Harlan Vaughn's Blog, page 8

June 7, 2021

Chase Sapphire Preferred 100K offer: It doesn’t get better than this!

Chase Sapphire Preferred 100K? Holy wow am I kicking myself. Chase keeps upping the ante on the Chase Sapphire Preferred. First 60K, then 80K, and now – 100,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months from account opening. WOW.

I don’t think it’s going to get better than this. 100,000 Chase Ultimate Rewards points are worth:

$1,000 in cash $1,250 toward travel booked through Chase (flights, hotels, cruises, car rentals, and excursions)Potentially much much more when you transfer points to travel partners like Hyatt (my favorite), United, British Airways, Air Canada (coming later this year), and others

Get back to travel in a big way with the new Chase Sapphire Preferred 100K offer

If you’re eligible for this offer, this is your sign! There’s no end date yet – get it while it’s still around!

Chase Sapphire Preferred 100K offer – what to knowLink: Chase Sapphire Preferred 100K offer Chase Sapphire Preferred 100,000 Chase Ultimate Rewards points • 2X Chase Ultimate Rewards points per $1 spent on travel & dining

• 2X Chase Ultimate Rewards points per $1 spent on travel & dining• 1X Chase Ultimate Rewards points per $1 spent on all other purchases

• The biggest bonus ever worth over $1,250 (toward travel) • $95 annual fee• $4,000 on purchases in the first 3 months from account opening • The best card for beginners• Compare it here

The Chase Sapphire Preferred earns 2X Chase Ultimate Rewards points on travel and dining. Both categories are broadly defined.

Travel includes flights, hotel stays, cruises, and the usual things you’d think of as “travel,” but also parking lots, commuter trains, subway passes, tolls, and other travel-related expenses.

Dining includes eat-in restaurants, but also cafes, diners, carry-out, delivery, services like Uber Eats, fast food, and coffee shops.

So there’s a lot of 2X earning potential here.

There’s a lot to like about this 100K offer

Each Chase point is worth 1 cent when you redeem for cash, and 1.25 cents when you book travel through the Chase travel portal.

Points value is more variable when you travel to transfer partners, but I always shoot to get 2 cents in value from each point. That means 100,000 Chase Ultimate Rewards points are worth at least $2,000, which is just incredible.

There is a $95 annual fee on this card, but it’s more than worth it for the value you get from the sign-up bonus.

Pair Chase cards to earn even more points

You can combine the points you earn from all Chase Ultimate Rewards card in one place, and transfer them to travel partners when you have the Chase Sapphire Preferred.

If you already have the Chase Freedom Flex or Chase Freedom Unlimited, you unlock that transfer ability by pairing it with the Sapphire Preferred. That’s a big reason they complement each other so well – and yes, the pairing principle works with Chase small business cards, too.

A few high-value examplesKeep in mind, Chase transfers to partners are 1:1 and instant – meaning they appear in your account right away as soon as you transfer!

1. Hyatt award staysHyatt Category 1 hotels cost 5,000 points night, while Category 2 hotels cost 8,000 points per night. Most of these are Hyatt Place or Hyatt House hotels, but if you can make it work, you could get:

21 award nights at a Hyatt Category 1 hotel13 award nights at a Hyatt Category 1 hotel4 or 5 award nights at a Hyatt all-inclusive hotel (depending on location)I’m including the minimum spending here. If those 21 award nights would usually cost $100 each, that’s $2,100 in value – and doesn’t account for taxes. Plus, you’d earn 21 tier-qualifying nights toward valuable Hyatt elite status.

There’s absolutely no reason you can’t get $2,000 or much more in value from this transfer partner alone.

2. British Airways for short flights on AmericanGet short hops on American by transferring points to British Airways.

Bahamas, anyone?

With a quick search, I found flights from Charlotte to Nassau, Bahamas, for $193 each way.

On this same route, I found 7 seats available for 9,000 British Airways points and $6 in taxes.

Short hops on American can be notoriously expensive

For this 2 hour flight, you could just redeem points instead of paying cash.

With 100,000 Chase Ultimate Rewards points, you could book 11 one-way flights @ 9,000 points each or 13 one-way flights @ 7,500 points each. That’s because the price of the flight is based on distance with the British Airways program.

In this example, 11 one-way flights to the Bahamas would cost $2,123 in cash or 99,000 Chase Ultimate Rewards points. You could easily hit $2,000+ in value for short flights on various routes.

3. Fly on SouthwestOn average, Southwest points are worth 1.4 cents each. With 100,000 Chase Ultimate Rewards points, you could get $1,400 in flights on Southwest (plus taxes and fees).

While that doesn’t hit the $2K+ mark of the other examples, consider you can use a Companion Pass on award flights and potentially get close to double the value which would be $2,800.

Or, you could book Southwest flights through Chase and earn tier credit toward status and the Companion Pass at the same time. If you go this route, you’d get $1,250 worth of flights, which could be worthwhile if it aligns with your travel goals.

4. Virgin Atlantic for Delta business classThese are patchy to find, but when they’re good, they’re amaaaazing. Flexibility is key! And requires some hunting and pecking. But again – 100% worth it.

Delta One business class to Europe sounds divine

Say you want to fly to Amsterdam, and find this one-way flight for $3,530. That’s… a lot.

But, it’s also available for 50,000 Virgin Atlantic miles plus $6 in taxes.

Doesn’t that sound much better?

If you booked two of these flights one-way (or a round-trip assuming the cost is similar to fly back), that means your 100,000 Chase Ultimate Rewards points are worth a staggering $7,060. How’s that for value?

I actually didn’t spend too much find finding this example. Just know that flights like this are out there for those who want to get the absolute maximum return for their points.

5. Mix and match!Fly to Europe in business class for 50,000 points and use the other 50,000 on a hotel stay. Or use them to book a car rentalFly your family to the Caribbean round-trip and save the rest for another short but expensive trip laterFly in opulent business class to Europe or South America and then in coach for short hops to see multiple cities on the same trip. Top off your hotel award accounts for a free night along the wayMany many more combinations!Transferrable points are flexible by design and you can use them however you wish! Even better, you can keep them in your Chase account until you’re ready to transfer them, as a hedge against loyalty program devaluations.

Who qualifies for this offer?Chase has some finicky rules to navigate. If this is your first Chase card and you’re new to points and miles, you’re mostly likely good to go.

You can NOT get this offer if you:

Opened more than 5 new cards in the last 24 months (excluding certain business cards)Earned a bonus on a Sapphire card in the last 48 monthsCurrently have a Sapphire card (that includes the Sapphire Reserve, the Preferred’s big sis)If you’ve had a Sapphire card for over 48 months, you can downgrade to a Chase Freedom Flex or Chase Freedom Unlimited (and you can have multiple of these).

Again, most newbies won’t have to think about these rules. Only us old-timers who want to apply for this incredible offer.

Chase Sapphire Preferred 100K bottom lineLink: Chase Sapphire Preferred 100K offerThere’s no two ways about it: if you qualify for this offer, this is as good as it gets. And it really is the best card for beginners.

100,000 Chase Ultimate Rewards points is a best-ever offer for the Chase Sapphire Preferred card and I don’t expect we’ll see anything better. I value Chase points at 2 cents each, which clocks this offer with a $2,000+ worth. Simply phenomenal. If I didn’t already have this card, I’d be signing up for it immediately!

Do you plan to apply for this offer? Or have you already? Out and Out partners with CardRatings – consider using my links to get this incredible deal.

Any questions? Comment below! As a credit card expert, I’m happy to provide guidance!

June 1, 2021

Crypto, traveling, & getting through a volatile market month – June 2021 Freedom update

Howdy from Knoxville! I’ve been in Tennessee for a couple of months, but later this week I’m heading to Asheville, North Carolina – and very much looking forward to it!

Tennessee’s been great. I reconnected with hiking and made an effort to get moving and active again. Now I’m unstoppable, especially after climbing mountains in the Smokies this weekend.

It’s been a fun month in Tennessee

On the money front, things held steady. I’m up ~$4,000 despite wild market gyrations. I was able to throw $1,000 into savings and pay off every cent I put on my credit cards. And I didn’t hold back this month with the eating (and drinking) out .

I had a friend in town and woof, Nashville is an expensive city. I’m caught somewhere between living in the now and saving for the future… but let’s say “the now” took over a little more this month.

Oh and I’m newly a Hyatt Globalist member! All it took was a 29-night stay, but it worked out almost exactly as planned. Actually, I came out ahead of my calculations by a bit.

It feels so good to be transient (and I don’t use italics a lot).

June 2021 Freedom updateLink: Track your net worth with Personal CapitalI’m getting into the swing of living on the road and also beginning the journey of my third $100K. At this point, I’d love to hit $250K by the end of the year – six more months to go! I think I can do it. (Can you believe the year is half over already?)

My biggest cost with all of this is housing. It’d be cheaper if I were splitting this adventure with someone but alas, I am alone in this. I’m trying to stay around $1,500 per month and so far have come in under budget every month. I’ll have a couple of expensive months coming up followed by a break, so it will balance out.

I spend a lot of time in my area, within town, or at home. It’s become paramount that I locate myself as close as possible to where I want to be. After work, I’m drained – and need attractions to be nearby if I intend to find them tempting.

What is DeFi?Link: Get 5% APY with Donut DeFiDecentralized finance. I’ve been learning about new ways to use crypto as a savings vehicle that’s also a hybrid investment. Nothing crazy, but I threw $50 into Donut just to try it out.

Apparently you can earn up to 15% APY if you’re willing to put in $5,000. I’m not there yet, but I’ve been comparing it to BlockFi and a couple other crypto-based accounts.

Donut has a slick iOS app and interface

Donut is currently only available on iOS, but I look forward to exploring it more. Once I reach my $30K savings goal, I’ll feel more comfortable with riskier assets. Almost there. More on this soon, but feel free to explore ahead of me!

More socialLink: Follow me on InstagramI’ve been trying to be more active on Instagram and adding more personal finance, travel, and miles content on there. My account has never really had a focus – just me and my journey – but I’ve been posting more often. It’s still scattershot, but these topics mean a lot to me and I’d love it if you’d follow me there.

View this post on Instagram

A post shared by Harlan Vaughn | Out and Out (@harlanvaughn)

I also use Instagram as a photo album and mini travel diary when I’m not posting here and as I’ve moved along this path, I’ve fallen further in love with my life and have wanted to share it more. So I humbly invite you to join me there. The thing that makes this adventure truly worthwhile is the amazing people I’ve met – thank you!

My favorite part!

CurrentLast monthChange2021 Goal ASSETS 401k (contributions only)$7,500$5,833+$1,667$19,500 Overall investments$168,373$165,306+$3,067As much as possible Savings$26,125$25,125+$1,000$30,000 Net worth in Personal Capital $202,508$198,676+$3,832$500,000 Track your net worth with Personal CapitalI used to think this section was getting boring – now I think it’s the most thrilling part.

Inching ever closer

Right now I’m throwing every spare cent into my savings account. It may take me a couple more months. Once that’s done, I can focus on purchasing riskier assets like crypto, DeFi, meme stocks (I’ve been missing out on that whole trend) and simply just loading up my taxable brokerage account with index funds.

View this post on Instagram

A post shared by Harlan Vaughn | Out and Out (@harlanvaughn)

The market was sluggish in May 2021, but I still realized positive gains. I try not to watch the market, but it’s fun to participate in the drama of it all. I’ve done well at tuning out and staying the course though. Some days I forget to even check at all, which is ideal.

June 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardI promised myself I’d make this update less than 1,000 words and I just might do that! This month finds me chugging along in good spirits. Of course I love reaching ever-higher heights with my net worth and moving toward my goal, but daily life has me in the most beautiful trance.

I’m still interested in crypto, like the Donut app I joined and put $50 into. I need to sit down and give myself a crash course because I don’t see crypto going away any time soon. The riskier the asset, the high potential for gains. Or something like that.

I’ve also been trying to post more on Instagram – follow me there!

I’m starting to explore the terrain between personal finance and miles/points. How can one love travel and still save toward financial independence? Especially me, as a digital nomad and switching homes every few weeks.

Next up, I’ve got Asheville, West Virginia, Pittsburgh, and upstate New York. I try not to plan too far beyond six weeks because anything can happen.

Speaking of which, I’m about to hit 1,000 words! Thank you for reading them if you’re still here. Now I want to know – are you planning your summer travels? Is crypto alluring to you, too? Or are you staying put and hanging tight for a little while more?

Stay safe and scrappy out there!  If you’re thinking about opening new credit cards, please consider applying through my CardRatings links!

If you’re thinking about opening new credit cards, please consider applying through my CardRatings links!

May 6, 2021

40% of my goal reached, nomad life, & crypto – May 2021 Freedom update

Y’all – I am so close to $200,000 that all I need is one good day in the market and I’m there. I’m officially at $198,676, which is 39.7% of my $500,000 goal. So close to 40% that I’m gonna go ahead and call it.

Hi from Nashville! I’m at a Hyatt Place about 25 minutes northeast of downtown. I’ve been here for nearly two weeks, and it’s been great so far! I’m eagerly awaiting my Hyatt Globalist status to kick in and in the meantime, I’ve been living and working.

There’s free breakfast with coffee and snacks to last most of the morning, and a fitness room where I can work out in the evenings. The local places have great lunch deals and happy hours, and I’ve been able to see a couple of things in Nashville and walk some quiet nature trails with my dog.

I look like a happy demon with black eyes

I’m beginning to find my rhythm with this digital nomad stuff, though sometimes it’s weird to realize I don’t have a permanent address any more. But like, good weird. I also have to always be planning ahead, which energizes and simultaneously stresses me. But like, a good stressor. Can you tell this is new for me?

May 2021 Freedom updateLink: Track your net worth with Personal CapitalNow where was I? Oh yes – let’s talk money.

Overall, I’m up $8K again this month. I have $25,000 in savings. In another couple of months, I should be at my $30,000 savings goal, and then I’ll switch the focus to loading up my taxable brokerage account. Reason being my 401k is set to fill up during the rest of the year, and I’ve already maxed out my $6,000 Roth IRA contributions this year. I started saving a little in a HSA through my employer, too (but won’t max that out).

I also realized something along the way.

Once I get to $250,000 invested in my retirement accounts, I really don’t need to do anything else – I can coast. In 30 years, I’ll be 66, and assuming a modest 7% return, I’ll have nearly $2 million dollars. At 8%, that jumps to $2.5 million. That’s great for Future Me, but I’d like to live off my savings and dividends long before then.

So, I’ll focus on filling up my taxable accounts and leave my retirement accounts to work their compound interest magic. Life becomes a matter of making enough to get by.

I think I’m at the point where the magic is starting to happen. I’m taking care of Future Me – and can soon think about living off savings and dividends.

I can’t believe I’m about to enter into the phase of accumulating my third $100K. Especially as someone who’s clawed their way out of poverty, broke a scarcity mentality, and started believing he could do something like this.

Hotel lifeIt’s been surprisingly chill and easy to live in a hotel full-time. The more I’m here, the more it feels like any other apartment building. Except there’s breakfast every day and I don’t have to clean. It’s actually really nice.

In my haste to book this Hyatt Place, I assumed there would be a full kitchen. And you know what they say about assumptions.

Anyway, there’s only a mini fridge and a little sink in here. No stovetop or microwave. Not a biggie, but it did teach me to review – like, really review – the room features before committing. Had I known there wouldn’t be a way to heat up food, I wouldn’t gotten more packaged snacks before I arrived.

This here is the place where I am stayin / there isn’t a number you can call the pay phone / and let it ring a long long long long time

I get the feeling though that no matter how much I review a place, there’s always going to be something where I think to myself – oh yeah, I should’ve thought of this. But whatever, I’m rolling with it. And will continue to roll with it.

The room is clean and big enough, the wifi is fast (and free), and it’s quiet here. Also, I can crank the AC as much as I want. I kinda love thinking of it as an apartment building. There are a lot of similarities when you think about it.

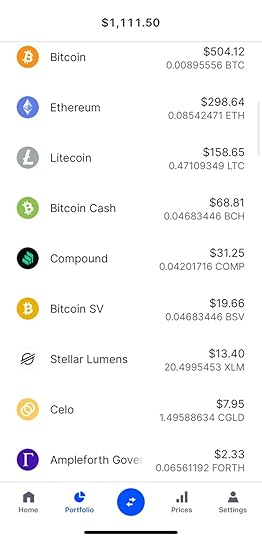

CryptoLink: Buy $100 on crypto on Coinbase, get $10 free BitcoinSo a few years ago, I put $100 into each of three buckets: Bitcoin, Ethereum, and Litecoin. My total investment was $300. I haven’t followed it much, but it’s in the news nearly every day. So I logged in to my old Coinbase account (click here to join) and it’s turned into $1,100+.

My Coinbase portfolio

I know crypto is highly volatile and fluctuates all the time, but I decided to include Bitcoin in my overall net worth. So this month, ~$500 of my overall total is from Bitcoin.

I’m still learning about crypto and am glad I put in a little a few years ago. I hear Ethereum is starting to make moves, so I may put some more money into that.

I see crypto as a supplement to my other goals – not my main strategy (right now, anyway). But it’s fun to start thinking about how crypto might evolve in the future.

I recommend putting a couple of hundred bucks into an account and seeing how it goes. Get your feet wet and learn more about it. I’m still into traditional stock investments, but want to be a part of this when and if it really takes off.

Bank of America Preferred RewardsI’m already at the Platinum tier with Bank of America’s Preferred Rewards program. Soon I’ll be at the Platinum Honors level.

I just got the Premium Rewards card with a $500 sign-up bonus. And I’ll get a $375 bonus for the new investment account, and $100 for the new checking account (free to keep with the status).

Gee thanks for the bonuses

Between the three, that’s nearly $1,000 in bonuses, so I’ll stick it all into ITOT or VTI and call it done. I say “all” but really mean “as much as I can” – Merrill Edge doesn’t allow fractional shares, which is the most annoying thing about them. Other than that, I’m pretty satisfied. Mostly because I’m letting my funds sit there and not actively trading.

So for my purposes, it’s great – and the $1,000 in bonuses for the new accounts is pretty nice, too.

By the numbersThis is getting long and I still need to show y’all the numbers. Here they are:

CurrentLast monthChange2021 Goal ASSETS 401k (contributions only)$5,833$4,167+$1,666$19,500 Overall investments$165,306$158,873+$6,433As much as possible Savings$25,125$23,110+$2,015$30,000 Net worth in Personal Capital $198,676$190,520+$8,156$500,000 Track your net worth with Personal CapitalI want to keep building up my retirement balances as much as I can while also padding my taxable accounts. But for now, I’ll keep adding to my savings accounts until I hit that $30K mark. And take it from there.

$200K, here we come

I’ll definitely be crossing the $200K mark this month (!!!). Somehow that feels more significant that $250K, even though that’s 50% of my goal. I think it’s because the first $100K was such a bear that adding the second $100K just feels insanely awesome. And now I can move on to the third $100K.

May 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardLink: Join Coinbase and buy cryptoI’ll be in Nashville until May 24, then head to Knoxville for a couple of weeks. Then Asheville. And then? Maybe to West Virginia for a couple of weeks. I’m really into not planning too far out these days. And living on the road full-time – so far – is as fun as I thought it would be. I’m sure it’ll wear on me after a while, but for now it’s all new and novel. Being in the present moment is nice.

I’m so glad I left my old apartment and job and life. I know I can always rent a place and settle down, but for now the journey is just beginning. And now that I’m on the verge of $200K net worth, I wanna keep it going.

My fantasy is for the world to open up again so I can do this in Europe or Chile or somewhere in Canada. Hopefully soon. Maybe this summer or fall?

And crypto, yeah! It seems like it’s getting… more stable? For now, it’s mostly interesting. But as more banks invest and a possible crypto ETF gets off the ground, I want to be sure to stay informed. So I’ll include my Bitcoin balance in my net worth and see how that goes. So far, it’s just $500. I’m thinking I might get into Ethereum a bit more.

How’s everyone doing? What are your thoughts on crypto/Bitcoin/Ethereum/Dogecoin? Are you getting excited to travel again?

Stay safe and scrappy out there!

40% of my goal reached, hotel life, & crypto – May 2021 Freedom update

Y’all – I am so close to $200,000 that all I need is one good day in the market and I’m there. I’m officially at $198,676, which is 39.7% of my $500,000 goal. So close to 40% that I’m gonna go ahead and call it.

Hi from Nashville! I’m at a Hyatt Place about 25 minutes northeast of downtown. I’ve been here for nearly two weeks, and it’s been great so far! I’m eagerly awaiting my Hyatt Globalist status to kick in and in the meantime, I’ve been living and working.

There’s free breakfast with coffee and snacks to last most of the morning, and a fitness room where I can work out in the evenings. The local places have great lunch deals and happy hours, and I’ve been able to see a couple of things in Nashville and walk some quiet nature trails with my dog.

I look like a happy demon with black eyes

I’m beginning to find my rhythm with this digital nomad stuff, though sometimes it’s weird to realize I don’t have a permanent address any more. But like, good weird. I also have to always be planning ahead, which energizes and simultaneously stresses me. But like, a good stressor. Can you tell this is new for me?

May 2021 Freedom updateLink: Track your net worth with Personal CapitalNow where was I? Oh yes – let’s talk money.

Overall, I’m up $8K again this month. I have $25,000 in savings. In another couple of months, I should be at my $30,000 savings goal, and then I’ll switch the focus to loading up my taxable brokerage account. Reason being my 401k is set to fill up during the rest of the year, and I’ve already maxed out my $6,000 Roth IRA contributions this year. I started saving a little in a HSA through my employer, too (but won’t max that out).

I also realized something along the way.

Once I get to $250,000 invested in my retirement accounts, I really don’t need to do anything else – I can coast. In 30 years, I’ll be 66, and assuming a modest 7% return, I’ll have nearly $2 million dollars. At 8%, that jumps to $2.5 million. That’s great for Future Me, but I’d like to live off my savings and dividends long before then.

So, I’ll focus on filling up my taxable accounts and leave my retirement accounts to work their compound interest magic. Life becomes a matter of making enough to get by.

I think I’m at the point where the magic is starting to happen. I’m taking care of Future Me – and can soon think about living off savings and dividends.

I can’t believe I’m about to enter into the phase of accumulating my third $100K. Especially as someone who’s clawed their way out of poverty, broke a scarcity mentality, and started believing he could do something like this.

Hotel lifeIt’s been surprisingly chill and easy to live in a hotel full-time. The more I’m here, the more it feels like any other apartment building. Except there’s breakfast every day and I don’t have to clean. It’s actually really nice.

In my haste to book this Hyatt Place, I assumed there would be a full kitchen. And you know what they say about assumptions.

Anyway, there’s only a mini fridge and a little sink in here. No stovetop or microwave. Not a biggie, but it did teach me to review – like, really review – the room features before committing. Had I known there wouldn’t be a way to heat up food, I wouldn’t gotten more packaged snacks before I arrived.

This here is the place where I am stayin / there isn’t a number you can call the pay phone / and let it ring a long long long long time

I get the feeling though that no matter how much I review a place, there’s always going to be something where I think to myself – oh yeah, I should’ve thought of this. But whatever, I’m rolling with it. And will continue to roll with it.

The room is clean and big enough, the wifi is fast (and free), and it’s quiet here. Also, I can crank the AC as much as I want. I kinda love thinking of it as an apartment building. There are a lot of similarities when you think about it.

CryptoLink: Buy $100 on crypto on Coinbase, get $10 free BitcoinSo a few years ago, I put $100 into each of three buckets: Bitcoin, Ethereum, and Litecoin. My total investment was $300. I haven’t followed it much, but it’s in the news nearly every day. So I logged in to my old Coinbase account (click here to join) and it’s turned into $1,100+.

My Coinbase portfolio

I know crypto is highly volatile and fluctuates all the time, but I decided to include Bitcoin in my overall net worth. So this month, ~$500 of my overall total is from Bitcoin.

I’m still learning about crypto and am glad I put in a little a few years ago. I hear Ethereum is starting to make moves, so I may put some more money into that.

I see crypto as a supplement to my other goals – not my main strategy (right now, anyway). But it’s fun to start thinking about how crypto might evolve in the future.

I recommend putting a couple of hundred bucks into an account and seeing how it goes. Get your feet wet and learn more about it. I’m still into traditional stock investments, but want to be a part of this when and if it really takes off.

Bank of America Preferred RewardsI’m already at the Platinum tier with Bank of America’s Preferred Rewards program. Soon I’ll be at the Platinum Honors level.

I just got the Premium Rewards card with a $500 sign-up bonus. And I’ll get a $375 bonus for the new investment account, and $100 for the new checking account (free to keep with the status).

Gee thanks for the bonuses

Between the three, that’s nearly $1,000 in bonuses, so I’ll stick it all into ITOT or VTI and call it done. I say “all” but really mean “as much as I can” – Merrill Edge doesn’t allow fractional shares, which is the most annoying thing about them. Other than that, I’m pretty satisfied. Mostly because I’m letting my funds sit there and not actively trading.

So for my purposes, it’s great – and the $1,000 in bonuses for the new accounts is pretty nice, too.

By the numbersThis is getting long and I still need to show y’all the numbers. Here they are:

CurrentLast monthChange2021 Goal ASSETS 401k (contributions only)$5,833$4,167+$1,666$19,500 Overall investments$165,306$158,873+$6,433As much as possible Savings$25,125$23,110+$2,015$30,000 Net worth in Personal Capital $198,676$190,520+$8,156$500,000 Track your net worth with Personal CapitalI want to keep building up my retirement balances as much as I can while also padding my taxable accounts. But for now, I’ll keep adding to my savings accounts until I hit that $30K mark. And take it from there.

$200K, here we come

I’ll definitely be crossing the $200K mark this month (!!!). Somehow that feels more significant that $250K, even though that’s 50% of my goal. I think it’s because the first $100K was such a bear that adding the second $100K just feels insanely awesome. And now I can move on to the third $100K.

May 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardLink: Join Coinbase and buy cryptoI’ll be in Nashville until May 24, then head to Knoxville for a couple of weeks. Then Asheville. And then? Maybe to West Virginia for a couple of weeks. I’m really into not planning too far out these days. And living on the road full-time – so far – is as fun as I thought it would be. I’m sure it’ll wear on me after a while, but for now it’s all new and novel. Being in the present moment is nice.

I’m so glad I left my old apartment and job and life. I know I can always rent a place and settle down, but for now the journey is just beginning. And now that I’m on the verge of $200K net worth, I wanna keep it going.

My fantasy is for the world to open up again so I can do this in Europe or Chile or somewhere in Canada. Hopefully soon. Maybe this summer or fall?

And crypto, yeah! It seems like it’s getting… more stable? For now, it’s mostly interesting. But as more banks invest and a possible crypto ETF gets off the ground, I want to be sure to stay informed. So I’ll include my Bitcoin balance in my net worth and see how that goes. So far, it’s just $500. I’m thinking I might get into Ethereum a bit more.

How’s everyone doing? What are your thoughts on crypto/Bitcoin/Ethereum/Dogecoin? Are you getting excited to travel again?

Stay safe and scrappy out there!

April 16, 2021

Stacking Hyatt offers: A month stay for $1,100 & net zero points + Globalist status

Hi from Memphis! I have about a week left here. The last few weeks have been filled with family visits and wayyy too much home cooking (if that’s even possible?).

Next Sunday, I’m heading to Nashville for a month to stay at the Hyatt Place Nashville/Hendersonville – a Category 1 Hyatt hotel, meaning award stays are 5,000 Hyatt points per night.

A month of free Hyatt breakfast and unlimited coffeeeeee

I’ll be there for 29 glorious nights, visiting local breweries, walking nearby trails with my dog, and seeing what Nashville is all about.

For the 29-night stay, I paid $1,158 and 70,000 Hyatt points. But thanks to multiple deals going on right now, I’ll get all 70,000 points back – and come out on the other side as a Globalist (Hyatt’s top elite status tier) and with an extra free award night. Which means my “rent” next month is $1,158, plus I get free breakfast and coffee every day, access to a fitness room and pool, free toiletries, and room service.

Here’s how I did it.

Stacking Hyatt offers for a one month stayI was originally going to pay for a two-week stay with points. At 5,000 points per night, 14 nights costs 70,000 Hyatt points. But I always check the cash price to make sure it’s the best deal.

To my surprise, this hotel had a third night free offer and prices were low – which got me thinking.

I checked the first two weeks and last two weeks in points (to verify availability) and cash (to check price). It turned out the first two weeks were cheaper – $99 a night, plus the third night free. The last two weeks had price spikes. But it was available with points.

I ended up booking the first 15 nights with cash and got every third night free:

Boom

Even after tax, that’s $77 a night, which is awesome.

Then booked an additional 14 nights with points.

Here’s where the stack comes in.

Bonus Journeys promotion adds huge valueLink: Hyatt Bonus Journeys promotionThrough June 15, 2021, when you register for this promotion, you’ll get:

2,000 bonus points every 2 nights (Chase World of Hyatt cardmembers get 2,500 bonus points every 2 nights – and I have this card)A free Category 1 through 4 award night after 10 nights

Also boom

Because I’m staying 29 nights, I’ll get 2,500 bonus points 14 times, or 35,000 points back. And I’ll get the free award night.

For the paid portion, I’ll earn 5 Hyatt points per night plus an extra 4 Hyatt points per night by paying with my Chase World of Hyatt card, so 9 points X $1,158 = another 10,422 points. Being Explorist gets me another 20% bonus, or 2,084 points.

Omg wow

But it gets better. On top of all that, I’ll get an additional 5X Hyatt points for the stay thanks to a promotion I added to my Chase World of Hyatt card. Chase has offers for all their cobranded cards right now – here’s the link to check yours. For the $1,158 stay, I’ll get an extra 5,790 Hyatt points with my card.

Adding it up, that’s:

Bonus Journeys promo – 35,000 pointsBase 5X and card 4X (for a total of 9X) = 10,422 pointsExplorist 20% bonus = 2,084 pointsChase card 5X promotion = 5,790 pointsFor a total of 53,296 points. When I add in the value of the free award night for a Category 4 Hyatt hotel, that’s an additional 15,000 points for a grand total of 68,296 points.

For this stay, I’ll put in 70,000 points and come out with 68,296 points – basically completely netting out, which means all 29 nights “cost” me $1,158. Not bad for a month in a cool town like Nashville!

And actually – this ended up being cheaper than any comparable Airbnb I could find (entire place, free parking, and pet-friendly because I have my dog with me).

Globalist awaitsIf that wasn’t enough, I’ll also come out on the other side as a freshly minted Globalist elite member through February 2023.

Globalist requires 30 qualifying nights in 2021 and this stay will put me over the top. I already have 5 qualifying nights in my account from the Chase World of Hyatt card.

Globalist also includes:

Free breakfast for two at any Hyatt hotel (you know how that thrills me)Club lounge accessSuite upgradesGuest of Honor bookings for friends and familyFree parking on award nights4pm late checkout when available

Suite upgrades are part of being Globalist

And because I’ll hit 36 nights with this booking, I’ll get Milestone Rewards, which are a completely separate thing, including:

2 club lounge access awards at 20 nights2 more club lounge access awards at 30 nights ANDAnother Category 1 through 4 free night award (!)With another free night award, which I value at 15,000 Hyatt points, I’ll easily recover my entire points portion of the booking – and then some.

If I can stay a couple more months this year with Hyatt, I could potentially reach 100 nights and earn allll the Milestone Rewards. That would be a little crazy, but then again… I’m a little crazy, especially when it comes to earning points.

If I can find another deal like this, or if there are more promotions I can find to stack, I mean heck, I might just go for it. Digital nomad and all.

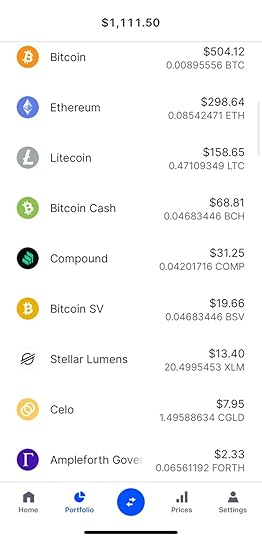

Dude, the Chase World of Hyatt card Chase World of Hyatt Up to 60,000 Hyatt points • 9 Hyatt points per $1 spent at Hyatt - 4 bonus points for paying with your card, and 5 bonus points for being a World of Hyatt member

• 9 Hyatt points per $1 spent at Hyatt - 4 bonus points for paying with your card, and 5 bonus points for being a World of Hyatt member• 2 Hyatt points per $1 spent restaurants, on airlines tickets purchased directly from the airlines, on local transit and commuting and on fitness club and gym memberships

• Receive 1 free night every year after your cardmember anniversary at any Category 1 to 4 Hyatt hotel or resort

• $95 annual fee• Earn 30,000 Hyatt points after you spend $3,000 on purchases in the first 3 months from account opening

• Plus an additional 30,000 Hyatt points by earning 2X points on up to $15,000 in purchases within the first 6 months of account opening

• 5 Hyatt hotels where the annual free night rocks• Compare it here

This card is really boosting the value of this stay and taking it to the next level. Because of It, I’m getting back 35,000 points from the Bonus Journeys promotion. Without it, I’d only get back 28,000 points.

MVP

It’s also earning me an extra 4X points per $1 on the paid portion. And the extra Chase promotion is another 5X points per $1 on the paid portion. Plus, I already had a leg up on this deal with 5 qualifying nights, which were automatically added to my account at the beginning of the year.

This card definitely earns its keep. If you’re at all interested in Hyatt hotels, having this card adds a ton of value to your status, earnings, and award nights. Highly recommend.

Another card to pair with Hyatt is the Chase Sapphire Preferred – here’s my post about why.

Stacking Hyatt offers bottom lineI’m trying to stay around $1,500 per month for my lodging, and next month, I’ll be well under budget thanks to stacking Hyatt offers for a month-long stay in Nashville. That frees up funds to eat out, invest, save, or roll over toward a more expensive stay later.

I am definitely digging these current Hyatt promotions. I was able to stack 3rd night free and Bonus Journeys promotions with an extra 5X promotion on my Chase World of Hyatt card to come out with:

Oodles of Hyatt points2 Category 1 through 4 free night awards (which I value at 15,000 points each)4 club lounge access awardsGlobalist elite statusAll this kinda makes me want to use my Chase World of Hyatt card even more to keep reaching those Milestone Rewards tiers this year. This was exactly the type of promotion I’ve been waiting for to take the leap into Hyatt and Globalist.

Is it safe to say I’m a Hyatt fan now? Have you had any good hotel deals lately?

April 15, 2021

Incentives for remote workers: Get paid to move to a new place

The other day my mom sent a text about how West Virginia is paying remote workers $12,000 cash to move to the state. I must admit – it got me thinking. About a few things.

Right now, I’m a digital nomad, so I can theoretically live anywhere. But getting paid to move would surely sweeten the deal.

Could I really live in West Virginia?

I pondered it for a couple of days and even looked at houses online. Then I saw there are no Costco or Whole Foods stores in the entire state. But then I was like – so what?

The biggest drawback would be living in a snowy place again. I’m not ready for heavy coats, frigid mornings, and driving on ice just yet, especially after my Texas experience.

Then I discovered there are many other places offering incentives for remote workers. It could lead to all new ways of living and traveling.

Incentives for remote workersI poked around a bit and found several other similar programs. Here are a few that got me thinking (and dreaming). It’s fun to imagine yourself in a new place, isn’t it?

1. West VirginiaLink: Ascend WVWhat it is: $12,000 cash – $10,000 paid monthly in monthly installments of ~$833 per month during the first year, and another $2,000 at the end of the second year. Also includes $2,500 in outdoor gear rental, free coworking space, and social events.

They’re currently accepting applications for Morgantown (an hour south of Pittsburgh) through May 2021, and opening up two more cities – Lewisburg and Shepherdstown – in early 2022.

Home to the newest National Park and situated close to Virginia (duh), Washington, DC, and Pennsylvania for day trips and travel, but definitely isolated enough to have outdoor adventures and plenty of room to roam. Housing is cheap, too.

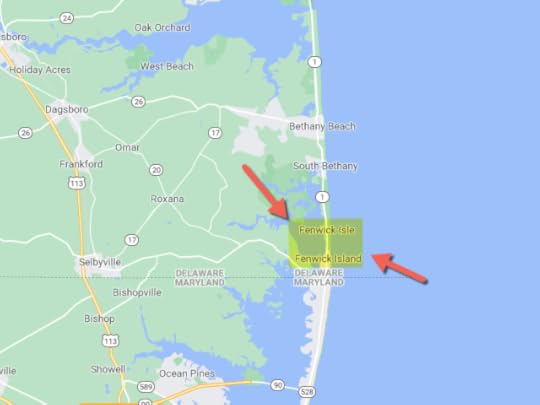

The three towns part of Ascend WV

The state has its share of social problems (obesity, poor education, economic dependence on fossil fuel, high suicide rate, high meth/opioid addiction rate, plus that whole red state, anti-LGBT thing going on), so it’s interesting to see this type of offer. They position the state as a springboard for whitewater rafting, hiking, mountain climbing, skiing – pretty much anything outdoor adventure-related. Excellent marketing.

Not gonna lie, I thought about how great my Insta feed would look.

2. Northwest ArkansasLink: Finding NWAWhat it is: $10,000 cash – $2,500 when you move, $500 per month for 12 months, and $1,500 at the end of your first year, a street or mountain bike OR annual museum membership.

Live in the Ozarks and get $10K

I’ve always said Arkansas is one of the most underrated gems in this country. Northwest Arkansas includes the Ozarks, which are sooo beautiful. It truly is The Natural State.

And I’ll also say, the region has been growing a lot recently, especially around Fayetteville. I actually applied to UA’s MFA program recently but was rejected – so I was already willing to live here.

And again, the outdoor opportunities – hiking, biking, camping – are bountiful year-round.

3. Tulsa, OklahomaLink: Tulsa RemoteWhat it is: $10,000 cash (seems like it’s paid all at once through a grant?), free desk pace, access to perks and social events.

Apparently, this one is competitive to get accepted into. They’ve renewed the program since 2018 and attracted ~400 new people to the area through the program in 2020 – good stuff!

Could you be an Oklahoman?

It seems like Tulsa (and Oklahoma in general) is growing, and it’s good to see the city working to promote themselves to new residents in this way. I’ve been through Tulsa a time or two, but it’s been, oh, years. Maybe $10,000 is reason enough to give it another look?

4. The Shoals, AlabamaLink: Remote ShoalsWhat it is: $10,000 cash – $2,500 when you move, $2,500 after 6 months, $5,000 after your first year.

Wanna live in Northwest Alabama? You’d be a couple of hours from Memphis, Nashville, and Birmingham. Moderate climate, and a few cities in the area with plenty to explore.

A great deal if you’re open to living in Alabama

I’m not familiar with the area, but their hilarious marketing video makes it sound like a great place to hang your hat – and they are clearly putting a lot into promoting this program to remote workers. $10,000 cash is a nice bonus, too!

5. Tucson, ArizonaLink: Remote TucsonWhat it is: $1,500 cash to move, access to coworking spaces, free internet, and support with career and housing.

This one isn’t as “much” as the others and applications are currently closed at the time of writing, but you can subscribe for when they open again.

Arizona is amazing

I was actually surprised to find this option, because Arizona has been booming with growth for the last several years. So to find any incentive at all is something worth a mention.

This package offers $1,500 cash plus help getting settled through a variety of other initiatives. If you’ve never been, it’s only about 90 minutes from Phoenix, depending on where you’re heading in the huge metro area and a quick day drive to California beaches.

If you’re interested, it wouldn’t hurt to have a little cash and access to resources when this one opens again.

Other considerations and resourcesLink: MakeMyMoveIf any of these sound appealing, be sure to read up on them. They all have their own age limits, residency requirements, and terms. That said, all of them do offer what’s advertised. So if your feet are itchy, you’re ready to move, or open to living in a new place, any of these would make excellent options to get you going.

There’s also MakeMyMove, which has many more opportunities like this. I included a few that were interesting to me personally and offered cash incentives to remote workers. Others offer down payment or rent assistance, a plot of land to build on, or some other type of exchange.

If you’re a remote worker, this might be the little push you need to take some action and get going. I know it certainly stirred up a lot of ideas within me and a little inspiration is sometimes all you need.

The website is also fun to explore just to see which areas are trying to attract new residents.

Personal noteI am a white man, and I’m also a gay man. A lot of these places are red states where I wouldn’t feel comfortable being out with a partner or friends for fear of being targeted. I’ve had my share of incidents and have lived in many conservative places – after all, I’m from Mississippi so I know how these places work and familiar with the coded language people to disguise their hatred and bigotry. I always keep my head down and try to not look “too gay” in public. You never know who’s looking for a fight. Or who will say something. This is why I mostly stick to cities, which tend to be more liberal.

As much as I’d love to explore Alabama, West Virginia, Arkansas, etc., I don’t picture myself having a great time with always watching what I say or wondering about the type of people I might interact with.

That’s everywhere, but ya know… conservative places and all. Some of these places also have horrific histories of racism, lack of worker protection, politics actively targeting women’s bodies and stripping rights away from people, and use religion as a justification for it all. Stuff like that – you know the drill by now. So it’s no wonder they want to attract people – and will even pay people to show up.

And while people should show up, it’s always hard to be the first to lead any measure of change. So I’ll just offer that up as food for thought and leave it at that. I was going to apologize for sounding bitter about these opportunities, but I’m not.

Bottom lineIf you can make use of these programs, though – wow, what a boost to get you going. It takes courage to make a big change and cash in hand would certainly help.

And to end on a bright note – yay remote work! It seems like that part of the whole covid experience is here to stay. As it should. I don’t think we’ll ever go back to the way it was before. And that’s a good thing. Change is good, inevitable, and constant.

Stay safe and scrappy out there!

April 7, 2021

Up $8K, becoming a digital nomad, & still saving – April 2021 Freedom update

Hi from Memphis! The last month has been an absolute whirlwind. I intended to do an update in late March, as usual, but then decided it would be better to do these updates near the beginning of the month instead.

The start of this month was Easter – and I was in Oklahoma meeting my bio-son for the first time, which was incredible. When I got back, I was exhausted – still am. But wanted to get this posted.

And just like that… I’m gone

Also at the end of March, I rented a truck and put all my stuff in storage. I’m now living on the road for an indefinite amount of time. I’ll be in Memphis for a few more weeks. Then Nashville for a month, Knoxville for two weeks, and Asheville, NC, for two weeks. And northeast for the summer.

And I dare say I’m saving more money than before? I’m getting close to a $200,000 net worth.

Living debt-free on the road: so far, so good.

April 2021 Freedom updateLink: Track your net worth with Personal CapitalI’ve already booked places until June. And paid up on “rent” until next month. That means my two April paychecks are all mine to save. In May, I’m staying at a Category 1 Hyatt House and can’t wait to tell y’all how I set that up with points + cash.

But this past month, I focused on getting out of Dallas. My brother came out to help me disentangle myself from my old apartment. I got to Memphis and checked into my first Airbnb. Then drove to Oklahoma for a few days.

It’s been a lot of moving and driving. Once the Memphis chapter is over, I’ll head to Nashville – then I’ll really be away from home.

There’s nothing like playing with a toddler outside

The highlight of the month was getting to visit with my bio-son. He’s almost two now and it was my first time meeting him. He’s so magical. So close to talking. And very wiggly! He gets around just fine. I think one day he will be an intrepid traveler.

And while all this was happening, my net worth grew nearly $8,000. Even as I paid for the U-Haul and all the other moving expenses. Even as the market dipped in March. I just keep sticking to my plan, and it just keeps working, month after month.

April progressI thought I was going to have to pay for my Dallas apartment through April. But they were able to rent it before I moved out, so when I left that was it. That situation resolved itself beautifully.

I paid a lot for gas and food on the road. And when I got to Memphis, ordered out a few times before I stocked up on groceries.

Fenwick loves being on the road with his daddy

I’m really into having a big emergency fund with $30,000 cash saved. As the economy begins to reopen, I might get comfortable having less in there, and maybe even buying a single family home as a real estate investment. But for now, the housing market is way too hot and I favor the cash-heavy position.

So I’ll keep moving cash into savings until I reach that goal. Then I’ll focus on adding to my brokerage account – probably the one at Fidelity because fractional shares (I can’t believe Merrill Edge doesn’t support fractional share buying, otherwise I’d probably use them out of convenience).

I’m going to try my best to keep my monthly expenses around $2,000 including $1,500 for an Airbnb or room and the rest for gas and eating out. My only recurring expenses are auto insurance, Spotify, and Netflix. Oh, and my new storage unit which is $86 per month.

My storage room filled with all my earthly belongings

I’ve pared my life down to the necessities and am on the lookout for anything else I can cut. I checked into the current Airbnb on March 24, so it hasn’t even been a full month yet.

But so far, I think I want to keep doing this for a little while. I’m enjoying the flexibility and most importantly, NOT having any responsibility aside from work. It has been so, so freeing to have those concerns removed from the vortex of my psyche. Life feels simple. And it actually does feel easier to save because of that.

By the numbersMy strategy has become so streamlined: save cash, contribute to 401k, watch investments rise.

CurrentLast monthChange2021 Goal ASSETS 401k (contributions only)$4,167$2,500+$1,667$19,500 Overall investments$158,873$152,644+$6,229As much as possible Savings$23,110$20,494+$2,616$30,000 Net worth in Personal Capital $190,520$182,610+$7,910$500,000 Track your net worth with Personal CapitalOverall, I’m up nearly $8,000 over the past month. While I do wonder about having a smaller emergency fund and putting more into a taxable brokerage account, I just really want the security of liquid cash right now

I’m putting ~$1,700 per month into the 401k to max it out and the rest of my disposable income into savings. That’ll be my strategy for a couple more months until I reach $30,000 cash saved. Then I’ll focus on the taxable brokerage account.

So close to 40% of my goal

I think I’ll soon hit the $200K mark, which will be a full 40% of my goal. And hopefully $250K shortly after. When I hit that milestone, it’ll be full speed ahead to reach $500,000.

Since I got my financial life in order, I’m amazed at how simple it’s been to make progress.

I’ve been thinking about what I’ll do once I reach $500,000. At that point, I’ll basically be “Coast FIRE.” I do know I want to shift focus from long-term retirement planning to a shorter-term (next 30 years) horizon.

But my thoughts aren’t there yet. For now, I’m going to keep plugging away. It’s working. And it seems like it’s starting to speed up the closer I get. I’d be thrilled to hit $250K by the end of 2021. Think I can do it?

April 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardI’m officially living on the road and still achieving my financial goals. It hasn’t yet fully hit me that this is my ne wlife (for now).

I’m feeling optimistic about future travel thanks to the vaccine rollout. It would be amazing to do some of this from a different country. I’ll consider that when it’s a possibility.

Hitting $200K, the next milestone, will be 40% of my overall goal. I’m gonna flip when that happens.

Until then, I’m reeling a bit. Letting it all catch up. A lot has happened in the last few weeks. My “boring” financial plan has been working hard to earn more money while life has been happening. That’s pretty incredible. I still haven’t fully processed everything. It’s been a lot packed into a short amount of time. But I think it’s starting to level out already. Thank you for following the journey. I’m so grateful for all the support and encouragement.

Hope everyone is staying safe and healthy out there!

March 26, 2021

The best card for beginners has a sign-up bonus worth $1,000 – and easily MUCH more (And I just got it again!)

If you haven’t had the Chase Sapphire Preferred yet – or if you’re eligible to get it again – the new sign-up bonus of 80,000 Chase Ultimate Rewards points is worth – at a minimum – $1,000. And really $1,050 because it also comes with $50 of grocery store credits in your first year of account opening.

And how are we getting to that $1,000 figure? Chase Ultimate Rewards points are worth 1.25 cents each when you redeem them toward travel through Chase, so 80,000 x 1.25 = $1,000. You can book flights, hotel stays, even cruises through the Chase Ultimate Rewards site. Set your payment to points and 80,000 of them are worth $1,000.

The Chase Sapphire Preferred was my first points card – and I just got it again after all these years

That’s an amazing sign-up bonus on its own. And can be worth soooo much more when you transfer your points to Chase’s travel partners, which include Southwest, United, and Air France.

But the best transfer partner? Wait, lemme start a new section for all that.

• 2X Chase Ultimate Rewards points per $1 spent on travel & dining

• 2X Chase Ultimate Rewards points per $1 spent on travel & dining• 1X Chase Ultimate Rewards points per $1 spent on all other purchases

• The biggest bonus ever worth over $1,000 (toward travel and groceries) • $95 annual fee• $4,000 on purchases in the first 3 months from account opening • The best card for beginners• Compare it here

Since my Chase status was 2/24 (two new cards opened in the last 24 months), I was wayyyy under the 5/24 threshold. Chase won’t give you their cards if you’ve opened more than 5 cards in the last 24 months (the 5/24 rule). That’s not an issue for most people, but for those heavily into points, it usually means Chase cards are a non-starter.

My low application recently was because, well… I’ve pretty much had all the cards worth having – including this one – so I often find myself at an impasse.

But not this time!

I was 2/24 and hadn’t earned a sign-up bonus on a Sapphire card since 2016 (?), so I was well within the bounds. I’ve never hopped on a card application so hard in my life.

Just went to get my $50 in free groceries last nite 🙂

I already met the minimum spending and know exactly how I’m going to use my points bonus!

Chase travel transfer partnersSo while you can get $1,000 in travel with this bonus, you can get much more travel by transferring to Chase travel transfer partners.

In the past, I’ve gotten excellent value with United, Flying Blue, Singapore Airlines, and British Airways.

Nowadays, there’s a lot of overlap between Chase Ultimate Rewards and other bank programs, including Amex Membership Rewards, Citi ThankYou, and Capital One.

Pair Chase cards to earn even more points

I wrote about 8 high-value ways to redeem Chase points. Of course, things are always shifting within the points space, but most of them still hold up.

But there’s one partner I zero in on with the focus of a laser and that partner is…

My favorite way to redeem Chase pointsHyatt. All day and night. Send them to Hyatt!

Why?

Chase and Hyatt have an exclusive relationship, so there’s no other way to transfer points to Hyatt except through Chase. Historically and now, Hyatt has a generous award chart and it’s relatively easy for even casual travelers to get a big return for their points.

Plus, transfers are instant. You can literally send Chase points to Hyatt, refresh the booking screen, and they’re in your account. (I’ve done that many times before.)

My last Hyatt stay was for Halloween 2020

Hyatt Category 1 hotels (think Hyatt Place and Hyatt house), start at 5,000 points per night.

With 85,000 points (the sign-up bonus plus the minimum spending), you could get:

17 award nights at a Hyatt Category 1 hotel10 award nights at a Hyatt Category 2 hotel5 award nights at a Hyatt Category 3 hotelAnd so on, up to Category 8You could even get a free night at some of the most exclusive and luxurious Hyatt hotels in the world, like the Ventana Big Sur (on my list), Park Hyatt Tokyo, or a few nights at an all-inclusive resort, like the Hyatt Ziva Los Cabos or Hyatt Ziva Puerto Vallarta (been to both).

Because I’m now living on the road, I’m definitely going to lean into those Hyatt Category 1 hotels, which can cost over $100 per night. Even assuming a base of $100 per night, 85,000 Chase Ultimate Rewards points are worth $1,700 (17 nights @ $100 each).

That’s an astounding bonus from one card.

Another reason I’d recommend Hyatt right now is because flights are generally cheap. Travel is coming back slowly and flight prices reflect that.

Also – for flights, the best award redemptions are usually long-haul international flights in a premium cabin and well… that’s not a possibility right now.

Or you can do what many others are doing and build up your point reserves for when travel does return. Nothing like a luxurious free trip to declare revenge travel.

If you’re able to open this card now, I’d highly recommend doing so. You can:

Stay at Hyatt hotels for freeWait until international flights open back upBook expensive flights as awards nowOr just save your points toward a fabulous post-pandemic vaycayAny way you slice it, you can’t go wrong because there’s never been a better bonus on the Chase Sapphire Preferred. I just opened the card myself and already have a use for my newly earned points in the works.

At a bare minimum, this bonus is worth $1,000 toward travel + $50 toward groceries which is a phenomenal value from one card. There’s a $95 annual fee, but that pales in comparison to the value you can potentially get.

Plus, if you have other Chase cards, like the Chase Freedom Flex or Chase Freedom Unlimited, you can pair and pool your points – and then send them to travel partners or book travel with them where they’re worth 1.25 cents each.

To be honest, I can’t think of a single reason why you wouldn’t get this card if you qualify. If you’ve been antsy to travel like I’ve been, those points are going to come in handy when you’re ready to travel again.

It’s no longer a great card for spending (you earn 2X Chase Ultimate Rewards points on travel and dining), but for that kind of bonus on a personal card, you really can’t go wrong.

Have you already gotten this card? Will you? How will you use your 80,000-point bonus?

February 27, 2021

My plan to be a digital nomad and slow travel for the rest of 2021

As I sat in the freezing dark for hours earlier this month, lit only by candlelight, a crisp and salient thought began to form: fuck this.

My windows were covered in condensation that made puddles on the window sill. I put towels down and tried to wipe it up as best I could. My power came back in flashes and I ran around charging everything and trying to heat the place. Over the course of a week, I paid $700 for what little electricity I got. In the middle of the week, my lease expired.

I didn’t want to renew it, nor did I want to move elsewhere in Dallas. So, I called to give what I thought was my 30-day notice. But noooo, it’s a 60-day notice. They’ll “try” to get it rented sooner. Oh and keep the power on until the last day, they reminded me.

Lovely

So this is how it ends – talk about a whimper.

I picked the date, called my brother, and reserved a U-Haul. I’m gonna throw my stuff in a storage shed and live on the road for a while.

First stop next month: Memphis.

Digital nomad lifeI was shocked how simple it was to undo everything. I mean, all it took was a couple of phone calls to the apartment office, my brother, and a storage facility.

I’ll have to pay all of March rent and most of April, so I chose to leave at the end of March.

Even though it came together quickly, the thought had been forming for a long time. I’ve known I wanted to get out of Dallas since the pandemic started. I was actually on my way out when the first lockdown happened. So what is that – a year?

A year of hanging on and sticking around and staying put. But when this storm and my lease expired the same week, that was all the impetus I needed to rip the cord.

And just like that –

Goodbye, Dallas.

All the “lasts”The last Costco trip. The last time at the grocery store. At the neighborhood bar. Walking in the dog park.

They hit rather profoundly, these lasts, reminding me of life’s inherent impermanence.

I bought a condo here in December 2015, then officially moved in June 2016. I sold that condo in June 2020. So… about five years here?

I wanna say it’s flown by, but it hasn’t. The experience feels like every one of its five years.

And I wanna say it’s been awesome, but that isn’t exactly true. A lot of hard stuff happened while I was here.

A few relationships and subsequent breakups. A traumatizing experience with my HOA. The worst work-related burnout I’ve ever had. Made some friends, lost some friends. Life stuff.

I also got a huge start on my journey to financial independence. Made a little from the condo sale. Got closer to my friend group. And, before the pandemic, got to travel to some incredible places. DFW is an amazing airport for getting around.

Dilly Dally

It was also a nice calm-down from my time in Brooklyn. The city was wearing me down, and Dallas felt positively provincial by comparison.

By now I’m used to Texas heat, driving in my car, and this new version of city life. So you know what that means. Time to shake it all up again.

How I untangledFirst, I found a job that allows me to work 100% remotely. I tried the office thing again, and I can definitively say the office isn’t for me. Not full-time anyway. I would consider a hybrid model where I go in once or twice a week, or a rotation schedule, or some other arrangement. But not every weekday in the office. I’m pretty sure that’s dead now, anyway. GOOD.

I’d already sold my place in anticipation of leaving. So I rented a little apartment around the corner and gave my notice. You know how these management companies are. There’s always some “gotcha” in the lease agreement. So I’ll have to pay basically double rent in March and April because of the 60-day notice. That sucks, but it’s the price I pay to get out of here.

I got a storage shed with month-to-month terms near my mom’s house in the Memphis area. So my stuff will live there for a while.

Then I booked a U-Haul, called my brother, and booked him a flight to DFW. I’ll drive the U-Haul back and he’ll drive my car.

Finally, I booked an Airbnb for a month in Memphis. So that will be my first stop.

Slow travelLink: Sign-up for Airbnb and get up to $65 off your first tripI’ve had a long relationship with Airbnb. Mostly as a host, but now as a traveler. I compared Airbnb listings against other sites like VRBO, Craigslist, and a couple more. None had the amount of listings and the price point I’m going for. That said, I’m open to learning about other ways to book slow travel.

I do like how Airbnb codes as travel on my credit cards, so I can use them to earn extra points on my “rent.”

I’ll take it

Plus, I can click through Acorns when I booked to get 1.8% cashback invested. It’s one of the methods I wrote about in 5 Easy Ways to Earn Points for Airbnb Stays (Updated 2020).

I thought about using Airbnb gift cards via MileagePlus X – but you can’t use them for longer stays. (So glad I read the T&Cs before I bought one.)

I figure Memphis will be a great place to use my training wheels. I’ll be close to my storage shed if I need anything and I’ll get to hang out with my family for a bit. After Memphis in April, I was thinking:

Nashville (May)Knoxville (June)Asheville (July)Providence (August)Maine (September)Vermont (October)

The last time I was in Maine, I was this old

I was also thinking at some point:

PhiladelphiaNew YorkFloridaChicagoNew MexicoAustinArizonaThese are all in the US because Covid. Internationally, I’d love to visit:

TorontoEnglandMexicoChileI also wouldn’t mind staying near National Parks and exploring them after work or during the weekends.

I’m gonna try to stick to Eastern or Central Time as much as I can as my job is on the East Coast, so I don’t want to be too far off from that. Not at first, anyway.

LogisticsI don’t know what’ll actually happen once I’m out on my own. Or how much stuff I’ll need (like knives for cooking, my blender, dog supplies). Or what to do with my plants or how to shop for groceries. All I know so far is I’m using my mom’s address to forward my mail to, and my gramma’s address for work/tax purposes (Tennessee has no state income tax, like Texas).

I don’t know how long I’ll need to get between places or if I’ll need to take a day off work for driving sometimes. Also, what happens if I need a car repair? Or if I want to go away for a weekend trip?

Will definitely have to hit up Fenwick Island! (My dog’s name is Fenwick and he’d love it)

So many unknowns. Also, I don’t want to end up spending more on the road than I do right now. I’m sure I’ll want to eat out more, visit local breweries, and stuff like that. So I’ll have to watch my budget and balance fun stuff while also keep everything from cutting into my work time. Speaking of which, I’ll definitely want to bring my extra work monitor. My little car is gonna be so full.

These are things I’ll have to figure out as I go – part of the adventure! Oh yeah, and I’m taking my dog with me. #roaddog

Bottom lineSoooo yeah! That’s my plan – to be a digital nomad and slow travel for at least the rest of 2021. I have no idea what will happen or how it’ll play out.

I might last a month and just end up getting another apartment in Memphis. Or I might try to go a few months. Or who knows, maybe I’ll be doing this a few years from now.

All I know is that my soul is stirring and I’m restless. Because of Covid, not traveling for so long, and feeling generally in a rut/over my current situation for a while.

My goal is to keep my spending right around what I’m spending now. That means $1,500ish for a monthly place (give or take), plus food and gas. I’ll try to make meals at “home” as much as I can. But really- I don’t how any of this is going to look. I’ll have to form new habits and routines.

Throughout everything, I still have 25% of my check going into my 401k and I’ll steadfastly save/invest as much as I can each month.

So, I’m going to give it a try and see what happens. Maybe these are famous last words or maybe they’re the beginning of a long journey?

Will keep y’all posted. I haven’t been posting much on Instagram lately, but I expect I’ll use it a lot while I slow travel, so if you’d like to keep up, follow me there as I’ll use it as my mini-blog throughout everything.

Is this totally bonkers? Have you slow traveled or experienced digital nomad life? Any tips on where to book long-term stays or anything to make things easier?

February 26, 2021

The level set and a miserable month, but still up $10K – February 2021 Freedom update

Well, this month just about broke me. There was a historic, once-in-a-generation cold snap in Texas accompanied by power outages and wind chills of -15 or more. I found myself without heat, power, water, and internet for the better part of a week.

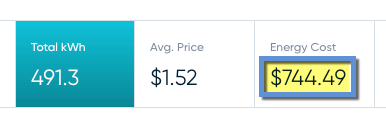

And there was nowhere to go because the roads were a slick, icy mess. Fort Worth had a 133-car pileup. I considered going to a hotel, but didn’t want to risk it. For the power I had, I paid $9/kWh and over $700 in electricity for February alone. My lease expired and I’m now paying a $400 per month upcharge.

Things are better now, but overall February was a cold, miserable month where I did work by candlelight and got price gouged out the eyeballs.

And I got new glasses for those eyeballs before the power outages

But, the positives: I had never ran out of food, work was amazingly sympathetic, and my net worth rose nearly $10,000 despite everything. I now have all the creature comforts again, but it’s too little, too late. Next month, I have some personal news to share but the gist of it is: I’m finally leaving Dallas!

More on that soon!

February 2021 Freedom updateLink: Track your net worth with Personal CapitalOK, so I had to start off with histrionics. But for real, this was a challenging month. It feels like every time I get caught up, I’m having to spend extra cash on whatever decides to pop up that month. I’m grateful to have enough to handle these things, but I had to cringe as I saw my electric bill vault over the $700 mark.

But, life’s good. And I made a lot of financial progress this month.

I moved my IRA to Merrill Edge!Yeah, I did it. Thanks to everyone who commented and shared their experience with Merrill Edge last month.

I still have my Roth IRA with Fidelity, but moved my traditional IRA to Merrill Edge – and qualified for a new account bonus and the Platinum Honors tier in the Preferred Rewards program In one fell swoop.

Pretty soon, I should see a $375 bonus and my rewards status updated. To join Preferred Rewards, I had to open a Bank of America checking account, so I sprang for the highest-tier Advantage Relationship account (which also has a $100 opening bonus) because it’s free with linked accounts.

Did itttt

Once my status is updated, I’ll likely apply for a new Bank of America credit card.

Notes about Merrill EdgeYou cannot buy FSKAX or FZROXVTSAX has a $20 fee to purchaseYou cannot buy fractional shares!!!None of these are problems as I was able to keep my existing funds, but some of it was cash because my FZROX fund didn’t transfer over. That’s alright, I thought – I’ll just buy more FSKAX once it’s in the Merrill Edge account. But nope. So I bought ITOT instead, which is very similar. But still – I wanted to keep everything in FSKAX or VTI as much as possible.

So with that cash, I thought I could use all of it to buy ITOT. But again – nope. No fractional shares. What modern investment firm doesn’t have fractional shares? Merrill Edge, I guess.

I bought as much as I could, but still have $60 hanging around that I can’t really invest. It’s not a huge deal, but I’m used to buying fractional shares in whole-dollar amounts.

I did my rollover during the historic Texas snow. It stayed like this – and got so much worse – for the better part of a week

It’s fine because I don’t plan to contribute anything to the account for a while so the funds can literally just sit there – which is another reason I made the transfer. I understand Merrill Edge isn’t the best for day trading, options, and margins, but I’m not doing any of that. Just a buy and hold with my existing funds. And for that, it’s perfect.

For the purpose of unlocking extra benefits with Bank of America, it’s worth it. The transfer only took a few days. But I wouldn’t use them as a beginner.

For that, I’d recommend one of these brokerages, especially Acorns for absolute beginners or Fidelity if you know what funds you want to purchase (hint: FSKAX works nicely in an IRA).

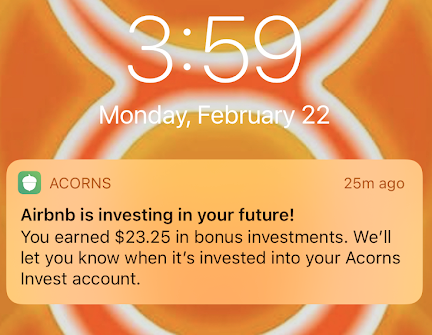

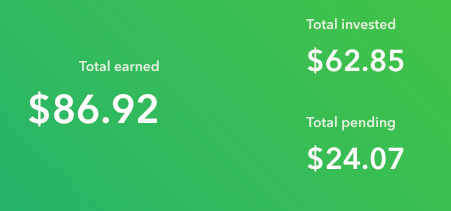

Notes about AcornsLink: Sign-up for Acorns and get $5 freeLink: 5 Reasons You Should Get Acorns for Micro-Investing (Even If You Have Other Accounts)On the subject of Acorns, I recommend this account to everyone! Why?

Acorns Found Money, which is basically a shopping portal, although there are some card-linked offers that are useful.

I’ve made great use of Acorns Found Money, especially lately

Over a few years, I’ve earned ~$87 in free money that’s automatically invested. Most of it has been through the card-linked partners, which requires no extra effort.

Free investments

This money earns dividends and continues to grow. It’s not much, but I consider it sort of “fun money.” I have it invested at the most aggressive level and it’s fun to see how it performs in the market. I’ve never actually put any money into Acorns aside from my $5 opening deposit. All the rest has been completely free, which is cool.

I use their taxable brokerage account, but they have IRAs and custodial accounts, too. But the Found Money pays for the account many times over and I recommend it if only for that reason alone.

February progressThis was the first month with my new 401k and because of how the dates fell, I got to contribute $2,500 within one month. How cool!

But, the markets took a beating this week and my current rate of return is currently -.20%.

I’m on track to fully max out my 401k this year. I’ve already maxed out my Roth IRA for 2021.

The next focus is refilling my savings account to get it back up to $30,000. After that, I’ll put my effort into my taxable brokerage account – specifically, filling it up with FSKAX/VTI as much as possible.

It might be difficult with upcoming life changes in March and April, but that’s what I’ll do with anything extra.

Ouch

I intended on getting a head start on everything this month, but unexpectedly had to pay my $744 electric bill on top of an extra $400 in rent. So that ate into my progress.

Cheers!

But despite everything, I still saw my net worth rise to nearly $183,000.

By the numbersHoly guacamole. It’s like it happened while I wasn’t looking. After hitting my first $100K, the growth is off like a rocket – even with the bad days factored in.

Here’s what moved:

CurrentLast monthChange2021 Goal ASSETS 401k (contributions only)$2,500xx+$2,500$19,500 Overall investments$152,644$143,742+$8,902As much as possible Savings$20,494$19,916+$578$30,000 Net worth in Personal Capital $182,610$172,966+$9,644$500,000 Track your net worth with Personal CapitalI love how simple and pared down my goals have become since I paid off my credit cards and car loan.

The 401k will take care of itself this year. Next up, it’ll be about making my next life transition, building up savings, and focusing on the taxable brokerage account. Simplicity.

And all this with the storm as a backdrop. It’s been a surreal time where time feels like it’s moving so fast and so slow at the same time. I want to break this stasis.

February 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardI’m kinda shocked at how much my net worth grew this month. It’s like it’s reached a level where the growth is more noticeable. It’s also much more reactive to shifts in the market. Any little move will send it up or down by thousands. I finally feel like I’m ahead with this $500,000 goal, as I edge into $200K territory.

A taxable brokerage account will be more of a strategy this year. I realized I won’t touch my retirement funds for many more years, but might like to live off dividends before then. Well, the retirement accounts are almost to a place where they’ll grow on their own as a natural function of compound interest. And now I can think about dividend income in the short-term. It’s a good, strong place to be. This month, I’m another percentage point closer to my goal.

My soul is stirring; I’m feeling restless lately. The next weeks will be focused on getting out of Dallas. This next Freedom update will come to you from a different city. I’ll make a new post about that soon! #excited

Until then, I hope everyone is doing well. Stay safe and scrappy out there!