Nick Reichert's Blog, page 24

December 13, 2018

Building a Financial Fortress

How to you protect your hard earned wealth, savings and investments? How do you make sure you continue to grow your money? What is the best strategy to implement these objectives?

How to you protect your hard earned wealth, savings and investments? How do you make sure you continue to grow your money? What is the best strategy to implement these objectives? You can visualize your personal finances as a fortress. A fortress offers you protection and peace of mind from the wild fluctuations of the stock / bond market, the economy, worries about retirement or funding children's educations, life's unexpected expenses, etc.

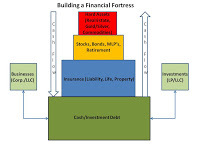

The graphic to the left depicts the Financial Fortress visually.

The Financial Fortress has 5 components as follows:Cash / Investment Debt form the base. Adequate levels of cash are needed to protect against uncertainties, for new investment opportunities and sometimes cash offers a superior return to other asset classes. Investment debt ("good debt") allows leverage (other people's money) to buy assets that will generate additional positive cash flow - i.e., a mortgage for an investment property or a personal loan to start a business or make a new investment. "Bad debt" like credit card debt, auto loans, etc. should be paid off as soon as possible. If you have cash earning 0.5% or less in a bank, you can't afford not to pay off "bad debt."Insurance (Liability, Life and Property) - form the next layer. Insurance provides protection against accidents or lawsuits and also protects your real and personal property in the event of a loss. Life insurance protects your family in the event of death and also provides a nice retirement planning vehicle.Businesses and Investments form the two components that are outside the fortress; these are like watchtowers, places where you can conduct a business or outside investment with other investors, but they are isolated from the main fortress for liability reasons; these will typically be held in limited liability entities, such as corporations, LLC's, LP's, etc. Everyone should have a business, even (and especially) if they work at a regular job - something you are passionate about that has the potential to make money. You never know, you may need to quit your day job to run your business! What business are you in?Stocks, Bonds, MLP's and Retirement - form the next component of the fortress. This is where paper assets, including stocks, bonds, master limited partnerships (which are excellent sources of cash flow with commodity upside), 401(k) and IRA accounts are held. The taxable stocks that pay dividends and bonds provide a source of positive cash flow to replenish the base of the Financial Fortress. I would include other alternative investments in this category as well, including music royalties, cryptocurrencies, and private equity.Hard Assets (Real Estate, Gold/Silver, Commodities) form the top of the fortress. These assets provide long term protection against inflation and in the case of real estate and some commodities, a great way to build wealth while offering a steady source of positive cash flow to replenish the base of the Financial Fortress. For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 13, 2018 22:46

December 10, 2018

Long Distance Real Estate Investing

Have you ever wanted to invest in residential real estate to diversify your investment portfolio away from stocks? If you are ready to get started investing in real estate on your own, you may want to read my book on Real Estate Investing.

Have you ever wanted to invest in residential real estate to diversify your investment portfolio away from stocks? If you are ready to get started investing in real estate on your own, you may want to read my book on Real Estate Investing.You may have the money to invest, but maybe you don't have the time to look for properties and do all the work involved in buying a property. Maybe your local real estate market is overpriced and it's very hard to find good deals and especially properties that produce positive cash flow. Maybe you live in an area where the cost of real estate is low, but the investment opportunities just aren't very good in terms of cash flow and / or long term appreciation. Being able to easily invest in good markets across the United States would help overcome these obstacles, however this is a difficult proposition.

I have done long distance real estate investing myself and can speak from experience. Fortunately I was lucky to find a good, hard working real estate agent, lender and property manager who were able to work with me remotely, but that's not always easy to do. Needless to say, finding, purchasing and closing a residential real estate investment remotely was challenging and there were many obstacles including just finding a property, completing inspections (my agent took lots of photos and sent them to me to review), finding a lender, getting through the loan approval process, finding a property manager, getting the unit ready to rent, finding a tenant, etc. In my case, I found a property in Hawaii and got a national lender on board initially, but when they did their due diligence, they found the building was a residential building in a nonresidential zone (grandfathered use) and they didn't want to do the loan. I ended up having to extend the closing date and start over. Fortunately I was able to find a local bank who was able to do the loan, since they are more familiar with that situation and was able to close the deal but what a headache!

However, if there was a platform that served up vetted properties for sale, leveraging big data about markets, cities and individual properties and also facilitated the transaction from sale, loan origination, closing, preparation for rental, property management and ultimately disposition, that might be interesting. Especially if you could still earn a competitive cash on cash return as well as total return, even with all those services provided. One such platform I have discovered is Homeunion (brief introductory video below):

As you can see, the process is pretty simple and it truly is full service. Their total returns over the past 12 months across the different markets they operate in aren't too bad and range from 10.04% in Chicago to 16.53% in Dallas. Annualized net operating income (cash on cash return, unleveraged) is in the 4% to 5% range.

If you are looking at long distance real estate investing, Homeunion or other platforms like it might be a good option for diversifying your investments.

Disclaimer: This is not a recommendation to invest and you need to make your own investment evaluation. I have invested in Homeunion's Fix and Flip fund this year but I have not purchased real estate on their platform. I have not received any compensation for this post from Homeunion.

Published on December 10, 2018 23:31

December 8, 2018

Real Estate Crowdfunding

I was recently introduced to CrowdStreet, a real estate crowdfunding site and wanted to share a bit about them that I learned. This site offers an intriguing way to diversify your investment portfolio into commercial real estate. First of all, you have to be an accredited investor to invest in these deals. See my post on Angel Investing for more info, but basically your net worth needs to be over $1 Million, not including your home, or you need to make $200K/year ($300K/year if you are married).

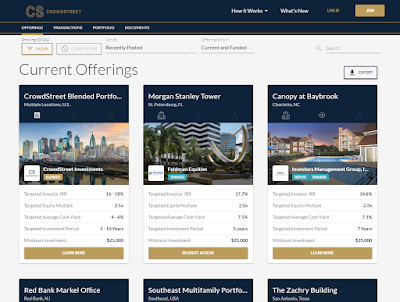

I was recently introduced to CrowdStreet, a real estate crowdfunding site and wanted to share a bit about them that I learned. This site offers an intriguing way to diversify your investment portfolio into commercial real estate. First of all, you have to be an accredited investor to invest in these deals. See my post on Angel Investing for more info, but basically your net worth needs to be over $1 Million, not including your home, or you need to make $200K/year ($300K/year if you are married). If you meet the requirements of an accredited investor, you can setup your account, submit an offer and if accepted, move to funding. The nice thing about this site is that it offers small investors access to institutional quality real estate investments that they don't normally have access to (other than investments in mutual funds or REITs). The site has a very rigorous, 26-step vetting process for deal sponsors (owners of real estate that are looking for funding) and less than 3% of the deals they review are accepted. The video clip link below describes this process, which I have to say is pretty thorough:

Expertly Reviewed Commercial Real Estate Offerings

Investments include individual properties (you can sort by asset classification like office, retail, hotel, apartment, industrial, etc.) and they also have a few blended fund type investments with multiple properties included. Minimum investments are typically $25K or $50K and the holding periods vary depending on the asset. Most of the time they have managed to exceed the target rates of return in a shorter period of time, but the good economy of the past several years has no doubt helped.

Here's a look at the screen that lists available deals.

The listings will feature the investment targets for hold period, cash yield, internal rate of return and equity multiple. The equity multiple is your total return plus your investment divided by the investment. Both equity multiple and internal rate of return take into account the sale of the property at the end of the hold period in the calculation, while the cash yield is simply annual cash distributions to equity holders divided by the total equity investment while the property is being held and operated.

For more investing ideas, click here.

Disclaimer: I have not received any consideration from the company or affiliate income and I'm not currently an investor on their platform. This is not a recommendation to invest and you will need to do your own due diligence before investing.

Published on December 08, 2018 21:38

Crypto Rankings

If you are looking at investing in crypto, you have probably noticed that there are many different coins to choose from and because the technology moves rapidly, some of the leading coins now may not have the same growth potential as they have in the past (i.e., Bitcoin).

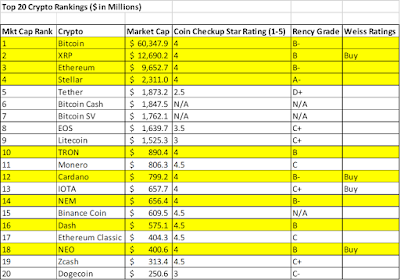

If you are looking at investing in crypto, you have probably noticed that there are many different coins to choose from and because the technology moves rapidly, some of the leading coins now may not have the same growth potential as they have in the past (i.e., Bitcoin).In order to sort through this and develop a better approach to choosing which coins to invest in, I started with a list of the top 20 cryptocurrencies by market capitalization. I reviewed all recent ratings available online and compiled the ranking matrix below that takes into account market cap, most recent star ratings (1-5) from CoinCheckup, letter grades (A-F) from Rency and where applicable, recent Weiss buy recommendations. By looking at those coins that have at least a 4 star rating and at least a B (with or without Weiss buy rating), the coins fall into two general categories: 1) large cap coins that are at the top of the chart and 2) small cap coins that are at the bottom of the chart, all of which I have highlighted in yellow as potential candidates for investment. You will need to do your own review / analysis and this is not a recommendation to invest in any particular coin.

This approach will slightly modify my recent post on crypto investing strategy which outlines how to allocate your investment between the various coins for diversification. Again, I would not invest more than 1% of your assets into crypto to be conservative.

I hope this tool is helpful for your crypto investing. If you haven't already opened a trading account or are interested in having a secondary account, I recommend Coinbase as a good app to invest and hold your crypto.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 08, 2018 01:06

December 6, 2018

Life Insurance for Retirement Planning

One of the drawbacks of traditional retirement accounts such as IRA's and 401(k)'s is the fact that they require minimum distributions, whether you need the money or not, after age 70 1/2. In addition, the full amount of the withdrawals are taxed as ordinary income at the tax rates in effect at the time you take the money out, except for Roth IRA's where you are only taxed on the earnings. Your reward for being an excellent investor is to pay much of what you have saved and earned back to the government in taxes. While it's possible you may be in a lower tax bracket when you retire, it is unlikely that taxes will be any lower than they are today with the government continuing to borrow money and inflation.

One of the drawbacks of traditional retirement accounts such as IRA's and 401(k)'s is the fact that they require minimum distributions, whether you need the money or not, after age 70 1/2. In addition, the full amount of the withdrawals are taxed as ordinary income at the tax rates in effect at the time you take the money out, except for Roth IRA's where you are only taxed on the earnings. Your reward for being an excellent investor is to pay much of what you have saved and earned back to the government in taxes. While it's possible you may be in a lower tax bracket when you retire, it is unlikely that taxes will be any lower than they are today with the government continuing to borrow money and inflation.An interesting alternative retirement plan idea is to buy a whole life insurance policy from a highly rated insurance company with a very low death benefit. You then pay the maximum premium allowable under IRS guidelines and the money paid in excess of the premium builds up as "cash surrender value" over time and earns a return based on the insurance company's general investments. Insurance companies tend to be very conservative and efficient long term investors and do well in good and bad markets - indeed very few highly rated insurance companies have failed, compared to many banks. One of my best investments during the Great Recession was my life insurance policy. The cash surrender value of the policy grows tax free. Funds can then be withdrawn in retirement by taking out loans against the policy. Those loans are not considered income and are therefore are not taxable. The loans are repaid out of the death benefit, with any excess paid to the beneficiaries of the policy.

A great book on this subject is Missed Fortune 101: A Starter Kit to Becoming a Millionaire

, by Douglas R. Andrew. You must be willing to commit some time to understanding life insurance, which can be a bit challenging. You will also need to consult with your tax adviser. You may cringe when the author suggests that you borrow against home equity as a source of funding for the up-front life insurance premium payments, but it's a great way to move your home equity into something safer, as long as you can handle the higher mortgage payment. The concept that home equity is neither liquid nor safe is not lost on most of us having survived the Great Recession.

, by Douglas R. Andrew. You must be willing to commit some time to understanding life insurance, which can be a bit challenging. You will also need to consult with your tax adviser. You may cringe when the author suggests that you borrow against home equity as a source of funding for the up-front life insurance premium payments, but it's a great way to move your home equity into something safer, as long as you can handle the higher mortgage payment. The concept that home equity is neither liquid nor safe is not lost on most of us having survived the Great Recession.One of the biggest advantages to the life insurance retirement plan is that you are not required to take minimum distributions with an insurance policy. You can withdraw only what you need. As mentioned previously, policy loans are not taxable as long as the policy meets certain requirements, which is great since it can help keep you in a lower tax bracket in retirement. This reduces taxes on your other income (social security, pensions, investments, etc.) and helps those dollars go farther. You do need to take some care in choosing a highly rated insurance company that will issue the policy as discussed previously.

Even if you are unwilling to go "all in," this strategy can still be used to supplement traditional retirement savings such as IRA, Roth IRA and 401(k) accounts.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 06, 2018 22:23

December 5, 2018

10 Monthly Expenses To Audit for Savings

Now, with the end of the year coming and a new year on the horizon, is a good time to look closely at your monthly expenses to see where you can reduce your spending and put that money back into savings or investments. It's good to do an audit once in a while, since we tend to spend money on things and then forget about them or circumstances change and we no longer need to spend as much as we have in the past.

Now, with the end of the year coming and a new year on the horizon, is a good time to look closely at your monthly expenses to see where you can reduce your spending and put that money back into savings or investments. It's good to do an audit once in a while, since we tend to spend money on things and then forget about them or circumstances change and we no longer need to spend as much as we have in the past. Here is a brief list of expenses you might want to look at:

Mortgage / Rent - Look at refinancing your mortgage if you haven't already done so. Even if rates have gone up, your payment could still be reduced since the new mortgage will be amortized over a new 30 year term, which can save you money every month; if you rent, look at moving to a new apartment with a lower monthly payment - many areas, especially on the coasts, are seeing lots of new apartment buildings opening and they are competing for your business Car Payment - Trade in your car for a smaller, more fuel efficient car - consider buying an electric vehicle to save money on gas and help the environment; if you live in California, there are many rebates available for purchasing new or used electric vehicles, installing a home charging station and other incentives. There are also many great incentives available for low income households to help buy a new electric vehicle. Go to Drive Clean website for more information. Utilities - If your appliances are old and failing, install new energy efficient appliances (many times rebates are available from the local utility for energy efficient washers and dryers). Check with your electric company to see if your electric usage warrants a different rate plan that can save you money - it's pretty easy to do this online. Do this especially if you buy an electric vehicle and charge at home. Cable TV - Consider stopping service for TV and just keep internet only; this is a great way to save money every month and there's still plenty of entertainment options with high speed internet. I'll admit the only thing that's a little tough is watching sports without cable TV!Credit Cards - Pay off credit cards with personal loans at a lower interest rate. I recommend Prosper, a good peer to peer lending platform - if you have good credit you should be able to qualify for a lower rate than credit cards offer. A few other personal loan options include: ICashLoans, GotLoans and ThriveFinance.Subscriptions - Do you still have newspaper or magazine subscriptions that you don't really read? Cancel them! How about online monthly memberships? Review your credit card statements for these charges and cancel the ones you don't use anymore. I had a guest membership attached to my LA Fitness membership that no one ever used, so I cancelled it and saved a few dollars a month. These types of things can add up. Cell Phone - When was the last time you checked with your cell phone carrier to see if you have their best deal? You may be able to switch plans and save money if you spend a few minutes on the phone. There may also be discounts based on your employer that you may not be taking advantage of. Insurance - Call your insurance company and see what you need to do to lower your rates. Maybe increase your deductibles? Maybe your car is paid for and is older now and you don't need as much collision coverage? Look to switch insurance companies if you can find a better deal elsewhere. Food - Eating out can get very expensive. If you eat out for lunch a lot, try to bring lunch a couple days a week. Try to limit dinners out to the weekend only (Friday/Saturday night) and cook meals at home during the rest of the week.Savings - If you aren't "paying yourself first," you need to make a plan to save some money automatically every month from your paycheck in a retirement account or taxable account. "Hiding" the money from yourself removes the temptation to spend the money and helps reduce impulse spending.For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 05, 2018 23:35

December 4, 2018

Diversification in Times of Volatility

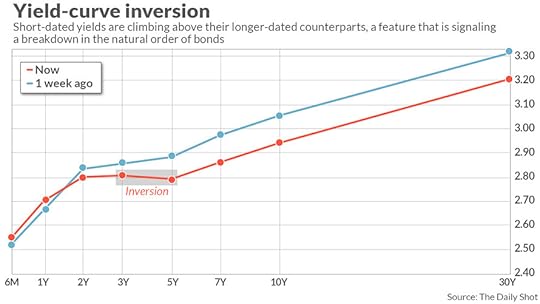

Volatility returned to the markets this week with more "Tariff Talk" and fears of an oncoming recession signaled by an inversion in the yield curve (see below chart), turning investors to bonds again for safety and resulting in yet another sell-off in the stock market.

Volatility returned to the markets this week with more "Tariff Talk" and fears of an oncoming recession signaled by an inversion in the yield curve (see below chart), turning investors to bonds again for safety and resulting in yet another sell-off in the stock market.Again the best strategy is a broadly diversified portfolio with no more than 20% in any one asset class (bonds, stocks, real estate, precious metals and cash). In fact, Goldman Sachs recently suggested that cash may outperform all other asset classes in the near term, suggesting a higher allocation may be appropriate for the time being and this is reinforced by the higher short term rates relative to longer term rates as noted in the chart.

I prefer not to worry about what's happening from day to day in the markets - trading is very difficult to do, even for those who are professionals, so a broadly diversified portfolio is the way to go.

Use leverage carefully in this environment, especially new real estate investments, margin loans on stock portfolios, etc. If you can invest to earn a cash on cash return at a higher rate than you can borrow at and the income stream is fairly safe, I would do that in this environment, rather than borrowing against stocks or buying more real estate at this stage of the cycle. Residential real estate may be at its peak in many local markets, with interest rates set to continue to rise into next year.

Avoiding the temptation to put a lot of your money in any particular investment at any time and especially now ("buying the dip" in stocks, for example) is very important. Get diversified and stay diversified!

I believe we are in a perpetual cycle of booms and busts that are driven by continuous credit expansion. Each one is successively worse than the one before. I fear that the next boom and bust will be far worse than the "Great Recession" that we just experienced and indeed many still experience due to high (real) unemployment and destruction of wealth that persist to this day, 12 years later. This is why I favor a diversified approach that includes a balanced allocation to hard assets (gold, silver, oil/gas real estate) and financial assets (stocks, bonds, mutual funds) to protect and grow wealth, particularly when we are facing the threat of inflation - a consequence of global central back "easy money" policies.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 04, 2018 22:15

December 2, 2018

The Value of Investing in Hard Assets

I have always advocated for investing a portion of your portfolio in hard assets (gold, silver, real estate, commodities, etc.). Hard assets can protect you against inflation, which can erode the purchasing power of your cash over time. You only have to look at the grocery store or the gas station to see why. Inflation is clearly happening all around us, yet the official government statistics don't show it. Did you ever wonder why the Consumer Price Index or CPI doesn't track with your experience? For one thing, CPI excludes food and energy costs - officially because these items are volatile and can skew the index, but these are the very things that people buy every day. Below is an alternative view of inflation compared to the official measure, which removes calculation methodology changes that have occurred since 1980 that have actually

lowered

the reported inflation rate. As you can see the real rate of inflation is most likely closer to 10% than the 2% reported. This is all the more reason to have hard assets as a part of your investment portfolio to protect against this "hidden" inflation.

I have always advocated for investing a portion of your portfolio in hard assets (gold, silver, real estate, commodities, etc.). Hard assets can protect you against inflation, which can erode the purchasing power of your cash over time. You only have to look at the grocery store or the gas station to see why. Inflation is clearly happening all around us, yet the official government statistics don't show it. Did you ever wonder why the Consumer Price Index or CPI doesn't track with your experience? For one thing, CPI excludes food and energy costs - officially because these items are volatile and can skew the index, but these are the very things that people buy every day. Below is an alternative view of inflation compared to the official measure, which removes calculation methodology changes that have occurred since 1980 that have actually

lowered

the reported inflation rate. As you can see the real rate of inflation is most likely closer to 10% than the 2% reported. This is all the more reason to have hard assets as a part of your investment portfolio to protect against this "hidden" inflation.

Beyond that, does the official measure of unemployment track with what you know is happening in your community to people you know, friends and family? The real rate of unemployment in this country is most likely north of 20% when you include "long term discouraged workers" who have exited the workforce, versus the official measure of just under 5%, as shown in the chart below. Again, official measures tend to understate reality. If unemployment is truly that high, then it's all the more reason to diversify your income from relying solely on your job and include passive income strategies, in addition to hard asset investing.

Another investment theme, which is linked to inflation concerns, is the continued deterioration in the value of the dollar. With the government printing more dollars every day through low interest rates and quantitative easing, the decline in the value of the dollar has accelerated - this worsens inflation and diminishes the purchasing power of dollar denominated assets (like your bank account). The charts below shows two views of this. The first is the growth of the money supply (M3 is the broadest measure). As you can see, while the money supply growth rate has flattened in the current economic recovery to just under 5% annually, the amount of money in circulation has continued to grow and is approaching $20 Trillion!

The long-term decline in the value of the dollar suggests that official reports also understate the true decline in the dollar index. When you think that the dollar today buys about 60% of what it did in 1980, that's cause for concern. Indeed, some are concerned that we may experience hyperinflation in the United States before too long.

If you are interested in this subject, I highly recommend two books that help explain what is happening and how to protect yourself as an investor:

The Dollar Crisis: Causes, Consequences, Cures by Richard Duncan - In this book the author describes the flaws in the international monetary system that have destabilized the global economy and that may soon culminate in a deflation-induced worldwide economic slump.The Dollar Meltdown: Surviving the Impending Currency Crisis with Gold, Oil, and Other Unconventional Investments by Charles Goyette - another alternative investing book focused on the author's concerns around our currency system and advocating for gold, oil and other unconventional investments to secure and grow wealth. Ironically, in an inflationary environment with a declining dollar, the best position is to be a long-term borrower and investor in hard assets. Real estate works best, since you can still get a 30-year fixed loan for 5% to 6% (on investment property) today, which will be repaid in devalued dollars, while the value of the property appreciates due to inflation. Most people claim they do not want to be in debt at all, but that misses the point that there is both "good debt" and "bad debt." I define "bad debt" as loans to buy things you consume - even your primary residence, because these things do not earn a return on investment. "Good debt" would include a mortgage on an investment property, assuming the property provides you with positive cash flow each month, or a loan to purchase a music royalty stream (assuming the rate of return on the royalty investment is higher than the interest rate on the loan you take out).

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on December 02, 2018 22:28

November 28, 2018

Should You Hire A Financial Planner?

Have you considered hiring a financial planner? Are you concerned that you need help figuring out how to achieve your financial goals or plan for retirement? Maybe you don't think you have the skills or knowledge to successfully take this on yourself?

Have you considered hiring a financial planner? Are you concerned that you need help figuring out how to achieve your financial goals or plan for retirement? Maybe you don't think you have the skills or knowledge to successfully take this on yourself?If you are willing to take the time to study a little, you can do it yourself . There are plenty of free retirement calculators available online where you can develop how much you need to save for retirement. The one from NerdWallet is pretty simple and easy to use.

According to the 2018 Trends in Investing Survey published by the Financial Planning Association, the majority of financial planners are recommending relatively straightforward investments such as ETF's (87%), cash and equivalents (83%), mutual funds (73%), individual stocks (56%) and individual bonds (46%). These are not complicated investments and there are plenty of research tools available, you just have to take the time to read up on them. Check out my recent post for my favorite investing books, which can help you get started. What's also interesting about the survey is that most advisers still think a portfolio of 60% stocks and 40% bonds is viable and only 1% are recommending that their clients invest in crypto currencies, which seems a little behind the times. In my book Investing in Gold and Silver (recently released on Audible), I recommend a very simple, defensive investment strategy to avoid losses resulting from extreme market movements and in order to make money in any situation:

Stocks (broadly diversified across size of company/international/various industries, ETF's work well for this) - 20%Bonds - 20%Real Estate (investment properties preferred, but REIT's are good too) - 20%Alternative Investments (gold/silver, oil/gas/commodities, royalties, crypto, etc.) - 20%Cash (direct investment in Treasury Bills is the way to go, see my post on this) - 20%There are also a number of "robo advisers" that you can choose from that are available on some of the newer investing apps that I have recently reviewed, if that interests you, but many people have complained that the returns aren't as good as the market in general recently and you may be able to do better following my simple approach above.

For more investing ideas.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.

Published on November 28, 2018 22:55

November 27, 2018

Investing in Gold and Silver - Now Available on Audible!

Building a Financial Fortress: Investing in Gold and Silver is now available on Audible!

Check it out!

Check it out!

Published on November 27, 2018 20:36