Nick Reichert's Blog, page 8

March 13, 2022

1031 Exchange Using Delaware Statutory Trust

For this week's post, I wanted to delve into 1031 exchanges for US real estate investors with a high level overview and then dive into Delaware Statutory Trusts and how those can be used as another tool in the 1031 exchange toolbox. I'm not a tax professional so as always, please use your own advisors and do your own research as everyone's tax situation is unique.

For this week's post, I wanted to delve into 1031 exchanges for US real estate investors with a high level overview and then dive into Delaware Statutory Trusts and how those can be used as another tool in the 1031 exchange toolbox. I'm not a tax professional so as always, please use your own advisors and do your own research as everyone's tax situation is unique.A Delaware Statutory Trust (DST) can be used in conjunction with a 1031 exchange to defer taxes on appreciated real estate you sell. A DST is an entity that qualifies as "like kind" property for IRS purposes. It allows for fractional ownership of real estate and is an alternative to buying a single replacement property and managing it yourself. This might be a good option for people approaching retirement with significant appreciated real estate used in their trade or business, for example. It might also be good for a long term real estate investor looking to be less active in managing the properties and looking for a more passive approach while deferring taxes.

Before I get into the pro's and con's of DST's, here's a very high level overview of the general 1031 rules:

1031 Exchange Overview

Allows for deferral of taxes if proceeds are used to acquire "like kind property" - this could include any type of investment property for another investment property like a condo for a duplex, a condo for a small shopping center, an office building for an apartment building, etc.What many investors know is that long term capital gains rates are 15% or 20% (depending on your income level) for Federal purposes and vary by state, in addition:Depending on your income level you may also be subject to a net investment tax of 3.8% on the gainAlso, to the extent you have depreciated your property your taxes on that portion of the gain (called "depreciation recapture") will be closer to your ordinary income rates (capped at 25%) which is a very unpleasant surprise for most investorsReplacement property must be identified within 45 days of closing of sale propertyPurchase of replacement property must be completed within 180 days of sale closingThe dates are very important and if you miss them, the transaction won't qualify and you'll be stuck with a big tax billSeller must not touch the sale proceeds, so they have to be deposited directly with a qualified third party intermediary (1031 exchange accommodator) who will use the funds to close the purchase of the replacement property - it's important to work with a reputable intermediary to make sure your exchange doesn't fail to meet IRS requirementsDST Pro'sYou can free yourself from the "Three T's" of property management (Tenants, Toilets, Trash), since the DST property is professionally managed Opportunity to collect monthly passive income and continue to benefit from proportionate depreciation and interest deductions passed-through to youAccess to multi-million dollar institutional quality assets that you might not be able to buy yourself due to the high cost, including triple net leased properties (i.e., industrial building leased by FedEx under a 20 year lease), large apartment buildings, office buildings, retail centers, hotels, self-storage facilities, etc.Potential for non recourse debt vs recourse debt - protects investors from liability (if you own a property yourself your lender may require you to personally guarantee the debt which is recourse, vs only being able to look to the property for repayment which is nonrecourse)In some cases you can invest in "debt free" DST's if you don't want the added risk of debt on the propertyPotential for diversification into smaller dollar amounts:Minimum DST investment can be $50K to $100KCan roll, for example, $500K proceeds into fractional ownership in multiple properties through multiple DST'sYou will need to work with a SEC/FINRA registered broker to get into these deals, but they will help select good DST sponsors and build a portfolio of properties (you can't invest in these directly as a small individual investor)DST Con'sNo guarantee for monthly distribution or projected appreciationMaterial risks associated with real estate investments, including vacancy, market, interest rates, economyCompletely passive beneficial interest, no right to participate in management of propertyRestrictions on trustee to protect investors ("7 deadly sins" of DST's):No future contributions after closingRestrictions on debt (no new loans and no renegotiations of existing debt)No reinvestment of sale proceeds - up to individual investors to decide whether to take distribution or "roll over" into new DSTRequired distributions (substantially all cash flow, except some held back for capital expenditures)Limited capital expenditures (normal repairs & maintenance, minor non-structural repairs, and repairs required by law)Restrictions on investment of reserves (only short term US treasuries and similar government obligations)Restrictions on leasesIlliquidity - perhaps the greatest risk in my mind7-10 year hold should be expected (until asset is sold)Secondary market for DST shares, if it exists, will likely be thinly traded and you could lose money if you sell earlyNot financial advice, only for information and entertainment, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.Always remember: freedom, health and positivity!

Please also check out my new Podcast now on YouTube here.

March 6, 2022

Startup Investing

This week's post is inspired by a conversation I had with a good friend at work about private equity investing. He's looking to eventually retire at some point and the reality is you need to do more than just invest in a 401(k) if you want to do that. Taking the right approach in terms of diversification and taking smart risks is an important part of securing your retirement and investing in startups is one tool you have in your toolbox. In this post, I'll cover Regulation C/F which opened up private company investing to everyone, what it takes to be an accredited investor, some platforms I have used for private investing and an overall strategy to apply to investing in private companies.

This week's post is inspired by a conversation I had with a good friend at work about private equity investing. He's looking to eventually retire at some point and the reality is you need to do more than just invest in a 401(k) if you want to do that. Taking the right approach in terms of diversification and taking smart risks is an important part of securing your retirement and investing in startups is one tool you have in your toolbox. In this post, I'll cover Regulation C/F which opened up private company investing to everyone, what it takes to be an accredited investor, some platforms I have used for private investing and an overall strategy to apply to investing in private companies.Regulation CF

Before the Jobs Act in 2012, you had to be an accredited investor to invest in startups. Title III (Regulation CF) of this law took effect in 2016. It allows early stage companies to raise funds from all Americans with a few requirements. This is great for allowing early adopters, customers and others participate in the early growth stage of a company. Here are the key requirements:

Capital raise is limited to $5MConducted onlineSEC/FINRA registered broker-dealer must conduct the capital raiseCompany must file a Form C with SEC before startingMinimum 21 days for offering to be open (gives investors time to think about their investment and cancel)Accredited InvestorThere are basically four ways you can qualify as an accredited investor:Net worth (not including your primary residence) equal to or greater than $1M$200,000 annual earned income with expectation that it will be substantially the same now and in the future ($300,000 annual income including spouse)Hold a Financial Professional License (Series 7, 65, or 82)Trust with assets equal to or greater than $5M, directed by a "sophisticated person" (i.e., someone with financial / investing expertiseInterestingly, the SEC is actually looking at a rule change to make it harder to qualify as an accredited investor, as noted in a recent Time Magazine article:

he Securities and Exchange Commission is pushing for significant changes in how private funded companies operate and who can invest in them, the agency said this week. The proposed changes probably won’t benefit rank and file American investors but will likely help people who are already rich get even wealthier.T

While the details remain unclear, the SEC says it wants to increase the financial transparency of large companies which raise money away from the public markets. In addition, the regulator wants to limit the ability of people with less than $200,000 in annual income or $1 million in net worth to invest in non-public companies. In short, the current system, which already excludes the vast majority of Americans, could get more restrictive. In turn, the changes could widen income inequality, something which the Biden administration says it wants to reduce.

Needless to say this isn't great news and if anything they should be making it easier for the average person to invest in private companies. The article goes on to say:

Those accredited investor requirements rule out most of the U.S. population from investing in private companies funded by private equity or Silicon Valley venture capitalists. That’s because the median household is far too low at approximately $67,500 in 2020, according to government data.

This barrier to investing means that most Americans cannot participate in the superfast growth generated by some startups in Silicon Valley or elsewhere in the private markets. A case in point is the spectacular growth of Meta (formerly known as Facebook) during its ultra-high growth period. The first investment of $500,000 occurred in 2004 when the company was valued at around $5 million. In 2012 the company went public with a value above $100 billion. That’s at least a twenty-thousand-fold increase in value in less than a decade. But only people who were already well-to-do could participate in such gains. Compare that to returns on the S&P 500 over the same period – that wouldn’t have even doubled your money.

That two-tier investing system – one of potential humongous gains for the elite and one of more subdued increases for everyone else – has attracted criticism. “The intent of the American capital markets should be to make them more inclusive,” Haslett says. “Yet, the majority of value appreciation in technology companies is not finding its way into the pockets of your average American.”

I call this the SEC's way of saying "have fun staying poor." We will need to keep an eye on this and hope it doesn't have much traction. Better still, they should open up private company investing to more Americans by lowering the accredited investor requirements.

Platforms

There are four startup investing platforms that I have used in the past and below is a quick summary of each:

Great appGood variety and quantity of companies Also does accredited deals if you qualifyWon't transfer investments made in your name to revocable trust for estate planning purposes (have to setup payment for trust and invest directly)Some novel investments like music NFT's, tokenized litigation settlementsCompanies are vetted and tend to be a little more established than other sites (i.e., revenue generating) Seed Invest: Good websiteWill transfer to revocable trust after completing a request form if desiredGood variety of companies, not as many as RepublicAlso has accredited deals if you qualifyEasier to handle multiple investing entities (i.e., trust)Companies tend to be much earlier stage and many are pre-revenue, which can have higher upside and also downsideVetted, similar to Republic StartEngine: Haven't used as much as the other platformsA lot of odd offerings like collectibles (rare trading cards), wineCompanies on platform tend to be really small compared to RepublicTypically smaller investment minimums than the other sitesAngel.co:Accredited onlyNeed to be invited by someone to join a syndicateSyndicates typically formed with Special Purpose Entities to pool investor money and then purchase equity in startup, so you don't own the equity directly like the other platforms (although the other platforms may use these vehicles for some of their accredited deals)High quality startups that can have big name Venture Capital funds involved, higher chance of successInvesting in Special Purpose Entities are a little more complicated from tax standpoint (K-1's)Strategy:Overall approach is to "spread the table" and invest small amounts in several different startups. This approach is inspired by the book Little Bets, where I learned that it's best to take a portfolio approach to new ventures and not put too much in one deal. You have to expect a high failure rate (maybe as much as 90% of your investments), but the 10% that are successful should do really well and should more than offset any losses you incur on the deals that don't work such that your overall return far exceeds what you would get by simply investing in the stock market. You can do as much due diligence as you like, but generally you would do more work the more money you are investing and limited due diligence if the amount invested is small.

Here are some things you can look at when you are vetting a startup that I have learned:What problem are they solving? Is it compelling?What is the market size (total addressable market)?What is the quality of the team - have they done this before, what is their industry background?What is the product?What is the business model (i.e., business to consumer, business to business)?What is the insertion point (where do they fit in the industry)?What is the traction / momentum (typically look at trailing 12 months revenue growth as one example)?What is competition?What is defensibility of the business model (are their patents, unique business model that can't be easily replicated)?Any other concerns?Financing needs (i.e., what is the cash "burn rate" and prospects for raising additional funds before money runs out or the business can be cash flow positive; what is potential for dilution of your investment through future fundraising rounds)?In conclusion, as I have written before, a diversified portfolio is very important to weather the market storms that seem to happen more frequently and with more intensity in recent years. An important part of this strategy is incorporating an appropriate percentage of private company / startup investments in your portfolio.

Not financial advice, only for information and entertainment, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my new Podcast now on YouTube here.

February 27, 2022

Russia SWIFT Ban Thoughts

I wanted to get this note about my thoughts on the recent decision to cut off select Russian banks from the SWIFT system before the market opens on Monday. Here's an article that provides a high level overview of what the SWIFT system does and what might happen as a result. Needless to say, it's a pretty strong measure that can have significant economic consequences not only for Russia but for the entire world. The SWIFT system is a messaging system that connects banks across the world to communicate dollar money transfers. Removal from the system basically means you can't transact in dollars without a great deal of difficulty. It also means Russia can't sell oil (which is all denominated in dollars currently) and can't buy anything denominated in dollars. Before I get into my thoughts and portfolio implications, I'd like to say that this conflict in Ukraine is deeply disturbing to me, is a major humanitarian crisis and my thoughts and prayers go out to all who are affected.

I wanted to get this note about my thoughts on the recent decision to cut off select Russian banks from the SWIFT system before the market opens on Monday. Here's an article that provides a high level overview of what the SWIFT system does and what might happen as a result. Needless to say, it's a pretty strong measure that can have significant economic consequences not only for Russia but for the entire world. The SWIFT system is a messaging system that connects banks across the world to communicate dollar money transfers. Removal from the system basically means you can't transact in dollars without a great deal of difficulty. It also means Russia can't sell oil (which is all denominated in dollars currently) and can't buy anything denominated in dollars. Before I get into my thoughts and portfolio implications, I'd like to say that this conflict in Ukraine is deeply disturbing to me, is a major humanitarian crisis and my thoughts and prayers go out to all who are affected.My Thoughts:

Oil price likely headed higher in the near term due to inability of Russia to sell oil and resultant global supply reduction (Russia is the third largest oil producer in the world), however if they are able to sell all of their production directly to China (the second largest consumer of oil in the world) for yuan - see 4 below, the impact could be mitigated - we shall see..Runs on and failures of Russian banks due to lack of liquidity have been all the rumor on Financial Twitter, but the Russian Central Bank will do what they must to ensure that doesn't happen - just saw that they will provide unlimited repo support to the country's banks; again, we shall see...Conflict escalation to a wider area if the conflict drags on much longer; already NATO is posturing and many countries are supporting Ukraine with weapons / supplies, putting up "no fly" zones, etc. - this increases the level of uncertainty which would be bearish for markets, but as I write this there is news of "talks" between Russia and Ukraine, so we'll seeRise of parallel money transfer systems:Bitcoin (censorship resistant and totally decentralized) - many in the Bitcoin community are predicting this could be a likely optionOther cryptocurrencies (but many are centralized and can be censored)CIDS (China's system for settling trades in their currency) - could allow Russia to trade with China using yuan - i.e., sell oil to China for yuan and buy products from China for yuanFuture sanctions could be less effective if multiple alternative global payment systems are developed and this would also usher in the beginning of the end of the dollar as the global reserve currency, which would itself have far-reaching implicationsGlobal recession due to persistently high oil prices and the resultant inflation caused by that and the disruption of global economic activity in the wake of the war and associated sanctionsIf the conflict is resolved relatively soon, the result would likely be a huge risk-on rally that would lift stocks and crush oil, bonds and precious metals - a "nothing burger" to the markets, as Ben Hunt said in a podcast I listened to today. He also thinks this won't stop the Fed from tightening financial conditions in either case (war on / war off), as some might otherwise hope.Portfolio Implications:Energy / commodities / gold / silver still look solid to hedge against what will likely be persistent, above trend inflation notwithstanding Fed action; may be able to buy on weakness if risk-off event early next week and if not already well positionedCash / US Treasuries will be short-term popular if there's a massive risk-off move, which many expect on Monday, but long term not a place I want to be due to inflationBitcoin behaves as a risk-on asset, so would be good to accumulate on any risk-off weakness as long-term thesis is still very much intact and it will likely do well when the current crisis endsLow-beta stocks like utilities, consumer staples and healthcare look like good places to invest as they will be more resilient in the current market environment versus high growth / technology which continues to be challenged, particularly if Fed follows through (as many expect) with tighter monetary policy to contain inflation; see my related post on 2022 Stock PicksHaving a well-diversified portfolio allows you to sleep well despite the market chaos - check out my latest portfolio allocation update post hereNot financial advice, only for information and entertainment, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my new Podcast now on YouTube here.

February 20, 2022

Bitcoin Self Custody

With all the events of the past week in Canada and the government adopting emergency powers which included freezing individuals' bank accounts who either participated in or funded the peaceful trucker protest, the Bitcoin community commentary was overwhelming about the importance of Bitcoin self custody. The discussion revolved around custodial accounts which can be frozen (bank accounts, credit cards, brokerage accounts, individual retirement accounts, money payment accounts like PayPal, and cryptocurrency accounts maintained on exchanges such as Coinbase, etc.) versus non-custodial accounts like a Bitcoin self-custody wallet which can not be frozen. Needless to say, this is deeply troubling since the government can essentially "financially cancel" someone on nothing more than suspicion of having done something wrong, versus actually charging someone with a crime and having to go to court to prove that. Lyn Alden wrote a great thread on this that I have reproduced below:

With all the events of the past week in Canada and the government adopting emergency powers which included freezing individuals' bank accounts who either participated in or funded the peaceful trucker protest, the Bitcoin community commentary was overwhelming about the importance of Bitcoin self custody. The discussion revolved around custodial accounts which can be frozen (bank accounts, credit cards, brokerage accounts, individual retirement accounts, money payment accounts like PayPal, and cryptocurrency accounts maintained on exchanges such as Coinbase, etc.) versus non-custodial accounts like a Bitcoin self-custody wallet which can not be frozen. Needless to say, this is deeply troubling since the government can essentially "financially cancel" someone on nothing more than suspicion of having done something wrong, versus actually charging someone with a crime and having to go to court to prove that. Lyn Alden wrote a great thread on this that I have reproduced below:

Lyn Alden@LynAldenContactCustodial financial services allow governments to freeze accounts first, and then sort out who is guilty or innocent later. Self-custodial financial services force governments to actually charge people with a crime before they can use pressure to freeze their accounts.1:50 PM · Feb 19, 2022·Twitter Web App1,285 Retweets120 Quote Tweets6,208 Likes

Tweet your reply

ReplyLyn Alden@LynAldenContact·21hReplying to @LynAldenContactCustodial money often can't be withdrawn from a jurisdiction if for whatever reason rule of law breaks down there. Self-custodial money can be withdrawn from a jurisdiction if the individual is able to move their self elsewhere (and sometimes, even if they can't).8881,007

Lyn Alden@LynAldenContact·21hIt's not a "right or left" issue, because one merely needs to imagine their least-favorite politician winning the next election, or two or three elections from now. Most people are in favor of rule of law, but the questions are "which law?" and "in which order?"131251,689

Lyn Alden@LynAldenContact·21hThus, bitcoin and cryptocurrencies aren't really about "avoiding the law" but rather are about putting the onus on governments to act within the law, and giving individuals more mobility options when governments begin to change the law in a way that trends away from liberty.1457944,559Show more replies

Also, from Investopedia:

Should You Trust a Custodial Wallet?A custodial wallet is a third-party service that allows users to store cryptocurrency, similar to a bank. This allows users to skip over the complication of private key storage, relying instead on the technological expertise of the company offering the service. However, there are tradeoffs. Custodial wallets are often targets for hackers or phishing scams, and they can also be seized or frozen by legal authorities. The best solution is to determine what type of wallet fits your individual risk tolerance and technological skill.

What is self-custody?

Self-custody is actually a pretty simple concept, no different than having a stack of $100 bills in your drawer or home safe, or having gold / silver coins held in the same manner. You control the physical asset at all times. Self-custody for Bitcoin is very similar, but you do have to educate yourself about the technology involved and some of the risks as well as the benefits associated with self-custody.

How do you self-custody?

There are a few different ways to self custody Bitcoin, including holding your coins in a hardware wallet (similar to a thumb drive or memory stick) or a software wallet that you download on your phone.

Hardware ("cold") wallet:

There are several hardware wallets available. Here are a few that I found and that are fairly popular:

LedgerTrezorColdcardI have a Trezor Model T, which I have been pretty happy with. There's an app you download to your computer that you can use to manage your coins and initiate transfers. You can also log in without plugging in your Trezor just to check your balances. I prefer the hardware wallet solution to other solutions because it is truly offline and gives me more peace of mind.Software ("hot") wallet:

There are also a number of software wallets available. Here are a few that I found and that are fairly popular. I have downloaded a Trust wallet before and think it's pretty easy to use.

Trust WalletMetamaskBitpaySetup process:

The setup process is basically the same whether you are using a hardware or software wallet. You need to either buy the hardware wallet and download the software used to manage it (also includes firmware updates that need to be done periodically) or download the noncustodial software wallet to your phone or other device. A hardware wallet will normally need to be directly connected to a computer via a USB cable to execute transactions and update firmware. Coldcard does not require a physical connection to operate, which provides a better "airgap" than other hardware wallets.

The next step is normally establishing your private key. A private key is a series of random words in a particular order and can be as few as 12 words and as many as 24 words. These words need to be either memorized or written down and stored in a safe place (preferably in a couple of places). I have chosen to use a simple single signature because I don't transact that much with my coins and I'm not as concerned about getting hacked. Multi-signature is another way to transact where a portion of the private key is stored in separate locations and each is required to complete a transaction. This is more secure but does make using your wallet more difficult and is probably best for an advanced user who has plenty of experience using a self-custody wallet.

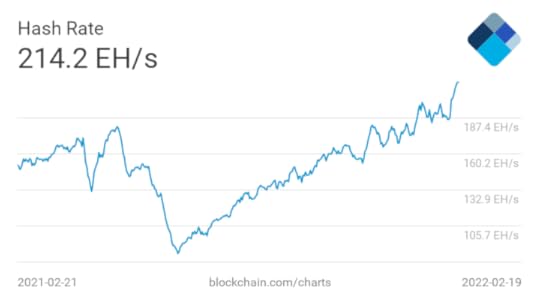

A Bitcoin transaction on the blockchain requires two things, a public key that is visible to everyone and a private key which is only know to you in order to move coins. The transaction is validated by a Bitcoin miner who receives a small fee as well as a "block reward" of newly issued coins for writing the next block. A competition of computing power makes the difficulty of solving the algorithm harder the more hash power there is and easier the less hash power there is, which helps ensure the system is always secure. Recently, Bitcoin's hash power hit an all time high, meaning the system has never been more secure:

Importance of private keys:

If you lose your private key, your Bitcoin is gone forever! It's very important to keep your private keys safe and offline. Recently the government was able to recover Bitcoin that was stolen several years ago and was allegedly being laundered by a couple of social influencers who may or may not have been the hackers that stole the original coins. While there are plenty of questions about this odd situation, one thing that was surprising was that the private keys were held in cloud storage where they could be easily accessed by law enforcement once they were able to connect that account to one of the overseas wallets that held some of the stolen funds.

Benefits:

Total control of your coins; no one can take away your coins without you consenting / providing the private keysPeace of mind knowing you have no counter-party or censorship riskDownsides:

Some people are not comfortable with the "risk" of holding their own keys and potential lossIf you lose your keys, your Bitcoin is gone forever!I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Always remember: freedom, health and positivity!

Please also check out my new Podcast now on YouTube here.

February 13, 2022

Portfolio Update - February 2022

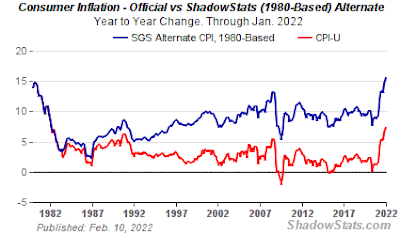

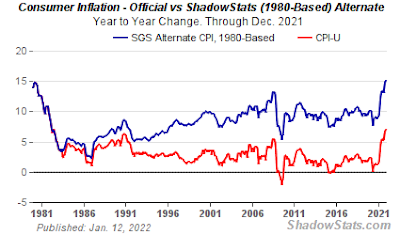

Another crazy, crazy month in the markets! Bitcoin showing some upside recently and helping out my portfolio overall. Also some good news on Bitcoin adoption this week as accounting firm KPMG - Canada adds Bitcoin to its balance sheet. However, stocks (especially tech / growth) and bonds got absolutely clobbered. Gold, silver and commodities (especially oil) continue to look strong in the face of a 40-year high inflation print of 7.5% from the BLS. With the inflation report as always, the devil is in the details, with energy +27%, used cars and trucks +40.5% and new vehicles +12.2%; oddly, shelter is only +4.4%, which seems low given we are seeing rent and home price appreciation in high double digits, at least where I live. My regular readers will know I don't have a lot of faith in the official statistics, since the method of calculation has changed over the years and I often refer to the alterative measure published by Shadowstats (see chart below), which would indicate inflation is really above 15%.

Another crazy, crazy month in the markets! Bitcoin showing some upside recently and helping out my portfolio overall. Also some good news on Bitcoin adoption this week as accounting firm KPMG - Canada adds Bitcoin to its balance sheet. However, stocks (especially tech / growth) and bonds got absolutely clobbered. Gold, silver and commodities (especially oil) continue to look strong in the face of a 40-year high inflation print of 7.5% from the BLS. With the inflation report as always, the devil is in the details, with energy +27%, used cars and trucks +40.5% and new vehicles +12.2%; oddly, shelter is only +4.4%, which seems low given we are seeing rent and home price appreciation in high double digits, at least where I live. My regular readers will know I don't have a lot of faith in the official statistics, since the method of calculation has changed over the years and I often refer to the alterative measure published by Shadowstats (see chart below), which would indicate inflation is really above 15%.

Despite the market madness, my portfolio is down only 0.5% since last month, so not complaining too much. Here's my portfolio breakdown for this month:Cash - 2.2% (basically just my emergency fund)Stocks - 18% US Large Cap - 4.8% (46% I manage myself in a trading portfolio and remainder is actively managed fund in retirement account)US Mid Cap - 2.4% (100% actively managed fund in retirement account)US Small Cap - 2.3% (100% actively managed fund in retirement account)International - 8.5% (100% actively managed funds in retirement account, including developed and emerging markets)Commodities - no current position, but will be looking to add back later in the year; in particular, basic materials and agricultural commodities look attractiveBonds - no current significant position, but adding back a small position in 401(k) (dollar cost average) to take advantage of higher ratesReal Estate - 28.2% (33% actively managed fund in retirement account and remainder is investment property I manage myself)Private Equity - 16.6% (includes numerous small Seed Invest, AngelList and Republic investments and a few direct investments - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, proptech, fintech, blockchain, energy, cybersecurity, eSports, cannabis, etc.)Bitcoin - 23.2% (mix of direct Bitcoin ownership mostly self-custodied in an offline wallet and also including Bitcoin IRA, some GBTC and MicroStrategy; continuing to add to small staked Etherium position and dollar cost averaging small amounts twice a month into ETH and BTC in my Coinbase account); Bitcoin has posted about a 12% return so far this month which has helped reverse a terrible January, but my time horizon is 10+ years so I don't get too worried about short term price fluctuations and I'm always looking to buy at attractive entry points to add to my position in addition to dollar cost averaging - stay humble and stack!Gold / Silver / Other Alt - 9.8% (gold/ silver is 100% physical coins; I also hold small positions in GDX and SIL miner ETF's. This category also includes a Masterworks account to invest in fractional interests in fine art, which is now about half of this category and which I added to this month - see my review of Masterworks here)Other - 2%Other than adding to my Bitcoin position this past month and one fairly significant private equity investment, I made very few changes to the portfolio. I feel it is well positioned to benefit from the current inflationary environment and although I have a low stock exposure overall at 18%, I see that also could recover with active managers moving into areas that are expected to do well this year as I noted above. In my trading portfolio, I'll be looking to sell calls and potentially take profits at appropriate times and reinvest in beaten-down sectors that I come across from time to time since I think that approach tends to do better than chasing performance. As always, do you own research and consult with your financial advisors before making any investment decisions. This is not investment advice.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

February 6, 2022

Bitcoin Retirement Plan

I have been thinking a lot lately about how to use Bitcoin or Bitcoin related investments as part of a retirement strategy. You may be like me and have a work 401(k) that offers a variety of investment options, but those are likely limited to stocks, bonds and possibly real estate options. You may have limited or no offerings for alternative investments that would be desirable in the current macro environment such as commodities, precious metals, or Bitcoin. A self-directed Individual Retirement Account is generally your best option for adding these types of exposures to diversify your portfolio. In particular, the Roth IRA is perhaps the best kind of retirement vehicle for that purpose. If you'd like a deeper dive into why to invest in Bitcoin, check out my past blog post here.

I have been thinking a lot lately about how to use Bitcoin or Bitcoin related investments as part of a retirement strategy. You may be like me and have a work 401(k) that offers a variety of investment options, but those are likely limited to stocks, bonds and possibly real estate options. You may have limited or no offerings for alternative investments that would be desirable in the current macro environment such as commodities, precious metals, or Bitcoin. A self-directed Individual Retirement Account is generally your best option for adding these types of exposures to diversify your portfolio. In particular, the Roth IRA is perhaps the best kind of retirement vehicle for that purpose. If you'd like a deeper dive into why to invest in Bitcoin, check out my past blog post here. Here are some of my ideas relative to blending Bitcoin and retirement tools:

Bitcoin Self Custody / Loan

The first option (and my preferred approach given the simplicity and flexibility - not having to deal with all the retirement plan rules, etc.) is to simply buy Bitcoin on an exchange like Coinbase, Crypto.com, or whatever other platform you use. Move the coins to a cold storage wallet (Trezor and Ledger are the most popular). Continue to accumulate coins in this fashion using dollar cost averaging by buying on a regular basis, buying pullbacks, etc. When ready for retirement, move some coins back to an exchange that offers secured loans (Coinbase currently does this and offers an 8% interest rate on these loans). The key here is to make sure you are very conservative with the loan to value ratio - I think a maximum of 10% is ideal to avoid the potential of a big sell off that could result in you losing your coins. You then simply repay the loan annually and reborrow, perhaps slightly increasing your borrowings as Bitcoin price increases. Because these are loans, they are not taxable. This strategy is not a lot different than using life insurance for retirement planning (if you're interested check out my past post for a deeper dive into this topic here). In summary, you can borrow against your whole life policy's cash surrender value tax-free and when you die, the death benefit (which is also not taxable) is used to pay off your loan principal and the remaining death benefit goes to your heirs tax-free. The Bitcoin loan option does not enjoy the same tax benefits upon exiting the position (i.e., your estate will have to pay taxes on the total estate value which includes the value of your coins), but with the step-up in basis at date of death, you could sell the coins for minimal tax exposure and retire the loans or just keep the loans in place, depending on needs at the time.

Roth IRA

I wish someone had told me about Roth IRA's when I was a lot younger, I would have used this a lot more than I did. One of the best benefits of using a Roth are no required minimum distributions (unlike traditional IRA's and 401(k)) and earnings grow tax free. Better late than never, I guess. As a reminder, you can contribute fully to a Roth IRA if you make $129K a year or less (single) and $204K if married and the contributions phase out fully at $144K (single) and $214K (married) in 2022. You can contribute up to $6,000 a year to a Roth ($7,000 if you are over 50). If you are within these income limits, it's a really good idea to contribute as much as you can to a Roth - you can even do this if you contribute to a workplace plan. Even if you make more than these limits, you can contribute to a Roth using a "backdoor" approach. This involves making a non-deductible contribution to a traditional IRA and then immediately rolling over the balance into a Roth IRA while in cash, which should not trigger any tax on the conversion. This is currently on the table to be eliminated in the tax legislation that is part of the stalled Build Back Better Act. Some have said it's unlikely the tax legislation will pass this year with an effective date of this year, but it's very uncertain. Nevertheless, this could be the last year for taking advantage of the backdoor Roth.

Leveraging Bitcoin investments into the Roth IRA with Bitcoin's asymmetric growth prospects makes for a powerful retirement vehicle. Here's a quick example. Let's say you contribute $40K to a Roth and pay taxes at a 40% rate, you would have paid $16K in taxes on that money since it is contributed after tax. If the price of Bitcoin rises 10x over the next 10 years to $400K, then you avoided $144K in taxes ($160K - $16K). If the price of Bitcoin rises 100x over the next 10 years to $4M, then you avoided $1.584M in taxes ($1.6M - $16K). That's very powerful stuff. Bitcoin has had an average annual increase of 200% since inception with plenty of volatility up and down. If you zoom out (chart below) the consistent upward growth rate on the log chart is impressive. With Bitcoin adoption globally still very low and a hard capped, fixed supply, the growth rate of Bitcoin seems likely to continue into the future.

One option for investing in a Roth leveraging Bitcoin is to setup a Bitcoin IRA that invests directly in Bitcoin (the coins are held by the IRA custodian but you can buy them directly). There are several providers out there (here's a link to an article comparing options). I ended up going with Bitcoin IRA which although it has higher fees, has a great product and customer service.

Another option is to have a traditional brokerage account and buy Grayscale Bitcoin Trust (GBTC), which owns Bitcoin directly. They do charge an annual management fee of 2%, which is a bit high, but it's expected to go down significantly when the SEC approves its application to become an Exchange Traded Fund. So far, the SEC has only approved Bitcoin futures-based ETF's, which I definitely do not recommend for a long term investor, simply because the futures contracts erode in value over time as they roll over and if Bitcoin trades flat or down you can lose a lot of money (known by futures traders as contango). GBTC is is probably the best way to have direct exposure to Bitcoin outside of owning it directly yourself with the aforementioned shortcomings. Currently the fund trades at a discount to the value of the coins it holds, which I think may present a short term opportunity for an investor with a long term horizon.

Another option in some brokerage accounts (for mine in particular I couldn't invest in GBTC at the time I wanted to move to Bitcoin, so this was my only option) is to buy shares in Microstrategy (MSTR). This is a business software company that generates about $100M a year in positive cash flow and it has converted its Corporate Treasury to Bitcoin. Microstrategy also has issued convertible debt, normal corporate debt and stock to buy additional Bitcoin and continues to buy Bitcoin at every opportunity. The CEO has stated they have no intention on ever selling and they will continue to look for additional opportunities to acquire more. Talk about "all in!" It is a highly leveraged play on Bitcoin and will tend to outperform the Bitcoin price both on the upside and downside. Like GBTC, it currently trades at a discount to the fair value of the Bitcoin it holds due to ongoing selloff in the technology sector as well as recent weakness in the price of Bitcoin, which again seems like an opportunity if you believe the long-term Bitcoin thesis.

Roth IRA Conversion

Another option that looks like it will be available to everyone for some time (even if/when the new tax laws take effect which will sunset this option for high earners eventually) is to convert your existing IRA to a Roth. You do have to pay taxes on the value of the account (less any contributions you made that are considered part of your "basis"). The best time to do this is when the account balance drops due to stock market volatility - this is called when life gives you lemons, you make lemonade. Perhaps if your traditional IRA is down significantly due to stock market losses, it would be a good time to convert via roll over directly into a Roth IRA invested in Bitcoin? That's basically what I did, although I converted into a traditional Bitcoin IRA at first when Bitcoin was close to $64K but then when the value dropped by 50%, I decided to take advantage of the short term decline and convert to a Roth since my tax bill was also cut in half and I'm undeterred by the long term appreciation thesis.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Also check out my new podcast "Building A Financial Fortress" available soon on all major platforms - here.

Stay safe, healthy and positive.

January 30, 2022

2022 Stock Picks

I recently realigned a small equity portfolio I maintain in my active trading account to better reflect what I think will the the market environment for the rest of this year and possibly into 2023. I shifted away from individual stocks and selected a basket of sector ETF's that I think will perform well in an environment where earnings matter, dividends are appreciated, inflation is persistent and high sales multiple stocks are shunned. In the current high-volatility stock market environment, my goal is preservation of capital, dividend yield and positioning for potential upside for gold, silver and Bitcoin given geopolitical risks and the fragile state of the global monetary system.

I recently realigned a small equity portfolio I maintain in my active trading account to better reflect what I think will the the market environment for the rest of this year and possibly into 2023. I shifted away from individual stocks and selected a basket of sector ETF's that I think will perform well in an environment where earnings matter, dividends are appreciated, inflation is persistent and high sales multiple stocks are shunned. In the current high-volatility stock market environment, my goal is preservation of capital, dividend yield and positioning for potential upside for gold, silver and Bitcoin given geopolitical risks and the fragile state of the global monetary system.Here's the breakdown:

Global X Silver Miner's ETF (SIL) - 16%Rationale: leveraged bet on inflation and weaker dollar and should outperform gold and industrial demand, particularly electronics and electric vehicles should be strong; 1.8% dividend yieldGrayscale Bitcoin Trust (GBTC) - 15%Rationale: inflation and weaker dollar, continuing adoption of Bitcoin globally and big discount to NAVVanEck Gold Miner's ETF (GDX) - 15%Rationale: leveraged bet on inflation and weaker dollar; 1.8% dividend yieldSelect Sector Healthcare (XLV) - 13%Rationale: resilient regardless of economic cycle/defensive, inflation resistant and 1.5% dividend yield Select Sector Industrials (XLI) - 10%Rationale: continued economic growth, even weak will benefit and inflation resistant; 1.3% dividend yieldSPDR Fund Materials Select (XLB) - 8%Rationale: solid inflation hedge (includes industrial metals and materials as well as precious metals); 1.8% dividend yieldSPDR Fund Consumer Staples (XLP) - 8%Rationale: resilient regardless of economic cycle but will do well if growth is weak or recession/defensive; 2.3% dividend yieldSelect Sector Utilities (XLU) - 7%Rationale: resilient regardless of economic cycle but will do well if growth is weak or recession/defensive; 3% dividend yieldEnergy Select Sector SPDR (XLE) - 7%Rationale: global supply / demand dynamics should continue to drive outperformance; 3.5% dividend yieldCash - 1%So far, this portfolio hasn't done that great due to weakness in the gold and silver miners and Bitcoin, especially given their weighting (46% of the portfolio), but I think that situation will change as the year moves on and inflation persists. There are also some geopolitical risks (like Russia/Ukraine, Taiwan) that could also drive a "flight to safety" bid. I still think the gold/silver miners are relatively cheap compared to other stocks if you look at earnings multiples, you get paid to wait with good dividend yield and have a lot of upside potential if gold and silver prices move up significantly in the coming months. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Also check out my new podcast on Podbean here.

Stay safe, healthy and positive.

January 16, 2022

Are Bonds Risky?

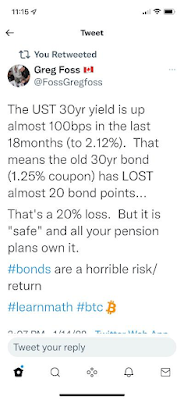

I was recently listening to a podcast "Chaos in the Bond Market" on What Bitcoin Did with Peter McCormack. His guests were two guys I follow on Twitter, Lawrence Lepard and Greg Foss. Lawrence is a precious metals fund manager who also has a strong and balanced appreciation for the benefits of investing in Bitcoin, which is very much in line with my way of thinking. Greg is a former bond trader and investor who has a significant allocation to Bitcoin but also advocates for some portfolio diversification, which again is very much in line with my way of thinking. After the podcast, Greg posted the below tweet which summarized one of his key comments about how bonds have traditionally been considered low risk investments, but that may no longer be the case. Here's the tweet:

I was recently listening to a podcast "Chaos in the Bond Market" on What Bitcoin Did with Peter McCormack. His guests were two guys I follow on Twitter, Lawrence Lepard and Greg Foss. Lawrence is a precious metals fund manager who also has a strong and balanced appreciation for the benefits of investing in Bitcoin, which is very much in line with my way of thinking. Greg is a former bond trader and investor who has a significant allocation to Bitcoin but also advocates for some portfolio diversification, which again is very much in line with my way of thinking. After the podcast, Greg posted the below tweet which summarized one of his key comments about how bonds have traditionally been considered low risk investments, but that may no longer be the case. Here's the tweet:

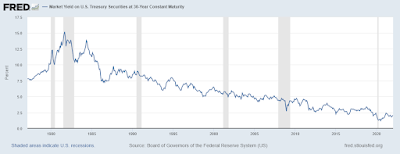

This really got me to thinking about how the current macro environment has flipped everything on its head and how a "traditional" portfolio (i.e., 60% equity / 40% bonds) is not only likely to perform poorly, but could actually expose the investor to more risk as rates rise from all time lows (see chart below). Even if rates continue their steady march toward zero or even go negative at some point, which some have postulated given the massive amount of sovereign debt outstanding and the inability of the government to afford to service the debt if interest rates move significantly higher, the upside to bonds is diminishing rapidly. Real rates of return would also most likely continue to be negative in that scenario. Until and if interest rates rise to a level where there is a "real" or positive rate of return after considering inflation, bonds are a money-losing proposition and as rates rise, this exposes bond investors to potentially huge losses as Greg points out in his tweet. For example, assuming inflation is 7% now as reported by the BLS, rates would have to be 8% on the 30-year bond in order to provide investors with only a 1% real rate of return. That's an increase of 6% (a 400% increase), from 2% where the 30-year bond sits today! I sincerely doubt this would be allowed to happen.

As I have written about before, however, the actual rate of inflation is likely much higher due to changes in the method of calculating the CPI that have been deployed by the BLS over time that have served to reduce the reported rate of inflation. If the methodology from 1980 was followed consistently, the actual rate of inflation is around 15%, very similar to what it was in 1981! See chart below from ShadowStats:

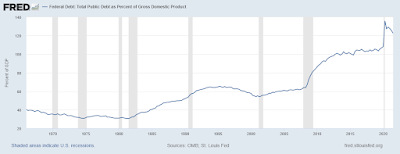

So if you're wondering why in my recent portfolio allocation update (check it out here), I reduced my allocation to bonds to zero, this is it in a nutshell. Bonds (and to a lesser extent cash) are probably the riskiest assets out there currently, certainly more risky in my mind than holding hard assets such as real estate, Bitcoin, gold, silver, commodities, etc. in the face of the kind of inflation we are seeing. Also, even though the Federal Reserve is talking a good game about pivoting to fighting inflation, if the economy slips into a recession (which seems possible in the next couple of years due to lower fiscal stimulus and tighter credit conditions) or even if economic growth simply slows meaningfully with high inflation (stagflation) and the stock market suffers a big enough correction, they will be forced to back off and resume the low rate, quantitative easing environment. As Lawrence said in the podcast, "you can't taper a Ponzi." The days of Paul Volcker raising interest rates to double digits to squash inflation are over, with debt to GDP ratio at levels we have not seen in recent history (see chart below).

One thing is for sure, the battle between market forces driving interest rates higher in response to inflation and central bank forces trying to keep rates lower will be epic and we are already seeing a tremendous amount of volatility in the bond market as rates make big moves, rising some days and plummeting other days. It's certainly not something that makes you "sleep well at night" as a holder of the safest asset. This is why it's critical for you to take an active role in your investments, stay broadly diversified, educate yourself and make appropriate decisions about risk in your portfolio based on the facts and the macro environment. This includes putting aside conventional thinking and what your financial advisor might be telling you and doing your own homework.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

January 9, 2022

Portfolio Update - January 2022

The last couple of months have been pretty brutal for most investors, especially those who are heavily invested in high-growth technology stocks, Bitcoin and cryptocurrencies, which have all seen tremendous selling pressure. The Federal Reserve inflation fighting "pivot" has a lot to do with the change in investor sentiment, since a very different investing environment appears to be shaping up this year with the Federal reserve removing accommodative monetary policy, higher interest rates, inflation and an economy that continues to show many signs of strong growth. While COVID continues to make headlines, inflation seems more and more on people's minds as the pandemic enters its final stages. Political pressure to address inflation will be growing stronger, especially as midterm elections approach. As a result, stock market investors have strongly pivoted to buying "value" stocks while selling "growth" stocks and sectors such as industrials (XLI), energy (XLE), financials (XLF) and consumer staples (XLP) have done quite well recently and look to continue to have momentum in the current environment:

The last couple of months have been pretty brutal for most investors, especially those who are heavily invested in high-growth technology stocks, Bitcoin and cryptocurrencies, which have all seen tremendous selling pressure. The Federal Reserve inflation fighting "pivot" has a lot to do with the change in investor sentiment, since a very different investing environment appears to be shaping up this year with the Federal reserve removing accommodative monetary policy, higher interest rates, inflation and an economy that continues to show many signs of strong growth. While COVID continues to make headlines, inflation seems more and more on people's minds as the pandemic enters its final stages. Political pressure to address inflation will be growing stronger, especially as midterm elections approach. As a result, stock market investors have strongly pivoted to buying "value" stocks while selling "growth" stocks and sectors such as industrials (XLI), energy (XLE), financials (XLF) and consumer staples (XLP) have done quite well recently and look to continue to have momentum in the current environment:

The reality is that it seems unlikely that the Fed can raise interest rates enough in the coming year or two to restore positive real rates of return to cash and bonds without significantly harming the economy or the stock market. There is simply too much debt out there, both private and public. As such, investing in cash and bonds will continue to be treacherous and will force most investors (those that can) to continue to seek better returns in other assets, including stocks, real estate, commodities, precious metals and Bitcoin. There is likely to continue to be tremendous stock and bond market volatility as these narratives play themselves out in the coming months, which is why the safest approach for most individual investors is to remain broadly diversified with a Financial Fortress and only make minor adjustments as needed to rebalance or take advantage of opportunities. Probably the only exception to my rebalancing discipline is Bitcoin, which I intend to hold with a very long time horizon and never sell. Another earnings season is on tap starting next week, which should add to the stock market volatility and make things even more interesting.

Here's my portfolio breakdown for this month:

Cash - 5.7% (basically just my emergency fund plus a little extra)Stocks - 20.4% US Large Cap - 6.8% (59% I manage myself in a trading portfolio and remainder is actively managed fund in retirement account)US Mid Cap - 2.5% (100% actively managed fund in retirement account)US Small Cap - 2.4% (100% actively managed fund in retirement account)International - 8.7% (100% actively managed funds in retirement account, including developed and emerging markets)Commodities - no current position, but will be looking to add back later in the year; in particular, basic materials and agricultural commodities look attractiveBonds - no current position, but looking to add back a small position in 401(k) when contributions resume this year (dollar cost average) to take advantage of higher ratesReal Estate - 28.2% (35% actively managed fund in retirement account and remainder is investment property I manage myself)Private Equity - 14.7% (includes numerous small Seed Invest, AngelList and Republic investments and a few direct investments - try to invest small amounts across a large number of companies following disruptive themes like artificial intelligence, genomics, proptech, fintech, blockchain, energy, cybersecurity, eSports, cannabis, etc.)Bitcoin - 20.7% (mix of direct Bitcoin ownership including Bitcoin IRA, some GBTC and MicroStrategy; continuing to add to small staked Etherium position and dollar cost averaging small amounts twice a month into ETH and BTC in my Coinbase account); I also have a small position in the the Proshares Bitcoin Futures ETF (BITO) in my trading portfolio; Bitcoin has struggled the past month and is down again significantly from all time highs, but my time horizon is 10+ years so I don't get too worried about short term price fluctuations and I'm always looking to buy at attractive entry points to add to my position in addition to dollar cost averaging - stay humble and stack!Gold / Silver / Other Alt - 8.3% (gold/ silver is 100% physical coins; I also hold a small position in Metalla (MTA), a gold royalty company that should also have a leveraged return in any precious metals rally. I also own a Masterworks account to invest in art which is now about half of this category - see my review of Masterworks here)Other - 2%Other than adding to my Bitcoin position this past month and a few additional small private equity investments on AngelList, I made very few changes to the portfolio. I feel it is well positioned to benefit from the current inflationary environment and although I have a low stock exposure overall at 20%, I see that also doing well with active managers moving into areas that are expected to do well this year as I noted above. In my trading portfolio, I'll be looking to take profits at appropriate times and reinvest in beaten-down names (quality companies trading around 52 week lows) that I come across from time to time since I think that approach tends to do better than chasing performance.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.November 21, 2021

Crypto Ranking Update - November 2021

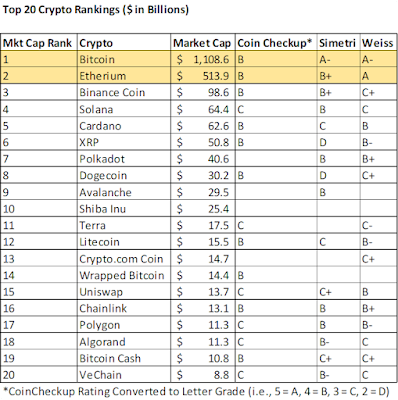

Seems like every week there is big news in the cryptocurrency industry. The latest news out of El Salvador is they are issuing $1Bn of "volcano bonds." Half of the bond proceeds would be used to buy bitcoin to hold as collateral and half would be used to build a new "bitcoin city," powered by geothermal energy from a nearby volcano. Value Added Taxes levied in the new city would be used partially for essential services and partially to repay the bonds. There would be no other taxes in the new city. After five years, the bitcoin can be sold to retire the bonds early and if bitcoin continues to appreciate at historical rates (200% per year on average), this could be very lucrative and allow for full repayment of all amounts outstanding while still being able to hold some of the originally purchased bitcoin. El Salvador is the first nation in the world to make bitcoin legal tender and requires merchants to accept it. The country has also started mining Bitcoin using one of its geothermal power plants. Pretty amazing. It is clear that there continues to be a lot of innovation, traditional finance is being disrupted and institutional adoption is growing rapidly. Below is my updated Crypto Ranking summary, excluding the stable coins and sorted by market capitalization from largest to smallest with ratings (where available) from three sources, including Coin Checkup, Simetri and Weiss.

Seems like every week there is big news in the cryptocurrency industry. The latest news out of El Salvador is they are issuing $1Bn of "volcano bonds." Half of the bond proceeds would be used to buy bitcoin to hold as collateral and half would be used to build a new "bitcoin city," powered by geothermal energy from a nearby volcano. Value Added Taxes levied in the new city would be used partially for essential services and partially to repay the bonds. There would be no other taxes in the new city. After five years, the bitcoin can be sold to retire the bonds early and if bitcoin continues to appreciate at historical rates (200% per year on average), this could be very lucrative and allow for full repayment of all amounts outstanding while still being able to hold some of the originally purchased bitcoin. El Salvador is the first nation in the world to make bitcoin legal tender and requires merchants to accept it. The country has also started mining Bitcoin using one of its geothermal power plants. Pretty amazing. It is clear that there continues to be a lot of innovation, traditional finance is being disrupted and institutional adoption is growing rapidly. Below is my updated Crypto Ranking summary, excluding the stable coins and sorted by market capitalization from largest to smallest with ratings (where available) from three sources, including Coin Checkup, Simetri and Weiss.

There has been a lot of buzz lately about up and coming coins that could overtake Etherium, like Solana (#4) or Polkadot (#7), offering faster and cheaper transaction processing, a growing developer base and strong adoption. Similarly there has been a lot of excitement about the so-called Metaverse tokens (none of which are included in the top 20 rankings yet), which include Decentraland, The Sandbox, Floki-Inu, Efinity Token, Terra Virtua Kolect, Epik Prime and Highstreet. Finally, there are the "meme coins" like Dogecoin (#8) or Shiba Inu (#10) that have a large and faithful following, but a business case that is questionable. While each coin or "project" has the potential for huge returns (especially the smaller market cap ones), in my mind that's taking a big risk equivalent to gambling. There's certainly a strategy for investing a small amount in a number of smaller projects and just holding on to it to see what will happen, but that's more akin to venture capital investing where you could lose all of your investment in a project or it could grow 10x/100x/1000x.

The two largest market cap coins, Bitcoin and Etherium, continue to distance themselves from the rest of the pack and the "first mover" advantage continues to be a powerful one as far as new technology is concerned. Each coin has a slightly different use case. Both coins are institutional quality assets to invest in, in my opinion and are the only coins I hold in my portfolio.

Etherium is the clear market leader in smart contracts which are used in DeFi projects and NFT's, has a large and diverse developer and user base and a well-funded organization that continues to make enhancements to the protocol. One of the things I like best about Etherium is the ability to stake your coins without leaving your wallet, giving you a yield (currently 4.5% on Coinbase). Below is an excerpt from the Simetri report:

Bitcoin is the leader in store of value and also has a growing smart contract / payment ecosystem with the Lightning Network that has great potential. Since Bitcoin is truly decentralized, major changes to the protocol are difficult to make since they require consensus across the entire network. However, the most recent upgrade, Taproot, recently went live and will improve security and smart contracts. Below is an excerpt from the Simetri report (you may also be interested in my post Why Invest in Bitcoin):

Ethereum Report HighlightsPhase 0 of Ethereum 2.0 upgrade (Beacon Chain) complete and expected to be finalized (merge with existing chain) in 2022Phase 0 features an entirely new chain, which operates on Proof of Stake (PoS)The capital locked up in DeFi smart contracts has grown from zero to nearly $200BEthereum browser wallet, Metamask, has recently surpassed ten million usersEthereum Foundation has around $100M to support the ecosystemEthereum is fundamentally stronger than it's ever been. Despite all of the criticism it continues to be the number one project by development activity, with a massive developer community. The project is in a good position to not only maintain its spot as the number one platform for smart contracts, but grow its dominance in the coming quarter.

Bitcoin Report HighlightsMassive market dominanceTraded virtually everywhere crypto is tradedGlobal ecosystem and brand recognitionActive core and third-party developmentPrimary on- and off-ramp to fiat currenciesWhile institutional interest in Bitcoin as a store-of-value continues to grow, other tokens have become more suited to payments. Despite this, Bitcoin’s massive market dominance makes it unlikely that it will be usurped as the undisputed crypto heavyweight champion anytime soon.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.