Nick Reichert's Blog, page 27

December 26, 2014

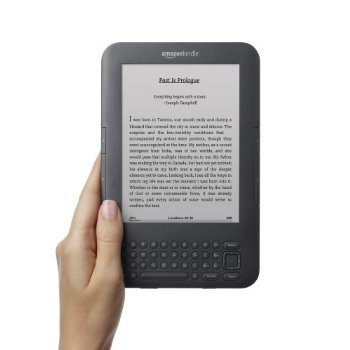

Building a Financial Fortress: Getting Started in Real Estate Investing - Free on Kindle 12/26 to 12/30

Make your New Year's resolution to grow your wealth in 2015! Kindle version free from 12/26 to 12/30 - Getting Started in Real Estate Investing

Related articles Investing Challenges in the Current Market

Investing Challenges in the Current Market

Undervalued MLP - Eagle Rock - Is Now the Time to Buy?

Undervalued MLP - Eagle Rock - Is Now the Time to Buy?

Gold and Silver Under Pressure - But for How Long?

Gold and Silver Under Pressure - But for How Long?

Identity Theft

Identity Theft

Related articles

Investing Challenges in the Current Market

Investing Challenges in the Current Market

Undervalued MLP - Eagle Rock - Is Now the Time to Buy?

Undervalued MLP - Eagle Rock - Is Now the Time to Buy?

Gold and Silver Under Pressure - But for How Long?

Gold and Silver Under Pressure - But for How Long?

Identity Theft

Identity Theft

Published on December 26, 2014 20:07

November 14, 2014

Investing Challenges in the Current Market

The markets have become significantly more volatile recently. I believe this is largely due to the manipulation of interest rates by the Federal Reserve and foreign central banks, which has encouraged borrowing and risk taking in the stock market for a few years now. This has had the result of distorting asset values from reality.

The markets have become significantly more volatile recently. I believe this is largely due to the manipulation of interest rates by the Federal Reserve and foreign central banks, which has encouraged borrowing and risk taking in the stock market for a few years now. This has had the result of distorting asset values from reality.  It's very difficult to discern where to put new money to work. Interest rates seem likely to rise, which makes bonds unattractive at current yields. The stock market is at stratospheric heights and it seems is destined for a correction or crash eventually - how long can the US economy go it alone when the rest of the world is in recession? Real estate values have risen considerably since the Great Recession and don't represent the bargain they once were. Commodities have been getting trounced due to the rotation of "hot" investor money into the stock market and the sluggish global economy - especially gold, silver and oil.

It's very difficult to discern where to put new money to work. Interest rates seem likely to rise, which makes bonds unattractive at current yields. The stock market is at stratospheric heights and it seems is destined for a correction or crash eventually - how long can the US economy go it alone when the rest of the world is in recession? Real estate values have risen considerably since the Great Recession and don't represent the bargain they once were. Commodities have been getting trounced due to the rotation of "hot" investor money into the stock market and the sluggish global economy - especially gold, silver and oil.Seems like increasing your cash allocation right now wouldn't be a bad idea. That way you are buffered from market swings and have "dry powder" for potential new investment opportunities.

Some have said the US stock market, at least in the near term is set to continue to break records. That may be true, since there is significant momentum. Only time will tell.

What's an investor to do? Maybe instead of trying to find the "next big thing," it's better to enjoy the power of compounding in a certificate of deposit? Probably not. I'm staying diversified across a broad range of assets. I think it's better to be able to weather any storm than to spend a lot of time trying to pick a winner and being wrong most of the time. Sometimes the best offense is a strong defense. I'm also not selling my gold - it may take a while, but gold will come back in time and won't lose its value like dollars will. All you have to do is go to the grocery store or gas station to know there is real inflation in the world. We also are seeing it every day in the construction industry - especially the rising cost of labor, as shown below.

Source: ENR.com

Construction Costs Building Costs Materials Cost +3.3

Sep 2014The annual escalation rate for the CCI increased to 3.3% from the previous month’s 3.2%, as the index’s labor cost component rose 0.2%.

1913 = 100INDEX VALUEMONTHYEARCONSTRUCTION9870.12+0.3+3.3COMMON LABOR21069.87+0.2%+3.9%WAGE $/HR.40.03+0.2%+3.9%

Related articles

Managing Investment Risk Through Diversification

Managing Investment Risk Through Diversification

Stay Diversified - Resist Temptation

Stay Diversified - Resist Temptation

Financial Fortress - Hard Assets

Financial Fortress - Hard Assets

US Federal Reserve ends QE stimulus programmeRelated articles

US Federal Reserve ends QE stimulus programmeRelated articles

Published on November 14, 2014 23:33

October 26, 2014

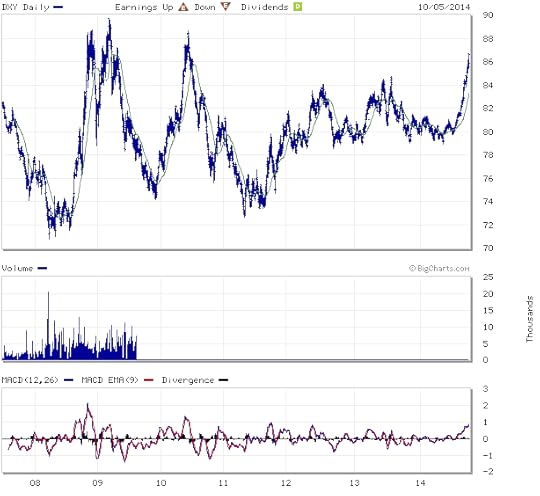

Undervalued MLP - Eagle Rock - Is Now the Time to Buy?

Here's a summary of Eagle Rock Energy Partners LP, a Master Limited Partnership:

Here's a summary of Eagle Rock Energy Partners LP, a Master Limited Partnership:"Eagle Rock Energy Partners LP engages in the business of gathering, compressing, treating, processing, transporting, marketing and trading natural gas. The company operates its business under three segments: Upstream Business, Midstream Business and Corporate and Other. The Upstream Business segment engages in crude oil, condensate, natural gas, natural gas liquids and sulfur production from operated and non-operated wells. The Midstream Business segment consists three divisions: Texas Panhandle, which engages in gathering, compressing, treating, processing and transporting natural gas; fractionating, transporting and marketing natural gas liquids; East Texas and Other Midstream division gathering, compressing, processing and treating natural gas and marketing of natural gas, natural gas liquids and condensate in South Texas, East Texas, Louisiana, Gulf of Mexico and inland waters of Texas; Marketing and Trading division engages in crude oil and condensate logistics and marketing in the Texas Panhandle; and natural gas marketing and trading. The Corporate and Other Segment engages in risk management, intersegment eliminations and other corporate activities such as general and administrative expenses. Eagle Rock Energy Partners was founded in May 2006 and is headquartered in Houston, TX."

Recently, the Company (EROC) completed a sale of some of it's operations (it's midstream business) and was able to pay down outstanding debt. Before the transaction closed, the Company temporarily suspended its distributions, at which time it fell out of favor with most investors since that's the main reason you want to hold one of these stocks.

The Company has indicated it intends to resume the distribution in November and an announcement is expected soon (in connection with reporting earnings for the third quarter ended September 30, which should be due out in the next couple of weeks). Analyst estimates vary on what the dividend will be when it resumes and what it could grow to in 2015, although some estimates indicate the yield based on the current price could be as high as 20%. The Company has transformed itself into primarily an upstream MLP with the transaction described previously. With over half of it's business in natural gas and the other half split evenly between oil and natural gas products, the Company is well positioned for the coming winter season and a rebound in oil prices.

Now might be the time to buy some shares of this beaten-down stock before the distributions resume. Not only is the potential yield attractive, there could be potential for capital appreciation as well.

Here are the current analyst recommendations:

Analysts Recommendations current1 Month Ago3 Months AgoBUY111OVERWEIGHT000HOLD555UNDERWEIGHT000SELL000MEANHOLDHOLDHOLD

Here are insider transactions, which include a lot of purchases indicating management's faith in the business:

Transaction SummaryTotal insider purchases and sales reported to the SECTimeframeTransactionsSharesLast 3 months9 Purchases1 Sales135,20355,000Last 6 months20 Purchases8 Sales766,213148,783Last 12 months21 Purchases13 Sales766,827219,787

Disclosure: I own shares in EROC.

Related articles

What is the True Meaning of "Diversified Investment Portfolio?"

What is the True Meaning of "Diversified Investment Portfolio?"

How To Build A Financial Fortress

How To Build A Financial Fortress

Zacks Upgrades Eagle Rock Energy Partners, L.P. to "Neutral" (EROC)

Zacks Upgrades Eagle Rock Energy Partners, L.P. to "Neutral" (EROC)

2 Energy MLPs Set for Earnings Beat amid Low Oil & Gas Prices - Analyst Blog

2 Energy MLPs Set for Earnings Beat amid Low Oil & Gas Prices - Analyst Blog

Published on October 26, 2014 14:24

October 18, 2014

Audio Book Free Download Promotion - Enter to Win!

Enter to win a free copy of one of my new audio books!

Related articles Introduction to My New Book - Building a Financial Fortress: Getting Started in Real Estate Investing

Introduction to My New Book - Building a Financial Fortress: Getting Started in Real Estate Investing

Getting Started in Real Estate Investing: Searching For a Property

Getting Started in Real Estate Investing: Searching For a Property

Related articles

Introduction to My New Book - Building a Financial Fortress: Getting Started in Real Estate Investing

Introduction to My New Book - Building a Financial Fortress: Getting Started in Real Estate Investing

Getting Started in Real Estate Investing: Searching For a Property

Getting Started in Real Estate Investing: Searching For a Property

Published on October 18, 2014 21:13

October 5, 2014

Gold and Silver Under Pressure - But for How Long?

The price of gold and silver has been under pressure over the past year and especially for the past few weeks. As you can see in the 10-year charts below, both gold and silver have more or less been trading in a narrow range during this time frame and recently, both metals have hit a downtrend due to recent dollar strength. This has resulted in 52-week lows for both metals. Buying opportunity? Perhaps. Let's look a little deeper.

The chart below tracks the US dollar index (DXY) and you can see the large spike recently, which has brought a lot of pressure on the prices of gold and silver since both are denominated in dollars.

You may ask yourself, why is that, since the dollar has been on a virtually nonstop downward spiral since the 1980's as shown below:

The answer is quite simple: in an uncertain world, the United States provides the greatest degree of certainty for investment capital, so foreign money flows to the United States in the form of stock market investments, real estate investments and US Treasuries, thereby driving the demand for dollars up in the short run. In the long run, however, US monetary policy continues to drive inflation which constantly erodes the value of the dollar over time, even at very low rates of inflation. As shown in the chart above, the dollar now buys about half of what it did in the mid-1980's. If you were holding gold or silver for the past 10 years, your investment would have grown significantly.

Now let's look at another chart that I like to review from time to time, that shows the relationship between gold and silver. For this, I charted two exchange traded funds (GLD and SLV) to demonstrate the relationship over time. As you can see, the "spread" between gold and silver is very wide compared to the past 10 year history, which suggests to me that now might be an excellent time to buy some silver, since that spread will tighten when it returns to the historical average. Also, both metals will benefit when the short term effects of the "dollar pop" wear off and investors begin to focus on what's really happening. As soon as there is any indication of significant inflation in the United States, the value of gold and silver will increase quickly.

The Fed is rarely quick enough to tame inflation once it gets started and it stands to reason that this time will be no different. Unemployment in the United States has continued to be a problem in the current "recovery" which has delayed the Fed from raising interest rates. Similarly, as Europe faces deflation, the European Central Bank has initiated their own version of "quantitative easing," which by it's very nature is designed to create inflation.

It seems like only a matter of time before gold and silver resume their upward path.

Related articles

Financial Fortress - Hard Assets

Financial Fortress - Hard Assets

Gold and Silver Making Moves Lately

Gold and Silver Making Moves Lately

Asset Class Review: Precious Metals Are Looking Attractive Again

Asset Class Review: Precious Metals Are Looking Attractive Again

Gold and Silver - Buy Now?

Gold and Silver - Buy Now?

Published on October 05, 2014 18:51

September 28, 2014

Identity Theft

Credit card (Photo credit: Wikipedia)Identity theft is a large and growing problem today. By some estimates, one in five Americans has been a victim of identity theft and it is the fastest growing crime in the United Statesover the past four years - an identity is stolen every two seconds. All an identity thief needs is your name, date of birth, social security number, home address, a fake picture i.d. and they can do any of the following:Open up credit accounts to steal goods/services, ruining your credit in the process Steal money from your bank accounts Steal your healthcare insurance coverage, potentially jeopardizing your future medical coverage and care Steal your social security benefits Apply for a job Commit a crimeThieves have gotten very sophisticated and no longer need to rely on stealing from you directly. It seems every day we are hearing about larger and larger security breaches at major retailers:

Credit card (Photo credit: Wikipedia)Identity theft is a large and growing problem today. By some estimates, one in five Americans has been a victim of identity theft and it is the fastest growing crime in the United Statesover the past four years - an identity is stolen every two seconds. All an identity thief needs is your name, date of birth, social security number, home address, a fake picture i.d. and they can do any of the following:Open up credit accounts to steal goods/services, ruining your credit in the process Steal money from your bank accounts Steal your healthcare insurance coverage, potentially jeopardizing your future medical coverage and care Steal your social security benefits Apply for a job Commit a crimeThieves have gotten very sophisticated and no longer need to rely on stealing from you directly. It seems every day we are hearing about larger and larger security breaches at major retailers:Home Depot has confirmed that its six-month long breach compromised approximately 56 million credit and debit cards, making it the largest retail card breach in history.

A bad credit historycan make it difficult to rent an apartment, get a job or purchase a home (or anything else on credit). In today's economy your personal information is out there at banks, credit cardcompanies, your employer, and is always at risk of being stolen as a result of a data breach. If you apply for mortgages, you have to provide tax returns and other personal information that can also include information about your children (social security numbers, home address).

Thieves can steal personal information out of your mailbox or the trash, which is why your mailbox should be locked and you should shred any junk mail. Unsolicited credit card offers received in the mail are a common source of identity fraud, which is why it is recommended that you "opt out" of credit card offers altogether.

There are several identity theft prevention companies out there that provide monitoring/protection services including credit report activity, bank and credit card accounts, internet "black market" sites where personal information is traded, support for "opting out" of credit card offers, public records, etc. You also have an option to pay a small fee to each of the big three credit reporting companies (Experian, TransUnion and Equifax) to completely "lock down" your credit, if you want to.

This website compares several of the top identity theft prevention companies. A few dollars per month and a few minutes of your time to setup the monitoring is well worth the effort.

The average person spends more than $3,000 and 500 hours to repair the damage caused by identity theft. If your child's identity is stolen, you may not know about it for years, until they open a credit card or other financial account.

Related articles

Is Your Identity Safe?

Is Your Identity Safe?

20 Things You Can Do to Weather the Next Big Financial Crisis

20 Things You Can Do to Weather the Next Big Financial Crisis

How to protect yourself and recover from Identity Theft

How to protect yourself and recover from Identity Theft

Me, Myself and I.D.

Me, Myself and I.D.

Published on September 28, 2014 22:08

September 21, 2014

FREE Kindle Promotion for Building a Financial Fortress - 9/30 to 10/4

Cover via AmazonI will be sponsoring a FREE Kindle promotion for my first book, "Building a Financial Fortress: Lessons from the Great Recession for Savers and Investors" from

September 30 until October 4

. During that time, the book will be available to download for free on Amazon.com.

Cover via AmazonI will be sponsoring a FREE Kindle promotion for my first book, "Building a Financial Fortress: Lessons from the Great Recession for Savers and Investors" from

September 30 until October 4

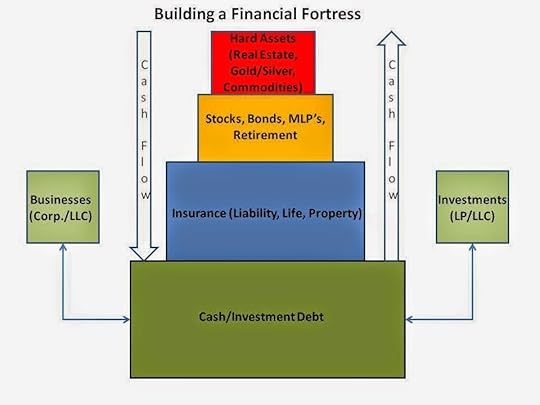

. During that time, the book will be available to download for free on Amazon.com. Building a Financial Fortress was conceived in the depths of the Great Recession, after much thought about a new investment philosophy that is at the same time defensive and opportunistic, taking into account the extreme and growing volatility in today's financial markets. In my career, I had the misfortune of witnessing the value of my 401(k) retirement account cut in half twice, first during the Dot.Com Bubble in 1999-2001 and again seven years later during the Great Recession. I was able to protect some of the value the second time around by going to cash a bit earlier than the rest of the market, but still suffered heavy losses. After half of our office was laid off in mid-2007, I began to realize how important it is to have a strong investment portfolio with multiple cash flow streams. In the book, I focus a great deal on alternative investment strategies, starting with a defensive base of cash and investment debt and ending with the inflation protection of hard assets, including real estate, commodities and precious metals.

Please download a copy and leave a review. Hopefully it can help you develop some alternative investing strategies to help build and protect your wealth!

Building a Financial Fortress Website

Related articles

Financial Fortress - Hard Assets

Financial Fortress - Hard Assets

How To Build A Financial Fortress

How To Build A Financial Fortress

More Commentary on Diversification

More Commentary on Diversification

Building a Financial Fortress: Now Available on Kindle

Building a Financial Fortress: Now Available on Kindle

Published on September 21, 2014 21:40

September 18, 2014

School's In But No Financial Education

(Photo credit: Wikipedia)My kids are back in school and once again buried in homework. Lots of reading, writing and arithmetic, but no financial education. That's my responsibility and teaching finances to my kids has been a big challenge. I tried to get my oldest son to read "Rich Dad, Poor Dad," over the summer - one of my favorite personal finance books, but I couldn't get him to engage in it - even when I offered a Silver Eagle coin for him to read it. Fortunately, he took a summer school class entitled "Entrepreneurship." It was actually pretty good and taught by a woman who owns her own business and from what I could tell she was pretty successful, not only in her business but in teaching basic concepts of entrepreneurship to 8th graders. They developed snack products to sell during recess and had to make enough money to pay back the loan they got to buy the materials. Any profit they earned could be used for a class party at the end of the session. Although he didn't like it at first, he ended up liking it in the end and I'm glad for that.

(Photo credit: Wikipedia)My kids are back in school and once again buried in homework. Lots of reading, writing and arithmetic, but no financial education. That's my responsibility and teaching finances to my kids has been a big challenge. I tried to get my oldest son to read "Rich Dad, Poor Dad," over the summer - one of my favorite personal finance books, but I couldn't get him to engage in it - even when I offered a Silver Eagle coin for him to read it. Fortunately, he took a summer school class entitled "Entrepreneurship." It was actually pretty good and taught by a woman who owns her own business and from what I could tell she was pretty successful, not only in her business but in teaching basic concepts of entrepreneurship to 8th graders. They developed snack products to sell during recess and had to make enough money to pay back the loan they got to buy the materials. Any profit they earned could be used for a class party at the end of the session. Although he didn't like it at first, he ended up liking it in the end and I'm glad for that. I try to encourage my kids to be entrepreneurs and not feel like they have to simply get good grades, go to college and get a job with a good company. While that's what they may end up doing, it's important for kids to understand that what matters most is loving what you do so you can be successful at it and have the potential to make enough money to live on, or even become wealthy. It's also important to have a few "irons in the fire" and not be solely dependent on one thing for your income. Not surprisingly, the kids have evolved their own system of profiting off of each other by selling old electronics, games or other junk to one another - the older child is always trying to rip off the younger one, so we have to watch to make sure the deal is fair. They also have a fairly complex candy barter system, I have learned.

I have tried to teach them about money by instituting an allowance for chores program - for a long time no chores were done and no money was paid out. Recently, I have gotten more interest in the money so the chores get done, so they are learning and my wallet is thinner as a result. I also make sure to take them down to the bank to deposit birthday or holiday money and while we are filling out the deposit slip and waiting in line, we talk about what the bank does for you. My son, of course, said "So you mean my account is only earning $1 a month? That sucks." Kids.

Related articles

Back to School - Now Where Can Kids Get a Financial Education?

Back to School - Now Where Can Kids Get a Financial Education?

20 Things You Can Do to Weather the Next Big Financial Crisis

20 Things You Can Do to Weather the Next Big Financial Crisis

Managing Investment Risk Through Diversification

Managing Investment Risk Through Diversification

Savings Strategy

Savings Strategy

Published on September 18, 2014 23:14

September 6, 2014

Gold and Silver - Buy Now?

Gold and silver have both traded in a flat range for about the past year after rocketing to all time highs in mid-2011 (see charts below). My view is that gold is a better long term hold and silver is better for short term trading, as silver tends to be more volatile. The announcement last week that the European Central Bank cut interest rates and is also going to initiate it's version of "Quantitative Easing" surprisingly did not cause the metals to rally. Instead, the dollar rallied as investors shifted from Euro to dollar holdings which put pressure on gold and silver prices since they are denominated in dollars.

Gold and silver have both traded in a flat range for about the past year after rocketing to all time highs in mid-2011 (see charts below). My view is that gold is a better long term hold and silver is better for short term trading, as silver tends to be more volatile. The announcement last week that the European Central Bank cut interest rates and is also going to initiate it's version of "Quantitative Easing" surprisingly did not cause the metals to rally. Instead, the dollar rallied as investors shifted from Euro to dollar holdings which put pressure on gold and silver prices since they are denominated in dollars.  10 Year Gold Chart

10 Year Gold Chart 10 Year Silver ChartI think the temporary indirect support of the dollar provided by the ECB's move is just that and the longer term trend is toward the dollar continuing its downward movement, continuing to lose value as shown in the chart below. This is why I favor hard assets (gold, silver, real estate, etc.) at the top of the Financial Fortress. The value of gold and silver is absolute and will increase over time as the dollar continues to lose purchasing power. Not only will real estate increase in value over time, but the value of the fixed rate debt will decrease as you pay off the loan with devalued dollars. From an investor's standpoint, that's the beauty of today's low rates on 30 year fixed mortgages.

10 Year Silver ChartI think the temporary indirect support of the dollar provided by the ECB's move is just that and the longer term trend is toward the dollar continuing its downward movement, continuing to lose value as shown in the chart below. This is why I favor hard assets (gold, silver, real estate, etc.) at the top of the Financial Fortress. The value of gold and silver is absolute and will increase over time as the dollar continues to lose purchasing power. Not only will real estate increase in value over time, but the value of the fixed rate debt will decrease as you pay off the loan with devalued dollars. From an investor's standpoint, that's the beauty of today's low rates on 30 year fixed mortgages. Dollar Index - Courtesy of Shadow Government StatisticsRelated Articles:

Dollar Index - Courtesy of Shadow Government StatisticsRelated Articles:Gold and Silver Opportunity

Gold and Silver Making Moves

Hard Assets

Published on September 06, 2014 19:17

September 1, 2014

Getting Started in Real Estate Investing: Searching For a Property

Excerpt from my new book: Building a Financial Fortress: Getting Started in Real Estate Investing.

Excerpt from my new book: Building a Financial Fortress: Getting Started in Real Estate Investing.Identifying market areasBefore you start your property search, you should get out a map of your local area and review the best areas to own property. It’s best to do this with your real estate agent, since they are likely to have the area knowledge and can also perhaps identify specific neighborhoods or projects that might be worth looking into. Make sure you have clearly identified the geographic areas you are interested in by circling on a map and don’t deviate from your overall strategy, even if you have a hard time finding properties that meet your criteria. More properties are listed every day!

Location, location, locationThese are a few of the considerations when you are identifying areas to target your property search. The old saw “location, location, location” should be at the forefront of your mind.

· Walkability

· Quality/proximity of schools· Retail proximity· Public transportation· Jobs· Amenities (parks, civic or community centers, trails, etc.)· Neighboring land uses (i.e., multifamily, single family, industrial/commercial, etc.)· Impacts – (i.e., drainage channels, high voltage lines, rail lines, proximity to freeways, etc.)

Search toolsThere are many free search tools available online that allow you to customize settings and get information as soon as the MLS is updated. My favorites are Redfin and Zillow but there are many others to choose from. Your agent may have access to a proprietary system through their brokerage that provides additional tools – make sure you ask about that. If you setup your search, you will be notified as soon as there are any new listings in the area, product and price range you are interested in.

Off-market opportunities through networkOne of the advantages of building your team is that they can help you connect with a network of real estate professionals including other agents and property managers. Through that network, you may become aware of opportunities to buy property before it hits the MLS (“off market”). These are rare, but do provide an opportunity to get a property without having all the hassle of having to deal with multiple buyers.

Stay close to home when starting outMy recommendation for your first property is that you stay close to home and find a property that is within a half hour drive of your primary residence.

I think that’s a good idea for a number of reasons:

· Your market knowledge is likely to be the best in your immediate area and your chances are better of finding a good property in a good area that meets the “location, location, location” criteria above

· It’s easier for you to manage the initial renovation of the property when you purchase it or even do some or all of the work yourself prior to turning over to property manager· If you choose to self-manage the property, it’s a must· You can keep an eye on the property and can easily get there if there is a major issue (as a practical matter, the property manager will be responsible for dispatching a plumber or electrician, if needed, with your consent for emergency repairs)When I purchased my properties, I drew a circle around the main employment centers in my area and looked for properties that were close to the perimeter of those circles. The properties were close enough to the employment centers to benefit but far enough from the center to allow for a more reasonable purchase price.

As part of that process, you will begin to identify certain neighborhoods and within those neighborhoods certain condominium projects popular with investors that might be worth monitoring.

Related articles

10 Things to Remember When Looking for Investment Real Property

10 Things to Remember When Looking for Investment Real Property

Financial Fortress - Hard Assets

Financial Fortress - Hard Assets

Timeshare (Vacation Ownership) - A Prepaid Vacation, Not An Investment!

Timeshare (Vacation Ownership) - A Prepaid Vacation, Not An Investment!

Published on September 01, 2014 13:21