Nick Reichert's Blog, page 23

January 6, 2019

EV's - Good for the Environment, Good for the Budget

An electric vehicle is good for the environment and also much cheaper to operate than a gasoline-powered car, so this should be attractive to the frugal-minded. Cost of electricity is much less than gas (I used to spend over $200/month on gas and now only spend about $60/month on electricity for my EV). With an EV, you also have lower maintenance cost. There are less parts to wear out and no oil changes, since there is no engine. Brake wear should be less since these cars use engine braking which puts charge back on the battery while slowing the vehicle down. Of course, you still have to replace tires. Other than batteries, electric motor, drive train and electronic components (which should be covered under warranty), there's not much to worry about mechanically.

An electric vehicle is good for the environment and also much cheaper to operate than a gasoline-powered car, so this should be attractive to the frugal-minded. Cost of electricity is much less than gas (I used to spend over $200/month on gas and now only spend about $60/month on electricity for my EV). With an EV, you also have lower maintenance cost. There are less parts to wear out and no oil changes, since there is no engine. Brake wear should be less since these cars use engine braking which puts charge back on the battery while slowing the vehicle down. Of course, you still have to replace tires. Other than batteries, electric motor, drive train and electronic components (which should be covered under warranty), there's not much to worry about mechanically. So for someone who watches their budget and also cares about the environment, getting an electric car makes a lot of sense. Now maybe you are ready to buy an electric car, but don't want to spend a lot of money. Well that could be a challenge, especially if you are looking at luxury cars like the Tesla or BMW. It is early days in the electric car market and new models are coming out regularly, but there are some good values out there now if you are in the market for a new car today.

Here are the top 8 best cars and their prices (for 2018, as ranked by US News & World Report):

Chevrolet Bolt EV* - $36,620 - Range: 238 mi ($154/mi)Tesla Model S* - $74,500 - Range: 259 mi ($288/mi)Hyundai Ioniq EV* - $29,500 - Range: 124 mi ($238/mi)Tesla Model X* - $79,500 - Range: 237 mi ($335/mi)Volkswagen e-Golf* - $30,495 - Range: 125 mi ($244/mi)Nissan Leaf* - $29,990 - Range: 151 mi ($199/mi)BMW i3* - $44,450 - Range: 114 mi ($390/mi)Kia Soul EV* - $33,950 - Range: 111 mi ($306/mi)

*Also included on Autobytel.com's 10 Best Electric Cars for the Money List; on this list but not on the USN report:

Tesla Model 3 - $44,000 (basic model, before Federal / State tax credits and estimated gas savings of $10,550) - Range: 264 mi ($167/mi)Ford Focus Electric - $29,120 - Range: 115 mi ($253/mi)Other than the Chevy Bolt and the Teslas, the other cars on the list are really only suitable for people who have relatively short commutes to work. Based on new purchase cost per mile of range, the two best values of the bunch seem to be the Chevrolet Bolt EV and the Tesla Model 3 (highlighted in blue above). Both of these cars have a very good range of well over 200 miles. I struggle a bit with the Tesla total price tag, however. So if my goal was to buy a new car with the best value and lowest price, I would go with the Chevy Bolt.

If the price tag of a new car is too high, a pre-owned car might be a better option. I found, for example, that the BMW i3 prices for certified pre-owned cars are about half the cost of a new car and you can find similar values in the other makes. Certified pre-owned cars are generally only two or three years old, were leased to one owner, have low mileage, may even have original manufacturer's warranty remaining and are generally a great bargain. But there are some cautions in buying a used EV.

Batteries can be very expensive to replace and are a concern when buying a pre-owned EV. The older the car, the bigger the concern. It's not yet clear how long they will hold a maximum charge before starting to drain more rapidly and ultimately need to be replaced, not unlike your iPhone. Battery life is likely a big factor in the unusually high depreciation in value of pre-owned electric vehicles. Also, the technology is moving rapidly, so the older the car the less safety and other features included in the car (like driver assist, radar / cameras, front / rear sensors, blind spot protection, etc.).

I hope this post helps you sort through the many options available and find the best EV for your budget.

Published on January 06, 2019 00:30

January 4, 2019

Investing In Volatile Markets: The 5-20 Rule

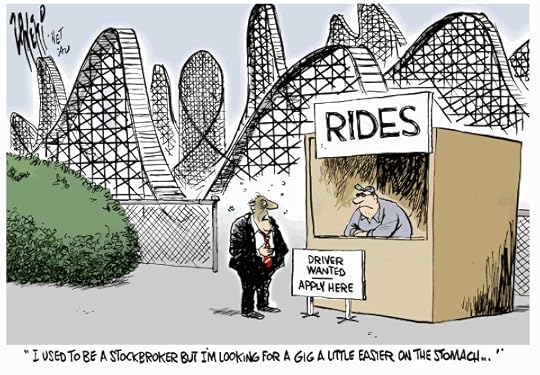

The new year has indeed brought with it more volatility in the stock market and fear is back in vogue. Why put yourself on the roller coaster of the stock market if you can avoid it? Wouldn’t you rather sleep at night knowing that no matter what happens to the markets you are making money? If you Build a Financial Fortress for yourself and your family, you can achieve financial freedom and peace of mind.

The new year has indeed brought with it more volatility in the stock market and fear is back in vogue. Why put yourself on the roller coaster of the stock market if you can avoid it? Wouldn’t you rather sleep at night knowing that no matter what happens to the markets you are making money? If you Build a Financial Fortress for yourself and your family, you can achieve financial freedom and peace of mind.

I have previously blogged about how huge drops in the stock market (like we have seen in the past and are seeing today) can gut the value of your portfolio; so much so that it could take years to recover what was lost. You should know that the stock market is a rigged game that is setup to benefit big financial institutions and program traders, not the little guy.

Most of us are not day traders and can’t move that fast with our retirement portfolio, especially when the stock market is in free-fall. For most people, their retirement accounts are where most of the money is. So a defensive strategy employed at all times makes the most sense, especially in today’s market environment of extreme volatility.

A few basic principles first: It’s really important to keep things simple. If you don’t understand it, don’t invest in it. Also, believe in the power of compounding - slow and steady does win the race and often people feel the pressure to earn great returns and take on too much risk in order to achieve those returns. Finally, cash is king and positive cash flow should be your primary focus in all that you do, whether it’s your day job, household budget, side hustle or investing approach. Maximize inflows and minimize outflows.Take a unified approach and look at your portfolio across taxable and non-taxable accounts; tax planning matters, but it should not override your fundamental strategy

I have been recommending a very simple portfolio allocation that really cuts down on the volatility while earning a good return over time with potential for upside. I call it the "5-20 Rule," and it goes something like this:

20 percent cash20 percent stocks (spread across international, US and all sectors including large and small cap - actively managed seems to be better lately than passive funds; try investing with Acorns if you haven't got an investing account20 percent bonds and fixed income20 percent real estate (either REITS or direct real estate investments)20 percent alternatives including life insurance, royalties, gold / silver, crypto (limit crypto to 1 percent or so of total)

In each bucket, ensure there is plenty of positive cash flow, so the goal should be to maximize yield of each investment. For example, cash yield can be maximized by investing in US Treasury Bills, which are extremely safe and are currently yielding about 2 percent (see my post on this one). Stock yield can be maximized by investing in solid dividend stocks like AT&T, ExxonMobil, Con Edison or Ventas (here's why I like these particular names). Bonds and fixed income yields are usually tied to duration, so best to have a balance of shorter and longer. For alternatives, use a blended approach of both yield (life insurance / royalties - follow links to my previous posts on these ideas) and appreciation (gold / silver and crypto) for upside.

If you have positive cash flow coming in from multiple sources, you can be less concerned when a small portion of your portfolio takes a hit due to market value declines. The goal should be in the worst market scenario to suffer no more than a 10 to 20 percent portfolio loss overall. When you are broadly diversified as outlined, that outcome is very unlikely.

It can take some time to get your strategy realigned and may take a year or two to complete, but better to get started now than wait. If you have cash to invest, put it to work in the new allocation and re-balance your other investments over time, when the opportunity presents itself. What’s most important is that once you set everything up, stay the course and eventually, you’ll see the results. Often times people become impatient with performance and make bad decisions that are not consistent with their strategy, or worse, they have no strategy. Having the discipline and focus to stay the course will help ensure your ultimate success.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 04, 2019 07:47

January 1, 2019

10 Personal Finance Ideas for 2019

With the new year already here, it's not too late to revisit your overall saving, investing and personal finance picture. What will you change? What will you do the same? Do you have the right strategy or do you need to make adjustments? One thing is for sure, we will continue to see plenty of volatility in the financial markets this year. We can also be certain a recession is on the horizon - exactly when and how it will be triggered, however, is unclear. We just need to be prepared. Now more than ever, it's important to have a plan to protect and grow your wealth, with flexibility to take advantage of opportunities that may arise in the new year.

With the new year already here, it's not too late to revisit your overall saving, investing and personal finance picture. What will you change? What will you do the same? Do you have the right strategy or do you need to make adjustments? One thing is for sure, we will continue to see plenty of volatility in the financial markets this year. We can also be certain a recession is on the horizon - exactly when and how it will be triggered, however, is unclear. We just need to be prepared. Now more than ever, it's important to have a plan to protect and grow your wealth, with flexibility to take advantage of opportunities that may arise in the new year.Here are 10 personal finance ideas for 2019:

Stay disciplined and focused in all that you do - whether it be your job or your side hustle, work hard and demand excellence from yourself and othersFully fund your 401(k) and IRA; if you can't do that, at least increase the percentage that you contribute - this is the best way to save automatically; out of sight, out of mindKeep plenty of cash as a buffer for uncertainty and to take advantage of buying opportunities - recommend 20% of portfolio and invest that cash in US Treasury Bills, the yields are great right nowKeep working toward passive income on multiple fronts; find out what strategy works best for you and keep working at it; What idea has generated the most cash flow for you? Please share in a comment!Keep your investment allocation set where you are comfortable; now doesn't feel like the time to put more allocation to stocks unless you are simply re-balancingMake sure you have 3-6 months of expenses in cash in an emergency fund Review your activities / investments where you have had the most success, especially positive cash flow and continue to focus your efforts there; read books and articles to generate new ideas and try them out with small investments to see how they work!Identify you speculative investment opportunities and make sure you have money allocated there at an appropriate level - consider Crypto, private equity investments and other "10x" opportunitiesUpdate your household budget and make sure you pay yourself first through savings; don't leave "extra" money in your checking account, where it can be easily spentCheck your withholding taxes and don't forget everything resets January 1 - goal should be to come out as close as possible to even when you file your taxes (maybe a small refund); if you need help, get a tax accountant!I hope you have a Happy, Healthy and Prosperous New Year!

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on January 01, 2019 19:54

December 28, 2018

Timeshare - Still Not An Investment!

We are on vacation in Cancun, Mexico at a nice resort and just barely missed having to sit through a timeshare presentation. Upon arrival here, I was reminded that the timeshare industry is alive and well. Very generous gifts and a nice breakfast await you if you are willing to sit through a one hour sales presentation. You will often hear people say how great it is to own a timeshare, especially one in a high-demand location since since you can exchange your week(s) for just about any place in the world easily. That's really cool if 1) you can actually get regular vacation time each year for one or two weeks, 2) you can find a suitable place to "exchange" into each year, or if not 3) you are happy returning to the exact same place year after year. The thing you have to remember is that timeshare (also called vacation ownership) is really pretty simple: it's a prepaid vacation. If you return to the same place year after year it might make sense, but why own when you can rent and why prepay your vacation at all? We just stay in different places whenever we go on vacation and this place is no different - great amenities for the whole family (sandy beach, pool with a waterfall/water slides, swim-up bars, activities for the kids - check!). I have really enjoyed our vacations at timeshare resorts - you book your trip online, find a good deal and away you go. If you can manage to avoid the sales presentation and high-pressure sales pitch, you're good to go.

Don't believe the timeshare sales agent when they say this is investing in real estate - it's not. You own a fractional interest in a unit, it's true, and you may even be able to deduct the interest on the loan (assuming you don't pay cash) as a second or vacation home, but you are on the hook for your proportionate share of all costs of ownership (including insurance, property taxes, homeowner association, etc.). In addition, you are also responsible for your proportionate interest in a vacation ownership association, which runs the front desk, housekeeping, maintenance of the units, etc. This can be quite costly and as an individual owner you have very little control over these costs. Reselling your timeshare can also be a nightmare - the resale market is generally loaded with units that are often priced below the developer's pricing (all the more reason not to buy from the developer if you do decide to buy a timeshare).

You might think owning a "condo tel" is better since you actually own an entire unit and when you aren't using it, the hotel rents it out to individual travelers and you get a share of the revenue (after covering all costs, of course). Unfortunately, these are much better for the developer (who gets to cash out by selling the units to individuals) and the operator who gets to run a hotel without having to own the property. As a unit owner, you are exposed to all ownership/proportionate hotel operating costs of the unit and if there are no visitors which can happen in difficult economic times, you are likely to incur a sizable loss each month. Not only that, but resale of these units will be a challenge since the buyer pool is limited (some units have very small or no kitchen - just like a hotel room).

If you really like taking vacations, stay in a condo or hotel - even if it's a timeshare operation, just avoid the free breakfast and/or the discounted tour/luau tickets.

If you really want to invest in real estate, then buy an investment property (if you're interested in getting started in real estate investing, check out my book here) .

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 28, 2018 18:24

December 25, 2018

Are We Starting to See the "Aftershock" of the Great Recession?

It's been a while since I read "Aftershock" by David and Robert Wiedemer and Cindy Spitzer, which I have included in my recommended reading list. In the book, originally published in 2011, the authors lay out the case for what lies ahead as the dollar bubble and government debt bubble begin to burst (the last two bubbles in our so-called "bubble economy"). Could this be unfolding now with the recent stock market sell-off?

It's been a while since I read "Aftershock" by David and Robert Wiedemer and Cindy Spitzer, which I have included in my recommended reading list. In the book, originally published in 2011, the authors lay out the case for what lies ahead as the dollar bubble and government debt bubble begin to burst (the last two bubbles in our so-called "bubble economy"). Could this be unfolding now with the recent stock market sell-off?When these bubbles burst, the authors claim that there are only two asset classes that you should be invested in: cash and gold - mostly gold. All other asset classes, including stocks, bonds, real estate, whole life insurance policies, etc. will suffer significant declines in value.

There may well be very good values in these non-cash/gold asset classes at some point in the future, but only after the bubbles have burst. At the core of their concern is the Federal Reserve printing money (lowering interest rates / quantitative easing) to stimulate the economy - they believe this is highly inflationary and that in the next one to three years, we could see very high rates of inflation - perhaps as much as 10% per year. They might have been a little too early with this call, but not completely off the mark. Indeed, despite the Fed raising short term interest rates recently, the bond market already sensed growing inflation, which is why longer term interest rates have been climbing rapidly over the past year, as shown in the 10-year Treasury chart below:

10-Year Treasury Rate - One Year (courtesy of www.macrotrends.net)The recent drop in Treasury rates is likely more due to uncertainty and a flight to safety from stock market losses, rather than a change in inflation expectations.

10-Year Treasury Rate - One Year (courtesy of www.macrotrends.net)The recent drop in Treasury rates is likely more due to uncertainty and a flight to safety from stock market losses, rather than a change in inflation expectations.I was a little surprised to see real estate included in the "avoid" category. I have long believed that investment property, especially residential real estate, that provides positive cash flow would weather an inflationary storm pretty well. We would normally expect the value of the asset to increase with inflation and your equity should further increase as the mortgage is paid down. Also, the largest cash outflow (the mortgage payment) is fixed, while rental income and other expenses should increase at about the same rate as inflation, which means your cash flow should grow faster over time. Of course in a recession, you could face falling rents in order to maintain occupancy. In that case you could potentially see negative cash flow, especially if you recently purchased the property. If the negative cash flow is sustained and you can't support it, you could be forced to sell the property at a loss.

The recent sell-off in the stock market adds to the credibility of their argument that there has been no real economic recovery since the Great Recession and the stock market increase can be largely attributed to the money printing operations of the Federal Reserve (which include keeping interest rates very low and quantitative easing, or purchasing of bonds in the open market to artificially lower interest rates). This is especially true if you believe that official statistics such as inflation and unemployment are under-reported due to changes in how the measures are calculated over the years.

In addition to the low interest rates, the government has also applied fiscal stimulus in the form of tax cuts and spending increases, further inflating the government debt bubble which was already growing with persistent deficits. Higher interest rates and debt balances also increases the amount of interest the government has to pay on all that debt, which further increases borrowings to cover the payments. As the Aftershock authors correctly point out, the cure will become the poison in the form of inflation and ultimately destabilization of markets due to over-leveraging.

Ironically, the "safe haven" investment of choice is US government debt each time the stock market sells-off, but that may soon change to gold (and to a lesser extent the other precious metals) when inflation becomes more significant.

If you haven't read this book, I'd recommend it. I'd also recommend you look at your portfolio and consider changing your strategy to adjust to these economic times. Check out my recent blog post on the subject here.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 25, 2018 22:06

December 22, 2018

Investing: In the New Economy

If you have been worried about the stock market lately, you probably don’t have the right investing strategy. Despite all the recent volatility, I have been sleeping well and not worried at all. Why is that you might ask? Well simply put, I switched to a very different investing strategy after the Great Recession, almost 10 years ago.

If you have been worried about the stock market lately, you probably don’t have the right investing strategy. Despite all the recent volatility, I have been sleeping well and not worried at all. Why is that you might ask? Well simply put, I switched to a very different investing strategy after the Great Recession, almost 10 years ago. I believe we are living in a time of major bubbles, followed by huge crashes that are amplified by leverage in the financial system including central bank “easy money” policy, which encourages speculative borrowing. Here are a few examples of recent bear markets and the loss of the S&P 500 stock index:October 2007 – March 2009 (Great Recession) – 56.4% lossMarch 2000 – October 2002 (Dot.com) – 49.1% lossAugust 1987 – December 1987 (Black Monday) – 33.5% loss

It’s interesting to note that the last three bear markets have seen losses grow each time. Traditional investment approaches, especially for small investors, just don’t work anymore. Buying stocks and holding on to them long term exposes you to huge losses in market downturns that are very difficult to recover from. I’ll give you an example. Say you invest in stocks and your portfolio loses half its value, so it goes from $50,000 to $25,000. How long will it take you to just to get back to $50,000? Well, it depends on your rate of return, but here are a few examples:5% - 14 years7% - 10 years10% - 7 years12% - 6 years

As you can see, a 50% loss is catastrophic to a portfolio and just getting back to where you started is extremely difficult.

While I don’t see tremendous returns, I do get slow and steady returns and most importantly little or no volatility in the value of my portfolio. Here’s what I do to enjoy solid returns with low volatility:

First of all, I made my 401(k) portfolio very conservative and I only have 20% exposed to stocks, broadly diversified with the rest in a relatively equal mix of bonds, fixed income and cash. My year to date return is only -3%, which feels pretty good given what has happened to the stock market recently. What’s even better, is that when the market recovers and as I continue to make contributions every month, the equity portion of my portfolio will enjoy out-sized gains and will help boost my overall return.

Secondly, I use a number of different passive income strategies to generate cash flow with little or no volatility, including:Cash invested in US Treasury bills, which have a very nice interest rate currently (much higher than banks) – close to 2% as of this writingResidential real estate with positive cash flowIncome producing music royalties

I also have a few investments that could enjoy tremendous (10x or more) returns, but are highly risky and therefore I have only allocated a small amount to them:CryptocurrenciesEarly stage company ("Angel") investments

I also keep a small amount of my portfolio in gold and silver coins for safety, inflation hedge and long term appreciation.

This is the essence of Building a Financial Fortress, which I have been practicing for the last 10 years and I believe it’s very important to find new, creative ways to protect and grow your wealth in the new economic environment we are facing today.

For more investing ideas, click here.

Published on December 22, 2018 18:09

Investing in the New Economy

If you have been worried about the stock market lately, you probably don’t have the right investing strategy. Despite all the recent volatility, I have been sleeping well and not worried at all. Why is that you might ask? Well simply put, I switched to a very different investing strategy after the Great Recession, almost 10 years ago.

If you have been worried about the stock market lately, you probably don’t have the right investing strategy. Despite all the recent volatility, I have been sleeping well and not worried at all. Why is that you might ask? Well simply put, I switched to a very different investing strategy after the Great Recession, almost 10 years ago. I believe we are living in a time of major bubbles, followed by huge crashes that are amplified by leverage in the financial system including central bank “easy money” policy, which encourages speculative borrowing. Here are a few examples of recent bear markets and the loss of the S&P 500 stock index:October 2007 – March 2009 (Great Recession) – 56.4% lossMarch 2000 – October 2002 (Dot.com) – 49.1% lossAugust 1987 – December 1987 (Black Monday) – 33.5% loss

It’s interesting to note that the last three bear markets have seen losses grow each time. Traditional investment approaches, especially for small investors, just don’t work anymore. Buying stocks and holding on to them long term exposes you to huge losses in market downturns that are very difficult to recover from. I’ll give you an example. Say you invest in stocks and your portfolio loses half its value, so it goes from $50,000 to $25,000. How long will it take you to just to get back to $50,000? Well, it depends on your rate of return, but here are a few examples:5% - 14 years7% - 10 years10% - 7 years12% - 6 years

As you can see, a 50% loss is catastrophic to a portfolio and just getting back to where you started is extremely difficult.

While I don’t see tremendous returns, I do get slow and steady returns and most importantly little or no volatility in the value of my portfolio. Here’s what I do to enjoy solid returns with low volatility:

First of all, I made my 401(k) portfolio very conservative and I only have 20% exposed to stocks, broadly diversified with the rest in a relatively equal mix of bonds, fixed income and cash. My year to date return is only -3%, which feels pretty good given what has happened to the stock market recently. What’s even better, is that when the market recovers and as I continue to make contributions every month, the equity portion of my portfolio will enjoy out-sized gains and will help boost my overall return.

Secondly, I use a number of different passive income strategies to generate cash flow with little or no volatility, including:Cash invested in US Treasury bills, which have a very nice interest rate currently (much higher than banks) – close to 2% as of this writingResidential real estate with positive cash flowIncome producing music royalties

I also have a few investments that could enjoy tremendous (10x or more) returns, but are highly risky and therefore I have only allocated a small amount to them:CryptocurrenciesEarly stage company ("Angel") investments

I also keep a small amount of my portfolio in gold and silver coins for safety, inflation hedge and long term appreciation.

This is the essence of Building a Financial Fortress, which I have been practicing for the last 10 years and I believe it’s very important to find new, creative ways to protect and grow your wealth in the new economic environment we are facing today.

For more investing ideas, click here.

Published on December 22, 2018 18:09

December 18, 2018

Passive Income: 4 Dividend Stocks

I recently spent some time investigating dividend stocks to help build passive income. My screening criteria were primarily: safety of company and dividend, good dividend yield, solid track record of dividend payment, good dividend increases over time, solid financial performance and balance sheet and some diversification across different industries. After reviewing many articles and doing my research, I landed on the following 4 "All Star" dividend stocks.

I recently spent some time investigating dividend stocks to help build passive income. My screening criteria were primarily: safety of company and dividend, good dividend yield, solid track record of dividend payment, good dividend increases over time, solid financial performance and balance sheet and some diversification across different industries. After reviewing many articles and doing my research, I landed on the following 4 "All Star" dividend stocks. Here they are and why they were selected:

1) AT&T (T):Sector - TelecommunicationsDividend Yield - 6.86%Market Cap - $217BnAssets: Liabilities - 1.53AT&T has grown its dividend for 33 years. 2013-2017 increase in cash dividends was 24%.Quick Take: T has grown its dividend consistently over time and especially the last few years, has a long payment record, represents a great yield compared to many other companies and has a strong balance sheet and a commanding market position.2) Ventas (VTR)

Sector - Real Estate - HealthcareDividend Yield - 5.14%Market Cap - $22BnAssets: Liabilities - 1.928% compound annual dividend increase since 2001.Quick Take: VTR has grown its dividend consistently, has a long payment record, represents a great yield compared to many other companies and has a strong balance sheet.

3) Consolidated Edison (ED)

Sector - UtilitiesDividend Yield - 3.57%Market Cap - $25BnAssets: Liabilities - 1.47Con Edison has increased its dividend for 44 consecutive years.Quick Take: ED has grown its dividend consistently, has a very long payment record, represents a great yield compared to many other companies and has a strong balance sheet.

4) Exxon-Mobil (XOM)

Sector - EnergyDividend Yield - 4.56%Market Cap - $313BnAssets: Liabilities - 2.25ExxonMobil's dividend payments to shareholders have grown at an average annual rate of 6.2% over the last 36 years.Quick Take: XOM has grown its dividend consistently, has a very long payment record, represents a great yield compared to many other companies, has a very strong balance sheet and has a commanding market position. If you are looking to increase your passive income, these four dividend stocks are a great way to start or build your passive income stream from dividends.

For more investing ideas, click here.

Disclaimer: This is not a recommendation to invest. I don't hold any positions in these stocks. I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 18, 2018 22:06

December 16, 2018

Is Now a Good Time to Invest in Silver?

Is now a good time to invest in silver? If you have been watching the price of silver versus gold, you know that silver generally tracks gold's price movements over time pretty closely. However, since the beginning of 2017 there has been a widening gap in performance and recently, the gap has widened even more, with gold moving up in value while silver continues to decline. Both metals are good hedges against inflation, are popular with investors and are available in many forms, both physical and non-physical. If you want to learn more about investing in gold and silver, please check out my new audio book Building a Financial Fortress: Investing in Gold and Silver on Audible.

Is now a good time to invest in silver? If you have been watching the price of silver versus gold, you know that silver generally tracks gold's price movements over time pretty closely. However, since the beginning of 2017 there has been a widening gap in performance and recently, the gap has widened even more, with gold moving up in value while silver continues to decline. Both metals are good hedges against inflation, are popular with investors and are available in many forms, both physical and non-physical. If you want to learn more about investing in gold and silver, please check out my new audio book Building a Financial Fortress: Investing in Gold and Silver on Audible. Inflation definitely seems to be a concern in the bond market with the movement of long-term interest rates recently and certainly has the attention of the Federal Reserve as they continue to raise short-term interest rates. While gold has demand from jewelry manufacturing, silver has many industrial uses especially in the high tech and medical industries. As such, the demand for silver is not only limited to investors but also industrial users.

The chart below shows the divergent price movement between gold (the blue line) and silver (the orange line). Silver has reached $21/ounce a couple times in the past 5 years and currently sits at about $14/ounce (a two year low), so there's potential to see a 50% increase in value, assuming silver can return its prior peak. Key drivers for silver will be inflation reading, investor demand and industrial demand (which to a large degree depends on continued economic strength). Back in September, it was reported that the US Mint temporarily sold out of Silver Eagle coins due to strong investor demand, which bodes well on that front.

Gold vs Silver - 5 years (www.macrotrends.net)

Gold vs Silver - 5 years (www.macrotrends.net)The chart below shows inflation over time. The true rate of inflation is actually much higher than currently reported in the press, due to changes in how it is calculated over time. The Shadowstats alternate shows the true rate of inflation which is about 10%. This is significant and could be a big driver of the price of gold and silver over time.

If you're interesting in investing in gold or silver, check out Money Metals Exchange for a great selection of coins. You might even find a great Holiday gift idea there.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 16, 2018 21:41

December 15, 2018

Advantages of Residential Real Estate Investment

Now might be an excellent opportunity to buy residential property to operate as a rental, despite what you might be reading in the news about slowing housing markets and rising interest rates.

Now might be an excellent opportunity to buy residential property to operate as a rental, despite what you might be reading in the news about slowing housing markets and rising interest rates.Single family homes, condominium units and small (4 units or less) apartment buildings continue to be very attractive long-term investments for several reasons:

All of these types of properties can qualify for conventional 30-year fixed-rate mortgage loans for a 20% - 25% down payment, a huge advantage to investors compared to commercial properties that typically can only secure financing for 10 years or so and could require a much higher down payment (equity) in the 30% to 40% range; this gets even more challenging when you have to refinance the property, especially when the market drops significantly and forces you to put more money into the commercial property Home prices, while higher than they have been recently, are still attractive in most markets and many good markets still have "bargains," if you look closely and are willing to fix a few cosmetic issues prior to renting the property. Interest rates, although moving higher recently, are still very low by historical standards.Demand for rental units will continue to be strong even if the economy slows down for a few reasons: 1) people will still need a place to live, 2) many people are "renters by choice" nowadays and 3) even more people have to rent because home ownership is unattainable due to down payment and credit standards, which have both remained at elevated levels since the Great Recession. Don't forget the tax advantages - if you meet certain requirements you can deduct the loss from real estate property (due to depreciation of the building, a non cash expense) against your ordinary income, lowering your tax bill! Check with you tax adviser.For all these reasons, it makes a lot of sense to purchase residential property and convert to rental use. The most important thing to remember is that cash flow is king, and this can save your investment whether property values are growing or shrinking. The goal is to have positive cash flow each and every month to build up for emergency repairs or renovation initially and then to use for other investments when you have enough saved.

It's best to ignore the fluctuations in the value of your property as long as you can pay the mortgage, since this will slowly grow your equity in the property regardless of what happens in the housing market. In the long run, property values will increase with inflation. There's no better way to grow your wealth than with real estate investments because you can make a small initial investment and use bank loan (leverage) to acquire the property and you get to keep all of the appreciation over time.

Here are some quick tips when looking for a property:

When reviewing property listings, do a careful analysis of the monthly cash inflows and outflows based on realistic (below-market) rent and higher operating expenses. Leave yourself some room if rents soften or expenses increase so you can still enjoy a nice positive cash flow stream regardless of the markets. This is a great way to build your passive income strategy.Use Craigslist, Zillow or other online sites to research rental rates that are being asked in your area and also talk to your real estate agent.If there isn't positive cash flow with conservative financial projections, don't buy the property - move on to the next one. You may have to look at many properties before you find the one that meets your criteria - be patient. Make a careful investigation of the property to make sure you are aware of all of the issues and also what the cost will be to fix-up the property to get it into shape to rent.Plan for repairs and maintenance after you own the property and include that in your cash flow budget. If you aren't sure how much to budget, ask your friends who own rental properties or your real estate agent what their experience is and set aside a percentage of the rent for these costs. Expect expenses to spike when you have new tenants move in (my experience) and plan accordingly. Make sure you have a good real estate agent who understands investment property (even better if they own a few themselves) and can write an offer quickly - this is especially important when buying foreclosed or short sale properties where there is usually lots of competition.Be prepared to have enough for the down payment, closing costs, a repair reserve and costs to fix up the property - your real estate agent should be able to help you put a budget together for those costsAlso consider using a property manager if the monthly cash flow allows - unless you want to fix leaky faucets and change light bulbs yourself; I prefer to use a property manager and it's worth the cost to me but some people prefer to self manage if the property is close to their home. Real estate investing is a team sport and you need to make sure you have a great team, including your real estate agent, lender and property manager!

www.macrotrends.net - 30 Year Fixed Mortgage

www.macrotrends.net - 30 Year Fixed MortgageFor more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 15, 2018 11:08