Harlan Vaughn's Blog, page 3

February 7, 2024

I Grew Up Poor and Learned Financial Literacy Late. Now, I’m Investing for My Children and Teaching Them to Become Millionaires

For those who are going to comment, “What’s this have to do with BoardingArea?”, the answer is nothing, so don’t bother. Close the tab and leave.

If you’re still here, know that I’m so excited to travel and can’t wait to post more travel stories. This article has a story behind it.

It was originally published on August 25, 2022, on NextAdvisor in partnership with TIME on the Time.com domain. That site folded in early 2023 and the story disappeared into internet ether. I thought it was a good one, so I want to republish it now—on my own blog—for posterity so it isn’t lost forever.

I’ll admit: It’s definitely on the personal finance side of things. It relates to my own personal finance journey that I’ve chronicled here since 2019 (a literal different world ago). It’s a great complement and explains more of my thinking and personal finance philosophy.

And so, I hope having one more personal finance post is OK. This one’s mostly for me, and I hope you enjoy it too.

I Grew Up Poor and Learned Financial Literacy Late. Now, I’m Investing for My Children and Teaching Them to Become Millionaires

Me and Warren in 2022

I’m going to teach my children how to be millionaires.

My oldest son, Warren, already has a brokerage account – and doesn’t even know it yet. Soon, he’ll have a little brother (and we’ll have another son). I plan to set up an account for him, too.

My efforts alone won’t make them millionaires. But I’m going to give them a big head start and show them the power of consistent, long-term investing with low-cost, broad-market index funds.

It’s something I wish I’d learned sooner. Teaching my children will be a big step toward building generational wealth in my family.

I grew up poor, and my family is mostly poor. They don’t own assets or leave anything behind to their children. If anything, they pass on debts to other poor family members to clean up when they’re gone. It took a long time for me to start saving. Even now, I often feel like I’m “behind” or should’ve started earlier.

Since having kids, I decided they’re going to grow up differently than I did.

Here’s what I’ve done so far, how much they’ll potentially have when they become adults, and how teaching my sons about money is healing my own money traumas.

My Brief History With MoneyThere’s a proverb that goes, “Shirtsleeves to shirtsleeves in three generations.” Variations include “From stables to stars to stables” and “The father buys, the son builds, the grandchild sells, and his son begs.”

They all address the notion that first-generation wealth is rarely sustained. Most often, it’s due to a lack of education and not understanding what money is or how it works.

My sons will know about their investment accounts, and money won’t be a taboo topic in our household. The concepts of long-term saving, compound interest, and living below their means will be introduced early and discussed often.

Contrast that with my upbringing, where I didn’t know what a brokerage account was until my mid-20s, money was described in terms of lack or frustration, and saving? There was nothing to save when life was paycheck-to-paycheck.

I’m now to the point that I’ll be a millionaire in my lifetime – perhaps several times over if my investments perform well. And even if not, I have enough to retire comfortably without ever adding another cent to my retirement fund.

Investing for Kids With a UTMARight now, I’m investing for my three-year-old son Warren in a UTMA brokerage account. The acronym UTMA is short for the Uniform Transfers to Minors Act, which allows a minor to receive monetary gifts with minimal tax implications.

I’m the custodian of Warren’s account, which means I choose the investments on his behalf until he reaches the age of majority and the account transfers to him.

That age is either 18 or 21, depending on the state you live in. Some states have UGMA (short for Uniform Gift to Minors Act) accounts instead. They’re basically the same, except a UTMA account allows gifting of additional assets, including equities like stocks.

You can give up to $15,000 per year to a UTMA account for a child, and your contributions are never taxed. The first $1,100 in earnings (like dividends, interest income, and capital gains) are not taxed. The next $1,100 are taxed at the kiddie tax rate, also known as the child’s marginal tax rate, which is much smaller than an adult would pay. Any earnings over $2,200 are taxed at the parent’s marginal tax rate.

Warren’s Investments: A Peek Under the HoodHere’s what I chose for Warren’s investments. I chose to invest in VTI, Vanguard’s total stock market ETF index fund. It’s extremely low-cost and captures activity throughout the entire stock market. The S&P 500 features heavily, but there are some small cap and alternative investments in there for good measure.

A fund like this provides instant diversification, so if one company or sector severely underperforms, the entire portfolio won’t go down in flames. This protects his investment portfolio from any downturn in the market.

Based on the stock market’s historical returns, they should see somewhere around a 10% return on average, which accounts for the market’s dips, crashes, and incredible bull runs.

And whatever happens, they’ll have their Dad to remind them to stay the course and keep investing. After all, it’s the best thing you can do to have a successful portfolio.

How Much Will Warren Have in His UTMA Account?Right now, there’s $1,100 in Warren’s UTMA account. I try to put in at least $100 per month (and more if I can swing it).

According to the compound interest calculator on Investor.gov, Warren can expect to have $63,872.79 when he turns 21 in 18 years, assuming a 10% return and $100 added monthly.

While that’s a nice chunk of change for a young person, the results are even more dramatic if it sits until he’s 60. In 57 years, he’d have $3.4 million if he keeps up a $100 per month contribution. And he’d cross the line into millionaire at age 48.

For $100 per month, he can retire as a multi-millionaire on his 60th birthday. That’s the power of compound interest. Should he choose to keep the money and increase the investments, the sky is truly the limit. And knowing he only has to minimally maintain his investments and have that kind of nest egg waiting for him should be plenty motivating.

Why Not Go With a 529?A 529 account is used solely for a child’s educational expenses. Some states even give a tax deduction or credit for contributing to a 529 plan. But there’s a 10% penalty if the funds aren’t used for educational expenses.

The biggest difference is that the funds inside a 529 plan are considered the parent’s assets, and therefore have a smaller effect on the child’s need-based financial aid calculations when it’s time to apply to colleges.

With a UTMA/UGMA account, the assets are considered the child’s assets and can be used as income, which could significantly lower financial aid qualifications, depending on how much is in the account.

And I’m fine with that.

I don’t want my children to feel like they have to go to college to enjoy their gifts. Already, the traditional trajectory of college after high school is being challenged.

What if Warren decides trade school is better for his career goals? What if he wants to attend community college and can’t spend all the cash in his account? What if he receives scholarships on his own merit and doesn’t need a 529 after all? What if he simply doesn’t want to go to college?

Further, if he decides to attend college, the funds in a UTMA account can be used for anything – including educational expenses. If that’s how he wants to spend his money, then that’s his decision. I don’t want to lock him into anything while he’s only three.

If he starts talking about college when he’s in high school, maybe I’ll switch gears. But for now, a UTMA account seems like a better choice because of its additional flexibility. For example, he could also just keep it and keep investing. The choice will be his.

I’m Doing This for My Next Son, TooOur newest child will make his grand entrance in just a couple of weeks. I already have a checklist of things I want to do for him, like set up an email account where I can send him letters through the years, give him a membership to my preferred financial institution, USAA, and open a UTMA account.

I’ll make my sons beneficiaries on my other investment accounts, but I also want them to have their own, separate accounts that we can watch and monitor together as they grow up.

My hope is that they’ll be one another’s accountability partner for ongoing financial stewardship when they’re adults.

Ongoing education is the make-or-break with making successful transfers of generational wealth. Instilling a sense of ownership and putting an account in their names will, I hope, give them encouragement – and power.

A Roth IRA Could Be a Good Play in the FutureI love Roth IRAs. They’re an amazing way to supercharge your retirement with flexibility, tax-free growth and withdrawals, and serve as a hedge against increasing tax rates.

The hitch is that you can only contribute as much as you earn in a year, or up to $6,000 a year in 2022, or $6,500 in 2023 (whichever is less). I can’t open a Roth IRA for Warren or his new sibling just yet, since they don’t have their own earned income. When they start working, I will.

I mention this to illustrate that there are many account types that would work well for what I intend to do: raise financially literate children. And will the strategy change over time? I sure hope so.

How You Can Set Your Kids up for SuccessThere are lots of ways to invest, and many account types – even for kids. It doesn’t matter where you start, because getting started is all you need to do.

The sooner you can invest for your children, the better, because compound interest will have an incredible impact over the years while they’re growing up. The earlier you can save for them, the more time their money will have to multiply.

And don’t get too caught up on the strategy. You can always learn more and change it later if you want. Even if you start with a little bit of money, it can give your kids a huge head start.

Because one day, you’ll blink and they’ll be all grown up – and so will their money.

Bottom LineI’ve broken through a lot of ideas about money that kept me down. After dealing with my own trauma and claiming back my power, I’ll teach my children to feel empowered about money, how to save, and why thinking long-term and multi-generationally is important to build and preserve wealth.

Warren playing with coins

Warren playing with coinsWarren just turned three, but already loves playing with coins. I tell him their values. He watches as we pay for gas and groceries with our credit cards. And I’ve occasionally remarked that we need to buy things before we can open them in the store.

He’s completely a sponge right now, so even if he doesn’t seem to “get it” yet, I know that introducing the concepts and language now is already setting him up in a way I wasn’t. He’s also observing our attitudes and energies about money.

He’d be absorbing all of this anyway. The shift here is molding the narrative for him while he’s young. And it’s healing for me to be able to give my children something I never had. As a father, that makes me feel proud of how far I’ve come.

As the boys mature, they’ll start working or talk about college and figure out their plans on the way to adulthood. There’s no way of knowing how these accounts will change over time, too. There could be new legislation, new rules could emerge, or there could even be a new type of investment account when they’re older. We just don’t know what will happen.

That’s why I’m always open to pivoting based on their financial goals and what changes over the next decade or so.

For now, all the future millionaires have to do is be kids, play, and grow. Their Dad’s got a plan to educate them as soon as they’re ready.

February 3, 2024

70% of the way to $500K! Will I reach my goal by August? – February 2024 Freedom update

I’m creating my own nail-biter over here. This is the third month in a row of a new net worth high. That feels dang good on its own: At nearly $350K, I’m 70% of the way toward my $500K goal.

But the goal is to hit $500K by August 2024. That’s in 7 months! Being $150K short means I’ll have to increase my net worth by over $21,000 each month on average until then to achieve it.

That’s… a lot. Is it realistic?

Sleep < Haircut

I mean, probably not.

Is it also incredible? Heck yeah! I continue to be amazed at how compound interest truly has a life of its own.

I’ve had plenty of months with gains and losses of that size. But to have 7 winning months in a row? I’m my own underdog. It’s unlikely but it would be soooo cool if it happened.

Even if it doesn’t, I think I’ll get pretty close. Either way, 2024 is already shaping up to be an incredible year.

February 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardI also have to keep the big picture perspective. According to this compound interest calculator, even if I never invest another cent, I’ll still end up with $2.5 million at age 65 with an 8% return.

That’s still really awesome

But I’ll continue to add around $1,500ish per month through my 401k, HSA, Roth IRA, and regular brokerage account and land closer to $4 million.

It was a snowy month, and we were homebound for most of it

All that to say, hitting the $500K isn’t absolutely imperative this year, especially considering we just welcomed our third child last month, but it’s on the horizon. And being 70% of the way there is really starting to feel like I’m closing in on it!

This month’s progressPretty much all of the gains this month were from stocks. The real estate market is holding steadily soft, and though I continue to pay the mortgage, the gains aren’t there. If there’s a rate reduction later this year, that may snap back… but not holding my breath on that.

I feel horrible that I have no savings right now. Our new baby had to be in the NICU, and I’m paying a lot for housing and [insert reasons]… I’ve dipped into savings and now it’s depleted. I have two 0% APR cards where I can charge stuff if needed, but that’s just kicking the can down the road.

We already met our out-of-pocket max on insurance, so it’s supposed to pay for all new charges, but the providers are sending bills generated before we hit the max, and they’re having to go back and adjust. The hospital bills continue to roll in and I don’t know what I’m supposed to pay any more.

There’s also life stuff going on. Long way of explaining the savings situation, but getting that part of my financial picture is becoming foremost in my mind. I’m sure others are in the same boat. I’m doing my best and until I come up with a better plan, that’ll have to do. Tbh, I’m just focused on sleeping more than anything right now.

To recap this month, I:

Am dealing with a lot of medical bills and hoping it’ll all come out in the washSlowly repaying balances on a couple of cards I used to get us by last monthDepleted the rest of my savings Started building my HSA account again (and thank gods for it, really!)Lost some value on my primary residence because of a soft marketStill got more gains from a strong stock market to reach another new net worth high

Warren at the children’s museum

By the numbersSo now that you have the lay of the land, here’s the raw data. Remember: Numbers never lie.

CurrentLast MonthChange2024 Goal ASSETS Overall investments$263,526$255,263+$8,263As much as possible Roth IRA 2023$63,213$61,109+$2,104$6,500 (in new contributions)$4,000 so far! Roth IRA 2024$0$0xx$7,000 (in new contributions)Starting May 2024 Taxable brokerage + UTMAs$3,495$3,366$129$25,000 (total invested) Savings$472$670-$198$30,000 Primary home equity + appreciation$53,005$55,788-$2,783$70,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITY TDB??? Net worth in Empower Personal Dashboard$349,887$342,551+$7,336$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITY TDB??? Net worth in Empower Personal Dashboard$349,887$342,551+$7,336$500,000 (overall goal)

Track your net worth with Personal Capital

Kapow, cowboy

Long-term goals include:

Put more money into Beck’s UTMA Contribute to new baby’s UTMA (we already got her SSN and I started one for her a few days ago!)Finish maxing out my Roth IRA for 2023 Build my savings account again (will I ever? )Start on 2024’s Roth IRAWork up to 15% in 401k contributions this year

Happy Valentine’s Day/Month

February 2024 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!!I’m getting inspired by my own journey—because with nearly $264,000 in pure stocks, I routinely gain or lose a few thousand per day when the market has a big movement. But each month, despite my other financial activities, the upward trend continues because of compounding interest.

It’s separate from me now and has a life of its own. Will it be enough to get me over the $500K mark? Yes, definitely! But… by August 2024? I can’t even guess what the odds are right now. 50/50? 30/70? I’m gonna keep my head down, keep working, and let this thing go where it’s gonna go. If I could get into the $400s, I’d consider that a huge win, even.

I hope this journey, with all its stumbles and randomness and momentum inspires someone out there. I feel good about knowing my financial future is secure and that I’ll have enough to leave to my kids. I’m also the kind of person that just really enjoys setting big goals and working hard to reach them—if only to challenge myself. That’s my “why” for this aggressive goal.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.

January 13, 2024

New Year goals, up $8K, and an announcement – January 2024 Freedom update

Like last month, this one finds me at yet another new net worth high. But unlike last month, it also finds us with a brand new baby girl. That’s right – we are now a party of five and have spent the last week getting to know our sweet new baby!

POV: you fell asleep on Dad

Even with all the expenses associated with delivery, my overall net worth continued to tick upward to over $342,000.

I’m excited and so tired. We’re currently on an adventure and making new memories in a new place. Here’s how it’s playing out as I start 2024.

January 2024 Freedom updateLink: Track your net worth with Empower Personal DashboardI had to make some allowances with the numbers this month. I charged ~$4,000, the amount of my insurance deductible, to a credit card. I’m not including that amount because I’m reimbursing myself from my HSA (a work account I’ve never included in my net worth calculations).

But this month is also a bit of a puzzle because I’m having to carry balances on a few cards until that reimbursement comes through. There were a lot of other expenses an HSA can’t cover, and I lost my side hustle this month.

These midwinter daze

I was working for a friend’s business and we had a big falling out. Like, a big one we won’t recover from. We were friends for nearly 20 years, and he completely snapped on me. At the time, he owed me several thousands of dollars for work I’d done for his business that he never paid.

I was depending on that money to get ready for the baby’s birth. It’ll take me a few months, but I’ll just have to pay it down when I can. For now, my hands are very full and, as always, I’m sticking to my investment plans.

You’ll also notice my savings number has decreased, and that’s why. There’s really no other way to explain it, so I figured I’d just be open and say what happened. My money bestie assured me we’ve all been there and I really needed to hear that because I was feeling guilty about it.

So, lots of deep breaths. This past month has seen loss, movement, joy, and a new family member. We’ve been so grateful for all the friends and family who came to wrap us in love, visit the kids, and deliver home-cooked meals. I continue to marvel at the stuff of life.

This month’s progressNow I’m excited to share more money progress. As last year wrapped up, I added a traditional 401k to my existing Roth 401k account and bumped up my overall contributions to 12% (from 10%). I have 10% going to the traditional 401 and 2% going to the Roth 401k.

I knew that little extra would pinch a bit, but I’m glad for it.

Got lots of good family time over the holidays in Memphis

A new year, a new Roth IRA limit. I still have $2,000 left to go with 2023’s Roth IRA and want to challenge myself to max it out for last year AND this year. Will I? Can I? I don’t know, but I’ll try.

Between my tax refund and any extra cash that comes through, I think I’ll be OK within the next few months. I’ll get there.

Also, the real estate market where our house is located has been softening, so I anticipate losing a little more net worth value from falling prices.

Like everything else, there’s been give and take, ups and down, but the overall trend is progress because my net worth keeps going up.

To recap this month, I:

Boosted my 401k contributions to 12% (and want to bump it up again to 15% if I can)Had to carry balances on a couple of cards to get us through the last monthAM NOW DAD TO A NEW BABY GIRL!Depleted some savings because an ex-friend totally stiffed me :/Emptied one HSA account but am now actively building it up againLost some value on my primary residence because of a soft marketGot more gains from a strong stock market to reach another new net worth high

And this sweet baby is growing so much

Whew! That felt like a lot to type out.

I also want to add that now that our insurance deductible (and out-of-pocket max) is almost met, the rest of the year should have no extra medical expenses, which is pretty awesome. Anyone else ever max out their deductible in January? This seems like a life hack or something. Either way, we got lucky with our sweet Capricorn girl!

By the numbersThis month had a lot going on. It’s been emotional, busy, wonderful, hard, and so many other things. I’ll continue investing aggressively with my 401k and find ways to make progress on the side. Maybe I’ll find another weekend side hustle.

CurrentLast MonthChange2024 Goal ASSETS Overall investments$255,263$241,704+$13,559As much as possible Roth IRA 2023$61,109$58,532+$2,577$6,500 (in new contributions)$4,000 so far! Roth IRA 2024$0$0xx$7,000 (in new contributions)Starting May 2024 Taxable brokerage + UTMAs$3,366$3,238$28$25,000 (total invested) Savings$670$2,236-$1,566$30,000 Primary home equity + appreciation$55,788$58,072-$2,284$70,000 Raw land$40,400$40,400xxNo goal, just including for completeness LIABILITY TDB??? Net worth in Empower Personal Dashboard$342,551$334,080+$8,471$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITY TDB??? Net worth in Empower Personal Dashboard$342,551$334,080+$8,471$500,000 (overall goal)

Track your net worth with Personal Capital

You’ll see everything mentioned above reflected in these numbers. As of now, I’m not including my credit card balances as liabilities because I’ll get reimbursed for most of it soon. And I’ve never included my mortgage because, with a 3% rate, I have no interest in paying anything above the monthly payment.

Almost 70% of the way to $500,000!!!

Long-term goals include:

Put more money into Beck’s UTMA Start an UTMA for new baby when we get her SSNFinish maxing out my Roth IRA for 2023 Build my savings account again (will I ever? )Invest as much as possibleWork up to 15% in 401k contributions this yearWe’ll also incur expenses for baby stuff in the near future. For example, we need a new stroller and will need another car seat down the road. Those will mostly be as-needed, but can be pricey. So, as usual, I’m gonna wing it and control what I can.

January 2024 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!!Suffice it to say we had a very Happy New Year. We now have a four year old, a one year old, and a newborn. I’m thrilled to be in my family-building season of life that just so happens to coincide with an aggressive financial goal I set for myself (to save $500,000 by August 2024 – my 40th birthday).

The market delivered over 20% returns last year and if that continues, I might just hit the goal. In this moment, I’m staying steady after a whirlwind month. I’ll figure it out and get back on my feet, but for now I’m smelling that new baby head and cocooning with my loves while it’s so cold outside.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there!

-H.

December 11, 2023

Up $30K, goal almost 70% complete, and closing in on $350K – December 2023 Freedom update

I’m at a new net worth high. In fact, a year ago in December 2022, I was also at a new high: $266K. Must be the so-called “Santa Claus Rally.”

This month I’m at $334K. That’s $68,000 higher than this time last year and $166,000 left to go to hit my $500,000 goal.

If I can increase my net worth by $18,000 over each of the next nine months, I’ll hit the goal. Is that possible? Well, this month I’m up nearly $30,000 so… if the trend keeps up I just might make it.

But I also know how quick it can turn, so don’t want to take mental possession of it yet.

I went to a Christmas market in Oslo last week

That was a lot of numbers. Here’s one more: I’m 67% of the way there.

Whether I hit the goal by the end of August 2024 as planned/hoped for or not, I’m gonna go ahead and give myself some grace. I’m doing so good.

December 2023 Freedom updateLink: Track your net worth with Empower Personal DashboardGood news: I completely paid off my 0% APR credit card. The rate was set to expire at the end of the month, but I went ahead and put every spare cent toward the balance. With that, my HVAC is completely paid off. I gave myself a 0% APR loan and paid it back at my own pace.

The danger is not paying off the balance before the rate expires, but that didn’t happen. It’s an easy pattern to get into, but I gotta say… when used correctly, you can’t beat a loan with 0% interest.

Landscape outside Longyearbyen, Svalbard

Next, I’d like to finish maxing out my Roth IRA. I also recently opened an UTMA account for Beck, my one-year-old, with $100. It’s already got $110 in it after a month – a wild return.

Then there’s always the savings account to pad. So there’s no shortage of financial goals or buckets. Throughout this whole journey, I’ve found a little here and a little there has worked for me, with most of the focus on pure investing in low-cost, broad-market index funds – primarily FSKAX and VTI.

This month’s progressThe big money move was knocking out that HVAC credit card balance. I feel like I’ve been going on about that for so long. Well, no more. It’s done.

I really socked every spare cent into that. Other than that, I contributed to my 401k as usual and let everything else coast.

:p

Speaking of 401ks, I’m about to switch mine from a Roth 401k to a traditional 401k. Because I started contributing more than halfway through the year, the tax savings wouldn’t be significant, so I chose the tax-free option.

Because I’ll be contributing for all of next year (hopefully), I’ll go ahead and take the traditional route. Whether that’s best is an eternal debate. I figure it’s better to have a little here and a little there: another way to diversify.

I also got the deeds for more land parcels, so I now own six little plots of land, worth about $40,000. I’m gonna pause on buying land for a while. But it’s been a fun diversion. I’ve already gotten a few offers for a couple of the parcels. Oh joy, another mailing list.

To recap this month, I:

Kept investing in my 401k and HSA accountsPaid ~$5,000+ toward my credit card (and now it’s done)Now own six parcels of land worth over $40,000Spent some money on a trip to Norway, but – worth it (feel free to check out the photos and follow me on Instagram)Got some great gains from a strong stock market to reach a new net worth highBy the numbersOverall, I’m pleased with this month’s progress. Paying off that credit card is symbolic in that it shows I can make a commitment—to myself—and keep it. It also shows how powerful it is when I shine all my attention on one thing.

For all the “little here, little there,” having one singular goal sometimes is also a complete strategy. For the next couple of months, I’ll return to topping up my various buckets: the kid’s UTMA account, the Roth IRA, and savings. I’d also like to challenge myself to turn up my 401k a notch in 2024.

CurrentLast MonthChange2023 Goal ASSETS Overall investments$241,704$227,539+$14,165As much as possible Roth IRA$58,532$55,281+$3,251$6,500 (in new contributions)$4,000 so far! Taxable brokerage + UTMA$3,238$3,067$171$25,000 (total invested) Savings$2,236$2,138+$98$30,000 Primary home equity + appreciation$58,072$53,557+$4,515$70,000 Raw land$40,400$27,400+$13,000No goal, just including for completeness LIABILITY Credit card/HVAC upgrade$0$5,461-$5,461$12,708 (starting balance)COMPLETE! Net worth in Empower Personal Dashboard$334,080$304,594+$29,486$500,000 (overall goal)

Track your net worth with Personal Capital

LIABILITY Credit card/HVAC upgrade$0$5,461-$5,461$12,708 (starting balance)COMPLETE! Net worth in Empower Personal Dashboard$334,080$304,594+$29,486$500,000 (overall goal)

Track your net worth with Personal Capital

It’s also cool that I’m closing in on $300,000 in investments. Really forward to starting my third $100K of stock holdings.

Long-term goals include:

Put more money into Beck’s UTMA Finish maxing out my Roth IRABuild my savings accountInvest as much as possibleSwitch to a regular 401k in JanuaryAnd uh, work on goals for 2024.

December 2023 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!!It seems like reaching my $500,000 goal next year is split exactly 50/50, like it could really go either way. It’ll take lots of significant gains and little room for error, but there is a path.

More realistically, I’ll probably end up splitting the difference and get close. But how close… is a question for next year, which begins in just a few weeks!

I will continue to share the journey! Thank you to everyone who reads these updates. Have a wonderful holiday and I can’t wait to share more.

Stay safe and scrappy out there!

-H.

November 4, 2023

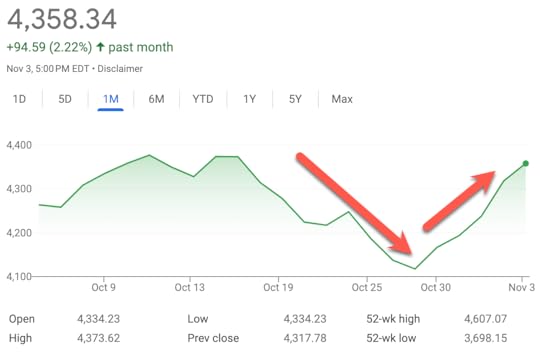

Bouncing back, up $19K, and are we on an upward trend? – November 2023 Freedom update

Somehow I’m back at 61% of my $500,000 savings goal and up nearly $19,000 this month. Not gonna lie, last month was devastating being down so much.

So while I love restoring growth, I know better than to get attached or assign mental possession to it. It could just as easily slide down again (and it has). In my case, it will.

Because we have a lot of expenses coming up in the next few months. The only thing that could provide levity is for the stock market to keep going in this upward trend, which… is it?

With my upgraded Hilton Aspire card

There’s been a lot of positive economic news lately (in the world at large), and my 401k has nearly recovered all the losses from earlier in the year. This month, my other investment accounts rose back to their October 2023 levels. If the market continues to improve, it could seriously make up for (and exceed?) my upcoming expenses.

And if the housing market improves, I could add to my home equity. Again, trying to stay level, but there it is: that hope that things will start to turn around.

Either way, I’m staying on track, adding cash to accounts when I can, cutting expenses wherever possible, and steadily paying down debt—all at the same time. As I have someone managed to do for years.

November 2023 Freedom updateLink: Track your net worth with Empower Personal DashboardThis month’s numbers gave me back some optimism. I hovered around the $300K mark for so long—it’s good to be back. I’d love to keep that moving up.

Despite contributing $1,000-ish per month to my 401k, my overall investments are at minus $58 this month. There were several days where I added cash and the next day, it was all worth less than the day before. But this past week has been positive, almost resetting all the loss. I’m to the point where I have enough saved that the investments can carry themselves in a strong market.

And I want them to. You always hear about “when it starts to snowball…” Well please, feel free to snowball. I’d love for the investments to tend to themselves while I go into heavy spend mode in the next few months.

Mentally, I’m here

I’m going to try my best to not only NOT rely on a credit card for extra expenses, but also hoping I can knock out the remaining $5,461 balance on my 0% APR credit card before the rate expires on December 26, 2023. (How’s that for a Christmas gift?)

Every extra dollar is going to knocking that out over the next couple of months. And you know what? I’m feeling confident that I can actually do it.

This month’s progressI was on a hustle in the last month. And not only are my Travis Scott tickets selling, they’re selling better than expected. I’ve sold everything I had for a few shows, and the others are picking up as the tour progresses. I might even make enough to pour it all into the credit card.

Plus, I finally filed my 2022 tax return and am getting back $1,100. That’ll all go toward the card, too.

This BABY

My homeowner’s insurance went up $500 last year and another $700 this year. I was with USAA for the last 15 years, but as of three days ago, I’m now with Allstate.

They beat my old rate by nearly $1,000 and gave me a great deal on auto coverage. So I’m waiting for the refund check to come in from that, which will also go—you guessed it—toward the 0% APR card.

With all my efforts combined, I might just get it done. And then I can work to max out my Roth IRA (knowing that I have until April 2024 to do that). But yeah, there’s always more to work on.

To recap this month, I:

Saved $1,000 by switching insurance companies. I saw my new premium, gasped, and got on the phone. Bye, USAA Kept investing in my 401k and HSA accounts. And this month, I bought at low valuationsNow own four parcels of land worth over $27,000. I wanna get one more then I’m done (for now)Set up at UTMA account for Beck and started it with $100. It’s not much, but the account is established, and he’s already gained $5Paid ~$1,500 toward my credit card and more on the way. I refuse to pay interest on that balanceLost some home value because of a soft market, but thinking that’ll turn around if the Fed is done tampering with interest ratesSaved a couple hundred in my savings accounts. Again, not much, but Yotta inspires meFiled my 2022 taxes! Finally—I’d been waiting to get Beck’s SSN. His passport is also on the way! Getting back $1,100 as a refund

Childhood. “I’ll just leave this here.”

By the numbersMy increases for the month were mostly investments recovering losses. And despite socking away $1,000 into my 401k, it’s still negative for the year.

Last month’s ride

The real estate market stayed low, but now that my homeowner’s insurance is cheaper, my monthly mortgage payment will be, too. And that’s definitely a win in this economy.

CurrentLast MonthChange2023 Goal ASSETS Overall investments$227,539$227,597-$58As much as possible Roth IRA$55,281$55,453-$172$6,500 (in new contributions)$4,000 so far! Taxable brokerage + UTMA$3,067$2,838+$229$25,000 (total invested) Savings$2,138$1,944+$194$30,000 Primary home equity + appreciation$53,557$57,343-$3,786$70,000 LIABILITY Credit card/HVAC upgrade$5,461-$6,930

-$1,469$12,708 (starting balance) Net worth in Empower Personal Dashboard$304,594$285,843+$18,751$500,000 (overall goal) Track your net worth with Personal Capital

Long-term goals include:

Put more money into Beck’s UTMA Finish maxing out my Roth IRABuild my savings accountInvest as much as possibleSwitch to a regular 401k in January (it’s currently a Roth 401K). I’m thinking I’ll use the tax break next year

Also: Stay above $300K—and keep it moving past 61%!

November 2023 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!!In a macro sense, I suppose it’s a win that I’ve been investing throughout all this and snagged more stock at low valuations. It’s been a rough couple of years with interest rates rising and general panic and paranoia (real or manufactured) about the state of the economy, inflation, etc. At times, I’ve thought it would be impossible to have this goal in such a rough financial environment.

I will say inflation is real. We feel it. Stuff that used to cost $6.99 is now $13.99. I can’t believe my eyes at the cost of routine grocery runs. It’s been hard to continue investing without that nice “pop”—which I’m hoping is on the way. It is sort of dystopian that we depend on Wall Street for our financial future.

Even if I don’t get to $500,000 by August 2024, I’d settle for $400,000. Or ya know, something above the low-$300 mark. Lol, I’m trying not to focus on it except for these monthly updates, which are helpful to process out what’s happening. I do still feel like the goal I originally set is both quantifiable and challenging. We’ll see what happens!

Thank you for reading! I hope this chronicle inspires someone to begin a journey of their own.

Stay safe and scrappy out there!

-H.

October 13, 2023

Down $27K and accepting more future losses, today – October 2023 Freedom update

I’m coming in sheepishly! My Travis Scott ticket reselling fiasco made a splash—for others in my situation and in the ticket reselling community. I’ve already talked about that here and don’t have more to say about it… for now.

I mention it because I sold stock for the first time in my life to correct my mistake and allll the life lessons that came along with that. Anywhomst’ve, I’m completely at peace with it. I learned my lesson, and I’m moving forward. It sucked, but it’s over.

Alt text: Blurry Tulsa hotel boy boss pic

You’ll see that debacle, a market that struggled through most of September (with one of the lowest days since March and the Dow that went negative for 2023 YTD), and a big decline in my home value reflected in this Freedom update.

As of now, I will most likely NOT hit $500K by August 2024. As my toilet stopped draining last week and lead to further large repair reckonings this month, I had my freakouts and regrouped. Here’s a link to the amazing BOY BOSS t-shirt from the photo above if you want one. (Sorry for the jarring transition.)

Life has changed a lot since I made that goal way back when. I will have multiple millions by the time I retire—even without adding another cent to my savings. And it’s true that, in general, I’m focused on the day-to-day more now.

I accept all that. And, not to get too philosophical, realized it’s not that serious. Spending money now, while I don’t love it, is what I have to do right now. (And maybe I do love it? Because we’re always getting what we want.)

All that to say, anything could happen and I’m still sticking to my plan of investing heavily, paying debt, and reducing expenses. There are speed bumps now. They won’t always be there.

Anyway, let’s talk about it.

October 2023 Freedom updateLink: Track your net worth with Empower Personal DashboardMy net worth would’ve been down this month without my interferences, but adding the ticket spending on top of it made it extra low. *whimper sounds *

I was feeling all triumphant last month and decided to serve myself a nice slice of humble pie, I guess. And it’s not a total loss. I’ve sold many tickets already and the tour goes through December so… I’m not totally ready to write it off as a total loss just yet.

“My Rose-Colored World” by Warren Vaughn. Watercolor on bristol board. 2023.

Those expenses are mostly paid off. And then the plumbing decided to go haywire. *increasing anguish*

I’m afraid of going into credit card debt again. But as of now, everything is on 0% APR cards, so I’m not paying interest. And I can always get a new 0% APR card, I just don’t want to get into that pattern again.

LOL/24 t-shirt interludeLink: Buy the LOL/24 t-shirt

Presenting the best, nerdiest points and miles shirt of all time (click to view, send it to all your friends, wear it to all your conferences and get-togethers)

OK, back to the Freedom updateStill, life has required me to use all the ingenuity and “creative solutions” I can muster. It’s exhausting. At a certain point, I gave in and decided to be at peace with it.

When slash if (leaning toward when) we move next year, I’ll likely recoup everything through the home sale and give myself a clean slate.

I’m letting it sit for now—the money stuff, I mean. I’m tired of tormenting myself with every perceivable scenario when in reality, things need to play out so I can respond in kind. My overthinking to “get ahead of it” isn’t productive, just obsessive. And anyway, I can only control what I can control. I can control my reactions. I can control what I think about.

My mom said it’s fortunate that I can pay for things when I need to. It’s simple, SO simple, but hearing that helped me zoom out and look at the bigger picture.

What’s true is simple—what’s simple is true. Do you love when I get all faux poetic?

This month’s progressThis month, I:

Lost my mind and bought a lot of crappy concert tickets thinking I’d instantly resell them :/Kept investing in my 401k and HSA accounts despite it all Bought my third parcel of land through auction, worth $5,400 (will add to my net worth once I get the deed)Got a few side hustle ideas and now want to figure how to use my dwindling energy reserves for extra cash long-term

Bought my third parcel of land through auction, worth $5,400 (will add to my net worth once I get the deed)Got a few side hustle ideas and now want to figure how to use my dwindling energy reserves for extra cash long-termIt was a down month overall, with some nasty stock market days and foreboding housing market forecasts. Mortgage rates also touched the 8% mark for the first time in decades. Very “doom and gloom” and “asunder” and panicky.

We saw this beautiful sea turtle at the Oklahoma Aquarium in Jenks

That’s another thing: I feel like I’m fighting a twisted economy on top of everything else, which it makes everything all that much harder. The big losses are hard to take.

On the plus side, investing in a downswing typically proves extremely valuable later. It might not be on my timeline, but once it bounces back, it’ll all have been worth it. Always now vs the future with this stuff, eh?

By the numbersAnd it stings to turn the plus signs into negatives. Note that I lump my taxable account and Warren’s UTMA together (since they’re both taxable) but I in no way touched his account, nor will I ever. The losses there were purely my own.

CurrentLast MonthChange2023 Goal ASSETS Overall investments$227,597$245,157-$17,560As much as possible Roth IRA$55,453$57,460-$2,007$6,500 (in new contributions)$4,000 so far! Taxable brokerage + UTMA$2,838$13,494-$10,656$25,000 (total invested) Savings$1,944$1,891+$53$30,000 Primary home equity + appreciation$57,343$60,370-$3,027$70,000 LIABILITY Credit card/HVAC upgrade-$6,930

$6,999-$69$12,708 (starting balance) Net worth in Empower Personal Dashboard$285,843$312,783-$26,940$500,000 (overall goal) Track your net worth with Personal Capital

The rest of Q4 and 2024 will be about level-setting as much as possible. There are other plans on the go that’ll cost a lot of money. I am probably done with my financial progress for the year.

October 2023 Freedom update

On the other hand, it’s still not too late for a big finish. I’ll try as hard as I can. What’s that saying? Make a plan and God laughs? Very much in that energy.

October 2023 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!! Link: Buy the LOL/24 t-shirt—a must-have for the points geeks among usLink: Buy the BOY BOSS t-shirt and go full intersectional feminism!All said, I’m down $27,000 this month because of falling stocks, falling home prices, pricey expenses, and the now-infamous concert ticket dustup.

September and October are also notoriously volatile anyway, and I seem to remember similar losses in past years even without the added pressure that I gave myself this past month.

So, lessons learned and still letting the flow take me. I will add: I’m proud of myself for continuing to invest throughout all of this.

I’m always hoping to get “caught up” (whatever that means), but more and more I’m just going day to day, and for tracking purposes, month to month. This is a down month (duh). There are more down months coming up. I might not (probably won’t) reach my $500,000 goal in August 2024 at this rate. I still want to keep doing this. And I already accept this.

If I’ve learning nothing else, it’s that life definitely continues. So let’s see what this next month brings.

Stay safe and scrappy out there!

-H.

September 8, 2023

Life lessons from my risky ticket reselling attempt (so far)

The post below is in reference to this post about ticket reselling.

Since last week, I’ve been spinning out because of this whole Travis Scott ticket reselling fiasco. Like, literally been saying some variation of, “Harlan, what did you DO?”

Well, today I did some 0% APR balance transfers and cashed out some stock (which I have never done before in my life) to take some pressure off the situation.

Somewhere in there, I realized how fortunate I am to have financial tools that can get me out of a mess—including the one I made for myself.

Or maybe I’m just intellectualizing the whole thing to feel better about something that was profoundly dumb and risky.

Pic for attention (on one of my walks)

Either way, I’ve learned a lot about my risk tolerance, evolving money philosophies, and how I’ve shifted to a place of security. Yes, security. Even after all that.

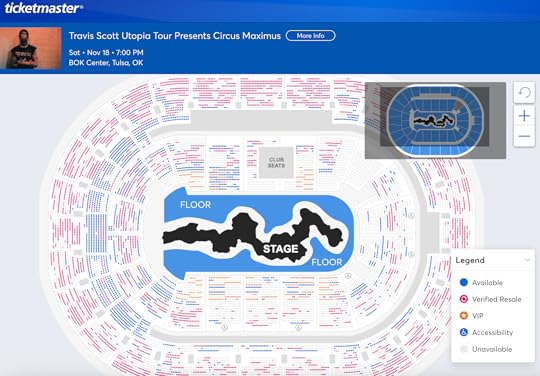

Lessons learned from ticket resellingWhat was I thinking, buying concert tickets (which I know nothing about) to Travis Scott shows (whom I’ve never heard of) to flip for miles and points (which is inherently risky)?

And why I did I smash that “Buy” button so hard?

This is a navel gazing portal: the Ticketmaster website

So you know me, over here neurotically refreshing the various shows to which I bought (so many) tickets. They’re starting to sell—slowly—but there are still lots of open seats. Too many for my liking. And none of my tickets have sold despite pricing them as low as possible to recoup my losses.

Any lower, and I will be taking a financial hit. Ugh.

By now, the charges have hit my various cards and seeing the amounts makes my stomach churn.

I took several walks to ponder the situation. I thought it over for a few days. And here’s what I’ve done in response.

0% APR balance transfersPretty much all my credit cards constantly have 0% APR offers for me: a testament to my prior responsible credit usage. (I’m always getting those blank checks in the mail, too.)

I reviewed offers from Bank of America, Barclays, Citi, Discover, and maybe a couple more. Many of them had a 4% or 5% transfer fee and promo periods of three to six months. And many of these cards have low-ish limits.

But then, Bank of America showed me a 0% APR offer for 13 months with a 3% balance transfer fee on a card with a $21,000 limit. I didn’t want to charge up any one card and throw off my utilization ratio too much.

I lined up my cards and sent them all over: boom, boom, boom.

Soooo… I’ve never sold any of my stock. I’ve always saved and never spent any of it. Until today: I finally cashed some out.

I had a balance on a business card (which doesn’t show up on my personal credit report, but does charge monthly interest) that I didn’t want to have.

I sold enough to cover the balance. It’s a mutual fund, so I have to wait until the trading day closes to get funds.

If that ain’t the truth

What a feeling. What’s all this money good for if I can’t use it to get myself out of a jam? Whatever returns I’d earn would be much lower than the APRs on credit cards.

It hurt, it burned to sell my precious stock. But I’m committed to never paying a dime of interest on my credit cards. More on this in a bit.

Consolidated savings accountsI’ve had a Citi Accelerate account for years. I don’t even remember why any more. And I’ve always kept at least $500 in there to keep it free.

That ended today. I transferred everything out and will close it on Monday.

I took this opportunity to use one main savings account: my Amex Personal Savings, which has the same APY as the Citi Accelerate account and no minimums. Consolidating feels good!

Plus, Citi’s wonky IT has always low-key bothered me.

Like using points, it’s OK to spend moneySpending money on dumb stuff hurts like actual physical pain.

It’s similar to when I spend points to book travel. There’s always that “oh GOD, there go my hard-earned points” moment that’s also pretty tough.

But then I remember I can always earn more points. And take more trips. And I have to spend the points to take the trips. Duh.

Like that, I can earn more money. I can replace the savings and stock. That’s wasn’t the end of my supply. It just felt like it was.

The scarcity mindset ran deep.

Some of my trips kinda sucked, tbhYeah but what about the fact that I spent money on something so totally dumb?

Well, some trips I’ve spent oodles of points to take haven’t been great, either. I love travel and of course I want every trip to be amazing and meet my expectations.

Once I went to Iceland and it rained the ENTIRE time

Have you ever gotten to the hotel or place or whatever and been like… “Oh. This is it?” THAT moment.

I want to spend money on things that are wonderful and bring me some measure of happiness, but the fact is not every cent is going to do that.

There will be more trips. And there will be other things to buy (or save for) that are much better than this.

What am I saving all this money for?I’ve tried for so long to be “Mr. Financial Independence” that I’d rather save everything than buy the extras, the upgrades, the stuff I want now.

I mean, I buy quality items and occasionally splurge because “YOLO treat yoself” but really place much emphasis on saving.

But this week, I actually had panicked moments that I figured I could use savings to solve. So I did.

Literally with NEVER adding another cent

I already know I could never save another cent and still be fine in 30 years. I’m just always so stuck on my $500K goal and saving that it’s the last option I consider. Really limited thinking.

I’ll use whatever tickets I do sell to further fix thisAll of this assumes the tickets are a total loss, but of course they won’t be. They’ll sell for something. Maybe (much) less than I’d like, but it won’t be a total wipeout. And anything could happen.

Travis could release a new single or the tour could start and more people will want to go or all the shows could get canceled and refunded. Literally anything could happen.

So whatever I get back, I’ll use to repay the balances, buy more stock, etc.

What I’ve done so far helps me today, short-term. What I get back over the next months will help my future self.

Ticket reselling bottom lineI used my available resources to pay a kindness—to myself. And saw how many tools are really in my kit. And how many options I have.

What’s the point in having all these backup plans if I never use them?

Nothing about this is ideal. But I won’t pay any fees or interest (other than the 3% balance transfer fee and many a long-term capital gains tax). With interest rates on many premium credit cards touching 30%, I’m positive this is the less-painful way to go.

This ordeal has shown me that I:

Have many options availableCan deal with crappy financial situations with relative easeHave a low-as-hell risk toleranceReally, truly do hate paying interest that muchCan think long-term even under pressureIt pains me that this will affect my net worth, at least short term, especially as I approach the one-year countdown to my $500K savings goal.

Also:

I was able to respond from a place of deeply earned securityI’ll probably recover financiallyAcknowledging my privilege in all this and grateful for thatAnd wow, I will never resell concert tickets again because this past week of constant anxiety has been terrible!September 6, 2023

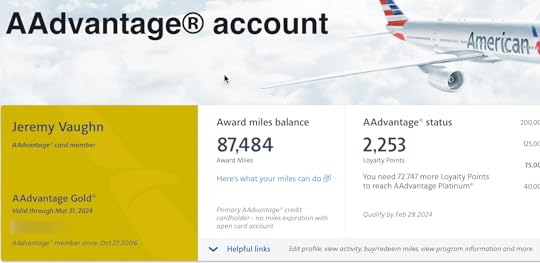

Update: My American Airlines account is back post-hack (kinda)

AA account post-hack is an update to this post.

My AAdvantage account was brutally hacked back in July. Someone got my login info and used nearly all the miles for an award flight.

They also used my email to sign me up for literally thousands of emails lists—I’m still unsubscribing from them to this day. It was a clever move, because the emails from American Airlines could’ve easily fallen through the cracks. I guess that’s what they were hoping for.

Keeping the “Since 2006” was a nice touch

Stuff is mostly back. All my activity ported over, along with Loyalty Points, elite status… even the date I joined AAdvantage.

I basically didn’t have an account for ~2 months. And I’m still discovering all the things that don’t quite work the way they should.

I’ve spent hours and hours on hold and talking to various American staff. It looks like more calls are needed.

Starting over isn’t easy following a hack.

What works in my AA account post-hackI must give kudos to the team at American. Hacks happens constantly, and they suck.

Because of that, I’d assume they have an easier way to transition things.

With the Loyalty Points model they’re using now, it’s incredible how much stuff was linked to my AA account. Here’s what transferred over beautifully:

Elite statusLoyalty points earned program year-to-dateCiti AA credit cardholdershipBarclays AA credit cardholdershipCredit card status for free checked bag, priority boarding, etc.All my account activityKnown Traveler NumberAddress and other contact infoFlights booked under the old accountThis is all great! American did a fantastic job transferring all this. It’s beyond the bare minimum and definitely usable. I could fly tomorrow and have all the benefits of AA elite status with little hassle.

What doesn’t work in my AA account post-hackBut it’s not all free upgrades and pre-departure beverages.

A lot of my account info didn’t make it over, including:

Reservation preferencesEmergency contacts and travel companionsSaved payment methodsSaved passportMinor things to update.

But a lot of the third-party stuff that makes the Loyalty Points program fun and rewarding are not connected AND it’s unclear how I can restore functionality to the new account, such as:

SimplyMilesAA diningAA shopping portalBusiness Extra (!)In the case of SimplyMiles, I couldn’t log in with my old AA number, so I made a new account. But I can’t add any of my cards because they’re still linked to the old account… which I can’t access.

The site seems to really not like that

I don’t know how to unlink my cards from the old and link to the new SimplyMiles account. So, that sucks. SimplyMiles is a great way to occasionally rack up a ton of Loyalty Points.

And considering the offers there sometimes align with Citi Merchant Offers, it’s disappointing to lose that method of earning extra points.

None of these cards work with SimplyMiles any more… including my AA credit cards :/

Same for the AA shopping portal. The old account is gone. I can just start over with that one, though.

I also can’t get into my Business Extra account and will need to call them. It’s minor, but I’ve already made so many phone calls. Sigh.

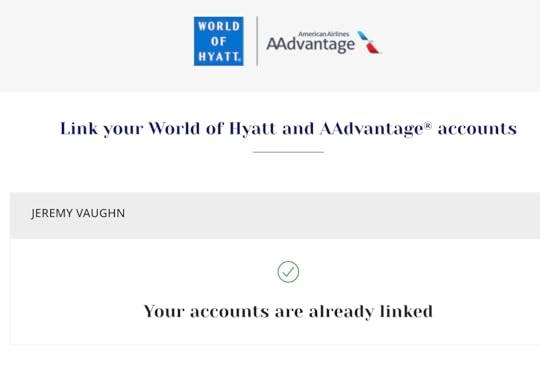

I’m also unclear about what will happen to my Hyatt dual accrual. When I try to re-link, the site just tells me my accounts are already linked. I’m guessing to the old one.

[grumblesigh]

There might also be other things I haven’t thought of yet. Like I said, I used my AAdvantage account for soooo many things over the years.Do this nowPlease, if you haven’t lately, change your passwords. I was using an old old password that was probably exposed a hundred data breaches ago. So, think of a new one. Make it a motivational phrase. Add a number. The longer, the better. Don’t be like me. Keep your account in good standing.

AA account post-hack bottom lineThis is a cautionary tale, as well as letting you know what will likely happen if your own AAdvantage account is hacked. You’ll probably lose your miles, but get them back after hours on the phone (including with your local police department to file a police report). You’ll have to wait to get that, then send various emails and wait some more. Your inbox may be deluged with thousands of email subscriptions that you’ll get for months, even after unsubscribing, reporting as spam, blocking, etc.

It might take a day or it may take a couple of months for your new account to work. And even then, it won’t be like before. Some things will transfer, some won’t, and others will be in a liminal limbo.

If you enjoy the Loyalty Points program, say what’s a functional goodbye to SimplyMiles. Open a new shopping portal account. Wonder if other things will ever make it over.

I’m not whining. AA did a great job overall. But it isn’t perfect. It affects how I can interact with their loyalty program, and it seems to be a common occurrence. The solution isn’t thorough or elegant.

With all the calls, all the emails, and all the calls I’m realizing I now have to make, this whole thing has been a PITA. I’d be extra annoyed if I had to do this while traveling on AA and not getting the earned program benefits.

Have any of your loyalty accounts been hacked? Was it an easy fix—or similarly thorny?

September 5, 2023

Adventures in concert ticket reselling for points (NOT for me, this is terrible!)

Ugh. I have a huge pit in my stomach. Inspired by hopes of quick points and miles, I went all-in on tickets for the upcoming Travis Scott tour. Like, alllll in.

I bought blocks of them, thinking I’d resell at face value right away. Well, they’re not moving and I can’t tell whether I’m in over my head, not the right type for this, or profoundly irresponsible (especially in light of my ongoing FIRE journey). Or just way too impatient.

Come on Travis, do your thing

I bought the tickets last week and the tour begins next month (October 11 in Charlotte). My first show tickets are for October 20 in Kansas City.

Since I bought them, all I’ve been doing in my spare time is refreshing the seat maps. I’m already thinking: Do I have to take a loss? Why did I do this? How else can I offload these things?

There are all sorts of ways to earn extra miles and points. For this one, I jumped in feet first wayyy too soon.

Travis Scott ticket resellingI have all these theories about how this tour and ticket reselling opportunity appealed to me psychologically.

I’m recovering from trauma, and that can manifest in all sorts of ways, including extremely irresponsible behavior.

And yet—I really thought this would be a quick way to buy tickets, let the tour sell out, and earn easy points.

It hasn’t even been a week and I am not keeping my cool at all. In fact, I’m going rather mad about the whole thing. What a fine mess I’ve made—and alllll that means about where I am in life.

If you’ve ever wanted a schadenfreude experience from me, this might be the one.

Thanks.

I can’t tell if I’m having shame or guilt about this. Or if I’m just spinning my wheels having all these Big Feelings and should take a chill pill and relax. I guess I’m not the “relaxing” type.

and should take a chill pill and relax. I guess I’m not the “relaxing” type.

There’s also some expectation vs reality going on. I thought:

The tour would sell out in a dayI’d list the tickets for saleAnd resell them the next dayViola!Instead:

The tickets are sitting thereI’ve priced them as low as I can to recoup what I spent (face value and nothing more)Am already thinking about taking losses, why did I do this, etc.I will absolutely never do this againThe other surprising thing to me is how hard I went with this. For maybe the first time in my life, not even kidding, I felt possessed and out-of-control as I was doing this. I just kept buying them. Like, yup, OK, buy buy buy.

I was thinking about earning points and making a few quick bucks.

How it’s actually goingI am like, tortured over all of this. Like how was I planning to float the cost when I have so little experience in this arena (pun intended)?

Plus, tbh, I really don’t know anything about Travis Scott except that I wanted his tour to be a juggernaut a la Taylor Swift or Beyonce earlier this year.

I’m refreshing my listings, hoping to get an email that someone bought them and that I can pay it all back and move on.

Also experiencing a lot of “omg why did I do this?” which doesn’t feel helpful or productive in case that isn’t already clear.

Let’s say the tour sells out and I resell the tickets and make it all back and life goes on. That would be my best-case scenario.

Even with that, waiting for these tickets to sell is actually painful. It has an element of gambling and “wait and see” that I don’t find exciting. I have quickly discovered this avenue is not for me.

The worst-case scenario is that the tickets don’t sell, or I sell with a huge loss. In that case, I’d be kicking myself over this for a long time.

Either way, I am learning a huge lesson and won’t soon touch this method again soon, if ever.

My planI have the tickets listed on Ticketmaster, Stub Hub, and Cash or Trade. Even if I could wait and realize profits later, I’d rather sell at face value and move on. The waiting is terrible for me.

I’m trying to be as calm as possible, and also fast discovering that’s not easy for me to do.

For now, I’m going to sit and wait. Then, a week or two before the shows, I’ll see where prices are and drop them as low as I have to go just to make anything back.

Typed out like that, it sounds like a terrible plan. Ugh. What tf was I thinking?

Ticket reselling bottom lineThis ticket reselling has been the ultimate “hot oven” moment for me. I have touched it and quickly learned.

I’m also thinking I’m a scalper, I deserve this, it’s people like me that ruin the system, what did I actually expect with next to no experience?

Allll that. I have genuinely resold tickets before when plans had to change, but in those times I was prepared to lose cash and pleased when they sold. The wait was nothing. This time, the stakes feel so much higher. I found out what my limit was—real fast.

Also, I will absolutely never touch this particular oven ever again.

Have you ever had an experience like this? Like you thought you could handle something (for the points or whatever), but then it just felt so totally not good? Uggggh. I feel like I really effed up this time.

Soooo… if anyone out there wants a block of Travis Scott tickets, get at me. All I want is face value and to never be in this situation again.

It has kicked up some really profound feelings of distress that signal I still have a lot of healing to do, and also that the process is starting. For that, I’m grateful. Now, get these tickets outta here!

September 4, 2023

Thinking out loud: Another move and new net worth $313K high – September 2023 Freedom update

September is my personal new year. I had a birthday last week and turned 39. And next week, Beck will be 1. [times flies, etc.]

It’s also a countdown to my $500,000 goal – one year left.

It’s looking unlikely that I’ll hit it—unless something massively shifts (which is always a possibility) with an unprecedented bull run, influx of cash, huge real estate increase, or something of that caliber.

Daddy mode

Not to say that won’t happen, just that it’s easier for me to grasp if I’m realistic. But there’s still that dreamer in me.

Right now, I’m at ~$313K. That’s $187K short. To hit $500,000, I’d need to collect $15,583 per month for the next 12 months.

I’ve had months like that before. And every time the stock market rises even 1%, that’s a huge gain for me. But it’s more than I can produce on my own.

So this month finds me, as always, pondering where I can place the best 20% of my efforts to get closer to 80% of the overall results I seek.

We’re also thinking about moving a lot these days. Warren will be 5 next year and we want him to be in a great school district. We’re currently in the core of Oklahoma City. There are good schools here, but not our current district. We’d have to either home school or move to be in a better one.

My sweet, curious kiddo

Oklahoma, as a state, is going through transitions with school funding, teacher certification, and more. It’s not reassuring. We are leaning toward moving to another state. I’d rather pay more in property tax to have a good school than pay for a private school here.

This is an ongoing topic, so we’ll know more when we know more. TBC.

A Hot Springs vacationFor my birthday, we all piled into the new van and took a 5.5-hour road trip to Hot Springs, Arkansas. It was our first time traveling with Beck. It was… a lot.

The hotel situation was less than ideal

For one, the drive was more like 7 hours for us. And it was miserably hot (my birthdays often are – I have so many memories of steamy-lush birthdays).

We tried to get out and “see the sights” but Beck kept overheating, so we couldn’t be out for more than a short walk to a restaurant the entire time. That was challenging. Luckily, there were several homestyle places within a few short blocks, but after a week of having down-home Southern-fried cooking, I was soooo bloated. And now all I want to eat is salads for the next month.  It was good, but… we definitely can’t do that every day.

It was good, but… we definitely can’t do that every day.

The other thing was the hotel situation. The rooms are so small and don’t allow for any amount of privacy. Because of the heat, we spent more time than we wanted in the little rooms. I went to the “business center” to work as we waited for the heat of the day to pass.

At least I had a urinal from 1913 to pee in

Family travel is hard. But, I only spent $100ish bucks + gas and food, so we got a nice vacation for next to nothing. Even though it was tough, it felt so good to get out of town for a little while.

This month’s progressMy Roth 401k and HSA accounts are in full swing capturing the bulk of my savings now. Automating is powerful. I’m putting away at least $1,000 per month into them while paying down my 0% APR credit card on the side.

There were a few dazzling stock market days within the last month, and a few down days. I’ve heard rumblings of a mild recession coming later this early or early next, but then, when hasn’t that been the case?

REALLY pleased with my raw land

The biggest change for most is student loan payments are restarting. I switched to the SAVE plan and my payments are currently $0, which is great because I don’t know how I could add another monthly expense to the mix. We are operating on a thin margin as it is.

In other news, I reached the HSA investment threshold and am investing all those contributions now. I’m just gonna keep pouring as many funds into savings and toward my credit card as I can, while living off the rest. For now, that’s the plan.

This BABY

This month, I:

Applied for the SAVE plan for my student loans—it was approved within a weekStarted investing with my HSA account, as mentionedHit a new net worth high (again)Used savings to speed up my credit card repaymentWent in person to see my two parcels of land, which was a really positive experienceFound a groove with investing and life expenses after doing a thorough budget last monthThere’s still plenty to work on. Automating some of it will help. And then, I’ll keep working—and doing my best work—to keep the manna flowing.

By the numbersI always love this part, because numbers never lie.

Some months, this part is hard to type up and post. Other months, it feels like a huge win—and everything in between.

CurrentLast MonthChange2023 Goal ASSETS Overall investments$241,279$241,320-$41As much as possible Roth IRA$56,998$56,491+$507$6,500 (in new contributions)$4,000 so far! Taxable brokerage + UTMA$13,376$13,253+$123$25,000 (total invested) Savings$5,292$5,900-$608$30,000 Primary home equity + appreciation$59,518$62,407-$2,889$70,000 LIABILITY Credit card/HVAC upgrade-$10,270$10,372-$102$12,708 (starting balance) Net worth in Personal Capital$304,726$299,127+$5,149$500,000 (overall goal) Track your net worth with Personal Capital

Getting closer!

I’m trending up and am now at ~63% of my goal. Wow. If I have get to 75% and the stock market continues to rise, I might just have a shot of hitting $500K.

It’s a big “if” but also not impossible. This next year is gonna be interesting.

Computin’ at the li-berry

September 2023 Freedom update bottom lineLink: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift cardLink: Join Yotta and get a Loot Box with free tickets!It’s such a tragi-comedy that I’m over here having all these big ~*~feelings~*~ about my journey while the money is off doing its own thing.

Despite my pontificating and observing, it’s taken on a life of its own. After the $200K mark, I began to feel like I was just along for the ride. Now, after hitting $300K, that feeling is more pronounced. Here’s hoping for that $400K mark soon. I’m hoping that’s a fun wave.

My ultimate lesson has been to stick to the plan and let it ride. When I look back, I see the upward trend. It’s been a trip, but I’ve definitely calmed down about the big swings in favor of the overall increase.

So I guess I should be excited to review all of this in a year? As a Virgo, my neuroticism will likely get the better of me. But I’ll try.

Thanks for sticking with me through all this. Hope everyone is doing well.

Stay safe and scrappy out there!

-H.