Harlan Vaughn's Blog, page 58

November 14, 2015

Citi Smart Savings Are Here!

Also see:

Citi Offers to Compete With AMEX Offers “Soon”

Swapping AMEX for Citi: Bye Platinum, Hello Prestige? And Bye, EveryDay Preferred, Hello ThankYou Premier?

Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

I wrote before about seeing hints that Citi might compete with AMEX Offers “soon.”

Looks like it’s here!

This is the first I’ve seen of this, so I’m excited to see what Citi will continue to do with Citi Smart Savings offers.

Here’s what I got on my accounts.

What’s Citi Smart Savings?

My 1st batch of Citi Smart Savings

When I checked, my offers were:

20% cash back from Starbucks

10% cash back from Sears

10% cash back from Hilton

10% cash back from Chili’s

10% cash back from Sports Authority

It’s interesting that it’s in a cashback format as a percentage instead of having to spend “X” amount and get “X” amount as a statement credit, like AMEX Offers does.

Click “Offers for You” under the “Card Benefits” tab to see your offers

To see what’s on your account, click “Card Benefits” after you log in, and look at the bottom right corner to find “Offers For You.”

Also interesting to note, I only had Citi Smart Savings for my Citi Hilton Visa, not for my brand new Citi Prestige card or Citi AAdvantage AMEX.

No Smart Savings for my Citi Prestige account

I had an inkling this would come along before Black Friday and the busy holiday shopping season, because when I logged in a few days ago I saw this message under my Citi Hilton Visa account:

“Check back soon.” Soon is now!

How it works

It seems to be like AMEX Offers in that you simply select the offers you want, and add them to your card.

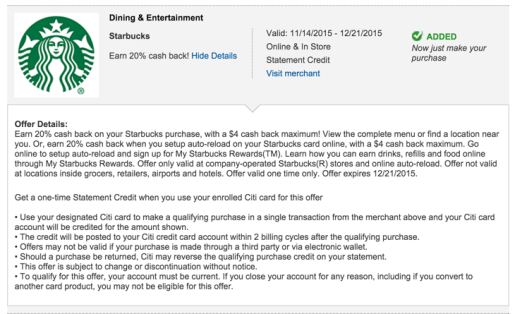

T&Cs of the Starbucks offer

I added the Starbucks offer to my Citi Hilton Visa, and saw I could earn a max of $4 back from a single purchase by December 21st, 2015.

And, it works for loading up your Starbucks card online.

T&Cs of the Hilton Offer

The Hilton offer is better. You have to spend between $200 and $500, and can earn up to $50 back. Same expiration date of December 21st, 2015. But only valid at Hilton Hotels, so not any of their sub-brands. Might be useful for my upcoming trip to Barcelona!

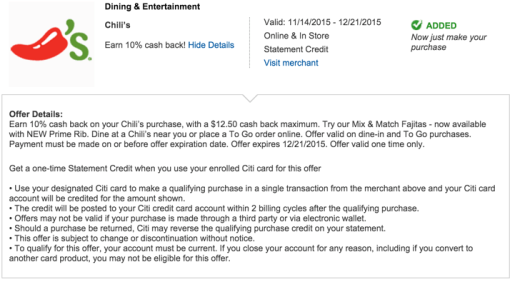

T&Cs of the Chili’s offer

And at Chili’s, you can earn up to $12.50 back. Not bad!

Same expiration date, and also valid online.

What’s next?

All of the offers I saw expire on December 21st, 2015, so they’ll likely be adding more before then, with expiration dates further into the future.

I expect to see frequent offers for Hilton, because Citi issues a couple of Hilton cards, and so does AMEX. So Citi will probably aggressively try to direct business toward their own cards.

It’s nice to see offers at Starbucks, Sears, Chili’s, and Sports Authority: it’s a nice variety of department stores, speciality stores, and restaurants. And it shows Citi is already interested in a variety of offers.

Maybe they’ll rapidly add more next week to prepare for the onslaught of shopping at the end of the month.

Is mobile next?

I also got a message in September that Citi was working to add this to their mobile app. I’ve noticed more updates in the past few weeks, and expect this functionality on their mobile app soon, too.

Again, just like AMEX.

Bottom line

It seems Citi Smart Savings is intended to be Citi’s direct competition with AMEX Offers.

I’ve always, always said, when banks compete, you win.

Citi Smart Savings are nothing earth-shattering – yet – but it’s a nice, modest start, and hopefully they’ll ramp up efforts soon enough.

The Citi Hilton Visa is a no annual fee card, so all of these offers are easy moneymakers, assuming you’re going to spend the money with the participating merchants anyway.

I’ll continue to keep an eye on it and hope the 5 on my account are the first of many!

Check your Citi accounts! Please comment if you have different or better offers, because AMEX is known to target certain cards.

Because this program is new, it’ll be interesting to see what offers are available, and who’s being targeted for them.

Do you have any Citi Smart Savings offers?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

November 8, 2015

Alaska MileagePlan: The Last Good Loyalty Program? (Alaska Vs. American by the Numbers)

Also see:

Taking another look at Alaska Airline’s MileagePlan program

Come in Houston, er, Dallas: Buying a House and a Move Toward FIRE

I’ve been interested in Alaska’s MileagePlan program for a while now. But I’ve never actually banked any flights to them.

As I get ready to base out in Dallas, I, like everyone else, am waiting for all of American’s little shoes to drop. And what it might mean.

For all the speculation, we haven’t actually heard anything from American yet.

It’ll be a shame the program might change as I move to their backyard.

There can only be one

I even thought, wow, I can really kick off earning miles toward Executive Platinum status with my biz class flight to Barcy in January. That’ll be a nice boost toward status right at the beginning of the year.

But now I’m looking at MileagePlan all over again.

The numbers

I don’t have any airline status right now. So no matter what, I’ll be starting from zero.

Switching might only appeal to you if American significantly cuts the program.

But here are the raw numbers:

Earning Alaska MVP Gold 75K

90K for partners

First, I’m only looking at qualifying on flights with partner airlines. I’ll have access to more American flights, but also more opportunity to credit them to Alaska!

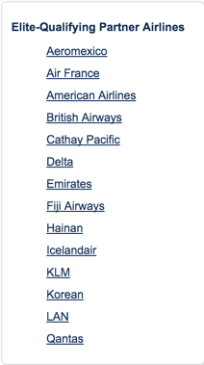

Alaska has an interesting list of elite-qualifying partners, including American and Delta

For reference:

Alaska’s elite bonus levels

Miles 1 – 25,000: 25,000 miles earned as General Member, 100% of miles flown

Miles 25,001 – 50,000: 37,500 miles earned with MVP status, 150% with bonus included

Miles 50,001 – 90,000: 80,000 miles earned with Gold status, 200% with bonus included

Mile 90,000: 50,000 miles, MVP Gold 75K bonus miles and MVP Gold 75K status!

Total: 192,500 Alaska Airlines miles for 90,000 miles flown on partners (25K + 37.5K + 80K + 50K)

Love love love this perk

My biggest wish is for Alaska to expand its reciprocal upgrades as a benefit when flying on American, like what Delta has. It seems plausible given that Alaska and Delta and slowing down their partnership. Now, if only they’d transfer it all to American.

Earning American Executive Platinum

More flying and less miles earned in the process on the road to Exec Plat

And again for reference:

American’s elite bonus levels

Miles 1 – 25,000: 25,000 miles earned as General Member, 100% of miles flown

Miles 25,001 – 50,000: 31,250 miles earned with Gold status, 125% bonus included

Miles 50,001 – 100,000: 100,000 miles earned with Platinum status, 200% bonus included

Mile 100,000: Executive Platinum status, no bonus miles for qualifying

Total: 156,250 American Airlines miles for 100,000 miles flown (25K + 31.25K + 100K)

The conundrum & other considerations

The wild card is the 25,000-mile bonus I’ll get on the Barcy flights thanks to American’s promotion that runs through the end of January 2016 on business class flights to Europe.

So for 10,000 more miles flown, I’ll end up with 181,250 American Airlines miles, and that includes the 25K bonus miles.

So for 10,000 more miles in the air, I’ll still earn ~11,000 fewer miles than if I credit everything to Alaska.

But, I’ll get more upgrades on American, assuming I’ll be flying them more. And with American, I’ll also earn 8 (or 4, guess we’ll see) Systemwide Upgrades, which are incredibly valuable.

I’ll also enjoy upgrades on Alaska sooner, after just 50,000 flown miles, but realistically, I won’t be taking too many Alaska flights.

So it comes down to practical application and most importantly for me, milage redemption.

That’s a sound list of partners

Here are the American Airlines partners I find useful (bolded partners not available with Alaska miles):

Airberlin

Air Tahiti Nui

Cathay Pacific

Etihad

Fiji Airways

JAL

LAN

Qantas

You can swap JAL for Korean Air (and can still fly Cathay Pacific to Japan). You can swap Etihad for Emirates (is it controversial for me to say that?).

The biggest loss is Airberlin and Air Tahiti Nui. I consider the latter a niche redemption, and the former can be replaced with flights on American booked with Alaska miles.

Also, Alaska has a decent partner award chart. And if American goes revenue-based, it’ll be both harder to earn and (maybe) redeem American miles.

And, I just got Citi Prestige after swapping out AMEX for Citi, and any American flights I booked with Citi ThankYou points, I can credit to either airline.

So, lots of good stuff to think about. I’m honestly leaning toward Alaska at this point, though. The sheer number of miles earned with less flying is appealing, especially if you’re starting “from scratch” like me.

Bottom line

Realistically, we’ll have most of 2016 with the current AAdvantage program. But definitely not beyond that (IMO). Guess we’ll have to wait for American to weigh in.

Alaska could always change things, too.

But for ease of earning more miles with fewer miles flown, Alaska wins.

I might credit my Barcy flights to American just to earn the 25K bonus miles, then focus on Alaska for the rest of 2016. Especially if American changes its program drastically in the next few months.

As far as who will change first, American or Alaska, it’s definitely going to be American. So for 2016, I’m thinking Alaska is the way to go. Unless, of course, you value American Airlines miles (and its partner airlines), systemwide upgrades, and their cute “sticker” system for upgrades prior to earning elite status.

Will AAdvantage changes sway you toward another program? Is Alaska MileagePlan a viable replacement for AAdvantage, pending any drastic moves by American?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

The 2 Best No Annual Fee Cashback Cards: Fidelity AMEX and Discover It

Also see:

Is the Fidelity Amex the best cashback card in the universe?

Cut the Crap: The Fidelity Investment Rewards Credit Card is THE BEST cash back card!

Discover It Is an Amazing Cashback Card (For the 1st Year at Least)!

Get an Easy $600 with the Discover It Card

Or, you’re crazy not to get these 2 cards. They’re free money!

I’m reviewing my cards because it’s getting to the end of the year and doing a little maintenance on what needs to get dumped or renewed.

On the dump list is:

Chase British Airways Visa

AMEX Platinum

US Bank Club Carlson Visa

Barclaycard Arrival Plus MasterCard

And 1 of my 2 American Airlines cards (can’t decide whether to keep Barclays or Citi version)

I need to clear out some clutter because I recently added:

Citi Prestige

Citi Hilton Visa

Discover It

Out with the old, in with the new as they say.

But, there are 2 cashback cards definitely worth keeping and/or getting. And yes, there’s a distinction.

Keep the Fidelity AMEX forever

As long as the gettin’s good with the Fidelity AMEX card, I’ll keep it. I love it.

It earns 2% cash back on every purchase. Full stop. Boom.

No categories to think about, easy peezy.

And, it’s super handy to load up your AMEX Serve account up to $1,000 a month.

On April 16th, 2015, AMEX stripped the ability to load AMEX Serve with anything other than an AMEX card. And that’s when the Fidelity AMEX started to shine.

Free money into my IRA!

As you can see, my first round of rewards started in June 2015. Before that, I let my rewards pile up, then started to dutifully load up my AMEX Serve account every month.

It’s how I pay my rent and utility bills, and I love it.

But I love compound interest even more

Even if you only load up your AMEX Serve account for $1,000 per month, you’d earn $240 in free money each year that you can cash out or use for statement credits.

Or, you can stash it away in an IRA.

Assuming a 7% return for 20 years, and a $240 contribution each year, you’ll end up with nearly $11,000.

Not bad for a card that’s free to keep!

I also use this card at Costco because they only accept AMEX cards (through March 2016), and it’s eligible for AMEX Offers – which can save you even more money.

While I don’t think this card will last for 20 more years, take the free money while you can. This year, I got $201 bucks – for free. (And there’s still 2 months left!)

Mostly from loading my AMEX Serve account, which is also free.

So it’s literally free money.

Even better, I’m never taxed on the rewards and because I’m putting it into a Roth IRA, I’ll never pay taxes on it. It’s “only” $240 a year, but damn it feels good to get this little slice of cash past the government!

Get the Discover It, and evaluate it for spending

You know what’s shocked the heck outta me?

The Discover It card.

Pick a card, any card…

Again, I can’t overstate how much I’m loving this card.

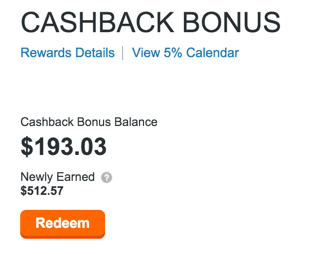

Wowza

Other than the cashback is pouring in like crazy. I’ve earned over $500 back since I picked up the card in August!

For a card with no annual fee and no foreign transaction fees, that’s pretty dang good!

Get $500 smackaroos from referring your frans

And, as you know, the bonus is doubled after the first 12 billing cycles. So I’ll get another $500+ bucks next August!

Even better, you can earn $500 from referring your frans. You get $50 per fran you refer, up to 10 frans each calendar year.

Which means you can earn $500 in 2015, and turn around and do it again in 2016.

$1,000 easy bucks… which will then be doubled. $2,000 (assuming you refer 20 peeps total, 10 in each calendar year).

So, feel free to post your referral links in the comments below! Or, if you want to pick up the card, it’s available via my links, too.

Discover Deals rocks

Then there’s the Discover Deals portal.

Combine it with Discover It’s 5% quarterly bonus category and get 30% off certain merchants, like my beloved Kohl’s.

Here’s how the math breaks down:

10% from Discover Deals

5% from the category bonus

Doubled after 12 billing cycles

You get 15% back now and another 15% back later, for a total of 30% off

You essentially get a 30% discount that’s stackable with other deals, promos, etc.

At Kohl’s, I like to stack it like this:

30% off with a promo code

Free shipping with a promo code

Earn Kohl’s cash

Earn Yes2You Rewards

Get another 30% off with Discover It (which is 2 “dips”)

Add it all up, and you have yourself a quintuple dip (and a huge amount of savings!)

Be careful to pay with your Discover card after you click through the portal, though. They’ve been cracking down on that recently.

So, this card is a fantastic deal for the 1st year. Because it’s easy to get at least $600 bucks out of it.

But the 2nd year? I mean 5% back is a handy category. But 1% back is lackluster.

That said, it’s free to keep, and who knows, there might be a nice promotion down the road.

At the very least, it’s good to keep to age your credit accounts for free.

Bottom line

The Fidelity AMEX is an amazing card to keep for ongoing spending, while the Discover It is an amazing card to get for at least a year.

Either way, they’re both free to have, and it’s easy to get nearly $1,000 bucks (or more) in solid cash money from these cards ($240 from Fidelity AMEX by loading to AMEX Serve, and $600 from Discover It – but probably more).

If I had to pick 1 single cashback card, it would be the Fidelity AMEX. But Discover It, man, it’s a solid card – for a year. Hence the keep vs. get with the 2 cards.

Feel free to weigh in if you agree – or think another card is better!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

November 7, 2015

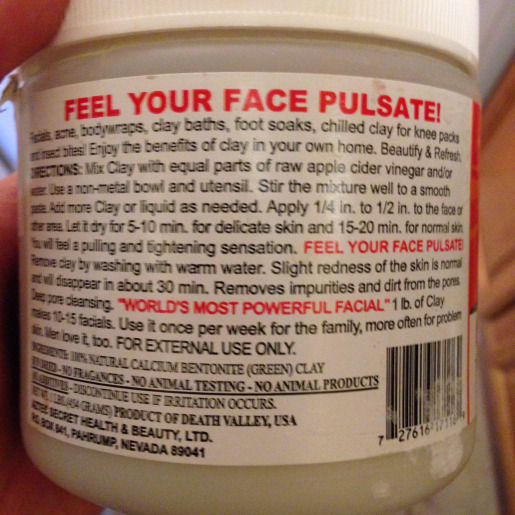

Must-Haves of Travel: Calcium Bentonite Clay

Also see:

Must-Haves of Travel: Coconut Oil

Must-Haves of Travel: Apple Cider Vinegar

Must-Haves of Travel: Activated Charcoal

Must Haves of Travel: Rose Petal Water

This stuff is intense!

WHAT AN ADVERT

Labeled, “World’s Most Powerful Facial” with a tagline of “FEEL YOUR FACE PULSATE!”

But seriously, this stuff gets down into your pores in a way that’s really incredible, and perfect for clearing out any build-up caused by travel.

What’s calcium bentonite clay?

Link: Calcium Bentonite Clay

This stuff is literally clay, composed of volcanic ash. It expands when wet, and can absorb many times its mass. In particular, it absorbs fat and oils, which is the gunk that causes zits, blackheads, and whiteheads.

Bentonite is known to remove toxins, heavy metals, impurities, and chemicals. Perfect for when you’ve been flying a lot and your skin feels wrecked.

After I flew back from Dallas a couple of weeks ago after putting an offer on a house, I couldn’t wait to slather this stuff on.

How’s it work?

You need to add liquid to the clay to “energize” it and make it porous. One of the best things to use in combination with calcium bentonite clay is apple cider vinegar. That’s because the clay is naturally alkaline, and the vinegar is naturally acidic, so they balance each other out really nicely. And ACV is also really good for your skin. It tones and helps to clean.

It makes a wonderfully satisfying “fizzy” sound as it mixes. I put a few scoops of the clay in a plastic baggy (with a plastic measuring spoon – do NOT use metal with this stuff or it loses its “charge”), then add a little ACV. I work out any lumps through the plastic bag, then cut off a corner and squeeze it out pastry-style. Then toss the bag in the garbage. No mess, no clean-up.

It turns an army green color after it mixes. You can adjust the proportions to be a little thinner (dries faster) or thicker (more of a mask) depending on what you want and how sensitive your skin is.

I like a nice, thick mask to spread all over.

Activate ninja turtle mode

You’ll want to leave it on for 20+ minutes, until it’s dry.

You’ll know it’s dry when it turns a lighter green and starts to crack. It’s not worth it to keep it on longer because once it’s dry, it’s not effective any more.

You can really feel it “pulsate!”

This stuff pulls out everything that’s lying on the surface of your skin.

When you go to wash it off, splash some water on your face, and peel it off in chunks. Try to use a napkin if you can, because the clay can be too thick to easily rinse down the drain.

After it’s all off, your skin might be red. That’s normal.

This photo is for educational purposes only. Please don’t zoom in lol. Right after the clay mask

You can see where I’m bright red, especially in areas that have been super sucked-up. Don’t look too closely lol, but you get the idea. A little redness is to be expected.

You’ll also be very dry. Use a good moisturizer on your skin. I recommend coconut oil. A couple of thin layers is more than enough to restore your skin’s moisture.

This mask is a good thing to do on a lazy Saturday morning, or after you get back from a long-haul flight (or any time really). Just don’t do it more than once a week.

I find travel mucks me up more than I expect, but a quick calcium bentonite clay mask is great to reset your skin’s balance, and to really deeply clean it out after a trip.

So this is NOT something you need to pack, but rather something to look forward to when you return home.

Other resources

If you’re interested, check out these links:

Amazon reviews

6 Health Benefits of Bentonite Clay

10 Proven Bentonite Clay Benefits and Uses

The Benefits of Bentonite Clay via Wellness Mama

There are lots of uses for the clay, including packs for muscles and internal cleansing. I haven’t gotten that far yet, but these links will provide you with more good info. Especially Wellness Mama. I really like her style.

Bottom line

Calcium bentonite clay has tons of great health uses. The one I like most is as a facial mask to remove skin impurities, especially after long trips or flights. It’s a nice way to “reset” your skin and keep it clean and healthy.

It’s best when you add a little apple cider vinegar because it “charges” the clay and balances the alkalinity of it. And because it’s drying, coconut oil is a perfect post-mask moisturizer.

All-in-all, a great product that blends nicely with other at-home all-natural remedies.

Plus, its tagline is “FEEL YOUR FACE PULSATE!” How is that not tempting?

I’ve had a great experience using calcium bentonite clay after traveling. It’s refreshing, and a nice way to pull out the build-up caused by recycled air on planes and travel in general.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

Yes! Instantly Approved for Citi Prestige!

Also see:

Swapping AMEX for Citi: Bye Platinum, Hello Prestige? And Bye, EveryDay Preferred, Hello ThankYou Premier?

Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

I just had 3 rum and cokes and bit the bullet.

I’m now the proud owner of a Citi Prestige card.

I was worried about not being instantly approved online because I’ve heard that lots of folks with perfectly good credit have had their applications “denied,” then approved after a few days of waiting, which sounds stress-y.

So, a bit drunkenly but full of courage, I approached the Citi Prestige application.

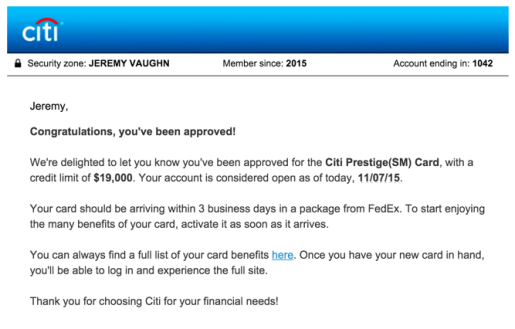

My experience applying for Citi Prestige

Link: Get a Travel Rewards Card

Is there any screen that gets your heart racing more? Geez!

I decided to just do it, unsure of what to expect.

And then…

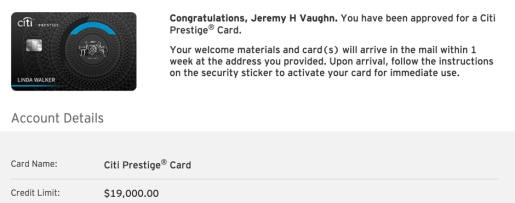

Yay!

The approval screen popped up. Instantly approved with a $19K limit! I’m beyond excited!

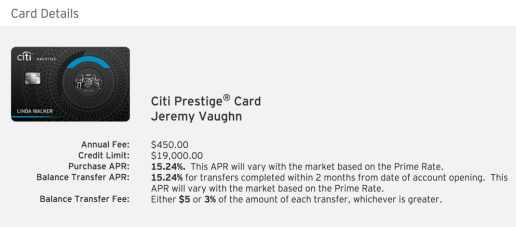

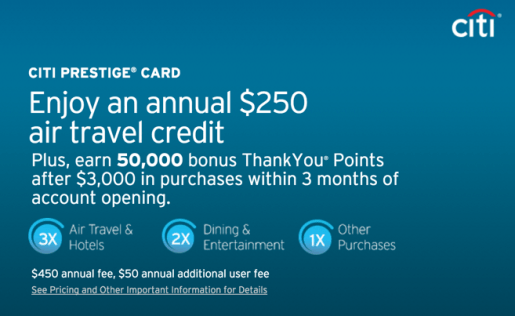

I clicked through a few more screens, and confirmed the annual fee of $450. Which I’m OK with considering it’s not possible to lock in the $350 annual fee any more.

That’s fine, man. I’ll get so much more out of it

A few minutes later, I got an email confirming the info and telling me to look out for a FedEx shipment within 3 days.

Already planning another trip!

I’m honestly so excited. I’ll use the $250 airline credit right away because it’ll reset next month. Then I’ll get another $250 to use, for a total of $500. That already more than covers the $450 annual fee.

And, I’ll use the 4th night free perk like a mofo.

This card also comes with Admirals Club and Priority Pass lounge access with together are worth $900, and free Global Entry or TSA PreCheck (but go for Global Entry because it includes PreCheck!).

Now that I’ve taken the plunge, I’m already seeing the possibilities with this card.

The 50,000 Citi ThankYou point sign-up bonus is worth at least $800 on American Airlines flights alone! That’s because each Citi ThankYou point is worth 1.6 cents each when you redeem for American Airlines flights – even codeshare flights!

This’ll be a great chance to explore Singapore Airlines’ KrisFlyer and maybe FlyingBlue promo awards.

And overall, I’m excited about learning about a new program and maximizing the perks. Bring it on!

Bye, AMEX Plat!

C yaaa

Now that this deal is done, it’s time to say goodbye to the AMEX Platinum Card.

I can’t have 2 cards with a $450 annual fee, and at this point Citi Prestige is worth more and will get me more benefits than the AMEX Platinum Card.

I’m also going to go ahead and downgrade my EveryDay Preferred to an regular no annual fee EveryDay card to keep my points alive and transferable. So, pretty much, goodbye AMEX. It’s been real (and actually not that great if I’m being honest).

What it all means

Citi is making huge strides recently, and it’s time I took notice.

AMEX, to me, is a floundering brand that isn’t trying any more. That leaves Chase and Citi as the heavy hitters in the credit card points space.

It’ll be interesting to watch them compete (because when banks compete, you win!).

I’ll lose 4.5X AMEX Membership Rewards points at grocery stores, but meh, I buy most things from Costco anyway. And they’re switching to Visa in March 2016. So the AMEX thing wouldn’t last anyway.

Interesting developments are happening, and I’m excited to start using Citi Prestige, its ThankYou points system, and the many perks it has.

Bottom line

Whatever glitch was causing peeps to get kicked out of Citi Prestige applications seems to be fixed. I was instantly approved with a pretty high limit instantly online.

Because you probably shouldn’t hold out for a reduced annual fee, 50,000 Citi ThankYou points online might be as good as it’s going to get for the time being.

Which is fine because you can recoup $500 in airline credits nearly right away.

I was nervous about applying, but I shouldn’t have been. And now I’m looking forward to getting rid of/downgrading my AMEX cards and moving into a Chase/Citi combo for the bulk of my spending (with a little Fidelity AMEX and Discover It thrown in for good measure).

If you decide to sign-up for this card, thank you thank you for clicking through my links!

Would love to hear opinions about Citi Prestige – does it hold the same allure to you as it did (does) for me?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

Also see:

Swapping AMEX for Citi: Bye Platinum, Hello Prestige? And Bye, EveryDay Preferred, Hello ThankYou Premier?

Complete the Hyatt Diamond Challenge in 9 Nights With the Citi Prestige Card

Citi Offers to Compete With AMEX Offers “Soon”

Wanted to share my experience about trying to get a reduced annual fee on the Citi Prestige card.

Like lots of peeps, I’ve been kinda/sorta intrigued by this card for a while now. Today, I woke up and decided I’d go apply in-branch. Because I’ve heard some folks have had luck getting a $350 annual fee as opposed to a $450 annual fee, which is obviously awesome and preferable.

So I strapped on my little booties and walked down to the branch on 86th St in Bay Ridge, Brooklyn.

I waited to speak with a banker and started it off with, “How much is the annual fee on the Citi Prestige card?”

The convo

He printed out some info about the card from Citi’s intranet, which I of course immediately scanned into my phone.

Here’s the doc:

$350 annual fee!

NO language about needing a Citigold account!

It said the annual fee was only $350, but had a superscript to refer to the fine print.

But I didn’t find anything that would disqualify me.

It said,

“As of October 1, 2015… the annual fee is $350.” NO language about needing a Citigold account, and nothing that I could see was off. Plus, I thought, I have this document in case I get charged $450, because it’s pretty much guaranteeing I can get the card for $350.

Sign-up bonus of 50,000 Citi ThankYou points after spending $3,000 within the first 3 months of opening the account (which is worth $800 toward American Airlines flights – 1.6 cents per points x 50,000 = $800).

Fine. Sign me up!

The womp-womp

I was getting excited to get the card! I asked the banker to please double-check the annual fee on the actual application.

He assured me he was still seeing $350.

Very cool.

I started to fill out the authorization form when he said, “Hmmm. Never seen that before.” A box had popped up saying something to the effect of, “Enforce the $450 annual fee unless the client has a Citigold checking account.”

I asked if he’d seen that message before, and he said he hadn’t. So I don’t know if this is a new thing or what.

Then I asked if there was any way to get this card with a $350 annual fee aside from the Citigold option.

He said, no, there wasn’t. So I took the papers and told him I’d think about it.

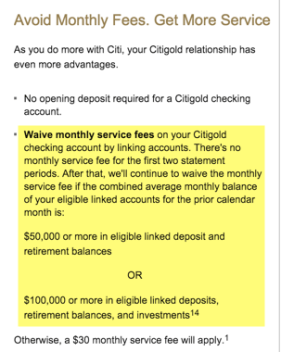

The Citigold option

Link: Citigold checking account fees

I don’t want a Citigold checking account. You guys know I’m super into no-fee checking accounts like the Fidelity Cash Management account and Aspiration Summit checking.

It’s just so ouch

You can get Citigold checking for free if you have $50,000 in the account, or $100,000 in a linked deposit, retirement, or investment account.

While I’d love to have that much in a checking account, it’s just not gonna happen. And I don’t want to switch my retirement/investment accounts to Citi just to save $100. That’s an incredible hassle, plus, I don’t even have that much to throw around.

If you don’t meet those conditions, the Citigold checking account is $30 a month, or $360 a year. It’s not economical to pay $360 to save $100.

You also get a 15% bonus on the Citi ThankYou points you earn from the Citi Prestige card when you have a Citigold checking account (I’m assuming the sign-up bonus doesn’t count).

Even if you earn 100,000 Citi ThankYou points in a year, that’s an extra 15,000 Citi ThankYou points. At 1.6 cents each toward American Airlines flights, that 15,000 points is worth $240.

Which still doesn’t cover the cost of having a Citigold checking account.

So, I tried, but I think I’m gonna cut my losses and go with the $450 option.

After all, it’s still the same annual fee as the AMEX Platinum Card, and you’ll get waaaay more out of it than $450 anyway.

The perks

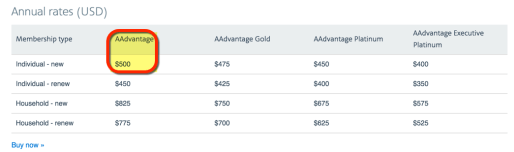

An Admirals Club membership usually costs $500 a year (less if you have American Airlines status).

$500 for new members

And a Priority Pass membership runs $400.

Citi’s version is actually better

But with Citi Prestige, you don’t have to pay the guest visit fee of $27 for up to 2 guests or your immediate family. So it’s actually better than what you’d buy directly from Priority Pass.

You also get 3 rounds of golf each year via Golfswitch. Note that this benefit is only for you, not for the people you play with (unless they have the Citi Prestige card, too).

And you get the 4th night free on hotel stays when you book through Citi Concierge. Any hotel you can find on Carlson Wagonlit, their travel agent, is book-able with the 4th night free.

It includes all-inclusive resorts and nearly all hotel chains. And, your elite status is recognized and you still earn elite stay credits and points. I plan on using the hell out of this benefit. Assuming you use it once or twice a year, you can recoup the annual fee easily.

My favorite perk that’s giving me panic

But my fave perk of all is the $250 annual airline credit.

You can use it on any airline each year.

But not calendar year. Or cardmember year.

No, Citi is much more specific about when this resets.

This statement credit is an annual benefit available for purchases appearing on your billing statements from December through the following December. Pending transactions that do not post in your December billing cycle will count towards the next year’s Air Travel Credit.

So what does this mean?

If you sign up, like now, your statement will run mid-November through mid-December, but it should be considered the “November statement.”

And in mid-December, the perk will reset again, and you’ll have most of 2016 to use the credit again.

So you can get $250 on the November statement, and $250 again right after that (or in 2016), to effectively get $500 in airline credits. This alone will cover the annual fee.

But only do it if you want to buy a ticket as soon as you get the card in the mail.

Otherwise, wait until December or January to get the card.

Although if Citi releases Citi Offers for You any time soon, it’ll be a fun added perk to the card. I hope they come out with it before the busy holiday shopping season.

So now I’m all panicked about whether or not I want to buy a $250+ plane ticket if I were to apply now.

It might be a fun excuse for a trip.

$300 round-trip to the French Caribbean. Whoa.

Norwegian has a sick fare sale right now from the US to the French Caribbean. Fly there now through March 2016 for, oh, $300 round-trip. (I’m seriously considering this, btw. Might make a fun trip report.)

It’s a 5 hour flight from NYC, but for a $57 ticket (after the $250 airline credit), I think I could survive it.

Martinique in February… YAASSS!

Especially if I use the 4th night free perk to get a free night a hotel. That would pretty much put the card to work (and recoup the annual fee!) right away.

Or you could, I dunno, buy a ticket home for Xmas, or buy gift cards to use later.

Bottom line

I was excited to get Citi Prestige for $350 today, but it seems Citi has put the kibosh on that little workaround.

Even still, $450 for a card with a long list of perks and benefits isn’t bad. It’s easy to more than recover it if you travel even semi-regularly.

If you decide to pick up this card, thank you for clicking through my links (yes, the best public offer is available there).

I’m a bit perturbed by the annual airline fee credit, because it runs from the December statement to the following December statement, NOT on a calendar year or cardmember year cycle.

Considering it’s nearly mid-November, you should apply sooner rather than later if you want to get $250 credit twice in a row.

If you don’t want to take a trip, you can always buy $250 in gift cards and use them for later. Then you’ll have nearly all of 2016 to get the $250 credit again.

I might have too many drinks today and go ahead and snap this card up. And then call AMEX to cancel the Platinum Card and downgrade my EveryDay Preferred.

Remember Citi will only let you get 1 card a day, and you need to wait 8 days between applications. And you can’t get more than 2 cards in a 65-day span! (Weird rules, but worth knowing if you want the Citi Prestige/ThankYou Premier combo, or another Citi card.)

Has anyone had any luck locking in the lower $350 annual fee? And what do you think, apply now or wait till January?

You know which way I’m leaning!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

November 6, 2015

Come in Houston, er, Dallas: Buying a House and a Move Toward FIRE

Also see:

My posts about FIRE

I rented an Apartment to Airbnb in NYC

The Two Most Powerful Words in the Travel Industry

Getting FIREd Up

Is Living In Cities Worth It?

Alternate titles for this post: Airbnb helped me buy a house in Dallas.

Most of y’all know I run a few Airbnb properties here in NYC.

Well, I’ve been ferreting away the earnings for a long while.

I’ve been using my Fidelity Cash Management account as a defacto business checking account, and my Aspiration Summit account to save up a down payment (and an AMEX personal savings account to pay Uncle Sam) because it has a sweet 1% interest rate.

My new empire state?

I haven’t posted my Dallas hotel reviews yet, and I haven’t meant to be not as chirpy as usual, but here’s what’s been up.

Way back in August, I flew down to Austin (and actually posted my review of my Austin hotel, go me) for a work meeting. On the way back, I tacked on a few days in Dallas and started shopping for a place in Oak Lawn/Uptown.

Why?

Do you ever get a feeling about a place you can’t explain, but it feels so right you simply can’t ignore it?

I went to college in Chicago. I’d only been there once or twice, but for some reason, the city was calling me. I applied to my school, got accepted, and bought a one-way ticket from Memphis, Tennessee (I’m originally from Mississippi) to Chicago. I started in the Winter, and promptly froze my butt off. A few years later, I got my degree in Painting and moved to New York (I actually wrote a book about it).

And when I visited Hawaii for the first time, it felt like something that was always meant to be (I know, Hawaii right? So corny. I felt the same way about Easter Island).

Now, I have the same feeling about Dallas. And I never saw myself living in Texas. For now, I don’t know exactly what it all means.

New craft beers to explore

I feel the universe is winding down my time in New York City, and I’m grateful for all of it.

I won’t ever write a good-bye to New York because I’ll never really leave.

I’m not sure if I want to set the place up, rent it short-term, occupy it myself, rent it out to tenants, or just hang on to it for a second before I decide.

The new living room where I’ll (hopefully!) be banging out new Out and Out posts!

I’m saying all this at the risk of jinxing myself because I’m scheduled to close on December 15th. So, fingers crossed that it all works out.

But I’ve already got my eye on a few single-family homes in the area. Paula from Afford Anything has been such a huge inspiration to me on this. I’m thinking of starting with 1 home to rent out, then expanding.

It’s all a move toward FIRE (financial independence, retire early). And it’s a term Sex Health Money Death has criticized because no one ever seems to really retire.

I have a strong work ethic. I always want to work.

Recently, I’ve been getting into reading tarot cards (this deck in particular), which you might’ve noticed on my Instagram account (feel free to follow me!).

Quiet nights in with a tarot deck and a sage stick…

Take it or leave it, but the cards have been telling me what to expect. (And even if it’s a tool for my own self-discovery, and nothing more, I’m fine with that, too.)

So I’ve been really trying to feel gratitude for everything and see what happens, and the universe has been sending me powerful signals to wrap up my work in New York.

I’m so bowled over with excitement I can hardly stand it.

So, while I’m not sure what it means yet, I’m most likely (*fingers crossed*) closing on a place in Dallas next month.

My travel allegiances

Ah, Dallas. Hub of American Airlines, Southwest, and Virgin America, flagship of the AMEX Centurion Lounge, what do I make of thee?

For one, I’m not even sure I want to cozy up to American Airlines at this point – a devaluation is too near.

But, I am considering swapping AMEX for Citi.

I don’t anticipate Dallas will sway my hotel allegiances any (I’m firmly Hyatt, with some IHG and Hilton thrown in. Don’t care about Starwood – they’re merging with Hyatt soon anyway).

But there’s one airline program left standing…

ALASKA

What does Alaska have to do with Texas?

Look at that weird, creepy face. I want to squeeze it

I’ve been considering saying eff it all and crediting everything to Alaska’s MileagePlan. I’ll do a post about this soon.

But I’m really thinking the other shoe is about to drop for American Airlines AAdvantage program. Unfortunately.

And right when I start to get involved with Dallas! #justmyluck

Other stuff

I’m figuring out what I’d do with my New York apartment, the Airbnbs (which might be ending soon anyway), and everything.

It’s a strange time, a big move that’ll affect a lot of my travel patterns (and give me more stuff to write about!).

But I’m feeling confident and grateful it’ll work out. This is my first time buying a home so I’m nervous/excited/emo/etc. about getting it all together and getting to the closing table. Going through the process of it all right now.

I wanted to post about it to officiate this next step, speak about it to make it more real for myself, and let you guys know changes are afoot/why posts have slowed down recently.

Bottom line

I’m buying a place in Dallas – the first, I hope, of many, in an effort to move close toward financial independence (OMG so many commas in that sentence!).

It’ll mean big changes for me, my travel plans, and the things I write about here. But I’ve been talking about FIRE for a while now, and in the background, I’ve been a busy bee, saving up and work work working toward my goals.

So I’m excited to share this step, and wondering what it’ll mean for how I think – and write – about travel. But more travel is for sure in the future. I’m so excited about that!

While I have you guys on the line, I want to be sure to say thank you for reading despite everything lately. It’s truly been my pleasure, and I look forward to more travels in the future!

If you’re familiar with Oak Lawn/Uptown. I’ll be looking for:

Craft beers

Amazing Mexican restaurants

Great gay bars

Cool experiences

Anything to do with art or art-making

Any tips/intros/observations from Dallasites more than welcome!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

Swapping AMEX for Citi: Bye Platinum, Hello Prestige? And Bye, EveryDay Preferred, Hello ThankYou Premier?

Also see:

Dear Amex: DIAF!

American Express Vs. Chase: Why Chase Is Winning

Booking Barcelona: $747 Round-trip in AA Business Class

Citi Offers to Compete With AMEX Offers “Soon”

And, bye EveryDay Preferred, hello ThankYou Premier?

Recently, I’ve seriously been pondering why it is I hang on to my AMEX cards.

I’ve had at least 2 since 2012, and haven’t accumulated enough points to actually do much.

Membership Rewards… meh.

I’ve always thought there might come a day when I’d finally transfer some AMEX Membership Rewards points for an award booking on ANA or Aeroplan.

Are any of these useful… or nah?

In particular, you can fly to Western Europe for 45K miles each way in business with Aeroplan, or 90K miles round-trip (until December 14th, 2015).

That’s changing in about a month. On December 15th, 2015, the price will increase to 110K miles round-trip for a partner award flight in business class.

There aren’t too many other sweet spots that rival other Star Alliance carriers.

Fine, what about ANA? The biggest upside is you can string along a trip with lots of stopovers.

I haven’t exactly been following closely because they change their award chart and routing rules so frequently.

But redeeming miles is always about the best deal you can get at the time of booking.

Again, I’ve always been curious about ANA and Aeroplan, but I’ve never had 110K (or close to there) to actually book an award. So, meh.

Look at this little collection of uselessness

And the hotel transfer partners? SPG, nope (bad ratio of 3:1). Hilton, nope (a waste when you could transfer to an airline partner instead). The best one is actually Choice Privileges!

But because I have Chase Ultimate Rewards, I can access Hyatt and I already have plenty of Hilton and IHG points, so…

And, Citi Prestige encourages paid stays, which I’ll get to in a bit.

Why keep the Platinum Card?

The AMEX Platinum Card is almost legendary for its long list of perks. You get:

Starwood Gold elite status

Hilton Gold elite status

Lots of car rental status

$200 airline credit on an airline of your choice (most large domestic carriers are on the list. American, Delta, United, Southwest, etc.)

Access to Fine Hotels & Resorts for late check-out, spa and dining credits, and possible upgrades

FREE CENTURION LOUNGE ACCESS

Lots of other ancillary benefits

The 2 perks I’m most interested in are the $200 airline credit and Centurion Lounge access.

I’ll do a proper post about this, but I’m closing next month on a house in Dallas. I’m not sure what that means yet (I’ll work out those thoughts in the post), but it seems the biggest perk – for me to keep or lose – would be the Centurion Lounge access.

Here’s my completely gratuitous review of the Centurion Lounge @ DFW.

Ah, craft cocktails at the Centurion Lounge, how I’ll miss you. Ah, huge crowds and the fight for a seat, how I won’t

The $200 airline credit is great, too.

I’ve been known to buy $50 American Airlines gift cards and/or buy lots of beers and liquor whilst sitting in coach. And this is nice, no doubt.

But…

Why get Citi Prestige?

Citi Prestige, you alluring little thing.

This card comes with its own laundry list of perks that make it worth its ilk.

The face of intrigue

The biggest perks I can see are:

$250 airline credit to use on ANY airline for ANYTHING including airfare

Points-earning of more than 1X! Take that, AMEX Plat!

Admirals Club access when flying on American

Priority Pass access for you and 2 guests or immediate family – for no extra charge (AMEX’s version charges $27 per guest)

The 3 free rounds of golf benefit (not for me, but definitely for some! Golf is expensive!)

4th night free on pretty much any hotel stay AND you get to earn points, have elite status recognized, and stack discounts

Now, I already get my lounge access to Admirals Club for free thanks to Business Extra, so this is a moot point for me. Although it would be nice to use the Business Extra points for award flights instead.

And I’d definitely use the Priority Pass access.

The biggest perks for me would be the 4th night free on hotel stays and the $250 airline credit.

Also, you actually earn points that mean something. You can redeem for miles-earning flights on American, and each point is worth 1.6 cents each. And:

You’ll earn 3X Citi ThankYou points on airfare and hotels

And 2X Citi ThankYou points on dining

That’s essentially a 5% discount or 3% discount on American (1.6 x 3X points is 4.8 cents for airfare and hotels, and 1.6 x 2X points is 3.2% from dining).

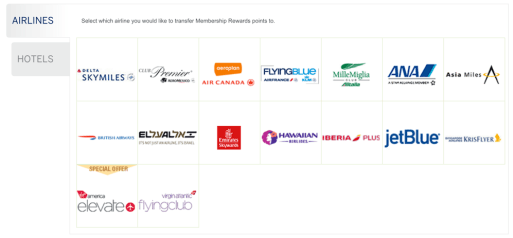

Plus, Citi ThankYou points transfer to FlyingBlue and Singapore Airlines, which duplicates AMEX Membership Rewards (and the Virgin duo of Atlantic and America). Those are the biggest upsides, IMO. I really wish they’d add a meaningful domestic carrier, but that’s another post, too…

EveryDay Preferred Vs. ThankYou Premier

When AMEX came out with the EveryDay Preferred card, they accidentally created the best Membership Rewards-earning card, which is kinda tragically hilarious.

It earns

3X AMEX Membership Rewards points at US grocery stores, up to $6,000 per calendar year, then 1X

2X AMEX Membership Rewards points at US gas stations, unlimited

1X AMEX Membership Rewards point everywhere else

But the kicker is that after 30 transactions in a month, you earn 50% more points, so 4.5X on groceries, 3X on gas, and 1.5X everywhere else.

I like that last bit: 1.5X everywhere else.

It’s almost not enough though. Too little, too late.

Combined with some not-so-great transfer partners, you really have to cherry-pick your award redemptions.

Delta still offers some great prices for awards on Virgin Australia and Korean Air

Singapore is great, but as mentioned, duplicated with Chase UR and Citi TY

Aeroplan and ANA for specific uses

The others can DIAF, especially since British Airways announced the devaluation of short-haul flights and AMEX sliced the ratio to 800 BA points per 1,000 AMEX points.

(Although Iberia Plus might be a saving grace. But I have their points via Chase UR and I can get to Australia or Asia with American miles.)

But for the $95 annual fee, Citi ThankYou Premier takes it on.

You get:

3X Citi ThankYou points on ALL travel, not just airfare and hotels

2X Citi ThankYou points on dining

Man, I wish Citi would switch up the categories on the card. But whatever, I can use my Chase Ink Plus card for gas. The only category I’m losing out on is grocery stores, but it’s not a huge loss. So many other cards earn points at grocery stores.

Bottom line

Both AMEX and Citi have a card with a $450 annual fee, and a card with a $95 annual fee.

Blow for blow, I think the Citi cards take on the AMEX cards well.

And after my devastating recent interaction with AMEX that cost me hundreds of dollars, combined with several other “bad taste” encounters before, I’m thinking of dumping the AMEX Platinum Card, and downgrading my EveryDay Preferred to its no annual fee version just to keep access to AMEX Offers (although Citi is supposed to release Citi Offers for You… soon).

My biggest loss from dumping the AMEX Platinum Card will be the Centurion Lounge access, especially as I consider basing myself at DFW.

But on all other points, the Citi cards handily overtake the AMEX cards point by point… literally.

Competition is a healthy thing, and I’m glad Citi is taking AMEX on. I’ve always said, when banks compete, you win.

I think I’m going to bite the bullet and sign up for the Citi Prestige card. (And if you are to, thank you for using my links to apply!) I’m looking forward to exploring a new points program.

As for the EveryDay Preferred, it’s too little too late. And I’m feeling both underwhelmed with AMEX Membership Rewards and interested in Citi ThankYou points. It’s a perfect storm for a little switcharoo.

What do you guys think?

AMEX Platinum Card or Citi Prestige?

AMEX EveryDay Preferred or Citi ThankYou Premier?

AMEX Membership Rewards or Citi ThankYou points?

All opinions valid, would love to hear your take on it!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

November 3, 2015

Get Instant Access to Aspiration Summit, the Best Checking Account in America

Also see:

New Aspiration Checking Account Has 1% APY and Free Global ATM Use

Tips to Get Started With Aspiration Summit Bank Accounts

Sign Up for Aspiration Summit Instantly

Time Magazine just named Aspiration Summit the best bank account in America for 2015.

#1… I’d agree!

I’m glad I got in on the ground floor of this account. You can sign up too if you’d like!

About Aspiration Summit

It’s actually tied for 1st place with BofI Rewards Checking, but I think Aspiration Summit is better because BofI requires $1,000 per month in direct deposit activity and 15 debit transactions per month to get the 1.25% interest rate.

The direct deposit isn’t so bad but 15 debit transactions sounds like a PITA. And I’m already occupied trying to make 30 transactions every month with the AMEX EveryDay Preferred.

Plus, Aspiration Summit has no requirements or minimums to get the 1% interest rate other than… you only get the rate on balances over $2,500.

And, you get free, unlimited ATM use anywhere in the world.

There’s a 1.1% foreign transaction fee, but you are refunded all of the ATM owner’s fees.

I think of it as a hybrid savings/checking because it essentially forces you to save a cushion in your checking account… but it’s a feature I’ve really grown to like over the past few months.

But there’s a lot to know

When you sign up for the account, it can be kind of disorienting. There’s (seemingly) no mobile app and it’s all kind of vague how it works.

That’s because Aspiration Summit is totally, 100% a Radius Bank account. I don’t know why they try to bury this, but it is.

So you’ll need to download the Radius Bank mobile app, and sign up for online access on the Radius Bank website. Then, features like bill pay, mobile deposit, and searchable transaction history are unlocked – thank god.

It took me a second to figure these things out, and I wrote about them and a couple of other things you’ll want to know when you open the account.

Who should consider this?

Quite simply, peeps who travel a lot. And if you want a checking account with a cushion.

Also, if you want to dump your brick-and-mortar bank and still have the best features of a checking account.

It’s between this and the Fidelity Cash Management account, IMO.

Skip the line

If you’re interested, feel free to sign up with my link to instantly open an Aspiration Summit account.

There’s usually a 7- to 14-day waiting list, but the folks at Aspiration have generously given Out and Out readers a special way to sign up.

I get absolutely nothing if you sign up and this post isn’t influenced by anything other than I think it’s a handy checking account. And this is a way to get it sooner if you’re interested, so I thought I’d share.

The only other account that comes close to this is the Charles Schwab High Yield Investor Checking Account. But it comes with a hard pull on your credit, and you have to open a (free) brokerage account. It also has absolutely NO foreign transaction fees (for ATM withdrawals or purchases), so in that regard it’s better than Aspiration Summit.

I like the “forced” savings aspect of Aspiration Summit and paying $1 on every $100 internationally isn’t a deal-breaker for me. Especially because I usually use a no foreign transaction fee credit card anyway, so it’s kind of a moot point. And with Aspiration Summit, I earn 1% APY whereas Schwab “only” earns .06%.

Aspiration Summit, Fidelity Cash Management, and Charles Schwab checking are all very similar accounts. Constant (or even occasional) travelers should have one of these.

Their differences are minute, and it comes down to which one you think fits best with your lifestyle, travel plans, and how you want to use the account.

I have 2 out of the 3 (the 1st 2 on the list), and am happy with them.

Bottom line

In case anyone’s interested, the folks at Aspiration have given me a link to share that offers instant sign up for the Aspiration Summit account. The wait is usually about ~2 weeks, so this is quite a good offer!

Please read my tips on how to set up and use the account.

And if you have any questions, send them my way! I’ll do my best to answer them for you!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

November 2, 2015

Giving Assistant Dropped 5% Cash Back at Amazon… But You Should Still Use It When You Shop There

Also see:

Easily Save Money at Amazon.com With Paribus and Giving Assistant

A Few Apps + Sites I Like to Save Money

Giving Assistant

RIP 5% cashback on Amazon purchases via Giving Assistant.

I really enjoyed getting that cashback on products sold and shipped by Amazon.

But, if you’re shopping at Amazon anyway, you should still click via Giving Assistant.

Why?

Donate 2% to charity

You typically don’t earn any portal bonus at Amazon. Cashback Monitor tells me you can still earn cashback on certain categories at Amazon:

Mostly shoes, and a few other items

The categories are shoes, handbags, and a few other things.

And on everything else… nothing.

Now, I’ve loved getting 5% cashback from both Giving Assistant and my new Discover It card.

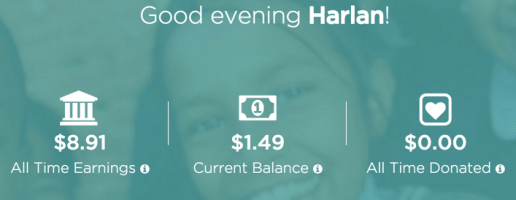

I expect “All Time Donated” to go up in the next few months

Plus, the Discover It card will double the cashback after the 12th billing cycle, so it was more like 15% cashback… which is awesome!

(Feel free to share your Discover It referral links in the comments!)

But I’m happy to get 10% back at Amazon with my Discover It card this quarter, even though Jet just dropped membership fees altogether and may sway me in future quarters.

I don’t foresee my Amazon shopping slowing down around the holidays, and because I won’t earn cashback from any other portal at Amazon anyway, I’m going to continue clicking through Giving Assistant.

Select a charity and donate 2% of your purchase

That’s because you can select a charity to give 2% of your purchase to. It costs nothing to do this. If you can’t earn cashback, you might as well give to an organization that can put a donation to good use. And there are a lot to choose from!

There are also tons of other stores there.

I always check Cashback Monitor before I click through any portal because I’ve found they have the most up-to-date info.

That said, I’ve gotten cashback from Giving Assistant within a few business days on average. And some cases, the next day.

Add $5 to that!

In addition to giving to charity, you get $5 when you sign up for Giving Assistant via my link and shop through the portal. And I get $5, too. So you can think of it as getting $5 for clicking a link, and giving 2% to charity (assuming you shop at Amazon).

You’ll also get 10% back on your Amazon purchases up to $1,500 this quarter with the Discover It card (5% back when your statement closes and 5% back after your 1st year is done). I am personally loving my Discover It card and think you’re crazy to not get it. You can apply via my links (and thank you for doing so!) or any referral links you find in the comments.

And, when you combine all this with Paribus, you can save even more money!

Bottom line

I’ll miss getting 5% back from Amazon through Giving Assistant. But I’ll still click through because Amazon doesn’t usually have a portal bonus, anyway. And I’d rather someone else benefit because of Giving Assistant’s 2% donation of your Amazon purchase to a charity of your choice (you can select one in the Settings tab).

I’ve been really pleased with Giving Assistant’s payout speed and overall integrity so far. They’re a fantastic new portal. And it’s wonderful they’re donating to charity, especially during the holiday season.

Plus, you get $5 for signing up and shopping. It goes right to your debit card.

Combined with other 5% cash back categories (like those on the Discover It or Chase Freedom cards), it’s a great match. Always remember to check Cashback Monitor before you click through a portal to make sure you’re getting the best deal!

Feel free to post your experience with Giving Assistant, or your Discover It referral links, in the comments!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!