Nick Reichert's Blog, page 19

August 24, 2019

Trader Mike's Picks for Next Week (8/26)

Here's the next weekly installment of Trader Mike's picks. Trader Mike spends hours a week combing the internet doing deep research on stocks he thinks will have great short term profit prospects. Lately, he has been bullish on retail names that have been reporting earnings.

Here's the next weekly installment of Trader Mike's picks. Trader Mike spends hours a week combing the internet doing deep research on stocks he thinks will have great short term profit prospects. Lately, he has been bullish on retail names that have been reporting earnings.Let's see how last week's picks did:

Home Depot - Home Depot (HD) reported earnings of $3.17, beating the estimate of $3.09 by 2.6%, jumping $10 per share or almost 5% by the end of the day. Calls were rock solid

Target - Target (TGT) reported blow out earnings of $1.82, beating the estimate of $1.62 by 12.3%, jumping almost $17 per share or almost 20% by the end of the day. Calls were rock solid.

Foot Locker - Foot Locker (FL) reported disappointing earnings of $0.66, missing the estimate of $0.67 and the stock got hammered closing down almost $8 or 19% by the end of the day after rising almost 10% in after hours trading leading up to the announcement. Additionally, Jerome Powell speech and Trump trade war angst didn't do much to help the market in general on Friday. Calls got destroyed.

Two out of three, not bad.

Here are Trader Mike's picks for next week:

Best Buy - Best Buy (BBY) reports earnings on 8/29 before the market opens; call options priced around $1.80 expiring 9/6 look good ($70); BBY closed on Friday at $66.21 (Friday's market sell-off has driven down cost of calls quite a bit, creating an opportunity)

Rationale:

>Consistently beats earnings

>US consumer is doing well based on WalMart, Target, Home Depot, Lowe's and other big box retailers who have reported recently

>Improved online sales platform; recent cost efficiency initiatives have been effective; smart television/gaming/health and wellness/connected home/virtual reality technologies offer product cycles that can drive near term top line outperformance

Ulta Beauty - Ulta Beauty (ULTA) reports earnings on 8/29 after hours; call options priced around $5 expiring 8/30 look good ($342.50); ULTA closed on Friday at $322.10 (Friday's market sell-off has driven down cost of calls quite a bit, creating an opportunity)

Rationale:

>Consistently beats earnings

>US consumer is doing well based on WalMart, Target, Home Depot, Lowe's and other big box retailers who have reported recently

>Robust traffic and sales, savvy partnerships with social media stars, attracting consumers to stores even as malls remain empty

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress this year.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on August 24, 2019 11:08

August 17, 2019

Trader Mike's Picks For Next Week

On vacation in Hawaii this week, but still thinking about investing and Building the Financial Fortress.

On vacation in Hawaii this week, but still thinking about investing and Building the Financial Fortress.This week's post will feature three of my son's stock picks for next week's earnings calls. He has a pretty good track record so far this earnings season, correctly buying calls on earnings beats for WalMart, Nvidia, Roku and Shake Shack. Bad picks included Disney (strangle) and Beyond Meat (call). Uber ended up being okay with a strangle as the puts came into the money the week after as stock dropped below $40.

Here they are:

Home Depot - Home Depot (HD) reports earnings on 8/20 before the market opens; call options priced around $1 expiring 8/30 look good ($215); HD closed on Friday at $204.51.

Rationale:

Consistently beats earnings

US consumer is doing well based on WalMart results last week

Drop in mortgage interest rates will provide added lift to home refinancing (including cash out for home improvements) and home purchases

Target - Target (TGT) reports earnings on 8/21 before the market opens; call options priced around $1 expiring 8/30 look good ($90); TGT closed on Friday at $84.49.

Rationale:

Consistently beats earnings

US consumer is doing well based on WalMart results last week

Like WalMart, pursuing strong internet strategy

Foot Locker - Foot Locker (FL) reports earnings on 8/23 before the market opens; call options priced around $1 expiring 8/30 look good ($44); closed on Friday at $38.80.

Rationale:

Consistently beats earnings

US consumer is doing well based on WalMart results last week

Currently trading close to a 52 week low, could move up a lot with positive results

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress this year.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on August 17, 2019 13:05

August 11, 2019

Time to Refinance?

You may have noticed that interest rates on the 10-year Treasury bond, which are what most mortgage loans are tied to, have been plummeting recently to lows we have not seen in a few years and are now well below 2%. This could be a great opportunity if you own a home or have investment property that has not been refinanced for a few years. See chart below.

You may have noticed that interest rates on the 10-year Treasury bond, which are what most mortgage loans are tied to, have been plummeting recently to lows we have not seen in a few years and are now well below 2%. This could be a great opportunity if you own a home or have investment property that has not been refinanced for a few years. See chart below. 10 Year Treasury Rate (One Year) Courtesy of www.macrotrends.net

10 Year Treasury Rate (One Year) Courtesy of www.macrotrends.netNow might be a good time to consider refinancing your mortgage, depending on the rate you currently have. A quick review of interest rates online at Bankrate.com shows rates on conventional loans averaging 3.88%. Chase is offering rates as low as 3.5%, while Bank of America is offering 3.625% and Wells Fargo is offering 3.75%. If you have a jumbo loan (over $484,350 conventional loan limit), rates are a little higher but still lower than they were just a few years ago.

The good news is if you refinance and don't take any cash out, even if your loan is above the new IRS deduction limits (loans over $750,000), you can still deduct interest on the full amount of the refinanced loan.

One idea is you can take the monthly savings from refinancing and rather than spending it, put that into an investing strategy. See my post on some investing ideas here.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress this year.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on August 11, 2019 19:50

August 10, 2019

Investing in Gold and Silver

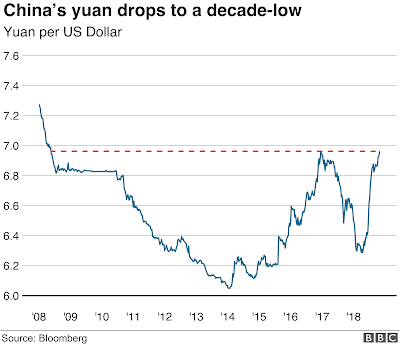

Fears about the China / US Trade War linger and global central banks continue to lower interest rates and devalue their currencies in an effort to keep the economic expansion going and forestall a recession. Indeed, devaluing currency has become a powerful tool for China, sending shock waves through the US stock market recently when the Chinese yuan was pegged at just below 7 to the dollar, the lowest it has been in a decade (see chart below). This makes Chinese goods cheaper and helps neutralize the effects of tariffs that have been added by the US government to Chinese imports (with more scheduled to come), and thereby helping ensure no quick resolution to the trade war.

Fears about the China / US Trade War linger and global central banks continue to lower interest rates and devalue their currencies in an effort to keep the economic expansion going and forestall a recession. Indeed, devaluing currency has become a powerful tool for China, sending shock waves through the US stock market recently when the Chinese yuan was pegged at just below 7 to the dollar, the lowest it has been in a decade (see chart below). This makes Chinese goods cheaper and helps neutralize the effects of tariffs that have been added by the US government to Chinese imports (with more scheduled to come), and thereby helping ensure no quick resolution to the trade war.

Gold and silver have had a good run lately (see chart below) as a result of these market uncertainties. For these and many other reasons, stocks and bonds have been very volatile in recent trading sessions and investors are nervous about the future. These are the times that hard assets such as gold and silver come into demand.

Some believe that the actual rate of inflation is much higher than what the government officially reports (see chart below), but even if that isn't true we all know that a dollar just doesn't buy as much as it used to and that's inflation, plan and simple. The second chart below shows the decline in the value of the dollar since 1987 - now worth about 40% less! Gold and silver are great hedges against inflation and dollar depreciation (so is Bitcoin, but that's another post)! Store of value and "safe haven" as well as near term upside are the key themes for investing in gold and silver currently, but gold and silver also have their place as a long term portfolio holding.

Courtesy of ShadowStats.com

Courtesy of ShadowStats.com Courtesy of ShadowStats.com

Courtesy of ShadowStats.comThere are many ways to invest in gold and silver. Perhaps the easiest is to buy shares in ETF's such as the SPDR Gold Shares ETF (GLD) or the iShares Silver Trust ETF (SLV). GLD is up 15.3% over the past 3 months and 6.36% the past month. SLV is up 14.65% over the past 3 months and 11.35% over the past month. It wasn't too long ago that silver doubled in value from about $15 per ounce to $30 per ounce, before dropping back down, so silver can be especially volatile. Shares in these ETF's are backed by actual physical stored gold and silver. Since these funds are actively traded, they are easy to buy and sell, much easier than buying the physical metal and having to store it yourself. I do think it's important to have some physical gold and silver in your portfolio as a long term holding, preferably stored in a bank safe deposit box. If you are interested in more upside, you can also invest in gold mining companies, either directly or through ETF's. For example, the largest such fund is Van Eck Gold Miner's ETF (GDX), with a year to date return of about 39%. This fund tracks all the largest gold mining companies included in the AMEX Gold Miner's Index. It also pays a small dividend.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

Check out my book on investing in gold and silver here (only $0.99 on Kindle and free with a Kindle Unlimited trial). To see all my books on investing and leadership, click here.

Disclaimers: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog. I am also long on SLV, GLD and GDX.

Published on August 10, 2019 11:13

August 3, 2019

Charting a Course for the Rest of 2019

With all the recent volatility in the stock market, concerns about a possible recession, lower interest rates, etc. you are probably wondering "Where should I put my money now?" If you have built your Financial Fortress, you don't need to worry too much about you overall net worth because it is safely and securely invested, but you may need to make some minor adjustments in your investment portfolio. I recently completed such a review and "tune up" and wanted to share some of my thoughts.

Better Yields. If you have excess cash, you may want to move some of that into a better yielding investment such as solid dividend paying stocks (see my recent post on this here). Some good names I have been tracking lately include Alliance Bernstein (AB) with an 8.29% yield, AbbVie (ABBV) with a 6.55% yield, ATT (T) with a 5.97% yield and ExxonMobil (XOM) with a 4.85% yield. These are all solid companies, with a long track record of paying and increasing dividends, but as always make sure you do your own research. Unlike investing in Treasury Bills, you do take some risk that the value of the stocks could decline in a market correction, but if you are willing to hold long term and the companies continue to operate consistent with their long term track record, there should be little reason for concern. True story: I know someone who bought 1,000 shares of Apple (AAPL) in 1996 for $4/share. Forgetting the enormous capital gain and just focusing on the dividend, those shares (after split adjustments) pay out a dividend of $3.08 per share or about $12,500 annually, so every year they are getting 3x their original investment back in the form of a dividend. Not bad.

Bitcoin. Bitcoin, which has rallied significantly this year, might be another option for excess cash. Although extremely volatile, I believe that Bitcoin has long term value as a more liquid alternative to gold or silver as not only an investment and store of value, but also a currency. While there are many other cryptocurrencies available and it may make sense to have some exposure to the more popular ones such as Litecoin or Etherium, I think a core holding of Bitcoin is the safest. As I have written previously, I don't recommend mortgaging the house to buy Bitcoin. Instead, I recommend no more than a small percentage of your total portfolio should be invested in it (5% maximum). I continue to invest $100 per month in Bitcoin but have been considering putting in a bit more. While I'm very bullish on Bitcoin, I do still like to have a core holding of physical gold and silver coins which are stored in a bank safe deposit box for safekeeping with no plans to sell that.

Real Estate / Royalties. Other ideas for getting a better yield include real estate investments (there are plenty of options available - see this post for some ideas) and investing in music royalties. I wrote about music royalty investing originally quite some time ago and have had over a year of actual experience with that investment. Over the last four quarters, the investment has yielded 6.9%, which is well above my loan interest rate 5.3% (I took out a small loan to make this investment and take advantage of the spread). With a continuing low interest rate environment, there will continue to be an opportunity to borrow funds at low rates for good investment opportunities, but as always you need to manage your risk when using leverage in your investing.

Retirement Accounts. If you have money in a 401(k) or IRA, keep it simple and safe. I recently moved my 401(k) funds into a "lifestrategy" fund with a risk profile that is appropriate to my general risk-averse nature. It's comprised of a number of bond and stock ETF's, is very low cost and has a 5 Star Morningstar rating. With a relatively high allocation to bonds, it shouldn't move too much in a major market downturn, which will help me sleep better at night. In my IRA, I just invest in QQQ (NASDAQ 100 tracking ETF) and SPY (S and P 500 tracking ETF), with the strategy of just holding and reinvesting dividends for the long haul. Since it's much smaller than my 401(k), I won't worry too much about fluctuations in these balances through market cycles. I try to max out my 401(k) contribution and by IRA contribution annually. I do a "back door" Roth IRA where I contribute to a nondeductible Traditional IRA and then immediately roll the cash balance over into the Roth so there is little to no tax impact.

Speculation. As I wrote about extensively in my series on Robin Hood, investing in stock options is extremely risky, but can also be very rewarding in any market environment. Although I wasn't too successful in my initial attempt, I learned a lot in the process and think there's a place in your investing program for at least some of this type of activity. Of course, managing risk is critical and if you are successful, you'll be paying plenty of taxes, so it definitely makes sense to set aside some of the profits for them. It also makes sense to go for small wins and not swing for the fences (like buying calls on Beyond Meat (BYND) before earnings)! What a disaster!

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on August 03, 2019 09:37

July 27, 2019

More Dividend Investing Ideas

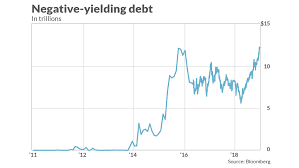

Last week I wrote about building a strong, diversified portfolio of reliable dividend stocks. As I discussed in that post, we seem to be headed into a very low interest rate environment, with the Fed set to cut interest rates next week (with a 79% chance of a 25 basis point cut and a 21% chance of a 50 basis point cut) and many other central banks around the world already heading toward negative interest rates, if they aren't already there. Below is a chart that has been circulating around social media for the past few weeks showing this disturbing trend.

Last week I wrote about building a strong, diversified portfolio of reliable dividend stocks. As I discussed in that post, we seem to be headed into a very low interest rate environment, with the Fed set to cut interest rates next week (with a 79% chance of a 25 basis point cut and a 21% chance of a 50 basis point cut) and many other central banks around the world already heading toward negative interest rates, if they aren't already there. Below is a chart that has been circulating around social media for the past few weeks showing this disturbing trend.

As I discussed last week, this makes it difficult if not impossible as an investor to put your money to work safely in an interest bearing account. Indeed, if you are investing at a negative rate, you are having to pay the bank to hold the money versus the other way around. While the US has not reached negative rates yet, if you consider the effects of inflation and the upcoming rate cuts from the Fed, we probably already have negative "real" interest rates.

As such, investors need to look into other ways to earn a yield while managing the amount of risk taken on in the process. Investing in solid dividend yielding stocks are one such way and with the lower US tax rate on "qualified" dividends, there's also a tax benefit to these vs interest bearing accounts.

This post will look into some other ways to achieve high dividend yields. Buying an Exchange Traded Fund or ETF is a very efficient way to invest in dividend yielding stocks and there are many to choose from. Indeed, buying an ETF is a lot easier than having to buy individual stocks and is an easy way to diversify your risk. Please note that you'll need to do your own research and this is not a recommendation to buy any particular stock or ETF.

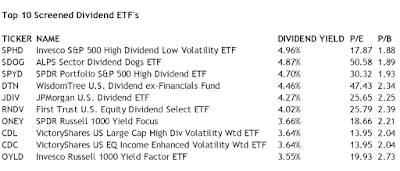

Below are the results of a quick screen I performed of the best performing large cap, US dividend ETF's:

As you can see, the best of the bunch is the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD), with a yield of 4.96% and a pretty low P/E. Coming in at Number 10 is the Invesco Russell 1000 Yield Factor ETF (OYLD) at 3.55%. Note that with the recent market rally, some of the yields have trended a bit lower that what is reported in the screener. It's interesting to note the P/E ratio of these ETF's compared to that of the S&P 500 which is about 21.3 based on last full quarter of data (March 2019). The higher P/E ETF's would appear to be a bit riskier than ones that are at or below the S&P 500 average and this should be a consideration when selecting a fund.

I hope you find this post useful as you chart your investing course and Build a Financial Fortress this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on July 27, 2019 11:23

July 20, 2019

Building a Strong Dividend Portfolio

As you may know, the Federal Reserve has signaled that it intends to cut interest rates (77.5% odds of a 25 basis point cut in July) in order to keep the economy and markets moving forward and proactively avoid a recession. If you are like me and have been enjoying the relatively high interest rates paid by banks and TreasuryDirect (TBills) as I have blogged about previously, that is all about to come to an end over the next year and depending on the pace of rate cuts, maybe sooner than we think. Where interest rates end up at the conclusion of this cycle is anyone's guess, but we already have examples in Japan and Germany where the rates have actually gone negative and it costs you money to put it in the bank. This should be concerning for any investor who is trying to build a safe, reliable stream of passive income.

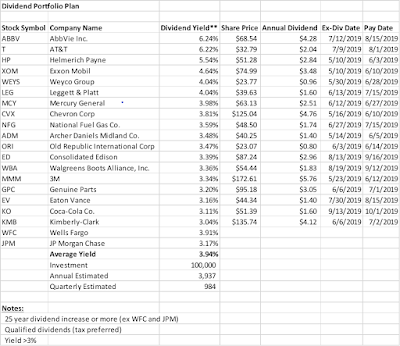

As you may know, the Federal Reserve has signaled that it intends to cut interest rates (77.5% odds of a 25 basis point cut in July) in order to keep the economy and markets moving forward and proactively avoid a recession. If you are like me and have been enjoying the relatively high interest rates paid by banks and TreasuryDirect (TBills) as I have blogged about previously, that is all about to come to an end over the next year and depending on the pace of rate cuts, maybe sooner than we think. Where interest rates end up at the conclusion of this cycle is anyone's guess, but we already have examples in Japan and Germany where the rates have actually gone negative and it costs you money to put it in the bank. This should be concerning for any investor who is trying to build a safe, reliable stream of passive income. As a result I have been looking into building a theoretical portfolio of 20 solid dividend yielding stocks that can perform well in this low rate environment. Using a dividend screener, I looked for well-established companies that have a 25-year or longer history of increasing dividends, the dividends are "qualified" meaning they are subject to the lower 0% - 20% maximum tax rate (depending on your income) and a yield of 3% or better. The screen results are shown below along with the expected return on an equally weighted $100,000 investment in the portfolio. As you can see, the average yield of this portfolio would be 3.94%, resulting in a $3,937 annual dividend or about $984 per quarter. Since all these companies raise their dividend regularly, the expectation is that the dividend yield would continue to grow over time.

I did take a look at Berkshire Hathaway's annual report disclosure of owned publicly traded companies for good dividend ideas, but all of the yields are very low except for Wells Fargo and JP Morgan Chase, which I added to the list because they are solid companies with good long term prospects and they meet the yield criteria. Note that three of the four stocks I recommended for a passive income dividend stream in a prior post made it to this list (AT&T, ExxonMobil and Consolidated Edison). The reason why Ventas (VTR) did not make this list is because the dividend is not "qualified." Typically, REIT dividends are not considered qualified, although they can be quite attractive. I like the diversified range of industries on this list as well (I didn't screen for any particular industry). Additionally, many of these names are also recommended by dividend investor blogs that I follow.

Having a balanced portfolio that includes a selection of excellent dividend yielding stocks for passive income is an important part of Building a Financial Fortress, regardless of the general investing environment, but especially as we head into a low interest rate environment.

I hope you find this post useful as you chart your investing course this year.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on July 20, 2019 18:14

July 13, 2019

Day Trading on Robin Hood - Peace Out (For Now)

This is the final post in my series on experimentation with options trading strategies on Robin Hood.

This is the final post in my series on experimentation with options trading strategies on Robin Hood.Last week, I reported that I was going to try a new strategy on Monday of this week. Well I was unable to get the Iron Condors opened for Coke and Sysco, so that didn't work out. Then I tried buying a put on SPY, since it was dropping from the market open on negative sentiment (I bought shortly after the market opened). By the time I finished getting ready for work, the stock reversed course and started climbing and the put started to drop in value (a put goes up in value if the stock price drops and goes down in value if the stock price increases). After I lost $300, I decided that I had had enough and I sold out. SPY continued to climb for a while in the early morning, peaked and then started to decline after that and actually ended the day down.

After all this, I realized that I just don't have the patience / temperament for trading. I hate losing money more than I like the prospect of large gains. I think this is my generally conservative approach to risk, which forms the foundation of my basic investing strategy, the Financial Fortress. I certainly don't have the time for trading with a day job. Time is probably the most important thing you need to perform basic research, track the market's activity from hour to hour throughout the day and take advantage of situations as they develop. You also need to have great instincts. For example, my son (he's 18 and his summer job is "day trader") woke up late that same day after SPY spiked and sensing that it was headed back down, bought his SPY puts and ended up making $2,000 that day. Now that's a trader!

So I pulled out the remaining funds I had in Robin Hood and parked in my savings account for another day. Maybe I'll buy some more 4 week Treasury Bills on Treasury Direct (see my post on best ideas to earn interest on your extra money) while I decide what to do next. I also still like Bitcoin a lot, as I have written about previously. I continue to own a small amount of Bitcoin myself and have been watching developments in the cryptocurrency space with great interest.

Lessons learned about options trading:

When investing in options, study them and make sure you understand how they work and what your risk level is in each situationIf you are selling a call or a put (i.e., in an Iron Condor), be very careful about the stock you pick and understand your downside risk; generally speaking buying puts and calls is much safer in terms of limiting downside risk, but you will lose all your money if they expire worthless or "out of the money"Don't invest more than you are prepared to loseWhen investing on margin, know that you can lose more than your investment (if your investment becomes worthless, you still have to pay back the margin loan)Do your research / homeworkKeep a watchful eye on your positions and be prepared to sell to lock in gains or cut lossesTiming is everything

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on July 13, 2019 10:33

July 6, 2019

Day Trading on Robin Hood - Part 5

As I mentioned in my previous post, this is an update of how Friday went in closing out my Iron Condor positions remaining on FDX on the Robin Hood app. It was ugly. Recall that I had sold a put at $165 that was "in the money" and also bought a put at $162.5 that was also "in the money" but only offsetting about half the loss of the sold put. As luck would have it, the jobs report this morning was strong (bad news for the market because Fed rate cut prospects this month are dimmed significantly and now a very low 4.9% chance of a 50 bp rate cut) and so the whole market was down from before the open, but recovered some losses later in the day. FDX was no exception, opening at $161, hitting a high of $162 and a low of $160 before closing at $161. I closed out my position with a loss of $2,415 after selling / buying back the puts. That basically erased all my profits and put me down about $700 overall, for the past few weeks of trading activity. A very valuable (and costly) lesson learned to enter positions carefully (do your homework and pick the right stocks), keep a watchful eye on your positions and exit quickly to limit losses when they start going south. Trading is definitely not "easy money."

As I mentioned in my previous post, this is an update of how Friday went in closing out my Iron Condor positions remaining on FDX on the Robin Hood app. It was ugly. Recall that I had sold a put at $165 that was "in the money" and also bought a put at $162.5 that was also "in the money" but only offsetting about half the loss of the sold put. As luck would have it, the jobs report this morning was strong (bad news for the market because Fed rate cut prospects this month are dimmed significantly and now a very low 4.9% chance of a 50 bp rate cut) and so the whole market was down from before the open, but recovered some losses later in the day. FDX was no exception, opening at $161, hitting a high of $162 and a low of $160 before closing at $161. I closed out my position with a loss of $2,415 after selling / buying back the puts. That basically erased all my profits and put me down about $700 overall, for the past few weeks of trading activity. A very valuable (and costly) lesson learned to enter positions carefully (do your homework and pick the right stocks), keep a watchful eye on your positions and exit quickly to limit losses when they start going south. Trading is definitely not "easy money." Not being one to give up easily, I decided to come up with a new strategy to try for next week.

Here it is:

1) Enter into 2 Iron Condors for small amounts (around $500 each position) to help ensure execution of the trade and limit losses if the position doesn't work out. Select low beta stocks that have low volatility.

Coke (KO) 7/12 $51.5 - $52.5 (1Yr Beta 0.48 / Volatility 1.24%)Sysco (SYY) 7/12 $71.5 - $72 (1Yr Beta 0.52 / Volatility 0.7%)By comparison Beyond Meat (BYND) has a Volatility of 3.87%, so the companies selected are good candidates for IC and also no earnings next week, which adds to volatility and should be avoided.

2) Set aside remaining funds for opportunistic put / call trades on the SPDR S&P 500 ETF (SPY), which is the largest and most liquid exchange traded fund. I'm currently researching strategies that can be used to make smaller profits with no more than one trade a day placed after 1pm EST, when most of the news for the day has been traded. With the right strategy, I believe you can be successful making small profits most of the time due to the size, liquidity and limited movement of SPX on a weekly basis. To do this it's important to be disciplined: set target profit (say 20% - 50%) and close out when you hit it, close all positions at the end of the day regardless to avoid "surprises" overnight that could impact you the next day and also monitor and close out if losses exceed your target (say 20%). Also, options are available that expire on Wednesday and Friday of each week for SPY, versus the typical weekly expiration on Friday, which is helpful for setting up trades. More to follow on how this works out in future posts!

Hopefully you found this insightful and it helps you Build Your Financial Fortress!

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on July 06, 2019 10:41

July 4, 2019

Day Trading on Robin Hood - Part 4 (Midweek Update)

Continuing on with my Robin Hood series, here's a midweek update on my option trading adventure.

Continuing on with my Robin Hood series, here's a midweek update on my option trading adventure.This week has been a wild ride, perhaps unnecessarily so as I'll explain later in the post. I put in two 7/5 Iron Condors on Monday for FDX $165-$170 and one for NFLX $370-$377.5 at market open. Netflix started moving up strongly on Wednesday when the market opened, with upbeat news about one of its shows Stranger Things, so I exited the contract at a profit of about $224. NFLX closed the day at $382, which was well above the call I sold, so I would say this was a "good call," pun intended. One thing I realized is that you have to watch these after they are setup and monitor your alerts. If there is a strong move in one direction or another, you need to risk manage. Even with very low volatility stocks, this can be a problem if there is positive or negative news on the company. In hindsight, there are much better stocks that have lower volatility and beta that are much better candidates for Iron Condors, such as Coke (KO) or Sysco (SYY) or even Nike (NKE). I have found that Iron Condors are hard to get into for companies like these, but what seems to work best is to put the order in the evening prior so it executes the next trading day rather than trying to place them during the day. Patience is better than jumping into positions that are riskier, but perhaps easier to get into. I also closed out my position in NKE $79-$86.5 at a profit of $156 on Wednesday morning. Nike ended the day up at $86.13, still out of the money from the sold call, but getting a little too close for comfort.

The big news of the week was FDX, which after further research I realized has really a high one year beta of 1.66 and volatility of 1.37 and to top it off, the stock has been under a lot of pressure since earnings release last week due to bad economic data, still unresolved trade war issues and a variety of other company specific concerns such as the cost of fuel, capital spending needs, etc. You typically want something less than 1 beta and volatility (the lower the better) for a good Iron Condor strategy. Also, Zack's put out a strong sell recommendation on July 3 for FDX, which didn't help matters.

Almost immediately after entering the Iron Condor, the stock started to drop, opening on Monday at $168 and closing at $163. On Tuesday FDX opened at $163 and closed at $160, putting me way under water on the put I sold at $165. The put I bought as part of the Iron Condor was also in the money, but it only offsets about half of the losses you incur in the sold put because the strike price is lower at $162.5. Fortunately on Wednesday, FDX closed at $161, recovering slightly so I closed out the call portion of the trade to lock in those profits and now need to take action on Friday since the put options expire that day. The original premium on the Iron Condor was $1,590, which would have been my profit had everything gone as planned, but now I'm looking at a loss of about the same amount. This is definitely not a low risk strategy if setup incorrectly and not carefully managed.

Friday will be interesting with a light trading session expected due to the July 4th holiday and the Friday Employment Report from the Department of Labor due out before the market opens, which could cause the market to move up or down depending on the result and the market's reaction. I'm sure bad news will be good news and vice versa, so if the report is weak investors will expect a Fed rate cut of 50 basis points this month and the market will be up. If the report is strong, then the market will sell off. That seems to be how it works. Right now, futures are up, pointing to a positive open which could be helpful.

The lesson here is that it's important to do your research, take a disciplined approach and don't "go with your gut" when trading options. Also, with all option strategies, you need to actively manage your positions and risk manage. There is no "set it and forget it" strategy. Better to take a small profit consistently than incur huge losses interspersed with huge gains by taking a lot of risk on.

In my normal end of week post I'll report on how things unfolded with unwinding the FDX trade and I'll let you know my setup for next week.

Again, no fees on any of these trades with Robin Hood, which is very helpful to overall profitability.

Hopefully you found this insightful and it helps you Build Your Financial Fortress!

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on July 04, 2019 12:15