Jonathan Chait's Blog, page 12

August 10, 2011

Jeb Bush's Economic Grand Strategery

Like most people, I've always believed that Jeb Bush is the smart Bush brother. And yet his Wall Street Journal op-ed today shakes that assumption to its core. The entire thing has to be read in its full, I-can't-believe-this-isn't-parody context. But I will helpfully summarize, and Ihope the readers will read it to see that I am not making this up.

Bush, along with co-author Kevin Warsh of the right-wing Hoover Institute, begins by asserting the standard conservative talking point that fiscal stimulus has failed -- ignoring objections such as, oh, that government has been cutting jobs on net since 2009 --promising instead a "Grand Strategy." He proceeds to deliver this grandiose unveiling of his Grand Strategy:

The debt-limit debate caused policy makers to recognize what citizens already knew: We must put our fiscal house in order. Cutting spending is essential. But we will never cut our way to prosperity.

So, what should be the economic grand strategy? In a word: growth.

Growth! Why didn't anybody think of that before? Oh, wait -- everybody has thought of that before. That's the Republican Party's idea (via low and more regressive taxes, deregulation and lower social spending). That's Obama's idea (via education reform, investing in infrastructure and science, and reforming the tax code.) It's the idea of pretty much every economic plan ever.

Shouldn't Bush's grand strategy narrow it down just a bit? Like this:

The scene was played for a joke, but at least he had a specific sector in mind. Imagine if, instead of plastics, the guy had just said, "money!"

Then Bush starts invoking his grand strategy over and over in defense of familiar right-wing bromides:

The grand strategy fights statism everywhere.

The grand strategy goes out of its way to ensure that big companies are not advantaged at the expense of smaller, entrepreneurial competitors. ...

A pro-growth strategy is decidedly long term in orientation. It aims for higher standards of living five, 10 and 20 years out, long past the next election cycle. It replaces the false promise made to the next generation of entitlement-program recipients with a solvent, dependable model that encourages work and savings. Reforming Social Security before costs multiply and uncertainties spread is both fairer and more growth-oriented. And enacting consumer-driven health-care policies represents the best way to control costs and improve patient care.

Okay, so the grand strategy means letting mass unemployment persist for years and years, pretending we won't bail out too big to fail companies when they threaten systemic risk, and privatizing Social Security and Medicare. I think we're familiar with the basic outlines of this plan. Anything else? Well, he name checks tax reform ("The strategy is a threat to those who take refuge in our burdensome tax code, and it is a great source of encouragement to those who seek higher rates of return on physical and human capital.") And then we wind up to this beaut:

The growth strategy also demands an abiding respect for the rule of law, and stable, cost-effective rules of the road from regulators. A constantly changing regulatory regime kills investment and limits economic growth. The strategy also demands investing in our own natural resources, such as shale gas and the commensurate infrastructure to re-industrialize our country, creating jobs here in the U.S. rather than shipping hundreds of billions of dollars abroad.

By stable rules, Bush doesn't mean that we should keep the current rules in place. He means we should change the regulations, one time, to the way he wants them, and then never change them again. Then, forgetting his sacred commitment six paragraphs earlier to never favor one sector over another, he proceeds to extol investment in "our own natural resources," specifically citing shale gas. Of course, energy extraction is already a heavily-subsidized field.

After a brief mention of education -- in a nutshell, Bush believes the children are the future -- he get to this rousing conclusion:

We should resist the temptation to wrangle with the green eyeshade folks who question our prospects. Instead, we must take actions that demonstrate our resolve and resiliency. We must restore our faith in growth economics and reform our policies accordingly. This will bring strength to our markets and reaffirm our place in the world.

Demonstrate strength and resiliency! Now that is a really smart idea. I wonder, though -- did George W. Bush fail to demonstrate strength and resiliency? At some point from 2001-2008, did Jeb ever suggest demonstrating strength and resiliency, and George W. ignored his proposal? Or did Jeb only think of the strength and resiliency demonstration concept after it was too late to help his brother?

August 9, 2011

&c

-- The difference between S&P and Moody's.

-- Over in Europe, they have a real (Italian) crisis.

-- The Fed knows things are bad and are likely to remain bad. Here's what they should do.

-- London: before and after the riots.

How Obama Can Win

Over the last week or so, after casually assuming that President Obama will probably win reelection, the notion that he won't is gaining sudden momentum. Clearly, the economy poses a very serious risk, and will determine the basic shape of the electoral landscape. On the other hand, some campaigns underperform or overperform the election fundamentals. A couple right-of-center writers today persuasively suggest reasons Obama should probably overperform. Eli Lehrer points out that Obama's approval ratings show a certain stubborn resilience:

Here’s an interesting data point however: Obama’s approval rating lows, to date, are higher than those for any President since Kennedy...

A president’s approval rating “floor” on the other hand, does seem to reflect something real: the number of people who will stick with the President’s policies even in very tough times.

And Ramesh Ponnuru argues along similar lines:

After last weekend, Republicans will also say: Has America’s credit improved or deteriorated?If the election is fought on those lines, then Obama will almost certainly lose. His strategy will therefore be to make it a choice election. He is going to want the small number of swing voters to think: No, I’m not satisfied with how things are going and I have my doubts about Obama, but I’m more worried about the radicalism of the Republicans on Medicare and their fealty to big business.

After last weekend, Republicans will also say: Has America’s credit improved or deteriorated?

As far as anyone can tell today, perceptions of the economy on Election Day are going to be closer to what they were in 2008 than what they were in 2004. That’s what the Republican referendum theory has going for it. But the president’s approval rating tells a different story. Since Obama’s honeymoon ended, it has moved in a fairly narrow range, never going below 44 percent and rarely going above 51 percent in the RCP average. It doesn’t put him in cinch-to-win or sure-loser territory.

That suggests that the election is going to be a choice -- and that merely being an acceptable alternative to a failed incumbent won’t be enough for the Republicans to win the White House.

What ties this together, I think, is the public's deep distrust of the Republican Party. Americans turned against the GOP en masse at the end of the Bush administration and never turned back. Republicans won the midterm elections in part by simply escaping public wrath against Democratic-controlled Washington, and in part by exploiting a much smaller, older, whiter electorate than you'd see in a presidential year. But very high-profile, very crazy Republican rule in the House of Representatives has rekindled and actually deepened the public's distrust.

Today's CNN poll is quite striking. In October of 2010, both parties were viewed about as favorably by the public (Democrats stood at 46% favorable/47% unfavorable, Republicans 44/42.) The Democratic party today is about the same -- 47% view it favorably, 47% unfavorably. But the Republican Party's favorability has collapsed -- 33% of Americans view it favorably, 59% unfavorably. That -26% favorability gap is lower than the party's rating before the 2006 election (-14%) or the 2008 election (-16%.) The GOP is completely toxic.

Now, one should caution that the Republican nominee will probably be able to distance himself a bit from the Congressional party. But Obama's strategy has to revolve around reducing his opponent's distance from the party. Today's story by Ben Smith and Jonathan Martin, suggesting that Obama's campaign plans to personally discredit Mitt Romney, suggests a campaign decision that's not just morally questionable but politically questionable as well.

The Obama campaign seems to have cast about for the last election in which a president with mediocre approval ratings, stopped at 2004, and decided it should therefore do the same thing Bush did. It certainly helps that they may -- may; I still think Romney is highly vulnerable -- face a Republican nominee with a record of extreme flip-flopping. But the far more straightforward message for Obama seems to me to be painting his opponent as, well, a Republican. That's an easy case to make!

Mitt Romney is probably the strongest potential opponent. But nobody is thinking right now about his general election liabilities. Here is an important fact about Romney that nobody ever mentions: He does not have an economic plan. He talks incessantly about jobs. But hs actual program to create them does not exist. Here is what his website offers in place of an economic plan:

Over the course of this campaign, Mitt will lay out a detailed plan for what he will do as President to jump-start economic growth and help create jobs. His plan will be based on the following principles:

Right-size government by cutting spending, repealing Obamacare, and ending wasteful programs

Make American businesses competitive in the global economy

Open markets abroad, on fair terms, for American goods and services

Ensure energy security and independence for America

Train and prepare American workers for the jobs of today and tomorrow

This can be summarized as "Plan TBA."

Now, maybe Romney will manage to win the nomination without first laying out a program. But, if his Republican opponents are remotely competent, they'll force him to explain his plan before he wins the nomination. And that plan will force him to take a lot of unpopular positions. The public hated Bush's economic positions and considered him only interested in helping the rich and business. Since Bush left the scene, the Republican Party has moved even further to the right and adopted even more unpopular positions. Now it's not just tax cuts for the rich, it's cuts to Medicare, deregulating Wall Street and greenhouse gas pollution.

Obama's path to reelection seems perfectly obvious. People are unhappy with the status quo, but they don't want to put the Republicans back in charge.

Impeachment Watch

[image error]

Via TPM, Rep. Michael Burgess endorses impeaching President Obama on unspecified grounds:

When one attendee suggested that the House push for impeachment proceedings against President Barack Obama to obstruct the president from pushing his agenda, Burgess was receptive.

"It needs to happen, and I agree with you it would tie things up," Burgess said. "No question about that."

When asked about the comment later, Burgess said he wasn't sure whether the proper charges to bring up articles of impeachment against Obama were there, but he didn't rule out pursuing such a course.

"We need to tie things up," Burgess said. "The longer we allow the damage to continue unchecked, the worse things are going to be for us."

And so the list of impeachment-friendly Republicans is growing, Scott Keyes points out:

Rep. Pete Olson (R-TX) confirmed to ThinkProgress this month that Rep. Tim Scott(R-SC) and other House GOPers were exploring impeachment over the debt ceiling. In the spring, Rep. Trent Franks (R-AZ) called for impeachment if the president refused to support the Defense of Marriage Act. Last year, Rep. Lamar Smith (R-TX) hinted at impeaching President Obama if he didn’t do more to stop illegal immigration. Even the birthers have gotten in on the action, with Rep. Tim Walberg (R-MI) last year saying he may force President Obama to release his birth certificate under the threat of impeachment.

Obviously nothing will happen between now and November 2012. But if Obama wins and Republicans keep the House, look out second term.

The Obama-Is-Dumb Meme

One of the right-wing memes still floating around is that President Obama is not very smart. Michele Bachmann has played to this sentiment by promising never to use a teleprompter. (There's a ridiculous right-wing meme that Obama only sounds smart because he reads everything off the teleprompter, a premise that ignores the copious number of times he's expressed himself in unscripted settings.) Wall Street Journal columnist Bret Stephens makes the point more bluntly today:

How many times have we heard it said that Mr. Obama is the smartest president ever? Even when he's criticized, his failures are usually chalked up to his supposed brilliance. Liberals say he's too cerebral for the Beltway rough-and-tumble; conservatives often seem to think his blunders, foreign and domestic, are all part of a cunning scheme to turn the U.S. into a combination of Finland, Cuba and Saudi Arabia.

I don't buy it. I just think the president isn't very bright.

Stephens' "evidence" for this proposition consists essentially of a free-floating list of political taunts with a varying degree of connection to reality. For instance:

Then there's his habit of never trimming his sails, much less tacking to the prevailing wind. When Bill Clinton got hammered on health care, he reverted to centrist course and passed welfare reform. When it looked like the Iraq war was going to be lost, George Bush fired Don Rumsfeld and ordered the surge.

Mr. Obama, by contrast, appears to consider himself immune from error. Perhaps this explains why he has now doubled down on Heckuva Job Geithner.

So the argument here is that Obama has not moved to the center (notwithstanding his deal to extend the Bush tax cuts, which the Journal praised as evidence of Obama's move to the center, and attempted deal to reduce the deficits on far more right-wing terms than the Gang of Six offered) and, from this rickety premise, we should conclude that Obama is not smart. Clearly a lack of intelligence is at issue here, but I don't think it's Obama's.

Eric Cantor's Pseudo-Economic Rationale

Eric Cantor is circulating a memo to House Republicans urging them to hang tough on their absolute opposition to any deficit reduction plan that includes higher revenue. He includes a little bit of apparent ballast to support his position:

Raising taxes in this economy will only make it harder for working families and the very small businesses we are counting on to create jobs and get our economy going.

But don’t take my word for it; here is what two Harvard economists concluded in a 2009 study about the various approaches to closing budget deficits, “For fiscal adjustments we show that spending cuts are much more effective than tax increases in stabilizing the debt and avoiding economic downturns. In fact, we uncover several episodes in which spending cuts adopted to reduce deficits have been associated with economic expansions rather than recessions.”

I'm gratified to see the House republicans invoking the Ivy League elites with such reverence. There are, however, several problems here. First, the paper in question jumbles together economies facing a liquidity trap with those that don't, as Paul Krugman has argued:

First, the whole stimulus debate is supposed to be about what happens when interest rates are up against the zero bound. Everything is different if the central bank is busy adjusting rates in response to conditions, and may well raise rates to offset the effects of any fiscal expansion. Yet the Alesina-Ardagna analysis doesn’t make that distinction; Japan in the 90s, which was up against the zero bound, is treated the same as a batch of countries in the 70s and 80s, when interest rates were quite high.

Second, they use a statistical method to identify fiscal expansions — trying to identify large changes in the structural balance. But how well does that technique work? When I want to think about Japan, I go to the work of Adam Posen, who tells me that Japan’s only really serious stimulus plan came in 1995. So I turn to the appendix table in Alesina/Ardagna, and find that 1995 isn’t there — whereas 2005 and 2007, which I’ve never heard of as stimulus years, are.

So to put it bluntly, I’m not much persuaded by a paper that doesn’t even identify the one clear example we have in the postwar period of large Keynesian stimulus in a zero-rate environment.

Another problem, and this is kind of intuitive, is that the appropriate mix of spending cuts and higher revenue is obviously connected with what the levels are in the first place. In a country where taxes consumed 60% of GDP and spending consumed 70%, you would obviously want to focus your attention on spending cuts. It's relevant, then, that the United States is a very low-tax country:

But let's ignore those objections. Forget about the paper's flaws, and forget about the fact that it takes no account of the existing tax levels in the countries involved. As Mike Konczal has pointed out, the conservative attempts to extrapolate from Alesian and Ardagna an appropriate ratio of revenue to spending in fiscal consolidations all wind up concluding that cuts should account for about 83% of the deficit reduction. That's about equal to the deal that Obama and Boehner agreed on, and that House Republicans refused to sign. Cantor is advocating a paper that advocates for exactly the kind of bargain he killed.

The truth is, there is no serious economic support, anywhere, for the Republican position that deficit reduction must consist of 100% spending cuts, or that no deficit reduction is better than deficit reduction with any revenue component. Fred Barnes argues in the Weekly Standard that Obama was silly to demand revenue because "For Republicans, not raising taxes is foundational, primal." He meant this, of course, in a positive sense. A primal belief is not a belief that relies upon empirical support.

JONATHAN CHAIT >>

The Bipartisanship Cargo Cult

The fetishization of bipartisanship in Washington has a cargo-cult quality to it. The worshippers of bipartisanship can see that the bipartisanship has disappeared, but they do not know why. And so they wistfully call for a return to the social mores of the old bipartisan era. This Washington Post op-ed, for instance, offers the hope that if we bring back dinner parties, bipartisanship will follow:

When I worked in the White House Social Office, I was often surprised at how many officials — some serving in the same agency or in the same house of Congress — had never met. Members of Congress and administration officials may be photographed together, but many barely know each other if they’re in different parties. How useful those dinner-party connections seemed, with guests exchanging e-mail addresses and making plans to get together. Once, this cross-pollination happened at dinners all over the city.

Today, however, political purists from both sides openly sneer at the idea of going to a dinner party. Who wants to risk hearing a viewpoint different from his own or be forced to defend her beliefs without the benefit of talking points?

I'm in favor of hearing opposing viewpoints, but I do question the author's understanding of cause and effect here.

Meanwhile, this bit had the opposite of its intended effect on me:

by skipping parties where journalists may be found, politicians are forgoing opportunities to informally shape the debate; for their part, journalists, too, may find it more difficult to savage a politician if they’ve broken bread with him.

Hilariously, she means this as a bad thing. Journalists would savage politicians they don't know, but if they're social pals, they'll pull back. I knew that mildly corrupt insider chumminess was the indictment of Washington dinner party culture. I didn't realize it was also the case in favor of it.

Vote For Obama Because... Romney is Weird?

Really? This is what they're going with?

Really? This is what they're going with?

Barack Obama’s aides and advisers are preparing to center the president’s re-election campaign on a ferocious personal assault on Mitt Romney’s character and business background, a strategy grounded in the early stage expectation that the former Massachusetts governor is the likely GOP nominee. ...

A senior Obama adviser was even more cutting, suggesting that the Republican’s personal awkwardness will turn off voters.

“There’s a weirdness factor with Romney and it remains to be seen how he wears with the public,” said the adviser, noting that the contrasts they’d drive between the president and the former Massachusetts governor would be “based on character to a great extent.” ...

The character attacks on Romney will focus on what critics view as a make-over, both personal (skinny jeans) and political (abortion). ...

Democrats also plan to amplify what Obama strategists described as the “weirdness” quotient, the sum of awkward public encounters and famous off-kilter anecdotes, first among them the tale of Romney’s once having strapped his dog to the roof of his car.

Indeed, Obama officials have made “weirdness” an epithet for Romney the way they tagged John McCain “erratic” in the fall of 2008, after the Arizona senator suddenly left the campaign trail and nearly backed out of the first debate as part of an attempt to get a deal on the bailout.

“Presidential campaigns are like MRIs of the soul,” said Axelrod. “When he makes jokes about being unemployed, or a waitress pinching him on the butt, it does snap your head back and you say, ‘what’s he talking about?’”

“It’s not just a matter of dodging the debate, not just a matter of flip flopping and putting his finger to the wind – it is that he’s not comfortable in his own skin and that gives people a sense of unease,” added a Democratic consultant expected to be involved in the re-elect.

I'm no political strategist, and I have no idea if this will work. It did work for George W. Bush in 2004. But I can authoritatively say it's total crap. Skinny jeans, dog on the roof, uncomfortable in his skin, butt-pinching jokes... do these things tell you anything meaningful about how he would govern?

Just to be clear, I'm carefully separating out the questions of what's true and what's politically effective. I'm not the sort of idealist who thinks the most analytically persuasive argument is also the one most likely to produce a successful election. Just focusing for a moment on the truth issue, I'd like to see if anybody really wants to defend the proposition that Romney's choice of pants, dog travel arrangements and whatnot is important information that ought to drive a voter's decision.

August 8, 2011

Diamonds: Still Bloody

[Guest post by Isaac Chotiner]

Isn't it nice that diamonds are not being used to fund horrific civil wars in Africa anymore? Isn't it nice that so-called "conflict diamonds" are not flooding the world market? Now, instead of fueling conflicts, diamonds are being used to prop up gross human rights violators like Zimbabwe.

The roots of the current problem have been clear for some time. After a decade of bloodshed and atrocity, the diamond industry was finally shamed into agreeing to a process whereby diamonds would be deemed "conflict-free" before being sold on the world market. The so-called Kimberley Process, established in 2003, had one glaring weakness, however: it was an industry-run effort with almost no verification mechanisms. So, naturally, last year, amid controversy over whether diamonds from Zimbabwe's Marange diamond fields would be allowed verification and export, the Kimberley Process granted Robert Mugabe's government its approval. That was in June. And now, here is a BBC report from Zimbabwe:

A torture camp run by Zimbabwe's security forces is operating in the country's rich Marange diamond fields, BBC Panorama has found. The programme heard from recent victims who told of severe beatings and sexual assault...The main torture camp uncovered by the programme is known locally as "Diamond Base". Witnesses said it is a remote collection of military tents, with an outdoor razor wire enclosure where the prisoners are kept.It is near an area known as Zengeni in Marange, said to be one of the world's most significant diamond fields. The camp is about one mile from the main Mbada mine that the EU wants to approve exports from. The company that runs the mine is headed by a personal friend of President Mugabe. A second camp is located in nearby Muchena. "It is the place of torture where sometimes miners are unable to walk on account of the beatings," a victim who was released from the main camp in February told the BBC. All the released prisoners the BBC spoke to requested anonymity. "They beat us 40 whips in the morning, 40 in the afternoon and 40 in the evening," said the man, who still could not use one of his arms after the beatings and could barely walk. "They used logs to beat me here, under my feet, as I lay on the ground. They also used stones to beat my ankles."

The New York Times has more here. Every time I write a post about diamonds, I am asked whether I think people should buy them, provided they (the diamonds) are deemed conflict-free. Putting aside this story, and others like them, there is no doubt that most diamonds sold today are not being used to support human rights violations or war crimes. But, as this example shows, the international diamond industry's major sellers are intimately involved in a shameful process whereby situations like the one reported here are allowed to occur. As long as the industry refuses impartial international verification and monitoring, the problem will continue. If you do buy a diamond from a large international seller, it is worth keeping this in mind.

Why Republicans Don't Want To Extend The Payroll Tax Cut

The first item on President Obama's agenda, and also the most apparently straightforward way to avoid imminent harm to the economy, is to extend the payroll tax cut next year. It's a tax cut, Republicans should favor it. You know, the worst thing you can do in a recession is raise taxes, as they've said a billion times? Easy call, right?

The first item on President Obama's agenda, and also the most apparently straightforward way to avoid imminent harm to the economy, is to extend the payroll tax cut next year. It's a tax cut, Republicans should favor it. You know, the worst thing you can do in a recession is raise taxes, as they've said a billion times? Easy call, right?

Wrong. Here's Paul Ryan, asked about extending the payroll tax cuts:

This is the same economic reasoning, policies and logic that the president used to sell his stimulus. He said it would keep unemployment from getting above 8 percent. It didn't. It gave us $1 trillion in debt hang over. It would simply exacerbates our debt problems in my opinion. I won't go through every one of those individual issues like unemployment insurance and others. But I really think we should do tax reform.

See? Those things are all temporary. They are demand-sided. And they are proven not to work and they still facilitate uncertainty for businesses.

And so, what's plaguing our economy today, especially for the small businesses who create most of our jobs is this just increases the amount of uncertainty as to what the future holds for them on regulations, on taxes, on interest rates and all of those things. So, this exactly exacerbates those problems.

So now we can't extend a temporary tax cut because it would exacerbate debt. Ryan is expounding here the extreme, anti-Keynesian viewpoint that has overtaken the Republican Party, which emphasizes the benefits of fiscal contractionary policy. Apparently this now even extends to tax cuts.

The first thing you have to understand about this position is that nobody within the Republican Party advocated it during the previous recession. Here's Ryan in 2001, arguing for stimulative tax cuts on precisely the grounds he now deplores:

I like my porridge hot. I think we ought to have this income tax cut fast, deeper, retroactive to January 1st, to make sure we get a good punch into the economy, juice the economy to make sure that we can avoid a hard landing.

The concern I have around here is that everybody is talking about let's wait and see, let's see if they materialize. Well, $1.5 trillion have already materialized in the surplus since then-Governor Bush proposed this tax cut in the first place. The economy has soured. The growth of the projections of the surpluses are higher. So we have waited and we do see, and it is my concern that if we keep waiting and seeing we won't give the economy the boost it needs right now.

To recap: In 2001, we faced a mild downturn, one which monetary policy was more than adequate to address. Ryan was nonetheless enough of an ultra-Keynesian to insist on immediate stimulative tax cuts to boost demand. Now, we face a massive economic crisis and the Federal reserve is almost out of ammunition. Now Ryan has been converted to an odd, economic doctrine that insists on imposing contractionary fiscal policy. I'm sure that in Ryan's mind, there's some deeper principle at work than "stimulate the economy under Republican presidents and de-stimulate it under Democratic presidents." But that is functionally the Republican position.

This little noir tale actually has a couple darker twists. Some Republicans are floating the possibility of trading the payroll tax cut extension for a tax break for repatriating overseas corporate funds:

Republicans are wary of renewing the tax break. A senior GOP aide said they will want to assess how many jobs were created because of it and evaluate its impact on the deficit before making a decision.

"I don't think most employers will tell you it motivates them to make a hiring decision," said tax lobbyist Ken Kies, managing director of Federal Policy Group.

Some Republicans have backed other strategies for boosting the economy, including temporarily lowering the tax rate for bringing U.S. corporate profits held overseas back home, known as a repatriation-tax holiday. ...

One way to entice Republican support would be combining the payroll tax break with the tax break for repatriating U.S. corporate funds, a proposal popular among many major U.S. businesses.

"There's a lot of near-panic about the jobs situation," said Mr. Kies. He said partnering the two tax breaks "might be enough to bring the political support necessary."

Attentive, long-time TNR readers may perk up their ears at the mention of Ken Kies. I profiled Kies in 2000. Kies is an intermittent Republican tax adviser and lobbyist for the shadiest, least justifiable tax dodging maneuvers that can be concocted and/or protected. Often he seems to be serving both functions at once. The association of Kies with an idea is a bright red signal that the idea in question is a way for some company or wealthy individual to fleece the public interest. And, sure enough, that is what this corporate repatriation plan would do:

Proponents argue that a second temporary repatriation holiday would boost domestic investment and jobs, which is the same pitch that proponents used to sell policymakers on a similar repatriation holiday in 2004 – and one with obvious resonance as the economy struggles to recover from recession and unemployment remains very high.

Nevertheless, the evidence shows that the first holiday failed to produce the promised results. Its primary effect was to provide a huge windfall to the shareholders of a small number of very large corporations.

Moreover, a new tax holiday would increase budget deficits by tens of billions of dollars over the coming decade. And unlike the 2004 repatriation holiday, which was sold as a “one-time-only” event, a second holiday would send a powerful message to corporations to shift investment and jobs overseas and hold the profits there — until yet another tax holiday is declared. Indeed, enactment of another such tax holiday would further embed the shifting of investment, jobs, and profits overseas as a major tax avoidance strategy for many U.S. multinational corporations.

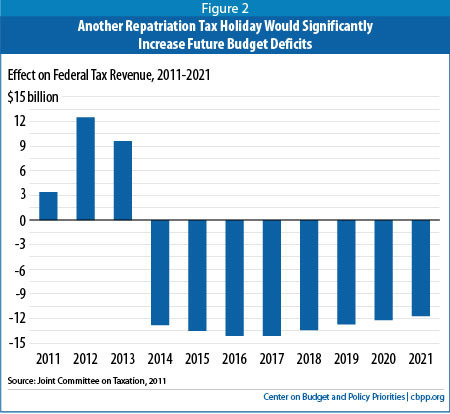

It would also increase long-term deficits:

So that's the likely shape of the battlefield now. Republicans oppose a payroll tax cut extension that does not add significantly to the long-term deficit on newfound anti-deficit grounds, unless it can be traded for another, far more regressive tax cut that does significantly add to the long-term deficit. Then they'll demand that either Obama submit to that policy or be complicit in an economy-harming tax hike.

Jonathan Chait's Blog

- Jonathan Chait's profile

- 35 followers