Nick Reichert's Blog, page 26

November 7, 2018

Why Not Be the Bank?

Have you ever wanted to be a bank and borrow money at a low rate of interest and lend the same money at a higher rate of interest, earning a "spread" on the money while having no net capital outlay?

Have you ever wanted to be a bank and borrow money at a low rate of interest and lend the same money at a higher rate of interest, earning a "spread" on the money while having no net capital outlay?One possibility (depending on your credit score) is to use one of the social lending sites such as Prosper.com. The way it works is you become a member of the site and first borrow money (up to $35,000 on Prosper). Once the loan is funded and you receive the cash, you then sign up to become an investor on the site and invest in a group of loans (usually $50 to $100 per loan) - Prosper has an automated bid platform that does all the work for you. Sometimes, due to a shortage of lenders, the site offers cash incentives to investors, which is nice and adds to your returns. The investor interest rates are quoted net of estimated losses, so as long as the net interest rate (after charge-offs) exceeds your cost of borrowing, you are making money on the deal. Recognize that a higher rate of interest (lower credit quality) comes with a higher risk of default, but that can be reduced by spreading the investment over many loans and over many different credit quality groups.

Since you are basically investing in consumer loans, a strong economy with plenty of jobs is a great environment for this asset class. There's a reason why you get so many credit card offers in the mail each week. Banks make a ton of money in this business, especially on late fees!

Here are a few other personal loan sources that I like:

ICashLoans - online lenderGotLoans - online lenderThriveFinance - online lenderFor more investing ideas, click here.

Published on November 07, 2018 22:56

November 5, 2018

Using Personal Loans to Jump Start Your Investments

Are you ready to get started investing but need to get your financial house in order? Maybe you are paying high amounts of interest on credit cards? Or maybe you don't have a lot of debt but you don't have any spare cash to invest? Personal loans, which are available from a number of sources, may be the answer. Many personal loans are available at interest rates well below credit cards, which would allow you to pay off your debt and get started investing quicker. Maybe you qualify for a lower interest rate on your personal loan than the rate of return on the investment you are planning. Banks call that positive "leverage" and that's a good thing since you are earning a "spread" over the cost of your money. This is how the wealthy make more money using "other people's money." Best of all, the interest you pay on loans used for investing may be tax deductible, but make sure you talk to your accountant first. Also, make sure you have a plan for limiting losses if your investment doesn't work out. If you borrow money for an investment and it goes to zero, not only do you lose your investment, you still have to pay back the loan!

Are you ready to get started investing but need to get your financial house in order? Maybe you are paying high amounts of interest on credit cards? Or maybe you don't have a lot of debt but you don't have any spare cash to invest? Personal loans, which are available from a number of sources, may be the answer. Many personal loans are available at interest rates well below credit cards, which would allow you to pay off your debt and get started investing quicker. Maybe you qualify for a lower interest rate on your personal loan than the rate of return on the investment you are planning. Banks call that positive "leverage" and that's a good thing since you are earning a "spread" over the cost of your money. This is how the wealthy make more money using "other people's money." Best of all, the interest you pay on loans used for investing may be tax deductible, but make sure you talk to your accountant first. Also, make sure you have a plan for limiting losses if your investment doesn't work out. If you borrow money for an investment and it goes to zero, not only do you lose your investment, you still have to pay back the loan!Here are a few of my favorite personal loan choices:

Prosper - a peer to peer lending network that I have used a few times to kick start my investments; highly recommendedICashLoans - online lenderGotLoans - online lenderThriveFinance - online lenderFor more investing ideas, click here.

Published on November 05, 2018 22:09

November 4, 2018

Investing in Crypto

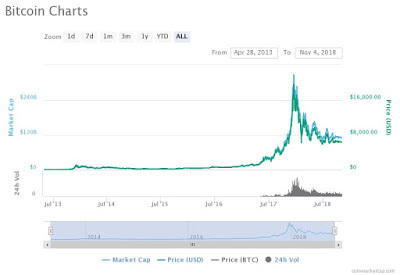

About a year ago. I began investing in cryptocurrencies by opening an account on Coinbase. Since then I have continued to invest $100 per month in Bitcoin (BTC) and I have also accumulated small positions in several of the other cryptocurrencies available on Coinbase, including Bitcoin Cash (BCH), Etherium (ETH), Etherium Classic (ETC), Litecoin (LTC) and 0x (ZRX). Crypto represents a revolution in how payments are processed and how value is stored and transferred. It's a payment system and an investment - a completely new form of digital money. There is limited supply (the coins are "mined" online by solving a computationally difficult puzzle). The reward to miners for solving the puzzles is to receive a small amount of coins and the mining also serves to validate prior transactions in the "blockchain." This requires a great deal of computing power and time and it is therefore not "easy" to mine crypto coins. Cryptocurrencies are the first practical use of Blockchain, a distributed ledger system that promises to change the way we transact and account for ownership of all things, including cars, real estate, good and services. The list is potentially endless.

About a year ago. I began investing in cryptocurrencies by opening an account on Coinbase. Since then I have continued to invest $100 per month in Bitcoin (BTC) and I have also accumulated small positions in several of the other cryptocurrencies available on Coinbase, including Bitcoin Cash (BCH), Etherium (ETH), Etherium Classic (ETC), Litecoin (LTC) and 0x (ZRX). Crypto represents a revolution in how payments are processed and how value is stored and transferred. It's a payment system and an investment - a completely new form of digital money. There is limited supply (the coins are "mined" online by solving a computationally difficult puzzle). The reward to miners for solving the puzzles is to receive a small amount of coins and the mining also serves to validate prior transactions in the "blockchain." This requires a great deal of computing power and time and it is therefore not "easy" to mine crypto coins. Cryptocurrencies are the first practical use of Blockchain, a distributed ledger system that promises to change the way we transact and account for ownership of all things, including cars, real estate, good and services. The list is potentially endless. Here are some reasons why you should invest in crypto:

Diversification - cryptocurrencies have evolved to the point where they are a legitimate alternative investment and a small portion - I'm recommending 0.5% to 1% of your investment portfolio - should be allocated to crypto Alternative Payment Method - crypto can be used to make online payments instead of using fiat currency, debit or credit cards and other forms of paymentsInvestment - Potential returns for crypto can be very large as their adoption and use become more mainstream and demand grows; although down significantly from its peak value, we have already seen Bitcoin increase almost 50x since it was first introduced.FOMO - No one wants to miss out on the next big thing and this could be it; many things will change as crypto continues to evolve and this is definitely the early stages, but given it's popularity as an investment, a form of currency and payment system it is not likely going away.

As mentioned earlier, I've been using Coinbase which makes it really easy and safe to buy, sell, and store digital currency (like Bitcoin). I got us $10 each of free Bitcoin when you sign up with my invite link and buy or sell at least $100 of digital currency:

https://www.coinbase.com/join/5a376c38a55f30013c465899?src=ios-share

Published on November 04, 2018 21:59

November 3, 2018

Will You Be Able to Retire?

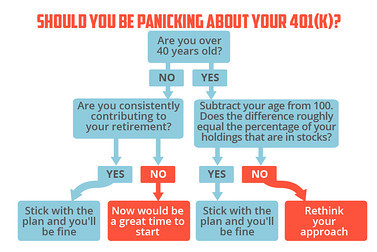

If you’re like me and have experienced two crushing stock market corrections in the past 30 years and you’re now looking at today’s stock market volatility, you might be wondering if you’ll be able to retire some day. There’s no question it has been challenging to build long term wealth in the stock market as an individual investor, since all the odds are stacked against you, competing against program traders and institutions with more resources. Timing never seems to work. Buy too late, sell too late, lose money. If this sounds familiar and you are tired of losing money, my very simple strategy might interest you.

If you’re like me and have experienced two crushing stock market corrections in the past 30 years and you’re now looking at today’s stock market volatility, you might be wondering if you’ll be able to retire some day. There’s no question it has been challenging to build long term wealth in the stock market as an individual investor, since all the odds are stacked against you, competing against program traders and institutions with more resources. Timing never seems to work. Buy too late, sell too late, lose money. If this sounds familiar and you are tired of losing money, my very simple strategy might interest you.First of all, I try to contribute as much as I can to my 401(k) account each pay period. If your employer matches your contributions, that’s free money and you should at least contribute enough to get the match. I have found that saving money automatically and putting it out of reach really works, especially if you have trouble controlling your spending. The annual contribution limit for 2018 is $18,500. If you’re 50 or older you are allowed to make additional “catch up” contributions as well. The limit for catch-up contributions in 2018 is $6,000.

Secondly, I invest like a retiree and try to keep 20% or less of my portfolio exposed to stocks (split roughly evenly between different classes like international and US, small cap, large cap, etc). 80% of my portfolio is in short term, fixed income and bond funds. It’s very conservative, but I have virtually eliminated big volatility from my portfolio. I’m a believer in “slow and steady wins the race” and the power of compound interest. Over time, a portfolio can grow nicely with a good rate of interest reinvested regularly. For example, $10,000 invested at 4% will grow to over $22,000 in 20 years - more than double. Patience really can pay off.

Finally, I periodically adjust my balances to maintain my desired diversification. Usually quarterly is enough.

Best of all, I don’t worry about what the stock market is doing anymore. I can just relax and focus on other things besides my retirement savings.

For more investing ideas click this Link.

Published on November 03, 2018 11:15

October 27, 2018

Passive Income Strategies

Maybe you have heard about making your money work harder for you or making money while you sleep. These concepts are the core of any passive income strategy. Unfortunately, there is no easy way to get started because each passive income idea requires commitment, focus and hard work and in many cases, money to invest, in order for it to pay off. Similar to successful investing strategies which hinge on diversification of risk, a successful passive income strategy will include multiple streams of income built up over time. The best approach is to start small, save the money that you earn using these strategies and then invest in higher yielding ideas. After trying some of these ideas myself, here are a few of my favorites (in order from least to most cash-intensive):

Maybe you have heard about making your money work harder for you or making money while you sleep. These concepts are the core of any passive income strategy. Unfortunately, there is no easy way to get started because each passive income idea requires commitment, focus and hard work and in many cases, money to invest, in order for it to pay off. Similar to successful investing strategies which hinge on diversification of risk, a successful passive income strategy will include multiple streams of income built up over time. The best approach is to start small, save the money that you earn using these strategies and then invest in higher yielding ideas. After trying some of these ideas myself, here are a few of my favorites (in order from least to most cash-intensive):Self-publishing - Writing a book and publishing it yourself on Kindle is super easy to do and you can earn royalties every time someone buys / downloads it; just write about something you are passionate and knowledgeable about - Kindle offers many easy ways to promote your book once you are done including free giveaway promotions and paid advertising. Selling stock photos - If you like taking pictures and want to make a little extra money you can publish your photos on sites like Shutterstock and you will get paid when your photos are downloaded. Selling items on EBay - Want to de-clutter your house and make a little money? Try selling your extra items on EBay. It's very easy to do with the app; just take a few pictures and search for the item and generally most of the listing will auto-populate. Make sure your description is accurate and detailed. Check what other items sold for before you price (you can also use EBay's pricing recommendations - they usually recommend an auction format but you can also do a fixed price with "Buy it Now"). Make sure you can cover the shipping cost for the item - USPS flat rate packaging is best I have found; include that in the price you set, either explicitly (buyer pays shipping) or implicitly (higher price). Beware of scammers - don't ship until you get paid (PayPal is usually best but there is a fee for that in addition to the fee EBay charges for selling your item). Investing in US Treasury bills - see my recent post on this; you can earn a lot more interest income than banks are paying with no risk. Dividend stock investing - search for the best companies that have the longest track record of paying and buy shares in a few - for example, I like AT&T (T), Consolidated Edison (ED), Exxon-Mobil (XOM) and Ventas (VTR); add to it over time as you have extra money; there are many easy ways to invest online now and here are a few suggestions Royalty investing - you can buy music royalties as an income investment see my recent post on this subject

Click here for more investing ideas

Published on October 27, 2018 11:58

October 13, 2018

Investing in Music Royalties

I recently learned about investing in music royalties as an alternative investing strategy. These investments can be purchased on an exchange (the best one I have found is Royalty Exchange) and will pay out for a set term like ten years or the life of the royalty, which is typically the life of the author plus 70 years. Music royalties are administered by one of a few major entities (ASCAP, BMI) and are paid to songwriters and performers, unless sold to someone else. The older the song, the more history of royalties there is, which helps to determine the value of the royalty payment stream. Royalty Exhange has a model that calculates the internal rate of return on a royalty investment using historical payments and a future earnings trend rate. So when you bid for the royalty, the IRR is automatically calculated. The internal rate of return is like a yield on a bond and assumes you get paid back your investment plus the stated interest rate. It’s important to note that future royalty payments could be higher or lower than historical payments, so you really have to think about the outlook for the artist. Are they actively touring, writing new music, promoting their songs through videos, movie/tv placements and other means (which should help their “back catalog”)? What’s interesting about royalties is that they are not correlated to stock or bond markets. They are more dependent on demand for music on radio, streaming, movies and television, etc. The popularity of streaming music has helped drive up overall royalty payments in recent years and the popularity of hip hop music has made these types of royalties very popular investments. Also if you happen to be a fan of the artist it’s kind of a cool investment as long as you are happy with the return.

I recently learned about investing in music royalties as an alternative investing strategy. These investments can be purchased on an exchange (the best one I have found is Royalty Exchange) and will pay out for a set term like ten years or the life of the royalty, which is typically the life of the author plus 70 years. Music royalties are administered by one of a few major entities (ASCAP, BMI) and are paid to songwriters and performers, unless sold to someone else. The older the song, the more history of royalties there is, which helps to determine the value of the royalty payment stream. Royalty Exhange has a model that calculates the internal rate of return on a royalty investment using historical payments and a future earnings trend rate. So when you bid for the royalty, the IRR is automatically calculated. The internal rate of return is like a yield on a bond and assumes you get paid back your investment plus the stated interest rate. It’s important to note that future royalty payments could be higher or lower than historical payments, so you really have to think about the outlook for the artist. Are they actively touring, writing new music, promoting their songs through videos, movie/tv placements and other means (which should help their “back catalog”)? What’s interesting about royalties is that they are not correlated to stock or bond markets. They are more dependent on demand for music on radio, streaming, movies and television, etc. The popularity of streaming music has helped drive up overall royalty payments in recent years and the popularity of hip hop music has made these types of royalties very popular investments. Also if you happen to be a fan of the artist it’s kind of a cool investment as long as you are happy with the return.For more investing ideas.

Published on October 13, 2018 13:27

Better Than the Bank: TreasuryDirect

If you’re tired of low bank savings account rates, consider opening an account with TreasuryDirect. This will allow you to invest directly in US Treasury securities and earn higher interest rates with no fees. Best of all, you don’t have to worry about FDIC insurance because the securities are direct US obligations and are guaranteed. Accounts can be setup in individual names or if you are managing a family trust, that can also be easily setup. You can invest in any duration of treasury securities. My current favorite is the 4 week TBill, which are currently yielding close to 2%.

If you’re tired of low bank savings account rates, consider opening an account with TreasuryDirect. This will allow you to invest directly in US Treasury securities and earn higher interest rates with no fees. Best of all, you don’t have to worry about FDIC insurance because the securities are direct US obligations and are guaranteed. Accounts can be setup in individual names or if you are managing a family trust, that can also be easily setup. You can invest in any duration of treasury securities. My current favorite is the 4 week TBill, which are currently yielding close to 2%.For more investing ideas click here.

Published on October 13, 2018 12:29

August 24, 2015

Market Volatility? Not to Worry!

Quite some time ago, I made a decision to once and for all go to a very defensive investment posture, including lots of cash and short term investments, some gold and silver as a true "safe haven" investment and reducing my exposure to equities and bonds. This is based on my experience over the last two major investment cycles of having seen my portfolio lose half it's value each time - first in 2001 (Dot Com) and then again in 2007 (Great Recession). No one knows for sure when the next cyclical downturn is coming but it will certainly arrive and you must be prepared when it does!

As I have generated new money from selling investments and other income, I decided to keep it all in cash for a relatively small interest return (I was able to find some higher yield alternatives paying close to 1%), rather than risk putting it in the market at the current lofty valuations.

Marketwatch posted this infographic today:

For my 401(k), I wanted to be in a position where if my equity portfolio lost half its value, I would lose no more than 25% of my investment so I made sure that no more than half of my portfolio was equities and I split that 50/50 between US and International stocks for diversification.

The last few days in the market have confirmed in my mind the wisdom of this approach. I believe volatility in markets will only get more extreme as time goes on, with low interest rates which continue to encourage borrowing and speculation in all investments.

As I discussed in a previous post, almost three years ago, a broadly diversified approach is really the best way for a non-professional investor to protect him or herself from market volatility.

For more investing ideas, please see my website at Building a Financial Fortress.

Published on August 24, 2015 21:48

January 29, 2015

Free Kindle Promotion 2/11/15 and 2/12/15!

Free Kindle Promotion 2/11/15 and 2/12/15!

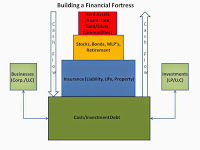

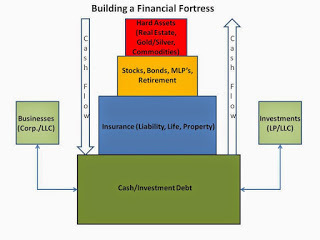

This book is a re-publication of a blog I started in the depths of the Great Recession in March 2011. During that time, as I agonized over investing, saving and potential job loss, I developed an investment philosophy I dubbed the “Financial Fortress” and wrote a series of posts about it along with other posts about specific asset classes, investment strategies and related topics.

My two biggest successes have been in real estate and precious metals. During the Great Recession, I made some aggressive moves, using retirement savings, to purchase distressed condominiums in Orange County, California. In addition to enjoying positive cash flow while I owned the properties, I have just completed one sale and have a second one in escrow, doubling my money in five years. I also made an aggressive move into silver (US Silver Eagle coins) to watch them triple in value, at which time I sold individual rolls on EBay and kept the rest for future appreciation.

The essence of the Financial Fortress is that as savers and investors, we need to first have a strong defense before we can have a strong offense. As volatility in world markets seems to worsen each year and booms/busts become more intense, preservation of capital is paramount but so is finding opportunities to leverage what we have in order to grow our wealth.

Related articles Managing Investment Risk Through Diversification

Managing Investment Risk Through Diversification

Stay Diversified - Resist Temptation

Stay Diversified - Resist Temptation

Financial Fortress - Hard Assets

Financial Fortress - Hard Assets

Investing Challenges in the Current Market

Investing Challenges in the Current Market

This book is a re-publication of a blog I started in the depths of the Great Recession in March 2011. During that time, as I agonized over investing, saving and potential job loss, I developed an investment philosophy I dubbed the “Financial Fortress” and wrote a series of posts about it along with other posts about specific asset classes, investment strategies and related topics.

My two biggest successes have been in real estate and precious metals. During the Great Recession, I made some aggressive moves, using retirement savings, to purchase distressed condominiums in Orange County, California. In addition to enjoying positive cash flow while I owned the properties, I have just completed one sale and have a second one in escrow, doubling my money in five years. I also made an aggressive move into silver (US Silver Eagle coins) to watch them triple in value, at which time I sold individual rolls on EBay and kept the rest for future appreciation.

The essence of the Financial Fortress is that as savers and investors, we need to first have a strong defense before we can have a strong offense. As volatility in world markets seems to worsen each year and booms/busts become more intense, preservation of capital is paramount but so is finding opportunities to leverage what we have in order to grow our wealth.

Related articles

Managing Investment Risk Through Diversification

Managing Investment Risk Through Diversification

Stay Diversified - Resist Temptation

Stay Diversified - Resist Temptation

Financial Fortress - Hard Assets

Financial Fortress - Hard Assets

Investing Challenges in the Current Market

Investing Challenges in the Current Market

Published on January 29, 2015 21:56

January 10, 2015

Introduction From New Book on Investing In Gold And Silver

IntroductionI have been investing in gold and silver for many years and have profited and also suffered from the volatility in values, particularly in silver. The last few years have certainly been a challenge for precious metalsinvestors, with both gold and silver significantly down from their peak values.

IntroductionI have been investing in gold and silver for many years and have profited and also suffered from the volatility in values, particularly in silver. The last few years have certainly been a challenge for precious metalsinvestors, with both gold and silver significantly down from their peak values.

However, I like holding a portion of my assets on a long term basis in precious metals for safety – particularly gold, which despite its volatility tends to increase in value over time as the effects of inflation erode the value of the dollar.

For centuries, gold and silver have represented “real money” and up until very recently were the foundation of our currency system. In 1976, the dollar was taken off of the gold standard and from that point forward was no longer backed by gold. Since that time, the dollar “floats” in value compared to other currencies and its value is driven by supply and demand. More importantly, the money supply is no longer dependent on the amount of gold reserves the US has and has theoretically unlimited potential to expand. The other major global currencies are also freely traded similar to the dollar and have no explicit gold backing. You will often hear this referred to as “fiat currency.”

Why is an expanding money supply a concern? The more dollars that are in circulation makes each dollar worth less, since the dollars themselves have no underlying value.

The chart on the next page shows that “M3,” the broadest measure of the money supply has grown steadily in recent years and is now over $15 trillion. Prior to the Great Recession, the money supply was growing in excess of 15% per year and then plummeted as credit dried up and the growth rate actually went negative for a brief period between 2010 and 2011. Notwithstanding the recently lower growth rates, the money supply continues to steadily increase each year.

Chart courtesy of www.shadowstats.com

Why would it be important for a currency to be backed by gold (i.e., a “gold standard”)? For one thing, gold cannot be created from nothing, so a country must have sufficient gold reserves to support the value of its currency. This acts as a natural regulator and prevents a country from “printing” more money, increasing the money supply and thereby causing inflation or erosion in the purchasing power of the currency, since the only way to create more currency is to acquire more gold.

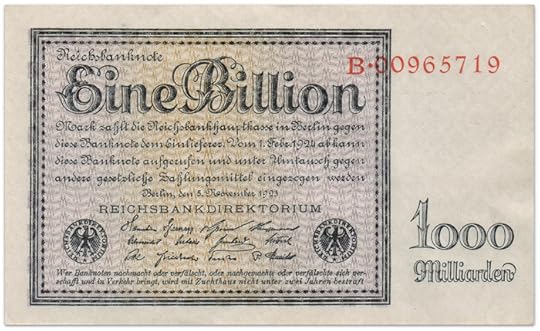

The picture below is a 1 Billion Mark banknote from post World War I Germany (Weimar Republic – circa 1923). At that time, Germany was experiencing hyperinflation which resulted from massive money printing in an attempt to pay war reparations. By November 1923, 1 US Dollar was equivalent to 4.2 Trillion Marks!

Related articles

Gold and Silver Under Pressure - But for How Long?

Gold and Silver Under Pressure - But for How Long?

Gold and Silver - Buy Now?

Gold and Silver - Buy Now?

Gold and Silver Making Moves Lately

Gold and Silver Making Moves Lately

Investing Challenges in the Current Market

Investing Challenges in the Current Market

Published on January 10, 2015 23:12