Bitcoin Investing and Broader Crypto Strategy

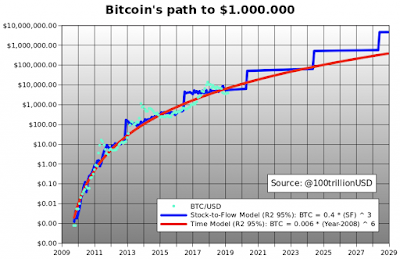

I have been doing a lot of research lately into cryptocurrencies, particularly in light of recent choppy price action and calls from a large majority institutions that Bitcoin in particular is in a "bubble." While my contrarian attitude continues to push me to go a different direction from the crowd anyway, from what I have learned, we are still very much in a bull market across a number of indicators and the long term trajectory, particularly of Bitcoin, continues to be very positive as it has been for the past ten years.

I have been doing a lot of research lately into cryptocurrencies, particularly in light of recent choppy price action and calls from a large majority institutions that Bitcoin in particular is in a "bubble." While my contrarian attitude continues to push me to go a different direction from the crowd anyway, from what I have learned, we are still very much in a bull market across a number of indicators and the long term trajectory, particularly of Bitcoin, continues to be very positive as it has been for the past ten years.

Global demand for a reliable store of value, fueled by declining value of fiat currencies due to pandemic induced monetary and fiscal policies that are inherently inflationary, will continue to meet immutably fixed supply. As such, I still believe the crypto investment thesis is intact. Buying and holding (with cash and avoiding leverage) continues to be the best long-term investment strategy for all assets, and particularly crypto due to the unusually good risk/reward characteristics for this asset class.

The first part of this post is about ways to hold your Bitcoin and how I have classified them in terms of risk / reward. The second part is about a broader crypto investment strategy, since there are really a tremendous number of innovations in the space and many ways to participate in what will no doubt be transformational change in how we handle our finances in the years ahead.

Bitcoin Investing / HODLing

Ways to invest in Bitcoin, ranked from highest to lowest in terms of risk / reward:

1) Buy and self-custody in offline wallet (I ended up buying the Trezor Model T along with a Cryptotag Zeus stainless steel private key storage device for some of my Bitcoin - so far I have been very happy with both; I do recommend you buy direct from Trezor to make sure you get full customer support)Benefits: you control your private keys and keeping your crypto in cold storage ensures you are never exposed to an exchange hack loss of your coinsCosts: you will have to invest $200 - $300 for the hardware wallet and key storage device; if you lose your private keys your Bitcoin is gone forever with no possible way to recover; you also miss out on potential profits from staking your coin on an exchange (that has counterparty risk, however, as noted below)2) Online wallet with a secure, reputable exchange (like Coinbase, Crypto.com, Kraken, etc.)Benefits: very convenient to buy/sell/transfer; no need to worry about loss of private keys since they are kept by the exchange and account recovery is possible if you lose your credentials/phone/app temporarilyCosts: exchanges charge fees either overtly and/or with a "spread" to the actual market value of the coin you are buying, so shopping around for the best fees especially if you are buying large amounts or frequently makes sense; risk of an exchange hack and loss of your coins (most of the major exchanges have dramatically improved their security over time to make hacking very difficult but it has happened before and will happen again)3) Buying into a Grayscale trust (GBTC, ETHE)Benefits: if you have a large amount of money to invest in a brokerage account, this is by far the easiest way to invest; no need to worry about security, regulatory oversight and audits since they have all three and the confidence of large institutional investors who also don't want the risk and hassle of self-custody; both trusts currently trade at a discount to underlying coins, which I think represents a nice upside opportunityCosts: you do have similar risks to coins on exchanges (risk of hack) although large trusts like Grayscale take even more extreme measures to ensure security including storing bits of private keys in multiple undisclosed locations; management fees come off the top of your returns which are fine in an up-market but can hurt in a down market (Grayscale currently charges 2%-3% for their funds but that is expected to come down when they convert to ETF's, when ETF's are approved in the US - in the meantime they are basically the only show in town) 4) Buying Microstrategy (MSTR)Benefits: you get exposure to Bitcoin with no management fees and are able to buy shares in brokerage accounts (IRA, etc.) where you might not be able to get direct exposure via GBTCCosts: like any other technology stock, MSTR can get beaten down with the rest of the tech sector in market selloffs and also faces other risks unrelated to its balance sheet Bitcoin holdings as an operating business5) Staking with a secure, online exchangeBenefits: you can earn interest on your coins while you hold them, increasing your position over timeCosts: you do face counterparty risk in the event that something happens to the exchange that you are handing your coins over to (bad investment decisions, insider fraud/theft, hack, etc.) and there is no insurance for loss, so you have to weigh the risk of loss with the reward - smaller balances that are staked are less of a concern than very large balances which may be better to keep in an online or even better, offline walletThoughts on Broader Crypto StrategyThere is a tremendous amount of activity in the broader crypto space, with new developments literally every week. It's very hard to keep up with all of it. There is a lot of activity in DeFi or decentralized finance, which has evolved to decentralized exchanges where crypto assets can be pooled and pledged as collateral for loans and loaned/staked in exchange for interest payments, using smart contracts.

This is a particularly interesting development in that you are no longer required to sell your crypto in order to monetize for fiat currency, since you can pledge your crypto assets as collateral and borrow in stablecoins (coins that are indexed to the US dollar) and use those for whatever the need is - your loan funds immediately and without dealing with a third party like a bank or having to fill out a loan application. The higher your collateral level, the lower the interest rate. Of course there is a risk in the event of a crypto market crash that you could could get a margin call, so it's best to only borrow relatively small amounts in comparison to your asset base to ensure you don't get liquidated and of course you'll eventually have to pay the loan back.

Similarly, individuals interested in lending their crypto can do so and collect interest on the balance in the same currency. These lending arrangements are also collateralized and if the crypto drops to a certain level, the collateral is returned to the lender, otherwise the lender just collects interest and ultimately gets the crypto back when the loan is paid off (which can also be paid off before maturity).

Another interesting development in stablecoin demand is they have emerged as a great way for companies to settle international payments quickly and without the need for intermediaries who are very slow to process transfers (some can take days) and charge significant fees. This may be another big reason why there has been so much growth in stablecoins recently.

We have also heard a lot recently about Non-Fungible Tokens or NFT's as a potential revolutionary change in the way creators can transfer and monetize their digital works of art. Payment for NFTs is generally facilitated by using Etherium. See my recent post on the subject here.

What much of the DeFi and NFT spaces have in common is they are built on the Etherium platform, which I believe will mean growth in the demand for the Etherium tokens over time as a means of settling transactions on these different applications. As such, I think investing in Etherium makes a lot of sense as a complement to Bitcoin, which I see as primarily engineered as a store of value asset not unlike gold or silver as a defense against inflation, but much easier to store and secure due to being digital vs physical.

One of the more obvious ways to make broader investments in the crypto space is to either invest directly in crypto exchanges like Coinbase (COIN), Bitcoin miners like Riot Blockchain (RIOT) or Crypto ETF's like Amplify Transformational Data Sharing ETF, Siren Nasdaq NexGen Economy ETF or First Trust Indxx Innovative Transaction & Process ETF. These ETF's have broader exposure to the crypto space and companies operating in the space vs investing directly in cryptocurrencies like the Grayscale funds.

I think following a broad diversification strategy across asset classes in accordance with the Financial Fortress model is critical and also within asset categories (such as crypto) it also makes sense to be diversified across direct crypto investments as well as companies involved in the space. Possibly the highest rewards (and risk) would be private equity investments in the crypto space, but I haven't seen any that small individual investors can take advantage of on Seedinvest or StartEngine, maybe because there is plenty of capital available from high net worth individuals directly these days but hopefully in the future there will be more opportunities for smaller investors. However, I did find one deal that was interesting on Republic for a company called Linen that might be worth looking into. Full disclosure, I have investments in many of the stocks and funds mentioned in this post.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

Published on April 25, 2021 22:16

No comments have been added yet.