Jeff Seymour's Blog, page 2

February 4, 2016

Horse meets water

Despite my efforts to engage with equity fund managers and convince them of the dire situation in global equities, I continue to be amazed at the garbage put out as research from long-only fund mgmt companies. Guess what? The future is bright and it’s a good time to buy my equity fund because prices have pulled back. Never mind that they’re going to fall much further this year despite misplaced efforts from every central bank to keep the bubble from collapsing.

I suspect the investment industry will be different after this collapse in global stock markets. It will represent a considerably smaller portion of the economy. Hopefully so.

Some good news: if you have a mortgage, you will likely be able to re-fi into a 15yr fixed at 1.5% by year end. Don’t be in a rush to pay that off…..

January 9, 2016

2011 Deja Vu

When was the last time the SPX was flirting with a 20% drop –as it likely will be in the next 1-2 weeks?

Answer: August 2011.

Before that happened, I put this ad in the Wall St Journal on July 25th 2011.

Let’s rewind to April & May 2011. I tried every news organization that mattered (and some that didn’t) to run a story explaining why global stock markets would begin crashing that summer. Lengthy emails were sent explaining the Greedometer input parameters, how it showed previous crashes (2000-2003, 2007-09, 2010 flash crash) and why it was clearly predicting a crash to initiate that summer (2011). I could not get anyone to be interested in running the story so I ran the ad. Hold that. One large news organization did launch a similar looking and sounding tool on their website — a year later (Some of the input parameters are shared with my Greedometer. Hey, it’s a free world. That said, I’m glad I had the foresight to register Greedometer with the US Patent & Trademark office.) So my efforts were not completely in vain. Wink.

Some of you will criticize me and say I was way off. The SPX only dropped 20% then rallied far higher. Yup. You may thank a steady flow of central bank sugar bombs for that. But was I really wrong? I don’t think so. The market began crashing when I said it would and had to be stopped by more central bank sugar bombs. Again it amazes me that someone working in the investment industry could believe monetary policy does not matter. Idiocy.

Here’s what I learned from the experience:

Don’t bother trying to get the mainstream financial media to run a story about a pending stock market crash. It’s bad for business. Also -and this comes from my FT contact- they do not want to be blamed for having a role in causing the crash.

Don’t bother running an ad. No one cares about ads. Anyone can write a check.

Don’t say there’s going to be a crash unless you also include that it will require more central bank sugar bombs to stop it.

I am older and wiser. According to Google, 160,000 more people now know of the Greedometers than in 2011. Many of them know the Greedometer is older than the tool on that other news organization’s website.

What crash? - stock market crash 2016

The last time the Greedometer and mini Greedometer were showing similar readings to what they were 1 week ago (before last week’s stock market drop) was the week ending August 14 2015. On Aug 18 2015 at 9:30am I posted this warning: here

The SPX was in free fall for 2 weeks and had to be stopped by NY Fed Prez Dudley. Granted we flirted with a 15% drop. 20% drop level would likely have been seen that week had Dudley not intruded. It cracks me up how many investment pros say monetary policy does not matter.

What’s happened since? Dudley stopped that opening dip. The Fed followed through with moving the goal posts (rate hike moved from Sept to Dec). The ECB threatened and delivered a slightly disappointing sugar bomb. The PBoC shut its markets down and doubtless went through many billions of yuan supporting its stock market (Go! National Team!). And 5 months of reprieve was obtained. Until last week.

Do not interpret the dip we’re in as being a 1-off event. It is the first drop in a series of larger drops.

Next Fed & ECB sugar bombs

The Fed and ECB will get the most bank (sorry, I mean bang) for their buck if they wait until after the BEA’s overestimated GDP report on January 29, and the BLS overestimated January jobs report on February 5th.

If I were pulling the levers, I’d have the ECB announce a 30B euro/month increase in QE in the second week of February. This might buy 2-3 months of global stock market crash reprieve (wealth effect slamming into reverse). Here’s your problem, ECB — you’ve already telegraphed you’re going to increase QE by 20B/mo or so. So you’re going to have to “beat” that expectation to win a 2-3 month stay of execution. Presumably you’re busy trying to coerce the Bundesbank to allow you to do this now. If you merely raise QE by 20B/mo I fear you’ll only get 1-2 weeks of reprieve. Or worse. You may experience the dreaded Fed QE3 v1.0 damp squib –>> only only a few hours of crash reprieve. This is as much new runway as you can buy.

Fed, you’re up next. Wait for the ECB to make their last move (and this will be their last move). When things are about to collapse again, begin leaking that you will not raise interest rates until some arcane and fudge-able macroeconomic threshold is met. (Call me. I’ll tell you when the Greedometers say things are going to roll over with speed again. But you’ll owe me a beer. ) Beware: you’re going to be tempted to go full Kocherlakota/Krugman and threaten a new QE program. Resist this natural and now ingrained tendency/urge. Threatening another Fed QE program may blow up in your face because Fed QE is no longer mystical. Too many people now understand it won’t solve the problem and that it only sets up a larger crash while the bottom 90-95% of income earners continue to be slowly squeezed.

Sorry there’s no happy ending. But you already knew this.

January 8, 2016

Wake the heck up.

There is a growing acceptance among the investment industry punditocracy that we may well experience a 10% drop in the U.S. stock market. Thanks for conceding that as the SPX closes down 10% from its all time peak today. Some of these brilliant folks are hedging by suggesting we may even see a 15% drop — but that it means nothing. They’re selling this view that a 15% drop would be healthy as it would shake out the “weak hands”. I cannot pound the table any harder as I write this: this dip is a wake up call and should not be considered on its own/in isolation. It is the opening salvo in a series of deeper drops in what will be an historic crash.

If central banks do nothing new we’ll experience the largest and fastest stock market crash since 1929 this year. Why would central banks do nothing? Because they’re out of ammo / their remaining tools have become impotent. Ex-Dallas Fed Prez Fisher said so this week. My proprietary algos back up this view with quantifiable evidence over the past 17 years.

I fully expect the Fed to begin backing away from interest rate hikes at this month’s FOMC meeting and for the ECB to expand its QE program by whatever it thinks it needs to in order to beat expectations (a 25B euro/month expansion?). I don’t know when these sugar bombs will be dropped, so I remain vigilant. At least one of these two sugar bombs will need to be dropped by mid February or things will begin getting quite scary.

I remain in a very large tactical SPX short (this week was awesome!) but will exit it next week or the week after (based upon what the Greedometer and mini Greedometer readings and their internals looks like). I then will “buy this dip”. Ahem. I’ll rent that dip and go long for roughly 2 weeks. (this estimate will get tightened in the coming week but I won’t post it publicly since I have newsletter subscribers to consider). Then I’ll get monumentally short the SPX. This plan will get changed if there is a new sugar bomb from any of the top four central banks – because that action will impact the input parameters to my proprietary algos. For the past 17 years we have not lived in a world where static risk models and trading systems with static price targets make sense –>> fodder for algo-bots. Forecasts must be adapted as central banks take action. Understand and accept that or pay a heavy price.

Wake the heck up. Please.

January 4, 2016

Stock Market Crash 2016 - Stock Market Crash 2016

Last week I got into the biggest tactical short position I’ve ever had on the S&P500. I will remain in this position until either:

A) my proprietary trading system (the Greedometers) provides an exit signal (likely in 2-3 weeks — but it is early yet — this forecast will be tweaked this week);

B) one of the top four major central banks introduces (or threatens to introduce — hello ECB!) more myopic monetary policy actions.

Let me be clear. If no major central banks (Fed, ECB, BoJ, PBoC) introduce more monetary policy sugar bombs, 2016 will see the largest global stock market collapse since 1929. That’s the default scenario. It remains to be seen if central banks have enough remaining tools and credibility to stop this collapse, though they probably have enough to slow it. We’ll see.

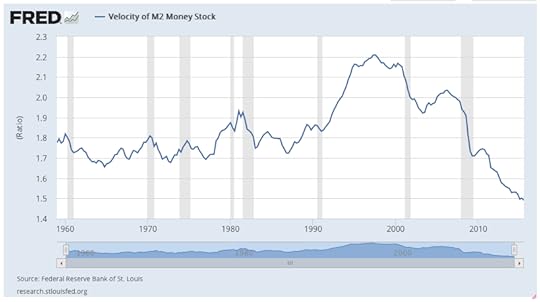

This next bit is going to be dry, but it is important, so put on your thinking cap. The velocity of money is directly related to GDP growth. In fact money velocity X money supply = GDP. With that now clear, if you want to understand why the U.S. economy has been on a steadily slowing trajectory since the late 1990s, you really only need this graph (thank you St Louis Fed):

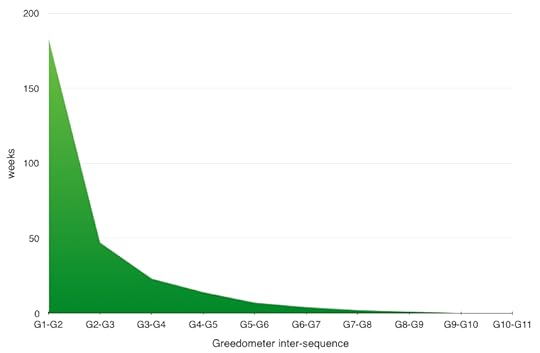

The Fed has diligently done what it could to mask, contain, and minimize the pain from this process by repeatedly taking actions. These actions have for the most part been increasing in desperateness, and with increasing frequency. I’ve been working on S&P500 market timing algorithms since 2005 and have data going back to January 1999. The following chart shows the time between stock market crash warnings generated by my proprietary system. Notice anything obvious?

Answer: this is a plot of an exponential decay curve. This is very clearly not random! The time between stock market crash warnings over the past 17 years has obeyed this curve, meaning the economy has been fighting the same problem for the past 17 years and has been losing — put more accurately– the Fed has been fighting a losing battle for the past 17 years. This chart explains how repeated Fed actions -and those of the ECB, BoJ, PBoC- have bought time via asset bubbles, but their tools are becoming less effective. There is an inevitable and unstoppable economic depression and global stock market crash on our doorstep.

It should be clear this view is really not helpful for an investment advisory business. It is far easier to land new clients when you can paint rosy pictures of the future and baffle them with complicated investment theories. I don’t do either.

Your existing adviser will likely do what he/she did last time things melted down:

Buy the dip until the dip gets too big and you have no liquidity to buy more.

Follow the financial media’s dumbed-down explanation regarding the reason for the dip (then crash).

Say no one saw this coming.

With this article it should be clear that some people see this crash coming.

China is going to get the blame for what happens this month and potentially this quarter and year. There always needs to be a scapegoat, so there will always be one. The scapegoat for the 2007-09 crash was U.S. subprime mortgages going bad. Understand that was not the cause. It was a symptom of a financial system with misguided incentives and terrible oversight; and of an economy that has been slowly and increasingly overburdened with unproductive debt since Reagan initiated the greatest U.S. debt binge in history. Now that I’ve offended the right by criticizing your patron saint, let me spread this to both sides of the isle— every President and every Congress since Reagan has overspent and effectively kicked the can. The only exception being George Bush Sr. He attempted to keep the budget in check and was rewarded with 1 term.

You have been duly warned.

p.s. let me encourage you to write to your senator and Congressperson to implore them to:

Introduce budget legislation that prevents debt mountains from building. If wars are to be waged, they should be paid for as we go –and they should be justified!!!!!!!

Stop being bought by Wall St / the financial sector. Our financial system is slowly eating our economy alive. Break up the big banks and dramatically increase oversight.

p.p.s go see The Big Short. It will educate and upset you. If it does not upset you, you missed something.

December 22, 2015

BEA GDP: The Big Lie

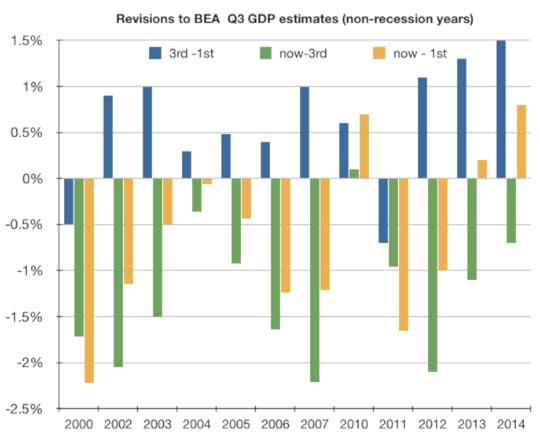

Since this morning has the BEA providing its 3rd estimate of Q3 real GDP growth, I thought it would be time again to shed some light on what the BEA has been doing for the past 15 years. The BEA has been over-estimating real GDP growth by an average of 1.16% on their 3rd estimates of Q3 real GDP growth. This is based on their own data, not my estimate of GDP.

background: The BEA estimates real GDP growth for a given quarter on the three successive months following that quarter. It then updates those estimates several times in the years that follow.

I have separated the trailing 15 years of Q3 real GDP growth data (from the BEA) into two groups depending on whether there was a recession in that year.

Here’s what it looks like for the 12 non-recession years:

Observations:

3rd estimates were higher than 1st estimates 10/12 times at an average 0.62% increase. Fair enough.

However — the current BEA view (years after the fact) has lower GDP growth estimates 11/12 times for an average of -1.26% vs their supposed best estimate — 3rd estimate. Put another way, the BEA has been overestimating GDP growth 91.6% of the time, then lowering it by more than 1% years after the fact when it won’t scare anyone.

The BEA’s 1st estimates were actually less worse (closer/better) than their 3rd estimate.

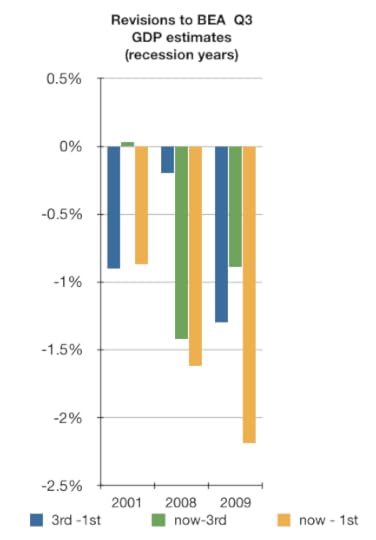

Here’s what it looks like for the recession years:

Obervations:

3rd estimates were lower than 1st estimates in 3 of 3 occasions at an average of 0.8%. That seems about right — more data is available and its all bad.

The BEA’s current view (again, years later) is that GDP growth was an average of 0.76% lower vs their 3rd estimate. Again, the BEA is overestimating their 3rd estimate and lowering it years later.

Their 3rd estimates were better/ closer than their 1st estimate. So the BEA still overestimates GDP growth in recession years but their 3rd estimates are better than their 1st estimates.

This morning, the BEA’s 3rd estimate of Q3 2015 real GP growth was 2.0%. According to their history, they’ll lower this estimate to something in the 0.9% neighborhood several years from now. When it won’t scare anyone.

With such blatant and repeated overstatements of GDP growth, how does the BEA’s month-end GDP estimate still matter?

December 17, 2015

The Non Event

Yesterday the Fed announced its first interest rate hike since June 2006. Result: stocks soared. Yawn. Is that supposed to happen? No, well, yes of course….. Sorry for doing a Draghi. The answer is yes — when there is this much at stake. The Fed -and by extension the other major central banks- cannot afford to have the great unwashed (hold mirror up here) figure out that all that really matters is whether central bank actions and threats are able to move stock markets higher. It needed an example wherein it tightened and stock markets did not drop. Wish granted — via the efforts of every major central bank’s spare liquidity — and the efforts of the shadow banking system that has profited so handsomely over the past few years from the Fed’s QE programs.

It is popular sport to bash the Fed for keeping interest rates so low for so long, for failing to assist ‘main street’ while sustaining an environment wherein its shareholders –banks– earn great profits. I too am guilty of being critical of the Fed. That said, I understand why the Fed bailed out the banks, then held interest rates low for so long. It’s really quite simple. The Fed had to do what it did to ensure the systemically important banks in its footprint could become solvent (or could at least fake being solvent via a fudged stress test that is endorsed / legitimized by the Fed). “The Bernanke” indicated -years after the fact- that the U.S. financial system was insolvent back in October 2008. You didn’t expect him to tell you the truth when it would have been really inconvenient did you? You can’t. For obvious reasons the great unwashed have to be lied to from time to time. As of now, the Fed is certain the systemically important banks in the U.S. have sufficient capital buffers they could withstand a similar mess to 2008-09. (good. they’ll have to.)

The ECB has been slower to react because it has the Bundesbank to convince regarding hugely inflationary policies. As a result I suspect there remain several important European banks that are insolvent. As long as there are systemically important banks in Europe at risk of failure, the ECB will “do whatever it takes” (whatever the Bundesbank will let) to maintain the illusion -as the Fed did- that all is well. If they bluff long enough –and have the ammo to pull off that bluff– they’ll eventually not be lying.

So how much of that yummy ECB QE frothiness is working its way to this side of the N. Atlantic? Not very much. Not near enough to support the lofty equity prices. If the Bundesbank will allow, the ECB will be forced to increase its QE program in Q1 or Q2 and drop further into the red its requirement to not buy sovereign bonds with yields under minus 0.2%. Imagine a -0.5% yield on the 10yr Bund and a +1.0% yield on the US 10yr Tnote. That’s where we’re headed late in 2016.

This game is far from over.

December 4, 2015

ECB down. Fed to go.

The biggest economic events of December were/are the Dec 3 ECB announcement and the Fed’s Dec 16 announcements. 1 down. 1 to go.

Yesterday the ECB announced several new policy measures to help prevent inflation from becoming deflationary. As we all know, the delivery fell short of market expectations and risk assets plummeted. Indeed, safe havens like core European sovereign bonds plummeted, as did the USD —pulling the entire U.S. Treasury complex down in a nearly unprecedented fashion.

An hour ago, Draghi gave a follow-on speech in New York wherein he reiterated another threat to do whatever it takes. His credibility is starting to take a bit of a beating. That said, I do not believe the ECB/Draghi miscalculated in their delivery of yesterday’s monetary policy yummyness. The ECB could not announce an expansion of their QE program just yet because German, French, and Dutch sovereign bond yields were dropping to new lows –well into the negative yields– prior to the ECB announcement. Had the ECB delivered a larger QE program (with a larger monthly purchase) this trend would have continued. A considerable portion of this core European bond spectrum would have become out of reach to the ECB’s QE program because of its rule to not buy bonds with a yield under -0.2%. The ECB could have found itself in a position 12 months from now where there weren’t any more sovereign bonds to buy. Yes, they added muni bonds to the QE lunch menu yesterday, but I’m not sure the ECB wants to delve too far into that realm.

The ECB is likely going to be forced into expanding its QE program in May-June next year, and will be forced to drop its -0.2% yield rule to -0.5% if not delete it altogether. It has a few months to lobby the Bundesbank to allow this to happen.

Closing note: I probably should not be surprised Draghi doubled down with more “do whatever it takes” threats an hour ago since I went short the SPX 3.5 hours ago (SPX 2078). The ECB must be seeing the same imminent air pocket in risk assets I am. Draghi!!!! Tight stops will come into play….. Not the first time the ECB/BoJ/PBoC/Fed surprised with more threats of candy after I went short. How about that?

November 28, 2015

Another Central Bank Pause Button

More central bank actions have paused a crash just as it was about to get going.

The next 3 weeks are once again going to be crucial. The European Central Bank (ECB) is on the hook to deliver a considerable amount of new monetary policy goodies this coming Thursday Dec 3rd. It had better impress. If not, the Fed won’t be able to hike interest rates on Dec 16th and would be painted into a corner wherein it would not be able to raise interest rates -continuing the charade that the U.S. economy is healthy and reaching “escape velocity”.