Attention winners: It’s time to sell your shares to the losers…. again. - stock market top 2013

A few months ago I wrote a short note about how some people were able to sell high in 2007, while others were not. It’s time for an update….

What we’re seeing so-far in 2013:

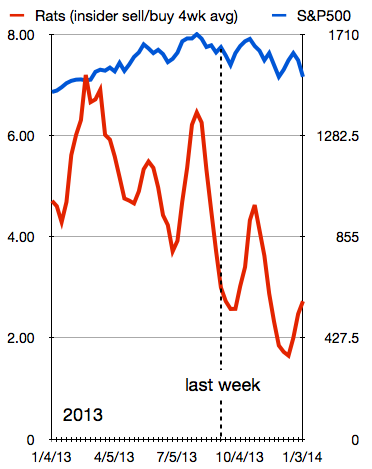

Corporate insiders selling their shares at the fastest pace in many years – and potentially ever. (Mind you 2011 and 2012 come close. Insiders were apparently right to dump their shares because there were three separate occasions in 2011 and 2012 where stock markets began collapsing — and yes they were all stopped by our central banker friends.) So far this year (January through last week) we’ve seen insiders selling their own shares at a pace greater than 5:1 (sold vs bought). Other then another short round of insider selling associated with another rally in October, the pace of selling will be far lower for the balance of the year. Doubtless the lower pace of selling late in the year will prompt some Wall St. shills to write about how there’s no correlation between insider selling and stock markets peaking. The 2013 data so far:

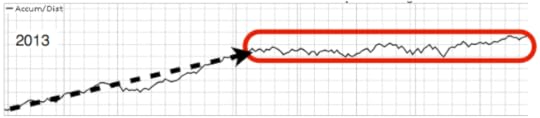

In general 2013 sees shares being sold by large/concentrated position holders to larger numbers of smaller share buyers. This is called distribution. This is particularly obvious from mid-May through last week (highlighted in red below).

We also saw these things in 2007:

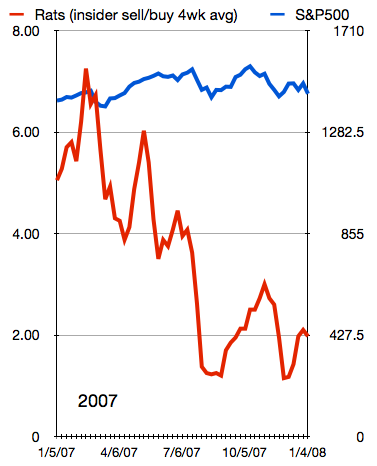

The rats were jumping ship in 2007. Like this:

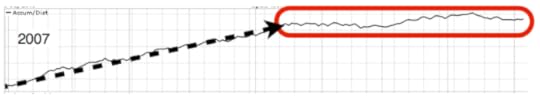

Distribution in mid-May through mid-September 2007.

If there’s a related phenomenon of interest, it would be high levels of share buy-backs. Share buy-backs are when corporate managers use the company’s money to buy shares of the company in order to reduce the number of shares outstanding. This increases the earnings per share and makes the company appear more profitable than it otherwise would (which in turn drives the stock price up). I’ve always found it interesting that during years when corporate managers are heavily selling their own personal shares (sell high), they’re also using company money to buy shares (buy high). Share buy-back data for Q2 earnings seasons will be updated in the coming weeks and allow for a comparison with previous years. Don’t be surprised if 2013 shows elevated share buy backs that resemble 2007. Mind you, the real troubling data won’t likely happen until Q3. I eagerly await that data.