Jeff Seymour's Blog, page 4

November 21, 2014

Adapt or die

There has been a wall of email and blog comments and questions. It’s going to be a while to go through it. This might help….

I’m not selling my SPX short. Not yet. The SPX is wildly overbought on a short term basis and will pull back (look at RSI, MACD and ADX). Plus advisor sentiment is going to go berserk (bulls/bears at 4+) if the cash SPX closes this week anywhere near 2070 (where it is now). When extremely high proportions of advisors agree on something, they’re going to be collectively wrong.

It may be a 1 week, 2 week or 3 week dip. The ECB’s December 4th meeting will play a leading role. The BEA GDP report and BLS employment reports will be secondary (macroeconomic data is trumped by monetary policy actions). Will Draghi deliver more monetary candy or merely continue threatening on December 4th? If he does not deliver more candy soon, bond market vigilantes will force his hand (peripheral european sovereign bond interest rate spreads will begin blowing out over the Bund).

This dip will be nowhere near as large as it would have been without the recent actions by 3 major central banks. Absent them, the SPX would have dropped to the low 1700s in the next couple weeks (if not high 1600s), and there would have been an ongoing series of deeper dips for the next year.

But we have seen central banks intrude — and impact the Greedometers as they always have. A 10th Greedometer sequence is all but a sure thing. I remain of the view that a 10th Greedometer sequence will not be stoppable — but that it will be slowable from new monetary candy from the ECB and PBoC.

I have some fairly tight ranges in mind in terms of selling the short and going long.

And how about that long bond? I guess the Tbond investor is still sniffing something foul.

ECB & PBoC spike punch bowl

A few hours ago, the ECB President (Draghi) gave a speech wherein he re-threatened to do more to combat a weakening inflation and economic backdrop. Two hours after that, the PBoC announced it is loosening monetary policy and has dropped the interest rate on the 1-yr benchmark by 40bps to 5.6% and 1-yr deposit rates 25bps to 2.75%.

The same thing happened to me 3 weeks ago when I proclaimed the S&P500 was in the final days of peaking and initiating a protracted crash. The BoJ increased the size of its QE program the next day. These surprise central banker intrusions are becoming really inconvenient in terms of their impacting my attempts to profit from reality (mind you, it’s been a boring and green year). But these surprise central banker actions are doing something else that is beneficial (to me). Their actions are reinforcing that my Greedometer-based views of impending peril are correct. Why else would these surprise support actions be taken while stock markets are setting new highs? I mean seriously — all three major central banks (after the Fed) have taken an action or threatened more action in the past 3 weeks. What are they worried about?

I will share this comment: the Greedometer and mini Greedometer readings since the BoJ announcement 3 weeks ago have been impacted, but only barely. Furthermore, the mini Greedometer was going to roll over this week (as of yesterday’s data). This suggests the sugar rush from the BoJ’s action was running out. This in turn is why I reiterated my position with the big SPX short yesterday –> the Greedometers suggested the crash was going to start today or Monday. So it makes imminent sense for the ECB and PBoC to come to the rescue at this point if they fear another dip in stock markets like what was seen 1.5 months ago (or worse).

SPX futures this morning are partying on the news of more monetary policy candy. This week’s Greedometer readings are going to be higher than they would have been without the new ECB threat and PBoC action. I wonder how badly the U.S. long bond is going to get pounded today. It has not blinked since the BoJ action.

Someone asked me for clarification on a statement in my post yesterday. I stated “There have been zero instances where the Greedometer sequence resembled what it has over the past 6 months and no stock market collapse initiated.” There was an implicit additional statement that I should make explicit –> … “OR where a major central bank did not have to come to the rescue (or 3 central banks) to stop the impending crash initiation”.

The truly ignorant (I’ve previously referred to them as stupid) will ignore the actions of the Fed over the past few years, and the BoJ, ECB, and PBoC over the past 3 weeks and focus solely on the stock market price. They’ll be critical of the Greedometer -and me- and call the forecast wrong. So be it. I won’t be able to convince everyone. Someone is -after all- going to have to lose big at some point.

I expect central banks to keep providing extraordinary and emergency support measures as long as they know their banking system will not survive the losses inflicted from the sort of crash the Greedometers are warning about. Plus they must also believe:

Any new action they take -or threaten to take- will buy them an appreciable amount of time for banks to improve their balance sheets to the point they can withstand the body blow — or at least buy enough time for another central bank to tag-in and similarly keep the game going.

Their action will still leave their central bank institution with enough credibility to take another action when the effects of this action wear off. Notice I wrote institution and not individual. The individuals at central banks can be recycled with new ones.

Observe the turnover in Bundesbank and German Minister of Finance leadership over the past 5 years. I will not be surprised when Jens Wiedmann resigns in disgust when it becomes clear he will not be able to stop the ECB from further polluting the sacred German balance sheet.

Consider how short the tenure was for Ben Bernanke.

I submit that the BoJ has probably hit the wall in terms of further actions. The Fed was running low on credibility, but U.S. banks are now sitting on mountains of cash and will probably be able to sustain large losses and remain afloat. The PBoC can and likely will do more to keep the game going. The ECB can and likely will do more to keep the game going. It may result in a German tantrum (I would not blame them at all), but more will come from the ECB.

Do central banks collectively have enough credibility and policy arrows in their quiver remaining to stop an epic collapse? I suspect and hope so. I do not want to see a flash crash that lasts all day and sees global stock markets lose 90% of their value. No one wants to see that. However, I do suspect/hope central banks will be able to keep the game going long enough that banks will be able to take the pain from what needs to be done in terms of writing off toxic debt. If that takes the form of a 60-70% stock market crash over a 1.5 year, 2 year, or even 2.5 year timeframe that does not start until next year, that would be fine with me.

My job is not to be dogmatic. I’m not gong to remain invested the same way if the Greedometers suggest there’s no imminent threat of a drop in the S&P500. I will go with the party and wait until the Greedometers once again warn another crash initiation is imminent.

Last night’s ECB & PBoC actions are clearly going to have an impact on today’s market. The cash SPX is going to see 2070 today. That will leave wildly bullish headlines in the weekend papers, drawing-in mountains of retail investor money next week. If there are any shorts left, they’re going to cover today.

Over the next couple weeks the combined impact from the BoJ, ECB, and PBoC actions are going to be absorbed by the Greedometers. There is now zero chance the same sequence that was at play over the past 5 months continues. At a minimum that sequence is going to be made considerably shallower (slower pace). This also means the slightest whiff of additional candy from any major central bank will truncate this sequence. We could also see this sequence truncated now and immediately start a 10th sequence. I would expect the same exponential decay that has been governing every Greedometer sequence initiation since year 2000 to remain a factor. I will get into more details in the Greedometer newsletter.

November 14, 2014

Europe GDP bounce. Translation: no ECB QE for Christmas

This morning’s headline is topped with a report that Europe’s GDP bounced in Q3. It was not much of a bounce mind you. Q3 is said to have grown .2% (0.8% annualized pace) over a flat (zero growth) Q2. Germany and France avoided contraction, but Italy did not.

Upshot: No new ECB monetary policy candy (full QE) will be announced at the December 4th meeting. Better hope this BoJ QE expansion keeps the party going. I have doubts.

March 17, 2014

Website Attacked

The Greedometer and Triangle Wealth Management websites were attacked last night. An outage of nearly 10 hours was sustained. Steps have been taken to defend against future attacks.

February 5, 2014

Why the Fed may increase the pace of QE3 taper

Philadelphia Fed President Charles Plosser is on the newswires indicating he’d like to see QE3 wound-down at a faster pace. This news probably shocks and worries many (especially in the investment business). However, I would not be surprised to see an increase in the QE3 taper announced at the March 19 FOMC meeting/press conference. March will likely see the QE3 program reduced from $65B to $55B/month –at the currently expected QE3 taper pace. Don’t be surprised if Ms. Yellen announces an increase in the monthly taper from $10B to $15B per month. This would allow the QE3 program to be completed as of a final round of purchases in June.

I have long maintained the Fed must avoid a worst case scenario wherein it is still engaged in its last remaining desperate attempt to stop an economic collapse (QE3). Granted, letting some air out of an epic stock market bubble as QE3 is reduced will be detrimental to consumer sentiment and may cause the economy to roll over into a recession. If so, the Fed could apologize, say it did not see a recession coming (supported by BEA estimates of high GDP growth), and then indicate it will come to the rescue once more with another round of QE.

This is a very prickly issue. In order to have QE3 pulled away from the economy without scaring people, the Fed needs Wall St and the economic community to discredit QE3. The rationale being something like “The U.S. economy is strong. We don’t need QE3 anymore. Take the training wheels off — they’re slowing us down.” Of course this is delusional. But in order to reduce the shock of QE3 being taken away, someone needs to sell the idea it won’t hurt. Here’s where things get prickly. What if the “QE3 is not needed anymore” position is successfully sold to the masses? QE3 would be tapered and all would be well. Escape velocity here we come right? Almost certainly not. Given how the U.S. economy has repeatedly fallen out of bed when QE1 & QE2 were ended, I see no reason to expect otherwise for QE3. With QE3 wound-down and discredited ,what will the Fed do to stop the next recession and stock market collapse? Another similar-looking QE program would be irrational and would fail. Consider that when QE3 was launched in September 2012, it was a $40B/month printfest. That did not sufficiently stoke the risk-on bet, so in December 2012 QE3 was enlarged to $85B/month. The next collapse (and it is in its infancy) will either not be stopped by the Fed, or it will –with a truly Krugmanesque price tag — say $150-200B/month. (I should point out that I don’t sell gold.)

On a related note, do not be surprised to read the ECB is going to launch its own QE printfest. Yes, yes, treaties make it illegal. So look for the ECB to use an intermediary and some investment bank talent to bundle national bonds of various geographies into securities to accomplish the same objective. Sound familiar? Hey, Germany had their elections last year. So Merkel won’t need to oppose it.

Japan’s beggar thy neighbor QE is going to make enemies

There’s a great story in the weekend FT (Japan in danger of missing 2020 budget target). The upshot: Japan is not likely to meet its year 2020 target to produce an annual budget with no new debt. Japan has the worst demographic profile and debt to GDP of any developed country. How Japan escapes this mess without a decade-long depression is beyond me. Their turbo-charged QE program (far larger than the Fed’s QE3 relative to the size of the economy) has served to stall a depression, but the resulting currency depreciation is going to squeeze the life out of pensioners, and is creating the perfect environment for a global currency war (some say we’re already there).

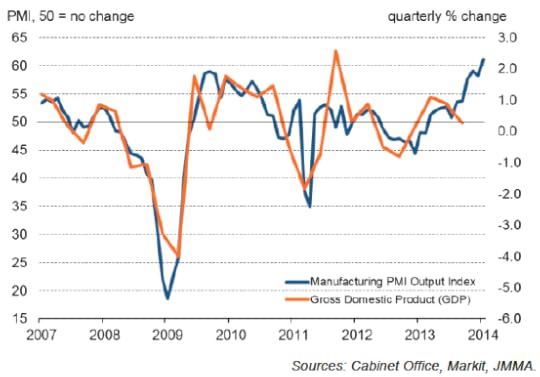

The manufacturing sector is on fire –the highest rate of growth in nearly 8 years (blue line in image below). Japan’s weak currency policy is working -for Japan. But as we’ll see, is hurting other competitors (South Korea).

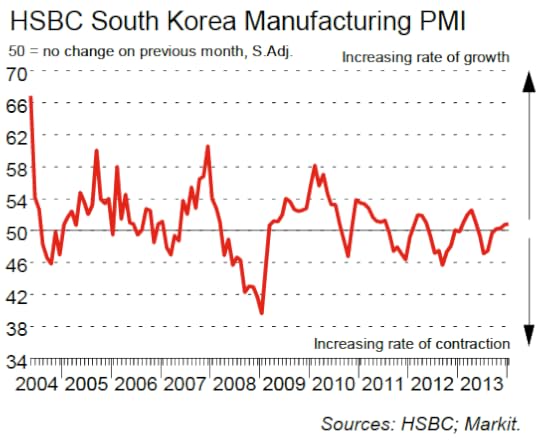

January’s manufacturing PMI in South Korea suggests the latest bounce is stalling. I would not be surprised to see South Korea’s manufacturing sector re-enter a slowdown by May. The Bank of Japan’s QE program is going to begin to bite into the Korean export machine -if it has not already.

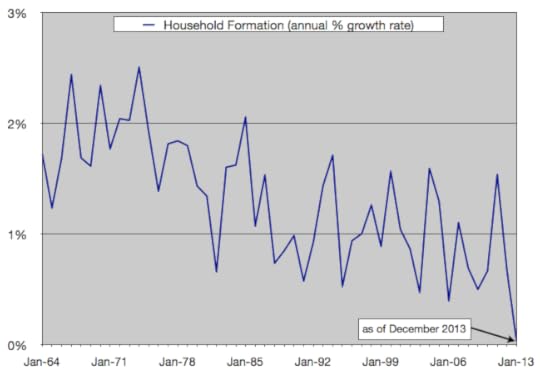

Collapse in Household Formation

Young people frequently get a bad rap / are accused of being lazy. I’m sure this has always been the case. What has not always been the same, however, is the current level of household formation. This chart speaks volumes about how young people are moving back with the folks instead of going into mortgage debt (like everyone that came before them). 2013 saw a new low for household formation. This has dire implications for the U.S. housing sector.

Is the economy really growing at 3%?

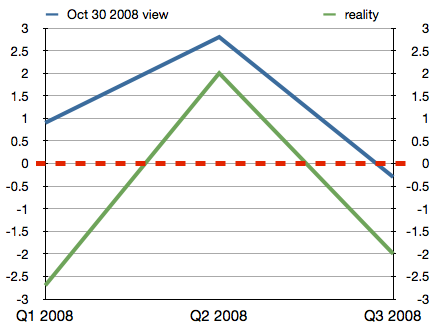

I have previously documented the BEA’s abysmal job in estimating Q3 GDP over the past 14 years (here’s a link). It turns out the BEA’s wildly overstated estimates extend to all quarters. This short story provides the BEA’s estimates of 2008 GDP at several points in time. First, here’s what the BEA now says about 2008 GDP:

Q1 -2.7%, Q2 +2%, Q3 -2%, Q4 -8.6%.

By the way, the last recession began in December 2007. Most of it was felt in 2008. Any guesses as to when the first report came from the BEA the economy had begun contracting? Try October 30 2008. I’m reminded of the saying A day late and a dollar short – because they were 11 months late, and as we’ll see below $600B off. Here’s a chart comparing their October 30th view with reality (their own reality):

By the time the end of January 2009 rolled around, the economy had been through 13 months of recession — the deepest recession since the Great Depression. At that point, the BEA estimated the economy had grown +1.3% in 2008. It continued to tweak its estimates over the ensuing years to the point where it now shows the 2008 economy actually contracted 2.8%. That’s a monumental 4.1% initial overstatement / overestimate.

The point of this story is to educate the public about the BEA’s continual overstatement of the economy — particularly when the news is bad. The U.S. economy likely contracted briefly in 2012, again briefly in 2013, and will likely begin again in June this year. That being said, it is not likely the BEA would report a June 2014 contraction in the economy until some point in mid 2015 (or perhaps 2016). Until then, overly positive GDP reports will help stop the stock market from crashing.

More in the Greedometer Newsletter…

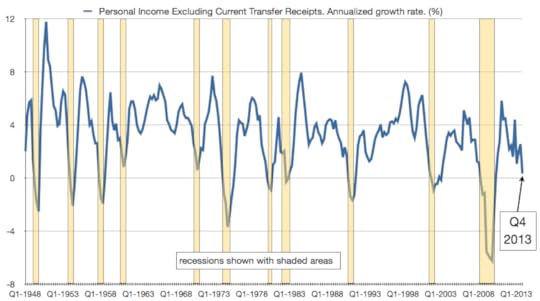

Personal income is dropping to pre-recession level

Q4 personal income dropped very nearly to zero. Consumers -in typical fashion- kept spending though. Based on the data since WWII, the U.S. economy is probably going to fall into recession at some point in Q2. Many of you will be familiar with the Chicago Fed CFNAI data I post every month. That data suggests the economy experienced a 1-quarter contraction in Q2 2012, and again Q2 in 2013. Yes, the BEA rejects that view (for now). The Chicago CFNAI suggests the economy grew in Q3-Q4, but is not far from contracting again (see last week’s letter for the latest on this).

Much more in the Greedometer Newsletter.

December 3, 2013

Greedometer Newsletter Posted

This week’s Greedometer newsletter has been uploaded.

Advisor’s have NEVER been more bullish than last week. Hello contrarians!

Insiders continued panic selling.

And the Greedometers continued to show the most extreme levels of long term and short term stock market risk ever.

No bubble here though….