Confirmation of Portfolio Realignment

After shrinking my portfolio's bond exposure last week to about 12.5% (short term Treasury Inflation Protected Securities exposure via the VTIP ETF), I received more confirming evidence this week that the move out of longer term, non-inflation adjusted bonds was a sound strategic shift.

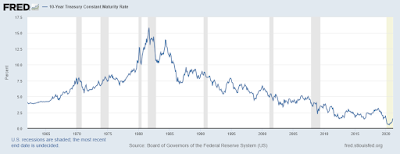

After shrinking my portfolio's bond exposure last week to about 12.5% (short term Treasury Inflation Protected Securities exposure via the VTIP ETF), I received more confirming evidence this week that the move out of longer term, non-inflation adjusted bonds was a sound strategic shift. Bond yields have declined steadily since peaking in 1981 (at that time the 10 year Treasury bond was yielding almost 16%!) and hit a low in 2020 of about 0.6%, a rate decline of about 96%. Rates have been rising recently as high as 1.5% and seem certain to head higher as the economy recovers and in particular if investors anticipate higher inflation. What's got investors spooked is how rapidly the rates have been rising recently. Here's the long term chart of the 10 year bond yield:

Here are a few more data points:

Mohamed El-Erian in an interview said rising Treasury yields are flashing a warning sign and are rising for the "wrong reason" - not because of the economic recovery but because of inflation fears.In another interview, Martin Malone (chief economic advisor at Alphabook) said we could see interest rates on the 10-year as high as 3% by the middle of 2021. He attributes this to "super monetary" and "super fiscal" policies that will continue, unabated.And finally, on Wall Street Week last week, former Treasury Secretary Larry Summers thinks we are "headed for the worst inflation risk in 40 years." He is concerned that there is not a balance between the risks of inflation and deflation or an awareness of the economic growth already underway and how the additional fiscal monetary and fiscal stimulus could "overheat" the economy.This from Warren Buffett's annual letter to shareholders (published on Saturday):

"And bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.

Some insurers, as well as other bond investors, may try to juice the pathetic returns now available by shifting their purchases to obligations backed by shaky borrowers. Risky loans, however, are not the answer to inadequate interest rates. Three decades ago, the once-mighty savings and loan industry destroyed itself, partly by ignoring that maxim."

All of these data points would suggest that bonds are not a great investment right now, which is particularly concerning for many investors, including retirees and those who are nearing retirement who typically rely heavily on bonds for retirement income and "safety." Indeed, real yields have been about negative 1% for the last couple of years and are now approaching zero with the recent rise in rates. If inflation rises rapidly, rates will be playing "catch up" for years. Also, the government can't afford for rates to rise significantly, since the cost to service the almost $28 Trillion national debt will be too great. This means it's very likely that rates will be "capped" (similar to what was done in the 1940's) while inflation is allowed to "run," resulting in a big hit to bondholders with potentially large and rising negative real yields. The bonds will get repaid, so there will be no default, but the decline in the inflation-adjusted value will result in a potentially significant loss of purchasing power. Lyn Alden has a nice overview of this historical context in this podcast.

Ironically, the volatility and risk of rapidly rising interest rates makes bonds one of the riskiest asset classes right now, while Bitcoin with its well documented volatility might actually be a less risky asset in the coming inflationary environment. Bitcoin has many other features, including ease of transfer, very strong security and a verifiable fixed supply and has been called my many well-respected investors as an alternative to gold. Gold and silver have been languishing of late, but that situation seems like it will change soon as well. Even though Bitcoin has stolen some of their thunder, gold and silver are still great hard assets / inflation hedges and an important part of the Financial Fortress. If you're interested in getting started in investing in gold and silver, check out my book here.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.Stay safe, healthy and positive.