There’s a great story in the weekend FT (Japan in danger of missing 2020 budget target). The upshot: Japan is not likely to meet its year 2020 target to produce an annual budget with no new debt. Japan has the worst demographic profile and debt to GDP of any developed country. How Japan escapes this mess without a decade-long depression is beyond me. Their turbo-charged QE program (far larger than the Fed’s QE3 relative to the size of the economy) has served to stall a depression, but the resulting currency depreciation is going to squeeze the life out of pensioners, and is creating the perfect environment for a global currency war (some say we’re already there).

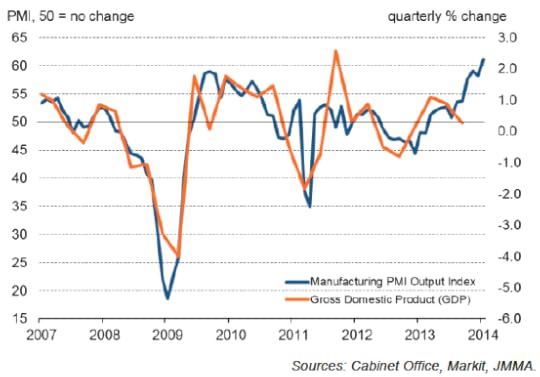

The manufacturing sector is on fire –the highest rate of growth in nearly 8 years (blue line in image below). Japan’s weak currency policy is working -for Japan. But as we’ll see, is hurting other competitors (South Korea).

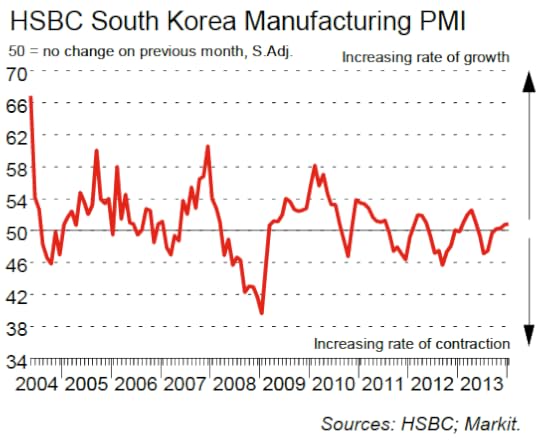

January’s manufacturing PMI in South Korea suggests the latest bounce is stalling. I would not be surprised to see South Korea’s manufacturing sector re-enter a slowdown by May. The Bank of Japan’s QE program is going to begin to bite into the Korean export machine -if it has not already.

Published on February 05, 2014 09:43