Nick Reichert's Blog, page 25

November 25, 2018

Before The End of 2018, Check Your Insurance!

Maintaining an adequate amount of insurance is essential to building a strong Financial Fortress. Insurance provides a buffer against uncertainties to protect your wealth and in the case of life insurance, has the added bonus of providing a retirement planning vehicle.

Maintaining an adequate amount of insurance is essential to building a strong Financial Fortress. Insurance provides a buffer against uncertainties to protect your wealth and in the case of life insurance, has the added bonus of providing a retirement planning vehicle.Here's a very brief summary of the different types of insurance and their benefits:

Health / Dental Insurance - Health and dental insurance are normally offered through the workplace and this post is focused on those types of insurance that aren't typically part of the annual enrollment process, which should be complete soon for January. If you haven't already completed your annual open enrollment, make sure you do and look at all your coverage even if you are happy with keeping everything the same Some things like flexible spending accounts, dependent care accounts and healthcare savings accounts do not "roll over" and have to be re-established each yearMake sure you take advantage of workplace life insurance and supplemental life insurance programs, as they are usually inexpensive, but as I mention below, it's also good to have "portable" life insurance outside of work in case you lose your job

Liability Insurance - This can include a portion of the insurance you have on your vehicle, separate liability coverage maintained on an investment property and an "umbrella" liability policy that provides excess liability coverage beyond the limits in your vehicle and investment property policiesLiability insurance is very important to have if someone is injured in a car accident or at your investment propertyAs a general rule, you should maintain liability coverage at least equal to your net worth (home equity plus all other assets, minus liabilities)Umbrella policies are relatively cheap and are a good source of excess liability coverageIf you have significant net worth, you can't afford not to have a liability policy

Life Insurance - there are many different types of life insurance, but the two main types are term life and whole lifeTerm life buys you insurance for a period of time (i.e., policy "term" ends at age 65 or 70) and the annual payment usually increases as you get older up to the policy expiration dateTerm life coverage is usually cheaper than whole life and does not build up any "cash surrender value," which I describe belowWhole life is "permanent" until death as long as you continue to pay the premiums and is usually a level annual payment, but the premium is quite a bit higher than term lifeThe nice thing about a whole life policy is that with the higher premium, a portion of it grows in value annually (this is called the "cash surrender value") and you can withdraw or borrow against it to fund your retirementYou can always cancel a whole life policy and get the cash surrender value if you need the cash (there may be fees involved in cancelling the policy that would reduce the cash you receive), but it's probably better to find some other source of funds in an emergency Life insurance policy loans are not considered taxable income and are paid-off with a portion of the death benefit; they are a great way to fund retirement income, although they do reduce the death benefit paid to survivorsYou really only need a small amount of life insurance if you are single, but once married and with kids you'll need to increase your coverage for each person in the household who works - ideally you should have coverage equal to 3x to 4x your annual gross incomeI also recommend you maintain at least one policy outside of work in case you lose your job to ensure you still have continuous life insurance coverage; a cheap term life policy to start with would be best and these are sometimes convertible into whole life later with no need for a physical exam

Property Insurance - protects your property in the event of loss or damageMost common is your homeowner's policy, which covers damage to your home and its contents from fire, flood, storm and similar events and may also include liability coverageIn California, you an also get earthquake coverage, but it's very expensiveIf you rent, you can get a renter's insurance policy that covers all your personal property in case it gets damaged or stolen; most policies also have some landlord property damage coverage Can also include insurance for personal articles (i.e., wedding ring), rental property and a portion of your car insurance policyFor a homeowner's or rental property policy, it's a good idea to make sure the coverage includes replacement cost and code upgrades - check annually at renewal time.It may be beneficial to buy all your insurance from one of the larger insurance companies since they offer discounts when you have multiple policies.

State Farm is the company I have used for years and they handle all my insurance needs except life and I have been happy with the customer service. For life insurance (outside of coverage I receive at work), I have used Northwestern Mutual for many years and have been happy with the financial stability of the company and the customer service.

Disclosure: I don't have any affiliate arrangements with the companies mentioned in this post.

For more investing ideas, click here.

Published on November 25, 2018 23:09

November 24, 2018

Quick Read: New Investing Apps In 2018

Here is a quick read on some of the more popular new investing apps I have come across in my research. I have included a very brief summary of benefits and concerns:

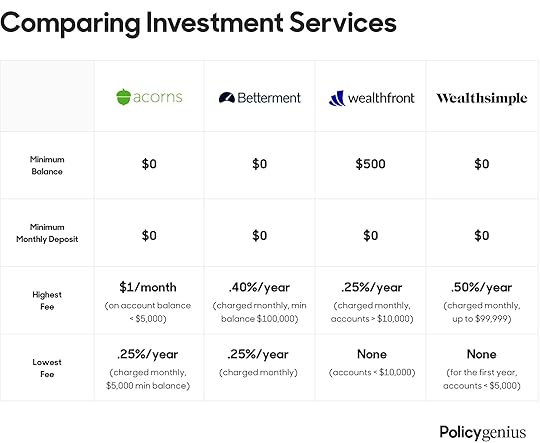

Here is a quick read on some of the more popular new investing apps I have come across in my research. I have included a very brief summary of benefits and concerns:Acorns - Benefits: Free for college students, robo-adviser, $5 minimum investment, saving "spare change" from purchases and also earn / invest cash back from retail partners, educational content; Concerns: flat management fee - $1 - $3 per month (could be a high percentage compared to other advisers if your balance is low), until your balance reaches $5,000 then 0.25% fee kicks in, offers a small investment portfolio, no active management (passive management may under-perform in certain market environments)RobinHood - Benefits: Ease of use, zero commissions, access to low-cost exchange traded funds (with some digging); Concerns: user interface serves up suggested individual stocks to invest in and may encourage stock-picking (difficult to be successful in), stream of various notifications about stocks in portfolio may encourage frequent trading (higher likelihood of losses), and allows margin investing which can be dangerous for inexperienced investors since you can lose more than your investment because you have to pay back the loanSwell - Benefits: Socially responsible investing portfolios, robo-adviser, $50 minimum investment, management fee is all-inclusive, invests in individual stocks; Concerns: 0.75% management fee is high compared to other robo-advisers, no joint account capability, no 401(k) rollover capability, no tax loss harvesting functionality, relatively new platform and still working out the "bugs"Betterment - Benefits: robo-adviser that learns your investment goals / risk preference and builds a customized portfolio of low-cost ETF's for you, offers financial advice from experts and tax-smart strategies, low all-inclusive fee of 0.25% - 0.4% of account balance plus fund level fees, no minimum balance and no fee for zero balance; Concerns: no ability to pick individual stocks or active management, some bad reviewsWealthfront - Benefits: same functionality as Betterment, low all-inclusive fee of 0.25% of account balance plus fund level fees, no trading commissions, withdrawal or transfer fees, automatic daily tax-loss harvesting on taxable accounts which can lower your tax bill and give you more money to invest; Concerns: $500 minimum balance, so-so reviewsWealthsimple - Benefits: low account minimum and no extra fees, socially responsible investment options, Shariah-compliant portfolio, investment in fractional shares, access to financial planners, free tax-loss harvesting, education focus; Concerns: high management fee compared to other advisers, higher fees on socially responsible funds vs typical ETF's, lack of personal finance toolsHere's a nice fee summary courtesy of Policygenius:

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 24, 2018 23:15

November 22, 2018

My 10 Favorite Investing and Business Books

Here is a list of my favorite business and investing books, just in time for Christmas!

Here is a list of my favorite business and investing books, just in time for Christmas! Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! by Robert Kiyosaki - This is a great, easy to read investing book and outlines some of the author's basic principles of growing wealth, which are not about "following the herd." I have read this and many of his other books and highly recommend. This is also a great college graduation gift.Aftershock: Protect Yourself and Profit in the Next Global Financial Meltdown - by David Wiedemer - This is also a pretty easy read and offers some great unconventional investing advice designed around avoiding future asset bubbles like the last financial crisis we had in 2008. Also highly recommended if you don't like to "follow the crowd."The Dollar Crisis: Causes, Consequences, Cures by Richard Duncan - In this book the author describes the flaws in the international monetary system that have destabilized the global economy and that may soon culminate in a deflation-induced worldwide economic slump.The Dollar Meltdown: Surviving the Impending Currency Crisis with Gold, Oil, and Other Unconventional Investments by Charles Goyette - another alternative investing book focused on the author's concerns around our currency system and advocating for gold, oil and other unconventional investments to secure and grow wealth. Missed Fortune 101: A Starter Kit to Becoming a Millionaire by Douglas Andrew - a fascinating alternative investment strategy involving using home equity and investing the proceeds in whole life insurance policies. Definitely unconventional and worth a read. Warning: he's not a fan of 401(k)'s and IRA's!Of Permanent Value: The Story of Warren Buffett by Andrew Kilpatrick - this is the biography of Warren Buffett, widely regarded as one of the greatest investors of our time.Little Bets: How Breakthrough Ideas Emerge from Small Discoveries by Peter Sims - This book describes how innovative companies use an approach of methodically taking small, experimental steps in order to develop new products and services. Rather than believing they have to start with a big idea or plan a whole project in advance, they learn a lot from small failures and drive great success.The Power of Moments: Why Certain Experiences Have Extraordinary Impact by Chip and Dan Heath - This book explores how science shows us that brief experiences can jolt, elevate and change us and how we can learn to create such extraordinary moments in our life and work.Taking People with You: The Only Way to Make Big Things Happen by David Novak - This is a practical, hands on book about leadership and bringing people along in an inspirational way and celebrating / sharing mutual success.Leaders Eat Last: Why Some Teams Pull Together and Others Don't by Simon Sinek - This book is about how great leaders put the interests of their teams ahead of theirs, fostering trust and cooperation and includes his studies of many organizations, including the US Marine Corps who do this well. A very inspirational book.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 22, 2018 19:44

November 20, 2018

Scams and Identity Thieves

I recently reconnected with an old friend from high school on Facebook a few days ago. Last night he sent me an invitation on Messenger. Or at least I thought it was him. In reality, it was a scammer from overseas that saw he was recently added to my profile and copied his photo into a fake profile and pretended to be my friend. I knew there was something odd when he only wanted to talk about a grant program that gave him $150,000 cash. He showed me a picture of a pile of cash and a FedEx driver who delivered the box of cash. "All you you have to do is call a number and pay a small application fee," he said. "Trust me, it's not a scam." Turns out this is a big scam and I ended up blocking this person. They just take your application fee and maybe any personal data you provide and you get nothing. This got me to thinking about data breaches and identify theft, which have been big news this year.

I recently reconnected with an old friend from high school on Facebook a few days ago. Last night he sent me an invitation on Messenger. Or at least I thought it was him. In reality, it was a scammer from overseas that saw he was recently added to my profile and copied his photo into a fake profile and pretended to be my friend. I knew there was something odd when he only wanted to talk about a grant program that gave him $150,000 cash. He showed me a picture of a pile of cash and a FedEx driver who delivered the box of cash. "All you you have to do is call a number and pay a small application fee," he said. "Trust me, it's not a scam." Turns out this is a big scam and I ended up blocking this person. They just take your application fee and maybe any personal data you provide and you get nothing. This got me to thinking about data breaches and identify theft, which have been big news this year.Data theft is a big business. According to Javelin Strategy, the number of identity theft victims in the US rose to 16.7 million in 2017. The cost of all of that lost data amounts to over nearly $17 billion. 2017 was not the worst year for identity theft losses so far, however. It seems every day we are hearing about larger and larger security breaches. Here are just a few of the biggest data breaches so far in 2018:

Facebook - 87 million recordsMyHeritage - 92 million recordsUnder Armour - 150 million recordsExactis - 340 million recordsAll an identity thief needs is your name, date of birth, social security number, home address, a fake picture i.d. and they can do any of the following:Open up new credit accounts to steal goods / services, ruining your credit in the processSteal money from your bank accountsSteal your healthcare insurance coverage, potentially jeopardizing your future medical coverage and careSteal your social security benefitsApply for a job in your nameCommit a crime using your identityA bad credit history can make it difficult to rent an apartment, get a job or purchase a home (or anything else on credit). In today's economy your personal information is out there at banks, credit card companies, your employer, and is always at risk of being stolen as a result of a data breach. If you apply for mortgages, you have to provide tax returns and other personal information that can also include information about your children (social security numbers, home address).

Thieves can steal personal information out of your mailbox or the trash, which is why your mailbox should be locked and you should shred any junk mail. Unsolicited credit card offers received in the mail are a common source of identity fraud, which is why it is recommended that you "opt out" of credit card offers altogether. If your child's identity is stolen, you may not know about it for years, until they open a credit card or other financial account.

There are several identity theft prevention companies out there that provide monitoring / protection services including credit report activity, bank and credit card accounts, internet "dark web" sites where personal information is traded, support for "opting out" of credit card offers, public records, etc. You also have an option to pay a small fee to each of the big three credit reporting companies (Experian, TransUnion and Equifax) to completely "lock down" your credit, if you want to. At a minimum you should put a fraud alert on your credit, so it will make it more difficult for new accounts to be setup without first verifying some personal information with you directly. It's pretty easy to do this by filling out an online form at one of the credit bureaus and they will share with the other bureaus.

Identity Theft For Dummies is a good book to read for more background on the issue. It's also worth it to sign up for a monitoring company like LifeLock or TrustedID so you can regularly monitor changes to your credit and also safeguard your bank accounts, credit cards, etc. A few dollars per month and a few minutes of your time to setup the monitoring is well worth the effort.

The time frame for recovering from identity theft and getting back on track depends on several factors, including: Your willingness to put in the time: According to SANS Institute, identity theft recovery takes an average of 6 months and 100 to 200 hours-worth of work.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 20, 2018 23:12

November 19, 2018

6 Ideas For Lowering Your Taxes in 2018

Soon it will be the end of 2018 and 2019 will be here before you know it. If you haven't already done so, now is the time of year to start tax planning. If you have to file a 1040 tax form, your taxes are probably complicated enough to require a tax accountant. I used TurboTax for many years and only recently began to use a tax accountant to help me with my taxes. Although it costs a little money, it's a lot less stressful and my estimated payments are way more accurate now. Whether you have a tax accountant or not, here is a checklist of things that you may want to think about to lower your 2018 taxes:

Soon it will be the end of 2018 and 2019 will be here before you know it. If you haven't already done so, now is the time of year to start tax planning. If you have to file a 1040 tax form, your taxes are probably complicated enough to require a tax accountant. I used TurboTax for many years and only recently began to use a tax accountant to help me with my taxes. Although it costs a little money, it's a lot less stressful and my estimated payments are way more accurate now. Whether you have a tax accountant or not, here is a checklist of things that you may want to think about to lower your 2018 taxes:Expenses to accelerate into 2018 (do this if you expect to make the same or less money next year and you are otherwise eligible to take the deduction this year to lower this year’s tax bill):

Pay your January mortgage payment in December (you'll get to deduct the interest in 2018)Pay all your property taxes in December (be careful if you are subject to the Alternative Minimum Tax, since this may not help reduce your taxes and you may be better off paying the second half in 2019)If you are eligible to make an IRA contribution ($5,500 for 2018, increasing to $6,000 in 2019), you have until April 15, 2019 to make your contribution and get the deduction for your 2018 tax return; if you are 50 or older you can make an additional catch-up contribution of $1,000. You can make an IRA contribution regardless of whether you participate in a retirement plan at work, but your ability to deduct the contribution may be limited. You can also convert a traditional IRA into a Roth IRA at any time, even if you can't contribute directly to a Roth because of your income level. This is called a "backdoor conversion." Roth's are great because you don't have to pay taxes on the contributions or earnings when you withdraw the money and the withdrawal rules are more flexible than a traditional IRA.Sell investments that have lost money and you no longer want to keep by December 31; the limit is $3,000 of (net) capital losses that you can offset against your ordinary income. Losses in excess of this amount are “carried forward” to future tax years, which means you can't use those losses until you have gains to offset or up to $3,000 against ordinary income per year.

Delay income from 2018 to 2019 (similar to expenses, if you expect to make the same or less money next year and you are otherwise able to delay the income):

Delay sale of investments with capital gains that you no longer want to hold until January or laterDefer cash bonus payments until January or laterHave your tax accountant check your estimated taxes paid and withheld to make sure you have paid enough so that you won’t be subject to underpayment penalties when you file your return in April. If you have significant investment or other non-wage income like fees, royalties and other passive income, you will likely need to pay estimated taxes.

If you're looking for more information on tax planning, I recommend Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes (Rich Dad Advisors) or Lower Your Taxes - BIG TIME! 2017-2018 Edition: Wealth Building, Tax Reduction Secrets from an IRS Insider (Lower Your Taxes Big Time)

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 19, 2018 23:00

November 17, 2018

Is Angel Investing For You?

If you qualify to be an accredited investor (more than $1 million in net worth, excluding your home equity, or you make $200,000 per year if single or $300,000 per year if married), you may want to consider angel investing. Angel investors make investments in early stage startup companies. These companies may still be developing their product / service and are in very early stages of raising money. In exchange for making these early investments, you will be able to purchase shares of the company at hopefully a very low valuation compared to what the company may some day be worth. While very risky, since many startups fail, angel investing provides an opportunity for significant returns if the company is successful and its value grows over time.

If you qualify to be an accredited investor (more than $1 million in net worth, excluding your home equity, or you make $200,000 per year if single or $300,000 per year if married), you may want to consider angel investing. Angel investors make investments in early stage startup companies. These companies may still be developing their product / service and are in very early stages of raising money. In exchange for making these early investments, you will be able to purchase shares of the company at hopefully a very low valuation compared to what the company may some day be worth. While very risky, since many startups fail, angel investing provides an opportunity for significant returns if the company is successful and its value grows over time. There are many sites where you can connect with early stage companies. Here are a few that I have come across:

CrowdfunderSeedInvestGustMicroventures

Like most other types of investments, it makes sense to keep your investments small (like many companies do as outlined in the book "Little Bets"), and diversified across a range of companies. It also makes sense to invest in companies and industries you know something about. Maybe you are a doctor or a dentist and you know about medical devices and products that you use every day. That might be a great area for you to invest in a startup company that could be bringing new technology or products to your industry.

I recommend keeping your initial investment small. See how the Company does and then consider participating in subsequent rounds of financing if you feel like the Company's prospects are continuing to improve. You may be exposed to a dizzying array of financial terms, including common stock, convertible preferred stock, convertible notes, warrants, etc. Always consult with your financial or tax adviser to make sure you understand the implications of your investment and the nuances of each type of security. Ultimately, what you are buying is an ownership stake in the company and you need to look at the company's value on a "fully diluted" basis, assuming all of the convertible instruments are converted into common stock. What is the implied valuation of the company on a fully diluted basis? Does that make sense given how it has operated in the past, the business plan and its future prospects? How does that valuation compare to competitors in the industry that are more mature in their business? Are you comfortable buying into that valuation? Is the management team capable of execution and transparent - can you trust them? These are the types of questions you need to ask before making an angel investment. As an early stage investor, you should have access to first hand information about how the company is doing in executing its business plan. You should demand transparency from the management team if you are going to be an angel investor, as this will help protect your investment. You always have the option of keeping your initial investment the same as later rounds of financing occur, but that will result in dilution of your ownership interest. This isn't necessarily a bad thing if you are risk averse. It can help reduce your losses if the company fails and if the company is successful, you will still own a (smaller) piece of the pie. Ultimately, the company if successful will have many options including going public, being bought out, or continuing to operate and pay out cash flow to investors. Regardless, if the Company is successful, you have the potential for superior returns by being involved at an early stage.

If you're interested in learning more about angel investing, David Rose the founder of Gust has a book called Angel Investing: The Gust Guide to Making Money and Having Fun Investing in Startups. You might also be interested in Angel: How to Invest in Technology Startups--Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000 by Jason Calacanis.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 17, 2018 19:49

November 15, 2018

Developing a Crypto Investment Strategy

As you have probably read recently, many of the cryptocurrencies have declined in value significantly. This may represent a great buying opportunity for opportunistic investors. While prices have been dropping, adoption and use of cryptocurrencies has continued to increase, although many barriers to widespread adoption still exist including a crowded field of many coins, volatility, association with criminal activity, usability, scalability and scams / hacks. Investing in cryptocurrencies, while a bit risky, can provide diversification. Due in large part to their volatility, cryptocurrencies also have the potential for very large returns. I don't recommend you invest more than 1% of your investment portfolio in them if you are risk averse like me.

As you have probably read recently, many of the cryptocurrencies have declined in value significantly. This may represent a great buying opportunity for opportunistic investors. While prices have been dropping, adoption and use of cryptocurrencies has continued to increase, although many barriers to widespread adoption still exist including a crowded field of many coins, volatility, association with criminal activity, usability, scalability and scams / hacks. Investing in cryptocurrencies, while a bit risky, can provide diversification. Due in large part to their volatility, cryptocurrencies also have the potential for very large returns. I don't recommend you invest more than 1% of your investment portfolio in them if you are risk averse like me. If you have decided to invest some money in cryptocurrencies, here is a potential strategy to maximize your returns while moderating risk:

Invest in all the larger market cap coins (values as of November 15, 2018):

Bitcoin (BTC) - $96B

Etherium (ETH) - $18B

Bitcoin Cash (BCH) - $7B*

Litecoin (LTC) - $3BInvest more in BTC than others (allocate your initial investment on a percentage basis by market cap)Continue small, systematic monthly investments into BTC and other large cap coins Buy and hold - be patient!Buy newer coins when available in small dollar amounts ($100 - $200 increments) - wait to see how newer coins shake out before making any big investmentsDiversification of risk across multiple coins is keyWhen investing in newer coins, look for those that have differentiating features beyond simply being a means of exchange (i.e. Etherium - smart contracts, Ripple - payment settlement) Monitor initial coin offerings, but be very selective in investing in these since many, if not most, fail to gain acceptance Monitor coins accepted by online retailers to see which coins are gaining more acceptance *Note that Bitcoin Cash is currently undergoing a "hard fork" in which the coin is essentially splitting into two. There is some risk that one or both lose the interest of the community of miners, investors and day to day payment users and become obsolete, so this will bear watching. Given the large market cap of BCH prior to the fork, it would seem that both new coins (Bitcoin ABC and Bitcoin SV) will have enough market interest to maintain their aggregate market cap, but only time will tell.

I like to do my investing on Coinbase, which is one of the cryptocurrency exchanges. There are others, but I like Coinbase for easy connection to banking / automatic investments, good security and simple layout. They also have a good selection of coins available to trade, including all the coins mentioned above.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 15, 2018 23:05

November 11, 2018

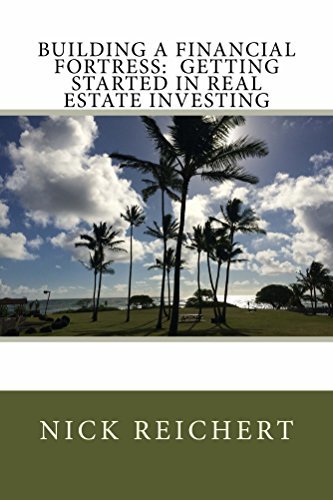

Free Kindle Promotion - 11/12 to 11/16

My real estate investing book will be available for FREE from 11/12 to 11/16 for download on Kindle. Here’s the Link

Published on November 11, 2018 10:21

November 10, 2018

10 Ways to Fix Your Finances Right Now

Here are some ideas for getting your financial house in order. Many people don’t know where to start and don’t take action. There's no time like now to take charge of your financial future!

Here are some ideas for getting your financial house in order. Many people don’t know where to start and don’t take action. There's no time like now to take charge of your financial future!Make a household budget - Using a simple budget template in Excel or Google Sheets, figure out how to spend less than you make; look at your expenses for the past few months and ask yourself where you can reduce your spending; even if only a few dollars a month, it will allow you to save and get out of debt. Here's a simple Excel template I built that you can use. Just open in Excel and save down a copy and you can edit it. Acorns is an app I like that helps you build your savings and investments while tracking your spending. Make sure you budget for automatic savings - if your company has a 401(k), contribute! Pay off your credit cards - You can pay off your credit cards with lower interest personal loans that allow you to pay off the balance over time - I really like peer to peer lending networks like Prosper. I also like ICashLoans, GotLoans and ThriveFinance. Review your monthly expenses regularly - what don’t you need to spend money on; what can you get for less money? Look for side hustles - You can make extra money outside of your day job - here are some passive income ideasLook for cheaper car insurance - many people don't realize how easy it is to shop around for car insurance and you may even get a better price if you use the same company for your homeowner's or renter's insurance. Buy a pre-owned car instead of new - you can save a lot of money and still have lower maintenance cost, especially with a dealer-certified pre-owned car. Eat more meals at home - eating out is very expensive; try to limit to one night a week and cook at home the rest of the week After you pay them off, cut up your credit cards but keep one or two for emergencies only. Stay away from the mall - shop online for only what you need - Amazon prime is great for saving money and getting free delivery, too.

I hope you find these ideas helpful. The most important thing is to take action now! Don’t wait until tomorrow!

Here are some other ideas for investing.

Published on November 10, 2018 21:10

November 9, 2018

10 Ideas to Save More Money

Are you having trouble saving money? Worried that you don’t have an emergency fund of 3 to 6 months of living expenses?

Are you having trouble saving money? Worried that you don’t have an emergency fund of 3 to 6 months of living expenses?Here are 10 ideas for saving more money that you can start today:

Contribute to your Company's 401(k) Plan - the money goes in automatically and you'll never miss it, just start small and increase your contribution rate each time you get a raise. Make sure you contribute at least the amount your Company will match - it's free money. See my other post on 401(k)'s.Automatically withdraw funds from your checking account and deposit into a savings account every pay period; again, start small but in time you won't miss it Look at cancelling some of your online subscriptions - do you have something you don't use anymore? Maybe you got a Netflix account and don't watch Hulu anymore? Cancel the one you don't need and add that amount to your monthly savings. Sign up for Amazon Prime; you can save a lot of money on everyday purchases, you get videos and music included (maybe cancel that other music subscription service and add that to your monthly savings) and the shipping is free. Open up an Acorns account . You can save your spare change automatically into a diversified online portfolio of stocks setup by experts. You'll hardly miss the money and before you know it you'll have a nice amount saved.Cancel Services You Don't Use - Do you still get the newspaper? How about a landline phone? Magazines? Cancel them! Take that money and roll into your monthly savings.Sell Your Extra Stuff on EBay - clean out the garage and the spare bedroom and make some extra money, but don't spend the money you earn; instead, put it away in your savings account!Look at Your Insurance - You might be paying too much for car or homeowner’s insurance; call around and see if you can get a better deal from another company. Take the money you save compared to old insurance and add to your monthly savings deposit.Pay Off Your Credit Cards With a Personal Loan - Invest the money you save in lower interest charges into your monthly savings. I like peer to peer lending programs like Prosper."Hide" Money From Yourself - Do as much saving as you can automatically as described above and put into accounts that you don't regularly look at and can't easily access to move back into your checking account and spend. Out of sight, out of mind!

I hope this helps you get some ideas on how to save more money. For more ideas on investing, check out my books here.

Published on November 09, 2018 07:05