Jeff Seymour's Blog, page 7

September 25, 2013

ECB will let stock markets crash in 2014 - stock market crash 2014

I read in this morning’s FT, that banking regulators in Europe are essentially saying “The banking system will be solvent very soon. We mean it this time.“. Granted, we heard the European banking system was fine shortly before some epic bank implosions and after bogus bank stress tests over the past few years. Could it be this time is different? (link to the FT article here)

According to the European Banking Authority (EBA) the largest 42 banks in Europe (the systemically important ones) will be able to meet Basel III capital rules by February 2014. That’s 5 years ahead of schedule. Nice. The EBA is trying to get this information out in front of the European Central Bank’s (ECB) review of bank assets. In its first job as uber-banking-system supervisor in Europe, the ECB is going to see how healthy banks are. The ECB’s banking system review will be followed by another round of bank stress tests by the EBA next spring. The objective -as was the case with previous bank stress tests- is to convince the public their financial system is sound.

And what of our (U.S.) banking system? Dr. Bernanke said the U.S. financial system was insolvent in late 2008. (Mind you he didn’t say it until years later. Wouldn’t want to spook anyone with reality.) The Fed’s actions in 2008, 2009, 2010, 2011, 2012, and 2013 have created an environment -steep yield curve- wherein banks could generate profits at a rapid pace. It also caused banks to build mountains of reserves, ostensibly so they’d be able to withstand a banking system shock without having to be bailed-out by the public purse again. So we’re good to go.

Let’s review the forces that have stopped stock market crashes over the past 14 years (No, stock market crashes were not stopped by market forces. They were all stopped by fiscal and/or monetary policy actions. So if you’re still long stocks, REITS, junk bonds, and commodities, you better be counting on these still working in 2014.) Will these continue through 2014?

Myopic, budget-blowing fiscal policies from the U.S. Congress. (No)

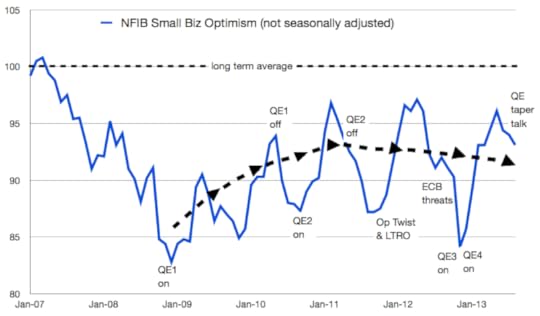

The Fed doing increasingly desperate monetary policy tricks. (No. QE is going to begin being ramped down next year since it no longer is seen to be doing anything other than inflating stock market bubbles.)

Governments in Europe allowing budget deficits via overspending sprees. (Nein)

The ECB doing desperate things -and threatening to “do whatever it takes”. In so doing, infecting its own balance sheet. (As soon as the ECB thinking the banking system can take the hit that reality will exact, it will allow it. The ECB doubtless sees the erosion of its own credibility going the same way as the Fed.)

Bank of Japan printing / continue printing like never before. (Yes. They’ve got no choice. As soon as they back off, deflation will return, and the stock market and economy will plummet.)

Peoples Bank of China flooding its banking system with liquidity. (Partial yes. The PBoC probably wants the next crash to crush the shadow banking system since they don’t control it. But it does not want to print so much that it causes food and fuel inflation to incite several hundred million rural poor to revolt. It also does not want to create another bubble supported by bad debt like it did when it opened the flood gates in 2008-2009. Those chickens are now coming home to roost.)

The central banks of Australia, Brazil, Canada, England, India, Russia, Singapore, South Korea, and Switzerland flooding their banking systems with money too. (Yes. But it won’t be enough.)

Apparently Europe’s financial system will be solvent enough next spring to withstand another financial system crisis. Be careful what you wish for.

September 24, 2013

Greedometer Newsletter posted

September 18, 2013

Bernanke kicks can. - stock market bubble 2013. stock market top 2013. stock market crash 2014

An hour ago the Fed released its widely anticipated statement regarding plans for the QE asset purchase program. It opted to continue the existing QE program unabated.

A range of outcomes were possible. A decision to continue QE without any reduction (no taper at all) is the most extreme. It means:

The Fed is all-in. It’s policies over the past 25+ years have been fundamental in creating an economy wherein those that assume extreme levels of risk are rewarded and even bailed out.

No QE taper is likely to happen until the new Fed chairman / chairwoman takes the helm in January, and has a few months under their belt to settle in.

The junkiest / riskiest assets will have their price supported and likely further inflated.

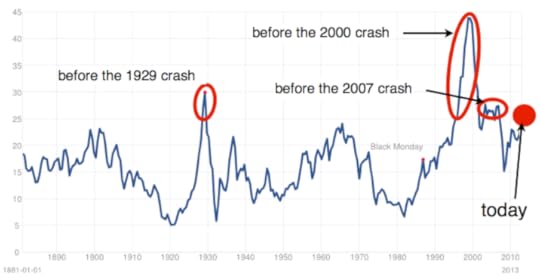

The adjusted P/E on the S&P500 has once again reached 25. In the past 133 years, that has only happened three times. A stock market crash of historic proportion followed each of them.

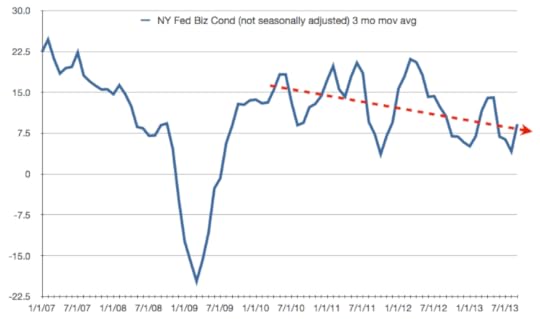

The rationale for today’s decision was the Fed wanted to “await more evidence that progress will be sustained before adjusting the pace of its purchases”. This of course assumes the Fed’s QE program is actually doing something to benefit the economy — or at least the very least that the economic benefit outweighs the costs. I have maintained since summer 2011 that QE has reached the point of diminishing returns. The Fed’s own research supports this view as of 2013.

The mother of all short covering rallies has been happening over the past hour. The Dow added 200 points in the hour since the announcement. There’s another hour until the close.

Over the coming 1-2 weeks, look for insiders to frantically dump their shares, anyone that’s short the stock market will cover, and retail investors will buy in droves. That’s what happens at secular stock market tops.

It remains to be seen:

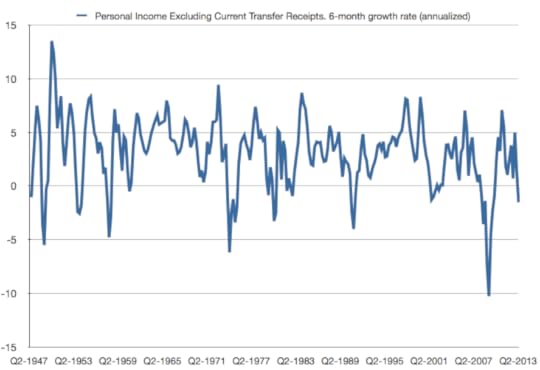

How the new Fed chairperson (Yellen?) will begin reducing QE next year when the economy is no better? Continued QE will raise inflation, squeezing the lower 95%, inducing a recession. Admittedly, the recession’s start may now get pushed from December 2013 to March 2014.

How will the markets react if the Fed waits until the economy is in recession to then begin cutting back on its QE program? Who will ‘save us’ then?

This sort of bubble is rare (4th time in 133 years), and has always ended badly. I see no reason for it to ‘be different this time’.

The impact of this afternoon’s announcement will be registered in the coming weeks via the Greedometer risk gauges. Once again there is a substantial chance of the Greedometer strategic risk gauge being broken in the coming month (exceeding full scale deflection at 8000 — showing the highest risk levels in its nearly 15 year span of data).

September 17, 2013

September 16, 2013

Things we discuss in the Greedometer Newsletter tomorrow… - US enters recession in Q4 2013

September 10, 2013

Greedometer Newsletter posted

September 8, 2013

Attention winners: It’s time to sell your shares to the losers…. again. - stock market top 2013

A few months ago I wrote a short note about how some people were able to sell high in 2007, while others were not. It’s time for an update….

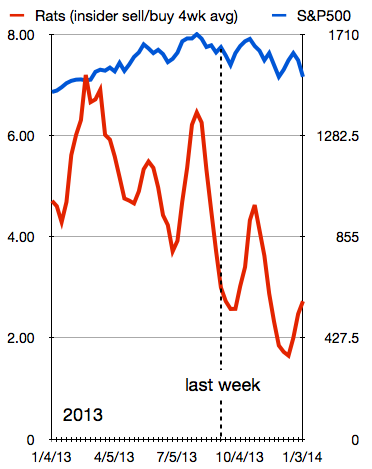

What we’re seeing so-far in 2013:

Corporate insiders selling their shares at the fastest pace in many years – and potentially ever. (Mind you 2011 and 2012 come close. Insiders were apparently right to dump their shares because there were three separate occasions in 2011 and 2012 where stock markets began collapsing — and yes they were all stopped by our central banker friends.) So far this year (January through last week) we’ve seen insiders selling their own shares at a pace greater than 5:1 (sold vs bought). Other then another short round of insider selling associated with another rally in October, the pace of selling will be far lower for the balance of the year. Doubtless the lower pace of selling late in the year will prompt some Wall St. shills to write about how there’s no correlation between insider selling and stock markets peaking. The 2013 data so far:

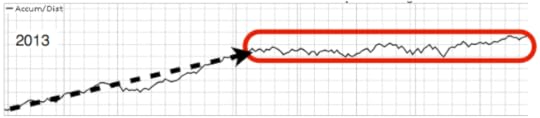

In general 2013 sees shares being sold by large/concentrated position holders to larger numbers of smaller share buyers. This is called distribution. This is particularly obvious from mid-May through last week (highlighted in red below).

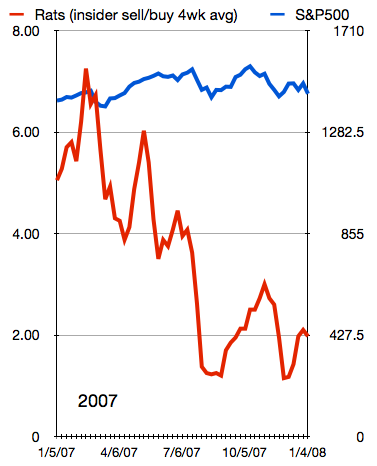

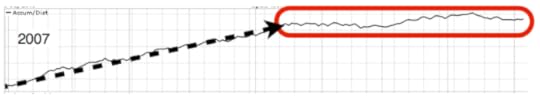

We also saw these things in 2007:

The rats were jumping ship in 2007. Like this:

Distribution in mid-May through mid-September 2007.

If there’s a related phenomenon of interest, it would be high levels of share buy-backs. Share buy-backs are when corporate managers use the company’s money to buy shares of the company in order to reduce the number of shares outstanding. This increases the earnings per share and makes the company appear more profitable than it otherwise would (which in turn drives the stock price up). I’ve always found it interesting that during years when corporate managers are heavily selling their own personal shares (sell high), they’re also using company money to buy shares (buy high). Share buy-back data for Q2 earnings seasons will be updated in the coming weeks and allow for a comparison with previous years. Don’t be surprised if 2013 shows elevated share buy backs that resemble 2007. Mind you, the real troubling data won’t likely happen until Q3. I eagerly await that data.

September 4, 2013

Ben: Channel your inner Mario - stock market top 2013

It’s September 18 2013. You find yourself at the helm of what has become the world’s most powerful institution: The United States Federal Reserve. Through a series of well orchestrated moves earlier in the year, you’ve managed to gradually set the expectation that you’ll soon begin reducing monetary policy support known as QE3.

The good news is the U.S. stock market (your obsession, since monetary policy seems unable to fix the two objectives actually within your mandate) is within a couple percent of its all-time high. If the stock market is going to hit an air pocket, all the better that it achieve as lofty a perch as possible first.

The bad news is:

you’re out of policy tools;

the economy has yet to resume a strong enough trend to sustain any removal in supportive policies;

the fiscal cavalry is not going to ride over the hill with tax cuts, or other myopic gimmicks.

This is not going to be easy. You do not want your legacy to be that you’re the guy that initiated one of the worst economic recessions and stock market crashes in history. No one wants that label (which is why we’ve had virtually no responsible long-term economic policies from the Fed or Congress in several decades). So you’re going to finesse this speech like no Fed Chairman ever has.

It is expected that you propose to slowly reduce QE so as not to spook anyone. But you can forget about threatening to resume a full-scale QE program if the economy (you mean stock market) stumble. That soothing option went out the window a month ago when the San Francisco Fed released a paper indicating QE has in essence reached a point of diminishing returns (albeit 2 years after I reached the same conclusion –> see www.noQE3.com ). If QE has become useless, offering to keep doing more of it will be equally useless and create an image of desperation. You’d be better served issuing a confident and firm statement wherein you suggest the economy is healing and strong enough to keep growing without currency debasement (QE). It’s a similar bluff as that of ECB Supremo — Mario Draghi last summer. His bluff cost nothing and worked brilliantly. Maybe yours would too.

Good luck on September 18th. Wear the blue suit.

Hat Tip to Jim Cramer

Jim Cramer has an article on the CNBC website suggesting investors consider selling and building a cash position (link here). He lists some near term risks.

I must take this opportunity to give Mr. Cramer some respect publicly. It is rare that a financial TV personality provides anything close to a sell statement or warning. How about that? Cramer and I agree on something. Granted the Greedometers are painting a more concrete and ominous warning. But we’re on the same page.

Hap tip to you sir.

Greedometer Newsletter posted

This week’s newsletter has been posted. The data was late in arriving because of Labor Day.

Lots of interesting things…

The long bond:

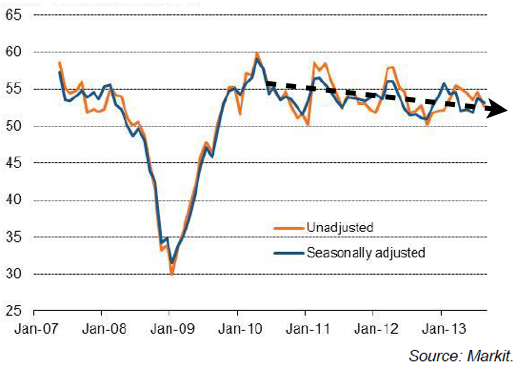

US PMI:

Lots of other manufacturing data. And a look at China’s debt bubble.