Nick Reichert's Blog, page 14

September 13, 2020

Volatility is Back!

The last couple of weeks have shown that volatility is back in the stock market. In particular, technology shares have taken a beating the last couple of weeks with the Nasdaq (QQQ) now testing a key technical trend line (the 50 day moving average). Similarly, the S&P 500 (SPY) is also testing the same trend line. Many market watchers think a break below the 50 day moving average means more downside to come - how much is anyone's guess, but an additional 10% correction (SPY is down about 7% and QQQ is down about 11% from their recent all time highs) is not out of the question. Most agree this correction is "healthy" in that the technology stocks have had quite a run since the March lows and even if you sell now after this small correction, you are locking in some pretty large gains if you own some of the more popular stocks such as Amazon, Facebook, Apple, Nvidia, Tesla, Google, Netflix, etc.

The last couple of weeks have shown that volatility is back in the stock market. In particular, technology shares have taken a beating the last couple of weeks with the Nasdaq (QQQ) now testing a key technical trend line (the 50 day moving average). Similarly, the S&P 500 (SPY) is also testing the same trend line. Many market watchers think a break below the 50 day moving average means more downside to come - how much is anyone's guess, but an additional 10% correction (SPY is down about 7% and QQQ is down about 11% from their recent all time highs) is not out of the question. Most agree this correction is "healthy" in that the technology stocks have had quite a run since the March lows and even if you sell now after this small correction, you are locking in some pretty large gains if you own some of the more popular stocks such as Amazon, Facebook, Apple, Nvidia, Tesla, Google, Netflix, etc. With the large weighting of these few technology stocks in the stock market indices, their decline (along with many other technology stocks) is pulling down the averages. Uncertainty about the US Presidential election, the course of the COVID-19 pandemic in the fall/winter, and the lack of another stimulus package from Congress, which almost everyone agrees is vitally necessary to keep the economic recovery on track, have been weighing on investors' minds and have added to the volatility. However, underneath all the headlines about tech stocks and stock market averages, many stocks that do well in an economic recovery are showing considerable strength.

Here are a few of my favorite "heavy industrial / cyclical" large cap stocks that look to perform well over the next several months as the economy recovers and investors continue to rotate from tech:

Caterpillar (CAT) - 2.7% dividend yield, up 8% in the past month and expected to grow as demand for heavy equipment grows in the recoveryUnited Parcel Service (UPS) - 2.5% dividend yield, up 2% in the past month and poised for further growth potentially after FedEx earnings next week, which is expected to show more growth in package deliveries due to the pandemicDu Pont (DD) - 2% dividend yield, up 2% in the past month and expected to grow as demand for chemicals grows with the recoveryUlta Beauty (ULTA) - No dividend, but up 6% in the past month and expected to be one of the better "reopening plays" as the economy opens post-COVID and people renew their focus on health and beauty productsRio Tinto (RIO) - 6% dividend yield, up 3% in the past month and expected to grow as demand for basic materials (iron, aluminum, copper, diamonds) grows with the economic recoveryPPG Industries (PPG) - 1.7% dividend yield, up 6% in the past month and expected to grow as demand for paints, coatings and glass products grows with the economic recoveryA good allocation to cash is also wise in these times to take advantage of opportunities as they arise and if you follow the Financial Fortress concept, you are already well diversified and not worried too much about the stock market's (or any other market's) short term gyrations.Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage positions in the stocks mentioned above. Stay safe, healthy and positive. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

September 6, 2020

SWAN With the Financial Fortress

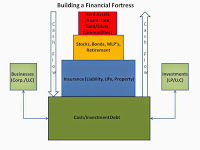

Stock market volatility has picked up the last couple of days and many are questioning whether the big crash is finally here or whether this is just a pullback / consolidation and we will continue to see further stock market gains as the economy continues its steady, but bumpy recovery. If you are worried about the stock market then you probably have too much of your money invested there and you might want to consider the Financial Fortress approach I have used for many years. This investing approach helps me SWAN (Sleep Well At Night). If the stock market does great, then a portion of my portfolio does too. If it doesn't, I'm not worried because other areas are continuing to hold their value or increase. Having been through two major stock market crashes in my life, including the dot.com bubble and the Great Recession prior to the COVID Crash, I have grown more cautious about the stock market and containing risk, but at the same time can't dismiss the fact that it's a great way to build wealth over the long term. Finding the balance between taking the risk of the stock market and playing it safe is a personal thing and is up to every investor to determine their own risk tolerance.

Stock market volatility has picked up the last couple of days and many are questioning whether the big crash is finally here or whether this is just a pullback / consolidation and we will continue to see further stock market gains as the economy continues its steady, but bumpy recovery. If you are worried about the stock market then you probably have too much of your money invested there and you might want to consider the Financial Fortress approach I have used for many years. This investing approach helps me SWAN (Sleep Well At Night). If the stock market does great, then a portion of my portfolio does too. If it doesn't, I'm not worried because other areas are continuing to hold their value or increase. Having been through two major stock market crashes in my life, including the dot.com bubble and the Great Recession prior to the COVID Crash, I have grown more cautious about the stock market and containing risk, but at the same time can't dismiss the fact that it's a great way to build wealth over the long term. Finding the balance between taking the risk of the stock market and playing it safe is a personal thing and is up to every investor to determine their own risk tolerance. Here's a breakdown of how I allocate my Financial Fortress portfolio currently:

Retirement Accounts (conservative profile - mostly bonds) - 37%Cash - 21%Real Estate - 20%Aggressive Stock - 14%Alternatives (Gold/Silver/Bitcoin/Royalties/Private Equity/Life Insurance) - 8%If the stock market does well, my overall portfolio grows, but I'm not dealing with huge fluctuations in the overall value because of the other asset classes and my aggressive stock investing is limited to 14% of the total portfolio.

While the retirement accounts do have some stock exposure, I'm even less concerned about those accounts since they are very long term hold in nature.

Even when investing aggressively in stocks, my primary focus is cash flow and I only own four stocks, all of which pay strong dividends:Alliance Bernstein (AB) - 9.72% yieldAbbvie (ABBV) - 5.14% yieldBroadmark Realty Capital (BRMK) - 8.99% yieldProspect Capital (PSEC) - 14.31% yieldThe rest of the portfolio is invested in selling covered calls and selling put credit spreads on "household name" stocks with good stock price support and low volatility. This portion of the portfolio swings the most with the market and can be a little scary, so it's important to manage risk to ensure best possible outcome - keeping position sizes small and overall maximum risk in line with cash holdings (don't over-leverage). AT&T is a key holding in the option portfolio due to it's large market cap, very liquid market for stock / options and low volatility. It's also a great dividend stock to hold long-term in your portfolio, sporting a 7% dividend yield (see my recent post here for a deeper dive into AT&T).

Selling options plus the dividend stream from these four stocks really supercharges cash flow from this account. As the cash balance builds, it can be deployed into more dividend-paying stocks which I continue to screen on a regular basis. Here's a recent post on my latest dividend screen if you're interested.

Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage positions in the stocks mentioned above. Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

August 30, 2020

10 Ideas for Multiple Cash Flow Streams

Financial planners often talk about the importance of having multiple cash flow streams and not relying solely on one (such as your job). It's important because in the event you do lose your job - which seems likely in the current recession, you can still rely somewhat on the other cash flow streams to cover your expenses while you are looking for another job. Also, when you are employed, those multiple cash flow streams can be invested to generate more income if not needed to cover living expenses.

Financial planners often talk about the importance of having multiple cash flow streams and not relying solely on one (such as your job). It's important because in the event you do lose your job - which seems likely in the current recession, you can still rely somewhat on the other cash flow streams to cover your expenses while you are looking for another job. Also, when you are employed, those multiple cash flow streams can be invested to generate more income if not needed to cover living expenses. Here are ten ideas for creating multiple cash flow streams:

Invest in Bitcoin / Crypto interest-bearing accounts - Most crypto exchanges today offer interest-bearing investments to deposit your cryptocurrencies in; for example Crypto.com offers 6.5% interest on Bitcoin deposits and 18% interest on their CRO coin and varying rates on many other coins; if you plan to hold your coins for the long haul, why not earn some interest on them?Invest in dividend-paying stocks - Buying high-quality "blue chip" companies that pay a good dividend is always a great way to generate passive income; as a buy and hold investor, you shouldn't worry about temporary fluctuations in the stock price and just collect the quarterly dividend in cash, while the best companies raise the dividend over time which increases your yield on investment as well; last week I wrote about AT&T (T); there are also riskier, higher yielding stocks that pay dividends monthly - some that I own include Broadmark Realty Capital and Prospect CapitalInvest in real estate - Owning a residential income property that cash flows positive is the best way to develop passive income as well as long-term capital growth, but if you don't have enough money for a down payment you can also buy shares in a residential real estate investment trust - currently largest ones are paying about a 4% yield; these include Avalon Bay, Essex and Equity Residential. Even in a recession, residential tends to outperform most of the other real estate property types, so it is a relatively "safe" real estate sector to invest in.Emergency fund - Your emergency fund should be invested in low-risk Treasury bills or savings accounts, which don't earn much interest now, but no matter how small the earnings are these represent an additional source of cash flowInvest in music royalties - While the pandemic and related shutdown of live entertainment venues has impacted this asset class somewhat, streaming music and radio play continue to be strong sources of royalty income and music royalties generally don't tend to be correlated at all with the stock market and therefore provide some diversity to your investments. Royalty.com is a great site to buy and sell music royalties that I have used in the past.Self-publish books on Amazon - If you are experienced in a particular area, it's fairly easy to write and self publish a book on Amazon and create multiple formats including audio, Kindle and paperback; promotion can be challenging and expensive if you decide to advertise, but you do earn royalties for every copy sold which can add up over timeOptions Investing - I have found a couple of relatively low-risk strategies to generate extra cash flow in options trading, which include selling covered calls (selling call options against stocks you already own in your portfolio at strike prices above what you paid for the stock so you will always make money) and selling put credit spreads (selling "out of the money" put and buying a put at a lower value as "insurance" in case the stock goes down); I have found the key to selling put spreads is making sure the stock you buy is a "household name" like Coke, McDonalds, Visa, Walmart, Target, etc. and has shown either a flat or upward trend in its recent stock price action, always sell "out of the money" and also keep the time-frame to between one week and five weeks while managing the size of each position to manage risk; I have learned that buying options is really a lot like gambling where you can have huge 10x gains or lose everything, but selling options is how the professionals make consistent returnsSell items on EBay - If you have things laying around the house you don't need, especially popular tech items, listing and selling on EBay can be a great way to generate extra cash and declutter your house; see my post on this topic where I share what I have learned over many years selling on the site here.Cut household expenses - A penny saved is a penny earned they say, so take some time to go over your household expenses and see if there's anywhere to trim back - start with your biggest expenses and work your way down the list (maybe you can refinance your mortgage or move to where the rent is lower or reduce your car insurance premium by switching to another company, as examples)Open an online store - I'll say I have not done this yet, but I always read about how many people are so successful in doing this; honestly the thought of having to deal with the customer service aspect isn't appealing to me nor the prospect of having to compete with the likes of Amazon, but the growth of online websites like Shopify would tell you there's obviously something there.

Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage positions in the stocks mentioned above. Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

August 23, 2020

AT&T - A Deeper Dive

One of my favorite stocks for long term, relatively safe dividends and share upside potential is AT&T (T). I thought it would be good to go into a deeper dive into why T is such a great stock to hold in your portfolio long-term, especially now since the market is ignoring value stocks in favor of the technology growth high-fliers.

One of my favorite stocks for long term, relatively safe dividends and share upside potential is AT&T (T). I thought it would be good to go into a deeper dive into why T is such a great stock to hold in your portfolio long-term, especially now since the market is ignoring value stocks in favor of the technology growth high-fliers. T is a holding company, which engages in the provision of telecommunications media and technology service. It operates through the following segments: Communications, WarnerMedia, Latin America and Xandr. The Communications segment provides services to businesses and consumers located in the U.S., or in U.S. territories, and businesses globally. The WarnerMedia segment develops, produces and distributes feature films, television, gaming and other content over various physical and digital formats. The Latin America segment provides entertainment and wireless services outside of the U.S. The Xandar segment provides advertising services. The company was founded in 1983 and is headquartered in Dallas, TX.

Here are some of T's key financial highlights:

Current price - $29.78Price/Earnings Ratio Current - 15.7x (compared to current S&P 500 P/E of 29.2)Dividend - $2.08/share/yearAnnual Dividend Yield - 6.98%Market Cap - $211.5BOperating Cash Flow (Annual - 2019) - $48.7BFree Cash Flow (Annual - 2019) - $29BThe company, while highly leveraged due to an acquisition spree over the last several years, has plenty of cash flow to service the debt. T has also been using its massive free cash flow and selling non-core assets to deleverage, is refinancing for more favorable rates in the current low interest rate environment and maintains a good medium investment grade credit rating with a stable outlook from all three rating agencies. T stands to benefit from the deployment of new 5G technology, which should be a catalyst for its mobile phone service and also has some upside with its entry in the streaming wars - HBO Max. T ranks #25 by market cap on the list of S&P 500 companies and ranks #14 on the list of Top 50 global brands.

Some investors have questioned the sustainability of a 7% dividend yield. At this point in the COVID-19 Recession, while many other companies have cut their dividends, T has not cut its dividend after raising it by a penny in 10/19. T has a very long history of steadily increasing its dividend and says it will continue to support the dividend in the future, understanding the importance of it to the Company's shareholders. For all these reasons, T seems like a great core holding for a value / income oriented investor.

Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage long positions in T. Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

August 16, 2020

Buffett's Move Into Gold

Many investors are talking about the recent move by Berkshire Hathaway (BRK.B) to invest $565M in Barrick Gold (GOLD) for a 1.2% stake. This is especially important since Warren Buffett in the past has has not recommended investing in gold due to its lack of a financial return (yield) or productive use (other than potentially increasing value). His track record lately hasn't been the best (buying airlines on the way down and selling at the bottom) and some have even questioned whether he has lost his touch. However, his recent moves to sell banks and buy a gold miner look to be a very smart move by the Wizard of Omaha.

With interest rates being incredibly low and looking to stay that way for a long time, banks will have a difficult time being profitable in such a low interest rate environment and many are saddled with bad loans which may get worse as the recession grinds on. Also, the decline in the value of the dollar (expansion of the money supply - see chart below) is driving up the value of gold (as shown in the chart above), making the gold mining business very lucrative. Also, Barrick produces a significant amount of copper and as the economy recovers, so will demand for this mineral that is essential to many industrial products.

Some are even saying that this news may impact the price of Bitcoin, driving it up even higher (who knows, Buffett may eventually invest in Bitcoin too). As is the case with Bitcoin, gold is very volatile at the moment and has seen extreme price spikes both up and down, so investing in gold requires considerable patience. One of the best ways to invest in gold is to simply buy some gold coins and put them in a safe deposit box and hold on to them. Owning some gold and silver as a portion of your overall portfolio clearly makes a lot of sense in today's world and is further validated by Buffett's recent moves. If you are interested in learning more about investing in gold and silver, check out my book here. You might also be interested in learning about other investing strategies in a declining dollar environment - see my recent post here.

Stay safe, healthy and positive. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

August 9, 2020

Investment Strategies for a Declining Dollar

I have often written about the declining value of the dollar over time, as inflation (even a small amount) consistently erodes away at the dollar's purchasing power. One of my favorite charts below from Shadowstats shows this pretty clearly. The dollar's value does fluctuate with demand and can go up in the short run, but the long term trend has been consistently lower. Most recently, when the COVID-19 pandemic began and the world's financial markets were in turmoil, there was huge demand for dollars as a "safe haven," but then as massive fiscal and monetary stimulus was unveiled, the dollar started to drop again over inflation fears and that decline has accelerated recently. There have been many indicators of investors' concern about this, including the rise in value of precious metals, Bitcoin and the stock market. What's interesting is that the bond market so far has not shown any signs of inflation concerns, but I believe this has more to do with the Federal Reserve's purchasing of bonds, which artificially suppresses interest rates, as well as "safe haven" demand from investors who have reduced their exposure to the stock market.

I have often written about the declining value of the dollar over time, as inflation (even a small amount) consistently erodes away at the dollar's purchasing power. One of my favorite charts below from Shadowstats shows this pretty clearly. The dollar's value does fluctuate with demand and can go up in the short run, but the long term trend has been consistently lower. Most recently, when the COVID-19 pandemic began and the world's financial markets were in turmoil, there was huge demand for dollars as a "safe haven," but then as massive fiscal and monetary stimulus was unveiled, the dollar started to drop again over inflation fears and that decline has accelerated recently. There have been many indicators of investors' concern about this, including the rise in value of precious metals, Bitcoin and the stock market. What's interesting is that the bond market so far has not shown any signs of inflation concerns, but I believe this has more to do with the Federal Reserve's purchasing of bonds, which artificially suppresses interest rates, as well as "safe haven" demand from investors who have reduced their exposure to the stock market.

We all know that interest rates are extremely low so holding cash in a bank, savings or money market account doesn't pay much these days (1% or less) and has typically trended below the rate of general inflation (most recently 0.6% overall, but food is rising at rate of 4.5%). However, having no cash is not a smart move because an emergency fund is important, especially in today's environment of job insecurity. Even if we didn't have to deal with looming unemployment, life always throws you a curve ball like unexpected car repairs and other surprises that require cash. But assuming you have an adequate emergency fund, what are some areas to invest extra cash that would be a good idea in today's declining dollar environment?

Bitcoin tops my list as a great investment in this environment for the simple reason that it is in limited supply, is well known and has the largest market capitalization by far of any of the other digital currencies. Although very volatile, Bitcoin represents the future of money as an investment, store of value and transaction currency. Indeed, many countries who have experienced hyperinflation in recent years like Venezuela are seeing a big increase in Bitcoin use for daily purchasing activity. If you hold and don't "trade" Bitcoin, over time you will be rewarded as this asset, unlike dollars which can be "printed," is expected to hold and increase its value by design. It's also very easy to transact and store, as compared to gold and silver. If you're interested in learning about a good strategy for investing in cryptocurrency see my prior post here and follow my crypto updates (most recent one was posted last week here).

Gold and silver are also good investments in this environment for a long-term investor. I prefer to buy and hold physical coins, but you can buy exchange traded funds (GLD, SLV) which are another way to invest. I do worry about "hot money" moving into this area, which temporarily pumps the price, making it unsustainable and causing a short term crash. Silver did this not too long ago when it went from $10/oz to $30/oz and then crashed back down after the speculators dropped out. Now silver is again making a run at $30/oz. If you can afford to be patient and hold long term, however, gold and silver can be very rewarding as the long term trend in the dollar will always be a backstop to their value. If you're interested I wrote a very concise book in the subject and it's available here.

We should also not forget about investing in stocks, especially the blue-chip companies that pay a dividend and that have mostly missed out on the recent stock market rally that favored large technology stocks. In many cases the dividend alone is 2x - 6x higher than the interest you can earn a high yield savings account, plus you get the capital appreciation over time which no doubt will be enhanced again by the declining value of the dollar. One thing to remember is that for multinational companies headquartered in the US, a weaker dollar allows them to be more competitive making their products cheaper and boosting their sales.

For safety, I prefer large cap blue chip stocks that have been paying and consistently growing dividends over a long period of time, while outperforming their industry, but have not been recognized yet by the market (i.e., with a low forward price earnings ratio). Because of the disruption in the markets caused by COVID-19, there are plenty of stocks that meet this criteria. I ran a quick screen with this criteria and generated a list that included Johnson & Johnson, Bristol Myers Squibb, 3M, CVS, Chevron, General Mills, Lockheed Martin, General Dynamics and many others as shown below. I am not recommending any particular stocks or investments here, but providing you with overall strategy ideas and you will need to do your own "homework" and assess your appetite for risk as part of the investing process.

Stay safe, healthy and positive. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

August 2, 2020

Crypto Update

Here's an update on the "Top 10" cryptocurrencies by market cap (courtesy of coinmarketcap.com).

Here's an update on the "Top 10" cryptocurrencies by market cap (courtesy of coinmarketcap.com).Clearly, Bitcoin continues to lead the pack at a market cap of $206.9B. Rounding out the top three are Etherium with a $43.1B market cap and Ripple with a $13.2B market cap. Bitcoin has almost tripled in value from a year ago, while Etherium has increased 4x during the same time frame and Ripple has increased 3x.

With returns like these, it's no wonder many people are seriously considering investing in cryptocurrencies now. I have long advocated for keeping a small portion of your portfolio in crypto for diversification and the potential for large gains. I also think crypto is a nice hedge against depreciation of fiat currencies, which seems to be accelerating in the post-pandemic world. Below is one of my favorite charts that tracks the declining value of the dollar over time.

Of course, with that level of volatility there is also the potential for large losses, which is why it makes sense to keep your exposure small. I consistently invest a small amount in Bitcoin every month and have been pleased with the overall result, since I can dollar cost average down when Bitcoin is trading lower and I never sell my Bitcoin, only accumulate.

While I have invested in the other coins in the past, I feel like the risk/reward isn't always there and it's better to focus on Bitcoin since it's clearly the leader in terms of market cap and liquidity. I use the Crypto.com app which has several different services on their platform, all of which I would recommend. First and foremost, they will pay interest on your crypto coin deposits - currently 6.5% simple interest on a three month deposit of Bitcoin, for example, and the interest is paid weekly. Interest rates vary depending on the coin. Getting that rate requires "staking" 500 MCO coin for 6 months (cost of about $2,000), but that stake pays 6% simple interest in MCO coin, also paid weekly. I also have their debit card and earn 3% cash back on all charges (paid in MCO coin), which I use periodically to buy more Bitcoin. Recently they have been running a promotion where you get 10% cash back (maximum of $50 per month) if you use your card for a delivery service like DoorDash, which I have been doing a lot lately. They pay a $50 referral fee, also in MCO coin. A deposit of CRO coin (which I was surprised to see on the top 10 list below) pays a whopping 18% simple interest for a three month deposit. The minimum amount to deposit is 5,000 CRO (or about $800) and they are also running a special currently to waive the normal 3.5% credit card fee to purchase crypto.

Stay safe, healthy and positive. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

1

Bitcoin$206,976,420,671$11,218.56$29,708,335,07118,449,468 BTC-3.60%

Bitcoin$206,976,420,671$11,218.56$29,708,335,07118,449,468 BTC-3.60%

2

2 Ethereum$43,100,578,424$384.77$20,198,167,673112,015,550 ETH4.98%

Ethereum$43,100,578,424$384.77$20,198,167,673112,015,550 ETH4.98%

3

3 XRP$13,234,532,763$0.295001$5,201,382,35144,862,646,997 XRP *5.03%

XRP$13,234,532,763$0.295001$5,201,382,35144,862,646,997 XRP *5.03%

4

4 Tether$9,996,828,694$0.999861$46,704,695,8079,998,221,723 USDT *0.16%

Tether$9,996,828,694$0.999861$46,704,695,8079,998,221,723 USDT *0.16%

5

5 Bitcoin Cash$5,344,422,295$289.22$3,542,516,09818,478,956 BCH-7.32%

Bitcoin Cash$5,344,422,295$289.22$3,542,516,09818,478,956 BCH-7.32%

6

6 Bitcoin SV$4,086,400,739$221.15$2,750,899,68818,477,596 BSV-7.22%

Bitcoin SV$4,086,400,739$221.15$2,750,899,68818,477,596 BSV-7.22%

7

7 Litecoin$3,743,275,296$57.44$3,738,016,15165,164,883 LTC-4.56%

Litecoin$3,743,275,296$57.44$3,738,016,15165,164,883 LTC-4.56%

8

8 Cardano$3,500,104,564$0.134998$513,368,27425,927,070,538 ADA-3.69%

Cardano$3,500,104,564$0.134998$513,368,27425,927,070,538 ADA-3.69%

9

9 Crypto.com Coin$3,095,061,090$0.166618$124,951,76218,575,799,087 CRO *-2.46%

Crypto.com Coin$3,095,061,090$0.166618$124,951,76218,575,799,087 CRO *-2.46%

10

10 Binance Coin$3,000,624,737$20.78$322,651,594144,406,560 BNB *-1.04%

Binance Coin$3,000,624,737$20.78$322,651,594144,406,560 BNB *-1.04%

July 26, 2020

Picking a Winner in the Race to a COVID-19 Vaccine

As COVID-19 cases continue to grow across the US and the world (total global cases over 16M and total deaths over 600K), the need for treatments and more importantly a vaccine is growing exponentially. Indeed, in the US given the struggles with containment in many of the southern and western states, there is a growing consensus that that a return to normal will be very much dependent on a vaccine. The stock market's reaction each time there is positive vaccine news is testament to this. Certainly the public's desire to get on a plane, go to a restaurant, or go to work (or even leave the house) will be impacted for quite some time until they feel "safe" in doing these activities. A safe, effective and widely available vaccine would go a long way toward helping. Below is a table summarizing nine pharmaceutical companies who appear to be ahead in the race for a vaccine that appeared in a recent Forbes article:

As COVID-19 cases continue to grow across the US and the world (total global cases over 16M and total deaths over 600K), the need for treatments and more importantly a vaccine is growing exponentially. Indeed, in the US given the struggles with containment in many of the southern and western states, there is a growing consensus that that a return to normal will be very much dependent on a vaccine. The stock market's reaction each time there is positive vaccine news is testament to this. Certainly the public's desire to get on a plane, go to a restaurant, or go to work (or even leave the house) will be impacted for quite some time until they feel "safe" in doing these activities. A safe, effective and widely available vaccine would go a long way toward helping. Below is a table summarizing nine pharmaceutical companies who appear to be ahead in the race for a vaccine that appeared in a recent Forbes article:

As an investor, it's an intriguing opportunity, since the "winner" or "winners" in this race to a vaccine will be rewarded with a tremendous surge in revenue and stock valuation. If the vaccine is like the annual flu, it may require an annual booster shot which will guarantee future revenue for many years to come. This is another reason why many in the investing community have been following these developments closely, including announcements around Phase I and II trials and the safety / efficacy of the vaccine candidates. Each company working on the vaccine is taking a slightly different approach. Some are taking a novel approach of using Messenger RNA (mRNA), which has the advantages of a shorter development timeline, lower dosage requirements and more rapid mass-production. Other companies are using a weaker version of the common cold as a base in some combination of COVID-19 genetic material. Regardless of approach, the goal is to develop the body's innate ability to recognize and attack COVID-19 when infected. The approach using the common cold (also a coronavirus) appears to be more "traditional" and would seem to have a better chance of success than a more novel approach like mRNA. The two companies that are regularly mentioned in this regard are Astra Zeneca (AZN) and Johnson and Johnson (JNJ).

AstraZeneca Plc is a holding company, which engages in the research, development, and manufacture of pharmaceutical products. Its pipeline are used for the following therapy areas: oncology, cardiovascular, renal, metabolism, and respiratory. The company was founded on June 17, 1992 and is headquartered in Cambridge, the United Kingdom. The Company has a $145B market capitalization, pays a 2.46% dividend yield and generated $2.4B in operating cash flow in its most recent fiscal year (2019).

Johnson & Johnson is a holding company, which engages in the research and development, manufacture and sale of products in the health care field. It operates through the following segments: Consumer, Pharmaceutical, and Medical Devices. The Consumer segment includes products used in the baby care, oral care, beauty, over-the-counter pharmaceutical, women's health, and wound care markets. The Pharmaceutical segment focuses on therapeutic areas such as immunology, infectious diseases ad vaccines, neuroscience, oncology, cardiovascular and metabolism, and pulmonary hypertension. The Medical Devices segment offers products used in the orthopedic, surgery, cardiovascular, diabetes care, and eye health fields. The company was founded by Robert Wood Johnson I, James Wood Johnson and Edward Mead Johnson Sr. in 1886 and is headquartered in New Brunswick, NJ. The Company has a $390B market capitalization, pays a 2.73% dividend yield and generated $23.4B in operating cash flow in its most recent fiscal year (2019).

Both of these companies being large, stable companies with strong financials and a solid dividend yield would be good investment candidates and a good addition to a diversified dividend portfolio, even absent the potential windfall of a COVID-19 vaccine.

The US Government recently ordered 100 million doses of vaccine (when available) from Pfizer (PFE) and BioNTech (BNTX), which might indicate the government feels like they could be successful in their novel mRNA approach, but they are still in an early (Phase I) stage. It could also just be a government strategy to secure the necessary vaccines if an when available and not a commentary on potential for success. Pfizer in particular has struggled overall compared to its peers over the past several years. Pfizer has a market capitalization of $209B, a dividend yield of 4% and $12.6B of operating cash flow in its most recent fiscal year (2019). Operating cash flow has declined for each of the past three years and the high dividend yield could be a red flag. Maybe a COVID-19 vaccine will provide a big boost? Time will tell.

If you are looking for another way to invest in a potential vaccine and maybe diversify a bit more, an index fund that owns these companies might be a good idea. Here are three that popped up on my review (courtesy of Investopedia):

SPDR S&P Biotech ETF (XBI)With net assets nearing $4 billion, the SPDR S&P Biotech ETF (XBI) aims to provide returns that correspond to the S&P Biotechnology Select Industry Index. Moderna commands the largest single stock allocation in the fund's portfolio of 123 holdings, with a weighting of 4.53%.

Invesco DWA Healthcare Momentum ETF (PTH)Charging a 0.60% management fee, the Invesco DWA Healthcare Momentum ETF (PTH) tracks the performance of the Dorsey Wright Healthcare Technical Leaders Index – a benchmark comprising U.S. health care firms selected and weighted by price momentum. Although not strictly a biotech fund, the ETF allocates 42.25% of its $265.46 million asset base to the sector. The fund's basket holds about 45 stocks, with Novavax taking the top weighting at 7.81%.

VanEck Vectors Pharmaceutical ETF (PPH)Created in 2011, the VanEck Vectors Pharmaceutical ETF (PPH) has an investment mandate to provide similar returns to the MVIS US Listed Pharmaceutical 25 Index. The fund, which has an expense ratio of 0.36%, holds 216,632 shares of Sanofi, representing 4.48% of its net assets, while GlaxoSmithKline carries a similar weighting at 4.79%.Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy. Stay safe, healthy and positive. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

July 19, 2020

Stimulus Package Update

This week, I wanted to provide a quick update on the status of additional fiscal stimulus legislation being considered by Congress. This has been top of mind for me, not only for its impact to the individuals who have been struggling to make ends meet, but also the impact to the broader economy and what it could mean to investors when passed. Bottom line is everyone is interested in what will happen when a new bill is passed.

This week, I wanted to provide a quick update on the status of additional fiscal stimulus legislation being considered by Congress. This has been top of mind for me, not only for its impact to the individuals who have been struggling to make ends meet, but also the impact to the broader economy and what it could mean to investors when passed. Bottom line is everyone is interested in what will happen when a new bill is passed.First, a quick reminder of some of the signature pieces of the CARES Act which included:

One-time $1,200 stimulus check for adults (and $500 for children)Weekly $600 federal unemployment benefit until July 31stWaived interest payments on most federal student loans until September 30th“Paycheck Protection Program” (PPP) small business loansNo 10% early withdrawal penalty from retirement accounts for qualifying coronavirus-related expensesTemporary waiver for required minimum distributions (RMDs)The current additional Federal unemployment benefit of $600 / week will expire at the end of July. If not extended in some form at least until the end of 2020, the result could be catastrophic. While the unemployment rate has improved over the past several weeks, overall it continues to be very high by historical standards (see chart below) and the "real" unemployment rate may actually be much higher than what is officially reported, possibly 2x - 3x. As states roll-back reopening due to elevated COVID-19 cases as been happening recently, this could lead to even more layoffs and more unemployment. At best, the recovery is uneven. At worst, it stalls out completely. The unemployed, already struggling to pay for rent / mortgage, car loans, credit cards, groceries and other necessities will quickly find themselves in a dire situation.

Also, the continued weakness in the economy now clearly calls for another stimulus payment in addition to the $1,200 made part of the CARES Act. Fortunately, it appears that both an extension of unemployment benefits and a stimulus payment will likely be part of the next stimulus package, although the income level for people to receive a stimulus payment is likely to be lower than the CARES Act (possibly half as much or $100,000 for couples and $50,000 for singles).

There has also been talk of reducing the additional Federal unemployment benefit from $600 / week, possibly by adding a "return to work bonus" while reducing the weekly benefit or adjusting the maximum weekly benefit based on the state's unemployment rate. This is because of concerns that individuals receiving unemployment are actually making more than they were when they were employed. Indeed, a National Bureau of Economic Research study recently found that 2/3 of unemployment recipients were receiving more and 1/5 were receiving double their lost wages.

Other requirements of the package will be assistance to state and local governments (who will soon be facing layoffs of their own without more funding to replace lost tax revenue). The package will also have to provide some support for healthcare as well, including possibly some provisions to help older people who are laid off switch from COBRA to Medicare (if over 65) without penalty.

Also, there is talk of including a payroll tax "holiday," similar to what was done during the Great Recession (2% temporary reduction in payroll taxes), which will help those who are working but not the unemployed or retirees. The Senate is very interested in adding liability protection for companies who bring back their workers to work and who subsequently contract COVID-19 - this will surely be debated.

The Senate and White House alike want to keep the total cost of the package down to $1 Trillion or possibly up to $1.5 Trillion to minimize the impact to the Federal deficit, so there there will be some pressure to limit the benefits to the hardest-hit portion of the population to reduce the cost.

Given the state of the economy, the real question is how quickly can this get done? Below is a timeline for the Senate. I think it will be important for them to get it done by August 7, but that could be a challenge given the differences between the House and Senate objectives. This certainly won't go as smoothly as the prior stimulus bills. Delaying action to September or October would not be a good idea.

SENATE TIMELINE FOR MAKING A STIMULUS CHECK DECISIONDatesSenate actionJuly 20 - Aug. 7In session. The Senate is not expected to work past Aug. 7.Aug. 10 - Sept. 7August recess.Sept. 8 - Sept. 25In session. If the Senate doesn't pass a bill by Aug. 7, this is the next period it will have to work on a stimulus package.Sept. 28 - 29September recess.Sept. 30 - Oct. 9In session. If the Senate still hasn't passed a bill, this is its last chance before the general election on Nov. 3.Indeed, even Chairman Powell of the Federal Reserve has called on Congress to approve more stimulus and has said (with regards to concerns about increasing deficit spending):

"When the economy is strong and unemployment is low, that's the time to be addressing those concerns. I think now, when we are facing the biggest shock that the economy has had in modern times, is, to me, not the time to prioritize considerations like that."I believe similar to last time, when a stimulus bill is passed it will be very bullish for the stock market and there will be a short-term rally in the wake of it. That will be good news for investors. As I have written previously, additional stimulus with Fed support of low interest rates and credit markets puts a very solid floor under the stock market. As the economy recovers in the coming months, this should be a good setup for the market to move higher, albeit with plenty of volatility day to day and week to week. Buy and hold quality stocks for your portfolio or if you seek diversification within your stock portfolio, index ETF's are a good choice for long term investors (SPY, QQQ, IWM). Patience will be a virtue.

Stay safe, healthy and positive. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

July 12, 2020

Cash or Stocks?

It seems like retail investors are "all in" to the stock market while many institutional investors are being very cautious about putting more money to work in this market. The fundamental question right now is whether stay in cash to be safe in case the market crashes, or put your money in stocks so you don't miss out on what will surely be a continued climb upward consistent with the long-term trend (75% of years are up, 25% are down as I discussed in a recent post). Every day I read articles forecasting doom and gloom and "1929" crash scenarios. I also read an equal number of articles saying the market is not irrational, just pricing in what it sees in the future and it will continue to slowly recover as the economy recovers. This is the age old battle between the bulls and the bears. What's an investor to do?

It seems like retail investors are "all in" to the stock market while many institutional investors are being very cautious about putting more money to work in this market. The fundamental question right now is whether stay in cash to be safe in case the market crashes, or put your money in stocks so you don't miss out on what will surely be a continued climb upward consistent with the long-term trend (75% of years are up, 25% are down as I discussed in a recent post). Every day I read articles forecasting doom and gloom and "1929" crash scenarios. I also read an equal number of articles saying the market is not irrational, just pricing in what it sees in the future and it will continue to slowly recover as the economy recovers. This is the age old battle between the bulls and the bears. What's an investor to do? We know that the Federal Reserve's unprecedented provision of liquidity and the US government's massive fiscal stimulus packages (with more to come) are providing a great deal of support to the economy and the markets, which effectively puts a "floor" underneath stocks. We also know that interest rates are abysmal and you can't make a decent return on cash or bonds, while many solid stocks pay a dividend of 2% or more as I have also written about recently. Even if you believe there will be deflation, why would you settle for near zero interest rates?

COVID-19 cases and deaths continue to grow around the world and especially in the US, bringing a lot of angst and concern to the market about slowing down the economic recovery, due to roll-back of reopening activities in several states hit hard with new cases in the south and the west and also people staying home and not going out shopping, eating out, traveling, etc.

Here's a summary of last week's economic data, which for the most part is positive and would indicate a slow, but steady recovery is underway:

Key stats in the week included consumer confidence, private sector PMIs, the weekly jobless claims, and June’s nonfarm payrolls.The all-important consumer confidence and labor market stats were largely skewed to the positive.The CB Consumer Confidence jumped from 85.9 to 98.1, with nonfarm payrolls jumping by a record 4.8m in June.A surge in hiring in May and June led the unemployment rate back down to 11.1%.The weekly jobless claims were disappointing, however, rising by 1.472m following a 1.482m jump in the previous week.In the equity markets, the NASDAQ and S&P500 rallied by 4.62% and by 4.02% respectively. The Dow ended the week up by 3.25%.If you have a Financial Fortress already, you don't need to worry about any of this because you already have a good, diversified allocation of investments across various asset classes so you are ready for anything the economy or the markets throw at you. Your stock portfolio would just be managed "business as usual" in accordance with your objectives and risk tolerance and would continue to be fully invested. There is nothing in the data so far that would suggest it would make sense to change your strategy or go "all cash" at this time. Since it's very difficult to time the market, it's better to just stick with your strategy. If that's buying diversified index funds like SPY and QQQ periodically and holding, then keep doing that. If it's buying and holding solid dividend paying stocks, then keep doing that. If it's buying solid companies and selling call options, keep doing that. Whatever your strategy is, keep doing it and in the long run you'll be glad you did.

Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy. Stay safe, healthy and positive. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.