Harlan Vaughn's Blog, page 55

January 30, 2016

10 Fun Things to Do in Barcelona

Also see:

Booking Barcelona: $747 Round-trip in AA Business Class

Hotel Review: Alexandra Doubletree Barcelona, Dream Suite

Out and Out Is in Barcelona! Any Must-Dos? (And Updates!)

I had a great time in Barcelona and wanted to share some adventures that rounded out the trip.

Barcelona reminded me of Paris in lots of ways: the buildings, the twisty-turny side streets, the grand thoroughfares, and the dozens of cafes lining every street.

Lemme go ahead and set the tone here

But it was decidedly very different. The Mediterranean replaces the River Seine as the city’s main waterway, the food had a much different focus, and the city itself has wayyyy different attractions. Including a few things you can’t do, get, or see anywhere else in the world.

Here are a few things I loved about Barcelona.

10 Fun Things to Do in Barcelona

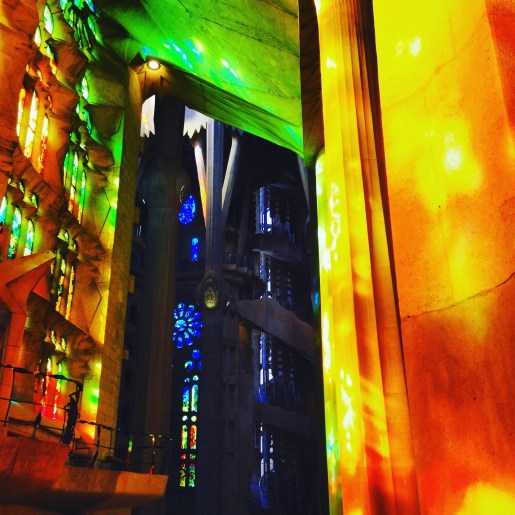

1. La Sagrada Familia / Gaudi Architecture

Dear light of heaven, this place was gorgeous. And you really will see the light of heaven if you go during the afternoon. That’s when the sun shines through the ornate rainbow-colored stained glass windows and streams over the otherworldly architecture, including massive pillars that will remind you of being in an enchanted forest.

Words can’t do it justice

It’s hard to describe how massive and beautiful this place is. The amount of details you’ll find are incredible.

Close-up of the stained glass

And from the outside, you’d never guess how beautiful the ceiling is. It’s soaring.

Amazing details of the ceiling

Here’s one more:

Make sure you have plenty of room for pictures on your camera!

When you get in there, you’ll go crazy snapping away. As the sun moves through the sky, different colors are accentuated within. So it changes constantly. And every nuance is beautiful.

Pro tip: Buy your ticket online. We bought ours and texted the PDF of the ticket to ourselves with the hotel’s wifi. And then pulled it up on our phones. Skip the massive lines outside. And go during mid-to-late afternoon when the colors are at their best. Although any time is a good time to see this place!

Gaudi’s architecture is everywhere in the city. Keep your eyes peeled for his influence in every corner of Barcelona.

2. Tapas & Sangria

You’ll be tapas’d out when it’s said and done. Tapas are hard to avoid. And they come in all varieties and qualities.

My advice: Try several. I didn’t regret one thing I tried.

If I had to give a recommendation based on my limited experience, I’d say head to Secrets Del Mediterrani near the Arc de Triomf.

Tapas and sangria at Secrets Del Mediterrani

It’s a small place with only a few tables set in the back of what looks like a market or grocery store. So you have to look for it a bit.

The service was so intimate, so attentive, and so delicious. Plus, you can stroll around the Arc de Trimof afterward.

Sangria every day. NOM!

Oh, and sangria! I was torn between the Spanish red wines and the sangria. My solution was to double-fist ’em both.

January 29, 2016

Just Booked: Tokyo and Osaka, Japan in April for Cherry Blossoms

Thanks to Frequent Miler for posting this “Quick Deal!”

It certainly did go quick.

I saw Business Class award availability shrink away from me with the Wicked Witch of the East’s shoes when the house fell on top of her.

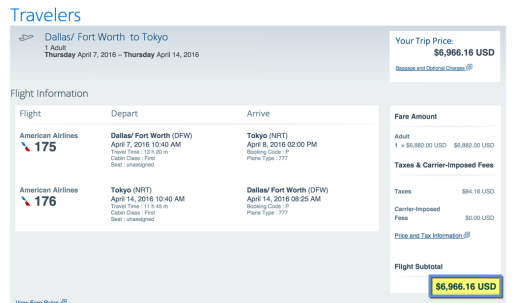

But First Class seats were still there – at least 2 of them – and I thought, you know, whatever. And just did it. DFW-NRT First Class on American Airlines. And ITM-NRT-DFW coming back.

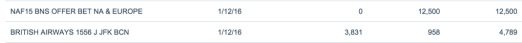

At least I got in on this one during its prime time unlike the ~$747 AA Business Class ticket to Barcelona (which still ended up being a very good deal).

This trip cost 62,500 American Airlines miles each way, but I got back 10,000 miles for having the Citi AA credit card.

In total, I paid 120,000 American Airlines miles round-trip.

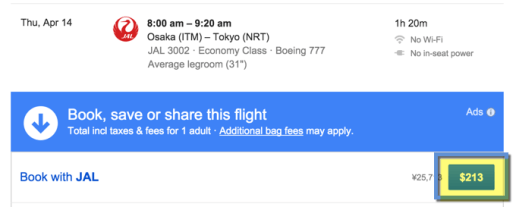

I wish it were on JAL, or Cathay Pacific, instead of AA, but oh well. It’s in the middle of cherry blossom season. I hope these dates are lucky so I’ll be able to see cherry blossoms during Japan’s spring.

By the numbers

Y’all know I love running numbers after the fact.

These flights would’ve cost over $7,000

I added in a domestic flight on JAL found on BA.com.

~$7,179 to be precise

At retail, these flights would’ve cost ~$7,179.

Jay is going, too. He added on a DFW-LGA segment in Biz for $0 extra, so his got even more value from his miles.

Business Class cost on the same flights

And booking First was a great way to redeem them. I got 6 cents of value out of each one, which is triple my minimum for redeeming miles.

It’s nothing like the 12-14cpm some folks have gotten. But the dates worked. And I’ve also wanted to visit Tokyo for a long time. So for me, it’s worth it.

Hotels

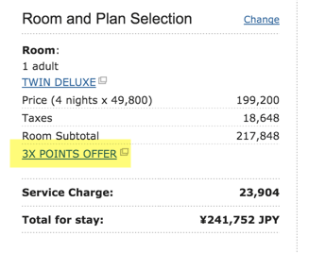

No hotels in Tokyo were available with points. Like, nothing. So I settled for the Hilton Tokyo‘s paid rate.

Literally so excited

Room rates were pretty high – ~$499 a night. But I booked a refundable room rate via Citi Travel Concierge, so will get the 4th night free. Between Jay and me, it works out to ~$748 per person for 6 nights in Japan, or ~$125 per night. The last 2 nights in Osaka are free with IHG points.

And it’s all able to be canceled, so I’ll be on the lookout for ways to get this number down.

I mostly booked these to prevent the price from going up any more. Because the other chain hotels I looked at were even higher. And I presume it’ll keep going up closer to time because it’s an extremely popular time to visit.

And, there’s always Airbnb.

The wrench now is that… well, a funny thing happened.

The Citi agent misspelled my last name. So I called Hilton to correct it.

The Hilton rep changed my room rate to a Triple points room rate.

The Hilton agent upped my room rate to 3X points

And there’s also the Double Points promo running through the end of April.

So according to the Hilton Points Calculator, I’ll get 16,440 base points for the stay.

Triple base points would be 49,320 points

Plus another 16,440 points with the Double Points promo

Plus another 16,440 points for being Hilton Diamond

That adds up to 82,200 Hilton points for the stay. Pretty cool – I could squeeze at least 2 nights out of mid-tier property with that. Or more at a lower-tier hotel.

Not to mention the free breakfast and access to the Executive Lounge I’ll get for having Diamond elite status.

And the 3X Citi ThankYou points I’ll get from booking with Citi Prestige. And if I decide to keep these rates as-is, I’ll add it to my Citi Prestige by the Numbers page before I go.

Bottom line

I’m heading off to Martinique next week and already have another trip to look forward to. So excited for Japan! My first time in Asia.

I’m proud of what I was able to cobble together in a couple of hours.

It’s not Cathay Pacific First Class and I didn’t get to burn any Hilton points or pull any other aspirational-type shenanigans. But when it came down to it, I saw this as a way to visit Japan during a busy time.

And, all things considered, I got a good price.

I’ll be on the lookout for cheaper accommodations. But I’m pleased with the flights. And glad to be off-loading these AA miles to Asia, too. Because starting March 22, 2016, these flights will cost even more.

Did anyone else book a flight and burn some American Airlines miles?

Let me know if you’ve stayed at the Hilton Tokyo, too – I’d love to find cool things to do in the neighborhood or nearby!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

January 25, 2016

Is the Citi AT&T Access More Card + RadPad a Viable MS Option?

Also see:

How to pay bills with PayPal My Cash + Business Debit Card + RadPad + Evolve Money

Get an Easy 1% Cash Back on Your Rent and Other Debit Card Purchases

I wrote earlier about my wishes for the Citi ThankYou program and increasing fascination with Citi.

Today, I had some sort of psychic break and picked up the Citi AT&T Access More card.

Oops, I did it again

I applied for it instead of the Citi ThankYou Premier card. Based on my current spending habits, and the fact that I already have Citi Prestige, the Citi ThankYou Premier seemed redundant.

Except for its broad 3X category for all travel including gas. But then I thought, you know, no.

Before I go all-in with Citi ThankYou, I wanna see what’s next. I can pick up that card up any time. And use my Chase Sapphire Preferred (or some other card) for gas/other travel.

And then, thinking more on the Citi AT&T Access More card, I thought about why it could be better. Including for paying rent at RadPad, a topic I’ve mined frequently.

About the Citi AT&T Access More card

Link: Citi AT&T Access More card

Link: RadPad rent payment

When you sign-up for the Citi AT&T Access More card and spend $2,000 on purchases in the first 3 months of account opening (the minimum spending requirement), you get:

$650 toward a new AT&T phone, if you activate and maintain service with AT&T for 15 days

3X Citi ThankYou points for every $1 you spend on purchases made online at retail and travel websites – this is key!!!

3X Citi ThankYou points for every $1 you spend on products and services purchased directly from AT&T (meh, maybe good for your phone bill, assuming you don’t have a Chase Ink card)

10,000 anniversary bonus points after you spend $10,000 in the prior cardmembership year – this offsets the $95 annual fee which is not waived the 1st year

OK, let’s peel this out a little more.

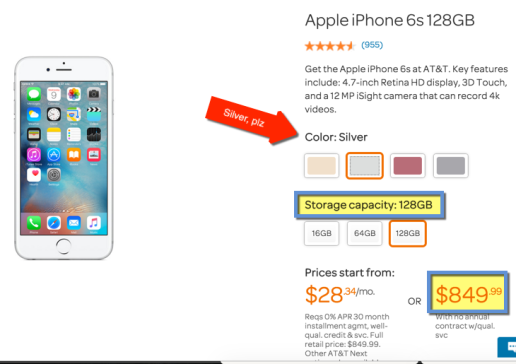

First things first, looks like I’ll be getting a new phone in a few weeks. I don’t need a new one, but eff it. I’ll get an iPhone 6S and spring for the 128GB version because I am sick of running out of space on my current iPhone 5. I’m always deleting apps and pics to make room for updates.

It was that or 50,000 Citi ThankYou points, worth $800 on American Airlines flights (with Citi Prestige). Or $625 in the (with Citi ThankYou Premier).

So, $200 plus taxes and fees. Fine

The bonus on the Citi AT&T Access More card is worth $650 (the amount of the credit) – no more, no less. I figure I can sell my iPhone 5 on eBay or something for a little more. Say it sells for $100. That’s net $750. Comparable to the bonus on the Citi ThankYou Premier.

I’m a current AT&T customer, so there’s no additional phone plan to consider.

For me, the real gem is that 3X category – online retail and travel purchases.

And, according to a commenter at Doctor of Credit, RadPad is eligible for the 3X category.

The key to the castle

I can’t yet personally confirm this works. But because purchases on RadPad are treated like any other online purchase (as a signature transaction), I see no reason why it wouldn’t.

Assuming it all works out, this could be a great way to lazily manufacture some spend – and even come out ahead.

By the numbers

My numbers assume you have either the Citi Prestige or Citi ThankYou Premier. Having 1 of these is the key to unlocking value with the Citi AT&T Access More.

I’m partial to Citi Prestige personally, especially if you like to travel. Read my experience getting the card and see how much I’ve saved so far. Apply for it using my links.

(If you want Citi ThankYou Premier, I’d pick it up sooner rather than later, as the bonus might decrease in late January 2016. It’s available via my links, too.)

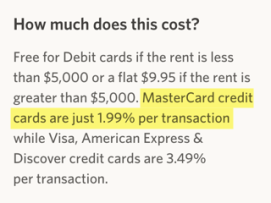

RadPad charges a 1.99% fee for MasterCard rent payments

Assuming your rent is $1,000 a month, here’s the breakdown.

RadPad charges 1.99% for MasterCard payments. (Citi AT&T Access More is a MasterCard.)

Pay $1,000 in rent, and $19.99 in fees.

Earn 3,060 Citi ThankYou points

3,060 Citi ThankYou points is worth:

$30.60 in cash (1% back)

~$49 toward American Airlines flights (~3% back with Citi Prestige)

~$41 toward flights on other airlines (2% back with Citi Prestige)

~$38 toward travel in (1.76% back with Citi ThankYou Premier)

~$61 if transferred to travel partners and redeemed at a rate of at least 2 cents per point (with Citi Prestige or Citi ThankYou Premier)

So you are paying ~$20 for at least ~$30 in value. You get at least $10+ in profit per $1,000 in rent.

Peeps who fly American Airlines and have Citi Prestige do better, because it’s like paying $20 for nearly $50 in flights.

And assuming you redeem them for 2 cents each, you triple your outlay ($20 fee turns into ~$61, with ~$41 in profit).

Over the course of a year, you’d pay ~$240 in RadPad fees. And you’d earn 36,720 Citi ThankYou points, worth at a minimum ~$367. Or ~$588 on American Airlines flights. Either way, you come out ahead.

Of course, this can scale up or down depending on how much you pay in rent each month.

And don’t forget the extra 10,000 Citi ThankYou points you’ll earn when you spend at least $10,000. For me, that offsets the annual fee of $95. But it’s worth $160 toward American Airlines flights because I have Citi Prestige too, so I’ll still come out ahead $60 in that scenario.

Other stuff

Also, RadPad aside, you earn 3X Citi ThankYou points for online shopping and travel. That includes:

Amazon.com

Costco.com

Apple.com

Walmart.com

Target.com

Expedia.com

Any other website where you won’t earn a category bonus with another card

Don’t forget to click through a shopping portal, for the love of god. With so much online shopping, check Cashback Monitor to earn even more points, miles, or cashback.

So this could be a nice little gravy machine when combined with Citi Prestige because it’s essentially 5% cashback toward American Airlines flights (3X Citi ThankYou points x 1.6 cents each = 4.8 cents).

Bottom line

I’m excited to get a new Apple iPhone with my new Citi AT&T Access More card. (I’m not looking forward to the setup and activation process.)

But once it’s said and done, I anticipate the new card will be a great way to earn extra Citi ThankYou points.

And a decent option for earning close to 3% cashback in pure profit (4.8 – 1.99 = 2.81%) when you pay rent with RadPad and apply Citi ThankYou points toward the purchase of American Airlines flights when you also have Citi Prestige.

Or even just 1% back from your rent assuming you straight up cash it out and don’t have Citi Prestige or Citi ThankYou Premier to pair it with.

The card has a $95 annual fee that I don’t mind paying because I’ll easily spend $10,000 and earn 10,000 Citi ThankYou points. So it’s more than offset.

The 3X category for online spending is all bonus.

I shop online for most things, and usually get 1 point or mile per $1 spent. Or 2% cash back with the Fidelity AMEX. But this’ll pair nicely with Citi Prestige and bolster both firmly into my wallet.

And if you want to pick up the Citi Prestige or Citi ThankYou Premier, thank you for using my links to apply.

So what do you guys think?

Have I finally lost my mind? Or is this crazy enough to actually work?

If you have the Citi AT&T Access More card, I’d love to hear your opinions.

And when I can confirm RadPad earns 3X Citi ThankYou points, I will be sure to update.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

January 24, 2016

Hotel Review: Alexandra Doubletree Barcelona, Dream Suite

Also see:

Booking Barcelona: $747 Round-trip in AA Business Class

Booking Barcelona: A Hilton Points Dilemma

Booking Barcelona: Citi Prestige + Hilton Diamond at Alexandra DoubleTree

My Hilton Diamond Experience in Barcelona (With Suite Upgrade Worth Over $1,600!)

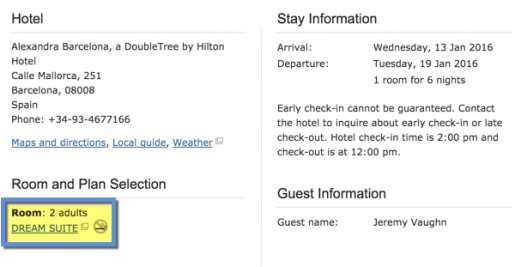

I wrote about my experience arriving and checking-in to the Alexandra Barcelona, a DoubleTree by Hilton Hotel.

Lobby of the Alexandra Doubletree Barcelona

It couldn’t have been better. I was upgraded to a Dream Suite worth ~$1,660 as a Hilton Diamond member.

Now, I want to show you the Dream Suite and review the hotel more in-depth.

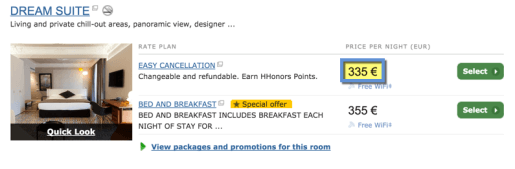

The Dream Suite at the Alexandra Doubletree Barcelona

Here’s the view upon walking in:

View upon walking in to the gorgeous Dream Suite

Soaking tub and robes

There was a huge soaking tub behind the bed in the main room.

We checked-in around 7:30am. The sun wasn’t up yet, so if the pictures look a little dark, that’s why.

Desk

Seating area

King bed

View from behind the bed

There were plenty of seats, including a couch, desk, and extra chair. And there was an alcove lined with pillows overlooking La Rambla.

Alcove seating – better in the sunlight

The room was very clean, with lots of booklets and info about the area set out.

There were several beautiful details in the room, including the molding on the ceiling and the original Modernist mosaic tiles in the floor.

Ceiling detail

Even the tiles in the floor were beautiful

Aside from the tub, there was also a walk-in shower with a sliding door.

Shower

Sink

Aroma Actives toiletries

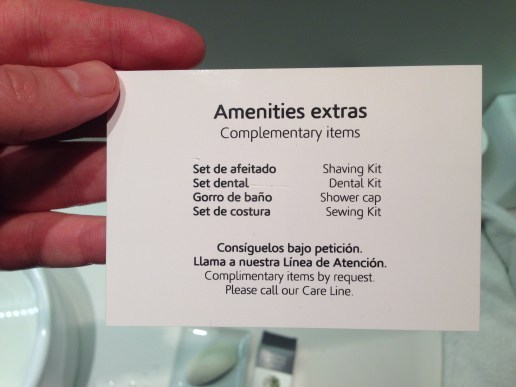

They didn’t skimp on the toiletries, either. There was the usual shampoo, conditioner, and lotion. But also a dental kit, shaving kit, shoe mitt, mouthwash, and various soaps and extras.

All the extras

Hair dryer, safe, shoehorns, extra blankets, and hangers in the closet

Balcony

And, there was a little balcony overlooking Mallorca Street (it was a corner room). There was a chair and table out there, and a nice view of the streets below.

Morning view, facing southwest

Here’s the location of the room from the outside

It’s the biggest room in the hotel.

Great amount of space!

Hallways of the Alexandra Doubletree

It was Room 216. On the “Hilton HHonors Floor.”

Whatever that means

Oh! And before I forget, here’s the minbar, bottled water, art books, and coffee station with Nespresso coffee:

Minibar

We kinda tore into it like monsters. Oops.

All-in-all, an incredible, beautiful room.

Here’s the scoop

Even though it’s a great room it’s not for everyone.

Ours was on the 2nd floor, and it’s a corner room. That means it’s situated close to not one street, but two.

Barcelona is a proper city, so you can hear busses, people, sirens, etc. from every window.

If you are a light sleeper, you might politely decline this upgrade if you think it’ll be a problem. I live in New York and am used to insane amounts of “ambient” city noise. But I can see this being really irritating for some peeps. If you need quiet in the evenings/early morning ask for a higher floor.

It’s also obviously made for couples. I mean, the bathtub is in the middle of the room. So unless you want to take a bath in front of your friends… know what I mean?

Same for the bathroom/shower. The shower is not in its own enclosed room, and there is no door to the bathroom area. So if you need a private bathroom, this room isn’t right for you. I’m not sure how the bathrooms in the other rooms are, but it’s something to consider.

For me and Jay, it was fantastic. But you may find yourself wishing it was a few floors higher and a little more private, especially if you’re traveling with friends or acquaintances. And not to mention, there’s only 1 bed in a King room.

But when we walked in, we both gasped. It isn’t a huge room, but it’s obviously very special.

We both loved all the little details.

Breakfast

You know I love a good hotel breakfast. As a Hilton Diamond elite member, breakfast was included for free – one of the perks I love most about the HHonors program.

Admittedly, we grew a bit tired of the same cold cuts and spread every day, but it was perfectly fine for us. All the basics were covered. And it was nice to drink some coffee and eat something before setting out each day.

The space is bright and clean with modern, updated furniture. And it was never packed. I loved that. At some hotels, breakfast can be a real stampede. But it was very quiet, almost meditative, here.

Breakfast seating area

Pastries

The spread

Cold cuts and cheese

Cereal, fruit, granola, yogurt

Hot foods

There were also some hot foods each day including eggs, sauteed veggies, ham, and tomatoes.

The staff did a great job of supplying fresh coffee and rotating out the food as people came and went.

Additional breakfast seating

My breakfast selections

Considering this would’ve cost 20 Euro for 2, we saved ~$130 on breakfast during our 6-night stay.

With that in mind, it was a fantastic value – and an easy way to save money on a meal each day. For that, I was very grateful.

Bottom line

I loved the Dream Suite. The curtains, the seating areas, the night stands, the quality of the furniture, and all of the little extras spread throughout the room. It just feels like they add extra attention to detail here.

Not to mention the amazing location. The hotel itself was modern, well-kept, and extremely well-managed.

The internet was fast, and the room was beyond all my expectations. Especially considering I booked the lowest room rate and got the 4th night free with my Citi Prestige card.

We were walking distance to La Sagrada Familia, the Mediterranean, “Gaixample” (the gay neighborhood), the museums, and so many wonderful little shops, cafes, tapas places, and restaurants.

Not only that, but the staff were all amazing, from desk agents to restaurant servers.

Overall a lovely, lovely visit. The Alexandra Barcelona, a DoubleTree by Hilton Hotel was a wonderful place to retreat to between rounds of exploring the gorgeous, historic city of Barcelona.

And, as my first time checking into a Hilton hotel as a Diamond member, I could NOT have asked for a better experience or hotel. Still smiling just thinking about it.

If you’ve stayed here, let me know how your experience compares!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

4 Things Holding Back Citi ThankYou From Being the Best Points Program

For too long, Chase Ultimate Rewards has been considered the best all-around points program for peeps who like collecting them (myself included).

You welcome

AMEX is failing miserably at just about everything right now, except for AMEX Offers.

They lost Costco and jetBlue, might lose Starwood, Membership Rewards doesn’t have (m)any great transfer partners (maybe Delta, Aeroplan, and ANA for niche award flight redemptions), and they’ve absolutely failed to make timely and industry-leading adjustments to their credit card and points line-up for a long time (thanks for dropping forex fees after like, a decade…).

That left the door wide open for Citi to swoop in (Barclays and Bank of America were never a concern). And man, they really took their chance.

I went from having 1 Citi AAdvantage card to wanting multiple Citi cards in a short while. I’m in love with Citi Prestige because of all the money it’s saved me in the few months I’ve had it.

Current Citi cards I have and want

I already have these 3 Citi cards:

Citi AAdvantage AMEX (yup, it lives on as an AMEX card not issued by AMEX)

Citi Prestige

Citi Hilton Visa

And I’d like to add 4 these, too:

Citi AAdvantage Platinum Select – 50K bonus miles before the devAAluation in March 2016

Citi AT&T Access More – 3x Citi ThankYou points per $1 spent on online shopping

Citi ThankYou Premier – 3X Citi ThankYou points on all travel including gas, and a nice sign-up bonus

Citi Hilton Reserve – 2 weekend nights at nearly ANY Hilton hotel, which would be nice now that I’m Hilton Diamond. Kinda like the Chase Hyatt Visa, which gives 2 nights at ANY Hyatt with no restrictions

1 of each, plz

Could I get them all?

I doubt Citi would let me have 7 cards all at once. Maybe 2 more. I’d probably snag the Citi AT&T Access More and Citi ThankYou Premier, and forgo the other 2.

But this is a great problem for a consumer to have – Citi has a lot of compelling products right now.

However, it’s not enough for me to abandon Chase Ultimate Rewards as my primary points program.

4 Things I Wish Citi Would Change

I touched on these topics before. But it’s worth expanding on. Because Citi is sitting on a goldmine… if they’d only make a few tweaks.

1. Remove dumb expiration rules and multiple types of Citi ThankYou points

As far as I can tell, there are 4 types of Citi ThankYou points:

Points earned from ThankYou credit cards – no expiration and can be transferred to partners

Points earned from checking accounts – expire in ~5 years and can’t be transferred to partners

Points transferred from someone else’s checking account to your checking account – expire in 90 days and can’t be transferred to partners

Points transferred from someone else’s ThankYou credit card to your ThankYou credit card – expire in 90 days and can be transferred to partners

Ugh, le whatever

This is a lot to keep track of. The upside is that if you have Citi Prestige, they’re always worth at least 1.6 cents toward AA flights and 1.33 cents toward other flights.

With Chase Ultimate Rewards points, a point is a point (is a point). It never expires and can be transferred to partners if you have the Chase Sapphire Preferred, or Chase Ink Plus/Bold. Simple.

Citi needs to clean this up, because the tiers are confusing, and it’s a good way to alienate customers who expect one thing from their points only to find limitations (or worse, expiration) later.

2. Add 4X or 5X categories

As it stands, the most number of Citi ThankYou points you can earn per $1 spent is 3.

Gimme five. A 5X bonus category, that is

With Chase Ultimate Rewards, you can earn 5 points per $1 with the Chase Ink/Bold/Cash card at office supply stores, and on cable/phone/internet charges. And, it’s a huge, wide-open category.

It’s also industry best. Citi needs to match it with some good categories.

3. Add a shopping portal

I use Shop Through Chase all the time to earn extra Ultimate Rewards points.

It’s easy and it works.

Just add ThankYou points instead of cashback and viola!

It seems like it’d be pretty easy for Citi to add a ThankYou shopping portal given they already have the Citi Bonus Cash Center. Give it good payouts, earn commissions, and let peeps increase their points balance.

AMEX used to have a Membership Rewards portal they took down citing maintenance, and then shuttered. That was a few years ago by now.

Come on, Citi. Compete!

4. Add at least 1 GOOD transfer partner

American Airlines or Alaska Airlines would be the dream. Preferably American though, to soothe the sting of the jacked-up award prices coming in March 2016.

It’s time

It also makes sense because Citi is their main credit card issuer. And, it would put American on par with the banking relationships of other legacy carriers (AMEX to Delta, Chase to United).

K cool, get even more flexible again

Or why not, I dunno, Korean or ANA or LifeMiles or some other decent international points program?

Another hotel program would be welcome, too.

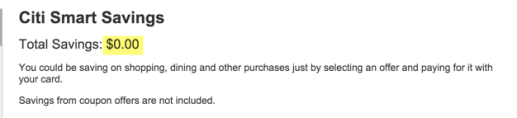

Bonus. Make Citi Smart Savings awesome

Citi Smart Savings should be a viable contender to compete with AMEX Offers.

It had a promising start. And when they rolled it out before Black Friday, I braced for the torrent of awesome offers.

Then it just kinda… sucked. And still currently sucks.

Failure to launch

Great offers on Citi cards would easily convince me to use them more. As it is, I use other cards for non-bonused spending. Either a Chase Ultimate Rewards card, or my Fidelity AMEX for 2% cashback (while I still have it).

Citi Smart Savings + Citi Price Rewind would be an excellent duo for Citi cards

Combined with Citi Price Rewind and the AT&T Access More card’s 3X points for online purchases, this could be an excellent shopping trio!

Bottom line

Citi has all the makings of a world-class points program.

They have the card products in place, the transfer partners, the infrastructure for a shopping portal, and the skeleton of an offers program.

All they need to do is go for it.

They’ve been going for it, so it’s like rooting for the little engine that could to go just a little farther. They could be the best points program if they made some changes.

So this is my wish list. What could Citi change that would make ThankYou your #1 points program?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

My Hilton Diamond Experience in Barcelona (With Suite Upgrade Worth Over $1,600!)

Also see:

Booking Barcelona: $747 Round-trip in AA Business Class

Booking Barcelona: A Hilton Points Dilemma

Booking Barcelona: Citi Prestige + Hilton Diamond at Alexandra DoubleTree

I was super looking forward to visiting Barcelona.

From the initial disappointment of not getting the best deal (but still a very good deal) on the flights, to wondering which hotel to stay at, to finally getting a Citi Prestige card and choosing the Alexandra Doubletree, it was a bit of a ride.

In the end, I was able to book 6 nights via Citi Travel Concierge with Hilton’s Winter Sale rate and 4th night free.

Here’s how it all shook out.

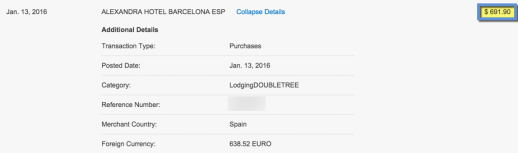

Booking by the numbers

I paid ~$692, but got back so much more

The final total was ~$692 for 6 nights, but I’ll get back ~$116 on the next billing cycle (the cost of the 4th night). So in the end, I paid ~$576 for 6 nights in Barcelona. Jay and I split that, so it came to ~$48 per person per night – a fantastic deal no matter how you slice it.

I was one of the many peeps matched to Hilton Diamond elite status (and one of the unlucky ones who missed out on Hyatt Diamond elite status – I’m still not over it).

This stay was my first as a Hilton Diamond member.

I’ll do a separate review of the beautiful and extremely well-located Alexandra Barcelona, a DoubleTree by Hilton Hotel.

When I checked in, right off the bat, I was given an upgrade to a Suite that would’ve cost ~$1,660. And I only paid ~$576 for it!

Upgrade to a Dream Suite at Alexandra Barcelona

Our flight was a red-eye that landed around 7am. We headed straight to the hotel and got there in about 30 minutes.

I never expect to check in that early, ever. I ask if I can drop my bags off, and then head out to explore. I come back after lunch (like I did at the Park Hyatt Paris-Vendome) and the room is usually ready by then.

The desk agent was so accommodating and friendly. He pulled out 2 envelopes – a welcome letter and breakfast certs – and said, “No problem, your room is ready. And it is a very nice room,” he added.

Cool! I wasn’t expecting it, but it was certainly appreciated. He typed for a minute or two, and handed us the room keys.

I booked the most basic, cheapest Queen room. But walked into the Dream Suite – the biggest room available at the hotel.

View upon walking in to the gorgeous Dream Suite

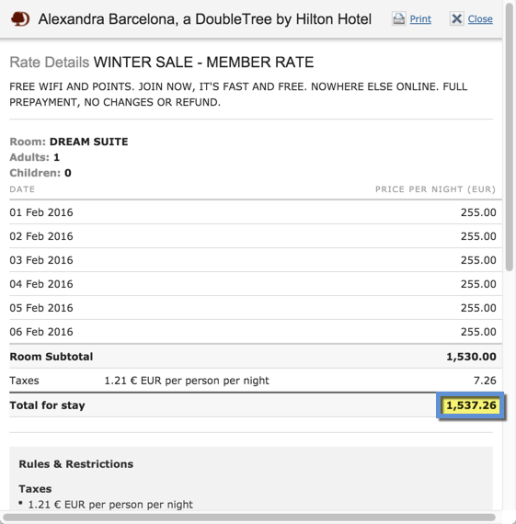

It was a lovely corner room with lots of ornate details, like the original Modernist mosaic-tiled floor. It also had an alcove overlooking La Rambla, and a private balcony over Mallorca Street.

Got the Dream Suite!

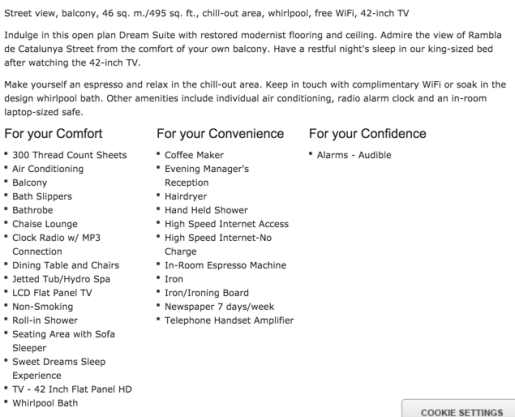

I logged in to my Hilton account, and saw the new room type. Dream Suite. Here’s the description:

Room description

Then, I plugged in the info to see how much a 6-night stayed would’ve cost out-of-pocket.

6 nights in the Dream Suite at the Winter Sale rate

~1,537 Euro or ~$1,660. Awesome!

I found rates as high as 335 Euro per night

Considering the nightly rate can sometimes be much more, I was blown away by the incredibly generous gesture.

I’m certain it had everything to do with my Diamond status. I really don’t think this upgrade would’ve cleared, even as a Gold.

Other observations

In the picture above, Hilton has the Bed and Breakfast rate at 20 Euro more than the non-breakfast rate. So OK, they value breakfast for 2 at 20 Euro.

By that yardstick, our breakfasts each day saved us another 120 Euro, or ~$130.

Was it the best breakfast? Not really, but they had coffee, cold cuts, fruit, pastries, and juices (the basics). And it was nice to get something in the ol’ tummy before heading out each day. Even still, I consider that an added value.

We got 2 bottles of water replaced in our room each day, in-room Nespresso coffee pods, and premium wifi. We also got a very early check-in, and were offered a late checkout even though we didn’t need it (our departing flight took off at 10am).

All of these little things add up. We drank the bottled water each day, had coffee in the evenings after our disco naps, and enjoyed saving time with high-speed wifi.

I’d say all told, these things (including the breakfast) added another ~$150 to ~$200 in value to the overall stay.

And, it made me want to look forward to my next stay with Hilton. I’d love to stay at a property with an Executive Lounge to compare/contrast with this experience.

Bottom line

I had a great fantastic experience checking-in for the 1st time as a Hilton Diamond guest.

While I won’t get my hopes up for future Suite upgrades, this one was certainly appreciated.

January in Barcelona is a very off-peak time to visit, but I don’t think I would’ve been extended such a generous upgrade even as a Gold member. And when traveling during peak times, I don’t expect the upgrades will be as frequent, or lucrative.

All that being said, wow. The quality of the stay at the Alexandra Doubletree in Barcelona (Barcy) far and away added a nice base to our overall visit.

I’d love to hear from peeps more in-tune with Hilton and their upgrades.

Have you received a Suite upgrade? If you stay often, at what percentage would you ballpark the upgrade possibility?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

January 23, 2016

Get Honey, Save Money! (Browser Extension for Chrome)

Also see:

Use Paribus to Get Money Back If There’s a Price Change

Save (or Earn!) Money at Amazon and More This Holiday Season

You guys know I’m all about saving money when shopping online.

In fact, I’m borderline obsessed with Paribus, which is an incredible way to save money when there’s a price change on items you bought.

Enter Honey

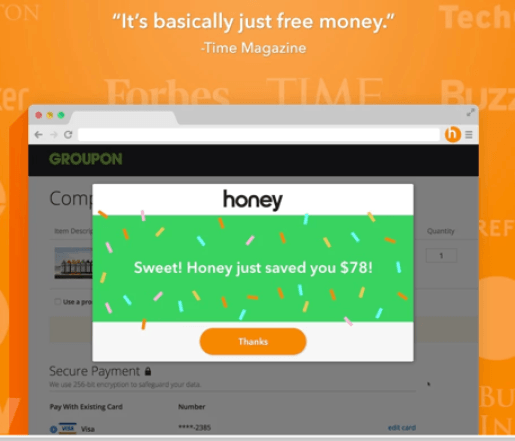

I recently discovered Honey, which is a browser extension for Google Chrome.

Save money effortlessly with Honey

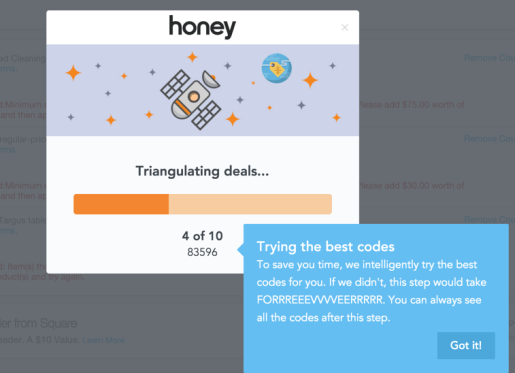

While you shop, it scours for any coupon codes you can apply toward your purchase.

So when you get to the checkout screen and see the box for a promotion code, you don’t have to go down a mini Google-spiral to find something that works.

Before, I’d spend an extra 10 minutes to find the best promotion code. But Honey finds and applies them for you with no additional effort on your part (aside from adding it to your browser).

It’s free to use, and there’s no adware, malware, spyware, etc. to worry about. In fact, they are adamant about not using your information maliciously.

It sits in the corner of your browser, and sets about finding coupons and codes to apply for you at checkout.

YAASSS, find those codes!

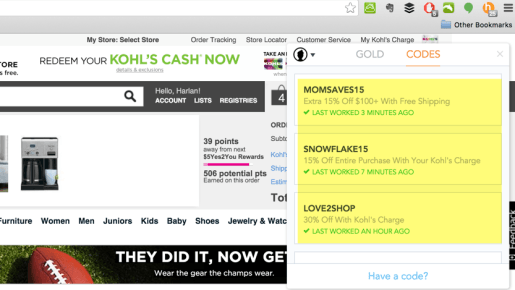

Of course, some sites don’t have any coupon codes.

But others, like Kohls.com, light up like a Christmas tree.

Honey found 25 promo codes for Kohl’s

After the codes are applied, you can go through the list and double-check that you did indeed get the best deal.

This is such an awesome timesaver, I had to share it with you guys.

OK, Great. Are There Drawbacks?

Not really a drawback, but something to be aware of.

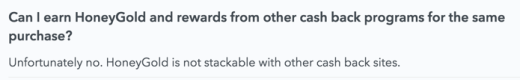

Honey can also act as a shopping portal. Not automatically, thankfully.

They have a reward system they call HoneyGold. You’ll earn cashback, like any other shopping portal.

But don’t forgo more cashback or miles for it

But I recommend checking Cashback Monitor to make sure you’re always getting the most miles/points/cashback possible. And consider Giving Assistant if you want a cashback portal that pays out fast.

Or earn points or miles instead.

Use Honey to find promo codes. Ignore the HoneyGold function (unless of course they have the highest payout, but I don’t think they would).

Bottom line

Honey is pretty dang cool. It finds promotion codes for you automatically while you’re shopping, and saves you money at checkout.

Combine this with Paribus and Giving Assistant, and you have an excellent money-saving trio. So you can save money at the point of purchase and after, and points, miles, or cashback.

If you use Google Chrome, add it to your browser to start saving. The rest all happens without any added effort.

Have you heard of Honey before? Any experiences?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for a new credit card at CreditCards.com!

10,000 Citi ThankYou points for catching a site error

Citi’s been hit-or-miss with peeps calling in about various website errors recently.

Doctor of Credit shared an experience about getting a 5,000 bonus Citi ThankYou points because the Citi Prestige application site showed an error on earning 3X ThankYou points on all travel purchases including gas.

It actually earns 3X points on airfare and hotel purchases, not travel broadly defined – probably my only complaint on this otherwise incredible card. (Here’s how much I’ve saved I picked up the card in November 2015. And it’s available via my links if you decide to apply.)

How I got 10K points

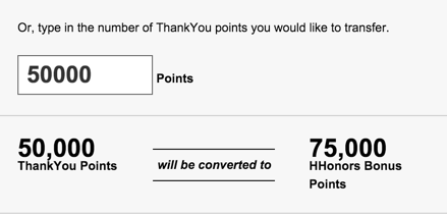

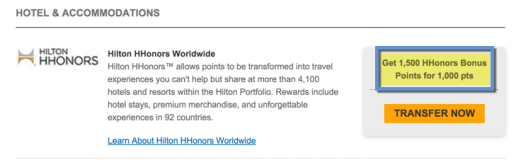

I noticed an error at ThankYou.com. I can’t find the screenshot, but the site advertised 2,000 Hilton points for every 1,000 Citi ThankYou points. It was an artifact from a transfer bonus promotion Citi had going on, which ended January 6th, 2016.

When I clicked “Transfer”, I saw the normal 1.5:1 ratio instead.

This is the normal ratio, although Citi was advertising a 2:1 rate

So I called Citi and told them what I saw on my account. The rep logged in and saw the same 2:1 price, and then the lower amount after clicking through.

I told her I was hoping to get 100K Hilton points for transferring 50K Citi ThankYou points. But now I’d only get 75K.

I was transferred twice. But everything went fast. The whole call took less than 15 minutes. I spoke with a supervisor, who’d already been informed of the situation before we were connected (I love that!).

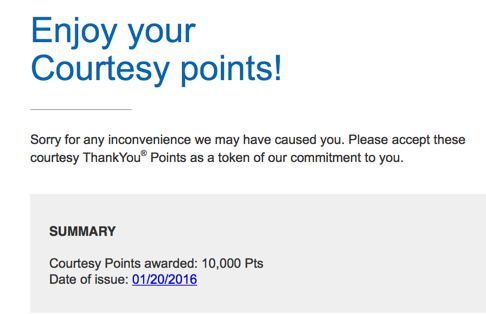

She instantly offered to split the difference and post 10K ThankYou points to my account so I’d have enough to make 100K Hilton points.

I accepted, and before I hung up, got this email:

Courtesy indeed!

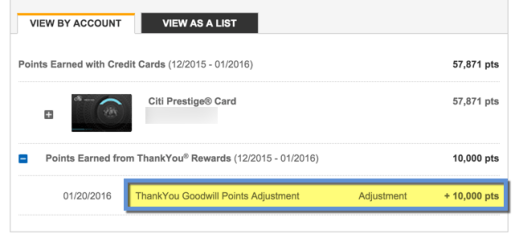

Then I logged into my account and saw the transaction and new points balance:

10K ThankYou points for a 15-minute phone call

I was blown away by the service and speed.

For 15 minutes on the phone, I got 10,000 Citi ThankYou points worth:

$100 in cash

$160 on American Airlines flights

$133 toward other flights

$200 with transfer partners (read how I came up with this number)

Not a bad haul!

If you wanna try

After you log in to your ThankYou.com account, click “Travel,” then “Points Transfer.”

Look for 2,000 Hilton points for 1,000 ThankYou points

One of the reps I spoke to said not everyone’s account has been updated yet with the correct totals. So you can see what your account says.

If you see the 2:1 rate, you can call to report it. Who knows, it’s worth a shot.

Or you can take Doctor of Credit’s advice, and see what your Citi Prestige application says about the 3X category.

Bottom line

Citi ThankYou is quickly becoming my favorite points program.

The second they add a meaningful (meaning large domestic airline) transfer partner, I’ll seriously consider focusing on collecting Citi ThankYou points over Chase Ultimate Rewards points.

There are still a few glaring omissions.

For example, there’s no ThankYou shopping portal whereas the Shop Through Chase portal is very good for earning Chase Ultimate Rewards points from online shopping.

And bonus Citi ThankYou points are limited to airfare, hotels, dining, and entertainment with Citi Prestige and Citi ThankYou Premier. Although you can earn 3X Citi ThankYou points with the AT&T Access More card for most online shopping, including Amazon, which is great.

There’s still no way to earn bonus points for office supplies, drugstores, cable, etc. So that means a set number of ways to earn more than 1X ThankYou point per $1 spent. And at most, 3X bonus points.

Finally, the weird expiration and transfer rules between all the different kinds of ThankYou points is confusing. Chase doesn’t do that when you combine your points – they all never expire no matter which card you earned them with, or who you transfer them to.

And one last thing. I was hoping Citi Smart Savings would be a viable contender to compete with AMEX Offers. They rolled it out right before Black Friday, which was promising. But then it just… wasn’t that great.

However, they are making huge strides. And the service I received over this error was incredible. The only thing you can never buy back from a customer is bad will. Take notes, AMEX!

Let me know if you have luck getting extra ThankYou points!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for a new credit card at CreditCards.com!

January 15, 2016

Out and Out Is in Barcelona! Any Must-Dos? (And Updates!)

Dear Out and Out readers, I miss you so.

I got to Barcelona (Barcy) Wednesday morning and have spent the past 3 days wandering, sleeping, working, eating (tapas), and drinking (sangria and Spanish wines and local craft beers).

Wandering in the Gothic Quarter

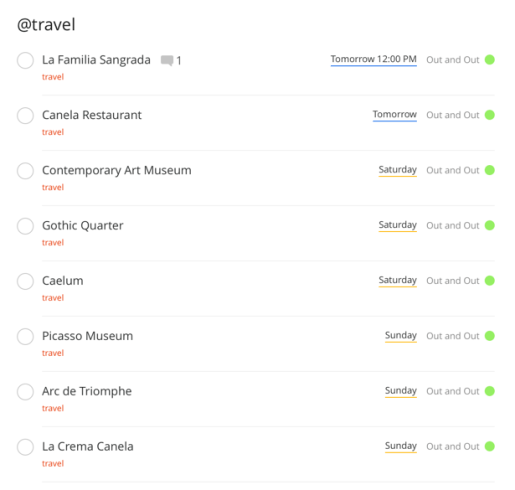

I still have 3 more full days in Barcy and am totally open to ideas about how to fill the time. I’m meeting with friends, and have a few things on my to-do list (on Todoist):

Restaurants, sites, and things to see. Anything I should add?

I’ll get up tomorrow and see La Sangrada Familia, then maybe head to the Picasso Museum and see the Arc de Triomphe along the way.

Feel free to share any tips about where to go, what to do, or great restaurants you love. I’ll try to work in as many things as possible!

A few updates

Here are a few quick off-the-cuff goings-on:

Hilton

Loving my upgraded room at the Alexandra Doubletree!

I’m at the Alexandra Doubletree by Hilton – my first stay as a Hilton Diamond guest. I got upgraded to a better room with a private balcony and a view of Las Ramblas – I love this hotel! The location is fantastic!

Full review soon. So far, impressed with Hilton Diamond perks.

AA

My miles already posted

My miles already posted! Including for the current 25K bonus miles promotion for round-trips, even though I obvi haven’t flown back yet. It seems they’re awarding the bonus miles in 12.5K chunks per segments flown, which is kind of interesting.

In any regard, I can safely say it works for AA flights purchased through the fantastic British Airways deal!

The flight over the pond was quick and easy. Again, full review soon.

And I’ll probably still ditch AAdvantage altogether after the flight home in favor of Alaska’s Mileage Plan.

Todoist

This is my first trip organizing my days with Todoist, and it’s been a godsend. I added things in rough order, and have been ticking them off one by one.

I added things like links to buy tickets, screenshots of maps, menus, opening hours, and other little notes and it’s been so helpful.

Sure, you could use any note-taking app.

I’m finding I love the easy format of Todoist. I created a new label called “Travel” that I’ll use while on trips, or as I find things to add to future trips. I’m still using Evernote and TripIt Pro to keep travel plans in order. And Todoist “on the ground.”

It’s going really smoothly so far. Not to get too “workflow” about it or anything.

New stuff

I have a few collaborations in the pipeline, and looking forward to writing about them.

These have been in the works for a few weeks now, so it’ll be exciting to finally get them out into the world.

More soon!

Money

I’ve been thinking about how to make extra dollas in 2016. I want this to be a positive, wonderful year full of travel and side hustles and money and major steps toward financial independence.

I went ahead and socked $5,500 into my Roth IRA, thus maxing it out in January and giving it a WHOLE YEAR of appreciation and dividends.

Next up: student loans, paying down the mortgage, another investment property, and who knows, maybe another Airbnb?

But for the next 3 days, I’m focused on Barcelona.

Next trip

Loving the momentum already. In early February, I’ll be heading to Martinique (Marty) on Norwegian Air!

Looking forward to experiencing a well-reviewed low-cost airline.

Bottom line

Loving this beautiful, historic city on the Mediterranean. And as a bonus, it’s 60 and sunny every day and I’m dodging a Nor’easter this weekend. Small stuff.

I can’t wait to bring it all full circle and report on the outcomes of the flights, the hotel booking, and the preparation that went into the trip.

Missing you guys!

But for the next 3 days, Barcelona is right outside. Feel free to add tips. I’d love to have a few packed days before getting back to the New York winter.

Thanks, as always, for reading.

And if you’re in New York on January 20th, consider joining us at the Reach for the Miles Meetup at Professor Thom’s from 6-9pm! I’ll be there (and definitely square).

Besos!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

January 1, 2016

Forget AAdvantage! I’m Switching to Alaska MileagePlan This Year

Also see:

Alaska MileagePlan: The Last Good Loyalty Program? (Alaska Vs. American by the Numbers)

Taking another look at Alaska Airline’s MileagePlan program

The beginning of the year is an excellent time to set new travel goals.

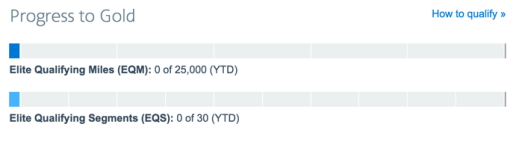

Especially when you’re looking at this:

Ruh roh!

I already broke down the numbers of qualifying for top-tier status on American and Alaska, and found that Alaska MVP Gold 75K status is easier to earn with less flying. And you end up with more miles than AAdvantage Executive Platinum status when you start from zero and hit the top tier – 36,250 miles to be exact.

And now it’s even more attractive in light of American’s upcoming devalued award chart.

But… what about Dallas?

Yup, soon enough I’ll be in DFW AKA… American Airlines’ main hub. So… what gives?

It seems logical to give up the ghost and go after American Airlines status if I live in their backyard. But then I thought, yeah, just like everyone else.

Realistically, even with top-tier status, what are my chances of an upgrade on pretty much any flight out of DFW? Especially between DFW and LGA (which will remain my top destination)? Forget it.

While others zig, I’m gonna zag.

I will miss the systemwide upgrades with American.

But I won’t miss the devalued award chart.

At least, until Alaska devalues theirs, then it’ll be a free-for-all.

Stay the course

And, I don’t expect Alaska to make big changes to their program in 2016.

Although, reciprocal upgrades with American would be a nice addition. Not holding my breath for that one.

Win some partners, lose some partners

As options, I’ll miss American’s partnerships with:

Airberlin

Air Tahiti Nui

Etihad

JAL

14 interesting and varied partners

But I’ll gain Alaska partnerships with:

Air France

Delta

Emirates

Icelandair

KLM

Korean Air

And, should I happen to find myself on a Delta flight, I can still bank Alaska miles. That’s a huge selling point – being able to credit 2 out of 3 legacy carriers to 1 program and earn valuable miles.

Plain ol’ curious

Given I probably won’t get upgraded on an American plane out of DFW, I don’t have much to lose by exploring a new program. And, I’ve been very curious about Alaska MileagePlan for a while.

Now that the meters have reset to zero, now is a perfect time to make a switch.

I hope the Bank of America Alaska card goes above a 25K sign-up bonus soon. That would be the icing on my curiosity cake!

Weaning off American

But, American has me on lock-down for 2 more round-trip flights.

I’ll be flying to Dallas next week and doing something I have done in years: checking luggage.

Thanks to my Citi AAdvantage card, me and Jay can both check a bag and save $50 each way – not a bad deal. But I’ll have to credit to American to take advantage of the perk. So I’ll forgo the Alaska credit on this flight to save $100.

And the flight to Barcelona this month. That’s because American is giving 25,000 bonus AAdvantage miles on round-trip Business Class trans-Atlantic flights. I want those 25,000 miles – it’s simply too good to pass up. That’s a free round-trip domestic coach award flight!

But after that, it’ll be full steam ahead with Alaska.

I might not earn top-tier status

I don’t pay for a lot of flights anyway. So all of this might be a moot point. Even still, I’ll look forward to doing what I can and seeing what happens.

Most of my flights are award flights these days, but when I have a paid ticket, I’ll credit to Alaska in 2016 (after the 2 mentioned above).

And who knows, maybe I’ll earn Alaska MVP Gold 75K status. It’ll be fun to try, and I’ll get to explore a new program. And besides, nothing’s ever really lost.

Bottom line

In light of American’s upcoming award chart devalution, I’m gonna zag over to Alaska to see how it goes this year.

I’ll look forward to new partner airline options, increased mileage earning, and a new program to get into.

The beginning of the year is a great time to set new travel goals, and set the tone for the upcoming year.

I want 2016 to be about creativity, exploration, and travel. And I wanna try something new by switching to Alaska MileagePlan this year. Maybe I’ll even hit MVP Gold 75K, their top elite status level. I’ll post with updates as it goes along.

Is anyone else thinking of switching their loyalty since the reset to zero on January 1st?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!