Nick Reichert's Blog, page 22

March 2, 2019

7 Tax Season 2019 FAQ's

It will be April before you know it and soon it will be time to file your taxes. I put together this FAQ that might be helpful as you decide whether and how you should file, what to do with your refund or if you have to pay, what to do about that.

It will be April before you know it and soon it will be time to file your taxes. I put together this FAQ that might be helpful as you decide whether and how you should file, what to do with your refund or if you have to pay, what to do about that.1) Do I need to file a Federal tax return?

If you made more than $12,000 in 2018 and are single ($24,000 if married) and under age 65, you have to file a tax return with the IRS2) When is the deadline to file taxes for 2018?April 15, 20193) How should I file?You can either complete your taxes by yourself and file on your own or use a service. That will normally depend on the complexity of your tax situation and whether you are comfortable doing the work, which can be tedious and involve a lot of math.

4) What is a "simple" tax return?

A simple tax return typically includes wage income (your employer sends you a W2 form), simple investments like bank interest and some stock dividends (you receive 1099INT and 1099DIV forms) and basic deductions like mortgage interest, state and local taxes, charitable contributions and maybe an IRA contribution

If you have a simple tax return, you can file it yourself for free at one of these sites:

TurboTax Federal Free Filing Option (Absolute Zero)

TaxSlayer.com Free Federal (Simply Free) eSmart Tax Free PlanH&R Block Online Free Edition (More Free)TaxAct Free EditionFreeTaxUSA Free EditionFree File Fillable Forms5) What is a "complicated" tax return?

A complicated tax return would include investments like real estate, cryptocurrency, alternative investments such as purchased music royalties or peer to peer loans, lots of taxable purchases and sales of stock/bond/other investments, small business or businesses, partnerships or trust investments in which you receive a K-1, etc.If you have a complicated tax return, you may want to use a paid service like a Certified Public Accountant, H&R Block or a similar type of service - I have a complicated tax situation and I'm very happy using a CPA to do my taxes and help me with my estimated tax payments so I can avoid a big payment (and potential penalties/interest) in April.6) What do I do with my refund?Apply to your estimated taxes for 2019 (I like this option since I have to pay estimated taxes and I can avoid writing a check for the first quarter payment)Pay off high interest rate credit cardsUse the money to fund your IRA contribution for 2019 - here's a retirement planning checklist for 2019 I recently blogged aboutSave the money and earn some interest - here's a list of great interest rates I recently blogged about7) What if I owe money and I don't have it?Ask a tax professional to help you negotiate a payment plan with the IRS, although you may have to pay interest and penalties (some of which could be waived, depending on how the negotiation goes)Take out a personal loan to pay the balance in full. Here are some options:

Prosper - a peer to peer lending network that I have used a few; highly recommendedICashLoans - online lenderGotLoans - online lenderThriveFinance - online lenderKabbage - online lender for small businesses

If you're interest in investing your tax refund in other ways, you may want to check out one of my books, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on March 02, 2019 10:46

February 23, 2019

HSA's and FSA's to Stretch Your Budget!

If you have access to a Healthcare Spending Account or a Flexible Spending Account at your work and aren't taking advantage of these accounts, you are missing out on an opportunity to use

pretax

dollars to pay for your medical, prescription drug, dental and vision co-payments. That can make a big difference, depending on your tax bracket. For example, if you are in the 24% tax bracket and contribute $2,000 to an HSA, you would need $2,631 to get the same after tax amount (after deducting $631 in taxes).

If you have access to a Healthcare Spending Account or a Flexible Spending Account at your work and aren't taking advantage of these accounts, you are missing out on an opportunity to use

pretax

dollars to pay for your medical, prescription drug, dental and vision co-payments. That can make a big difference, depending on your tax bracket. For example, if you are in the 24% tax bracket and contribute $2,000 to an HSA, you would need $2,631 to get the same after tax amount (after deducting $631 in taxes). A Healthcare Spending Account (HSA) currently has a maximum annual contribution of $3,500 for individuals and $7,000 for families. Many employers also kick in a little extra if you do some wellness activities, such as flu shots, health screenings, etc. The nice thing about an HSA is that the unused account balance can carry forward indefinitely to future years and can be used at any time in the future to pay for medical expenses. Most of these accounts allow you to use a linked debit/credit card to pay your bills (or you can enter payments online similar to a bank's online bill payment service). Many HSA's also offer the ability to invest excess funds in a variety of mutual fund-type investments with different risk profiles. All income and withdrawals are tax free as long as they are used for qualified medical expenses.

A Flexible Spending Account (FSA) currently has a maximum annual contribution of $2,700 and can normally be used for medical, prescription drug, vision and dental payments. When you have both an HSA and an FSA, the FSA becomes "limited purpose" and can only be used for vision and dental copayments. You must use the HSA for medical and prescription drug payments. The downside of the FSA is that any unused balance at the end of the calendar year over $500 is forfeited, although you have until March 15 of the following year to file a reimbursement claim. The $500 balance can roll-over to the following year but must be used that year. If you have kids with braces, it's pretty difficult not to use the entire FSA balance, but it's good to plan ahead at annual enrollment time just to make sure.

If you missed out on this during annual enrollment at the end of 2018, you can always enroll in 2019.

For investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 23, 2019 10:09

February 16, 2019

12 Tax Secrets of the Wealthy - 2019

When I was living in Honolulu about 20 years ago, I remember a local infomercial where a guy was talking about how the wealthy understand the tax laws and are able to take advantage of them to increase their wealth. He referred to the different pages of the IRS 1040 tax return as "rooms." Some of the rooms were green and made you money, while others were red and cost you money. It was called "Tax Secrets of the Wealthy." His message was rather simple:

It doesn't matter how much you make, it's how much you keep that counts

. His message still rings true today. If you work for a paycheck, most likely your main opportunity to reduce your taxes is with 401(k) or IRA contributions and a mortgage deduction. With the recent tax legislation, mortgage deductions will be worth less in the future with the new limitation on the amount that you can deduct. The 401(k)/IRA deduction is good, but you will pay a lot of taxes in the future if your investments do well.

When I was living in Honolulu about 20 years ago, I remember a local infomercial where a guy was talking about how the wealthy understand the tax laws and are able to take advantage of them to increase their wealth. He referred to the different pages of the IRS 1040 tax return as "rooms." Some of the rooms were green and made you money, while others were red and cost you money. It was called "Tax Secrets of the Wealthy." His message was rather simple:

It doesn't matter how much you make, it's how much you keep that counts

. His message still rings true today. If you work for a paycheck, most likely your main opportunity to reduce your taxes is with 401(k) or IRA contributions and a mortgage deduction. With the recent tax legislation, mortgage deductions will be worth less in the future with the new limitation on the amount that you can deduct. The 401(k)/IRA deduction is good, but you will pay a lot of taxes in the future if your investments do well. The wealthy, on the other hand, have many strategies to reduce taxes:

Use a team of experts (i.e., tax / estate attorney, tax accountant) to structure investments and their ownership to minimize taxes and liability, maximize returns and optimize estate planningOwn one or more businesses, which allow for deduction of business expenses and payment of a salary to the owner (also a business expense)Own real estate through limited liability entities and lease to their company(ies), which provides a tax deduction to the business (rent), minimizes taxable income at the entity owning the property due to depreciation and ownership expense deductions that offset the rental income, and allows for ultimate sale of the underlying business while retaining control over the real estateChange ownership of their companies to take advantage of tax rates; recently many companies are converting from "S" to "C" Corporations to take advantage of the new lower 21% "C" corporation tax rate, which is less than the top individual tax rate (which is also the "S" corporation tax rate) of 37%Beginning in the 2018 tax year, the new tax law provides small business owners with a 20% deduction against business income. It’s officially referred to as the Section 199A deduction, and it applies to small businesses, other than “C” corporations. There are income limits against which that deduction can be taken. Invest in tax-preferred investments such as municipal bonds (tax free for Federal and possibly for State as well if issuer is state of residency, which can meaningfully boost returns)Invest in stocks that pay qualified dividends or generate capital gains (taxed at 0%, 15% or 20% rate depending on tax bracket, which is much lower than corresponding tax bracket rates for ordinary earned income)Invest in oil/gas/affordable housing partnerships, which have various tax benefits including deferral of taxes on cash distributions and income tax creditsOwn investment real estate, which provides tax benefits due to depreciation and operating expense deductions that offset rental income, thereby reducing or eliminating taxable income, while providing positive cash flow and building wealth through appreciation of property and leverage (mortgage that reduces your initial cash investment)Sell investment property using a 1031 exchange transaction, which allows for the deferral of taxes and the use of all of the sale proceeds to buy a new, more valuable investment propertyInvest in alternative investments using leverage (debt), the interest cost of which can be deducted against the investment income and generating infinite returns using "other people's money"Use life insurance to fund a portion of retirement needs and for estate planning (death benefit is tax free and life insurance loans to fund retirement are also tax free, but reduce death benefit)For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 16, 2019 10:04

February 9, 2019

Crypto Update

Crypto has woken up recently, with Litecoin up about 30 percent in the past couple of days and many other coins are also seeing some nice increases. Do we think this is sustainable? Not sure, but it certainly helps to have some portion of your investment portfolio in Crypto as I have blogged in the past. If you're interesting in learning more, here is a quick summary of my past posts: Investing in Crypto is a basic overview, Crypto Rankings attempts to make some sense of various published rankings that are out there as a basis for choosing from the dizzying array of crypto coins and Developing a Crypto Investing Strategy proposes a rational, diversified investment strategy to take advantage of the incredible upside of this asset class but also managing the downside risks. I'm not a trader, nor do I recommend trading in crypto. I think buy, hold and diversify with a relatively small portfolio allocation makes the most sense with crypto.

Crypto has woken up recently, with Litecoin up about 30 percent in the past couple of days and many other coins are also seeing some nice increases. Do we think this is sustainable? Not sure, but it certainly helps to have some portion of your investment portfolio in Crypto as I have blogged in the past. If you're interesting in learning more, here is a quick summary of my past posts: Investing in Crypto is a basic overview, Crypto Rankings attempts to make some sense of various published rankings that are out there as a basis for choosing from the dizzying array of crypto coins and Developing a Crypto Investing Strategy proposes a rational, diversified investment strategy to take advantage of the incredible upside of this asset class but also managing the downside risks. I'm not a trader, nor do I recommend trading in crypto. I think buy, hold and diversify with a relatively small portfolio allocation makes the most sense with crypto.Here's the current "Top 10" cryptocurrencies by Market Cap (see links to detailed profiles on coinmarketcap.com for more information about each):

Bitcoin - BTC ($64.0B)Ripple - XRP ($12.7B)Ethereum - ETH ($12.4B)Litecoin - LTC ($2.6B)EOS - EOS ($2.5B)Bitcoin Cash - BCH ($2.2B)Tether - USDT ($2.0B)TRON - TRX ($1.8B)Stellar - XLM ($1.5B)Binance Coin - BNB ($1.2B)If you haven't already started investing in Crypto and want to get started, I have been recommending opening an account with Coinbase. If you click the link, you'll get my invitation and we both get $10 in Bitcoin when you open your account with at least $100! Most of the coins listed above are available on Coinbase. You may also look at Crypto.com, which also has Ripple. Crypto.com also has great perks like a no annual fee metal MCO Visa Card and cash back. If you click the link and enter my referral code (UQWQBQM9CV), you can get a free $20 sign-up bonus for a limited time only!

Good luck with your crypto investing!

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 09, 2019 10:51

February 2, 2019

Side Hustle - Selling on EBay

If you would like to earn some extra money by selling items on EBay as a side hustle idea, here are a few tips based on my experience over the years. There are other sites you can use, but EBay has the best platform / audience and a high degree of trust which is critical, especially if you are selling something valuable.

If you would like to earn some extra money by selling items on EBay as a side hustle idea, here are a few tips based on my experience over the years. There are other sites you can use, but EBay has the best platform / audience and a high degree of trust which is critical, especially if you are selling something valuable.I like to use the EBay app to setup a listing; you can use your phone to take pictures of the itemIf the item is fairly common, the app will be able to pre-populate a lot of the listing details for youUse auction format to get maximum value - start with a $0.99 listing price if you want to get a lot of interest; you can also accept offers until the first bid comes in or you can just do "buy it now" at a fixed price (but people can still make offers)Make sure you take lots of pictures and use all of the 12 available photo slotsDescription should be honest, detailed and informative; the more detailed, the less emails you will get with questions (which can be annoying)Make sure you calculate the shipping correctly before you list (I prefer to have buyer pay but you can also setup your listing where you pay the shipping) - either way, use USPS flat rate Priority Mail packaging where you can, since the cost is fixed and you can ship anywhere in the US - just make sure your item fits in the box or envelopeMake sure you pack your item well (use bubble wrap or other padding and make sure your item is in a sturdy box and doesn't "rattle" around)Selling internationally gets complicated with shipping and customs, so I don't do itPost your listings on your social media accounts to get more "looks"Ship quickly and leave buyer feedback right awayDon't ship until you have confirmed payment first (usually best through PayPal)Be careful of scammers who buy your item, pay and receive the shipment and then file a claim with EBay for a refund - this happened to my son and it was a bummer because he had to pay back the sales proceeds and never got the item he sold back. Make sure the person you are selling to has good ratings and isn't a brand new account, which can be a red flagEBay usually waives the listing fee for the first 50 items per month and charges a final value fee of 10% of the item (including shipping charge, if any). PayPal fees add another 3%. An easy to use EBay fee calculator is located here.

For my personal finance books, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on February 02, 2019 09:38

January 26, 2019

10 Best Interest Rate Ideas for 2019

Many institutional investors are saying that cash may be the best investment in the coming year, especially after the recent volatility in the stock and bond markets at the end of 2018 and early 2019.

Many institutional investors are saying that cash may be the best investment in the coming year, especially after the recent volatility in the stock and bond markets at the end of 2018 and early 2019.“We forecast S&P 500 will generate a modest single-digit absolute return in 2019. The risk-adjusted return will be less than half the long-term average. Cash will represent a competitive asset class to stocks for the first time in many years,” analysts at Goldman Sachs, led by David Kostin, wrote in a research reported dated Nov. 19.

Regardless of whether you plan to shift more of your investments into cash, you should have an emergency fund at least and a portion of your investment portfolio already allocated to cash.

Here are 10 ideas for earning better interest rates in 2019. My favorite of these is the first one, investing directly in 4 week US Treasury Bills. I have included links to the websites (Disclosure: I don't receive any referral fees from these companies if you click the link).

TreasuryDirect (4 week US Treasury Bills) - 2.36%PNC Bank - 2.35%Investors Bank eAccess - 2.35%Goldman Sachs Bank USA - 2.25%State Farm Bank - 2.25%HSBC Direct Savings - 2.22%Sallie Mae - 2.20%American Express National Bank - 2.10%ETrade Bank - 2.10%Capital One - 2.00%I recommend having at least 20% of your investment portfolio in cash at all times in order to buffer against unplanned events (emergency funds) and also to take advantage of investing opportunities that may come up. For more information about my recommended portfolio strategy to guard against volatility, see my prior post on the "5-20 Rule."

I hope this post helps you earn more in 2019!

For my personal finance books, click here.

Published on January 26, 2019 12:06

January 20, 2019

2019 Tax Planning - 9 Areas to Think About

Here are 9 things to know about the recent tax law changes. While you can't do much about your 2018 taxes now, it's a good time to start thinking about your 2019 taxes. This is especially true if you live in coastal areas where state income taxes and home prices are high and particularly if you own one or more homes. As always, your own tax situation will be unique and you should consult with your tax adviser.1) Standard deduction - doesn't matter if you itemize, but helps those that have simple tax situationsIncreased to $12,000 for single or married filing separately, $24,000 married filing jointlyIncreased to $18,000 for Head of Household65 and over, blind, or disabled will get an additional standard deduction2) Families - loss of dependent exemption offsets lower tax bracket savings

Here are 9 things to know about the recent tax law changes. While you can't do much about your 2018 taxes now, it's a good time to start thinking about your 2019 taxes. This is especially true if you live in coastal areas where state income taxes and home prices are high and particularly if you own one or more homes. As always, your own tax situation will be unique and you should consult with your tax adviser.1) Standard deduction - doesn't matter if you itemize, but helps those that have simple tax situationsIncreased to $12,000 for single or married filing separately, $24,000 married filing jointlyIncreased to $18,000 for Head of Household65 and over, blind, or disabled will get an additional standard deduction2) Families - loss of dependent exemption offsets lower tax bracket savingsDependent exemption of $4,050 is eliminatedChild Tax Credit doubles to $2,000Adds $500 credit for other types of dependents3) Home mortgages - pay attention to these, especially if you own a home or have a second home

Mortgage interest paid on new loans deductible up to $750,000 (or existing loans up to $1,000,000) - this is a significant change since it includes all residential loans, including your primary and secondary home ; if you are thinking of buying or refinancing a new or second home this year, you'll need to do the math on a potential loss of tax deduction benefit if the loans will exceed $750,000Interest paid on home equity loan or home equity line is limited to building and improving your home - t his is also a significant change , since previously you could use deductible home equity line of credit to pay off non-deductible credit cards or other personal loansIf your home equity line and the first mortgage on your primary (and if applicable secondary) home exceed $750,000, the interest paid in the excess is not deductible!

Here are some more details:

For anyone considering taking out a mortgage, the new law imposes a lower dollar limit on mortgages qualifying for the home mortgage interest deduction. Beginning in 2018, taxpayers may only deduct interest on $750,000 of qualified residence loans. The limit is $375,000 for a married taxpayer filing a separate return. These are down from the prior limits of $1 million, or $500,000 for a married taxpayer filing a separate return. The limits apply to the combined amount of loans used to buy, build or substantially improve the taxpayer’s main home and second home.

The following examples illustrate these points.

Example 1: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home with a fair market value of $800,000. In February 2018, the taxpayer takes out a $250,000 home equity loan to put an addition on the main home. Both loans are secured by the main home and the total does not exceed the cost of the home. Because the total amount of both loans does not exceed $750,000, all of the interest paid on the loans is deductible. However, if the taxpayer used the home equity loan proceeds for personal expenses, such as paying off student loans and credit cards, then the interest on the home equity loan would not be deductible.

Example 2: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home. The loan is secured by the main home. In February 2018, the taxpayer takes out a $250,000 loan to purchase a vacation home. The loan is secured by the vacation home. Because the total amount of both mortgages does not exceed $750,000, all of the interest paid on both mortgages is deductible. However, if the taxpayer took out a $250,000 home equity loan on the main home to purchase the vacation home, then the interest on the home equity loan would not be deductible.

Example 3: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home. The loan is secured by the main home. In February 2018, the taxpayer takes out a $500,000 loan to purchase a vacation home. The loan is secured by the vacation home. Because the total amount of both mortgages exceeds $750,000, not all of the interest paid on the mortgages is deductible. A percentage of the total interest paid is deductible.

4) Tax rates & brackets - loss of dependent exemptions and deductions for some will offset the benefit of the lower rates

Most taxpayers will see lower ratesHighest rate drops from 39.6% to 37%5) State & local taxes - pay attention to this if you live in a high tax state like California or New York

State and local property, income, and sales taxes limited to $10,000 - this is a major change and will impact people who live in high tax states like California or New York (although if you were in an Alternative Minimum Tax situation already, the impact may not be as significant since state income and property taxes are not deductible for AMT purposes)No income tax prepayment for 2019 allowed6) 1040 form

New 1040 form with six new schedulesEliminates 1040EZ and 1040A versions - this will make tax compliance more difficult for people with very simple tax situations and may require more people to get a professional to do their taxes7) Alternative Minimum Tax

Raises the income cap so that less people are impacted, which is significant since unlike the ordinary tax schedule, alternative minimum tax is not "indexed" to inflation so it gets worse every year unless the tax law adjusts the exemptionSingle taxpayers raised exempted income from $54,300 to $70,300Married filing jointly raised exempted income from $84,500 to $109,4008) Self-Employed

New 20% Qualified Business Income Deduction, which is a big boost for small business owners:

Section 199A of the Internal Revenue Code provides many taxpayers a deduction for qualified business income from a qualified trade or business operated directly or through a pass-through entity.

The deduction has two components.

1) Eligible taxpayers may be entitled to a deduction of up to 20 percent of qualified business income (QBI) from a domestic business operated as a sole proprietorship or through a partnership, S corporation, trust or estate. For taxpayers with taxable income that exceeds $315,000 for a married couple filing a joint return, or $157,500 for all other taxpayers, the deduction is subject to limitations such as the type of trade or business, the taxpayer’s taxable income, the amount of W-2 wages paid by the qualified trade or business and the unadjusted basis immediately after acquisition (UBIA) of qualified property held by the trade or business. Income earned through a C corporation or by providing services as an employee is not eligible for the deduction.

2) Eligible taxpayers may also be entitled to a deduction of up to 20 percent of their combined qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. This component of the section 199A deduction is not limited by W-2 wages or the UBIA of qualified property.

The sum of these two amounts is referred to as the combined qualified business income amount. Generally, this deduction is the lesser of the combined qualified business income amount and an amount equal to 20 percent of the taxable income minus the taxpayer’s net capital gain. The deduction is available for taxable years beginning after Dec. 31, 2017. Most eligible taxpayers will be able to claim it for the first time when they file their 2018 federal income tax return in 2019. The deduction is available, regardless of whether an individual itemizes their deductions on Schedule A or takes the standard deduction.Qualified business equipment can be deducted up to $1,000,000 - this almost doubles the prior "Section 179" deduction that was previously allowed to expense the purchase of new business equipment in the first year (vs having to depreciate over many years) and is also a big boost for small business ownersPotentially a greater business auto depreciation deduction9) HealthcareEliminates tax penalty for not having health insurance (starting in 2019) - this is a nice changeLowers floor on out-of-pocket medical expenses to 7.5% for 2017 & 2018; probably not a big deal unless you have a lot of medical expenses and don't have a high income

In closing, now is a good time to be thinking about the new tax law changes and how they will impact you in 2019. It's never too early to start planning!

For my personal finance books, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 20, 2019 21:17

January 14, 2019

Home Equity is Not an Emergency Fund and Other Lessons

Back in 2006, when I bought my new house and sold my old house, I learned some valuable lessons about emergency funds and home buying and selling.

Back in 2006, when I bought my new house and sold my old house, I learned some valuable lessons about emergency funds and home buying and selling. I bought a brand new house from a home builder that year. It was really nice, but of course expensive. It was also great because I didn't have to sell my old house first (they did something where they assumed you rented out your old house so you basically have no net payment on it if for some reason you weren't able to sell). Today, that would never fly. The builder used Countrywide Financial (failed in the Great Recession and taken over by Bank of America) to originate a 70% first mortgage that was interest only for the first 10 years, after which the payment stepped up in years 11 - 30 and a second mortgage home equity line of credit for 20% of the purchase price of the new house that was also interest only and matured in 10 years. Yes, it was the "good old days" of the housing bubble. The 10% cash down payment actually came from a home equity line of credit on my old house, so I had no cash in the new house - it was 100% financed and all my cash was tied up in the sale of my old house. That would also not fly in today's lending environment.

Selling my old house was a white knuckle experience for sure, since I was doing it after I had bought my new house (I didn't want to move twice) and also considering all of this was happening:

My real estate agent didn't want to work with me (she actually pulled her sign from my yard after we got into a disagreement)My agent refused to show the house, so I ended up having to do it myself and actually met with the buyer in my living room one evening to go over their offer (they really wanted the house and fortunately their agent was a little more level headed and made the deal happen)The Great Recession and real estate crash were right around the corner - the house closed in July 2006; subprime loan problems started to show up in the fourth quarter of 2006 and things began to snowball after that with subprime lender failures throughout 2007 and 2008, culminating with the bankruptcy of Lehman Brothers in September 2008The buyer needed a subprime loan at 100% loan to value to buy the house - it was probably one of the last loans New Century Financial did before they went under in April 2007 (they stopped accepting loan applications one month earlier)

After I miraculously closed on the sale of my old house, I used the proceeds remaining after paying off all the loans to pay off the home equity line on the new house, thereby making it available for future use and getting my monthly payment down to something I could handle. Since I had used all of my available cash from the sale of my old house to pay off the equity line, I had no "emergency fund" at that time. However, I did have the home equity line of credit available with no draws on it, which I figured would be a perfect emergency fund.

What I didn't count on was less than two years later, the value of my property took a 30%+ hit and the bank shortly thereafter sent me a letter letting me know they were suspending draw privileges on the home equity line. There went my emergency fund. Thankfully, I was able to build a real cash emergency fund back up over time. Also, I was able to refinance the interest only mortgage for a lower payment with a traditional 30 year fixed loan before the loan adjusted in 2016 when interest rates were much lower, which was also a big relief.

So, lessons learned:

Don't buy more house than you can afford with a conventional mortgage; bigger is not better, it's only more expensiveSell your old house before buying a new one; don't worry if you have to move twice, the cost and inconvenience is minor compared to having two mortgagesEmergency funds should be held in cash in a bank account or in Treasury BillsHome equity credit lines are not good for emergency funds because banks can shut them down at their discretion if something happens to the value of your homeFor more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 14, 2019 22:35

January 12, 2019

Omeros Looks Like a Buy

I don't normally write about individual stocks, but there are some Companies that are very interesting to me. One of them is Omeros Corp. (ticker OMER). Omeros operates as a biopharmaceutical company that specializes in discovery, development, and commercialization of both small-molecule and protein therapeutics for large -market as well as orphan indications targeting inflammation, coagulopathies and disorders of the central nervous system. The company was founded by Gregory A. Demopulos and Pamela Pierce Palmer on June 16, 1994 and is headquartered in Seattle, WA.

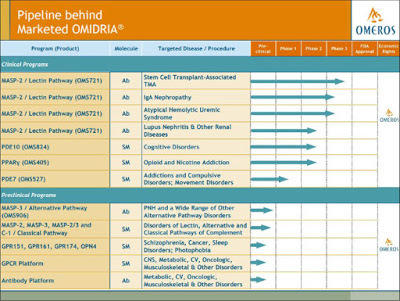

I don't normally write about individual stocks, but there are some Companies that are very interesting to me. One of them is Omeros Corp. (ticker OMER). Omeros operates as a biopharmaceutical company that specializes in discovery, development, and commercialization of both small-molecule and protein therapeutics for large -market as well as orphan indications targeting inflammation, coagulopathies and disorders of the central nervous system. The company was founded by Gregory A. Demopulos and Pamela Pierce Palmer on June 16, 1994 and is headquartered in Seattle, WA.Omeros' drug product OMIDRIA ® is marketed in the United States for use during cataract surgery or intraocular lens replacement to maintain pupil size by preventing intraoperative miosis (pupil constriction) and to reduce postoperative pain. Omeros' pipeline features clinical-stage development programs focused on: complement-associated thrombotic microangiopathies; complement-mediated glomerulonephropathies; cognitive impairment; and addictive and compulsive disorders. In addition, they have a diverse group of preclinical programs and two platforms: one capable of unlocking new G protein-coupled receptor, or GPCR, drug targets and the other used to generate antibodies. For OMIDRIA and each of their product candidates and programs, they have retained control of all commercial rights, which is key for unlocking long term value should these drug candidates be approved and commercialized.

Below is a summary of the Company's drug pipeline:

Of particular interest are the drug candidates for relief of opioid and nicotine addiction as well as cognitive disorders, which are very attractive commercial markets.

Investing in development stage companies can be very risky since they have to continue to raise money in order to fund their operations until they can reach a high enough level of sales. Omeros is not unique in that respect. Based on their most recent quarterly report (September 2018) their "burn rate" of cash is about $9 million per month. With their current cash, investments and receivables that gives them about six months of operations before they will run out of cash. Their cash position was significantly impacted by an unexpected change last year in their OMIDRIA product's Medicare reimbursement coverage between January and October of 2018 (so called "pass through" status was restored in October). This resulted in a $43M drop in sales over the prior year to date period and cut into available cash flow. The Medicare reimbursement issue appears to have been addressed with a new ruling in 2019 and it looks like sales of this approved product should begin to grow again. They have a history of being able to continue to finance their operations without too much dilution to shareholders and while there are go guarantees, it seems like they will continue to do so.

The stock is currently trading at about $12 and has traded as high as $27 in the last year and so seems to be a relative bargain at the current price. The recent stock market volatility has really beaten this stock down and it was trading as low as $8. With the drug candidates in the pipeline, the stock certainly has the potential to go much higher than that if the Company can continue to successfully finance its operations and grow its commercialization effort. This one might be worth a look.

Disclosure: I have investments in OMER. This is not a recommendation to buy.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 12, 2019 08:40

January 8, 2019

Retirement Savings Planning Checklist for 2019

Saving for retirement can be the best way to build your wealth, especially through a workplace 401(k) account, since you can put the money away before taxes to grow tax-free until you have to withdraw the money. Most importantly, you save the money before you have a chance to spend it. I call that "hiding the money from yourself" and it really works! If you don't already have a plan, put retirement savings planning on the top of your to do list for 2019!

Saving for retirement can be the best way to build your wealth, especially through a workplace 401(k) account, since you can put the money away before taxes to grow tax-free until you have to withdraw the money. Most importantly, you save the money before you have a chance to spend it. I call that "hiding the money from yourself" and it really works! If you don't already have a plan, put retirement savings planning on the top of your to do list for 2019!Here are some ideas for boosting your retirement savings for 2019:

Max out your 401(k) contribution at work ($19,000 in 2019 and if you are over 50 you can contribute an additional $6,000 for a total of $25,000); if you can't do that, at least contribute as much as you need to get the employer match and then each year when you get a raise use a portion of that to increase your contribution until you max out.Contribute to a Roth IRA the maximum amount each year ($6,000 in 2019 and if you are over 50 you can contribute an additional $1,000 for a total of $7,000) - although the contributions to a Roth are not deductible against income, the Roth IRA has several advantages over the traditional IRA including tax free withdrawals and no minimum required withdrawals when you reach age 70 1/2; a Roth can be a nice estate planning tool, although there are income limitations.If you can't contribute to a Roth IRA because you earn too much ($137,000 single and $203,000 married in 2019), contribute to a traditional IRA instead and convert to a Roth IRA later (called a "backdoor" conversion); the annual contribution limits are the same for traditional IRA and Roth IRA and if you are not able to deduct the traditional IRA contributions, that will reduce the tax liability on the Roth conversion significantly - this can get fairly complicated so always check with your tax adviser.Setup a whole life insurance policy or if you have a convertible term life policy, convert it to a whole life policy; the cash surrender value of the policy will build up over time and can be tapped for potentially tax free retirement income through insurance policy loans, and unlike 401(k) and traditional IRA accounts, does not require a minimum annual distribution once you reach 70 1/2, so this can also be a nice estate planning tool (see my prior post on this subject here)Make sure you have plenty of cash saved for emergencies, so you don't have to liquidate your investments before you are ready to!Hope this helps you develop your own plan for preparing for your retirement. Don't delay, start now!

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 08, 2019 21:49