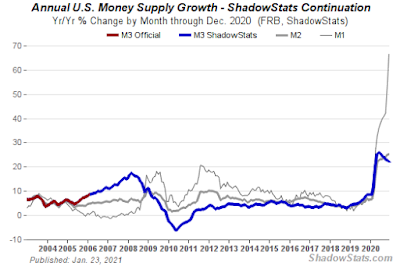

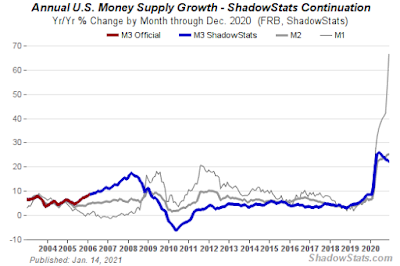

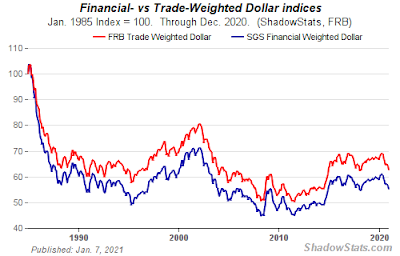

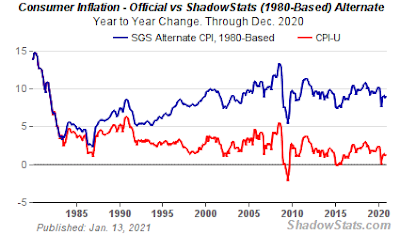

Unfortunately for investors, low short term interest rates continue to lead to negative real yields in bank and money market accounts, which forces many investors to abandon cash for risk assets especially as inflation expectations rise. Many investors also seem to be carefully watching for signs of inflation, although certain key indicators like the dollar (which has been steadily declining), gold / silver (which have been flat to down), bitcoin (which although off its recent all time highs has held up pretty well) and commodities (which have been mixed) are sending mixed signals. In the medium to longer term, I think it's safe to assume gold, silver, commodities and bitcoin will continue to rise as the world economy recovers from the pandemic and demand increases strongly in the face of constrained supply. The unprecedented fiscal and monetary stimulus will serve as a powerful force driving this and if inflation does indeed spike, it could be very difficult politically and take quite some time to tamp it down if history is any guide. Here are a few charts that highlight some of the challenges:

M1 Money Supply Continues to Grow Exponentially

M1 Money Supply Continues to Grow Exponentially  Dollar Continues to Struggle

Dollar Continues to Struggle Inflation May Be Hiding in the Numbers

Inflation May Be Hiding in the NumbersMy game plan in the coming weeks and months is still essentially unchanged and my overall portfolio requires very little adjustment since it is already broadly diversified according to the Financial Fortress methodology I follow. I am looking at moving some excess cash into Bitcoin in the coming weeks to increase my exposure slightly (still less than 6% of my total portfolio even after that move). Despite the volatility, I see Bitcoin as a superior asset to hold long term, continuing its long steady climb higher as adoption increases (especially growing institutional ownership) and supply remains constrained at ultimately 21M coins.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

January 10, 2021

The Power of Discipline

Since the Global Financial Crisis (GFC) in 2007, when I first began to formulate the Financial Fortress concept after suffering another major blow to my net worth, I have made an effort to stay true to the Financial Fortress strategy of broad diversification across many asset classes, regular investment, simplicity and fostering multiple cash flow streams. One of the key tenets of the Financial Fortress that I probably haven't always highlighted enough is the importance of cash flow. Developing multiple cash flow streams and after retaining adequate funds for emergencies, deploying those funds into a broad array of investments is really important. What I have learned over the years and especially over the past year with the COVID stock market correction last March, is that discipline to a strategy is very powerful. Indeed, as the stock market now reaches all time highs again each day and some market observers are calling for a crash, while others think the rally will continue, I can tune all that out through the power of discipline.

Since the Global Financial Crisis (GFC) in 2007, when I first began to formulate the Financial Fortress concept after suffering another major blow to my net worth, I have made an effort to stay true to the Financial Fortress strategy of broad diversification across many asset classes, regular investment, simplicity and fostering multiple cash flow streams. One of the key tenets of the Financial Fortress that I probably haven't always highlighted enough is the importance of cash flow. Developing multiple cash flow streams and after retaining adequate funds for emergencies, deploying those funds into a broad array of investments is really important. What I have learned over the years and especially over the past year with the COVID stock market correction last March, is that discipline to a strategy is very powerful. Indeed, as the stock market now reaches all time highs again each day and some market observers are calling for a crash, while others think the rally will continue, I can tune all that out through the power of discipline.A younger me (the one that also experienced the dot.com crash and the GFC) would have sold everything at the bottom back in March and held cash while the market recovered dramatically, missing out on any chance at recovery and again being wiped out financially. I'm sure there were plenty of investors who did just that this time around, perhaps having all their investments in the stock market and very little cash on hand, panic selling and giving in to their fears. Instead, comfortable with my asset allocation strategy, I just let it all play out and looked for my opportunities to put fresh cash to work as the market recovery unfolded. I did suffer some losses in stock options as I have written about previously, but have learned my lesson there as well that you don't want to be a buyer, it's far better to be a seller, especially when the market is volatile like it has been the past several months. I also learned that selling covered calls is probably the best strategy for me personally to generate consistent, relatively low risk double digit returns, provided I hold stocks in good companies and can be patient.

I recall reading somewhere that if investing has become "boring" for you, you are probably doing it right. In reflecting recently upon my portfolio performance, investing cadence and the need for adjustments relatively infrequently, it has become just that for me - boring. Instead of spending all my time looking for "hot" trades and new investments to get into, I spend a lot more of my time on research, watching educational videos and trying to become a better investor. Since the amount of time I have is limited, I feel like investing in education has and will continue to pay off. I have also learned the hard way by losing money over the years on bad investments and those are expensive lessons you will never forget. The good news is that you always have a chance to recover, even if you're older and sticking to a disciplined strategy is a big part of success.

Here's my current portfolio allocation:

Cash - 21.6%Stocks - 33.7% (about 33.8% of total I actively manage and the rest is passive in ETF's, etc.)Bonds - 17.7%Real Estate - 19.5%Alternatives - 7.5% (includes physical gold, physical silver, music royalties and Bitcoin - this category has grown a lot recently due to the Bitcoin rally, but is still a relatively small allocation in the overall portfolio and I plan to continue my regular purchases of Bitcoin with an indefinite hold timeframe)I don't plan to change anything dramatically as we move into the new year in terms of the overall allocation or my cadence of regular investing. I have been looking at shifting some of my active stock portfolio investments toward more commodity exposure as the new year unfolds. I recently added a small position in Freeport McMoran (FCX) for this, since it is focused on mining copper and gold, both of which seem poised to continue to rally as the economic recovery gathers steam and especially with Democrat controlled government that will be bullish for fiscal stimulus, infrastructure spending, alternative energy and electric vehicles.I'm also looking at possibly adding additional positions selectively in gold, silver and energy to capitalize on potential massive fiscal stimulus spending coming soon and further borrowing / debt monetization to finance it. For those areas I like GLD, SLV and CVX. GLD has been trading in a range between $170 and $180 for the past several months and may continue to be relatively flat for some time, especially due to rising interest rates until it can break out of the range. Similarly, SLV has been trading in a range of $21 to $25 in the past several months but probably has better upside as the economic recovery unfolds due to its industrial uses in addition to investment demand. If you are interested in learning more about investing in gold and silver, check out my book here. I'm expecting the Fed will need to act soon to curb the rise in rates (if this trend continues) to support the economic expansion, which should be a positive catalyst for precious metals.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

January 3, 2021

Bitcoin Investing Options

With Bitcoin recently moving to all time highs, I thought it might be good to review some of the ways that an individual investor can invest in Bitcoin, other than the obvious way of buying the coins from an online exchange like Coinbase or Crypto.com as I have done in the past. As my long time readers know, I have been an advocate of buying small increments of Bitcoin on a consistent monthly basis (dollar cost averaging) and just holding as a portfolio diversification strategy and limiting to around 2%-5% of the total portfolio. That approach has paid off nicely with the current run-up and I intend to continue to follow that approach moving forward. Having said that, in my research, I have learned about other ways to invest in Bitcoin that I thought would be interesting to share.

With Bitcoin recently moving to all time highs, I thought it might be good to review some of the ways that an individual investor can invest in Bitcoin, other than the obvious way of buying the coins from an online exchange like Coinbase or Crypto.com as I have done in the past. As my long time readers know, I have been an advocate of buying small increments of Bitcoin on a consistent monthly basis (dollar cost averaging) and just holding as a portfolio diversification strategy and limiting to around 2%-5% of the total portfolio. That approach has paid off nicely with the current run-up and I intend to continue to follow that approach moving forward. Having said that, in my research, I have learned about other ways to invest in Bitcoin that I thought would be interesting to share. Grayscale Bitcoin Trust

The Grayscale Bitcoin Trust (GBTC) is a publicly traded closed end fund that holds Bitcoin, much like the GLD exchange traded fund holds actual gold in secured vaults. The difference is that an exchange traded fund's market value more closely tracks the book value per share of the ETF, whereas in the case of GBTC there is often a premium between the market price and the book value per share, due mostly to timing differences between valuations. As of 12/31/20 that premium was about 17%. The fund also charges a two percent annual fee and you have to be an accredited investor to buy in to one of their private placements, however you can buy shares on the market if your broker offers them - for example I don't see it on Robinhood but it does seem to be available on Schwab. These are pretty significant drawbacks in my mind and I'd rather wait until there is a Bitcoin ETF launched. Van Eck has recently submitted another application for a Bitcoin ETF and perhaps this time will be successful in getting it approved by regulators.

Microstrategy

Microstrategy (MSTR) is a publicly-traded data analytics and software company that generates considerable cash flow from its core business. The Company has decided to invest a significant portion of its cash on hand in Bitcoin (purchased almost $1Billion in 2020). The Company's CEO, Michael Saylor has articulated that the alternative to holding cash in a zero (and if you include inflation, negative) return environment for the next several years doesn't make much sense. Bitcoin's design has engineered it to be a superior store of value, with a limited supply and a very large (and growing) public network. He compares Bitcoin to a Google or Facebook network, but for money and the price appreciation is not a bubble, but the result of the network effect. By taking this approach of moving a large portion of the Company's treasury into Bitcoin, it makes the company an interesting play on Bitcoin that anyone can invest in. The stock is currently trading at about $392, but is obviously highly volatile due to the Bitcoin exposure plus the normal market volatility associated with a tech company so if you do decide to buy some shares you'll need to be prepared for a bumpy ride.

Paypal and Square

Paypal (PYPL) and Square (SQ) remind me of the merchants that supplied the gold miners during the gold rush, making money selling picks and shovels These companies allow their customers to buy and sell bitcoin on their apps and charge a fee for that service, without taking the underlying Bitcoin risk. Also, Square like Microstrategy has decided to invest a much smaller portion of its cash into Bitcoin (about $50M purchased). Paypal also has suggested that it may eventually allow for payment within its network for goods and services using Bitcoin, which would be a game changer. Either way, Paypal and Square are an interesting way to play the boom in Bitcoin without having a lot of direct exposure to Bitcoin. These companies also have a strong investment thesis in their own right as well run, profitable and financially strong fintech companies.

Blockchain ETF's

There are a few ETF's that invest in companies that are active in supporting blockchain technology, which although includes Bitcoin also includes other applications for blockchain technology so these would not be a pure Bitcoin play. The two largest ones (by market cap) are Amplify Transformational Data Sharing ETF (BLOK) and Siren Nasdaq Nextgen Economy ETF (BLCN). If you look at the ticker symbol links and scroll down, you can see the top holdings in the ETF to get an idea of what companies each one owns.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

December 27, 2020

2021 Focus on Alternative Investments

2021 might just be a big year for alternative investments. These include a broad range of investments and many people define these differently, but for me alternative investments include cryptocurrencies, precious metals and royalty assets.

2021 might just be a big year for alternative investments. These include a broad range of investments and many people define these differently, but for me alternative investments include cryptocurrencies, precious metals and royalty assets. Crypto As many of my long term readers know, I am focused solely on Bitcoin as a cryptocurrency investment. If you're interested I recently updated my crypto ranking here. This is primarily due to Bitcoin's dominant market capitalization compared to the other cryptocurrencies, acceptance as a commodity investment by the regulatory authorities, rising institutional interest and tremendous liquidity. In reviewing my portfolio I would have to say my small stake in Bitcoin has clearly outperformed all of my other investments this year and I intend to continue to hold and grow my position through small monthly purchases just as I have been doing all along. I expect more volatility in the future with Bitcoin and certainly some strong pullbacks, but long term I see this as a great hedge against inflation of fiat currencies.

Precious Metals As far as precious metals go, my focus has historically been in gold and silver. I lean more towards physical ownership (coins stored in bank vaults), but other forms of ownership such as the exchange traded funds GLD and SLV are also good and liquid ways to own the metals. Gold and silver are expected to continue to do well in the coming year due to the continued strong monetary and fiscal stimulus that will be required to recover from the COVID recession. This puts tremendous downward pressure on the dollar which makes other assets more valuable, including gold and silver. Although gold and silver have been trading relatively flat lately, many believe a big upward move is due during 2021. Since gold and silver don't pay interest, the near zero interest rate environment only makes owning these more attractive as a store of value since you aren't really giving up much in the way of income vs holding bonds and there certainly seems to be some upside. If you're interested, I wrote a book on investing in gold and silver - check it out here.

Options Trade on GLD/SLV One idea I had if you are interested in earning a yield on GLD and SLV and you are bullish about these commodities long term is to buy shares of the ETFs and sell call options at the same time. For example, you can buy 100 shares of GLD for $17,600 (at Friday's closing price) and sell one contract for about $360 with an expiration 30 days out at $176.50 strike price. Whether GLD is higher or not when the contract expires, you'll make $360, but if it's higher you'll get your investment principal back to reinvest when the option is called and you can repeat the process. If GLD closes below that level, you can sell another call for 30 days out. If GLD goes down a lot, you may have to wait for the price to recover before you can sell more calls, but again if you are bullish about the long term you shouldn't be concerned about this. Similarly for SLV, you can buy 100 shares of SLV for about $2,400 (at Friday's closing price) and sell one contract for about $125 with an expiration 30 days out at $24 strike price. Again, whether SLV is higher or not at the expiration of the contract, you make $125, but if its higher you'll get your investment principal back to reinvest when the option is called. Again like GLD, if it closes lower you can just wait to sell calls again. It's important to note that while these seem like small amounts relative to the capital invested, the returns are actually quite good. For example, you are earning 2% on your investment in GLD for a 30 day hold, which is 24% annualized. Similarly, for SLV you are earning 5% on your investment for a 30 day hold, which is 60% annualized. You can capitalize on investor demand for call options and make steady profits while holding the shares for the long term and protecting your downside risk with patience. This is why selling call options is my favorite (and most profitable) options investing strategy.

Royalty Assets Although they may appear attractive at times for the apparently high yields, these do require a bit of caution. I would have to say that now as we look at the COVID situation, those assets are probably very fairly priced and could see some upside over the future as concerts, live performances, movie / tv production and other similar types of activities restart and music consumption is not limited to only streaming and radio. As such, now might be a good time to check out sites such as Royalty Exchange and bid on some royalty streams. You can buy "life of rights" or for a set period - typically 10 years. My experience with this hasn't been that great because I bought my royalty assets a couple of years ago and they have not yielded much the past two years as what I anticipated (I discuss that experience in a post here), however the rebound I discussed above should help the cash flow return to normal and therefore I'm not planning on selling those assets.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.

December 20, 2020

2021 Investing Trends

This week, I thought it would be good to write about some emerging investment trends moving into the new year and some stocks I have been following that should benefit from these trends. While the stock market looks like it will have more bumps ahead and maybe a pull back or two along the way, the consensus seems to be that we will see a strong showing in 2021, especially as the economy is expected to recover, some economists say quite strongly, in the second half of the year. The approval and distribution of two vaccines and the US federal stimulus ($900B to start with and likely more to come in the new year) will help to keep the recovery on track, even if it has faltered recently with rising unemployment and lower consumer spending due to ongoing COVID lockdowns. While almost every sector seems poised to do well, some will do better than others.

This week, I thought it would be good to write about some emerging investment trends moving into the new year and some stocks I have been following that should benefit from these trends. While the stock market looks like it will have more bumps ahead and maybe a pull back or two along the way, the consensus seems to be that we will see a strong showing in 2021, especially as the economy is expected to recover, some economists say quite strongly, in the second half of the year. The approval and distribution of two vaccines and the US federal stimulus ($900B to start with and likely more to come in the new year) will help to keep the recovery on track, even if it has faltered recently with rising unemployment and lower consumer spending due to ongoing COVID lockdowns. While almost every sector seems poised to do well, some will do better than others. My favorite 2021 trends and a few of the stocks that I like in these areas are the following:Housing - The confluence of Millenials coming of homebuying age and needing more space along with the flight from cities to suburbs due to COVID plus all time low interest rates have served to turbo-charge the housing market. Lennar as one of the nation's largest homebuilders has been a big beneficiary of this and in addition to great earnings, has made several announcements recently that bode well for the company, including raising the dividend and paying down debt. Home Depot and Lowe's will continue to be beneficiaries of homebuying and also people who aren't moving but want to make their homes more comfortable since they are working from home and many people are likely to continue to do so at least a couple of days a week in the future. Stimulus checks won't hurt their results, either.LennarHome DepotLowe'sAutos - Fear of public transit has driven the need for people to own a car and especially with the move to the suburbs discussed above, a car is essential. The pivot to clean energy clearly benefits Tesla, who has a great product line and a lot of momentum, even if the stock is a little expensive. Admission to the S&P 500 will only drive the stock higher as long as they can keep up their execution. Ford and General Motors are more value themes, but they also have big plans for moving into the electric vehicle space and already have products in this category, which should drive their growth. I believe there is a lot of pent up demand for EV trucks and SUV's, since there is very little appealing product on the market today. Ford and GM have a great opportunity to deliver here.TeslaFordGeneral MotorsTravel and Leisure - as soon as a vaccine is widely available there's likely to be tremendous pent up demand for leisure travel, which will benefit hotels, airlines, restaurants and credit card companies among others. Business travel is another story and could take years to recover since so much can be done now via video conference and companies can (and have) saved a lot of money from less business travel. Although many people recommend the traditional hotel chains like Hilton or Marriott, I prefer the "asset light" model of Airbnb and I think they will have a lot more operating leverage and profitability than traditional hotel chains going forward and are more directly connected to leisure travel, even if the valuation is a bit steep. Visa will stand to gain a great deal from increased credit card use for travel and Boeing will start to get new plane orders as airline activity picks up. Better trade relations with China (expected with the new White House) will also bode well for Boeing, plus it is still 37% below its 52 week high.VisaAirbnbBoeingArtificial Intelligence - Applications within the business environment in almost every industry are accelerating and AI coupled with big data has tremendous promise to vastly improve efficiency and save money. "Data is the new oil." While the valuations are high, Snowflake and C3.ai seem to be on the cutting edge of this trend. Google is an interesting play since it is considered a bit undervalued relative to the rest of the FAANG stocks and also stands to benefit from increased advertising driven by resurgence of leisure travel, plus it has a strong presence in AI and autonomous vehicles, which is mainly why I put it in this category.C3.aiSnowflakeGoogleBitcoin - Bitcoin continues to prove itself as a great alternative to precious metals and will benefit from large amount of fiat money printing resulting from massive fiscal and monetary stimulus due to COVID-19 as well as broader adoption, as I wrote about recently. Microstrategy has committed to invest a portion of it's cash into Bitcoin as a better hedge against potential devaluation of the dollar. Square has also committed a portion of its cash to Bitcoin, in addition to facilitating the purchase of Bitcoin for it's customers on its platform like Paypal has. Corporate Treasury diversification, institutional investor interest and expanding platforms to facilitate investing in Bitcoin will further drive adoption, providing price support and driving this scarce asset (there will only ever be 21 million bitcoins) higher.MicrostrategySquarePaypalValue and Yield - Value stocks that have not participated as much in the rally will attract more attention as investors look to more cyclical names and especially those with dividend yields over 5%. Cash is earning hardly anything currently and this is expected to be the case for at least the next couple of years so the quest for yield will only grow stronger.DowAT&TChevronCyber Security - The recent Solar Wind cyberattacks underscore the importance of cyber security for both businesses and government agencies; this will be a huge focus in the coming year and many companies that provide these services, especially the "best in class" will stand to benefit from what's to come.ZscalerCrowdstrikePalo Alto NetworksAlternative Energy - The Biden Administration will likely lean heavily toward alternative energy, starting with the US rejoining the Paris Climate Accord and this will be supported by consumer and corporate demand for more clean energy including electric vehicles, solar power, hydrogen fuel cell technology for trucks and commercial vehicles, etc. Companies that enable this technology will continue to see strong growth, especially with more government support. Ironically, this focus on alternative energy will also drive down oil exploration and production, which should have the effect of driving up the price of oil as supply moderates and demand increases as the economy recovers. Chevron, recommended above, will benefit from both trends as it also has a strong position in renewables.First SolarEnphase EnergyPlug PowerThere are many other companies to invest in that will likely do well in the coming year and certainly other trends, but these are the ones I like best from the research I have done. Full disclosure, I currently have positions myself or that I manage in many of the companies mentioned above.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

December 13, 2020

2021 Portfolio Strategy

With the end of 2020 thankfully coming into view, I thought it would be good to review different asset classes, their relative recent performance and evaluate portfolio strategy heading into 2021. One theme that is consistent is that asset prices have seen tremendous inflation recently, and no asset class has been spared. There have been many drivers to this, including expansive monetary and fiscal policy in response to the COVID-19 pandemic and a nascent economic recovery. Finding value has become increasingly difficult, which is why in the stock market for example, many analysts are saying it's a "stock picker's" market. Bitcoin, gold/silver and bonds have also enjoyed a good run this year and with low interest rates, residential real estate is starting to see some strong price appreciation (about 7% year to date nationally, which is quite a bit higher than the 10 year average of about 5%).

With the end of 2020 thankfully coming into view, I thought it would be good to review different asset classes, their relative recent performance and evaluate portfolio strategy heading into 2021. One theme that is consistent is that asset prices have seen tremendous inflation recently, and no asset class has been spared. There have been many drivers to this, including expansive monetary and fiscal policy in response to the COVID-19 pandemic and a nascent economic recovery. Finding value has become increasingly difficult, which is why in the stock market for example, many analysts are saying it's a "stock picker's" market. Bitcoin, gold/silver and bonds have also enjoyed a good run this year and with low interest rates, residential real estate is starting to see some strong price appreciation (about 7% year to date nationally, which is quite a bit higher than the 10 year average of about 5%). The stock market continues to reach new highs on a daily basis as shown in the charts below for the S&P 500, Dow Jones Industrial Average and NASDAQ:

S&P 500

S&P 500

Dow Jones Industrial Average

Dow Jones Industrial Average NASDAQ

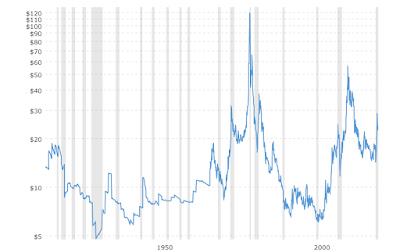

NASDAQGold and silver have also done quite well recently, with gold again approaching all time highs, while silver still looks like it has more potential upside, at least relative to all time highs:

Gold

Gold Silver

Silver30 Year Treasury Bonds have also rallied tremendously as interest rates have steadily declined, leaving little to no upside to owning Treasuries with rates so low, and only downside if rates begin to rise:

30 Year Treasury Yield

30 Year Treasury YieldBitcoin has also had a great run this year, nearing an all time high:

Bitcoin

BitcoinWith all major asset classes moving upward, almost in unison, except for some isolated opportunities (i.e., picking overlooked or unfairly beaten-down stocks poised to increase in value or maybe investing in silver), its a very difficult environment for investors to navigate. Cash (in excess of any emergency fund requirements) is not a great place to be, since interest rates currently being paid barely keep up with inflation. It would certainly not be wise to attempt to short any of these markets given the considerable upward momentum, which many analysts expect will continue into the new year. Also, the underlying drivers of low interest rates, strong fiscal and monetary stimulus and an economic recovery seem likely to stick around for a while, which will only drive asset values higher, at least in the medium term.

This is why now more than ever it's important to maintain a broadly diversified investment portfolio, like I have outlined in the Financial Fortress concept. For small, individual investors like me it's the only way to "win" in the long run, since we just can't time the market or move as quickly as the institutional money.

Here's my current portfolio allocation:

Stocks - 33% (34% I actively manage myself, the rest is indexed)Cash and equivalents - 21%Real Estate - 20%Bonds - 19%Alternatives - 7%Lately, private equity (angel investing) has started to look attractive for a small allocation. There are many crowdfunding sites, but I have used Seed Invest in the past and recently started monitoring their deals again. They have made it a lot easier to invest over the years and many of their deals only require a $1,000 minimum and you don't even need to be an accredited investor in all cases. While there is a high probability of loss in this type of investing, there is equally a great chance for reward however angel investing does require a great deal of patience. Spreading out an investment of $1,000 each, over multiple startups and just patiently waiting seems like a great approach to add a little upside to your portfolio while keeping the overall risk low through asset allocation (maybe no more than 2-5% of your total investable assets). An interesting theme right now is the commercial application of big data, Artificial Intelligence (AI) and robotics in all industries. I believe this is the next major technology revolution, which the COVID-19 pandemic has greatly accelerated as companies look to become more efficient and competitive. Last week, I wrote about three upcoming IPO's and one of them, C3.ai is in this type of business. Like the other IPO's last week, this one blew up on opening day, but if it drops below $100, it may be worth picking up some shares.Other alternative investments such as music royalties have not panned out as well as I would have liked as I have written about previously, even though I continue to monitor new offering activity. The payments I received this year were less than half of what I received last year. I think the pandemic hit these investments really hard with the cancellation of live events and new movie/show production, leaving only streaming, radio play and legacy movie/show productions that incorporate the music as viable income streams for audio rights holders. So much for "non-correlated."

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

December 6, 2020

IPO Watch

There are three IPO's coming up (two that will start trading on Wednesday next week) that I have been watching and wanted to share with you. I think these might be worth buying if you can get some shares from your broker, even if only a few.

There are three IPO's coming up (two that will start trading on Wednesday next week) that I have been watching and wanted to share with you. I think these might be worth buying if you can get some shares from your broker, even if only a few.Airbnb (12/9)

Everyone should know about Airbnb, since it has become a popular site for booking travel accommodations, often at a much better price than hotels and delivering a more "authentic" travel experience. While the business took a hit (like all travel industry businesses) from COVID-19, the business has rebounded recently with people taking vacations closer to home, avoiding crowded hotel lobbies and also long-term stays for people who can work remotely and want a change of scenery. What I didn't know is that Airbnb's business, unlike a lot of internet companies that I recall from the 2000's, is actually cash flow positive.

In the Company's Registration Statement, the financials show that for the past four years they were consistently generating positive free cash flow, up until 2020, which is not surprising given the COVID situation.

How the Company performs post-COVID is anyone's guess, but many analysts expect a strong rebound in travel once vaccines are widely available and there's no reason to believe that Airbnb can't participate in that rebound and with it's "asset light" business model generate much better returns than "asset heavy" hotel companies. The IPO will give them about $2.3B - $2.5B of proceeds that they can use to continue to scale the business. Pricing is expected at between $45 - $50 per share and seems likely to open up higher given recent stock market strength and focus on "recovery" plays, which this company certainly seems to fit.C3.ai (12/9)

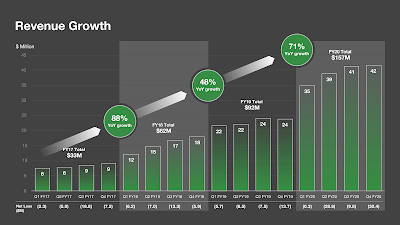

For those are old enough to remember Siebel Systems (the granddaddy of CRM) in the 1990's, you will know the founder Tom Siebel who has a strong track record in the technology industry dating back to his early involvement in Oracle. He later sold Siebel to Oracle after building a $2B business. Well, he has been at it again, this time quietly building over the past 11 years a company called C3.ai. This company provides a customizable layer of AI decision support tools that is database platform-independent and can combine large amounts of data both inside and outside the enterprise to support decision making. He has some great partnerships, including Microsoft, and has seen tremendous revenue growth as shown in the chart below:

Also, this Company is a SAAS model, which means they get 86% of their revenue from subscriptions. While the company posted a loss and there's certainly some risk, the business model and the team that Siebel has assembled should give investors some comfort that they will be able to successfully execute in what will certainly be a rapidly growing industry of enterprise big data AI analytics. It's all I hear about nowadays at my company. What's perhaps most interesting is that in the most recent period, the company reported $17.9M of positive free cash flow for the six months ended October 2020, compared to -$4.9M in the same period a year ago. With the strong revenue growth, positive cash flow, great business opportunity and solid team this one looks like a good bet as well. The stock will price at up to $34 per share.

Roblox (IPO Date TBD)

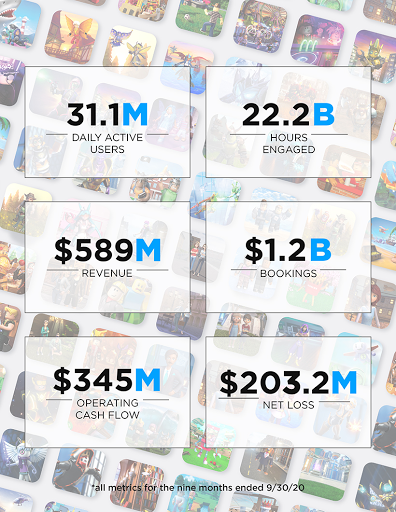

If you have a tween in the house, you have probably heard about Roblox. I have to say I'm amazed at how much time my son spends playing this game (and how much money he's willing to spend to enhance his character and game experience). It's truly something else. Roblox is an online gaming platform that has several unique features, not the least of which is a dedicated group of developers who are constantly creating new mini-games and experiences making the platform more engaging. By the numbers, Roblox although posting a net loss due to noncash charges required for GAAP purposes, is actually generating positive cash flow of $345M for the most recent nine month period ended September. This is pretty impressive and is being driven by 31.1M daily active users who are spending on average about $39 each buying "Robucks" which can be used to purchase in game items (that drives the $1.2B bookings number). Roblox is a great business now and is certainly a big beneficiary of the pandemic, but a key question is how will it do post-COVID? I think this one might be worth taking a position in. Video games will continue to be popular with kids, just like they have been before COVID and unique experiences that combine socializing with friends and constantly changing content that should perform well in the future.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.