Portfolio Allocation Update

Time again for my monthly update on portfolio allocation. Over the past month, I decided to shift away from TIPS and more into Bitcoin, increasing my overall allocation to Bitcoin and reducing my bond allocation to zero. I decided to do this largely based on my ten year time horizon and desire to hedge against what I believe will be higher than normal inflation in the coming years and continued low or negative real interest rates. I'm thinking inflation could be at least 3% to 5% in the US for a sustained period of time, but definitely more than 2% and hyperinflation is not in my base case. I'm currently reading When Money Dies by Adam Ferguson and it's a pretty scary tale of what happened in the early 1920's with hyperinflation in Germany, Austria and Hungary - all I can say is I hope policymakers have learned their lessons from history. I don't think TIPS will provide the best protection in this environment since I believe CPI understates the real rate of inflation due to calculation methodology changes over the years (not to mention excluding critical day to day items like food and gas).

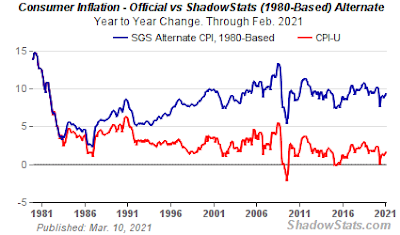

Time again for my monthly update on portfolio allocation. Over the past month, I decided to shift away from TIPS and more into Bitcoin, increasing my overall allocation to Bitcoin and reducing my bond allocation to zero. I decided to do this largely based on my ten year time horizon and desire to hedge against what I believe will be higher than normal inflation in the coming years and continued low or negative real interest rates. I'm thinking inflation could be at least 3% to 5% in the US for a sustained period of time, but definitely more than 2% and hyperinflation is not in my base case. I'm currently reading When Money Dies by Adam Ferguson and it's a pretty scary tale of what happened in the early 1920's with hyperinflation in Germany, Austria and Hungary - all I can say is I hope policymakers have learned their lessons from history. I don't think TIPS will provide the best protection in this environment since I believe CPI understates the real rate of inflation due to calculation methodology changes over the years (not to mention excluding critical day to day items like food and gas). Here's a ShadowStats chart I have shared previously that shows actual inflation could be closer to 10%:

The bigger issue in my mind for TIPS is the risk of yield curve management, where shorter dated securities including 0-5 year TIPS can be sold by the Fed in order to buy longer dated maturities to drive down long term interest rates. This can depress prices of the shorter dated bonds and result in losses, a situation which could persist for some time - possibly years depending on inflation behavior, economic growth, unemployment and policy constraints. This can be a problem for TIP holders, especially with very low yields (around 0.76% currently for VTIP). We don't have to experience hyperinflation to do a lot of damage to cash and fixed income holdings in this environment. Some day, of course, when real interest rates are positive and interest rates are higher, it may make sense to move some money back into cash and bonds but for now, that part of the market doesn't seem like a good place to be and many respected investors appear to share that view.

Here's the latest allocation:

Cash - 2.0%US Large Cap Stocks - 16.5%US Mid Cap Stocks - 5.5%US Small Cap Stocks - 5.6%Emerging Markets - 5.3%Commodities - 5.5%Real Estate - 22.1%Private Equity - 10.2%Bitcoin - 23.2%Other (Gold/Silver/Royalties) - 4.1%I have been reading lately that some analysts believe hard assets are relatively undervalued in this environment (vs financial assets such as stocks), including real estate, precious metals and collectibles. While I don't have any collectibles in my portfolio (see my post last week on NFT's), I do have a healthy allocation to real estate and precious metals. I do believe that gold and silver look attractive at current levels. My equity portfolio includes some direct exposure to gold miners as well as cyclical, tech and natural resources companies. I still believe, consistent with the Financial Fortress methodology, that broad diversification is critical to protect your portfolio over the long term, especially since it's very difficult to predict what will be "working" as markets shift through their cycles (i.e., growth vs value) and as macro conditions evolve.Future Bitcoin price predictions range widely, but I feel pretty comfortable that the price will continue to appreciate over the next 10 years at a rate that will substantially exceed inflation and therefore will provide a good store of value. The short-term volatility is expected to go down over time as Bitcoin gains more institutional adoption and acceptance / use continues to grow. My Bitcoin holdings are primarily Grayscale Bitcoin Trust (GBTC), Bitcoin held in a Crypto.com account and Microstrategy (MSTR). If you're interested, I recently did a post here on ways to invest in Bitcoin. There are currently several applications pending with the US Securities and Exchange Commission for Bitcoin ETF's, but so far none have been approved in the US. There are a couple of popular ETF's approved in Canada. Also, GBTC's sponsor has said they intend to convert to an ETF (they are a currently organized as a closed end fund) as soon as practical. When/if these ETF's are available, this will give investors more options to own Bitcoin. Although hard-core Bitcoiners say you should self-custody (not your keys, not your Bitcoin), some people may not want to deal with the potential risk of loss of Bitcoin that is in self-custody. The main value proposition for a fund or ETF is convenience (in a brokerage account) as well as peace of mind, since they have robust security, regulatory oversight, audits, etc. That especially appeals to institutional investors who may not have the expertise or risk appetite for self custody.

Last week, I watched an interesting interview with Mark Cuban, billionaire owner of the Dallas Mavericks and regular on Shark Tank. He has developed a deep understanding of the blockchain space and while he is bullish on Bitcoin for its store of value thesis, he's more interested in Etherium as an enabler of smart contract transactions across the blockchain and particularly with respect to NFT's, an area he has already made several investments. He also has a bit more of a "real world" perspective of how most people will respond to crypto adoption, which is somewhat refreshing. That got me thinking that maybe a small allocation toward Etherium (1% - 2%) might make sense in a broadly diversified portfolio. The argument against Etherium is that it is still very much a "work in progress" as a protocol and therefore is more speculative than Bitcoin at this stage of its evolution. The investment thesis would be that continued growth in demand such as NFT's (which require Etherium for payment settlement and the to support the underlying smart contracts that allow creators to collect royalties in perpetuity) would drive corresponding demand for Etherium and which would therefore result in rising prices over time, perhaps at times even better performance than Bitcoin.I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

Published on April 11, 2021 21:23

No comments have been added yet.