Harlan Vaughn's Blog, page 4

August 25, 2023

Yotta review: A savings account that lets you gamble in a daily lottery for free

Savings and gambling! What could go wrong?

Yotta, an online-only savings account, lets you play the lottery in such a way that you always win. Or at least, never lose.

Instead of earning interest like other high-yield savings accounts (where interest rates are currently 4% or more), Yotta pays you in daily lottery tickets with drawings up to $1 million.

Fascinated? Horrified? Maybe a little curious? That was my initial reaction.

Also, why not?

When I saw their partner banks are FDIC-insured and then literally 1,000s of 5-star reviews on the App Store, I decided to throw in $100 bucks (which gets me 4 free daily tickets) just for fun.

I don’t have to pay for these tickets, and on average, Yotta claims to return 2.70% APY with winnings included.

But let’s be real. Yotta is about the thrill. The dream. The “what if?” The “somebody’s gonna win, and it could be me!”

Hey, in this world, we need to have fun whenever we can. And if Yotta gives you a daily boost of feel-good chemicals well… that’s worth it.

My Yotta reviewLink: Join Yotta and get a Loot Box with free tickets!I joined Yotta, read through the site, and downloaded the app. “Fine,” I thought, “Count me in for $100.”

I connected my bank, but there’s no way for Yotta to “pull” money in. Instead, you have to “push” it in from your external account. I found that weird and a little red flag went up.

I actually put my phone down and thought, “I’ll come back to this.” And it was like a little seed was planted.

I want in!

I noticed Yotta reliably pays out over $10,000 daily to 35,000+ winners.

People are getting money in there somehow, I reasoned. And I didn’t want to miss out on the fun. In a moment of delirium, I found I could Zelle money into the account.

Bing bang boom

Within literal seconds, the money was in my Yotta account—and I even got some bonus tickets for making the transfer.

Then I was off to the races. Here’s how it works:

You get 1 daily ticket for every $25 in your account (so my $100 gets me 4 free daily tickets),Drawings are every night at 9pm Eastern. You can either pick numbers or go random (like any other lottery).If you win, your money is in your account immediately.There are opportunities to score extra tickets.There is no out-of-pocket expense, and the more you save, the more free daily tickets you get.What a truly fun incentive to save money! As noted, the normal APY is only .02%, but with winnings it’s closer to 2.70% APY.

Can you do better than this? Absolutely. But for my $100, the difference in interest is literal pennies—and I love the anticipation this gives me each day.

Comparison with other savings accountsMy Citi Accelerate account has a 4.25% APY. I keep $500 in there to keep it free. Here’s my interest payouts from the last few months:

Not even a full $2

Nothing life-changing. For the 4 free daily lottery tickets, those are worth much more to me—even in entertainment value—than the under-$2 monthly payouts I’m getting on my $500 balance.

So unless you’re savings $1,000s of dollars, the APY thing isn’t going to amount to a hill of beans.

More about YottaYotta offers a debit card with more bonus incentives, loans, and even a credit card. I don’t plan to bank, or store very much money, with Yotta, so these don’t interest me.

The way I see it, this is low-risk thrills with a fun concept and slick execution, and their partner banks, Evolve Bank & Trust and Thread Bank are FDIC members insured up to $250,000.

And then I started thinking: Lottery? What lottery? Like, Mega Millions? Powerball?

Nope. Yotta has their own internal lottery and the top prize can vary daily. Usually, it’s $1 million but in the past has been lower, or something else, like a new car. But for the most part, they stick to their script.

Fun!

They claim to’ve paid out over $17 million so far, which is pretty cool.

Another thing to know: if you win less than $600, it’s yours to keep. If it’s over $600, you’ll get a 1099 and will need to claim the winnings on your annual taxes.

So while all of this is really cool, the thing that really drew me in was the app’s security. They send me a text every single time I log in, and the “having to push money” thing is to reduce fraud. They also collect your real, legal details upon enrollment.

In the end, the security, app reviews, and fun concept are what drew me in. There are no fees whatsoever, and they’re been around for a few years—so they’ve had time to work out the kinks.

Yotta review bottom lineLink: Join Yotta and get a Loot Box with free tickets!And that’s the story of how I play a lottery for free every night.

If you’re interested, Yotta also offers a full suite of banking services. The debit card looks interesting, but I prefer to use rewards-earning credit cards and I bank with Fidelity’s Cash Management account, with no interest or capacity to switch right now. Plus, it takes me a long time to build up loyalty.

But I’m having a blast otherwise. The app is easy to set up, everything runs well, and I’ve had zero issues. I haven’t won so far, but my hope shines eternal.

Wanna join? Use my Yotta link and we’ll both get extra tickets and you’ll get a “Loot Box” with a few welcome goodies in there.

Have you used Yotta? If so, how’s your experience been? And if not—will you join?

August 24, 2023

I bought land on the internet and earned credit card rewards

Just what the headline says: buy land with credit card. I think it was purely luck. But now I’m wondering if I could do it again.

Plus the document fees, which were another ~$300

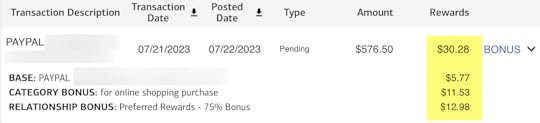

I paid with my Bank of America Customized Cash card, had my bonus category set to “online shopping,” paid through PayPal and earned full + bonus rewards for the purchase.

I’ve been trolling eBay looking for other parcels. So far, I haven’t found anything as sweet as the one I bought, but there have been a couple where I came close.

Questions I immediately had were:

Is this legit?They’re selling the crappiest lots, right?There could be soooo many issues with the land, the title, the neighbors, access, easements…….Here’s what I’ve discovered so far.

Buy land with credit card? Apparently yes!I fell into the rabbit-iest of holes one night on eBay of all places. For whatever reason, I was thinking about how you could buy a whole house in Detroit for beans in the middle of the financial crisis.

Wondered if that was still a possibility.

Turns out, it is. There are houses and plots of land at all price points, starting from literally $1 with no reserve to “buy it now” offers to huge $500,000 tracts to yep, some totally shady stuff.

My land is somewhere around here

I learned how to cross-check and research using county tax assessor property records, Google Earth, and sales history. This is exactly the kind of research-driven thing I love.

There are a lot of pitfalls and things to watch for—there are also some real diamonds in the rough out there.

Once I found and researched the parcel, I noticed the seller accepted PayPal as a payment method, which got me thinking… could I really use a credit card to buy that plot?

I figured if I could try it for $300ish, I could pay it off right away if it codes as a cash-like purchase or similar. And if not, then yay! I have a piece of land and some added rewards.

Sale ends, credit card comes outSo I won the auction. The PayPal option popped up. I typed in the info and waited for the purchase to post.

Hit all the right categories

Not only did it code as an online purchase, but I also got my Preferred Rewards for being a Bank of America Platinum Honors customer. The limit is $1,500 in all combined bonus categories per quarter, so this purchase put me right up to the edge for Q3. I earned 5.25% cashback.

I kinda can’t believe it worked. Then I thought… what else is out there?

What I checkSo I literally don’t care what the land I bought actually looks like (I am going soon to check it out in person, though.)

At the price I bought it, I consider it the tuition for learning about this stuff. Some of the parcels for sale are genuinely valuable and desirable. I see many auctions with anywhere from 20 to over 100 bidders. I’m thinking exclusively long-term with this.

The immediate issues are easements and access. If there’s not a road (dirt, gravel, paved, or otherwise) in front of the plot, that means you’ll have to cross someone else’s land to get to yours. An easement may be recorded with the deed to address this issue, but for raw, vacant land—probably not.

Gotta love being next to that government land (this is another parcel of mine)

I don’t want to deal with issues of easement or access, so I avoid those. Although I can see the value in them: Maybe 20 years from now, someone will buy you out to expand their own property.

I verify the parcel with the local government records, then check it on a variety of terrain maps. If there’s a road, it’s usually visible on one of these. It’s a good sign if you can see homes nearby. That means there’s probably electric service available and maybe a sewer system.

If all you want is raw land, this doesn’t matter. But if you think you want to build, that’s good info to have.

What else I checkIt’s also important to check the sales history as much as you can to see if anything looks wonky in the chain of title. Of course you can never really know without paying a title company and/or buying title insurance—and I would for an expensive plot—but if all the exchanges have been through warranty deed with clean sales and the taxes are paid current (which you can also check on the county tax assessor’s site), you can be reasonably assured there aren’t liens on the property.

You can also check the circuit clerk’s office by typing the previous owners’ names and seeing if there are any claims against them.

It really doesn’t take that long, and I find it all really interesting. I check everything on the county tax map, then dig in more if I have interest.

I also check the terrain. Is it near a body of water? Is it fully wooded? What’s nearby? How close is it to… stuff?

You can type any address into FEMA’s flood maps to see if flooding is an issue. If it is, know that flood insurance is expensive if you ever want to build. If you just want it for hunting or camping, then it’s whatever. But something to be aware of, anyway.

Why I’m interested in thisLong-term, the value of most land will rise. I do NOT think of this as an investment. Not for me, anyway. Maybe for my kids—or their kids. In my lifetime, these plots probably won’t do diddly.

It’s something I want for myself because I think it’s neat. But I’m really hoping it will one day be something nice for the next generation(s).

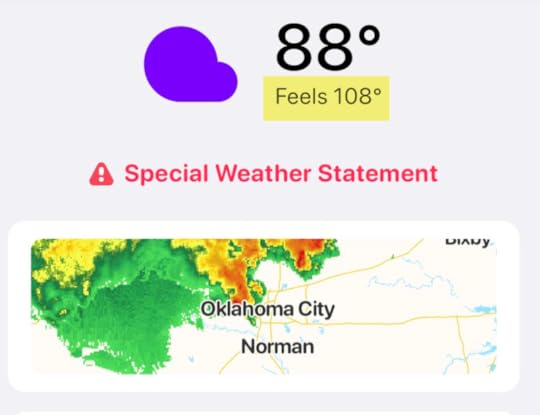

I’m also thinking about climate change. I will not buy anything in the desert Southwest, California, most of the Southeast, and definitely not Florida or anywhere coastal.

Instead, I think north and toward the middle is the way to go: Michigan, Wisconsin, Western New York, Minnesota. They are prime to withstand rising temperatures, and all have access to fresh water. Wildfires, earthquakes, tornadoes, hurricanes are generally not a problem in these places. Will people flock there in 20 years? Maybe, maybe not. 50? Probably. 100? Definitely.

It’s already hot AF in Oklahoma pretty much every day. Hot, dry places will get hotter and drier—and more unlivable.

wtf

Also, it’s just kinda cool to have your own land. A place you can just have to enjoy. Use it for a little cabin, a tiny house, a campsite… whatever. It’s good to have options.

I’m also secretly hoping someone will buy me out to get me out of the way, the local government will claim eminent domain, or a phone company will lease it for a cell phone tower or something. And if not—I’ll just have and keep it.

Thinking about how to buy land with credit cardSo then this got me thinking… if I can buy land with a credit card, then…

I can use a 0% APR to self-finance a nice parcel (I wouldn’t now, but in theory… later on)Or just float the purchase with the card’s usual grace periodMeet minimum spendingEarn rewards, meet spending thresholds, or take advantage of promos (esp. with the PayPal option)So far, I’ve only bought the one lot online. I looked at others. But I wanna check it out and give it time to settle before I get anything else.

Bottom lineI thought this was cool and unusual and wanted to share. Lots of people have interest in owning land, and buying land with a credit card is another path to that.

I must mention the usual disclaimers about paying your card in full, not purchasing beyond your means, and point out that this is based on a sample size of one, so YMMV.

My parcel cost $228, but has consistently appraised for $1,000 for several years:

At least it’s stable

Not as if that means much. Will it go up in value? Go down? Who knows.

I’m gonna start small, gather ideas, and go from there. I’m in my frog-kissing phase now. Maybe I’ll find a land prince soon.

Has anyone out there bought land with a credit card before? Are there any big pitfalls to consider? Will you look into this?

August 23, 2023

My American Airlines account was hacked—and it’s still not fixed two months later

On July 13, someone hacked into my American Airlines account. I got this email as I was wandering through Target:

None of these details are known to me

My AAdvantage award? I knew right away that my AA account had been hacked. I had about 87,000 miles in there and 85,000 of them were redeemed for a business-class flight from Houston (IAH) to Toronto (YYZ), under the name Deborah Niang.

At first, I was mostly annoyed. I figured I’d call AA when I got home, have them cancel the flight and redeposit the miles, and move on.

Nearly two months later, I have the miles back… but my AA account is completely messed up. Unsurprisingly, after many phone calls and looong wait times, nothing’s been done.

I’m in this liminal space between two AA accounts: my old, hacked one and a new one with nothing in it but the redeposited stolen miles.

Reaching out to American AirlinesOK so, the AA security department closes at 5pm and by the time I got home, was closed. I called back the next day.

The security people were pleasant enough. They closed the old account and walked me through opening a new one. There was no way I could keep the old account or loyalty number. They assured me everything would switch over “overnight, while you’re sleeping.”

What my AA account looked like the night of July 13

My AA account wasn’t amazing or anything – I’m not ultra elite, haven’t flown around the world 10,000 times with AA or anything. I had modest Gold elite status, a handful of loyalty points, and just under 2,000 miles left after the hacking.

I had soooo much stuff plugged into that account

I’d had that account since 2006, so it did sting to lose that loyalty number. I had it memorized and had a bajillion things linked to it:

Two AA credit cards (Citi and Barclays)My Hyatt accountSimplyMilesAA diningAA shoppingBusiness ExtraBilt, for transfersI explained all of this to the security department, who assured me it would transfer over. All of it: the loyalty points, the million miler status, the credit card for flight benefits, the dining account, and all the rest.

I wanted it to be as easy as that, but that skeptical voice in my head said, “Yeah, right. You don’t really believe that… do you? This is American Airlines you’re talking about! Ha!”

The new AA account, post hackingNow I have a new, raw AA loyalty account.

This is all the activity in the account, two months later

First and foremost, I wanted to get the miles back. To do that, AA required me to report the loss and get a police report. Within 30 days.

I thought that was a little extreme and I didn’t want to deal with the cops here in Oklahoma City – they’re stretched thin and pointedly asked if I was reporting an “accident, shooting, stabbing, or break-in” when I called.

“Uhhhh… my American Airlines account has hacked? Yeah. And they want me to get a police report.”

To say I was shuffled around to the lowest “I don’t give two shits about this” level of the OKCPD is an understatement. I called and called and called.

I get it: This isn’t that big of a deal in the grand scheme, but American Airlines sent me detailed instructions on what to include in the report and like… just do it. This shouldn’t take days.

American Airlines said my 85,000 miles were worth $2,507.50. And that’s not nothing. So yes, I wanted to report this theft.

The email from AA security

After a million phone calls to OKCPD and a clunky filing system that required filling out forms and sending payments online, I had to wait to receive a paper copy in the mail. (I hope you felt the eyeroll in that italics.)

This is what an OKC police report looks like, in case you ever wondered. Also, “SKY MILES”

I emailed this report to AA on July 27. Later that night, the missing 85,000 miles and whatever was left appeared in my new AA account. And that’s been the extent of all the activity since then.

So guess I’ll just wait forever?I’ve called American Airlines security back a few times saying something to the effect of “WTF?” So on the second or third call, the representative told me a “bug would crawl” my account (whatever that means) and move over all the missing information (the AA credit cards, my loyalty points, Gold elite status, etc.)

She said that a status challenge promotion from 2016 (?!) was causing the issue and that there’s no way to take it off my account. Yes, a promotion from seven years ago.

Last week, I called again. They said they’d “escalate” it, which is code for shut up and go away.

I can no longer log in to the old account. The new account has nothing in it. I have a couple of trips later this year that I booked with my old AA number. They said those flights won’t be affected, but now I’m not so sure.

I’ve been checking back daily to see if the “bug” has “crawled” my account, but so far: nothing.

Everything attached to the old account is effectively useless now

I tried opening a new SimplyMiles account, but when I went to re-add my cards, the system told me they were already linked to another account. Same for Business Extra. And I’m assuming, same for my AA credit cards and linked Hyatt account and all the other zillion things I linked to the old number over the years.

This is basically a giant hassle and no one is helping me resolve it. My account was hacked and now I’m basically screwed I guess?

I don’t have it in me to be on the phone for more hours or to beg someone to help me with this. This has already taken up way too much of my time already.

Other observations from this “American Airlines account hacked” dramaSo that email up there talking about the award redemption was one of many… VERY many. Like, over 1,000 emails gushed into my inbox over an hour.

I’d look every few minutes and dozens more would roll in. It was absolutely crazy-making.

Whoever hacked me added my email to some sort of spam database and the email from American Airlines was buried among them. They were hoping I wouldn’t see it.

Even now, I’m unsubscribing from random email lists (thank gods for spam software).

And despite following American’s instructions to a T, all they’ve done since I emailed the police report is tell me dumb stuff to get me off the phone and then not do anything.

In the end, I have a new, useless account and many services I can’t use with it. Despite assurances of a seamless transition, I don’t think I’ll trust it even if everything does magically roll over.

But, I’m coming up on two months since the hacking and theft and this whole thing is hugely frustrating and time-consuming.

It makes me not want to bother with AA or AA miles or the loyalty points or any of it any more. I’m disappointed, but can’t say I’m surprised. This is exactly what I expect from AA.

American Airlines account hacked bottom lineI’m sharing this to highlight how easily an account can be hacked and the incredible amount of drama required to put everything back into place.

The takeaway for you, dear reader, is to change your passwords often. All of mine are now so “secure” not even I can remember them.

I don’t know what will become of the police report or Deborah Niang or the old AA account – or the new one. This is all so frustrating and will take a long time to fully “reset.” I realize how very white collar this all sounds, but miles are a form of currency and have value. About $2,500 in my case.

Also, just that you can be wandering around Target one minute then bam! – 1,000 emails to scour and literal hours of your life gone to sorting it all out – is rather nuts. And I don’t have any more time to spend on this.

I’m curious if anyone else has experienced this recently? It surely can’t have just been me. Did your situation have a better result than mine? Did American Airlines come through for you? I’m still waiting.

August 7, 2023

New this month: Money trends, 401k, and over $300K! – August 2023 Freedom update

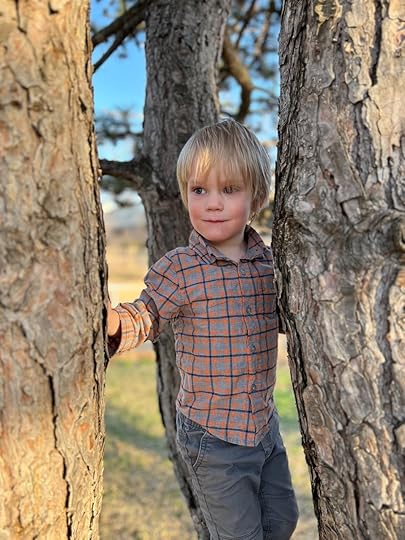

Whew! This weekend (and past month) was a doozy. Warren had his 4th birthday party (I can’t believe I have a four-year-old!) and my mom was in town visiting. Lots of setup and hosting and having fam around.

I also hit the $300K mark officially!

I noticed the stock market dropped in the last week or so, but not enough to drop me below $300K again. Now that I’m over 60% of the way to my $500K goal, I’m feeling extra motivated.

This is a real place

And yet, life keeps delivering. We finally got Warren’s updated birth certificate and passport – and Beck’s stuff is on the way. I have a mountain of crap to pay off and the expenses are always rolling in.

But also – later this month I become eligible for the company 401k. Between that and the HSA, I will be consistently investing again. So despite feeling financially held back in so many ways, I’ll still be making (automated) progress. And that’s something I’m really excited about.

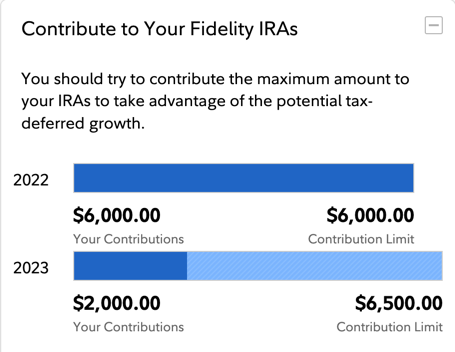

August 2023 Freedom updateLink: Track your net worth with Personal CapitalSo I’m redirecting 10% of after-tax pay into a Roth 401k – that’s a new one for me! I chose the Roth option because I started this job halfway through the year, so a traditional 401k wouldn’t do much to lower my taxable income since it’s already pretty low.

Next year, though, I’ll switch back to a regular 401k. I think the deductions will help, and it’s good to have a variety.

There’s so much conjecture about Traditional vs Roth and all the counter-arguments… I’m gonna try an even mix and strategize down the road. If you have a viewpoint one way or the other, sound off!

I’ve since trimmed the beard

I’m giving myself over to the fact that I may not ever be fully where I want to be financially. With two littles, a big lawyer bill, and various little BS expenses, I haven’t felt “caught up” in a long time. I look at my goals and feel down about not being further along.

I gotta find calmness though, because I’m doing everything I can. And whenever I get the chance, I do contribute toward my goals. It’s not happening as fast as I’d like, yes, but small steps are working anyway. When I look back to this time last year, I have made progress and things are different.

That will always be the case, I think. This entire year has been a lesson in surrendering to – and trusting – the process.

This month’s progressMy net worth is up but my overall investments are flat? I looked at the numbers and ran the calculations over and over and yes? What’s here looks accurate. I didn’t realize stocks were that flat. And the only other thing I can think of is that I made a lot of credit card payments and a mortgage payment? Also I’m paying my lawyer on the side and that’s not always reflected in these updates. But I think we’re almost to the end of that.

This month, I:

Set up 10% in contributions to my Roth 401k (my employer matches 4%) that begin this monthAlmost reached the threshold where I can invest with my HSA (also begins this month)Acquired two parcels of land worth about $11,000, but had to pay some document recording fees and back taxesFinally hit the $300K mark for net worth!Booked travel for later this month and December, which cost a little out of pocketMade a definitive household budget which really shocked me at how much we were spending on soooo much stuffResolved to cut expenses because of that budgetHad a couple of doctor visits, haircuts, therapy, and other self-care sessions that were worth the money

With Mama

I’m relieved about the 401k and HSA thing because it’ll be essentially forced savings (kinda like the house and mortgage). And I still need to max out my Roth IRA. Always plenty to work on. It doesn’t all have to happen at once (but I kinda wish it did lol).

Oh, I know! The net worth increase is because I added the land value to my portfolio. One parcel is about two and half acres, while the other is a quarter of an acre.

Future goals (or maybe the rest of this year)So my opportunities right now are:

Add the remaining $2,500 to my Roth IRAPay down credit cards (all with 0% APR yet all hanging over me)Bulk up savings – this is the eternal dilemmaAdd cash to taxable brokerage and UTMAs for the kidsUpgrade things around the house (paint, pipes, landscaping, tree trimming, deck – the list could be endless, really)Once I get the HVAC credit card paid down, I will feel soooo much better. That’s been a focus for a while and it’s about time to go all-in attacking that. Feeling like a broken record about that.

We are also prepping to move out of Oklahoma. I don’t know where yet, just… away. Too much bad stuff happened here and the schools are crap. Warren will be five next year and we want to find a great school for him. There’s nothing good left for us here. Just getting ideas for now.

By the numbersHere’s what the story says this month:

CurrentLast MonthChange2023 Goal ASSETS Overall investments$241,279$241,320-$41As much as possible Roth IRA$56,998$56,491+$507$6,500 (in new contributions)$4,000 so far! Taxable brokerage + UTMA$13,376$13,253+$123$25,000 (total invested) Savings$5,292$5,900-$608$30,000 Primary home equity + appreciation$59,518$62,407-$2,889$70,000 LIABILITY Credit card/HVAC upgrade-$10,270$10,372-$102$12,708 (starting balance) Net worth in Personal Capital$304,726$299,127+$5,149$500,000 (overall goal) Track your net worth with Personal Capital

This guys shows up on your Ring cam wyd

It’s interesting that I’m only up $5K but how significant that feels.

The land value boosted me up even though stocks were flat overall in July. It’s nice to own some raw land. I’m gonna go check it out soon, just to get an idea of what I’m working with. Who knows, maybe one of them could be a building site one day?

For now, though, I will keep plugging along. The dreaming will come back one day. And I won’t always owe the amounts I currently owe. Plus, having a 401k again will be a huge relief for me. Even with “only” 10% contributions, that will anchor me to this journey to $500K. I’d ideally bump that to 25% but… small steps.

August 2023 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardHolding steady! I have my work cut out for me and life is busy and good overall. Having the kids’ birth certificates is/will be a huge relief. We are getting our docs together in preparation to move soon. Where? TBD.

Until then, I know what I can work on, like the work I do, and have lots to look forward to. Optimism is coming back. After a long couple of years, I know I’m a different person now. I’m still processing it all, in a way. And outraged on my own behalf that I went through all of that.

Excited to travel later this year, starting with a fun trip for my birthday in a couple of weeks! I used many points & miles tricks and will share some of them later this month as well.

Thanks for sticking with me through all this. Hope everyone is doing well out there.

Stay safe and scrappy!

-H.

July 4, 2023

New net worth high, at 60% of goal, and the march to $300K invested – July 2023 Freedom update

Because the stock market has been thriving and the economy is beginning to even out, my net worth saw a new high this month – just shy of $300,000 and nearly 60% of my ultimate $500,000 goal.

Yay! I’m thrilled/relieved for this update. On one hand, I cognitively know that investing during a downturn means huge gains down the road. On the other, that road felt (feels?) really long.

In fact, I hit $200K invested in November 2021 – the same month I moved to Oklahoma. Right now, I’m sitting at $241,320 invested despite maxing out my 401k and Roth IRA in 2022, and opening an UTMA for Warren, my three year old. I’d been flat and hovering around the same level for over a year and tbh these updates were starting to get same old.

Friend to all trees

But I know that powering through that slog will benefit me well in the future. It’s to the point where if the stock market has a good month, I can see gains of $20K+. This is the momentum I’ve been looking forward to. My hope is always cautious, especially these days, but I’m having a milestone month and I’m gonna celebrate those accomplishments.

As I work my way back toward financial stability and pay off lingering debt, I’m seeing the light again and am beyond ready to plow forward.

Let’s review.

July 2023 Freedom updateLink: Track your net worth with Personal CapitalNext month, I’ll get my 401k fired up again. Not with the 25% I was doing before. I’ll start with 10% and nudge it up as I get other things paid down, like adjusting levers.

Those things are: paying down my 0% APR credit card, my lawyer, and a business card I’ve been using for expenses here and there (also 0% APR). All told, this is about $20K. Thankfully, my lawyer is allowing me to pay what I can and there’s no interest there, either. Still, I just don’t like owing people money. So those are my current liabilities.

Look what I found! Points old-timers will remember this

Asset-wise, my home equity is going strong. I’m almost to $70K in equity and appreciation. It feels reassuring to know I could sell this place and come out with some profit. I’m not planning to sell any time soon, but do enjoy that feeling of security.

It’ll feel good to invest at regular intervals again, starting next month. In the next year, I want to be done with paying everyone and everything off and put all my extra income toward investments.

To that end, I’ve completely switched all my banking over to my Fidelity Cash Management account. That way when I have extra funds, I can easily dump them into my Roth IRA, taxable brokerage, or Warren’s UTMA. It’s been functioning well as my primary bank for over a month now. I’ve been using it for everything with no hiccups at all.

I’m working really hard on all these goals. It’s nice to see that start to pay off. I’m looking forward to $300K invested.

Also: 60% of the way toward my goal! Getting over that halfway hump feels SO motivating. I’ll try my best to celebrate the wins and remain stoic about the losses and flatlines.

So this month was all about catching up (next month probably will be too). I was starting to drown there for a sec, but things are turning around.

This month, I:

Opened and began funding an HSA account with $200 semi-monthly to startRented an office space in OKC to get work done (it’s been a total panacea)Pulled Warren out of daycare. We reached a critical point with that. I was a hard decision, but so far it’s been much better for him.Paid $500 to get the mini split cleaned. It was spitting out black grime, which is apparently a common issue with them? Did NOT contribute to my Roth IRA again this month. $2,500 left to go. Ready to tackle that.Paid only the minimums on my 0% APR credit cards. Those are first on my hit list.Paid a lot of lot of crappy little outstanding bills, bought baby gates and a playpen for Beck (he’s crawling everywhere now), and made a few needed upgrades around the house.

Did NOT contribute to my Roth IRA again this month. $2,500 left to go. Ready to tackle that.Paid only the minimums on my 0% APR credit cards. Those are first on my hit list.Paid a lot of lot of crappy little outstanding bills, bought baby gates and a playpen for Beck (he’s crawling everywhere now), and made a few needed upgrades around the house.

Very full hands and hearts 🙂

This month felt like setting myself up for success. Now that things are stabilizing, I’ll can work on everything else.

I also keep reminding myself that paying down debts also increases net worth because it decreases liabilities. It doesn’t have that sweet compound interest like investing does, but I’ve been happy to “invest” in home upgrades and things for the kids.

Future goals (or maybe the rest of this year)For the rest of 2023 (the next six months-ish), I want to:

Start contributing to a 401k again. This is already set up to go into a Roth IRA with 10% to start in August.Max out my Roth IRA ($2,500 left).Pay down the credit card by December (that’s when the 0% APR expires).Rebuild savings and add funds into taxable brokerage and Warren’s (my son’s) UTMA.Break $300K net worth finally!It looks like I’m about to break $300K (unless the market suddenly dips again). And I will start adding to a 401k again, so that’ll get checked off next month. I’m about to go into beast mode on that credit card, then can get to the investing portion of my goals.

Here for the upswing

This month felt like such a turnaround in so many ways. I’m excited and encouraged. The general funk I’ve been feeling cleared out in a big way, and I’m optimistic about the future again

Here it all is, in cold daylight:

CurrentLast MonthChange2023 Goal ASSETS Overall investments$241,320$229,940+$11,380As much as possible Roth IRA$56,491$54,322+$2,169$6,500 (in new contributions)$4,000 so far! Taxable brokerage + UTMA$13,253$12,746+$507$25,000 (total invested) Savings$5,900$5,390+$510$30,000 Primary home equity + appreciation$62,407$60,197+$2,210$70,000 LIABILITY Credit card/HVAC upgrade$10,372-$10,381-$9$12,708 (starting balance) Net worth in Personal Capital$299,127$280,014+$19,113$500,000 (overall goal) Track your net worth with Personal Capital

Sooooo close to $300K/60%

The biggest opportunities here are to attack that credit card and finish maxing out my Roth IRA. That’ll probably keep me busy for the next few months. Typing all this out feels like a mantra, like giving myself marching orders. You can see how focused I get on a couple of particular ideas lol.

If the stock market could continue to hold, that’d be even better!

July 2023 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardAll in all, I’m in a good spot. Things are leveling out, I have plenty keeping me busy, and life is returning to a sense of normalcy and momentum.

I can’t wait to burst past that $300K mark (maybe next week?), get things paid down, and invest again. Life’s good, the kids are healthy, and there’s never a dull moment.

I know where my opportunities are—and that’s controlling those liabilities so I can keep building assets. I look forward to hitting more milestones along this journey and getting back to slow and steady instead of sloooooow and all the place in a market dip.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

June 7, 2023

New minivan, new job, feeling bright – June 2023 Freedom update

This past month has been nonstop in the best way possible! It’s been one good thing after another. I’m so grateful – I really needed some things to work out.

We went to my partner’s brother’s graduation, spent a week exploring Dallas (so different with kids), and had a weekend visit with family.

This weekend, I lost my mind and bought a minivan (used, of course). We got a great deal on an 8-passenger minivan and the finance terms and monthly payment were agreeable. So we drove it home. And so far, we love it. We quickly outgrew my little Nissan Versa Note, lol.

Dad reporting for dad duty

I start a new job on Monday and am very much looking forward to it! This infusion of new energy is seriously good.

I also found a new barber and have been doing yoga when I can (because self-care is so important, especially when you’re parenting). It’s been pretty nonstop, but all in the service of moving forward and making progress.

With all of that, let’s see how it impacted me financially.

June 2023 Freedom updateLink: Track your net worth with Personal CapitalI put $6,000 down on the van. $5,000 on my Amex Blue Business Plus card for 2x Amex Membership Rewards points and $1,000 pulled from savings and ran through a debit card ($5,000 was the dealership’s credit card limit).

We also had some cash outlay for the Dallas trip. We used CityPass to get discounts on the Dallas Zoo, Perot Museum of Nature and Science, and Reunion Tower – those were all excellent activities for the littles.

Overlooking Dallas at Reunion Tower

We stayed at the Hyatt Place Dallas/Park Central to take advantage of the Bilt/Hyatt Globalist promo (and Dallas was a bonus points city for Hyatt’s Bonus Journeys promo, which is now over). I need 11 more nights in the next month and half to get Globalist through February 2025.

I used “Pay My Way” for a cash & points combo

We’re gonna try to get out of town again to complete the rest, although Oklahoma City has a couple of great “mattress run” properties if it comes to that. The room in Dallas was 5,000 points per night, but I got back 3,500 points for every second night. It divided to 3,250 points per night. Not bad.

I wish we could’ve stayed longer. It’s hard to get someone to look after the dogs, although now that we have the van, it’ll be much, much easier to just take them with.

Warren at Klyde Warren Park in Dallas

It was also fun to chase a promo. Felt like old times again there for a bit.

Financially, this month was kinda of a mess. Here’s how it played out:

I switched to Fidelity for all my banking and transitioned all my deposits and autopayments over a few weeks. Really excited about this. #DumpYourBankSpent ~$1,000 all told for the Dallas trip, including activities, meals, gas, lodging, etc. We needed to get out of here for a sec.Put the aforementioned $6,000 down on the van purchase. This was the sweet spot to get my payments where I wanted them.Did NOT contribute to my Roth IRA this month. $2,500 left to go.Paid only the minimums on my 0% APR credit cards. Those are first on my hit list. So grateful to have them.Like last month, the progress wasn’t huge on paper (or screen) either. But the money I spent this month went a long way to provide us with more options, more comfort, and peace of mind. Also we needed a little vacation and that was really beneficial to get away and make new memories.

All-in-all, I’m pleased with how things are going and also looking forward to pushing some of these goals forward next month. 🙂

Future goals (or maybe the rest of this year)Yesss, now we’re talking.

For the rest of 2023 (the next six months-ish), I want to:

Start contributing to a 401k again (I think I’m gonna do the Roth option this time)Max out my Roth IRA ($2,500 left)Open and fund an HSA accountPay down the credit card by December (that’s when the 0% APR expires)Rebuild savings and add funds into taxable brokerage and Warren’s (my son’s) UTMABreak $300K net worth finally!

I saw this at a playground and felt it so much

I have until August 2024 to reach my $500,000 goal and am still a ways off. Without the stock market and economy putting wind in the sails, I’m pretty much on my own. At this point, I’m gonna get as close as I can and keep it going. But wow, I’d love for the market to pick up steam and make a huge leap forward (who wouldn’t though, right?).

By the numbersMy home appreciation went up a lot this month! OKC is growing and I think the house will continue to appreciate. It’s nice to know I can always sell and come out with a net profit – but I want to keep the house for as long as I can. Who knows, maybe pick up another one at some point. It’s a great market and there are gems out there.

The sweetest BABY

Investments picked up a fair amount, too. That’s encouraging, and hopefully the overall market will start to bounce back. It’s been a brutal year for stocks, which are most of my net worth at this point.

CurrentLast MonthChange2023 Goal ASSETS Overall investments$229,940$220,968+$8,972As much as possible Roth IRA$54,322$52,137+$2,185$6,500 (in new contributions)$4,000 so far! Taxable brokerage + UTMA$12,746$12,244+$502$25,000 (total invested) Savings$5,390$6,997-$1,607$30,000 Primary home equity + appreciation$60,197$51,188+$9,009$70,000 LIABILITY Credit card/HVAC upgrade-$10,381$10,485-$104$12,708 (starting balance) Net worth in Personal Capital$280,014$273,218+$6,796$500,000 (overall goal) Track your net worth with Personal CapitalI want to get back to putting a bit into Warren’s UTMA (and open one for Beck). I’ll likely need a couple of months to get some breathing room, then can resume doing that.

Life’s good and I’m doing what I can. For now, that’s more than enough.

This

June 2023 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardThat’s all I got for this month. It was a busy one – this one will be, too!

What a market environment within which to chronicle this journey. It feels like life is baby steps when I was hoping for giant leaps. Expectations are definitely getting adjusted, but things are most decidedly moving forward. This was so fun to write. I want to get back to more travel content. Hope everyone is doing well!

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

May 8, 2023

A flat month for stocks and pondering the future – May 2023 Freedom update

It’s been a good month. The weather is warmer and we’re all starting to feel the shift that’s coming.

I’ve been working diligently behind the scenes to arrange trips, find new opportunities, and move the family forward. I’ve been embroiled in court drama since December 2021, and there are just a couple more obstacles to knock out of the way. Once it’s done, we’re seriously contemplating moving to a new place. And a remote working visa in Europe is looking really appealing right about now. #expatlife

Cute spring scene

But we’ll see what happens.

Financially, I’m flat month-over-month, but that’s to be expected. The U.S. stock market is reeling in the wake of bank foreclosures, ongoing interest rate hikes, and the fight against inflation.

I personally managed to get everything paid for the month, plus laid out cash to get some documentation for the boys, and didn’t get to invest much. Oh, and our fridge decided to give up, so we had to order an emergency replacement – which was a whole saga unto itself.

Anyhoozers, the first half of the year was a great push forward. I’m hoping the second half will be full of progress, travel, and fresh ideas.

May 2023 Freedom updateLink: Track your net worth with Personal CapitalFor now, I’ve feeling a bit drawn inward, toward safe places. Like I’m incubating in a chrysalis. Getting ready for my renaissance. This past year has been a lot. But again, turning – turning.

Containing multitudes

Financially, I’ve continued to do what I can, including:

Opened a new credit card to finish paying my attorney – 0% interest through September 2024Bought a new fridge from Lowe’s to max out Chase Freedom’s 5% category this quarter (after finding that none of the Costco fridges would fit through my door. Believe me, we tried)Set up my partner with Fidelity accounts – specifically a traditional IRA and a cash management account because #DumpYourBankFinally paid a crew to trim and haul out fallen branches and get the yard into shape. It looks amazing out there, but

Believe me, we tried)Set up my partner with Fidelity accounts – specifically a traditional IRA and a cash management account because #DumpYourBankFinally paid a crew to trim and haul out fallen branches and get the yard into shape. It looks amazing out there, but

That doesn’t sound like “enough” progress for the last month, but it is enough. Not every month has to be some giant leap forward.

This money, I used money as a tool to organize my immediate environment and present self as opposed to future self. I’m kinda glad the market is flat right now, because I’m not missing much. But of course I want to get back to regular investing. It was just a month full of things that popped up.

Future goals (or maybe the rest of this year)I feel like I’ve already missed too much living this past year. I don’t want to keep missing more stuff. I’m really hoping the economy and market bounce back in a big way, especially after hovering around the same level for what feels like forever by now.

SRSQ

But I do want to:

Get a new job and start contributing to a 401k againMax out the Roth IRAPay down the credit card by December (that’s when the 0% APR expires)Buy a new car (the family is expanding)Spend money on TRAVELKeep saving and socking away funds into taxable brokerage, Warren’s (my son’s) UTMA, and general savingsBreak $300K net worth finally!

This is Hank, he’s our new dog

Long-term, I still want to reach my $500K net worth goal. When I started blogging about this, my original goal was to have this amount by August 2024.

Unless the stock market really picks up or I get a windfall of cash from something, it’s looking more and more like that won’t happen. Of course, this was before Covid, kids, legal battles, and all the rest.

Even still, it’s good to have a goal. So I’m challenging myself to make some big strides in the next year or so. And hey, anything’s possible!

By the numbersYeah, these lines were… flat.

Before Warren’s haircut

There was some good progress with home appreciation, but I had to dip into my savings a little to pay for things that were “cash only.”

Overall, it was a kind of “meh” month for progress. So while I have big goals, I’m trying to reconcile that with the fact that every month doesn’t have to be amazing. A little at a time will do.

May 2023 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardY’all, I feel like a broken record for this May 2023 Freedom update. I’m sure everything will turn around in a big way – very soon – and it’ll be like a rubber band snapping.

In the meantime, I’m doing a lot of yoga, meditating again, and focusing on the things I can control. I’m feeling happy and healthy and overall good again. Now I’m waiting for everything else to catch up. The money stuff will happen. For now, I’m looking forward to posting good news and missives again from beyond my little cocoon.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

April 5, 2023

Up $11K, end of Q1, and finally looking to the future – April 2023 Freedom update

The stock market had its best quarter since 2020, and I’m now back to where I was two months ago. If that ain’t a metaphor.

These gyrations (plus life) have kept me hovering around the halfway mark of my $500,000 goal (that’s a long way of saying $250K) since I first hit it… exactly a year ago. #GroundhogYear

Inching ever closer

I’ve had my sights set on $300K for a long time. As life continues to come together, saving money should get easier. I’ve been saving what I can while fighting down 0% APR credit card debt and lingering legal bills.

All said, I’m doing good – and hoping that compound interest will do some of the heavy lifting for the remainder of the year.

April 2023 Freedom updateLink: Track your net worth with Personal CapitalWe have a few more court dates to get the case finished. It’s still not done, but it will be soon. It can’t go on forever.

I’ve been doing a lot of freelance work and applying to jobs here and there. Just the ones that look super interesting. We’ve also been thinking about getting out of Oklahoma.

There’s nothing for any of us in this place, and there’s no way we’re putting Warren in public school here. We were thinking somewhere in the Northeast or Northwest. Anyone have good recommendations for a place with excellent public schools? The only requirement is that it’s 1,000+ miles from anywhere in Oklahoma.

Or maybe a different country. Portugal sounds nice. Someplace that’s easy to get a visa for the fam. (Can you tell I’m finally dreaming about the future? We’re gonna get out of here, like, soon.)

Financially, I’ve continued to do what I can, including:

Finish funding my 2023 Roth IRA – Getting there! I’m at $4K / $6.5KBig credit card payments – Paid $1,000. More this month!Invested in a brand new top of the line MacBook Pro for my writing and freelance businessSent cash to savings. Maybe a new house is on the horizon?Added some cash to Warren’s UTMA account

Thankful for friends who work at Apple for 25% discounts on new computers (that’s Fenwick in the background)

The computer was a $3,000 purchase, so that took the lion’s share of my financial efforts last month – but so worth it. My previous computer was dragging and on its last leg. And the new computer has basically already paid for itself with new freelance projects.

Money movements (and a new card)This month, I want to focus heavily on paying down my credit card debt that’s currently at 0% APR until December 2023, as well as max out my Roth IRA for the year.

$2.5K to go

I also opened a new credit card – The Bank of America Customized Cash Rewards card to get:

18 months of 0% APR – I think I might just go ahead and pay my attorney everything I owe3.5% cashback at wholesale clubs including Costco, where we shop weekly. I get this rate from being a Platinum Honors member with $100K+ invested through Bank of America5.25% cashback on a category of my choice. I’m gonna go with online shopping for now. Again, I get this rate from my banking relationship with BofAThe $200 cash welcome offerLower debt ratio overallNo annual fee, so it’s free to keep long-termA new card in general. I’ve had or can’t get cards from other banks, and yes, I tried to get in on that sweet Chase Ink 90K offer and was denied :/

Oh man, haven’t done one of these pics in a while

I checked my 5/24 status and I’m at 8/24 right now. The oldest inquiries will fall off in the next 6 months. At that point, I will be eligible for another Chase card. Just hoping there’ll be a good offer at that time. Daddy’s ready for more Hyatt points (which let’s be honest is all Chase Ultimate Rewards points are good for any more).

For now, I’m focused on saving, paying down debt, and adding cash to my savings account. Planning for a move soon. I live a life of upheaval. This one I want.

By the numbersLast month, I was down about $11K. This month I’m up by the same amount.

I’m making good progress on saving and Roth IRA contributions, as well as paying down my credit card balance. Instead of plowing into one thing, I’m spreading everything out: a little here, a little there.

It all affects the bottom line (net worth number) in the same way. And especially since stocks are flat now, this seems like a good moment to save cash for the next thing.

CurrentLast MonthChange2023 Goal ASSETS Overall investments$220,220$209,162+$11,058As much as possible Roth IRA$52,001$49,863+$2,138$6,500 (in new contributions)$4,000 so far! Taxable brokerage + UTMA$12,194$11,798+$396$25,000 (total invested) Savings$7,993$6,693+$1,300$30,000 Primary home equity + appreciation$49,881$46,074+$3,807$70,000 LIABILITY Credit card/HVAC upgrade$10,691$11,708-$1,017$12,708 (starting balance) Net worth in Personal Capital$273,654$262,014+$11,640$500,000 (overall goal) Track your net worth with Personal CapitalHoping for some forward progress this year, that the stock market picks up and that I’ll be able to get ahead of everything.

April 2023 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardAlso hoping to get some forward motion with regard to moving on with life. I’m ready to travel again and get back out in the world. And to plan for the future. And to talk more about what I’ve been through since November 2021. Maybe I’ll write a book one day.

Looking forward to having more good news to report soon. I feel like I’ve been stuck in the same scenario for months and months by now. Hanging in there.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

March 8, 2023

Freelance and $262K, progress after layoff and ruling – March 2023 Freedom update

Life is completely different than it was even a few weeks ago. We got our ruling, finally, in our favor. We’ve been in and our of court for the last year, and now we can take some action and move on with our lives.

There will inevitably be appeals, but we’ve been assured they’ll either be thrown out or the higher court will uphold our ruling. It’ll be some more paperwork, but it’s a non-issue so I’m going to put it out of my mind and not even think about it. For the first time in a while, I’m dreaming about the future and what that could look like. Definitely a lot more travel once I get all the documents switched over.  Ya know, travel blog and all.

Ya know, travel blog and all.

How we feel about our court ruling

Money stuff has shifted, too. It’s been a lousy patch for the stock market, my home lost some of its appraisal value, and I’ve had to charge up my cards to get stuff paid.

That said, I’m thrilled because I’ve been picking up a few freelance projects that pay more than my previous income. I think I’ll come out ahead – it’ll just take a little bit for things to settle.

So let’s get into that.

March 2023 Freedom updateLink: Track your net worth with Personal CapitalLast month found me at a new net worth peak. This month, I’m still hovering around that $250K mark again. I’ve had drastic swings in the past, but I’m ready to get some traction. Things like inflation, a sluggish economy, rising interest rates, and student loan uncertainty are making it hard for folks to find financial footing.

Despite being laid off last month, I’m grateful for all the income streams I kept open. They are my safety net now, and making me feel settled and secure during this time. That so valuable.

Last month, I riffed about everything I’d try to do by now. Let’s review – and I’ll add what happened:

Finish funding my 2023 Roth IRA – Getting there! I’m at $3K / $6.5KMake a big credit card payment – Paid $1,000. More this month!Give my lawyer a big payment – Yep Maybe get a new MacBook Pro (the one I’m using is literally from 2013

Maybe get a new MacBook Pro (the one I’m using is literally from 2013  ) – Arriving Monday! I got a tricked out upgrade with extra storage, faster processing, the newest software… I’m soooo excited about the possibilities it’ll unlock!Add to my savings – Didn’t happenMaybe plan a trip? I really really really miss traveling – Going to Seattle in July!

) – Arriving Monday! I got a tricked out upgrade with extra storage, faster processing, the newest software… I’m soooo excited about the possibilities it’ll unlock!Add to my savings – Didn’t happenMaybe plan a trip? I really really really miss traveling – Going to Seattle in July!

We’ve also been raising baybeeees

All said, it was a month full of progress… it just isn’t reflected in my finances – yet.

Money movementsI rid myself of all my ex-employer’s financial institutions and moved everything to Fidelity: my 401k and HSA. The 401k came over quickly, but still waiting on the HSA to appear.

I got tired of seeing the little BS fees like “asset fee” and “fund fee” and other random junk. But not any more! I got everything set up with FSKAX to keep things simple.

Then, I got my lawyer’s fees paid down to 4 digits, so that was good. Ready to be on the other side of all the legal drama. I’m glad the public has started to dig around more, discovered the truth, and lost interest in the other party’s lie and the media’s sensationalism. We prevailed, so I won’t dwell on it. I’m just grateful.

My sweet baby

Other money goalsMy droogs, I wrote a list of goals and they add up to $40,000. That’s how much it’d take to make me level-set, right as rain, zeroed out, back to baseline.

They include:

Paying off my lawyerGetting a new couchPaying off the HVACInstalling new pipes in the house (the current ones are v old)Saving up for a down payment on a new SUV/van/something bigger for the kiddosGod I’m so domestic. When tf did that happen? I also want to keep investing in Warren’s UTMA, max out the Roth IRA, build savings… the usual.

It’s just gonna be slow and steady out this way for a while. But I’m getting there. I have hope for the first time in a long time. Hope and energy and a will to make it happen.

By the numbersI went ahead and killed the 401k goal because I don’t have a traditional W-2 job at the moment. I also rolled my traditional 401k balance into “overall investments” since I now have a new rollover IRA account, just to streamline.

My big focus now will be on paying off that credit card (0% APR until December) and filling up my savings so I can go car shopping. My current car situation is really tight, y’all. We have no room for air after we all pile in and add a stroller.

And the other stuff falls into “nice to have” but I’d rather get them done before they become “fix this right now.”

CurrentLast MonthChange2023 Goal ASSETS Overall investments$209,162$220,780-$11,618As much as possible Roth IRA$49,863$50,665-$802$6,500 (in new contributions) Taxable brokerage + UTMA$11,798$12,011-$213$25,000 (total invested) Savings$6,693$6,691+$2$30,000 Primary home equity + appreciation$46,074$49,868-$3,794$70,000 LIABILITY Credit card/HVAC upgrade$11,708$12,708-$1,000$12,708 Net worth in Personal Capital$262,014$273,473-$11,459$500,000 (overall goal) Track your net worth with Personal Capital

Red dirt boys

That’s where I’m at this month. Plugging away and looking forward. Hopeful and grateful.

February 2023 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardI also want to write more here too. In that spirit, I’m so tired rn I’m just gonna glance over this and send it out semi-raw. This post has turned into a massive time investment, so I want to streamline and just get things out, even if they’re not up to my perfectionistic standards.

Let’s do the dang things. I feel love for being able to write this right now. I realize how incredibly blessed and fortunate I am. My ultimate goal is to inspire people to keep forward on their own paths, even when it’s difficult and even when it looks like it’s going nowhere. I just got beyond all that. Trust yourself and the process. Slow and steady wins the race.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

February 4, 2023

Close to $300K, laid off, and this year’s goals – February 2023 Freedom update

I feel like my life is on hold. Like I’m on hold, but life just keeps on life-ing.

We’re days away from getting the judge’s ruling for a set of cases that have been going on for the past year, hopefully early next week. We think it’ll be in our favor, but until we get that document, we’re kind of just… on hold. Stuck. Like we can’t move forward.

Oof

Oh, and I was laid off from my job this week, so go ahead and add that to the mix. I’m taking some time to regroup. I’m not worried about the future so much as I can’t even imagine the future right now.

With that, I’m making February 2023 the month of self-care and taking my insurance for all it’s worth before it expires in a few weeks. I’m:

Getting new glasses and contacts and a fresh eye examHaving a tiny cavity filled next weekSeeing a doctor for an all-around checkup and allll the preventative care my insurance will allowGetting a couple more chiropractic adjustments (Baby Beck is now over 15 pounds!)Going to therapy every week this monthI also snagged an appointment for an in-demand dermatologist. Plus, I already have new insurance so I’m taking advantage of being double insured and criss-crossing town to keep myself healthy and active. I’m feeling good about everything.

With all that in mind, let’s talk about money.

February 2023 Freedom updateLink: Track your net worth with Personal CapitalLots of good things happening here. This month, again, finds me at the peak of my net worth. This time it’s $273,473—a stone’s throw from $300K.

Stocks performed in a big way, my ex-employer finally matched by 401k contributions, and I also got a little bonus. If stocks keep going up, I could be to $330K as soon as next month.

I’m getting severance money in a couple of weeks along with my last paycheck, so I’ll use that to:

Finish funding my 2023 Roth IRAMake a big credit card paymentGive my lawyer a big paymentMaybe get a new MacBook Pro (the one I’m using is literally from 2013 )Add to my savingsMaybe plan a trip? I really really really miss traveling

)Add to my savingsMaybe plan a trip? I really really really miss traveling

Life’s good

I’m not worried about employment or money. I have a few income streams and already working on a couple of projects. I even thought about taking a month to just write. We’ll all be fine, we all have health insurance, and the bills will get paid.

Tbh, I was out of love with my job for a long time (if you couldn’t tell by previous Freedom updates). So this is a good thing. I just want to figure out where to go from here.

Money movementsYou’ll notice my savings went down. I transferred some of it to my Roth IRA and Warren’s UTMA, and paid down my credit card/HVAC with the rest. This was before the layoff. I might’ve used it differently if I’d known, but… no going back. Just forward.

I only did it because I finally got tired of dealing with Citi’s funky interface for my Accelerate savings account. So I transferred out everything except $500 to keep it fee-free. While it was sitting in my checking account, I thought what the heck and put it to work.

Sure do

Looking to $300KI still have some savings, and definitely want to save more this year. I gotta get my attorney paid and find my balance. I’ve tried various strategies, but now realize how fluid it all is, especially now. So I’m gonna ride the wave and do my best. Now that I’m close to $300K, I definitely want to keep up the momentum.

Getting close

I’ll be 40 in 568 days, and want to get as close as possible to my $500K goal by then. 2023 will be a pivotal, make-or-break year. I plan to make the absolute most of it.

Other investment goalsNow that I’m without a 401k (at least for a while), I’ll turn to my taxable brokerage and Warren’s UTMA for a while. As far as retirement goes, I’ll be fine coasting by and can use this lull to really set up Warren (and Beck).

My sweet baby and future millionaire

In a few weeks, I’ll have my Roth IRA maxed out and will turn to that.

$4,500 more to go

January was a rough month, but I typically have amazing Februarys. And you know what? I can’t wait to see where 2023 takes us. Already I feel things stirring.

By the numbersIn the last couple of months, I:

Hit another new net worth peakContributed $2,000 to my Roth IRAPaid nearly $2,000 toward my credit cardBuilt up a little more home equitySent more funds to Warren’s UTMA CurrentDecemberChange2023 Goal ASSETS Overall investments$220,780$212,973+$7,807As much as possible 401k (overall balance)$43,863$40,617+$3,246As much as possible Traditional IRA$106,760$104,552+$2,208xx (can't contribute bc I'm doing Roth) Roth IRA$50,665$47,461+$3,204$6,500 (in contributions) Taxable brokerage + UTMA$12,011$11,248+$763$25,000 (total invested) Savings$6,691$10,312-$3,621$30,000 Primary home equity + appreciation$49,868$48,360+$1,508$30,000 LIABILITY Credit card/HVAC upgrade$12,708$14,351-$1,643$12,708 Net worth in Personal Capital$273,473$266,210+$7,263$500,000 (overall goal) Track your net worth with Personal Capital

Love seeing that percentage get closer to 100%

Lots of shifts! This month will have even more thanks to my severance and ongoing projects. As always, I’ve got an eye toward progress and hoping for the best.

My priority is on self-care and getting things going after getting the court ruling. Everything else is incidental, but of course – life will keep on life-ing, eh? Always does.

February 2023 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardAfter all of this, I feel myself slowly coming back to life. Getting laid off this week was a huge shock, but really, no love lost. The layoff is already setting other events into motion, so I’m going to let them take me with their current.

If ever there was a time to do a trust fall to the universe—it’s now. Trust the process and all that.

My mom came to visit her grandbabies last month

This month will also have lots of money movements. For one, I’m going to rollover my 401k to an IRA to get rid of all the crappy junk fees. It’ll be nice to regroup and just get things together again. And make sure I’m happy and healthy for whatever is already on its way.

I want to write more here, too. Once travel comes back into my life and we get past this court drama, I’ll be ready. I appreciate y’all sticking with me. This is the hardest thing I’ve ever done in my life.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.