Jeff Seymour's Blog, page 3

September 28, 2015

Crash warning - stock market crash 2015-2016

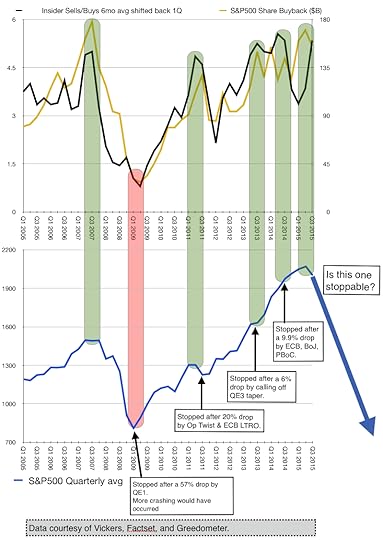

This is a public service message. The S&P500 is embarking on a crash of historic scale and speed. This crash will be deeper and faster than the October 2007 -March 2009 57% drop — until/if there is an announcement of another large central bank myopic policy support measure (QE, LTRO, threats to put short sellers in jail etc).

Every major central bank has been taking action to stall this collapse since April 24 (the crash launch point at SPX 2117). As a result of epic levels of central bank actions and threats, the collapse was stalled until July 20th (SPX 2128). It’s catch up time. There’s a long way down for the SPX to catch up to where it would otherwise have been without all this central bank candy.

On the eve of the previous market drop, I posted a blog note indicating the S&P500 was going to drop imminently. link to blog post here

I will not go into further details because it would not be fair to the paying subscribers to my Greedometer® services (market timing insight).

The next drop began a week ago and will be larger than the previous one –unless there is a new announcement of monetary policy candy from at least 1 of the top 4 major central banks. This drop will be the next leg down in a series of larger dips of a much larger protracted crash.

The great stock market crash of 2015-2016 is under way.

CRASH WARNING NOW - stock market crash 2015-2016

This is a public service message. The S&P500 is embarking on a crash of historic scale and speed. This crash will be deeper and faster than the October 2007 -March 2009 57% drop — until/if there is an announcement of another large central bank myopic policy support measure (QE, LTRO, threats to put short sellers in jail etc).

Every major central bank has been taking action to stall this collapse since April 24 (the crash launch point at SPX 2117). As a result of epic levels of central bank actions and threats, the collapse was stalled until July 20th (SPX 2128). It’s catch up time. There’s a long way down for the SPX to catch up to where it would otherwise have been without all this central bank candy.

On the eve of the previous market drop, I posted a blog note indicating the S&P500 was going to drop imminently. link to blog post here

I will not go into further details because it would not be fair to the paying subscribers to my Greedometer® services (market timing insight).

The next drop began a week ago and will be larger than the previous one –unless there is a new announcement of monetary policy candy from at least 1 of the top 4 major central banks. This drop will be the next leg down in a series of larger dips of a much larger protracted crash.

The great stock market crash of 2015-2016 is under way.

May 14, 2015

VisionQuest Wealth Management acquires Deckert Financial Management

VisionQuest Wealth Management last week purchased Southside-based Deckert Financial Management for an undisclosed sum. http://www.richmondbizsense.com/2015/...

The post VisionQuest Wealth Management acquires Deckert Financial Management appeared first on VisionQuest.

March 13, 2015

Earnings & Economic Update

ECRI’s latest WLI is a -4.0 .

The Atlanta Fed GDP data is presenting a 0.6% Q1 GDP growth picture.

Retail sales are contracting since November at a pace almost never seen outside of recession. That’s not all attributable to cold weather!

I expect Q1 real GDP growth to be around 1%, and the same for Q2. I expect recession in Q3.

S&P500 Q4 2014 earnings are now done.

As-reported earnings per share are down 17% from the previous quarter (despite share buybacks, or this would be even worse), and 14% from Q4 the previous year. A lousy quarter. Didn’t see that in the financial press? Hmmm. Here’s what you were told by the financial press:

69% of companies beat (sandbagged) earnings estimates, so it was OK.

Trailing 12month operational earnings (aka earnings before bad stuff), were up 5.3%. It’s all good. Believe what you want.

The Fed released the second part of its view on bank capital requirements. All U.S. banks got approval to start returning money to shareholders. Bank of America will have to re-submit a new and improved plan in a few months time. Santander and Deutsche Bank (2 of the largest banks in Europe) had capital reserves that were deemed insufficient to pass the Fed’s stress test, so they’ll have to hold more money and try to pass next year’s stress test. The fact that 2 of the largest European banks did not pass the Fed’s stress test but they did pass the ECB’s stress test speaks volumes. A bank regulator will avoid making one of the banks it is responsible for look bad — even if it is undercapitalized and therefore at risk of bringing the entire financial system down. This reinforces what I’ve been writing for years now i.e., the European banking system remains highly susceptible to a melt-down. The ECB’s QE program has been implemented to buy time for their banks to built capital reserves so they may sustain severe damage once the training wheels come off, but not take the global financial system down.

As a follow-up to the previous bullet — U.S. bank execs are going to trip over themselves using company reserves to buy back shares in the next few weeks and months. They’ll increase the dividend and reduce loan loss reserves. You’ll begin to see this in their Q1 report 4 weeks from now. Earnings growth will be non existent, but after loan loss reserve reductions and the impact of share buybacks, earnings will be blown away (exceeded by considerable margin). This makes for a great headline to drive stock prices higher, but a deeper look reveals a much weaker fundamental view. Also: expect to see these same executives in a panic sell of their own personal shares. In fact I expect to see extremely elevated insider selling across the board for the entire S&P500 for Q2.

Here’s food for thought:

The U.S. 10yr Tnote is yielding 2.1%. That’s pretty low by historic standards. However, money is flocking to the USD because you need a magnifying glass to see the yield on other 10yr Tnotes:

Japan 0.39%

Germany 0.25%

The Netherlands 0.28%

France 0.49%

Italy 1.13%

Spain 1.15%

Yes, Italian and Spanish Tnotes are yielding 1% less then their U.S. equivalent. With the ECB sucking-up piles of new eurozone sovereign debt, BBB-rated Italian and Spanish sovereign debt is lower risk than AAA-rated U.S. debt. How about that?

If the U.S. dollar remains this strong — or continues to get stronger- a large part of S&P500 earnings are going to drop (40-50% of S&P500 company revenue comes from outside the U.S.).

January 22, 2015

ECB QE. Finally.

Borrowing a page from the CFO playbook, yesterday the ECB sandbagged things by leaking news of a 50B euro/month QE program to be announced this morning. It then provided a “beat” by announcing a 60B euro/month QE program at 8:30am this morning. Can you tell that ECB President Draghi used to work for Goldman Sachs?

SPX futures took the news in stride this morning. Not a lot of evidence of risk-on partying. This is not good for equity bulls….

The 60B euro /month will be a mix of asset-backed bonds, covered bonds, and sovereign bonds. I don’t see this stopping the M3 money supply from contracting.

January 17, 2015

Jan 17 2015 Letter

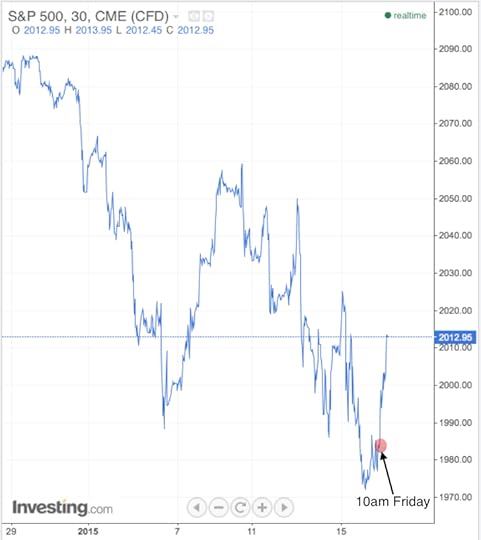

Things looked very good for a mini Greedometer baseline point to be set this week where I expected it. I expected the cash SPX to close the week in the 1955-1965 range (and to plummet to the 1925-1940 range on Tuesday, then ramp like heck back up to re-test the 2089 weekly close peak in the next 1.5-2 weeks).

Shortly after 10am, SPX futures got a jolt (see cross hairs point on the chart below).

Let’s zoom out to get some perspective…

Futures continued to be spiked the rest of the day when short term momentum was flagging. This pulled the cash SPX along for the ride. The cash SPX was within 1 point of testing the 150dma (1987) at 10:18am (it dropped to 1988).

Instead it was jolted higher from SPX futures algo-bots. I was expecting that bounce to run out of steam by 10:45am, oscillate sideways until 2pm, then roll over to close the day in the 1955-1965 range. No dice. SPX futures were continually jammed higher on points with flagging momentum the rest of the day. Something new must have happened from our friendly central bankers. I discovered what that was –around 4:30pm when I read an FT article.

Yesterday afternoon at 1:30pm (east coast N America) the FT posted an article indicating the ECB would announce QE next Thursday. That’s not news. But this is: Germany would not be forced to assume losses on non-German sovereign bonds the ECB buys as part of its QE program. Apparently the news of the ECB cutting a deal with Germany began impacting markets around 10am (4pm in Europe, 3pm UK). In the “shoot first and ask questions later” mode that markets work (also referred to as buy the rumor, sell the news), SPX futures were continually spiked higher from that point.

Bear in mind, S&P500 breadth continued falling throughout yesterday’s 30-point ramp. Not a ringing endorsement or otherwise healthy indicator of an organic ramp. Dark pool algo-bot finger prints are all over this. That’s OK, dark pool algo-bots have been driving markets for years now — and Greedometer sequences continue to be impacted and function.

Let’s consider what this ECB news means. If Germany does not have to assume responsibility for non-German sovereign bonds purchased in an ECB QE program, who will? Apparently all eurozone national central banks are going to be responsible for losses only on their own sovereign bonds. Not to pick on Italy, but this means the Italian central bank will be responsible for recapitalizing Italian banks after they’re made insolvent from losses on Italian sovereign bonds. Huh? Have you seen the size of Italy’s sovereign debt? Italy is home to the 3rd largest sovereign bond market on the planet. A 10-15% drop in Italian sovereign bond value would likely render most (all?) large Italian banks insolvent. ECB bank stress-test or no. What’s the Italian central bank going to use to recapitalize its banks? In short, an ECB QE program wherein national central banks are responsible for losses on their own sovereign bonds without the benefit of owning their own currency printing press (to print their way out) is crackers.

Given where we closed -2019- there’s no chance this past week sets a new miniG baseline point where I expected it. Ever since the Oct 31 BoJ surprise announcement I’ve been on alert for this sequence to be truncated and give birth to a 10th sequence. It seems the 9th just won’t die — but it has been gradually warped shallower by the barrage of central banker intrusions. The ECB’s unscheduled announcement yesterday is the 3rd un-scheduled intrusion in the past 3 months. I estimate last week’s mini Greedometer reading would correspond to setting a baseline with a slope virtually identical to the slope of the 2007-09 sequence. No Greedometer sequence since 2007-09 has been that shallow (slow). Does this represent a crash speed limit that central bankers are OK with?

If last week’s mini Greedometer value ends up defining a 9th Greedometer sequence baseline, the cash SPX will ramp all the way through the previous weekly close peak at 2089 to the 2120-2150 range by the first week of Feb. Then a march breather and re-test in April (crash launch point). I suspect a 500B euro ECB QE announcement next Thursday would keep us in the 9th sequence.

An open ended ECB QE program announcement would likely truncate the 9th sequence and load a 10th that would not be stoppable. The SPX would climb to the 2200s in Feb and 2300s in April, and re-test in July (crash launch point). As you know, 1T euro/year is going to be needed to stop the eurozone M3 money supply from contracting. Since the ECB doubtless knows this, there will be a desire to announce an open ended QE program next week.

As ever (16+ years), the Greedometers are being influenced by new and extreme central bank policy. (And yes, I would call it extreme that the ECB is going to embark on a currency printing program where national central banks are holding the bag.) As ever, we need a mature sequence and central banks to be out of bullets to maximize profitability on our tactical moves –in both directions. We should be there by April or July this year.

Kind Regards,

Jeff Seymour

January 16, 2015

Jan 16 2015 Client Letter

Hello Folks.

Of note:

Volatility is back. We saw some big intraday swings this week.

Q4 2014 earnings season has started this week. Per the norm, the front end of earnings season is heavily laden with the financial sector. Not terribly surprisingly, they are trading weak on earnings misses. A flattening yield curve has something to do with it. JPM was down 5% at one point on Wednesday after they disappointed. BAC and C also provided disappointing earnings. Reminder: the financials lead the overall market in direction.

U.S. retail sales data for December was posted this week. It disappointed. This will lower expectations for Q4 GDP growth. Fear not! I’m confident the BEA will over estimate Q4 GDP by 1% and post a 2-handle in its first estimate late this month.

U.S. inflation at the wholesale level is virtually non-existent (up 1.1% over the past 12 months). Actually it is deflationary over the past 2 months. Hmmmm.

Oil dropped under $46 — a 5.5 year low.

Copper and the commodity complex dropped to lows not seen in 5 years as well.

Gold has powered back up through the 200dma ($1245) to the $1260s. A nice bounce after the BoJ’s Oct 31 announcement. This is happening while the USD is rallying –> suggesting added strength in the metal’s price (and declining confidence in paper currency…. I wonder why….)

The U.S. long bond has been bid way up in price as the yield plumbs new all-time depths. A 2.37% yield was seen on the 30yr long bond yesterday. WOW! I know there is less supply since the budget deficit is smaller, but this is not just a supply-demand imbalance. The long bond is acting like it sees a depression on our doorstep.

The ECRI WLI (a good proxy for real GDP growth) registered a -5 last week (the data is 1 week behind). Unless something changes (central bank candy), the ECRI WLI will likely drop to the -8 neighborhood by early March — a level that has significant chance of representing the entry point for recession.

The U.S. 10yr Tnote yield broke through resistance at 1.8%, dropped to 1.7%, and is on its way to re-test the all time record low of 1.42%.

Sentiment from U.S. consumers and small business owners is as good as its been since before the Great Recession. No wonder the Fed felt it would be OK to take the training wheels off. That being said, watch the Fed now back pedal from plans to begin raising interest rates.

A reminder: the S&P500 CAPE was at 28 in December. That’s 3rd place in history for most overpriced stock market. Only 2000 and 1929 top it. 2007 is 4th. Also, S&P500 breadth is falling significantly this week.

A huge increase in the value of the swiss franc yesterday as the swiss central bank removed a cap on the value of the currency. The cap was put in place over 3 years ago when there were fears the euro currency union might fall apart. With the ECB expected to announce full QE next week, the swissie would be sought as a refuge to preserve wealth. The swiss central bank would have a hard time holding its currency down against a heavy onslaught of buyers.

I plan to sell the tactical inverse S&P500 position very soon because I’m expecting this stock market pull back to run out of steam very soon. I also plan to sell a large chunk (or perhaps all) the long Tbond position very soon because it is wildly overpriced (sell high). I may buy it back again in a month or 2 when it’s cheaper. Next week I will open up a tactical long stock market position to ride an anticipated bounce back to re-test the previous all-time highs.

We are having an excellent start to the year!

Kind Regards,

Jeff Seymour

January 13, 2015

2015 Forecast - stock market crash 2015

This being January, stock market and economic forecasts abound. Here’s mine….

Global economic growth in 2015 will be the slowest in decades and global stock markets will have one of their worst years in history. The only reason this forecast does not materialize is new policy actions are taken by the world’s 2nd, 3rd, and 4th largest central banks to stop the downward spiral. Central bank actions have stopped every meltdown that initiated since 2000 –all at different stages of maturity. There have been 9 according to the Greedometers. That said, central banks may no longer be able to stop a collapse but merely slow it.

What remains to be seen is whether central banks have enough remaining credibility to keep applying sugar-rush monetary policy that treat symptoms not the illness. They’ve used up all their tools and are left with debt monetization via the currency printing press.

It’s a tie in terms of most likely epicenters for this meltdown: Europe and Japan — though China gets an honorable mention.

Europe’s banking system remains laden with sovereign debt that cannot be repaid. Greece is the poster child for Europe. Haircuts have been given to bond holders but the country’s debt to GDP remains in the 175% neighborhood . I doubt Greece is still in the eurozone by year end. It’s possible that several years of euro currency printing will be able to keep the money supply from contracting. But we’re talking about 1T euro/year for 2-3-4 years. It

Japan has been able to avoid imploding under the weight of monumentally ugly demographics and debt. Their 230% debt to GDP makes Europe actually look good. The BoJ keeps bolting on larger turbo-chargers to their yen printing press so that now the BoJ is the Japanese bond market. Amazing. FYI: this morning the yield on the 5yr JGB dropped to zero. You read that right.

I don’t see this with a happy ending. If central banker actions fail to materialize or fail to stop the collapse, we’ll be positioned to profit from the inevitable crash. However, if central banker actions do manage to buy more time, we’ll go with the party — but we’ll never be far from the door and will keep the car running.

The Greedometers provide a mechanism to understand where we are in a stock market collapse and the impact recently announced central bank actions (and threats) are having / will have on the collapse. The ability of the Greedometers to track the response from central bank actions is a very valuable feedback loop. Ignoring the impact of monetary and fiscal policy actions is foolish.

January 10, 2015

Jan 9 2015 Client Letter

Hello Folks.

We’ve started 2015 very nicely.

Love that US long bond! Too bad Wall St always hates it (because they can’t make enough money from selling it to clients). Continuing to go well despite traditionally weak seasonal factors for safe havens. The ONLY reason for this much strength is the U.S. economy is heading into recession. The US 30yr long bond fell to a 2.5% yield –flirting with the record low 2.4% seen in summer 2012 when Europe sent investors fleeing for cover to this side of the North Atlantic.

The US 10yr Tnote yield fell back under 2% earlier this week. That ain’t nothin. Same story for Japanese JGBs and German Bunds — record low yields. Bring your magnifying glass because you’ll need it:

0.3% yield on the 10yr JGB!! Some brave soul is going to make a killing by shorting the JGB here (otherwise known as the widow maker trader because shorting the JGB has been perilous for years now).

0.46% yield on the 10yr German bund.

Hell, even Spain’s 10yr note fell to 1.5%. In what world is a Spanish 10yr yield worth 50 basis points less than a US 10yr tnote? Seriously.

I expect Q4 2014 GDP growth was +1%ish but the BEA will maintain a 2% guess until it gets embarrassing (a year from now). 2015 Q1 GDP growth is likely to be in the 2% neighborhood if the ECB spikes the punch bowl on Jan 22nd. Otherwise, I expect a 0% Q1 GDP growth (again, higher guesses from the BEA that will be lowered a year + from now).

Oil has only ever dropped this much once in the past century. That caused havoc with the Russian economy -as now. Good for gas guzzling economies though (U.S., China).

Copper is down to 4 year lows. Another canary in a coalmine.

The most recent data (December) show Europe is back in deflation. January will be worse still due to the pronounced drop in gas prices over the past month. Cover for the ECB to announce full QE. Germany be damned!

The Baltic Dry Index (related to shipping costs) has plummeted 50% in the past 2 months from $1500 to $750. It was $2300 13months ago. Ouch.

Q4 earnings season begins next week and will be lead as always by the financials. They’re facing a headwind in terms of a narrowing yield curve — since banks make money off a steep yield curve. Provided banks kept share buybacks elevated and kept reducing loan loss reserves, they’ll post a decent quarter. But otherwise, it will be weak.

This morning’s BLS December employment report managed to beat expectations with a headline of 252,000 new jobs and 5.6% initial claims U3 rate. This should help keep the party going into earnings season. We are WITH the risk-on party this week and will likely stay with the party through this month –unless my gauges tell me something alarming.

My proprietary algorithms continue to go in search of new bearings. New bearings will likely be acquired next week (one way or the other). This is taking longer than previous sequences to give birth.

Kind regards,

Jeff Seymour

December 3, 2014

Is the stock market right?

There is a distinctly different story being told by markets. Stock markets suggest a rosy future and are discounting more earnings growth.

But junk bond markets -heavily correlated with stock markets- seem to be discounting an economic soft patch. Hmmmm….

Commodities markets in the aggregate are also acting like they’re discounting an economic soft patch.

Safe havens (U.S. Tnote & Tbond) markets are discounting a soft patch or worse.

Either stock markets have it right (all is well) or the other 3 markets do.

Now consider that stock markets are being kept afloat by share buybacks, central banker interventions into equity futures markets, and –oh yes– QE.

Something is going to give….