Nick Reichert's Blog, page 17

February 2, 2020

Model Investment Portfolios

I have recently been researching "model portfolios" and wanted to share a few I have identified that would be good for long term investors.

I have recently been researching "model portfolios" and wanted to share a few I have identified that would be good for long term investors.Some of the key themes I have discovered in my research that are important to maximizing long-term returns include the following:

SimplicityDiversification across asset classes Low cost (almost everyone agrees that keeping the cost low is critical to supporting strong long term returns - Jack Bogle, founder of Vanguard, calls it the "relentless rules of humble arithmetic")What I have learned in my research, is that a small number of Exchange Traded Funds (ETF's) can deliver on all of these requirements and don't require a lot of maintenance. ETF's have very low costs because they are not actively managed and instead track underlying indices. I suppose this could also be called a "lazy portfolio," but there's nothing wrong with that way of investing, since it can expose you to less risk, better returns and all for less effort.

Since the time horizon I was looking at was long, these portfolios skew more toward "aggressive" but you can easily adjust the percentage allocations back to levels that you are more comfortable with, depending on risk tolerance and timeline.

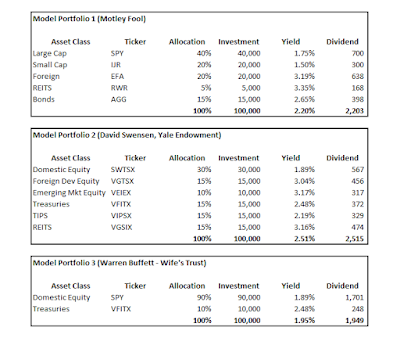

I looked at several model portfolios, but the ones I liked best were inspired by Motley Fool, David Swensen (he successfully managed the Yale Endowment to an average annual return of 13.9% over the past 20 years) and Warren Buffett (the allocation supposedly called out in the trust for his wife).

For the illustration below, I assumed an investment of $100,000 and I also show the dividend yield provided by each of the funds, since that is also important (whether you take the cash or reinvest). Reinvesting the dividends would greatly improve the overall long-term return, of course, but you may have a situation where you want or need the regular passive income. The funds selected are among some of the lowest cost ETF's available on the market for the specific asset class. There may be better ones out there, but these pretty consistently popped up in the research.

Here are the model portfolio examples:

I think out of the three, my favorite is Portfolio 2 since it provides a lot of diversification across various asset classes and is designed to do well in pretty much any market environment. I do like Portfolio 3 for its simplicity, but really all three are pretty simple and easy to manage. As you can see, you can accomplish a lot with between 2 and 6 ETF's. This is certainly a lot easier than having to manage a large portfolio of stocks and a lot cheaper than having a portfolio of actively managed funds, even if returns might be slightly better in some years. You would just need to rebalance once or twice a year and otherwise these would be very low maintenance once setup.

Here are links to the funds included above if you are interested in researching them further:

SPDR S&P 500 ETF Trust (SPY)iShares Core S&P Small-Cap ETF (IJR)iShares MSCI EAFE ETF (EFA)SPDR Dow Jones REIT (RWR)iShares Core US Aggregate Bond ETF (AGG)Schwab Total Stock Market Index Fund (SWTSX)Vanguard Total International Stock Index Fund (VGTSX)Vanguard Emerging Markets Stock Index Fund (VEIEX)Vanguard Intermediate-Term Treasury Fund (VFITX)Vanguard Inflation-Protected Securities Fund (VIPSX)Vanguard Real Estate Index Fund (VGSIX)

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 02, 2020 20:41

January 26, 2020

Free Trades May Cost More Than You Think

What started with RobinHood and spread, as other online trading platforms appeared, to all of the major trading sites, including TD Ameritrade, ETrade, Vanguard, Charles Schwab, Fidelity and others? Free trades! How cool that you can buy and sell as much stock or as many options as you want with no commissions!

What started with RobinHood and spread, as other online trading platforms appeared, to all of the major trading sites, including TD Ameritrade, ETrade, Vanguard, Charles Schwab, Fidelity and others? Free trades! How cool that you can buy and sell as much stock or as many options as you want with no commissions!We have already heard about how you still "pay" for your trades in the form of worse pricing (bid / ask spreads) when buying and selling and also slower execution at times, which can cost you quite a bit of money in a much less visible way. In fact, you could be paying more now than you did when you had to pay commissions!

But there is a much more sinister side to the online trading phenomenon. By making it so easy to trade options on your phone and providing so much information at your fingertips, including real time market data, individual stock data, fair value estimates, analyst estimates, earnings trends, news, etc. on a very professional looking app, new and even experienced investors are empowered to think they know what they are doing and that they can make money. Indeed, some have "beginner's luck" and do well, at least at first. The reality is, as it has been said, "online trading is gambling, only you think you can win." This is especially true with trading options, where if you are correct you can get a gain of a multiple of your initial investment and if you're wrong, you can lose it all. This is gambling, plain and simple. Anyone who says they are "investing" when trading stock options is kidding themselves. How far we have come from options simply being used as "insurance" for hedging against an unexpected increase or decrease in the value of a stock you own.

Stock options include "plain vanilla" puts and calls, but the complexity of options offered on RobinHood (as an example) is mind boggling and includes extremely complex structures like Iron Condors, straddles/strangles, call debit spreads, put credit spreads, etc. These are much more risky than the "plain vanilla" options, especially for beginners. With the addition of margin accounts, available to just about anyone, the damage you can do to yourself with these complex options grows exponentially. This problem still exists even after the "infinite leverage" debacle that occurred at RobinHood recently, where someone was able to borrow $1M with a $4,000 deposit. Here's a real life example of how this "double leverage" of the options and margin can clobber you. I know someone who invested $500, grew it to $2,000 with a few successful trades, leveraged it 2.5x with options and margin and ended up losing it all, for a total loss of $5,000. A $500 investment turned into a $5,000 loss! Imagine that!

What's worse, many people sell options trading strategy classes and programs, which further inappropriately legitimize options trading as investing. Options traders are taught to ignore the doubters and the negativity and focus on the "program," manage risk and make money. Here's an example called "11 Lessons in Trading Psychology:"

My favorite is number 11, "Challenge your ideals." Someone with a gambling problem is simply not capable of managing risk, and I believe many people may be developing a gambling problem they didn't have by using these online trading app's.

I fear that today's online brokers have already become the bookies of the current generation and we are only just now beginning to see the toll this will take on our society.

If you or someone you love seems to have a gambling problem, check out Gambler's Anonymous.

If you are interested in how RobinHood works, I wrote a whole series about it here (spoiler alert, it didn't work out too well for me):Day Trading on Robin Hood - IPart IIPart IIIPart IVPart VFinal

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 26, 2020 10:14

January 18, 2020

Identity Theft Protection

If you have ever had your identity stolen or know someone who has, you know its a lot of work to unravel what happened and clean up the mess that's left behind in your credit history. Identity thieves move quickly and by the time you figure out what happened, they are long gone and you are left with the credit card bill.

If you have ever had your identity stolen or know someone who has, you know its a lot of work to unravel what happened and clean up the mess that's left behind in your credit history. Identity thieves move quickly and by the time you figure out what happened, they are long gone and you are left with the credit card bill.Credit card companies, banks and other financial institutions have gotten smarter with verification of identity and other protections, but criminals are always ahead of the game.

It's best to protect yourself and make sure it never happens to you. There are several things you can do to protect your identity, and many of them can be done at little or no cost.

Tips for protecting your identity:

If you have an account at a major bank like Wells Fargo or Chase, they now offer free credit monitoring and post an updated credit score weekly or monthly; any changes in your credit report show up there as well with alerts, so you can see inquiries, new accounts added or other changes to your credit file in a timely manner; you can also sign up for a service like LifeLock, TrustedId or any of a variety of other credit monitoring programs - each of the major credit bureaus has one if you are interested in that option.Put a fraud alert on your credit file; this should result in a phone call to you with some challenge questions based on your credit history before a new account can be setup in your name, but not all financial institutions remember to do this; these are free and easy to do online at each of the three major credit bureaus and you don't have to be a victim of fraud to use them:

Experian

Equifax

TransUnionLock or "freeze" your credit; this will make it impossible for anyone to run your credit or open an account in your name, but it can be a hassle to manage if you are planning on opening new credit accounts, renting an apartment, buying or leasing a car, or refinancing (pretty much everything that requires a credit check) - this service is offered free by all three major credit bureaus and you will need to do it at each one to fully protect yourself - you also don't need to be a victim of fraud to use these; they can be unlocked for a period of time if necessary to complete a transaction and then re-locked again:

Experian

Equifax

TransUnionBe careful with old tax returns, loan applications and other documents that include your social security number and other personal information; always shred when disposing of these documentsBe alert to "phishing" attacks either by phone, mail or email - urgency should be a warning sign that something is not rightWatch your paper mail and shred credit card offers that you don't needUse credit cards versus debit cards for better fraud protection, especially for big ticket items and set alerts in your mobile app to alert you about unusual credit card or debit card activity (like gas station charges, charges over a certain dollar amount or international charges)Be careful where you store your credit card data online; using PayPal or other third party payment service can be more secure when making online paymentsI hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 18, 2020 21:04

January 11, 2020

Best Online Savings Accounts - January 2020

If you have a good sized emergency fund and / or idle cash you have been saving but are not yet ready to invest, it's important to earn the highest interest rate you can. Traditional bank savings accounts generally pay extremely low rates of interest, as you have probably seen.

If you have a good sized emergency fund and / or idle cash you have been saving but are not yet ready to invest, it's important to earn the highest interest rate you can. Traditional bank savings accounts generally pay extremely low rates of interest, as you have probably seen. I did a quick search for online savings accounts. Nerdwallet has a pretty good summary here. But the best summary I was able to find was on Bankrate.com. Here are Bankrate's selections for the best savings account rates from top online banks:

Best Rate: HSBC Direct - 2.05% APYRunner-up Rate: Vio Bank - 2.02% APYHigh Rate: WebBank - 1.95% APYHigh Rate: Comenity Direct Bank - 1.90% APYHigh Rate: Popular Direct - 1.90% APYHigh Rate: Citibank - 1.85% APYHigh Rate: CIBC Bank USA - 1.85% APYHigh Rate: Citizens Access - 1.85% APYHigh Rate: MySavingsDirect - 1.80% APYHigh Rate: Synchrony Bank - 1.80% APYHigh Rate: PurePoint - 1.80% APYHigh Rate: CIT Bank - 1.80% APYHigh Rate: FNBO Direct - 1.75% APYHigh Rate: Discover - 1.70% APYHigh Rate: American Express National Bank - 1.70% APYHigh Rate: Goldman Sachs Bank USA - 1.70% APYHigh Rate: Barclays Bank - 1.70% APYHigh Rate: Ally Bank - 1.60% APYCharles Schwab's money market account didn't make the list, but it currently yields 1.51%, which isn't too bad. You can also invest directly in 4 week US Treasury bills that yield about the same rate at TreasuryDirect.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 11, 2020 22:25

January 5, 2020

10 Ideas to Get Your Financial House in Order For the New Year

Here are 10 ideas to get your financial house in order in the New Year.

Make sure your emergency fund is fully-funded - This is pretty common advice given by financial advisers, but so often we forget to set aside enough cash for emergencies (3 to 6 months of living expenses is usually the guideline) and end up having to go into debt on credit cards to cover an unexpected emergency, whether a job loss, car breakdown, home repair, uninsured medical / dental costs, etc. If you don't have the emergency fund at all or if you aren't at an amount you are comfortable with, now is the time to set aside some money to build that up! As I have written previously, don't be lured into thinking a home equity line of credit is an emergency fund - it's not! Here are some ideas where you might want to park that cash. I plan to update this research in the near future for 2020.Increase your retirement savings - If you are contributing to your workplace 401(k), congratulations, that's a great start! If your employer matches your contributions, you always want to contribute at least that amount to take advantage of the "free money" available from your employer. After that, try increasing your contribution rate in small increments each year, maybe 1 percent at a time. I have found over the years that the money taken out of the paycheck is the best because it's out of sight and out of mind and there's no temptation to spend it. Some people advocate saving a portion of your raise each year by increasing your contribution rate. Eventually, you will get to the point where you contribute the annual maximum ($19,500 in 2020, plus an additional $6,500 if you are over age 50). You may also want to consider contributing to a non-deductible IRA even if you are participating in a 401(k) at work. I like contributing to a traditional IRA (nondeductible) and rolling over immediately into a Roth - this is called a "back door" Roth because it's a compliant way to circumvent the income limits imposed on a direct Roth contribution. As long as you keep the money in cash prior to roll-over there should be no tax hit and you get to enjoy appreciation, income and ultimately distributions tax free in the future from the Roth. IRA limits for 2020 are $6,000 ($7,000 if you are age 50 or older), unchanged from 2019.Increase your taxable investing - Especially if you are maxing out your retirement savings at work and with your IRA, but even if you aren't, it's important to build your taxable investing portfolio. I really like buying stocks that pay a good, steady and growing dividend - "qualified" dividends also have a distinct tax advantage over "non-qualified" dividends and you pay a lower tax rate than on ordinary income. See some of my past ideas in Building a Strong Dividend Portfolio and More Dividend Investing Ideas. You can either opt to reinvest the dividends and buy more shares in the stocks, which will allow your investment to compound, or you can take the dividends in cash and reinvest them in money market for emergencies or to buy additional dividend stocks as the opportunities arise. I have also learned that you don't need to go crazy on diversification. A good portfolio can consist of maybe 5 or 10 different stocks as long as the selection criteria are appropriate (i.e., long history of steady and increasing dividends, strong business fundamentals and outlook, etc.). If the market tanks, don't panic and just hold and enjoy the dividend income stream that you have built. Use the extra cash you have built up to buy more of your favorite stocks at a bargain!Build more passive income - In many ways this is related to #3 above. Dividend stock investing is an excellent way to build passive income, where you don't need to do anything other than setup the initial investment and you just collect the money every month or quarter. There are other ways to build passive income as well, which I laid out in this post. It's a good idea to have multiple streams of passive income. Some that I like are buying music royalties, owning investment real property, and self-publishing. It may not seem like much individually, but with multiple streams of passive income, the money can add up over time. Also, working on these "side hustles" can also be really engaging, fun and you can learn a lot about business and investing in the process. You might even become so successful that you don't need to work your day job anymore! End the side hustles that are a lot of work and aren't making you any money - I have observed that often in the rush to make more money, people plunge themselves into multiple side hustles that are a lot of work and really aren't worth it. Usually, it's the ones that require a lot of your personal time like driving for Uber or Lyft, delivering for DoorDash or GrubHub or UberEats, and the list goes on. With the new year, do yourself a favor and look at these side hustles to see whether or not your time is being adequately rewarded. In particular, look at the after-tax income you are getting from all that work. If you are doing well, then by all means keep doing it. But if there's one or two things that you are doing that just aren't worth it, then quit and put your energy into something more productive that leverages your mind and not your personal labor. Review your household budget for opportunities to save / cut expenses - This is an annual tradition in my house and actually happens more often than that, but the new year offers a great opportunity to review all your spending and look for places to cut back. I have found over the years that credit cards tend to be a big challenge, especially after the holidays and birthdays. Some tricks I have learned over the years include limiting the number of cards used, keeping them usage specific (i.e. one card used only for travel, one card for kids' stuff), using debit card for most of day to day spending on groceries, food etc., set up a monthly maximum budget per credit card and configure alert settings to let you know when you are getting close to that and of course, paying off the balance in full each month to avoid paying huge interest charges. Keeping your credit card balances low relative to your limits also really helps out your credit score, I have learned, which is really important when you are ready to buy a car or home.Check your insurance to see if you can get same or better coverage for a lower price - A lot of insurance companies give you good discounts for "bundling" all your coverage together, including car, homeowners/renters, personal umbrella (which I highly recommend having), personal articles (i.e., wedding rings), etc. If you find yourself with multiple insurance companies, look at getting a quote from a few of the large insurers to see if there's any advantage to switching. Even if you can't bundle, it still makes sense to shop around for insurance and the new year provides an opportunity to do so, especially for car insurance. If you are buying a car, buy a used one - A new car is nice, but as we all know, cars depreciate in value the minute you drive them off the lot. Why not use this to your advantage and buy instead a used car (maybe one that is only a few years old and in great condition just off of lease)? The savings can be substantial and the cars, especially the ones that are dealer certified, are like new and many still have warranty or extended warranty can be purchased for a relatively small amount. If you have to get a loan, pay it off as soon as you can. You'll be happy to enjoy at least a few years before your next car with no car payments!Ask for a raise from your boss - If you are doing a great job and the job market is tight, and especially if your research shows that you are "under market," you should think about talking to your boss about a raise. You don't have to threaten them with "I'll be quitting if you don't give me a raise," but you can say "I have been checking the market and it looks like my pay is below market, could you please check into that and get back to me?" If you are branded as disloyal for doing that, you probably aren't working in the right place anyway. If you are doing a great job and they find you are underpaid, you might be getting a raise!Update your estate plan - No one ever wants to think about this or talk about this, but we all have a limited amount of time here on earth and we never know how or when our time will be up. Only God knows that. Having a good estate plan prepared by a qualified attorney is really important, not only for you and ensuring your wishes are carried out after you are gone, but it also makes things easier for your grieving family to execute those wishes with less hassle. Revocable living trusts are typically used to hold all your assets and avoid the probate process, which can be expensive and also very time consuming to go through. If you don't have a will, the courts decide who gets your stuff. You don't want that, obviously. Also, things like having a durable power of attorney for if/when you are incapacitated and you need someone to make decisions for you and an advanced healthcare directive to help determine your healthcare wishes when you are unable to are also really important parts of a comprehensive estate plan. Also take a fresh look at your life insurance and make sure you have enough to take care of your family should you pass. I prefer term life policies since they are cheap and do the job of covering you - often you have these available through your work benefits, but it's also good to have one outside of work just in case you lose your job. Term life policy premiums increase as you get older, but are still cheaper than whole life. Whole life policies have a high, but flat premium and part of the money grows (called "cash surrender value") over time and can be withdrawn tax free as a loan in retirement. Whole life policies might interest you for the retirement planning benefits. Take the new year opportunity to create or update your estate plan. You'll be glad you did! I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 05, 2020 11:41

December 28, 2019

What Really Matters

In coping with the loss of a loved one recently, I was reminded of not only how fragile life is and how quickly it can end, but also what really matters. It's not all the things you have - investments, money, cars, homes, clothes, etc. It's cliche, I know, but you can't take it with you. Life is all about the people who care about you. It's also about treating them with the love and respect they deserve. All the people we love and who love us back - family, friends, work family: they are our true wealth and our greatest strength.

In coping with the loss of a loved one recently, I was reminded of not only how fragile life is and how quickly it can end, but also what really matters. It's not all the things you have - investments, money, cars, homes, clothes, etc. It's cliche, I know, but you can't take it with you. Life is all about the people who care about you. It's also about treating them with the love and respect they deserve. All the people we love and who love us back - family, friends, work family: they are our true wealth and our greatest strength.Having a career and a good job or successful business, being a great investor, growing your portfolio and building a solid retirement nest egg - these things are nice and certainly fill you with a sense of accomplishment, are important to live a comfortable life and lay the groundwork for an equally comfortable retirement. But the reality is, we don't accomplish very much in life on our own without any help. This is particularly true in leadership. Our relationships are what sustain us and help us achieve success in life.

Also, what good are all the accomplishments if not for the people in your life to share your journey, to lift you up when you fall and to celebrate your successes? In the Seven Habits of Highly Successful People, the author talks about how you should "Begin with the End in Mind." That means living your life in a way that you want to be remembered when your life is over. What a powerful guiding principle to live by! What will they say about you when you are gone? A great investor? Or a great person?

I came across this quote that I think lays it out really well, and since I grew up in Hawaii, it really resonates with me. Indeed, it was how my wife chose to live her life, and what she taught all of us who knew her and loved her:

Best wishes to you, your friends and your family this Holiday Season and have a Happy and Prosperous New Year.

As we begin a new year and a new decade, let's not forget what really matters.

In loving memory of Zena - 1970-2019. You lived Aloha.

Published on December 28, 2019 21:49

November 29, 2019

Simplify Holiday Giving For the Kids

For several years now, we have had a holiday tradition in our family of giving each of our kids an equal amount of cash for the holidays and then we let them buy what they want. This works pretty well from pre-teen on up. They receive their cash gift normally before Black Friday, so they can take advantage of the holiday deals. After that, when we celebrate the holidays, we just have a few small things to open (mostly small stocking stuffers) without all the stress and hard work of finding and purchasing gifts, hiding them, wrapping and then putting them out. We can also avoid a lot of the mess we used to have to clean up after opening all those gifts. That may not sound like a lot of fun, but it works for our family - especially since we celebrate both Hanukkah and Christmas (so the kids get a few small things to open on each holiday in addition to the main cash gift).

For several years now, we have had a holiday tradition in our family of giving each of our kids an equal amount of cash for the holidays and then we let them buy what they want. This works pretty well from pre-teen on up. They receive their cash gift normally before Black Friday, so they can take advantage of the holiday deals. After that, when we celebrate the holidays, we just have a few small things to open (mostly small stocking stuffers) without all the stress and hard work of finding and purchasing gifts, hiding them, wrapping and then putting them out. We can also avoid a lot of the mess we used to have to clean up after opening all those gifts. That may not sound like a lot of fun, but it works for our family - especially since we celebrate both Hanukkah and Christmas (so the kids get a few small things to open on each holiday in addition to the main cash gift). This has really helped reduce the amount of money we spend each year on gift giving for the kids, so it's been terrific from a household budgeting standpoint. Also, the kids really like it because they can get what they really want at the best prices. Any gifts of cash from other relatives for the holidays are immediately deposited into the kids' savings accounts. This teaches the kids not only how to be smart shoppers, but to also save some of the money they receive. This year, the kids did most of their shopping online and made very limited ventures into stores. The online shopping favorite is Amazon of course, especially with free one or two day shipping.

If you are looking for ways to control your holiday spend and simplify your life, you may want to try this cash approach next year. Have a Happy Holiday season and a healthy and wealthy 2020!

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here. A perfect gift idea for the holidays!

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 29, 2019 21:52

November 23, 2019

Year End Tax Planning - 2019

Soon it will be the end of 2019 and 2020 will be here before you know it. If you haven't already done so, now is the time of year to start tax planning. If you have to file a 1040 tax form, your taxes are probably complicated enough to require a tax accountant. I used TurboTax for many years and only recently began to use a tax accountant to help me with my taxes. Although it costs a little money, it's a lot less stressful and my estimated payments are way more accurate now. Whether you have a tax accountant or not, here is a checklist of things that you may want to think about to lower your 2019 taxes:

Soon it will be the end of 2019 and 2020 will be here before you know it. If you haven't already done so, now is the time of year to start tax planning. If you have to file a 1040 tax form, your taxes are probably complicated enough to require a tax accountant. I used TurboTax for many years and only recently began to use a tax accountant to help me with my taxes. Although it costs a little money, it's a lot less stressful and my estimated payments are way more accurate now. Whether you have a tax accountant or not, here is a checklist of things that you may want to think about to lower your 2019 taxes:Expenses to accelerate into 2019 (do this if you expect to make the same or less money next year and you are otherwise eligible to take the deduction this year to lower this year’s tax bill):

Pay your January mortgage payment in December (you'll get to deduct the interest in 2019)Pay all your property taxes in December (be careful if you are subject to the Alternative Minimum Tax, since this may not help reduce your taxes and you may be better off paying the second half in 2020)If you are eligible to make an IRA contribution ($6,000 for 2019, with no change in 2020), you have until April 15, 2020 to make your contribution and get the deduction for your 2019 tax return; if you are 50 or older you can make an additional catch-up contribution of $1,000. You can make an IRA contribution regardless of whether you participate in a retirement plan at work, but your ability to deduct the contribution may be limited. You can also convert a traditional IRA into a Roth IRA at any time, even if you can't contribute directly to a Roth because of your income level. This is called a "backdoor conversion." Roth's are great because you don't have to pay taxes on the contributions or earnings when you withdraw the money and the withdrawal rules are more flexible than a traditional IRA. You just have to make sure you don't roll over traditional IRA with gains, since you'll pay tax on that (keep in cash until you convert).Sell investments that have lost money and you no longer want to keep by December 31; the limit is $3,000 of (net) capital losses that you can offset against your ordinary income. Losses in excess of this amount are “carried forward” to future tax years, which means you can't use those losses until you have gains to offset or up to $3,000 against ordinary income per year.Good news for RobinHood traders: your trading losses can be used to reduce your taxable income, but if you have gains be prepared to pay taxes. Most stock option trading activity is considered short term capital gains or losses and are generally taxed at ordinary income rates up to 37%, depending on your tax bracket (vs long term capital gains rates which are taxed at 0%, 15% or 20%). Be careful when you have trading gains at year end and you have significant losses on unclosed positions - it might make sense to close all your positions at year-end and avoid the tax hit, if they are not likely to turn around in the new year. Also, make sure you pay estimated taxes if you made money on your trading this year!

Delay income from 2019 to 2020 (similar to expenses, if you expect to make the same or less money next year and you are otherwise able to delay the income):

Delay sale of investments with capital gains that you no longer want to hold until January or laterDefer cash bonus payments until January or laterHave your tax accountant check your estimated taxes paid and withheld to make sure you have paid enough so that you won’t be subject to underpayment penalties when you file your return in April. If you have significant investment or other non-wage income like fees, royalties and other passive income, you will likely need to pay estimated taxes.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 23, 2019 21:39

November 16, 2019

Broadmark: Great Passive Income Idea

Broadmark Realty Capital Inc. (NYSE: BRMK) offers short-term, first deed of trust loans secured by real estate to fund the acquisition, renovation, rehabilitation or development of residential or commercial properties. Broadmark Realty Capital manages and services its loan portfolio across a variety of market conditions and economic cycles. Since its inception in 2010 through June 30, 2019, Broadmark Realty Capital has originated over 1,000 loans with an aggregate face amount of approximately $2.0 billion.

Broadmark Realty Capital Inc. (NYSE: BRMK) offers short-term, first deed of trust loans secured by real estate to fund the acquisition, renovation, rehabilitation or development of residential or commercial properties. Broadmark Realty Capital manages and services its loan portfolio across a variety of market conditions and economic cycles. Since its inception in 2010 through June 30, 2019, Broadmark Realty Capital has originated over 1,000 loans with an aggregate face amount of approximately $2.0 billion.Broadmark deals in several different types of short term secured real estate loans, including construction loans, land development loans, bridge financing loans and heavy rehab / redevelopment loans. They have originated loans in 15 states and Washington D.C.

Recently only available to accredited investors through private placement, the family of privately-held Broadmark Real Estate Lending Funds merged with a public shell company to form Broadmark Realty Capital (BRMK) and its first day of trading was last week Friday (11/15). The merger had many benefits, including public market liquidity for the private equity owners, diversification for shareholders across a much larger portfolio of loans with broader geographic diversity, additional capital to grow the loan portfolio, ability to expand lending to other states, and self-management (eliminated loan origination and management fees previously paid to the management company).

Broadmark has a 10 year track record of success and has been providing yields of between 9% and 11% to its investors, paid on a monthly basis, without the use of leverage. The lack of leverage is significant, since many mortgage REIT's borrow money to improve shareholder returns, which can significantly increase risk depending on the leverage ratio. All of Broadmark's loans are conservatively underwritten, funded with investor equity, secured with 60% or lower loan to value ratios and are for very short terms, typically a year or less, which significantly lowers the risk of default. The company has had very few defaults in its history - most recently, $1.8M for the year ended December 31, 2018 and $73K for the six months ended June 30, 2019. This is notable for a loan portfolio of over $700M.

Short term real estate lending was once the domain of regional banks, but since the Great Recession and with all the changes in the banking regulatory environment, this part of the real estate market was essentially left behind and created the opportunity for Broadmark. That situation has not changed even now, and there is still substantial demand for short term real estate financing that is not being met by banks, so the outlook for continued loan demand and growth looks promising.

The numbers are pretty compelling, based on the registration statement filed with the SEC. The company has assets at book value of over $1.2B, including $722M of loans and $283M of cash based on the unaudited pro forma condensed combined balance sheet as of June 30, 2019. Assuming results for June 30, 2019 are annualized, the new combined company will earn almost $120M, which translates into between $0.94 and $1.04 per share on a fully diluted basis (depending on how many shareholders of the old shell company redeem their shares). Based on the first day closing price of $10.89, that's a yield of 8.6% to 9.5%. Since the company is a REIT, it's required to distribute at least 90% of taxable income to shareholders, but for simplicity I assumed all of the net income is distributed.

In summary, Broadmark is a great passive income idea for someone looking for a strong yield with less risk than a typical leveraged mortgage REIT.

Disclosure: my family and I own shares in Broadmark.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year. If you are interested in other passive income ideas, see my post here.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 16, 2019 22:54

November 9, 2019

Don't Ignore Recession Warning Signs

Every week we hear more about how the economy might be slowing, companies are reporting lower earnings than last year, trouble brewing in Europe with a slowing economy and yet the stock market keeps going up, most recently the bond market has dropped as long rates have risen and most investors continue to be bullish and pile into stocks. As an investor it's important not to ignore the warning signs and make sure you have Built a Financial Fortress for yourself and your family.

Every week we hear more about how the economy might be slowing, companies are reporting lower earnings than last year, trouble brewing in Europe with a slowing economy and yet the stock market keeps going up, most recently the bond market has dropped as long rates have risen and most investors continue to be bullish and pile into stocks. As an investor it's important not to ignore the warning signs and make sure you have Built a Financial Fortress for yourself and your family. It's not whether we will have a recession, it's simply a matter of when. Every recession is a little different. The Great Recession was triggered by a collapse in residential real estate values and lending, ultimately bringing down with it some of the largest financial institutions of the time and many banks. This time it may be different. I have assembled a few charts to help tell the story of what is happening now and what might trigger the next recession.

US stock market (S&P 500) continues to move up due to low interest rates, favorable trade news, generally good economic news (mostly about the US consumer), with no sign of weakness in the near term; a collapse in stock market values from their current highs (30% or more correction, which is certainly possible especially as the market continues its move up) will impact consumer sentiment and ability / desire to spend money, which is a key driver of economic growth:

Money supply has resumed a strong upward growth trajectory, keeping cost of borrowing low and ensuring a steady flow of credit, which is very important to the consumer and the Fed has an unlimited capacity to print money. The downside is that it makes the dollar weaker in the long run, which makes everyone poorer who holds cash.

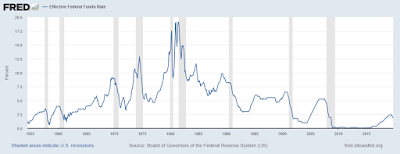

Interest rates are already getting close to zero so there is not much more room to continue to lower rates. The Federal Reserve has stated that they don't plan to allow interest rates to go negative as they are in many other countries - a situation that is unprecedented and no no one really knows what the long term effects of this will be. With rates already so low and with a recession looming, it's certainly possible to see negative rates in the US regardless of what the Fed has previously stated:

Meanwhile, real GDP growth has actually been negative for years (that's why for many it feels like the Great Recession never ended); even the official number has been dropping recently:

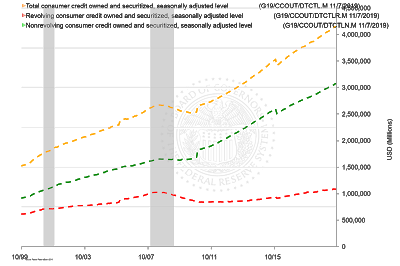

The real story behind the recovery since the Great Recession is the growth of consumer debt, which currently stands at just over $4 trillion and has almost doubled since the end of the last recession; the collapse of consumer credit could trigger the next recession, since the consumer drives about 70% of the economy:

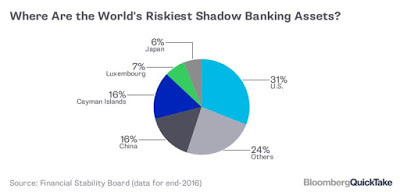

Indeed the growth of "shadow banking" $45 trillion or about 7.6% of all financial assets in 2016 when last measured, is also a significant risk since these are beyond the reach of regulators (think Bear Stearns and Lehman Brothers), with the US leading the rest of the world in having the largest share of risky shadow banking assets - see chart below. Today shadow banking comprises pawn shops, peer to peer lending (i.e., Prosper), private equity lending and businesses that provide credit to customers for buying their products in addition to broker dealers and money market funds.

If you're interested, I recently put together a recession preparation checklist post here. Hopefully we'll have another year or so of calm before the storm, but it pays to always be prepared.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 09, 2019 11:44