Harlan Vaughn's Blog, page 6

March 3, 2022

Holding the line with a $1K increase & riding major volatility – March 2022 Freedom update

I considered not posting this month. With the war crimes and attacks on Ukraine, talking about the impact to my 401k feels inconsequential compared to the loss of life and destruction of major cities.

The stock market has of course been extremely volatile, and I’m right around the same place I’ve been for the last few months – that $240K mark, give or take. I really want to get to $250K and it’s so close and yet…

I flew for the first time in two years – to Washington, DC!

But it’s also been a happy time. I took my son, Warren, on his first plane ride and he had his first swanky hotel stay at the Park Hyatt Washington, DC where the entire staff was amazing and treated him like mightily princely. He’s a natural traveler like his dad and it was a phenomenal experience. He’s already asked to get on another plane. We have a traveler on our hands!

I hadn’t been on a plane myself since March 2020 when I went to the Hyatt Ziva Los Cabos. It was good to be back in the air. I even paid attention to the safety demonstration.

And with money stuff, I changed nothing about my strategy. My house appreciated, and I was able to sock $1,000 into savings. My net worth went up and down all month. But now, it’s at the same place as it was last month. Somehow things keep evening out despite everything happening in the world – and in my life.

March 2022 Freedom updateLink: Track your net worth with Personal CapitalWhat a month. The instant I bought new stocks and invested them, they lost value. Then bounced back. Then went down again. It’s been a bumpy ride, but hey – that’s how it goes.

My overall goals for 2022 haven’t changed. I still want to:

Save $30,000 in savings accountsGet to $25,000 invested in my taxable brokerage accountMax out my 401k againShoot for a $350K net worth by year endI’ll definitely max out my 401k this year. And the other goals? They’re beginning to look insurmountable. I managed to ferret away $1,000 to savings this month, but with everything else coming up – who knows what’ll happen.

I went to an airport! To get on a plane!

And of course, the stock market is probably going to keep crashing. But again, who knows about that. Maybe this is a time of continuing to invest and it’ll pop up again down the road.

MilestonesI’ve continued to invest in family, too. We took our first trip to Washington, DC, last month and Warren absolutely loved it.

Just like dad, he loves a window seat

I’m starting to think about diverting funds to a custodial account for him, and setting him up for his future. He is very bright and active, and we have a big job of keeping his endless curiosity satisfied. I’m already thinking about our next trip.

Travel is another thing I consider an investment.

Warren at the Washington Monument

Plane plans

It was amazing to experience his first trip with him. We also went to his first movie in a theater and to an arcade for the first time. Sometimes he wakes up and I swear he’s taller. Being his dad has given me much to think about in terms of financial planning and legacy. That is, when I can get a spare moment. He keeps us very busy with all he’s discovering about himself and the world.

It’s a privilege and an honor to guide him along his way during this earthly existence we’re sharing together.

By the numbersAnywhomst’ve, my house is slowly but steadily appreciating. In fact, it’s responsible for most of my net worth gain this month.

So close to halfway

My overall investments are down, and the investment accounts I don’t actively contribute to (my traditional IRA that’s comprised of past 401ks and the Roth IRA I maxed out in January), keep sliding into the red. What a time to be alive.

But we’re still alive, and it still deeply pains me to think about the needless loss of life on both sides of the Russia-Ukraine conflict. May there be a peaceful resolution. If the world goes to war over this, none of anyone’s little portfolio movements will matter any more.

CurrentLast monthChange2022 Goal ASSETS Overall investments$202,627$208,496-$5,869As much as possible 401k (contributions only)$3,333$1,667+$1,666$20,500 401k (overall balance)$23,998$23,786+212As much as possible Traditional IRA$111,939$116,374-$4,435xx (can't contribute) Roth IRA$50,993$52,890-$1,897$6,000 (in contributions)COMPLETE! Taxable brokerage$9,436$9,770-$334$25,000 (total invested) Savings$7,117$6,116+$1,001$30,000 Primary home equity + appreciation$21,876$18,183+$3,693$20,000COMPLETE! Net worth in Personal Capital $239,845$238,904+$941$500,000 (overall goal) Track your net worth with Personal CapitalIn any regard, I’ll keep to my plans and keep sending money to my savings account every chance I can. I’m working my butt off to get ahead, but between that and parenting, I know that’s not sustainable. So I’m going to do my best and that’ll have to be enough. The money will do what it does, which is likely keep going up long-term, and dad needs to rest.

Watching him play in the backyard is everything

March 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30ish days, I:

Met the minimum spending on my my Capital One Venture X card and used nearly all the travel credits for another future tripStuck to my overall investing plan and added more funds to my 401k and HSA accountsVisited Washington, DC, for my son’s first domestic plane ride and hotel stayMade modest gains with home equity and appreciationManaged to put a little money aside in my savings accountThe attacks on Ukraine are weighing heavily on my mind this month, so I’m grateful to be safe and employed right now. I’ll stick to my plan and ride the many waves that it seems are inevitable short-term.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

February 4, 2022

FoundersCard Review 2022: Benefits, Updates, Cost – And Is It Worth It?

Time to update my FoundersCard review for 2022! I’ve been a member for 8 years by now. Each year, they add more (and more useful) benefits, keep the best ones, and refine their partnerships based on member demand and use.

The upshot is making the most of even ONE perk can outweigh the $395 membership – and the rest is gravy. And when you sign up with my link, your rate will never go up.

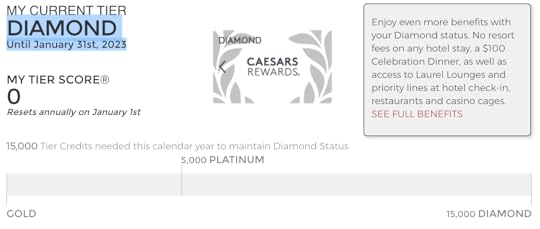

I’ve used the 15% AT&T discount, Hilton Gold elite status, and Caesars Total Rewards Diamond elite status (which is back this year through January 2023!) to cover and exceed the membership cost.

And there are new benefits for 2022, mostly focused on business and lifestyle. A couple of the travel benefits have gone away, but I believe that’s reflective of where we currently are with Covid-19 and that they’ll return. Until then, what’s left is still a long list of benefits.

Has it really been 8 years? Just renewed my FoundersCard membership again as a Charter Member

Here’s everything to know before you apply for membership.

FoundersCard Review 2022Link: Apply for FoundersCard and lock in the $395 annual rateFoundersCard is a membership built for small business owners and entrepreneurs. And the benefits reflect that – especially in 2022.

But many of them, particularly travel and lifestyle benefits, would be useful to most people. Definitely if you’re a frequent traveler. And if you’re not traveling this year, a fresh crop of small business benefits can easily make up for it. It just depends on what you personally find useful.

FoundersCard breaks down their perks into 4 categories:

Travel BusinessLifestyle HotelsOver the years, I’ve saved with from discounts with AT&T, elite status and offers for travel, a cheap trip to the Bahamas, and perks like free magazine subscriptions, free TripIt Pro for a year, access to a free private jet flight, and an event in Dallas with drinks and gifts.

Basically, if you can find 2 or 3 perks that make sense, you can do well with a FoundersCard membership.

With that, here are popular benefits in each category.

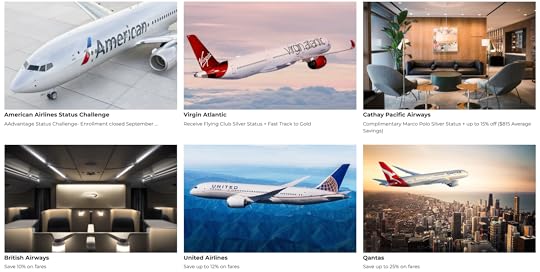

1. TravelAirlinesBritish Airways – Up to 10% off most fares between the US/Canada and the UK (this is also a perk of the Chase British Airways card)Cathay Pacific – 5 to 15% off flights and Marco Polo Club Silver elite statusEmirates – 5% off fares from the USQantas – Up to 25% off fares between the US and Australia/NZ, depending on flight directionSingapore Airlines – Up to 15% off select flights from the USSurf Air – Round-trip trial flight for $650 and two round-trip guest flights when buy an All-You-Can-Fly membershipUnited – Up to 12% off select flights booked directly through United.comVirgin Atlantic – Flying Club Silver elite status after completing one flight, and a fast track to Gold status

If you pay for flights with partner airlines, these are easy savings

These aren’t huge discounts in most cases, but they’re certainly nice when you can use them. Especially if you get travel reimbursed or fly those airlines a lot.

Again, these aren’t as bountiful as they once were. Notably absent in 2022 is the American Airlines partnership, which has been around for as long as I can remember. I really hope they get back on board soon.

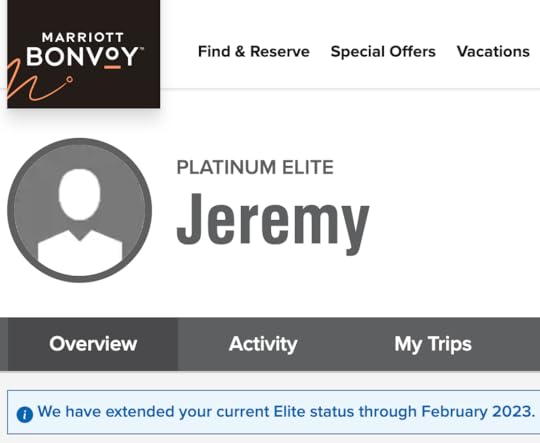

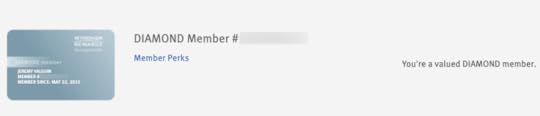

HotelsCaesars – Free Diamond elite status through January 2023 (waived resort fees on any hotel stay, VIP lines, $100 Celebration dinner, 20% off select room rates, free parking at most hotels)Hilton – Free Gold elite status through March 2023 (breakfast credits, upgrades when available, late check-out, 25% extra points on paid rates)IHG – Free IHG Rewards Gold elite status (must register by February 28, 2022)Marriott – Fast track to Bonvoy Platinum elite status (stay 15 paid nights within 3 months of enrollment, and get status for up to a year)

I’m Platinum with Marriott Bonvoy thanks to this FoundersCard promotion

I love Hilton Gold status for the breakfast credit. And if you stay at Hilton hotels often, you can get:

Bonus pointsFree breakfastLate checkoutRoom upgradesPossible lounge access, if you score a Club floor roomCaesars Diamond is back for 2022This year, Caesars Total Rewards Diamond elite status is back, which gets you:

$100 celebration dinnerTier status match to Wyndham Diamond elite statusNO resort fees15% off best available room ratesOccasional free nights at Caesars hotels4 free nights at the Atlantis hotel in the BahamasI had a $100 Celebration Dinner at the Horseshoe Casino in Tunica, Mississippi, over Thanksgiving break.

If you like Caesars hotels, FoundersCard membership can pay for itself with one trip to Vegas

And when you go to Caesars casinos, you can skip most lines – and you never pay resort fees. In places like Las Vegas, that can save you a ton of time and money. Plus, if you like Wyndham hotels, you can match your status to top-tier elite status with them.

If you stay at Wyndham hotels, you can check in as a Diamond member there, too

I’ve always found a fun way to use my Caesars status, whether it’s just popping into one of their hotels for a free dinner, or trying my luck getting into the lounges (which is not guaranteed to work any more, and you may have to pay). But if they’re slow, they might just let you in. Never hurts to try – I’ve gotten in a time or two despite their official policy.

This is by far one of FoundersCard’s most popular perks

Car rentalsAvis – Free Avis Preferred Plus Membership and up to 25% off rentalsHertz – Free Hertz Gold Plus Rewards membership and up to 20% off ratesSilvercar – 20% off rentals (this discounts also comes with the Chase Sapphire Reserve card)Sixt – Platinum status and 15% off rentals

Save on your car rentals and get status that lets you walk right to a car and drive away

Again, these are all perks of certain cards. I usually rent through Priceline/Costco/Chase Ultimate Rewards. But it’s worth checking every time for the best deal (and I always do – I sometimes find cheaper rates with Hertz status than I find anywhere else, FWIW).

Other travel savingsCouple extra lil bennies.

ZipCar – Waived setup fees for small business owners, $50 toward your first drive, and $35 annual membership feeTripIt Pro – Free year of Pro, then $39 annual rate for three years

TripIt Pro has become a must for me. Try it free for a year

I had a Zipcar membership when I lived in New York and loved saving on the initiation fees. Plus you get $50 in credits.

I’ve also gotten hooked on TripIt Pro. It’s become part of my travel organization and flow thanks to alerts for gate changes, delays, and connecting flights – often before the airline itself will ping you.

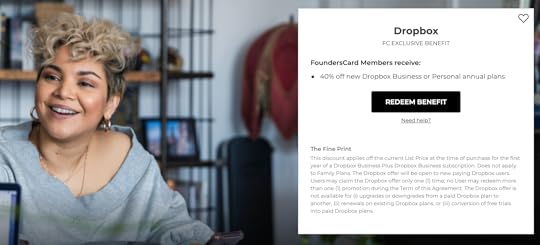

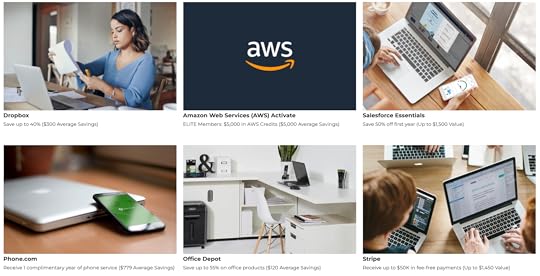

2. BusinessShipping, phones, and data backupAT&T – 15% off most wireless plans OR up to $10 off per line, per month on the AT&T Unlimited Elite planDropbox – 40% off new annual plansPhone.com – 1 free yearUPS – Big discounts on shipping (up to 47% off)Zoom – 20% off Zoom services (10 license minimum), one free Zoom Rooms license, 10% off Zoom phone

Save 40% off a Dropbox annual plan

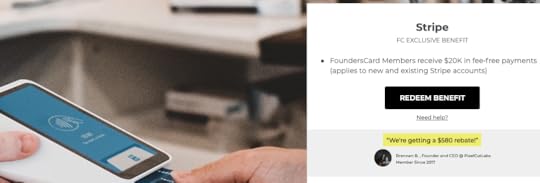

Promotion and documentationMoo – 20% off business printingConstant Contact – 15% off marketing tools and emails and a 60-day free trialShopify – 20% off for a year after a 14-day trial, to have your own e-shopBizFilings – 25% off servicesStripe – $20,000 in fee-free payments (!!!)Salesforce – Free 14-day trial and 50% off first annual subscription of EssentialsDocusign – 15% off annual plans for the first year for a minimum of 5 seatsHelloSign – 30% off first year of an annual Essentials or Business subscriptionSquarespace – 20% off first annual website planHubspot – 30% off software and a free CRM – 20% off services (domain registration and web hosting)

Save on promotional materials, email services, and business filings – indispensable. And the Stripe $20K deal is pretty sweet

I’ve personally used these combined discounts several times. It really does add up. I’ve incorporated LLCs, written a will, and gotten business cards for the blog with the participating companies.

And the $20K in fee-free Stripe payments can pay for a FoundersCard membership all on its own, considering the fee is 2.9% + 30 cents per transaction. On $20,000 in payments, that’s $580 saved – at least.

These benefits are super-focused for where we are in 2022. Discounts on electronic signature services like Docusign and HelloSign, cheap domain registration through Namecheap, personal websites through Squarespace, and email marketing through Constant Contact. These are big, recognizable names and discounts many businesses and entrepreneurs can actually use.

Other business savingsDell – Up to 40% off Dell branded productsGoogle Workspace – 20% off Standard and Plus plansLenovo – Up to 60% off select Lenovo and Think productsOffice Depot – Preferred pricing up to 55% off in-store and online, and free next-day shipping of orders of $50+1Password – 40% off Teams serviceZendesk – 6 months free of sales and support serviceSlack – 30% off plan upgrades for the first 12 months

I’ve gotten unexpected heavy usage from FoundersCard’s business discounts

You’ll find most of the discounts and offers, especially this year, in the business category – and there are lots more. You can poke around with a preview to see them all.

3. LifestyleThere are lots of discounts in this category, too:

Mr Porter – $200 off your first $500+ order, free next-day shippingEntrepreneur magazine – Free 1-year subscriptionAdidas.com – 30% off most itemsSpafinder Wellness 365 – 15% off gift certificatesShopRunner – Free membership (although this comes with many credit cards, including all Amex personal cards and some Citi cards)Many gyms, including Crunch, Equinox, CorePower Yoga, and Pure Yoga – Preferred ratesMost of them are for online shopping at upscale clothing stores. But there’s also gyms, spas, flower shops, and lots more.

The lifestyle benefits are full of savings on gym memberships, clothes, and much more

I’ve used them here and there (like Mr Porter and an Equinox gym membership). And the free magazines were handy to toss in a bag to read during a flight or layover.

Everything here is a “nice to have” – not crucial, but a fun extra. And again, it adds up if you shop often at a few of the merchants.

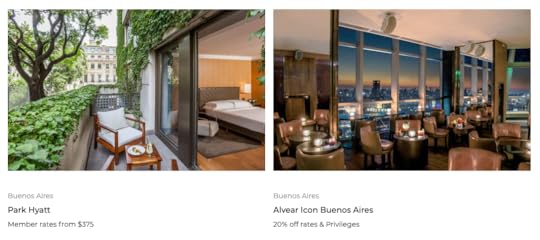

4. HotelsFoundersCard has relationships with hotel chains and independent/boutique hotels around the world. At 500+ hotels, you can get:

Exclusive members-only ratesUpgrades and extra perksMore flexible cancellation policiesNo travel agent/booking feesFor example, at certain Marriott hotels, perks include:

Complimentary welcome drinksMore flexible cancellation privilegesSpa discountsFree breakfastDiscounts off the standard room rateYou get similar treatment at Park Hyatt hotels – although the specific perks are unique to each hotel.

Even better, you can book directly. So you’ll still earn credit toward elite status and enjoy your elite status benefits. The caveat is that only:

16 Marriott hotels participate (8 W hotels and 8 Ritz-Carlton hotels)5 Park Hyatts participateBut there are many boutique hotels, including Arlo NoMad, Standard High Line, Ace, and YOTEL in NYC and Boston. And lots all over the world.

It’s aightWhile this is a cool benefit, it’s certainly not all-encompassing. But if you have paid cash stays in a FoundersCard hotel city, you can get a few extras at places that don’t partner with Amex or Chase and their respective upscale hotel programs (Fine Hotels & Resorts and Luxury Hotel Collection).

The selection in Buenos Aires leaves a lot to be desired

I ran a search in Buenos Aires and turned up 2 hotels in the FoundersCard program. New York has 22. Tokyo has 6. Hong Kong has 5.

I don’t consider this a huge money-saver as it’s so limited, but nice to have in your back pocket. And worth checking the prices for paid stays at upscale hotels.

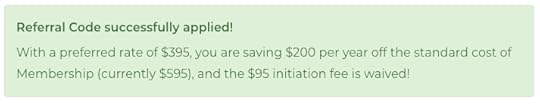

What’s it all worth?As of writing, FoundersCard is $395 a year with waived initiation fees for Out and Out readers.

Boom

If you can make good use of 2 or 3 benefits, it can easily save you that much – and often more.

FoundersCard has a Chrome extension so you won’t miss savings online

For example, my AT&T phone bill is ~$110 per month for 2 lines. I save $15 per month with the FoundersCard discount (applied before taxes). That’s $180 saved per year on something I need anyway – and brings the net cost of membership down to $215.

I have easily saved that much with the:

TripIt Pro discount (free for a year, then $10 cheaper for 3 years)Total Rewards Diamond elite status with $100 Celebration dinners and trip to the Bahamas (huge discounts with this perk alone)Marriott elite status for upgrades, lounge access, and free breakfastAlso, if you value hotel elite status, you can get Gold elite status with Hilton.

FoundersCard has become an invaluable part of my life, travels, and blogging business

The airfare discounts are also handy to save, if you fly those airlines often.

Using the deals = savings, not using them = not savingIt’s easy to completely cover the cost of the annual membership. But the real value is when you can use the benefits. If you do, you come out way ahead – $1,000s ahead, in some cases.

And if you don’t find the discounts useful, then skip it.

The goal of FoundersCard is to give small business owners access to discounts typically enjoyed by huge corporations. In that way, it gets you more access, savings, and perks than you’d ordinarily have with a small company.

I’ve had my FoundersCard membership for 8 years. And will definitely keep it as long as keep up the value proposition.

Ready to dig in and explore?

Preview the membership here. If you like it, use promotion code “FCHARLAN818” to lock in the special $395 a year rate for life.

FoundersCard review 2022 bottom lineLink: Apply for FoundersCard and lock in the $395 annual rateI hope this is a balanced review of FoundersCard. The upshot is: if you use the benefits, you can do well to recoup the entire annual membership fee – and much more. If there’s nothing that appeals to you, skip it.

I get enough return on my membership with the AT&T discount, which saves me $180 a year (this is irrelevant if you don’t have AT&T, of course). And all the other savings are easy and fun – which is the feeling I get from FoundersCard membership. It’s easy and fun. I love checking the new perks and using the various discounts that appear through the year.

Many of the built-in benefits are ancillary with co-branded credit cards. But here, you can access them without signing up for lots of cards.

As long as the value remains, I’ll keep FoundersCard. The savings are easy, discounts pop up often, and they’re engaged in the end product and user experience. It’s excellent for small business owners looking to access many of the same travel, hotel, lifestyle, and business benefits usually given to large corporations.

Interested? Preview the membership here. And if you want to apply, use promotion code “FCHARLAN818” to lock in the reduced membership rate.

If you have FoundersCard, what do you think of it? Have you gotten outsized value from your membership like I have?

February 3, 2022

Down $8K and sticking to the plan – February 2022 Freedom update

January 2022 felt like the longest month in a while. As I write this, the stock market will close on a downswing, which means all the numbers I just changed from pluses to minuses are going further into negative territory later today. Such is the stock market roller coaster ride, especially lately.

On top of a volatile month, I had some cash outlays that I’ll get caught up this month. All around, it felt like the hits kept comin’.

I’m still standing

But, life’s good and things are in the works, as they always are. I keep dancing around this midpoint in my FI journey – right around the $250K mark. When I cross it, there will be much celebration. I’ve been thisclose for a few months now.

This month, I’m down $8K. But we know how quickly things can change. Slow and steady. Except it’s really slow and feels shaky?

Unlike other months, I’m detached from the numbers and continuing to invest as I always have. I have 2.5 years left to reach my $500K goal.

February 2022 Freedom updateLink: Track your net worth with Personal CapitalI don’t mean to sound dour. Au contraire – it’s been a great month full of growth and change.

Grrr-ness

It’s just that – I maxed out my Roth IRA on January 1, like an eager investor. The market was strong and things looked promising. Days later, it all tumbled and that $6,000 isn’t worth $6,000 any more. Which is fine – it’ll go back up. It’s just part of the ride.

My overall goals haven’t changed. In 2022, I still want to:

Save $30,000 in savings accountsGet to $25,000 invested in my taxable brokerage accountMax out my 401k againShoot for a $350K net worth by year end

My son and dog playing in our yard

I’m also in the full swing of #dadlife and all that entails. I get to actively co-parent my son every day and he’s doing so great. I swear he grows taller almost every day. It’s going too fast!

This month, I’ll get caught up with my credit card bills from attorney fees. It was expensive – but worth every penny. That was part of my long, roller coaster-y January. Good thing my lawyer accepts credit cards. #minspend

The good thing about the dip is that I’m dollar cost averaging with my 401k contributions and bought low a couple of times. That resulted in discount stocks, so I’m pleased with how that turned out.

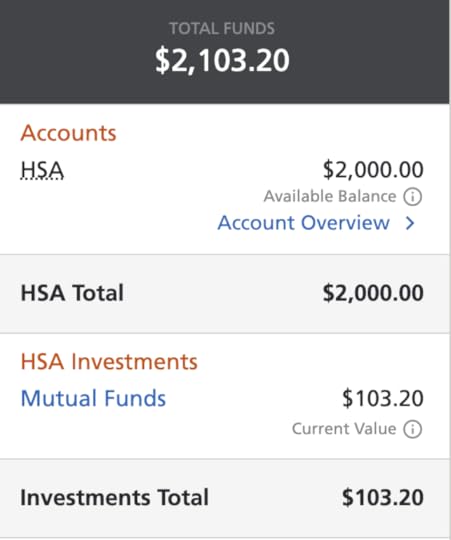

I also continued to add money to my HSA and bought the dip with investment funds inside that account.

But I was mostly in spend mode last month.

Cute dog alert!

The good news is that I’m quickly meeting the spend on my brand new Capital One Venture X card (which I am LOVING, btw!). And now I’m working to pay it all down before interest hits. That means lots of extra freelance work and late nights working while my son is taking naps or sleeping. I try to spend as much time as I can with him during the day.

I feel my identity and relationship to money changing because of him. More and more, I just want to make sure I’m secure enough to take care of his needs. It’s been such a shift, and I’m still catching up to that, too. These past few months have been nearly nonstop action.

By the numbersI added $1,667 to my 401k last month, but my overall balance is only up $801 – just to illustrate the effects of this current dip.

My house is already appreciating. The payments are manageable and it hasn’t needed any big maintenance yet (thank gods). I love my little house so much.

Once I get caught up this upcoming month, I’ll start funneling cash into my savings account to rebuild my emergency fund. That’ll give me some security in case anything happens. But as it stands, I have some more attorney fees to pay before I can really focus on that.

CurrentLast monthChange2022 Goal ASSETS Overall investments$208,496$217,160-$8,664As much as possible 401k (contributions only)$1,667$0+$1,667$20,500 401k (overall balance)$23,786$22,958+801As much as possible Traditional IRA$116,374$122,427-$6,053xx (can't contribute) Roth IRA$52,890$55,829-$2,849$6,000 (in contributions)COMPLETE! Taxable brokerage$9,770$10,250-$480$25,000 (total invested) Savings$6,116$6,113+$3$30,000 Primary home equity + appreciation$18,183$15,591+$2,592$20,000 Net worth in Personal Capital $238,904$247,214-$8,310$500,000 (overall goal) Track your net worth with Personal CapitalI know I keep alluding to lawyers, and suffice it to say I can’t speak about any of that yet. But I will as soon as I’m able. It’s just gonna be a little while longer, but we’re almost there.

Beautiful sunset here in OKC

So that’s my financial snapshot going into February 2022. I’m heavily invested in stocks, but continuing to add more all the time.

I always think about buying more crypto or stashing something away in a REIT through Fundrise or Elevate Money, but feeling like that’ll be a distant goal from where I’m at now.

Still, it’s good to diversify and once I get to a good spot, I’d love to explore some alternative investments.

February 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30 days:

I’m thoroughly in the swing of #dadlifeMy stocks are down like everyone else’sMy home equity continues to buildI got a running start on my Capital One Venture X card minimum spending with retainer feesI stuck to my overall investing plan and added more funds to my 401k and HSA accountsI’m working my hiney off to pay everything down right now and keep everything flowing. The stock market is doing its thing and I’m staying fully invested because I’m doing my thing, too. If this year is a rough patch – so be it. Investing in stocks is still the best long-term investment out there, even if this year ends up with negative returns. I’m in the mindset of wow – I’m getting everything on sale. Here’s hoping February picks up.

In a couple of weeks, I’m heading to Boston and Washington, DC – my first time flying since March 2020! I’ll have to do another post on that. I’m suuuuper excited to be back in the sky!

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

January 3, 2022

Almost to $250K & new goals for the year – January 2022 Freedom update

With 965 days left to reach my goal, I think I’ll cruise past the halfway mark of $250,000 this month!

December was a doozy. The markets rallied, I had over a week off to rest, and had my first Christmas in my new house in Oklahoma.

I’m still reeling from November and feeling a little whiplash at dropping $24,000 and then bouncing back over $30,000 in the last month of the year.

On top of all that, I started adding money to savings again and on January 1, went ahead and maxed out my Roth IRA with a $6,000 contribution.  I was waiting to let that settle before I posted this update.

I was waiting to let that settle before I posted this update.

In my new office. The house is coming along nicely

In my January 2021 update, my net worth was $173K. This month, it’s $247K. If I can manage a $73K increase in one year, then I’ll shoot to have a $100K increase this year and be at $347K by January 2023.

Now that the year is done, I’ll assess what happened and set new goals for 2022. I’m back to filling up my savings account (this year’s goal is $30K again) and then will add everything else to my taxable brokerage account. I just made my first mortgage payment and am still getting into the swing of the new house.

In 2022, I want to:

Save $30,000 in savings accountsGet to $25,000 invested in my taxable brokerage accountMax out my 401k againShoot for a $350K net worth by year end

View from my kitchen window with my son in the foreground

I’ll do that by:

Hopefully getting a raise at my current job (just hit my one year anniversary, so I’m due for a review)Continuing my freelance writing for Business Insider and NextAdvisorBlogging here on Out and Out moreLetting time in the market do its magic

Basically, I’ll just stick to the same playbook that got me to this point.

I depleted my savings with the down payment on the house. And I kinda want to buy an investment property next. I’d also like to have savings for emergencies.

Either way you slice it, saving $30,000 is my primary goal and what I’ll tackle first. I’m currently at $6,113.

Assembling furniture with my curious, helpful boy

Then I’d like to get up to $25,000 invested in my taxable brokerage account. These items alone should handily carry me into 2023.

Roth IRA is already maxedThe reason my savings dipped last month is because I sent cash to Fidelity to max out my Roth IRA. The first thing I did when I woke up on January 1 was buy $6,000 worth of FSKAX. And then went back to bed.

View this post on Instagram

A post shared by Harlan Vaughn | Out and Out (@harlanvaughn)

I’ve been setting up Roth IRAs for my friends and family and telling them to just buy FSKAX and let it sit, which is the exact same strategy I use. I recommend Fidelity, Schwab, or Vanguard and to buy whatever their Total Market Index fund is.

Can’t go wrong with a Total Market Index Fund

Low-cost, broad-market index funds are what I’m invested in.

By the numbersInstead of keeping my 401k on one line, I broke it into my contributions and overall balance to provide a little more detail there since I’m regularly contributing every two weeks.

I’m also putting a little money into an FSA account, and would like to purchase more crypto this year. Those are part of my “overall investments” even though I don’t break those out in this table (yet).

CurrentLast monthChange2022 Goal ASSETS Overall investments$217,160$196,110+$20,050As much as possible 401k (contributions only)$0xxxx$19,500 401k (overall balance)$22,958xxxxAs much as possible Traditional IRA$122,427$116,002+$6,425xx (can't contribute) Roth IRA$55,829$47,250+$8,579$6,000 (in contributions)COMPLETE! Taxable brokerage$10,250$9,554+$696$25,000 (total invested) Savings$6,113$9,812-$3,699$30,000 Primary home equity + appreciation$15,591xxxx$20,000 Net worth in Personal Capital $247,214$215,765+$31,449$500,000 (overall goal) Track your net worth with Personal CapitalIf you don’t already use Personal Capital, it’s a fantastic tool for tracking net worth. I like how it puts your number right at the top for easy tracking. I log in pretty often and really like the interface a lot.

For the home equity and appreciation row in the table, I’m calculating that figure as the Zillow estimate minus my mortgage. I knowwww it’s all relative and isn’t exact and all that, but I want to include my primary home as an asset for net worth purposes, mostly because a HELOC or refinance might be a tool for me in the future. And it’s actually shockingly accurate for my area.

[image error]Sooo close to halfway

Anywho, that’s how my net worth went up over $30K last month. I get more amazed each month as the snowball gets bigger and starts to grow on its own. Before I know it, I’ll have $300K invested (!).

January 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30 days:

I maxed out my Roth IRAStarted adding money to savings againMade my first mortgage paymentAm up $31,000 and nearly halfway to my goalDo you have a tiny pause after every bullet point like I do?I usually have more to say, but I’ll keep it short and sweet this month and save it for when I’m officially halfway to my goal. As y’all know, brevity is a challenge for me. But life is good and I’m getting to spend so much quality time with my son these days. A two-year-old is a particular type of tiring – one I’m grateful to have because time is moving entirely too fast already.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

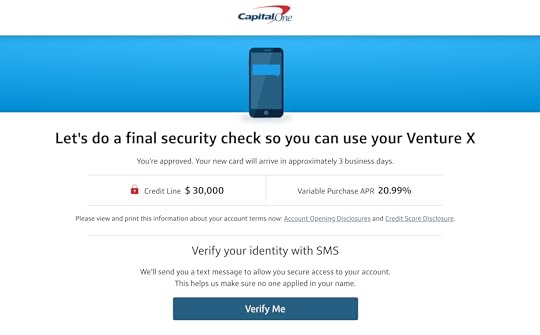

Success! How I got my Capital One Venture X approval (The BEST premium card)

I just got my first Capital One card over the weekend – and not for lack of previous trying. I’ve applied several times over the past few years but have always gotten a big fat denial. The official reason has always been “too many card accounts” or some other vague message, and I missed out on some really great offers.

I’ve tried to get the Capital One Venture card, the Capital One Spark Miles for Business card, and most recently, the fantastic Capital One Venture X card when it launched in November.

The Capital One Venture X card is THE card to have right now.

The Capital One Venture X card is the best premium card to come along in years. Using this photo until I can take one with my new card

It checks all the boxes: huge welcome bonus, great earning potential, ongoing benefits that justify the annual fee, and an overall simple yet powerful card. For most people looking for a premium rewards credit card, this is the one – and I don’t say that lightly. I really really wanted this card.

Here’s what convinced me to apply again. This time, I was instantly approved online with a $30,000 credit line.

Capital One Venture X approvalLink: Capital One Venture X Rewards cardCapital One didn’t like me for the longest time. I watched offers come and go, and even threw my hat into the ring a few times. With each application, I filled out the information, Capital One pulled my credit from all three bureaus, and then… denied. I even had an auto loan with Capital One that had perfect payment history. Surely that would give me a boost?

I was getting seriously bummed over this, because Capital One has a great card lineup – and has made strides with transfer partners and most recently, brand new airport lounges.

With each denial, I turned around and got a different card with another issuer, usually with instant online approvals. When I applied for the Capital One Venture X card in November and got turned down, I was just about ready to give up on Capital One altogether.

Capital One preapproved cards made me change my mind about applying againLink: Check your Capital One preapproved offersI’ve been checking my Capital One preapproved offers every so often, just to see what comes up (there’s no impact to your credit). Despite having ultra-premium cards from other issuers, a 100% on-time payment history, and 20 years of revolving accounts under my belt, Capital One did NOT like me.

My preapproved offers were for secured credit cards. Clearly they didn’t like what they were seeing. Did I have too many card accounts?

[image error]Seems promising

Then it changed.

When I checked over the weekend, I was preapproved for two actual credit cards. That was new.

But here’s what made me apply: the fixed interest rate.

The cards had a 26.99% interest rate, which is ridiculous of course but I never carry a balance and don’t pay a dime of interest, so it was moot.

What struck me was that it was a fixed rate instead of a range. That made me think that Capital One had reassessed me, enough to show me one interest rate and two preapproved card offers. Could I parlay this to the Venture X card? I decided to apply again.

Instant approvalI was halfway expecting to get another denial. But, there are few cards I’m eligible to get any more and I closed on my house so I thought, “YOLO” and spun the wheel again.

There’s no high like hitting the “Submit” button on a credit card application

I literally gasped when I was instantly approved with a $30,000 credit line. I verified my information and set up my online account.

Finally, after all these years, I got my first Capital One card – and I’m really excited about it!

Capital One Venture X detailsLink: Capital One Venture X Rewards cardThough there’s a $395 annual fee, the card benefits more than make up for it. The Capital One Venture X card comes with:

Capital One Venture X100,000 Venture miles (Worth $1,000 toward travel) • Earn unlimited 2x miles on every purchase

• Earn unlimited 2x miles on every purchase• Transfer your miles to 15+ travel loyalty programs

• Enjoy free access to Capital One lounges for you and two guests

• Limited time: Get up to $200 back in statement credits for vacation rentals (Airbnb and VRBO) charged to your card in the first year

• Get 10,000 miles very anniversary year (worth $100)

• Get an annual $300 credit for bookings through Capital One Travel (flights, hotels, and more)

• $395 annual fee• $10,000 on purchases within 6 months from account opening It doesn't get much simpler to earn and redeem points than this• Learn more here

The annual $300 statement credits plus the 10,000 anniversary bonus miles (worth $100 toward travel) easily cover the annual fee. Then there’s lounge access to Capital One and Priority Pass lounges, 10x miles on hotels and rental cars booked through Capital One, 5x miles on flights booked through Capital One, and 2x miles on all other purchases. Plus, you get $200 to use toward vacation rentals (like Airbnb or VRBO) the first year.

That doesn’t even include the huge 100,000-mile welcome offer, which is worth $1,000 toward travel on its own.

You can transfer Capital One miles to a variety of transfer partners for even more value per point, which is likely what I’ll end up doing.

And while those transfer partners are still a bit limited, I can see myself using the Venture X card for regular purchases just to get the 2x miles. If anything, it pays for itself and can be an “everywhere else” card. It’s definitely the one I’ll use at Costco from now on, because it’s a Visa card. (Actually, this might the new best card to use at Costco… I’ll have to think about that.)

Capital One Venture X approval bottom lineI’m pleased as punch that I got an approval for the new Capital One Venture X card! Maybe this will help others who’ve struggled with Capital One approvals in the past.

The switch for me was getting preapproved offers for credit cards with a fixed interest rate. Based on that, I decided to apply for this card, and it worked. On the flip side, if you check your preapprovals and don’t get anything – or only get secured cards – you might not get approved for this (or other) Capital One credit cards.

While I don’t think the Capital One Venture X card completely kills other ultra-premium rewards cards, it does have an annual fee that’s lower than most, and the built-in rewards easily cover the cost of the annual fee. For most people (even casual travelers) this is the best all-around travel rewards card on the market right now.

I’m excited to get it and put the benefits to use. It is my highest recommendation now. The welcome offer, the simplicity and versatility of the card, the benefits – all superb. This card is a game-changer.

Have you had a hard time getting approved for Capital One cards in the past? Are you interested in the new Venture X card?

December 4, 2021

In recovery: Down $24K & bought a house – December 2021 Freedom update

It’s getting real in Oklahoma City. What a month. I’m emotionally and spiritually depleted – and my finances took their expected dip.

Along with furnishing a down payment for a house, the markets also reacted because of Omicron fears. Moving and setup costs were more than anticipated.

But I’m here in Oklahoma City. I’ve been coughing and sickly since I moved in – and two days after I closed, my dad died.

So I drove all way the to Mississippi to get my stuff and go to his house, which went terribly. His wife was awful to me. I missed a lot of work and the following week was Thanksgiving.

Now there’s talk about a new Covid variant and I am still shell shocked. My nervous system is shot and I haven’t even begun to process everything that’s happened.

This was two days before my dad died and I’d just closed on my new house

This month, I should find out who my new mortgage holder is (my lender is going to sell the mortgage) and be able to add my house and mortgage account to my net worth calculations.

I almost didn’t post this month. My finances are in flux and things haven’t settled yet from the move. But in the spirit of honestly documenting this journey, I’m here, raw as I am, dips and all.

I will say – the house is so, so sweet. Such a good energy. Once I catch my breath, I can’t wait to get it decorated and furnished and work in the yard.

But for now, I’m being extra extra gentle with myself. Losing a parent you weren’t really close with has so many complicated emotions.

December 2021 Freedom updateLink: Track your net worth with Personal CapitalAll that said, my automatic investments still went through. I dumped some cash into my 401k and only took what I absolutely needed from savings. I want to guard those funds for emergencies or Things That Really Matter, and this month had both. I’m unable to speak freely on this topic right now, so the vague description will have to do.

I put 5% down on the house and got the seller to contribute $5,000 toward closing. So I brought ~$15,000 to the table, which is now part of my home’s equity.

My back yard is so park-like

I had to pay for the moving truck, setup costs for all the utilities, new bed, gas, and all the rest. Once I get a few more paychecks in my account, I’ll be able to make progress toward my $500,000 goal.

Being down ~$24K does sting, especially when I was almost to the halfway point. But January 2022 should put me near where I was – plus I have a house accruing equity and appreciation. It feels good to have a home base again.

And with that, my nomadic adventure is over.  Ah, but it was fun while it lasted. Now I have other things to focus on here.

Ah, but it was fun while it lasted. Now I have other things to focus on here.

Just last month, I hit $200K invested and today I’m at $196K invested. Because of my stock-heavy position, I’m down across all my accounts. But, I’m sure it’ll pick back up eventually. Another Covid variant is all the world needs right now. #sarcasm

I got to hang with this cuddly pup last month

But for real, I’m going to stay the course and keep working and investing. I believe Oklahoma City is on the up and up – and I’m really glad I own property here now. I want to scoop up a couple more as soon as I’m able.

Back to hardcore savings modeMy current savings number is $9K – which is a lot less than my desired $30K. But that’s what it was there for – to use for something when I needed it.

But on January 1, I fully plan to add $6,000 to my Roth IRA, which will cause my savings to dip even more – again, temporarily.

Now my desk is in front of that window and I’m using this room as my office. It gets amazing light all day long

After that, I’ll spend 2022 getting my savings back up to $30K and potentially looking to spend it on an investment property here in Oklahoma City.

So here it is all laid out.

You can see the dips all across the board – in my investments, savings, and overall net worth.

2022 will definitely be about bulking up my savings and putting any excess into my taxable brokerage account.

Work also just announced a 3% 401k match starting in January, so that’ll be a little extra toward my overall investments. As I always say, it all adds up (lol I say that like I came up with it).

CurrentLast monthChange2021 Goal ASSETS Overall investments$196,110$200,190-$4,080As much as possible 401k (contributions only)$17,500$15,833+$1,667$19,500 Traditional IRA$116,002$118,923-$2,921xx (can't contribute) Roth IRA$47,250$48,655-$1,405$6,000COMPLETE! Taxable brokerage$9,554$9,847-$293$15,000 Savings$9,812$30,241-$20,429$30,000 Net worth in Personal Capital $215,765$240,017-$24,252$500,000 (overall goal) Track your net worth with Personal CapitalIt hurt to turn nearly all my pluses into minuses.  But I know it’s just a season and that it’ll all swing back up again soon.

But I know it’s just a season and that it’ll all swing back up again soon.

All in all, life’s good. I have a lot to look forward to now. This past month brought changes that will stick with me for a long, long time.

December 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30 days:

I bought a house (!!!)My father passed away on November 17My savings went way down because of moving and down paymentMarkets dipped in a big wayMy net worth went down $24KIn life, it’s the natural progression of things to lose your parents as some point. I really thought I would have my dad for a lot longer – at least a few more years. He was only 61 and passed away two days before his 62nd birthday. I’ll be working through a complex network of feelings about it for a long time. It didn’t directly affect my finances, but I think it’ll change how I view money long-term. I’m still thinking about that.

And now I’m officially an Oklahoman. On top of feeling pretty sick most of last month, I’m ready to put this year in the can and get to 2022. It has been a good year. A lot happened. A lot of good changes that I’m grateful for. I’ve been quiet here and on social media – so now you know why. But, I look forward to sharing more once I start feeling better about everything.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

November 1, 2021

$200K invested, up $14K, and buying a house in Oklahoma – November 2021 Freedom update

Hi from Oklahoma City! I have a house under contract here and am scheduled to close in two weeks. Hell on an intro, eh?

I figure it can be a primary residence, and later on, an investment property. I’m finally getting started with real estate investing.

My rate is 3.125% and I’m getting a great deal on a nice-sized house – 4 bedrooms and 2 full bathrooms. My monthly payment for mortgage, property tax, and insurance will be ~$1,500 – which was my monthly nomad budget. The urban core area is on the up and up. It’s on a quiet dead-end street with only 9 houses.

Of course I’ll want to buy furniture and spruce the place up a bit, which will cost more money. But I figure it’ll all even out.

My new house in Oklahoma City

This means my nomadic adventure of living on the road is coming to an end soon. But for the best reasons possible – I’ll get to spend more time with my son, start buying investment properties, and make art again. I’ll also get to keep up with my health and exercise goals a lot more easily.

I’m nervous, excited, second-guessing everything, and ultimately deciding to take all of this on. It’ll be good. I feel it.

But, my net worth is gonna take a short-term plunge – right when I was getting to the halfway mark. What a journey!

November 2021 Freedom updateLink: Track your net worth with Personal CapitalMy other big news is I officially have $200K invested!

As you’ll see, my current net worth is $240K, so investments are basically all of my net worth.

View this post on Instagram

A post shared by Harlan Vaughn | Out and Out (@harlanvaughn)

I hit $100K invested on July 22, 2020. So it took about a year and three months to add another $100K. As of today, I’m working toward my third $100K.

This includes my 401k, Roth and traditional IRAs, taxable brokerage account, and a small amount of crypto.

House house… house!So… I’m buying a house. I’m putting 5% down and locking in a low interest rate. There were other places I wanted to go on my nomadic adventures, but I feel it’s time to make room for other things. There will always be places I’ll want to go. But I want to be here for a while.

And, there are a lot of other factors at play that aren’t my story to share. Suffice it to say that this decision transcends finances, but is about family and connection and having a stable place. I believe this’ll be a good long-term move that will set me up for the next phase of my life – which includes being closer to my bio-son.

Playing with him is everything

In a way, I’ll still feel free. There is a lot of good for me here. I want to be part of that goodness for a while.

Plus – financially – it’s time to diversify and add some equity and real estate to my portfolio. The plan is to keep this house around for a long, long time in one way or another.

Net worth gyrationsBecause of the house purchase, the $30K I had in savings will go toward the down payment. So my net worth will fall later this month. But really – I’m just moving that money into another place. I don’t think I’ll ever lose it.

But, it’ll take some time for my net worth to bounce back after the sale is done. And all the furniture. And the repairs I want to make, including adding central heat and air. (The house is from 1938 and still has AC window units and a gas furnace. Yay modernity!)

Coffee in Memphis

I’m also potentially getting another – actual investment from Day One – property in New York state. It’s a place I found over the summer while I was in the Catskills. That place is under contract too, and I’m looking to close on it right after the Oklahoma place.

I’m also being gifted three acres of land in Arkansas. So in another month, I could potentially go from nomadic and houseless to having three pieces of property with a combined total worth of $500,000. Holy smokes.

But I get ahead of myself. My point is: net worth fluctuations are coming, but so is a lot of other stuff.

By the numbersI had a stretch goal to get $15,000 into my taxable brokerage account my the end of the year. It’s looking more and more like that isn’t going to happen.

I also worked really hard to put $30,000 in savings. Between the move and property purchase(s), that’s probably going to sink closer to $0.

In 2022, my goals will be to bulk up my savings again and invest extra cash in my taxable brokerage account.

But for this year, I’m on track to max out my 401k, and have made some huge and significant financial progress. Here are the numbers:

CurrentLast monthChange2021 Goal ASSETS Overall investments$200,190$184,870+$15,320As much as possible 401k (contributions only)$15,833$14,167+$1,666$19,500 Traditional IRA$118,923$110,917+$8,006xx (can't contribute) Roth IRA$48,655$45,344+$3,311$6,000COMPLETE! Taxable brokerage$9,847$9,200+$647$15,000 Savings$30,241$30,180+$61$30,000COMPLETE! Net worth in Personal Capital $240,017$226,460+$13,557$500,000 (overall goal) Track your net worth with Personal CapitalOverall, I’m pleased with my progress. I’m really glad to be borrowing bank money for a home loan. Other people’s money, baby. OPM.

This is a good place for me now

And there are other things in 2022 that will help me financially that I’ve been working on. I can’t say just yet, but… things are shaping up to be really, really good. I can’t wait to share everything!

November 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardThis past month found me:

Hitting $200K in investment accountsPutting a house under contract in OklahomaPutting an investment property under contract in New York stateContinuing to invest 25% of my paycheck into my 401kUm that’s a LOT going on thereYes, that’s definitely enough for one monthI didn’t even get to tell y’all about driving from New York to Vermont to Delaware to Virginia to Tennessee to Oklahoma. It’s been… a ride (literally). Everything moved so quickly once it got going. I’m fairly breathless at the moment.

You can also follow me on Instagram for more pics and stories over the next few weeks. Thank you to everyone who reads these updates. It’s the world to me.

Stay safe and scrappy out there – more updates to come!

-H.

October 1, 2021

Down $4,000 & getting back to nomadic life – October 2021 Freedom update

I’m writing this on my last day in upstate New York, between bouts of packing. I have been here for 76 days.

In that time, I’ve saved a few checks, completed my savings goal, and looked into buying a couple of properties (but haven’t pulled any triggers quite yet).

I’m sad to leave and excited to be back on the road at the same time. Next up is two nights in downstate New York, four days in Delaware, picking up my friend at Dulles and staying a night in Roanoke, then Nashville for a night, Memphis for two weeks, and Oklahoma City for two weeks. Looks like I’m hopping right back to nomad life!

I loved spending time in Vermont

I was also able to spend two glorious days in Vermont last week. I would’ve stayed longer, but it proved to be an expensive destination.

Depending on what happens this month, I’ll either be buying a house somewhere or continuing my nomad journey. (Or both?) Either way, I’m letting the destinations guide me instead of trying to choose places. I’m following prices to places where my dollars go further.

Oh and of course September was a bad month for my Freedom update – down $4,000. Still hoping I can hit $250K in Q4!

October 2021 Freedom updateLink: Track your net worth with Personal CapitalI looked back to my Freedom update from September 2020, whose title is “Down $4,000 & feeling nervous this month.”

And had to laugh because I’m similarly down $4,000 from September 2021 and also feeling… Nervous? Anxious? Excited?

I feel things beginning to shift.

I saw Alanis, Garbage, and Cat Power live in September 2021. My first concert since February 2020!

I also didn’t know September is notorious for downward stock prices because of selloffs before the end of the fiscal year. Now I do.

And despite loading up my brokerage account, investing $2,000 in retirement accounts, and saving $3,000 from paychecks, I’m still down from last month. All good though – living and learning.

House house… house?I’m bent on buying a house to have as an investment property. I figure I should jump in while rates are low and before prices jump any higher. It would be a primary residence first, then an investment property later. The thing is, I don’t know where to buy.

I’m considering Memphis or Oklahoma City. Memphis to be close to my family and because it’s a place I know well. Or Oklahoma City because my son is there and I could be more of a father to him. I don’t know much about the area, but it would be nice to be closer for bonding time now that the option is there.

I feel – at this moment – that OKC will win out.

But I still want to look in Memphis to get a basis of comparison.

Or, third scenario. Neither works out and I continue living on the road. In that case, I would drop my dog at my mom’s and spend winter in Mexico. These next few weeks are pivotal.

Not beating inflation, but it’s fineBecause I’m uncertain about my next move, I’ve been stashing all my extra income in a checking and/or savings accounts, which I never do. Y’all know I keep my checking account balance low on purpose.

But the thought of an impending down payment, renovation project, or set of closing costs has me keeping money out of my brokerage account and in savings for now. It pains me to not give every job a dollar – and I hated missing on September’s “dip” – but I might need that money soon.

More mountains

I wonder if that means I’m poised to buy something and how long I’ll wait to invest it. This has truly been the signal of my intentions. As much as I get lost in thought, and despite all my processing here, I find myself making plans almost unconsciously. In that way, following the money is guiding the decisions I’ll make for the future.

By the numbersIt pained me to turn my pluses into minuses this month, but that’s how it goes. I’ve broken out my investments by account and kept that setup from last month. Here are the numbers.

CurrentLast monthChange2021 Goal ASSETS Overall investments$184,870$191,277-$6,407As much as possible 401k (contributions only)$14,167$12,500+$1,667$19,500 Traditional IRA$110,917$116,399-$5,482xx (can't contribute) Roth IRA$45,344$47,627-$2,283$6,000COMPLETE! Taxable brokerage$9,200$8,766+$434$15,000 Savings$30,180$30,178+$2$30,000COMPLETE! Net worth in Personal Capital $226,460$230,333-$3,873$500,000 (overall goal) Track your net worth with Personal CapitalI’d love to be at $250K by the end of the year, so I guess we’ll see where we land. I’ll keep dumping $2K per month into my retirements accounts and save as much as I can otherwise. The rest is up to chance and the stock market.

I’m still proud of my progress

Everything has felt so uncertain this month. I removed the stock apps and trackers from my phone because I was getting too attached to watching the markets every day. In some ways, I think it’s best if I don’t know.

I want to keep in touch with my goals, but the longer this journey goes on, the more I realize I’m at the mercy of the market and its dips.

October 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardThis month I:

Invested $2,000 in retirement accountsSaved $3,000 in checkingSent extra funds to my taxable brokerage accountStill ended up $4,000 down from last monthExplored houses in Memphis and OKCThe chance to spend more time with my son in Oklahoma City would be amazing. His mom and I have been talking and they’d like for me to be around more.

(For those who don’t know, I have a bio son after donating sperm to a lesbian couple – and I’m a gay man.)

To think this would be a part of my journey was something I hadn’t considered before, but I’m open to it, and seeing if I can make it happen. Me, an Oklahoman? What is life, anyway?

Being able to work remotely has made this so much easier. And like everyone else, I’m desperately ready to travel again. It’s been hard having a travel blog these past couple of years. But I am hopeful, and looking forward to Japan in April 2022.

Thanks to everyone who follows these updates. As always, I’ll post on Instagram these next few weeks as I head back down south. Please follow me there to keep in touch!

Stay safe and scrappy out there – hope everyone has a good weekend!

-H.

September 2, 2021

Up $13K and near the halfway point – September 2021 Freedom update

Hi again from Upstate New York! I’ll be here a couple more weeks, then drive to Vermont and Delaware – then home to Memphis. From there, I’ll regroup and maybe do one more big loop around the Southwest this winter.

And then?

Well, you know I don’t plan that far out – but I’ve been looking at houses in Memphis and will hopefully snag one soon.

This Freedom update finds me with my highest-ever net worth, up over $13,000 since last month, and nearly halfway to my $500,000 goal.

The Catskills have been good to me

When I leave here, it will have been two months in Upstate New York. By staying at a friend’s house, I’ve been able to save all my extra cash, complete my savings goal, and put the excess into my taxable brokerage account. My only expenses have been groceries and eating out, with the occasional splurge.

Professionally, it’s been great too. I started writing for NextAdvisor on Time.com and have built up a cadre of articles on Business Insider. I’ve also been killing it at my regular 9 to 5, and posted on social media every day in August 2021 as part of my trashy mystery witch school (which I’ve been doing for one year now).

You can follow me on Instagram for thoughts about divine masculinity, sexual awakening, daddy issues, travel and travel memories, investing, and random slice-of-life stuff.

Now for the money!

This month has been an absolute steamroller. My net worth is $230,333, which puts me just $20,000 away from the halfway point of my $500,000 goal. That means that for the rest of 2021, it only has to increase $5,000 each month to hit 50%. And that is pretty certain.

The only “hiccup” would be if I buy a house. I’d put some cash down, which would go into equity. But considering it would be a primary-then-investment property, I think I’d include it in my net worth.

This is starting to take on a life of its own

And, I’m close to hitting $200,000 in my investment accounts – another milestone! But clearly most of my net worth is in index funds, which is great, but adding real estate to the mix would add some diversity.

However the pendulum swings, I’m working toward my third $100K. And I’ll be over the total halfway point to kick off 2022. That’s super rad.

I reached the $30,000 savings goal – so I set another one. In the next four months, I want to get $6,000 more into my taxable brokerage account – for a total of $15,000 by year end.

After I pay bills from my checking account, I move the rest to invest in FSKAX. And I keep my checking balance low – like $100 or less. There is no reason to keep much in checking now that I have a cash emergency fund.

Work.

I consider the checking account to be the “clearing house.” Everything gets dumped into there, then I send it to various places and put it to work.

In this way, I sent $3,500 to my investments last month.

Once I get back on the road, I won’t have as much extra to invest. But I’ll still send every last sent when I can. So yeah, I think $6,000 is a realistic goal.

What happens if I buy a house?I just spent so much time building up my savings – what if I tap it for a down payment? You know what? GOOD.

Then I can focus on rebuilding my savings to have money for another future investment. With rates still low and prices coming down a little, I feel like the next few months are the prime time to pounce.

All I’m saying is – don’t be surprised if I pop on here next month and say I closed on something.

Being upstate has been absolutely bucolic

Then I can spend time and cash getting a place all cute before renting it out and buying another one. Now that I’m a roll with index funds, I’d like to get another income source going. It’ll be slow and worthwhile.

I would like to keep $30,000 in cash at all times though. Any time my savings dips below that, I’ll pause everything else and switch to replenish mode.

I invested with my HSA, tooThe HSA available through my employer requires $2,000 in cash before you can start investing. Anything over that amount, you can invest.

When I saw Vanguard’s Total Market Index Fund was available, I decided to move enough cash over to meet the threshold and start investing.

My new triple tax advantaged account

I’ll throw in $200 per month into this account through payroll deductions because I can contribute before-tax funds, the investments grow tax-free, and I’ll pay no taxes at withdrawal (for healthcare expenses). I don’t spend a lot on healthcare, but Future Me might. So now I have this working on my behalf, too.

Future Me is gonna be so set!

I decided to expand this section to show exactly where my investments are. I have a mix of 401k, traditional and Roth IRAs, and now – my taxable brokerage account.

CurrentLast monthChange2021 Goal ASSETS Overall investments$191,277$179,445+$11,832As much as possible 401k (contributions only)$12,500$10,833+$1,667$19,500 Traditional IRA$116,399xxxxxx (can't contribute) Roth IRA$47,627xxxx$6,000COMPLETE! Taxable brokerage$8,766xxxx$15,000 Savings$30,178$29,160+$1,018$30,000COMPLETE! Net worth in Personal Capital $230,333$216,898+$13,435$500,000 Track your net worth with Personal Capital

Fire emoji

My traditional IRA is all rollovers from 401ks of previous employers. Sort of a 401k graveyard. Except it’s still living.

Anyway, I put all my IRA money into the Roth IRA and you bet your tuchus I’m maxing it out again on January 1, 2022.

Beyond that, I’m tracking my current 401k until I hit the $19,500 max for the year and added a new goal to focus on for the rest of the year: $15,000 in the taxable brokerage account.

I considered making it $20,000, but between hitting the road again and maybe buying a house, I thought it best to keep it conservative. But between us, $20,000 is still my stretch goal.

So there we go. Money moves this month were:

Starting investments with an HSAReaching my $30,000 savings goalSending all extra cash straight to index fundsA big $13,000 net worth increase over last monthClose to $200,000 invested (!)Almost at 50% of my overall $500,00 goalFor the rest of the month, I’ll collect a couple more paychecks, head to Vermont for a while, then start heading down South. I’d still love to spend a few months in Mexico at some point, but if a good house pops up, I might try to snap it up. We’ll see what shakes out.

All that to say, it was a good month – and the halfway mark is just around the corner. Now that I’m almost to $200,000 invested, this is starting to really locomote.

Thank you to everyone who reads these updates. Your comments and encouragement are everything. Thank you.

Stay safe and scrappy out there! – H.

August 30, 2021

Booked for April 2022: Business class flights to Japan on JAL worth $19,000!

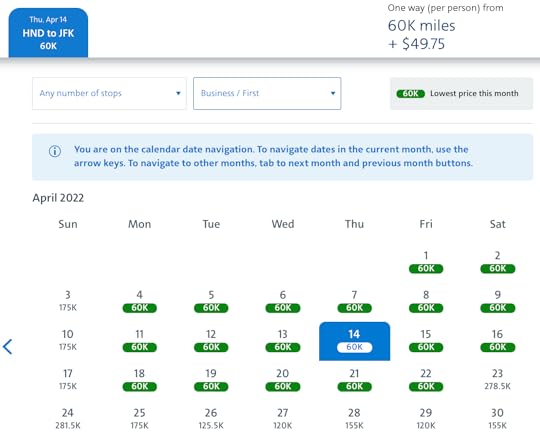

Late on a Saturday night, I ran award searches on the American Airlines site, as one does. Tokyo is one of my favorite places on this planet, and I found business class flights on JAL for only 60,000 miles each way – and dates were (are!) wide open in April 2022.

So, I took “AAdvantage” of Citi’s limited-time partnership with American and transferred Citi ThankYou points to American miles – to book two nonstop round-trip flights in the middle of cherry blossom season.

Here’s hoping this works!

I haven’t flown – anywhere – since March 2020, and this will likely be my next international trip. Japan isn’t open for travel now, but who knows where the world will be in eight months. American’s cancelation policy is flexible, so there’s nothing to lose.

The best part? I’m (hopefully) going for an entire month. And these flights would’ve cost nearly $19,000 had I paid cash!

Japan 2022 in JAL business classLink: Review: JAL Business Class Sky Suite 787-8 NRT-DFWI’ve flown JAL business class before, so I mostly know what to expect (though that was pre-covid). The biggest X-factor here is whether Japan will be open for travel by April 2022. That’s eight months away – and over two years since the country closed to foreigners.

When the news broke that Citi ThankYou points would transfer to American Airlines through November 13, 2021, I got curious about what was available. In my searches, I noticed several nonstop flights to Japan landing at Haneda (HND) instead of Narita (NRT), which is much closer to Tokyo. When I pulled up the monthly calendar, award flights were wide open in April and May 2022.

Still available!

As I write this, there are still tons of nonstop award flights available – many with multiple seats in business class.

For two nonstop round-trip flights, I needed 240,000 miles but only had 140,000 miles in my American account. Luckily, American allows you to place partner award flights on hold for 5 days if booked 14 days before departure, which was plenty of time to transfer the extra 100,000 miles from my Citi ThankYou account. I initiated the transfer on Sunday night and they were in my account on Tuesday morning.

Boom

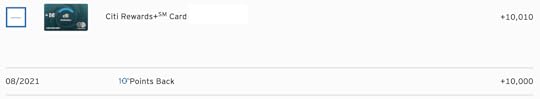

Plus, thanks to my Citi Rewards+ card, I got 10% of my Citi ThankYou points right back in my account!

Ticketing the “on request” flights through AmericanMy friend and I are both flying there JFK-HND. He is flying back HND-JFK and I’m flying HND-DFW (I’m loving these nonstops from HND). After making the transfer from Citi ThankYou points to American miles, I had a little over 240,000 miles in my American account – more than enough for these flights.

I booked my friend’s flights as a round-trip ticket (JFK-HND) and 120,000 miles came out instantly. The taxes and fees for round-trip flights are only ~$55, and that was charged to my credit card immediately.

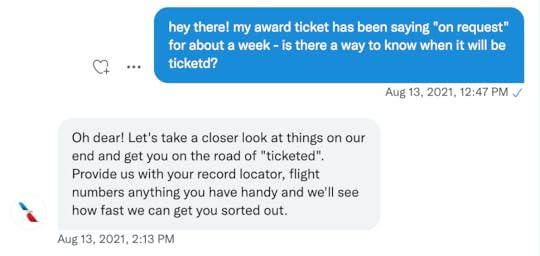

But then, the AA site was being glitchy when I tried to book a multi-city award for JFK-HND-DFW, so I had to book two one-way flights, which is fine. These two segments were “on request” for about 5 days. I started getting nervous.

I called American and they assured me it would be fine. Another couple of days passed. The tickets were still “on request.”

I was getting a bit anxious

So I reached out to the Twitter team and they told me the same thing. I figured I’d forget about it and let the ticketing department do what they do.

My road from “On request” to “Ticketed”

I transferred the ThankYou points on Sunday, August 8The American miles showed up on Tuesday, August 10My return segment HND-DFW was ticketed on Monday, August 16My departing segment JFK-HND was ticked on Monday, August 23Over two weeks until I was fully ticketed. Point being – if your ticket is “on request,” just wait it out. It seems like things are taking longer than usual across the board, so I wanted to share my timeline for reference.

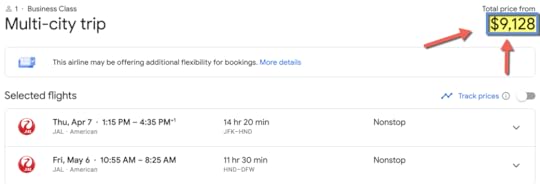

These flights are worth $19,000 in cashMy friend’s flights are $9,426.

And mine are $9,128.

That’s a combined cost of $18,554. Using 240,000 points/miles divides to nearly 8 cents per point in value, which is an excellent deal.

And really, because I got 10,000 of those points back, the points are worth that much more for this trip. Can’t wait to be back in Japan – hopefully soon.

It’s free to cancelLast year, American stopped charging reinstatement fees for canceled award flights. And because I can cancel them on AA.com, the miles will be instantly redeposited if I can’t go.

So while I’d love for these flights to work out, I can always save them for when Japan does open (assuming I have to push the trip back). For this reason, I had zero hesitation about booking.

But gosh, it would burn to have to cancel this. A month in Japan would be an absolute dream.

AA transfers make the Citi Premier 80K offer that much betterFor a limited time, the Citi Premier card is offering 80,000 Citi ThankYou points after spending $4,000 in purchases with your card within the first 3 months of account opening – a best-ever offer that I personally value for at least $1,600.

Considering the flights I booked were $4,500 each way and only required 60,000 points, it’s clear this welcome offer can be worth much, much more. And with my booking example, 60,000 points would get you a one-way business class flight to Japan – and you’d still have 20,000 points to put toward another flight.

Looking forward to international travel again!

The Citi Premier is one of the best all-around travel rewards card because you earn 3 points per dollar spent on:

Restaurants for dining outGas stations for fuel and snacksSupermarkets for groceriesAir travelHotelsThat’s a huge number of bonus categories from one card. There’s a $95 annual fee, but between the bonus categories and welcome offer, it’s well worth opening and keeping long-term. It’s available with my links (available throughout the site) through CardRatings, which is an Out and Out partner. Thank you for using them to apply!

There are lots of routes available with American Airlines right now. When I saw nonstops to Japan in business class, I booked without a second thought because of American’s easy cancelation policies. And if it works out, I’ll hopefully spend all of April 2022 in one of my favorite countries, enjoying the food, culture, sights, and springtime cherry blossoms.

Another reason it was so easy to book was because Citi ThankYou points transfer to American for a limited time, and the fact that American allows you place partner awards on hold for up to 5 days.

I just about lost my mind seeing the tickets “on request” for over two weeks, but now that they’re booked, I’m hoping the world clears up in the next 8 months. Not letting myself get too excited just yet, but… it would be really cool.

If you don’t have a Citi Premier card, now is the time. Between a highest-ever welcome offer, AA transfers through November 13, 2021, and incredibly useful 3x bonus categories, now is a great time to get into ThankYou points.

What about you? Any trips planned? Would you speculatively book a trip right now, or are you waiting for the official all-clear?