Harlan Vaughn's Blog, page 2

September 2, 2024

Newly 40, 67% toward my goal, and up $17K – September 2024 Freedom update

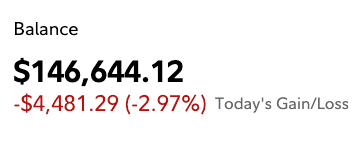

I’m currently at 67.2% of my $500,000 goal. My previous net worth peak was $363,002, and this month I’m at $335,872. I’m tired of being at this level, though I’ve been mostly at the mercy of the stock market. I’m to the point where I’ll do whatever it takes to get over the $400,000 hump and into the home stretch to $500,000.

I’ve been working nights and weekends to freelance, pay down credit cards, and get my savings built up.

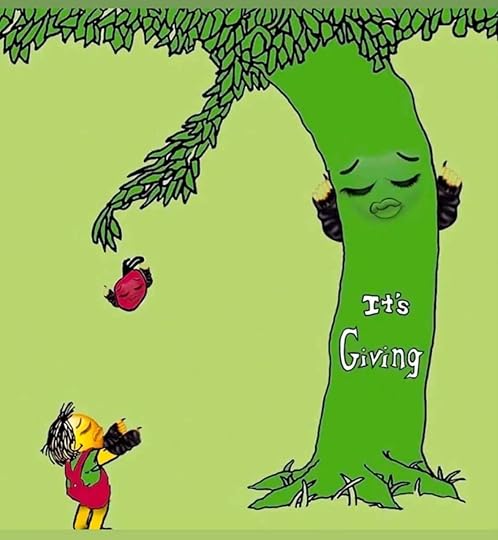

I had the sweetest 40th birthday party, y’all

Something about turning 40 last week lit a fire under my butt. I’m over the halfway mark and ready to push through this last 30% or so that’s left.

I love this sweet drawing!

You think I can do it by August 2025? That would divide to about $14,000 a month for the next 12 months. That sounds like a lot, but then again, I’m up nearly $17,000 this month alone. But a lot of it is the stock market, which I can’t control. So now I’m working on producing as much as I can—which I can control—to clear this hurdle that’s been in the works for a few years now.

I’m proud of my goal and progress so far, and now I’m beyond ready for the final phase.

September 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardLink: Join Points Hub, the ultimate points, miles, and travel rewards community on Circle!It’s been a month of transitions.

Warren turned five and started kindergarten, I turned 40 started new work projects, and we’re all adjusting to new schedules.

This absolute sweetheart rides the bus every ay

I have to decide what to do about my outstanding credit card debt, as my 0% APR rates expire this month and next. Can I ramp up payments enough to pay them off with an interest charge or two, or should I pay the 3% fee to roll over the balances to another card?

On one hand, I’d love to have more time but on the other, I’m sick of carrying balances. It’s been a constant stream of expenses and being laid off in the middle of everything set me back quite a bit—although I’m grateful I was able to pick up work right away. I feel like I’ve been in catch-up mode for so long (can you feel my “over it-ness”?).

Anyway, I’m confident I can knock it all out with a few months of solid work and then be on the path to saving and investing, which is what I’ve been wanting.

This month’s progressThe stock market had a strong month in August 2024, and I saw my overall investments go up over $18,000. However, I dipped into my savings to pay bills as I didn’t get my first paycheck from my new job until the end of the month, and didn’t want to incur more interest.

I set up a new 401k, which will get going in October 2024, and didn’t add anything to my Roth IRA or any UTMAs for the kiddos. I made a couple of car payments and the minimums on my existing credit cards with said savings.

This crystal cave blew my mind

This month will be the turning point for getting the credit cards under control as checks get predictable and freelance work continues to roll in.

Then, I can start on my savings goal and other investments. It feels like it’s far off, but I’m determined.

Every dollar that rolls in will be given a job toward these things. We cut our grocery bill as much as we can and have basically no “excess” spending. We eat out once or twice a month and use the local parks and libraries for entertainment, as well as playing in the back yard. It’s an austere life, but we get out nearly every day and spend lots of time outdoors.

To recap the last month or so, I:

Got health insurance again!Paid down my car loan by about $700Set up the new 401k with 10% contributions to start in October 2024Turned in a few freelance assignments to keep the funds flowingAdjusted our spending to focus on the basics and tried to stay as frugal as possibleBy the numbersThe overall net worth went up nearly $17,000 this month alone. It’s wild how much a good month on the stock market can affect this number. I grapple with this a lot—how dependent I am on the market doing well. After I get the credit cards paid off, I’ll focus on having pure cash for a while—although I’ll continue investing via my 401k and employer match (can’t say no to free funds!).

At this point, I’m ready to catapult over the $400,000 mark and will do whatever I have to do. I’m picking up assignments and working every day, while taking care to eat nutritious foods, take breaks, sleep at least eight hours, and move often—and interact with the kids. It’s a project to balance.

I can’t miss these sweet little fingers

I feel stretched thin, but sticking to a strict schedule helps. We get the kids down for bed between 8 and 8:30 pm, I work until 10 pm or so, and I shut my laptop at 10:30pm no matter what so I can be up at 7am and get plenty of rest.

I don’t look at social media as much and can’t read a lot of junk or mess around, so it’s all business all the time. But that’s what I want right now, so it’s good, especially with the election coming up and all the crap that goes along with it. I don’t miss social media and would rather be working.

CurrentLast MonthChange2024 Goal ASSETS Overall investments$319,164$300,435+$18,729As much as possible Roth IRA total$84,050$78,906+$25,144 Roth IRA 2024$2,700$2,700xx$7,000 (in new contributions) Taxable brokerage + UTMAs$4,082$3,739+$343$25,000 (total invested) Savings$258$2,162-$1,904$30,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITIES Car loan $23,578$24,332-$754? Credit card #1 (0% APR)$8,492$8,577-$85$0 Credit card #2 (0% APR)$11,581$11,696-$115As much as possible Net worth in Empower Personal Dashboard$335,872$318,903+$16,969$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITIES Car loan $23,578$24,332-$754? Credit card #1 (0% APR)$8,492$8,577-$85$0 Credit card #2 (0% APR)$11,581$11,696-$115As much as possible Net worth in Empower Personal Dashboard$335,872$318,903+$16,969$500,000 (overall goal)

Track your net worth with Personal Capital

LFG

Short- and long-term goals include:

Pay off credit cards Build my savings account again in 2024Work up to 15% in 401k contributions at the new jobPut more money into Beck’s UTMA (tabled for now)Contribute to new baby’s UTMA (ditto)Max out my Roth IRA for 2024September 2024 Freedom update bottom lineLink: Join Points HubLife’s good! I’m getting into work mode and want to knock out this lingering stuff. I’m tired of the $300K mark, the credit card debt, and not having savings. It’s time to work and catch up.

The kids are healthy, Warren loves school (and the bus), and the new gigs keep me busy. Travel is probably off the table for the rest of the year, but I’m newly 40 and ready to ascend to the next level, so that feels almost as enriching.

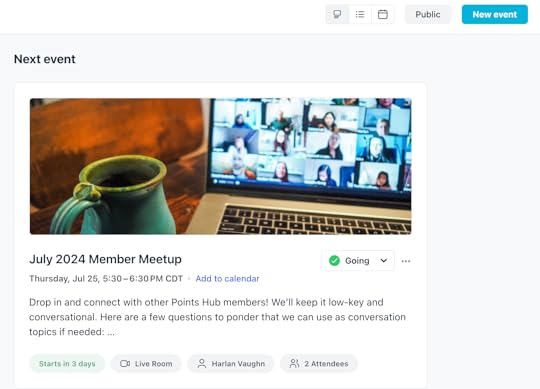

If you’re keen, check out Points Hub—the points, miles, and travel rewards community I built. It’s two months old and finding a groove. We have some amazing members, lively conversations, and incredible partnerships so far—and we’re just getting started. Join us! It’s how I’m contributing to the travel world right now and it’s a total blast.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.

August 5, 2024

Market swings, down $14K, but on and up with a new job – August 2024 Freedom update

August 2024. This date has been in my mind for a long time as the original goal date to accumulate a $500,000 net worth. Now it’s here—and my net worth is still hovering around the $300,000 mark.

This date was set because of my 40th birthday, coming up in a couple of weeks. Back then, I didn’t know I would move, buy and sell two houses, be a digital nomad for a stretch, or have three kiddos. And who could’ve predicted a pandemic in the middle of everything?

Not bad for 40

Despite many ups and downs (this month AND in the last few years), I’m in good spirits.

I have a lot to report and process this month, so let’s get crack-a-lackin’.

August 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardFirst of all, I start my new job tomorrow! After being laid off last month, I was only unemployed for about three weeks, with many leads along the way.

Wow. I am so grateful for how the community immediately came to support me. I needed it, and will forever be amazed at how many good people are on my side.

Layoffs are rough, no doubt, and three weeks is nothing compared to what others have endured (including myself last year).

Splash pad and pool time

I regrouped quickly, rested a bit, hung out by the pool and had a few margaritas about it. I lost the employer part of my 401k, health insurance, and a couple of paychecks—that all stung, and obviously I wasn’t able to make much financial progress in the last month.

But—I have freelance income rolling in and will soon have back all those things I lost: a 401k, health insurance, and steady checks. Big sigh of relief there. I’m glad for me, but even more for the kids.

On the other side of the coin, the stock market is currently going down down down. When I woke up it was down 4%, and is down 3% right now. For my portfolio, these are huge drops.

Big ouch

A 3% drop (or gain) equates to $1,000s lost (or made). I was up $13K last month and am down $14K this month. You can see how even small changes add up to hundreds. And that’s just my Fidelity accounts.

Just two weeks ago, I was touching $340K

I’m looking forward to consistent work. I’m going to sit in this room and make as much money as I can over the next year.

My five-year-old boy starts school this week, so we both have new “jobs.” While he’s at school, my partner will look after the other kids, and I’ll be up here writing my little heart out.

I took my previous goal seriously. And now that I have a little wiggle room, I intend to take full advantage of it to close the gap in this final stretch.

This month’s progressWith little income and many expenses, I didn’t make much financial progress this month. Well, I did in the sense that I quickly found a new job and got a few freelance projects completed (those payments should appear soon).

I also started Points Hub, which I hope you’ll join to geek out about points and miles with me. Click the link in that previous sentence to read about it—there are some cool partnerships in there.

To recap, I:

Got a new job!Made enough to make my car payment, credit card minimum payments, and buy groceries—and that’s about itDidn’t invest a cent Kept three kids aliveThat is plentyBy the numbers

Kept three kids aliveThat is plentyBy the numbersYou’ll notice my net worth number in the table below is $4,000 higher than in the net worth screenshot above. That’s because my $4,000 HSA rollover is still processing and should land in my Fidelity account any day now. (I’m hoping soon so I can buy the current “dip.”) So I added that to the total.

CurrentLast MonthChange2024 Goal ASSETS Overall investments$300,435$311,576-$11,141As much as possible Roth IRA total$78,906$76,076+$2,830 Roth IRA 2024$2,700$2,700xx$7,000 (in new contributions) Taxable brokerage + UTMAs$3,739$3,936-$197$25,000 (total invested) Savings$2,162$2,073+$89$30,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITIES Car loan $24,332$24,715-$383? Credit card #1 (0% APR)$8,577$8,663-$86$0 Credit card #2 (0% APR)$11,696$11,815-$119As much as possible Net worth in Empower Personal Dashboard$318,903$333,007-$14,104$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITIES Car loan $24,332$24,715-$383? Credit card #1 (0% APR)$8,577$8,663-$86$0 Credit card #2 (0% APR)$11,696$11,815-$119As much as possible Net worth in Empower Personal Dashboard$318,903$333,007-$14,104$500,000 (overall goal)

Track your net worth with Personal Capital

Summertime gladness

Over the next few months and year, I’ll work as much as I can to pay off those dang credit cards, max out my 401k, and build my savings. At this point, I am off to the races. I feel good and ready to go.

Short- and long-term goals include:

Pay off credit cards Build my savings account again in 2024Work up to 15% in 401k contributions at the new jobPut more money into Beck’s UTMA (tabled for now)Contribute to new baby’s UTMA (ditto)Max out my Roth IRA for 2024Find new sources of income All good here!I’m set up for success. At this point, I just have to sit down and do the work. I enjoy working, so for me, that’s a good place to be.

August 2024 Freedom update bottom lineLink: Join Points HubI’m mentally steeling myself to go into full-time work mode again. This time, the house will be a little calmer because my oldest is heading to kindergarten.

I’ll use the extra headspace to take on extra work to generate revenue, both to catch up and get ahead.

I am fully cognizant that it’s now August 2024. I’m ready to get beyond this level. One good push could take me the rest of the way, so I’m preparing to wrap up this portion of my journey.

I also must say how incredible this community had been over the last month. Y’all know how to make a guy feel special. I hope I can return that in some way, whether it’s words of encouragement, being an ear, or just holding positive space. I’m ready to give back and feel both rested and energized for the next chapter.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.

July 22, 2024

Points Hub partnerships with PointsYeah and Foxtrot Dash—now live!

Points Hub is rockin’ and rollin’! If you haven’t heard yet, Points Hub is a paid membership community to talk all things points and miles.

The mission of Points Hub is to provide members with their best points and miles year ever no matter where they are in their journey, from beginners to experts.

Join us!

It’s an election year, in case you haven’t heard, so I wanted a space far away from social media. I find Facebook groups fatiguing because notifications and divisive posts are still there—and because most of them don’t allow member referral links.

There’s the value prop for Points Hub: Experts can talk with beginners, and beginners can, in return, learn and use referral links for credit cards and other products to begin their points journey.

It’s got a nice give and take, and there’s plenty of room for everyone—and now there are partnerships for even more added value for members.

New Points Hub partnerships with PointsYeah and Foxtrot DashLink: Explore Points HubLink: Points Hub + Foxtrot Dash Instagram Live replayExclusively for Points Hub members, partnerships add value to your membership and save you money on popular points and miles services. You can currently get:

PointsYeah : Exclusive 25% discount (worth $20) Foxtrot Dash : Exclusive free Max membership for a year (worth $50) through August 31, 2024PointsYeah and Foxtrot Dash are both robust search tools that help you find deals, get ideas, and wisely spend your hard-earned points and miles. Between the two, there are also guides, alerts, and booking concierge if you want additional guidance.

I also have a heap of upgrade coupons for:

AwardWallet : Free AwardWallet Plus upgrade for six months (worth $15)And I can’t say just yet, but there are a couple more partnerships arriving in the next few weeks that will add even more value and be of interest to points and miles folks.

Get 25% off PointsYeah via Points Hub

Member events and communityI’ve already had one member event and have another coming up this week. We’ll have a loose agenda and get to know one another to facilitate ongoing friendships and exchanges.

I’m super excited about this, and hope to ramp up to bi-weekly events on a variety of topics.

I’ve also recorded a course for beginners that I’m uploading and adding all sorts of guides and information throughout the space to make it a “hub” of points and miles information.

There are no credit card affiliate links anywhere in the space. Every link is a referral link from a community member. I’ve already used a member link to apply for a new card and hope to keep that going. Beginners and experts both are welcome to use and drop their links!

There’s also a nice app for iOS and Android that’s dedicated to the community. You can get alerts and access everything from any mobile device, so it’s pretty nifty.

Join Points Hub to get in on the ground floorPoints Hub just turned two weeks old and has ~30 members so far. If you’re ready to connect and engage with others interested in the space, you can get:

Pro Monthly – Just $5/month forever with coupon code OUTANDOUT -> Join now .Pro Annual – Just $99/year (10% discount) forever with coupon code HALFOFF -> Join now .Pro Lifetime – $99 for first 200 members. → Join now .Bottom lineLink: Announcing Points Hub: A new points and miles communityI’m thrilled to announce partnerships with PointsYeah and Foxtrot Dash. If you can use them, it’s a $70 savings and a big value add to what’s shaping up to be a fun and formidable community away from social media with its own space for members.

I’m committed to Points Hub for the long haul and ready to welcome new folks. Keep an eye out for a couple more partnerships that I think will be special and appealing (and add even more value to the membership).

I’ll need to increase the price at some point, but the links above are all valid for now. Get in and lock in the price while it’s still good. We’d love to have you!

July 16, 2024

Amazon Prime Day Deals July 16 & 17, 2024

$200 smackaroos and 5% back (note: it’s a Chase card)

Product DealsLink to all Amazon Prime Day dealsGovee 100ft LED Strip Lights for $11 after 50% couponLabel Maker Machine, Upgrade Version Bluetooth for $17.99 at checkoutPacking cubes (set of 6) for $9.96Amazon eero mesh WiFi system – router replacement for whole-home coverage (3-pack) for $99.99The Alchemist by Paulo Coelho (Kindle Edition) for $2.99Back to School Supplies starting at $1Shark Vacuums and Mops starting at $58.99Hydro Flask Tumblers starting at $24.95 (a personal fave)Nintendo Switch Games starting at $22.99Ring Video Doorbell – 1080p HD video, improved motion detection, easy installation – Satin Nickel for $49.99Device DealsLink to all Amazon device dealsAmazon Fire TV Stick for $17.99All-new Amazon Echo Spot (2024 Release) For $44.99Apple AirTags 4-pack for $74.98 (or one for $24)Apple AirPods 2nd Gen For $69Apple AirPods 3rd Gen for $129Apple AirPods Pro with MagSafe Case (2nd Gen, USB-C) for $169Apple Apple AirPods Max Wireless Over-Ear Headphones for $398 + 10% back with Prime Visa41mm Apple Watch Series 9 for $279 + 10% back with Prime VisaApple MacBooks starting at $799Smart TVs starting at $74.99Apple iPad (10th Generation): with A14 Bionic chip, 10.9-inch Liquid Retina Display, 64GB, Wi-Fi 6, 12MP front/12MP Back Camera, Touch ID, All-Day Battery Life – Pink for $299Apple iPad mini (6th generation): with A15 Bionic chip, 8.3-inch Liquid Retina display, 64GB, Wi-Fi 6, 12MP front/12MP back camera, Touch ID, all-day battery life – Starlight for $379Card-Linked Bank Program DealsAmazon: Get 50% off Amazon when Using 1 U.S. Bank Point (Max $20 Savings) through September 28, 2024Amazon: Get 30% off Amazon when Using 1 Discover Point through July 26, 2024Amazon: Add Citi Card & Get $15 Off (Promo Code 24CITIPD) through July 19, 2024Amazon: Add Discover Card And Get $20 with promo code 24DISCOPD until July 26, 2024Amazon: Get 40% off when Using 625 Capital One miles (Max $20 Savings) until July 19, 2024

If you can stack this, then…

Sign Up for Amazon PrimeGet a free 30-day trial for Amazon PrimeSwagbucks is offering a $15 Amazon gift card and TopCashback is offering $15 (referral link)Students can get six months for free (requires .edu email), then 50% off

Free for 30 days

Amazon Prime Day Deals 2024 bottom lineGo get ’em! I’ll post more throughout the day(s) as I find them!

July 8, 2024

Laid off again, up $13K, and starting a dream – July 2024 Freedom update

What a month already! A week ago, I was laid off from my job. It was my second layoff in as many years, just when I was starting to feel like I was doing well in the position. Oh well—it lasted a year. So that was how June ended.

It was a particularly nasty layoff: the kind you hear so much about on LinkedIn these days. I was shocked/sad/mad for about a day, then decided to move on. Easy come, easy go.

Here’s to more peaceful and prosperous times ahead

While I look for the next thing, I decided to go full force into creating a points, miles, and travel rewards community packed with info, courses, events, and more. I announced Points Hub on Friday. As of today (Monday), many members joined with a Pro Lifetime membership, which showed me how crucial this resource will be for so many people.

I’m still applying to full-time jobs on the side. I’m also making outlines for courses, adding info, and building the community at Points Hub. It’s just getting started, but already a blast. Come on in!

Also, spoiler alert, this is kind of an anti-update because, uh… no income at the moment. But this journey has its own life, so let’s see what’s up.

July 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardObviously the layoff deeply affected my finances. I lost my 401k, didn’t get any of the company match because of the vesting schedule (Which like, what company still does that in 2024? That always bugged me), lost health insurance for me and my family, and am only getting pennies as a severance. What a joke.

I already started transferring the 401k to Fidelity where I can invest in low-cost, broad-market index funds of my choosing, and will transfer the HSA account this week (also to Fidelity for the same reason). Despite this, my net worth went up this month.

Arcade lighting FTW

I of course don’t know how long I’ll be “unemployed” in the traditional sense, but it feels good to finally make a bet on myself and pursue a passion project until something pans out. The layoff was definitely the kick in the pants I needed to get Points Hub going, so it was a net positive in that regard.

Unlike when I was laid off last year, I don’t have that sense of rising panic. Instead, I know I have a lot to offer and am simply picking up the next thing. Is this… growth? (The devil on my shoulder is whispering “delulu” in my ear.)

This month’s progressThis month is/was an inflection point with my finances. To recap, I:

Got laid off aaaagain, dammitPaid down my credit cards as much as I could pre-layoff (which wasn’t much)Invested in my 401k and HSA before they were closedPulled back on spending as much as possible (but the kids need diapers, so no getting around that)Spent money on software to launch Points Hub—but already made it all back with membership sign-upsHad a busy week applying to jobs and launching my passion project

It’s actually taking

By the numbersI have no idea what these numbers will look like in a month. I have to make my car payment, but currently have no 401k or HSA to build. And, no sense of when the next opportunity will come along. I’m truly floating along and trusting the process. Here’s where I landed for the month:

CurrentLast MonthChange2024 Goal ASSETS Overall investments$311,576$295,867+$15,709As much as possible Roth IRA total$76,076$72,677+$3,399 Roth IRA 2024$2,700$2,700xx$7,000 (in new contributions) HSA$3,958$3,441+$182$6,000Done for now Taxable brokerage + UTMAs$3,936$3,776+$160$25,000 (total invested) Savings$2,073$1,989+$84$30,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITIES Car loan $24,715$25,014-$299? Credit card #1 (0% APR)$8,663$8,838-$175$0 Credit card #2 (0% APR)$11,815$12,055-$240As much as possible Net worth in Empower Personal Dashboard$333,007$320,018+$12,989$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITIES Car loan $24,715$25,014-$299? Credit card #1 (0% APR)$8,663$8,838-$175$0 Credit card #2 (0% APR)$11,815$12,055-$240As much as possible Net worth in Empower Personal Dashboard$333,007$320,018+$12,989$500,000 (overall goal)

Track your net worth with Personal Capital

The big news is I now have well over $300K invested. Now I’m working on my fourth $100K! I may have to dip into my savings, depending on how things go this month. But I’ve managed to leave it alone so far.

Freedom’s just another word for nothing left to lose

I don’t know when I can finish maxing out my 2024 Roth IRA. But I know how quickly things can change, so I’m ready for anything by this time next month.

Short- and long-term goals include:

Pay off credit cardsBuild my savings account again in 2024Work up to 15% in 401k contributionsPut more money into Beck’s UTMA (tabled for now)Contribute to new baby’s UTMA (ditto)Max out my Roth IRA for 2024Find new sources of income

Check out Warren’s latest art: “The Paper of Liberty,” mixed media on paper, 2024

July 2024 Freedom update bottom lineLink: Join Points HubThis month, a lot of life happened. Instead of lingering in bitterness, I jumped right into making one of my long-standing dreams a reality.  It may not improve my finances, but I’m following my heart—and that’s value of another kind.

It may not improve my finances, but I’m following my heart—and that’s value of another kind.

I know there are many travel rewards groups in an already crowded space, but I don’t care. I’m putting everything in a centralized location, making courses for beginners, and working on features no other group has. I decided to go with a membership model to weed out lurkers and because what I have to share will return ongoing dividends.

I set out to provide real value in a community setting and after only a few days in, I can feel the energy buzzing through this new project. This is your invitation to join Points Hub. I have some $99 Pro Lifetime seats left (limited to the first 200 sign-ups), so snag one before they disappear.

Financially speaking, I have no idea where any of this is heading, other than making a big trust fall to the universe. But my net worth is up $13K, life is good, and I’m busy working. Sometimes I feel like I’m watching myself from the outside when I write these updates like “What’s gonna happen next?” Whatever happens, I’ll be back to update in another month or so. Here goes… somethin’!

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.

July 5, 2024

Announcing Points Hub: A new points and miles community

I’ve been working on a new points and miles community, and I’m excited to launch it! It’s called Points Hub, hosted by Circle Communities.

It’s a paid membership community that has features you’re probably used to—and others that are new and exclusive.

Points Hub is here

It’s a really cool space, so let me tell you more about it.

Announcing Points HubLink: Explore Points HubI’ve thrown around the idea of making a community for a while. At first, I thought it could be on Slack, Facebook, or even Substack. I liked the quick, casual nature of Slack, the posting ability of Facebook, and the members-only areas of Substack.

Then, I found two SaaS membership options that had all of these: Mighty Networks and Circle. Mighty Networks felt too cluttered. I landed on Circle, and wow: The interface is clean and simple, with powerful features that promote discussion and connection.

I also like that it’s NOT part of a social media platform. I’ve personally been moving away from social media, mostly because of endless notifications that aren’t relevant and endless doom scrolling.

So simple

I thought about the community I’ve always wanted to have, what would’ve helped me in the beginning, and what I value about groups I’ve loved in the past. A lot of thought and love went into making this, and it’s well worth the price to join.

What Points Hub offersDedicated spaces for Women, 2SLGBTQIA+, and BIPOC, which are historically underrepresented in travel/points & milesBeginner courses. I’ll explain the nuances of this hobby with videos, links, and diagrams. Currently working to get the first one up and running!Regular events to connect with others in the space. We’ll have loose agendas and topics, with a low-key, conversational feelCommunity experts including myself and some of the best friends I’ve made in my points & miles journey to keep conversations goingMember referral links allowed so members can earn points, miles, or cash from sharing credit cards and other servicesApp access so you can interact from any mobile device and have a dedicated space

I’m really proud of everything here, particularly the beginner courses and ability for members to share their referral links.

With the courses, I’m going to break down what beginners need to know to get started without feeling overwhelmed.

Your referral links welcomeMember referral links are not only allowed, but encouraged. That way we can keep it within the community and help one another. Most groups don’t allow this at all, so it’s a huge perk that sets Points Hub apart—and can be well worth the price of admission.

Planned partnerships and roadmapsI’ve got some fun offers up my sleeve: Think travel-related discounts and special access to services. I’d love to expand the partnerships to deliver ongoing value and engagement. The first conversations have begun—so don’t miss out. I’ll post them as they go live. Some are ongoing, but others will be limited-time only.

There’s also a roadmap. As the project iterates, I’ll improve features members love and use and get rid of fluff that’s not working. And believe me when I say I want to hear from members about what they want.

What Points Hub doesn’t offerJudgement, snarky comments, or rudeness. I think a space where kindness is the norm is SO refreshing (no FlyerTalk vibes)Clutter. A clean, simple interface that’s easy to navigateDistraction. Again, Points Hub is not connected to social media, allowing for a focused experienceAffiliate links. No allegiances here, which allows members to talk openly without hidden agendasExclusive Out and Out reader coupon codesThere are two membership levels and one special offer: Pro Monthly, Pro Annual, and Pro Lifetime.

Pro Monthly is just $9 a month and Pro Annual is $99 a year (10% discount).

However, you can lock in lifetime access with Pro Lifetime for a one-time fee of only $99—strictly limited to the first 200 members. After that, the coupon code will expire. Everyone who purchases Pro Lifetime will also get a “Founding Member” badge automatically applied to identity them around the community.

If you’re reading here, I’ve prepared two forever coupon codes for you:

Pro Monthly – Just $5/month forever with coupon code OUTANDOUT -> Join now .Pro Annual – Just $99/year (10% discount) forever with coupon code HALFOFF -> Join now .If you’re all in and know this is an incredible community (which it is) that will offer tons of ongoing value (which it will), you can sign up for the limited lifetime membership:

Pro Lifetime – $99 for first 200 members. → Join now .This is a special launch tier that I recommend if you feel called to the benefits and features described above.

Bottom linePoints Hub is launching. Join me on the ground floor, because we’re going up up up!

I’ve always wanted a place to talk shop away from social media with people that want to share their knowledge and also learn—that could be symbiotic to so many conversations. And a place where beginners are comfortable joining the conversations without fear of snark or confusion.

I’m burned out on Facebook (and social media in general), and the idea of a private community that’s a central spot is really appealing. I’m still going to post here on BoardingArea and envision Points Hub as a way to have conversations and connect with even more new people in the community.

So, you are invited to join Points Hub, and I hope you will. I’ve been working on this group for many midnights by now and felt like today was the right day to put it into the world. So now it is. See you there (and here, too)!

There’s a lot of good energy flowing through this project already. As always, thank you with my whole heart for supporting this scrappy publication that’s been around for over a decade now. Here’s to the next part of our points & miles journey.

June 2, 2024

Midyear goal transparency and up $10K – June 2024 Freedom update

Now that the dust has settled on the house sale, I can more fully take “stock” of my financial situation. I’ve been stressed about it for a few weeks, but ready to lay it out in gleaming detail.

Turns out, months of two housing payments, moving a house full of stuff across two states, and the birth of a child will really put a dent in your short-term financial goals.

The beach in Arkansas was so nice

I put a lot of expenses onto two 0% APR credit cards, figuring I’d use the money from the sale to pay them down. Well, I barely touched them before the money was gone from other things (which I detailed in the last two updates).

But it’s good! I have a few months to figure out how I want to approach everything and in the meanwhile, I’ve completely retooled my midyear goals now that we’re halfway through 2024.

June 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardI am transparent about my financial journey, and these past few months have been clear as mud. Both are true.

There were a lot of expenses flying around from the hospitals and insurance company, and getting the house ready to sell came with extra expenses like removing trees and little repairs.

I wasn’t sure what was going on with my HSA either. I depleted it to pay bills, but didn’t know when the expenses would stop. Now that the baby is five months old, I’m fairly sure I’m done paying everything? I was also waiting to receive my escrow funds from the old mortgage company (which I have now received).

A bucolic park with a paved walking path

Daily life expenses have been outrageous. I can’t believe how much we spend on groceries and at Costco each month.

Ughhhh

I also missed a step coming down the stairs last week and landed hard on my left foot and ankle. I heard a pop and sat there in shock for a few moments before sharp pain flooded in. Nothing was broken, but it really, really hurt (and still does).

So I went to a doctor and got a boot and pain medicines that have been making me super woozy. I haven’t been able to do as much with the kids or around the house, but it’s given me the luxury of time to think. I can either:

Find a side hustle to pay things down fasterGet another 0% APR card and give myself wiggle roomPause my 401k for a while to get caught upDo one, two, or all of these and really triple downThis month’s progressTo recap this month, I:

Paid down my credit cards as much as I couldContinued investing in my 401k and HSATook a vacation that cost ~$1,000 and realize now it was a poor financial decisionSpent an insane amount on groceriesUsed time and energy to rehabilitate my sprained ankle and footReflected on how I want to move forward and what my financial future might look likeAlso check out my boot:

lol ow

Want to touch on that $1,000 vacation real quick. I took my dad stepdad, and our family of five to Hot Springs Village in Arkansas for a weekend. There aren’t any points hotels there, so I paid cash for the rooms, figuring it would be fine. And then we did it. I got the bill.

I didn’t anticipate this month would be so tight, or that I’d come back and sprain my foot. I’m not exactly regretting the trip, mostly just wishing I had more funds to travel (and that travel was easier right now). But it’s just the season and there will be many more travels for all of us. I just wanted to expand on that line item in case you were like uhhhh what was that?

By the numbersSo by now, we all agree that I will not meet my $500,000 goal by August 2024, yes?

It was an audacious goal that originally didn’t involve kids in the mix. It was also before the pandemic, the current political unrest, and interest rates and home prices going through the roof, if you’ll excuse the pun. All that to say: a lifetime ago.

You’ll notice I’ve added my HSA as a new asset. I don’t intend on spending much more out of it this year (though of course anything could happen). There’s $1,000 in cash and the rest is invested in broad-market index funds.

I also added my car loan and two 0% APR credit cards. The rate on #1 expires in September and #2’s expires in October. I will figure out what I want to do about those in a couple of months.

CurrentLast MonthChange2024 Goal ASSETS Overall investments$295,867$283,058+$12,809As much as possible Roth IRA total$72,677$70,780+$1,897 Roth IRA 2024$2,700$2,700xx$7,000 (in new contributions) HSA$3,441xxxx$6,000 Taxable brokerage + UTMAs$3,776$3,674+$102$25,000 (total invested) Savings$1,989$1,989xx$30,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITIES Car loan $25,014xxxx? Credit card #1 (0% APR)$8,838xxxx$0 Credit card #2 (0% APR)$12,055xxxxAs much as possible Net worth in Empower Personal Dashboard$320,018$310,416+$9,602$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITIES Car loan $25,014xxxx? Credit card #1 (0% APR)$8,838xxxx$0 Credit card #2 (0% APR)$12,055xxxxAs much as possible Net worth in Empower Personal Dashboard$320,018$310,416+$9,602$500,000 (overall goal)

Track your net worth with Personal Capital

I don’t intend to pay off my car loan quickly – just adding for completeness.

At this point, my income is devoted to paying credit cards and rent for the foreseeable future. After that, I’d like to build my savings up and get to a place where I’m investing everything else.

Let’s goooo

Also, did you see I have nearly $300,000 invested? I should cross that milestone in July and am super excited about that, even with everything else happening.

Short- and long-term goals include:

Pay off credit cardsBuild my savings account again in 2024Work up to 15% in 401k contributionsPut more money into Beck’s UTMA Contribute to new baby’s UTMAMax out my Roth IRA for 2024June 2024 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)It feels like I have two options. I can either increase income or slash spending (or both, for a third option). But as the primary support for our family, expenses are literally unpredictable. Someone is always sick, or needs something, or things break, or a zillion other things.

I’ve been feeling like I can’t get ahead of it lately. It’s been hard to stay positive about it. I know I have several options.

I need to figure out a plan and be honest with myself about how much I can actually handle. My extra energy appears so limited these days, like I don’t have time to try things out or experiment. Like I need all my shots to be sure and stick.

I know it’ll be alright, but as I type this with a throbbing foot, I’m decidedly grumpy about the forecast and performance for this month.

That said, I hope the addition of literally every single line item of my finances will promote transparency—even when things aren’t totally amazing. I’ll set my mind to thinking these things over and update y’all on the plan next month.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.

May 10, 2024

Down market and a huge $50K hit after selling house – May 2024 Freedom update

I’ve been semi-avoiding writing this update to detail this month’s huge losses, but eat the frog, as they say.

The Oklahoma house sold, April 2024 was the first losing month for the S&P 500 after five positive months in a row, and the house sale money was gone in a poof.

We went to Chicago for five days!

I used the money to pay down debt, start on my 2024 Roth IRA, and build up my savings a bit. But, to further illustrate the losses, I invested ~$4,000 but my investments are only up $435 for the month.

I also might’ve been overestimating my old home’s value and didn’t include transaction fees against my net worth in previous updates. But now the house is gone, and so too are the mortgage and equity estimate from my net worth calculations.

Now that I’m renting again, maybe this is a more “pure” version of calculating net worth. All that to say, it was a rough month—and I am down nearly $53,000.

May 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardAnd what about the tax sale? There were a few properties that I bid on, but I was quickly outbid.

I saved the money from the sale (about $35,000) and was willing to use it all on a valuable deal. But it was competitive, and I bid up to the max. Some of the houses went to the hundreds of thousands. Like I said last month, it was my first rodeo. There’s another one in October. I will follow these for a while as I build up my savings.

Warren watching from the CTA train in Chicago

As soon as I got back from signing the papers in Oklahoma, we went to Chicago for five days. That was extremely challenging in many ways.

It was the new baby’s first flight—and Beck’s (he’s 1, almost 2). New baby was only 3 months old. I still can’t believe we did it.

The flights to/from Memphis were a little over an hour each. Not bad, but they were loooong hours. Getting on and off was by far the hardest part.

Now that I’m relieved of the extra house payment, I can focus on investing and saving.

This month’s progressAs far my goal to save $500,000 by August 2024, I’m letting go of that. Barring some miracle, the odds are against me now. It’s OK. The biggest thing is that I’m tired of hovering around the $300K mark despite all my efforts.

But of course, there is much more going on in the world now. It just means I’ll have more time to blog about than I originally thought.

Also, I’m currently less than $15,000 away from having $300,000 invested, and that’s a fantastic achievement on its own.

Pretty sunsets during these spring nights

For the first time in a while, I don’t have a side hustle. I’m mostly too tired these days. Not that I don’t have ideas. I’ve just been content to work my day job and spend time with the kids in the evenings. Then I go to bed. The weeks fly by this way.

Also, anything could happen. One good month for the market could boost me closer to $400K. I also think that, following the house sale, it’s just gonna take some time to find a new equilibrium. But all good.

To recap this month, I:

Added $2,700 to my 2024 Roth IRAContinued investing in my 401k and HSASOLD A WHOLE ENTIRE HOUSEPaid rent with my Bilt Mastercard and am earning Bilt pointsAdded nearly $2,000 to my savings accountPaid down debt accrued from the last few months of life and getting the house readyDid not buy a tax sale property, though it was an amazing learning experience for the future

Now I’m a t-ball dad

By the numbersSince pulling these numbers, I’ve already gone up another few thousand. But this was where I was at a few days ago. It felt grim at the time. But here’s where it all stands.

CurrentLast MonthChange2024 Goal ASSETS Overall investments$283,058$282,623+$435As much as possible Roth IRA total$70,780$69,455+$1,325 Roth IRA 2024$2,700$0+$2,700$7,000 (in new contributions) Taxable brokerage + UTMAs$3,674$3,731-$57$25,000 (total invested) Savings$1,989$495+$1,494$30,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITY ??? Net worth in Empower Personal Dashboard$310,416$363,002-$52,586$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITY ??? Net worth in Empower Personal Dashboard$310,416$363,002-$52,586$500,000 (overall goal)

Track your net worth with Personal Capital

You’ll notice I removed the real estate numbers and still haven’t added my liabilities. I thought about adding my car payment for my van and another credit card I’m working to pay off in the background.

Le sigh

Short- and long-term goals include:

Build my savings account again in 2024Work up to 15% in 401k contributionsPut more money into Beck’s UTMA Contribute to new baby’s UTMAMax out my Roth IRA for 2024Buy more propertyMay 2024 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)Another saying: You can’t improve what you don’t measure. I’m glad I’m doing this. This month felt hard in many ways, and I have hugely mixed feelings about selling the house. On the one hand, it needed more ongoing upkeep that I could manage from afar. On the other, that housing payment was so low and I wish we could’ve made it work.

But, the golden handcuffs are off. And I do look forward to whatever’s going to happen over the next few months. If this month has shown me anything, it’s that wild swings are back on the table. For now, I’m doing t-ball a few days per week with Warren and enjoying the weather before it gets too incredibly hot.

Money stuff is always operating in the background, and I enjoy these forensic-style snippets even if this one was on the losing end. Even so, I’ll stick to the plan and report back in a few more weeks!

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.

April 3, 2024

House sold, shifts ahead, and planning for a tax sale? – April 2024 Freedom update

The Oklahoma house is closing on Friday after being on the market only 6 days. I’m thrilled, sad, nervous, etc.

Thrilled to no longer make two housing payments, sad because a ton of bad stuff happened to us in that house, nervous because I don’t want any last-minute surprises, and etc. because.

THIS BABY. Three months old

I’ve been using my credit cards to get us through this patch and very much looking forward to paying them off with the money I get from the sale.

But I also discovered a tax lien sale and have a few properties on a watch list. The auctions are in late April. So, I’m going to hold the money for a few weeks and see what I can do there. If nothing, then I’ll eradicate all my credit card balances.

And if so… well, I still have until October with my 0% APR rates. Either way, not too worried and seeing a lot of upside and potential.

One thing is certain: My net worth will see BIG gyrations this month. I am more at peace with it now, yet I remain hopeful.

For one thing, I didn’t factor in the $20,000 it would cost to sell the house…

April 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardThe baby is doing so good. She’s sleeping more and has already doubled her birth weight. She’s three months old and so precious. We’re all settling after many recent transitions.

Mood AF

I’m traveling tomorrow to get the house sold. I think I’ll get around $36,000 after everyone gets their cut. I was hoping for $40,000, so that’s pretty close; I’m pleased.

I’ll be removing the house as an asset and the mortgage as a liability from my net worth calculations after it’s paid. I’ve been using Zillow’s “Zestimate” (which was actually super accurate in this case), but didn’t factor in transactions costs… so that will drop my net worth.

I’ve diligently kept contributing to my 401k and maxed out my 2023 Roth IRA, and last month saw 10% gains in the stock market.

So, those things could cancel each other out. At that point, most of my net worth will be my investments (which are sooo close to $300,000), and the market will dictate a bigger slice of it.

I am eager to see what happens in April 2024. I just have this feeling like… something big is going to happen.

I’d love if one of the tax sale properties worked out. Even if it did, that’s a chick that could take a year to hatch because of the redemption period (where the owner can come forward and pay the taxes to get the property back). And even if, the interest rate is 12%, so it’s all a win-win: I either get high interest or a new property. Or nothing—this is literally my first rodeo.

This month’s progressIt’s been hard to stay afloat. Everything helps, but having two housing payments and keeping five mouths fed and five booties wiped and/or diapered is soul-crushingly expensive. Though I realized nearly $7,000 in stock gains, I had to float expenses on credit cards and that resulted in a small overall gain of “only” $1,442.

Also, selling a house is expensive. The buyer’s insurance company required that I trim one tree and take down another. Well that was $1,000. Then the inspector came, and I had to make some small repairs. Those were another $1,000. Plus I’ve been paying two power bills, two water bills, two trash bills… Not to mention all the other little crap. It’s all been so much.

But I got paid a week ago and thought, you know what? I’m gonna max out my 2023 Roth IRA while I still can. So I did.

BOOM. This felt so good

I’d been meaning to complete that goal for a while and decided everything else could wait for a moment. Now I can start on my 2024 Roth IRA and my other financial goals. Selling this house is going to free up a lot of money that was getting eaten by maintaining it and getting it ready to sell.

I’m breathing a big sigh of relief, and feeling this is a huge weight lifted. It feels like my 2024 can really start now.

Check out this cute n cozy situation

To recap this month, I:

Maxed out my Roth IRA with the last $2,500 stretchContinued investing in my 401k, HSA, and Roth IRAPut $1,000 toward SCHD (Schwab US Dividend Equity ETF), a high-dividend stock in my Roth IRA—curious to see how that performsPaid rent with my Bilt Mastercard and am getting into Bilt points all over againStill got more gains from a strong stock market to reach another new net worth high, even if it wasn’t “much”Spent thousands to get the house ready to sell (what a racket)By the numbers$363,000. Wow. Getting closer to that $400K mark. Then that last $100K toward my $500K goal should go a LOT faster than my first $100K.

Here it all is, in cold blue daylight:

CurrentLast MonthChange2024 Goal ASSETS Overall investments$282,623$275,652+$6,971As much as possible Roth IRA 2023$69,455$65,731+$3,724$6,500 (in new contributions)COMPLETE! Roth IRA 2024$0$0xx$7,000 (in new contributions)Starting May 2024 Taxable brokerage + UTMAs$3,731$3,634+$97$25,000 (total invested) Savings$495$418+$77$30,000 Primary home equity + appreciation$56,224$61,524-$5,300$70,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITY TDB??? Net worth in Empower Personal Dashboard$363,002$361,560+$1,442$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITY TDB??? Net worth in Empower Personal Dashboard$363,002$361,560+$1,442$500,000 (overall goal)

Track your net worth with Personal Capital

Warren wrote “Dad” in sidewalk chalk

I’m moving a lot of money around this month. I also went ahead and decreased the value of my van and hatchback (the van has a payment, the hatchback is paid off). That shaved off $3,000. I used the Kelley Blue Book values and rounded down to the lowest number, to keep myself nice and honest.

Once I pay down the credit cards and build savings, I’d like to pad out the kids’ UTMA account and contribute more to my 401k. Maybe later this year (?!).

Short- and long-term goals include:

Build my savings account again in 2024Work up to 15% in 401k contributionsPut more money into Beck’s UTMA Contribute to new baby’s UTMAMax out my Roth IRA for 2024Buy more propertyApril 2024 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)Warren starts t-ball at the end of the month, and we’re hoping he can burn off some energy and meet kids around the neighborhood. He’s ready to start kindergarten in a few months. I look forward to traveling more, as always. We’re going to Arkansas next month for a family vacation.

This month finds me optimistic: Things are happening, working out, moving quickly. I genuinely have no sense how these changes will reflect in the next update, so I have the wonder of an onlooker in a way.

We are all healthy and getting outside nearly every day and that has felt so good in my body and spirit. No matter how much you have or save, you’ll never have anything without your health. What’s the point of being a millionaire if you’re too sick to enjoy it?

I am putting my health first and may get an Apple Watch soon to help me track my fitness goals. I’ll be 40 later this year and want to begin my next decade on a high note. I’m always amazed at how connected everything is. The kids are growing, I love and am loved, enjoy my work, and get to see my family often. Life is good.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.

March 4, 2024

New city, new energy, and up $12K – March 2024 Freedom update

Bye, Oklahoma! A lot happened there—like, a LOT—and I’m glad to say goodbye to that place. As of this month, we’ve officially moved for a better school district and to get a fresh start. I first moved to Oklahoma City in October 2021.

I was sad for a week but over it now

Our old house is listed for sale as of March 1.

Considering August 2024—seven more months—is the goal date to save $500,000, that could push me ahead, move the dial back, or be uneventful. I already got the estimated proceeds of how much I’ll get if it sells for the listing price.

Also, until it sells, I’ll pay rent for our new place plus mortgage on the old place. We’re renting now which feels… different after owning my house (and before that, a condo). So far, it’s been freeing not dealing with the stuff of ownership.

I’d like to buy again eventually—but, one thing at a time. Anything could happen this month (this year, this lifetime). But in this moment, I’m at yet another net worth high (and will never tire of typing that).

March 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardPraying the house sells fast so I can tightly close the Oklahoma chapter. I thought about keeping it as an investment property, but it isn’t ideal for that.

I hate to give up that sweet 3% mortgage rate because that is NEVER coming back, and my housing payment will never be that low again. But it was time.

Since we left, our family has experienced a lot of healing. That, combined with the overall sense of peace I have about everything, makes it more than worthwhile.

Our old living room

Between the new baby’s birth (we have an eight-week-old baby girl), the move, and having to pay for two places for a while, it’s been tough financially and I am fraying. But I’ve maintained my 401k contributions and should be able to pay off any lingering debt—and invest again—after the house sells.

The main area I want to focus on is padding my savings, because it’s dismal. I’ve blown it all on the many things we’ve experienced in the last year or so.

This month’s progressShould probably be “this month’s setbacks.” Yet, somehow my investments are buoyant enough to keep me afloat despite all the expenditures. It’s incredible how they have a life of their own.

A whole house worth of stuff in one room

The move cost about $4,000, and I had to come up with a security deposit on the new place. I also spent money on food, gas, packing supplies, a few small repairs, things we needed to get moved in, and of course, every grocery trip is $200 minimum.

I got my tax refund, which was ~$3,000, but that went toward repaying everything. We’ve crash landed a bit in this new place, and it’ll take a month or two to regain balance. For now, I’m going with the flow and looking ahead to sorting things out one bit at a time.

To recap this month, I:

Spent $4,000 to move out of OklahomaGot a $3,000 tax refund, which is already *poof* gone Rented a new place and paid a security deposit, pro-rated rent, and first month of rentContinued paying my mortgage and hoping the house sells like, today Upped my 401k contributions by a percentage pointStill got more gains from a strong stock market to reach another new net worth high

Rented a new place and paid a security deposit, pro-rated rent, and first month of rentContinued paying my mortgage and hoping the house sells like, today Upped my 401k contributions by a percentage pointStill got more gains from a strong stock market to reach another new net worth high

These sweet brothers

By the numbersWhew! I’m amazed at what a release this is, to type it all up in this way. It feels like a lot and it is. Deep breath.

CurrentLast MonthChange2024 Goal ASSETS Overall investments$275,652$263,526+$12,126As much as possible Roth IRA 2023$65,731$63,213+$2,518$6,500 (in new contributions)$4,000 so far! Roth IRA 2024$0$0xx$7,000 (in new contributions)Starting May 2024 Taxable brokerage + UTMAs$3,634$3,495$139$25,000 (total invested) Savings$418$472-$54$30,000 Primary home equity + appreciation$61,524$53,005+$8,519$70,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITY TDB??? Net worth in Empower Personal Dashboard$361,560$349,887+$11,673$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITY TDB??? Net worth in Empower Personal Dashboard$361,560$349,887+$11,673$500,000 (overall goal)

Track your net worth with Personal Capital

My biggest takeaway this month is: After the house sells, I need to rebuild my savings.

That’s been a weak link for a while, and it’s time to focus on that. I’ve been prioritizing investments, but these last few months highlighted the need for sweet liquid cash.

Other than that, wow, compound interest is magic.

Somewhere over Arkansas

Short- and long-term goals include:

Put more money into Beck’s UTMA Contribute to new baby’s UTMAFinish maxing out my Roth IRA for 2023 (next month is the deadline!)Build my savings account again in 2024Start on 2024’s Roth IRAWork up to 15% in 401k contributions this yearMarch 2024 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!!I was in this exact scenario in April 2020 with selling my Dallas condo. Of course, that was mid-pandemic and three kids ago, but it’s not lost on me that I’m once again repeating this pattern.

Nor that, like then, I’m at another new net worth high. I’m also feeling grateful that my past self built a set of investments that live and work completely outside anything that’s going on in my life—no matter how big or small my personal changes are.

Back then, the condo eventually sold and I got the money and life continued. I’m certain that will be the case again as I continue to vault toward the $400,000 mark. And it’s so crazy to me that my investments are about to touch $300,000: my third $100K.

I’m at peace with everything that’s happened in the last month. Moving was good and necessary to be away from a place that contains so much (good AND bad) history for our family. But now we’re starting a new phase, Warren will soon begin kindergarten at a fantastic school, and we’re in a community where we can move around and be physically active. Plus, we feel much more supported—which is worth everything and more.

Seven months to go until August 2024 (the date I originally wanted to reach my $500K goal). No doubt there will be (seven more ) shifts until then. As long as I’m into the $400s, I’m good. Now I want to see how far in I can push it. I watch with invested (lol) yet detached amusement.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.