Increasing Bitcoin Allocation

Over the past few months as I have continued my Bitcoin research, I have decided to increase my recommended allocation from 2-3% to 5-6% of a diversified portfolio. I post relevant videos and other content on my Twitter @NickReichert if you're interested in following and I also post links to my recent blog posts there as well.

Over the past few months as I have continued my Bitcoin research, I have decided to increase my recommended allocation from 2-3% to 5-6% of a diversified portfolio. I post relevant videos and other content on my Twitter @NickReichert if you're interested in following and I also post links to my recent blog posts there as well. This recommended allocation increase is driven by the following:Excellent recent performance of Bitcoin (300% increase over past 12 months) and great long term growth potential as discussed in more detail belowGrowing adoption as the first global, decentralized monetary networkMonetary and fiscal stimulus measures that governments around the world are taking in response to the COVID pandemic to "print money" that will continue for the foreseeable future. Below is a long-term logarithmic chart that shows the steady, yet volatile, growth of Bitcoin market cap, price and volume. I like to look at the log charts because they are more helpful in visualizing the long term trend and smooth out a lot of the short term volatility, which shouldn't matter to a buy and hold investor:

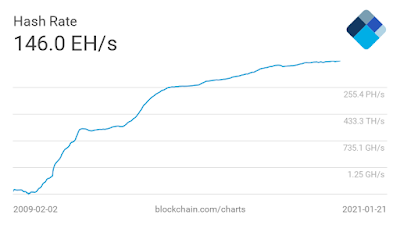

Below is another key long-term logarithmic chart of Bitcoin's hash rate, or the computational power and mining speed of the cryptocurrency. This is a good indicator of transaction volume as well as protocol acceptance:

Below I have summarized some of the reasons for investing in Bitcoin for the long haul that I have gleaned from my research:

Limited supply (only 21 Million coins will ever exist)Largest market cap by far in the crypto space ($600+ Billion), and like other internet social networks and businesses (i.e., Google, Facebook, Amazon, Netflix, etc.), first mover advantage is very importantPlenty of opportunity for growth in the future - global gold market cap estimates range from $6 - $8 Trillion, by comparison and in many ways, Bitcoin is superior to gold as discussed belowMost developed, mature network of all the crypto currencies and yet still early enough in its adoption to have plenty of upside Steady growth in trading and transaction volume over time as shown in the charts aboveSecure, trustless (verification is built into the software / blockchain), which is very appealing especially with widespread hacking of computer systems recently; if you hold your bitcoin on a crypto exchange like Coinbase or Crypto.com or in a fund like GBTC, you do need to consider the security of the exchange or fund and similar to bank accounts you may want to enable dual factor authentication, but you don't have to worry about the security of the Bitcoin blockchainEasy and low-cost to store and transfer (as compared to precious metals, for instance), without need for an intermediary Growing investment acceptance by institutional investors as well as retail investorsExpanding use cases, including PayPal plan to support payment transactions by converting in and out of fiat as well as supporting crypto investing on its platform; adoption as alternative to gold / precious metals and short term cash investmentsBeginning to see use in Corporate Treasury function instead of cash / cash equivalents (Microstrategy, Square)Price is totally dependent on demand since supply is fixed (unlike fiat currency) and many catalysts for demand to steadily grow over timeFuture demand seems assured with global monetary and fiscal policies in the wake of the COVID pandemic likely to cause all fiat currencies to experience inflation at an accelerated rate (even "normal" inflation causes devaluation to occur by default over time)Total addressable market is enormous (global currency / investment market)Government intervention is a risk, but the more broadly Bitcoin is adopted the less likely there will be an outright ban or other extreme action and more likely that there will be controls over use as a payment method (similar to fiat); I believe the government will be more interested in collecting taxes on crypto sales and limiting criminal use than anything else - since the blockchain is a public ledger, it's actually much more auditable by the authorities than cash in suitcasesAs I wrote last week, I'm looking to increase my exposure to Bitcoin in the coming weeks to get closer to the 5%-6% portfolio target and I'm leaning toward GBTC, versus buying more coins directly in my Crypto.com wallet. I'm hoping a lower-cost ETF will be available in the near future, but until then I think GBTC is probably the best option. Most of my Bitcoin at Crypto.com is staked, so I earn a 6.5% interest rate for a three month term and since I'm a long term investor and don't plan to sell any, that suits me well. I also increased my monthly Bitcoin purchase this month from $200 to $300.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

Published on January 24, 2021 20:44

No comments have been added yet.