Harlan Vaughn's Blog, page 5

December 1, 2022

New net worth high, new cash strategy, and investing my third $100K – December 2022 Freedom update

I didn’t post a November update last month. It was such a blur – complete with a week in court, then a nasty virus and holidays – that it sucked me under. I am just now emerging.

And wow, it’s great on the other side. I feel like the court stuff is getting behind us, though we must wait for a final ruling. Still, I think we’re going to win. And then we will be free to talk about everything we’ve been through the past year. It’s beyond ridiculous.

Omg look at this wiggly cutie

I was thinking how my blog doesn’t resemble a travel blog any more. Though I am swimming in points and miles, and planning for a lot of future travel. Someone said, “Well, just write about that.” So I will.

Even as we wait for the legal crap to clear the pipes, it’s not like I stopped planning stuff. It’s hit me in the pocketbook and stifled my travel, but I’m still here and feel myself slowly coming back to life.

December 2022 Freedom updateLink: Track your net worth with Personal CapitalI’m racking up attorney bills, but let’s not bury the lede here: this is the best month I’ve ever had for my net worth. Stocks came roaring back, and so did my portfolio. I’m currently over halfway to my $500,000 goal, my house is appreciating, and I never stopped investing through it all. In fact, I just maxed out my 401k for the first time in my life.

Been spending a lot of time at Science Museum Oklahoma

I’m currently working on investing my third $100K, and about to acquire a few acres of land in Arkansas. I’ll focus on paying my lawyer these next few months, and while it sucks, it’s also paving the way toward solidifying this chapter of my life. I can’t wait to travel with my sons next year.

Turning off my 401kAfter I maxed out the 401k, I set my future contributions to 0%. That’s because I don’t want it to start again in 2023. Instead, I want to get a new job and keep it all in one spot at the next employer.

Also, I need to pay my lawyer and until she’s paid, I won’t have an extra cent. But I want to keep the investing momentum going, so I’m planning to max out my Roth IRA in early January (dang, that’s in just a few weeks!).

Too real

I feel good about this, though. It’s just where I am right now, in life. This has been such a long, nasty fight.

I’m glad for it though, because the case record is now so complete (and the other party’s lies and disastrous behavior so thoroughly documented it’s basically appeal-proof) that it will reach its own conclusion. Once we get the ruling in our favor, we can move on with our lives and never see that person again. It’ll be like that person never existed. We’re so tired of having to look at and deal with them. 🙂

Looking to $300KIt looks like the Federal Reserve is nearing the end of their rate hikes. Stock prices responded in a hugely positive way this week, but then flatlined again as every said, “Oh wait, there might actually be a recession now.”

The “soft landing” might not be coming after all. So while I’m excited about reaching a new net worth high, I know how quickly it can fall again. So I’m not celebrating yet. Maybe once it sticks for a few months. Even then… it’s all so tenuous. It’s like I don’t trust anything any more.

Lookit this lil face

I do want to focus on saving cash, both to pay off my debts and to potentially snag an investment property for cheap. But yeah, I need every dollar that comes my way for a while. I still want to max out my 401k next year, it will just have to be later in the year. I have other jobs that my money needs to clean up right now.

Thinking of money as a tool, I’ll use it to attend to Present Harlan. Then I can get back to traveling and saving for Future Harlan. It’s safe to coast for a while at this point.

It’s been 60ish days since I posted an update. In that time, I:

Added ~$32K to my net worthPaid $1K+ toward my HVAC/credit card debtMaxed my 401kRacked up $10K in lawyer fees I have to payAchieved a $266K net worth – my new personal record CurrentOctoberChange2022 Goal ASSETS Overall investments$212,973$186,415+26,558As much as possible 401k (contributions only)$20,500$16,500+$4,000$20,500COMPLETE! 401k (overall balance)$40,617$31,904+$8,713As much as possible Traditional IRA$104,552$94,117+$10,435xx (can't contribute) Roth IRA$47,461$42,755+$4,706$6,000 (in contributions)COMPLETE! Taxable brokerage + UTMA$11,248$10,124+$1,124$25,000 (total invested) Savings$10,312$10,298+$14$30,000 Primary home equity + appreciation$48,360$44,957+$3,403$20,000COMPLETE! LIABILITY Credit card/HVAC upgrade$14,351$15,506-$1,155$12,000 Net worth in Personal Capital$266,210$234,279+$31,931$500,000 (overall goal) Track your net worth with Personal Capital

A new high

The land I’m receiving will be worth about $10K though, so it’ll offset the lawyer fees. And of course, will be an asset moving forward.

I also want to buy a bigger vehicle for the fam and continue to service my credit card debt. And look for a new job that pays more in the next few weeks. All in all, I’m feeling optimistic about everything and looking forward to writing and working more. Life’s picking up again as my parental leave winds down. And for that, I’m grateful. Next year should be like turning a corner. The biggest one ever, in fact.

December 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardI’m thrilled about ascending to new net worth heights, but if this year has taught me anything it’s to not take mental possession of a gain too quickly. And anyway, it’s been a shitty year smeared with a lot of anxiety and unnecessary tension on the personal front. I’m ready to get my ruling and move on. I’m ready to travel again. And ready to figure out what the next iteration of Out and Out will look like. I’ve had this blog nearly 10 years and intend to keep it going.

This sweet, bright boy

I basically have to put my entire financial life on hold to pay my lawyer and then get on with it. It could take some time. If my stock investments continue to go up in the meantime, I’d be pleased as punch. And if not, well, I’ll figure it out later.

Sorry if I sound dour. I really am hoping for the best and feel very encouraged. Now to get it all in writing and ordered by the court. What a stupid ride it’s been. One I never wanted to take and can’t wait to put behind me. Soon. I’m still in here and still myself, I promise. And of course, my children bring so much love to my heart I can barely take it sometimes.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

October 4, 2022

Progress in a bear market? Mixing it up as a strategy – October 2022 Freedom update

So, September was the worst month for the U.S. stock market in over a decade. The month (and Q3) ended with losses for the S&P 500, Dow, and Nasdaq.

And because most of my net worth is in index funds, I lost out too – despite continuing to dump funds into various accounts.

Not that I’ve had time to notice. Having a toddler and a newborn in the same house is… tiring.

But if anything, it’s helping me stick to my investment plans?

I love being a dad

Really, I just kept everything trucking along, which I’m happy about because I do think this is an excellent time to buy in at lower valuations. In another 10 years, we’ll all be ecstatic about the buying opportunities right now. It’s hard to be excited when you’re in the midst of it.

I also paid down some of my 0% APR credit card debt and added more cash to my taxable brokerage and my son’s UTMA accounts. But mostly focusing on our newborn, who’s now three weeks old and already so vibrant.

October 2022 Freedom updateLink: Track your net worth with Personal CapitalSo, it’s not a great feeling: knowing I added $2,000 to my 401k but that it’s also down $903 for the month. It creates the sensation that I’m losing money / creating losses / flushing cash down the drain. In a sense, I am – for now.

My investing horizon is around 15 to 20 more years, and I know long-term the trend is upward but dang. I get the feeling that I shouldn’t have looked or am checking on it too much or something, especially since I’ve been in this halfway zone for a whiiiile now. It’s such a particular headspace one needs to occupy and yeah, it’s an old hat that I don’t want to be used to wearing.

I’m currently reading The Psychology of Money so maybe that’ll help me get my head back in the game. So far, it’s a really well-written book. Mostly about human nature as it relates to money.

The stock market last week/month/quarter

Did I also mention I’ve been really tired? Like, so tired? I don’t think I’ve slept more than three hours at a stretch for a few weeks and it’s… you know.

Lol

New focus on saving cash?I keep going back and forth on whether to put more in my taxable brokerage account or save cash. As the real estate market keeps tanking, I’m thinking more and more that I can get an investment property at a great price sometime early next year. Even if I finance with the current mortgage rates, I can always refinance down the road.

I could also make it a short-term rental and just make sure the estimated earnings would more than cover a potential mortgage payment. I think the market has farther to fall, so now would be the time to sock away extra cash and step away from investing any extra cash (I’ll leave my automatic investments alone).

Boyhood

I’m leaning that way, but still undecided. I’m mostly just sitting back and watching the market’s real-time downward spiral.

This will great fodder for thought in those wee hours.

Hitting the HVAC debtI had a new HVAC system installed back in June and slapped it all on a credit card with a 0% APR offer through December 2023. I’ve got it down to ~$15,000 which is perfect because the rate expires in 15 months.

The plan is to now pay $1,000 per month every month to get rid of it.

I keep fighting the impulse to go really hard on it because I don’t like knowing I have a credit card balance. Something about my urge to pay credit cards in full every month combined with my past struggles to pay off my debt really doesn’t like that.

I like science

The reframe for that is that I gave myself a 0% APR loan and I get to pay myself back for something I really needed while the bank floats all the expense. Thanks, bank! All I have to do is stick to paying myself back. That was so nice of Past Me to look out for Current Me and Future Me.

I like that much better, and it feels truer to my original intention. Man, money traumas are hard to break!

By the numbersIn the last 30ish days, I:

Continued investing $2,000 per month in my 401kIncreased my savings by $2,000Lost $8K of my investment value (this has been up and down basically all year)Gained another $2,800 toward my home equity and appreciationStashed away $800 in my taxable brokerage account and Warren’s UTMAThat’s quite a lot, especially considering the last few weeks.

No surprises here

CurrentLast MonthChange2022 Goal ASSETS Overall investments$186,415$194,811-$8,396As much as possible 401k (contributions only)$16,500$14,500+$2,000$20,500 401k (overall balance)$31,904$32,807-$903As much as possible Traditional IRA$94,117$100,273-$6,156xx (can't contribute) Roth IRA$42,755$45,533-$2,778$6,000 (in contributions)COMPLETE! Taxable brokerage + UTMA$10,124$9,426+$698$25,000 (total invested) Savings$10,298$8,298+$2,000$30,000 Primary home equity + appreciation$44,957$42,156+$2,801$20,000COMPLETE! LIABILITY Credit card/HVAC upgrade$15,506$17,962-$2,456$12,000 Net worth in Personal CapitalSo $235,049-$770$500,000 (overall goal) Track your net worth with Personal CapitalCould I put all my effort into the credit card, the taxable brokerage, or just saving all my extra cash? Yes, but I’ve got a little here and a little there.

I don’t know which one thing will be the most likely successor, so my strategy is to give each one a fighting chance. Even if something totally tanks, everything else backs it up. And if they all tank, well… there are bound to be other things to worry about.

I like the variance of all this, at least until I get a more solid plan formed. That’s where I seem to usually end up: with a good mix and balance. Strong Virgo energy.

October 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardLike everyone, I’m eager for good news re: the stock market. I know this is a natural (and necessary) part of the investing journey, but it sucks to lose ground on my goal from day to day, despite all my efforts. Maybe I’m not as patient as I thought I was? This is definitely an opportunity to keep working on that. It’s not a straight line that goes up and to the right.

We’ll see how October and (Q4) turn out and then go from there. Until then, I’ll be in a land of endless diaper changes and smelling that newborn head as much I can because I know it’s all gonna change so fast. It already is. Our baby is already getting so strong and chubby.

If you’re in the market for a new travel credit card, consider using my links to apply. I’ll get a commission and will use it for the ongoing diaper fund.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

September 16, 2022

Baby Beck is here! The bear market is the only negative thing this month – September 2022 Freedom update

This month’s update is a little late – for the best reason possible.

On September 10, baby Beck was born early in the morning under the Full Harvest Moon.  So far, he’s already back at his full birth weight and has lost his umbilical plug. He’s a sweet, happy boy – already looking around with deep blue eyes and smiling as he stretches his fingers and toes. We are already completely in love with him.

So far, he’s already back at his full birth weight and has lost his umbilical plug. He’s a sweet, happy boy – already looking around with deep blue eyes and smiling as he stretches his fingers and toes. We are already completely in love with him.

Welcome earthside, baby Beck

I can’t wait to set up an investment account and USAA membership for him. But for now, we’ve all been resting and adjusting to this sweet new energy.

It’s been hard to keep up with the outside world, but every time I check on the stock market, it seems the lows get lower.

I’m continuing with my investment plans, but my overall net worth is obviously down this month. More and more, it’s looking like this is going to be a lost year for the market – and for my progress.

All good though.

History tells us that incredible bull runs usually follow lows like this. And anyway, I have my hands full for a while with a newborn.

September 2022 Freedom updateLink: Track your net worth with Personal CapitalHistory also tells us that September is a harbinger for how the rest of the year will go. If September is down – watch out. October isn’t exactly a picnic either. Some of the worst crashes have happened in October (Great Depression, Black Monday…).

The only X factor is that the market tends to perform well during midterm election years like this one. But something tells me that won’t matter this year.

Daddy H

As it stands, I’m personally preparing for the market to keep dropping. But instead of pulling back, I actually increased my contributions. And just added some cash to my HSA and to Warren’s UTMA account.

I’ve also seen real estate prices drop with price cuts aplenty, even here in Oklahoma. For that reason, I want to focus on having enough cash to snag a cute little bungalow house in Oklahoma City over the next few months. The best time to buy is when there’s blood in the streets… and these streets are getting bloody.

Beck is here!We had an incredibly smooth birth at home last weekend. Active labor was only two hours or so. The midwife and her team did the delivery and followup care and left, and suddenly there we were – already at home with our new baby boy.

He nursed immediately and slept peacefully throughout the night. We kept waking up to look at him and see if he needed anything. Such a serene soul already. And I’m happy to add another Virgo to the mix.

BABY

Warren is adjusting well – slowly but surely. As Beck “un-squishes,” he’s looking more like Warren every day. They are definitely brothers.

We were well prepared for his arrival and had everything we needed, including an arsenal of diapers. Because of that, we haven’t spent much since his birth. Just groceries and the usual expenses.

My parental leave started and I’ll be off work until January. Mama and baby are doing great. We’re all just finding our feet again after the big event. *big deep breaths*

Continuing to investOn the financial front, I:

Started paying down my 0% credit card that I used to upgrade our HVAC systemAdded $200 to my HSA accountAdded $200 to Warren’s UTMA and $100 to my own taxable brokerage accountKept investing $2,000 a month through my 401k

First day of preschool

Warren turned 3 and started preschool – and now has a little brother. Lots of transitions for him, but he’s handling them in stride. Such a great kid.

Seeing the lower real estate prices really makes me want to snag an investment property. I’d like to have many valuable assets to pass along to my sons one day. And now is a once-in-a-generation opportunity for wealth creation.

Because of that, I’m also actively looking for another job that pays more. It’s clear my current job isn’t going to give me a raise, so I’m going to take the parental leave and look for something else. Having kids to look after really motivates one to move it along.

Plus, I’ve decided it’s time to give myself a raise and promotion.

I think these next few months will bring even more news and progress. I already can’t wait to share!

By the numbersIn the ongoing tale of up and down and up and…

I turned more pluses into minuses this month.

You’ll notice I added $2,000 to my 401k, but it’s only up by $651.

That’s because the market is falling faster than I can invest. It doesn’t bother me per se, because I know that’s how it goes, it’s just that I’ve been at this same level for a while and I’m yearning for progress.

47%!

My consolation is that when the bull market returns, I’ll roar back too, having bought in at lower valuations with a better cost basis.

For now, I’ll prioritize saving cash and snapping up another house around here. My own home has held its value pretty well. Here’s the full picture:

CurrentLast MonthChange2022 Goal ASSETS Overall investments$194,811$200,312-$5,501As much as possible 401k (contributions only)$14,500$12,500+$2,000$20,500 401k (overall balance)$32,807$32,156+$651As much as possible Traditional IRA$100,273$104,425-$4,152xx (can't contribute) Roth IRA$45,533$47,488-$1,955$6,000 (in contributions)COMPLETE! Taxable brokerage + UTMA$9,426$9,830-$404$25,000 (total invested) Savings$8,298$8,293+$5$30,000 Primary home equity + appreciation$42,156$40,957+$1,199$20,000COMPLETE! LIABILITY Credit card/HVAC upgrade$17,962$18,143-$181$12,000 Net worth in Personal Capital$235,049$238,918-$3,869$500,000 (overall goal) Track your net worth with Personal CapitalTrying not to add pressure on myself, knowing that slow and steady wins the race. For now, things are good and opportunities are either here or right around the bend.

NOW is the time to invest heavily in the market. I’m personally on track to max out my 401k, Roth IRA, and HSA this year – the first year with that triple whammy.

So even though I’m “down” this month, I know I’m actually right where I need to be.

September 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30ish days, I:

Welcomed a newborn son!Added $2,000 to my 401kKept investing in index funds every pay periodGot a bit more equity + appreciation on my houseChipped away at my credit card, HSA limit, and taxable brokerage accountFor what it’s worth, I pulled these numbers on September 4 and will update again in early October. Trying to maintain a sense of integrity about this data, even if it’s late this month.

My growing family and the support of so many has touched me deeply in this past month and despite my net worth number, I am certainly a very rich man in so many ways.

I’m almost ready to alert my realtor to my plan to buy another house – just need a bit more cash and I’m trying to get that rolling in through the rest of the year. I can’t wait to travel with my boys. We’re all doing well and taking it slow with our new arrival.

If you’re in the market for a new travel credit card, consider using my links to apply. I’ll get a commission and will use it for the ongoing diaper fund and to care for these boys.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

August 6, 2022

Up $18K again, money thoughts, and new baby incoming – August 2022 Freedom update

This upcoming month, we’ll be gearing up for the birth of our second son! Last month was all about the baby shower and getting the nursery together (as much as possible – lol oof). I’ve been meaning to get this update out for the past few days.

June was a hard month for the stock market where we saw the potential bottom mid-month. And then, the last two weeks of July brought a scorching hot bear market rally.

Because of the gyrations, I keep hovering around the ~$240K mark and am currently level set from where I was a couple of months ago.

Cheers to bear market rallies!

But it wasn’t without significant ups and downs, personal expenditures, and trying to keep up with all the transitions. I’m doing a lot of freelance work on the side to afford everything.

Next month, I’ll kick off four months of parental leave when the new baby is born. So for the next few weeks, we’re getting as prepared as possible.

I feel bad that I haven’t posted more travel-related content in so long. First there was Covid, now it’s nearly time for the new baby. It’ll be a while before I travel again, but I can’t wait to travel with our children. That’ll be a whole new adventure.

For now, I’m still working on financial goals that’ll allow that travel to happen down the road. After all, this journey is about having choices and freedom to do what I love most in this world: travel to new places.

August 2022 Freedom updateLink: Track your net worth with Personal CapitalI kept my 401k contributions at 30%. Try as I may, furnishing the nursery and paying the midwife ate into any extra that I would’ve used to pay down my 0% credit card balance or invest in one of my brokerage accounts.

I anticipate using the next few months to catch up financially. Really, we just want a smooth birth and that’s all I’m thinking about.

I’m hoping the stock market will continue its recovery (as we all are). But if it’s going to drop further or if we find ourselves in a shallow recession – well, I’ll be nice and distracted so… bring it on.

New baby stuffYes, kids are expensive. Having another butt to wipe and mouth to feed (the true circle of life) is no joke. I now understand why people label themselves as SINK (single income no kids) or DINK (double…).

That smile tho

As much as it costs, god, it’s so worthwhile. There is no feeling in the world like looking into your son’s eyes. Warren is so bright and kind already. He’s a very “shiny” person.

But yeah, we wanted to make sure things are as “turn-key” as possible when the big day arrives. We’re stocked up on diapers, baby wipes, clothes, and allll the rest (so many accessories!).

The new baby will surely affect our finances, too. In ways I expect and for things I don’t even know how to include yet. So we’ll see. All I know now is that we’re super excited and can’t wait to meet our new little guy.

Yeah, I need more moneyMy employer has apparently instituted a freeze on pay raises. So while I had a glowing annual review, all I got was a “good work” and a pat on the back. Of course, inflation is rampant and I have aforementioned new baby on the way – things that back pats don’t pay for.

To make ends meet, I’ve been picking up freelance work on the side, but this pace isn’t sustainable – short-term or long-term.

My company’s parental leave policy is amazing. But by the time I return, it will have been two years at the same salary with no raise (and as much work as ever, of course). A lot has changed in the last two years, both personally and in the world, so I need to either:

Go completely freelance and pick up more workGet a meaningful raise at my current jobFind a new job that pays more

Those little juice boxes aren’t free

The goal is to make enough to cover the increased costs plus a little extra to save on the side. I’ll be putting some energy toward exploring these options in the next few months because let’s be real, no one wants to feel like they’re stagnating as costs keep going up, up, up.

I will say, having kids is motivating as hell to make more money. I’m an excellent and dedicated worker, but I’ve even more dedicated to my family.

Mark this as pending. And if anyone knows of a senior copywriting position a financial or healthcare service company or agency… let me know. 😉

By the numbersI first hit $240K in November 2021. Since then, I’ve been kind of dancing around this number – and the stock market’s rough first half of 2022 did no one any favors.

In August 2021, I was at $217K, so I’m up over $20,000 year-over-year. My returns are down, but when they come roaring back I’ll be ready, having bought the dip at a lower cost basis all year.

Last month, I was down $18K. This month, I’m up $18K. So I’m right back to where I started. We’ll see what the rest of the year brings.

CurrentLast MonthChange2022 Goal ASSETS Overall investments$200,312$184,392+$15,920As much as possible 401k (contributions only)$12,500$10,500+$2,000$20,500 401k (overall balance)$32,156$28,125+$4,031As much as possible Traditional IRA$104,425$97,167+$7,258xx (can't contribute) Roth IRA$47,488$44,144+$3,344$6,000 (in contributions)COMPLETE! Taxable brokerage + UTMA$9,830$9,147+$683$25,000 (total invested) Savings$8,293$8,290+$3$30,000 Primary home equity + appreciation$40,957$38,559+$2,398$20,000COMPLETE! LIABILITY Credit card/HVAC upgrade$18,143$18,325-$182$12,000 Net worth in Personal Capital$238,918$220,660+$18,258$500,000 (overall goal) Track your net worth with Personal CapitalI’m up across the board this month. Though it’s slow and steady, it’s gradually moving in the right direction.

I wanna get over 50% again

I’m curious what the next month – and rest of the year – will bring. Between the Fed raising interest rates, inflation through the roof, and lots of geopolitical instability, it’ll certainly be interesting to see what shakes out.

August 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30ish days, I:

Added $2,000 to my 401kCross the $200K mark again with my investmentsKept investing in index funds every pay periodGot a bit more equity + appreciation on my houseContinued getting ready for a new baby!Life’s been good – and super real. I’ve been plugging away to earn extra coins. While taking parental leave to spend with our new baby, I’ll figure out how to increase my income one way or another. It’s time. I need to feel like I’m moving up because now, I have to.

This year has been wild for the market with so many swings I can’t even keep up. I imagine I’ll be well distracted for the remainder of the year, but hoping the market is up when I have the wherewithal to check.

Until then, I’ll throwing everything I have into getting things ready this month. In late August, we’ll be in the zone of potential delivery, so my next update might be as a new dad for the second time. And if not, then very anxious and excited but what else is new lol.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

July 2, 2022

Bear market, down $19K, plus a HUGE announcement! – July 2022 Freedom update

What a month! The stock market had its worse first half since:

1970 for the S&P 5001962 for the Dow Ever for the NasdaqIt’s still firmly in bear market territory – and I believe it has farther to fall. There are real-world issues that need solving that no amount of interest rate hikes from the Fed can touch. Namely supply chain backups, geopolitical tension from the Russia-Ukraine invasion, and lower company earnings and forecasts from too many of the wrong products and a tight labor market.

Interest rate increases are affecting home sales, and certain sectors are seeing hiring slowdowns (particularly tech). So how’s it affect me, the average investor?

It me: “average investor”

Well, I contributed $2,000 to my 401k last month, but my overall 401k balance is only up $146. That means my money is losing value in real-time. It also means I’m getting more stocks at a lower cost basis. Instead of lowering my contributions during this volatility, I opted to increase them.

And the accounts I don’t touch (my Roth IRA that’s maxed for the year and my traditional IRA) are negative since last month.

The average bear market lasts for under a year, but the average bull market lasts nearly three years and has much higher highs than the bear market’s lowest lows, percentage-wise.

So I’m staying the course, sticking to my plan – and I have huge news I’m finally ready to share! Ahhhhh!!!!

July 2022 Freedom updateLink: Track your net worth with Personal CapitalSo the big news is:

We’re having another baby!!!!!!This September, we’ll welcome a new little one to our family.

Dad x2

We are beyond excited to have another baby. Warren will be a big brother, and we’ll have a new baby boy in about a month and a half.

He’s the reason I was so keen to get a new HVAC system installed. We’re building the nursery now and getting ready for the baby shower – and I really wanted to get the heating and cooling figured out before the baby gets here. Because when that happens, we’ll be focused primarily on him for… a while.

It’s also why I’ve been spending more money recently. My net worth is taking a turn backward, mostly because of the market. But I’ve been spending more to get ready for the new addition, too – a confluence of factors.

Whew, I’ve been wanting to talk about this for so long! But now he’s nearly here and it’s starting to feel real. Our lives will be totally different – again – later this summer.

The journey into fatherhood has been incredibly intense. I’m catching up to all the changes. So much is different, but I absolutely love being a father and parenting. September will be a busy month!

HVAC falloutAs mentioned, the HVAC installation took a bite out of my finances – but I simply had to get it done. It’s been a few weeks and it’s blazing hot here in OKC. The house has been cooled well and it’s working like a dream.

Despite all the dips and gains, my current net worth drop is nearly identical to the balance on the card I used to pay for the upgrade ($18K). It’s 0% interest until December 2023, so I’ll be paying it off a little at a time until then.

Warren playing with his new tool set

It was the best thing for the house and to get ready for the new baby. I couldn’t let my family deal with window units this summer and one small furnace this winter. Plus, the house is appreciating well, so this was also an investment toward that end.

Next year, I’ll get around to improving the deck and landscaping, but… one thing at a time. We have much more coming up before that’ll be a possibility.

Recession, bear market, losing gainsAs far as my money mindset, making this financial journey during a(nother) recession – (and as a millennial) – suuucks.

It’s hard to see the constant negatives knowing it’s probably going to keep dropping. Inflation is high and recovery likely won’t happen until 2024. Not being negative here – just realistic.

Also not complaining, but DAMN, it does feel like my generation keeps living with recessions and setbacks one after another. I do believe we’re living in a recession now.

Father’s Day was extra special this year – shoutout to my Allbirds shoes

Of course, having this new baby will distract me for a while. I’m OK with backsliding. Remind me of this when the bull market returns and I’m shooting toward my goal at warp speed.

But for now, I keep hovering around this halfway mark despite my efforts. I’m figuring out how FIRE fits with parenthood. And I’ll continue investing no matter what happens.

Slow and steady wins the race. I have 786 days to reach my $500,000 goal. Will it happen? We’ll see. I still think it will.

In a way, it’s good that I’m making home improvements now. With stocks dipping so much since the bear market began on January 3, I might as well take all my losses at once – in the hopes that the gains come back in a big way.

I think Q2 earnings reports will be a bloodbath, and Q3 forecasts will get lower. I think the Fed has another 75 basis point increase on the docket for this month, and that investor confidence is low. But dips are part of the cycle, and a healthy part. Valuations were getting waaay too high. It’s good to have a reset sometimes.

Between the new baby, paying down the HVAC, and rebuilding my savings, I’m stretched to the max. I’m doing my best – and that’ll have to do.

Ughhhh

But the constant losses are hard. I’m reeling. I’m also sticking to my plan and dollar-cost averaging my investments. No one knows where the bottom is, so I’ll keep buying every two weeks despite what the market is doing.

Millionaire status is inevitable

In fact, even if I never add another red cent to my accounts, I’ll end up with $1.5M in 20 years, assuming an overall 10% return. The foundation is set. Now I’m hoping compound interest will work its magic.

CurrentLast MonthChange2022 Goal ASSETS Overall investments$184,392$195,998-$11,606As much as possible 401k (contributions only)$10,500$8,500+$2,000$20,500 401k (overall balance)$28,125$27,979+$146As much as possible Traditional IRA$97,167$104,600-$7,433xx (can't contribute) Roth IRA$44,144$47,502-$3,358$6,000 (in contributions)COMPLETE! Taxable brokerage + UTMA$9,147$9,854-$707$25,000 (total invested) Savings$8,290$8,172+$118$30,000 Primary home equity + appreciation$38,559$36,162+$2,397$20,000COMPLETE! LIABILITY Credit card/HVAC upgrade$18,325$18,434-$109$12,000 Net worth in Personal Capital$220,660$239,242-$18,582$500,000 (overall goal) Track your net worth with Personal CapitalSo that’s it for this month.

Not where I began, and surely not where I’ll end

Life’s good. Tbh, I’m too over the moon about our new baby to really think about anything else. This money stuff will resolve itself. I know I’m still on my way – and that’s a good place to be.

July 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30ish days, I:

Added $2,000 to my 401kSaw a dip because of the HVAC + the marketKept investing every single pay periodGot a bit more equity + appreciation on my houseEnded with a dip this month over lastContinued getting ready for a new baby!But the big news this month is that in about 45 days, I’ll be a father to another beautiful son. We’re concerned with getting the house and nursery together, and steeling our resolve and reserves for all the nursing, diaper changes, wake up calls, and all the rest that come with a newborn. I’m preparing to be eternally tired, basically.

Life really is wild and magical and unpredictable. I’m enjoying it. Everything happening now is part of the journey – financial, emotional, human. We are so ready to meet baby Beck and get him settled in.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

June 6, 2022

Crypto crash, a new UTMA account, and timid stock market – June 2022 Freedom update

It’s been a scorching month.  I lost money to crypto, started an UTMA account for my son, and pulled the trigger on a brand new HVAC system – to the tune of $20K+.

I lost money to crypto, started an UTMA account for my son, and pulled the trigger on a brand new HVAC system – to the tune of $20K+.

Throw in some court appearances  and continuing to get the house together, and it was more than enough to make the month fly by.

and continuing to get the house together, and it was more than enough to make the month fly by.

In Knoxville for a work trip

And then the travel! I drove to Dallas and flew to Austin for Tori Amos concerts, and flew to Knoxville for work. It was SO good to be on planes!

I was going to visit family in Memphis for a weekend, but that trip never happened. And I won’t be making any other trips for a while. I’ll share more about this in a few weeks. Between life and the pandemic, it seems I’m destined to be a travel blogger who doesn’t blog for a little while yet. I’ve got my points poised for several big trips and continue to accrue them.

To the update!

June 2022 Freedom updateLink: Track your net worth with Personal CapitalThe market continued to be up and down. A seven-week losing streak came to an end, and the movements were a little more mild, though the gloomy predictions and outlook continued.

To take advantage of the ongoing dip, I upped my 401k contribution to 30% of my check and will continue to dollar cost average with VFIAX until I max it out for the year.

Inflation felt like it hit its peak in March and April, but the ongoing war in Ukraine (over 100 days now), rising fuel prices, ongoing supply chain issues from fresh Covid lockdowns in China, and a Federal Reserve that wants to keep raising interest rates through the rest of the year contributed to a push/pull effect all month.

How darest thou

Somewhere in the midst of that, I came to terms with the fact that I need to install an HVAC system. Prices could come down once the supply chain recovers… but for now it seems like they’re going up.

This old house is getting by on window units and one paltry little furnace. It’s just not enough to keep the place heated and cooled, especially for my little one.

Plus, I’d like to keep this house as an investment property and couldn’t expect tenants to keep up with ACs and a finicky furnace. At least, I wouldn’t want to deal with those systems as a renter.

So, after much hemming and hawing, I decided it’s time to start upgrading systems – and it’s definitely reflected in this net worth update (and will continue to be for some time).

Effects of HVACYes, I want to talk about this a little more – in a new section, even.

After getting a few cost estimates, we decided the best way to slice it is to get a traditional HVAC unit installed for the second floor, and a ductless mini split for the first.

So, that’ll be two new systems – and they need power. Another upgrade I’ll make is to the electrical panel and wiring, so that’s more added cost.

Heating and cooling is awesome

And, my property value continues to increase. This upgrade has to happen at some point – and to wait is to kick the same can down the road.

I do want to keep this property in the family for perpetuity, so I feel like the added comfort, modernity, and energy efficiency will pay off both short-term and long-term.

To pay for it, I used a balance transfer promo offer. I transferred $18,000 from a card I don’t use often to my checking account. There was a 3% ($540 fee) to access the funds, and I have to pay it back in full by December 2023.

That’s 19 months. If I pay back $1,000 a month, I’ll be able to avoid interest. It was better than financing or taking out a personal loan. And I have enough saved to pay for the electrician and additional costs.

So with this, my savings rate will drop again – and I’ll use more of my available credit, which increases my debt ratio. But it’s not like I qualify for a ton of new cards anyway, and I’m confident I can repay the cost and get caught up over the next year or so. Let’s go – heating and cooling!

Was I saving too much?Yes and no. I think having $30,000 in savings is a lot for an emergency fund, but I’m keeping my eye open for another investment property around Oklahoma City. It’s a great place to invest – especially now, while things are still relatively cheap.

The city has a lot going for it, with low unemployment, a growing population, and initiatives to revitalize. I find it extremely livable – and the traffic isn’t nearly as bad as it was/is in Dallas.

This article from Bitches Get Riches (amazing site, love them) says:

Ladies! Queers! Children! I love you so much. Please stop hoarding cash, you precious chucklefucks. You’re losing money doing it. There are better ways to make yourself safe. I need you financially stable and politically powerful, m’kay?

They’re proponents of using a credit card when you need extra cash, assuming no extra debts and job stability, and get into how marginalized people tend to oversave. I feel more secure than ever in my job and line of work. So much that I’m confident I could get a new job quickly if I needed one.

But really, I was saving that money for opportunities. And when it came down to it, I jumped on the chance to improve my house. The new HVAC and mini split should last a while. I’d also eventually love to get solar panels installed and upgrade the plumbing… but that’s another project for another time.

Stablegains/cryptoWell, it happened: I got burned by crypto and lost some money. I have lingering shame about this, but want to share anyway in the spirit of honesty.

In last month’s update, I mentioned how I’d put $1,000 into a DeFi/Terra/Anchor account called Stablegains (ha!). Well, Terra crashed hard. To literally nothing. I think I got $33 out of that $1,000 back. Yeah – dismal.

I’ve mentioned wanting to learn more about bitcoin, ethereum, DeFi, and other alternative/crypto investments. And now, yes, I’m appropriately soured on the experience.

Booooo here’s me in an airport

For now, I’ll focus on investments I understand: index funds, real estate, and potentially REITs (such as Fundrise). But more crypto? No more – not for a while.

In a conversation, a friend brought up a great point about crypto. People are hoarding it and using it as an investment. But that wasn’t the intent for it.

Crypto was intended to be an alternative currency to buy goods and make transactions – not as a long-term investment. Until it’s more widespread and understood, I’m not in a position to speculate or lose any more cash.

So, while it was an experiment done in good faith, I learned my lesson: stick to what you know. Index funds FTW.

Warren’s UTMAAnother thing I did was start an UTMA account for my two-year-old son. I cruised over to Fidelity and started his account with $1,000. I plan to add some cash here and there.

I also updated my other accounts to include him as a beneficiary, so the idea is to keep padding my accounts and add to his when I’m able.

That’s something that made me really proud as a dad. I look forward to sharing his account with him, talking about it, and watching his money grow through the years. I want him to feel empowered about money and financially literate.

Dad and son

That’s something I never had while growing up. Money was a sore subject and discussed mostly in anger, described in terms of lack. I had a lot of wounding about the topic and it took me a long time to dig myself out of debt and begin collecting assets as an adult.

I still often feel like I got started too late.

But I don’t want that to happen to him. Instead, I plan to talk about money in an informative and practical way. It won’t be an off-limits or taboo topic like it was for me. I want to empower him to take ownership of his money and future early and often.

Healing my money wounds and viewing cash as a tool has done so much for my confidence and outlook on life. That’s how I want him to think about money, too.

By the numbersUnless this month is amaaaazing for the market, I already expect next month’s update to be lower. This week, I’m paying for the HVAC, mini split, and upgraded electrical, so the house appreciation and investments will have to pick up the slack for spending on those items and services.

I think it’s… something… (hilarious? unsurprising? exasperating?) that I keep hovering around this $240K mark, but remain optimistic that it’s all headed in a good direction.

Also, I left my savings goal at $30,000 even though I no longer identify with that number. I’ll have to think on it; leaving it alone for now.

Finally, I’m adding Warren’s UTMA to my taxable brokerage account for tracking purposes.

CurrentLast monthChange2022 Goal ASSETS Overall investments$195,998$195,980+$18As much as possible 401k (contributions only)$8,500$6,667+$1,833$20,500 401k (overall balance)$27,979$26,482+$1,497As much as possible Traditional IRA$104,600$106,261-$1,661xx (can't contribute) Roth IRA$47,502$48,300-$798$6,000 (in contributions)COMPLETE! Taxable brokerage + UTMA$9,854$8,955+$899$25,000 (total invested) Savings$8,172$8,170+$2$30,000 Primary home equity + appreciation$36,162$29,665+$6,497$20,000COMPLETE! LIABILITY Credit card/HVAC upgrade$18,434xxxx$12,000 Net worth in Personal Capital$239,242$239,425-$183$500,000 (overall goal) Track your net worth with Personal CapitalMost of my accounts are down, but I continued to invest – and actually increased my overall contributions. After this month, I’ll need to focus on repaying my credit card for the HVAC upgrade. I’ve added that line item here, too. I’ll shoot to pay off $1,000 a month, and more if I can swing it. I’ll have to rely on my freelance work to pay for this. I love it, but wow, I’m working so much to pay for everything these days.

That’s the current state of my finances. It won’t always be this way, but I’m grateful and feeling secure this month. I suppose that’s about as good an outcome as any, all things considered.

June 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30ish days, I:

Lost $1,000 to crypto – lesson learned to stick with what I knowAdded $1,000 to kick off Warren’s UTMA accountTook out a $18,000 balance transfer to pay for HVAC upgrade to my houseStarted rethinking my savings rate and goal, but no clear answer just yetKept investing every single pay periodGot a bit more equity + appreciation on my houseThe stock market is the only market where people are afraid to buy things at a discount.

I’ll be able to add much more color to this month’s update in my July update. Life’s happening fast. Warren continues to grow and find his autonomy and independence. Things are good and I am happy.

Financially, I’m empowered despite the big cash outlay for HVAC. Last year, that would’ve frightened me. Now, I can handle whatever comes up – and even make major upgrades to my house if I want to.

I’m thinking much longer-term now, especially as I consider generational wealth and leaving this to Warren and eventually, to his children.

For now, I’m enjoying the house, my family, work, and spending some cash when it counts. I can see the changes in myself as I review my progress. Small steps make up big shifts over time.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

May 3, 2022

Back down $15K, staying the course, and getting into DeFi – May 2022 Freedom update

Last month was absolute murder for the stock market. Earnings season revealed, if anything, that we’re still dealing with fallout from Covid and navigating headwinds from:

The war in UkraineInterest rate hikes (with another one being announced tomorrow)Runaway inflationA “post”-Covid market that no longer cares about Netflix, online shopping, and delivery services – or can’t afford to

I made it back to Dallas last month!

It was the worst start to a market year since 1939, the worst year for Nasdaq stocks since 2008, and the worst month overall since March 2020. So course my portfolio is down.

Mentally, I see this as an opportunity to buy more stocks at a lower cost basis. But seeing the drops in real-time is hard, especially with murmurs of “recession” and “bull market” everywhere you look.

This month, I also got interested in a new DeFi app with 15% APY that pays daily interest. More on that and the rest of my updates below!

May 2022 Freedom updateLink: Track your net worth with Personal CapitalDespite the drain in the stock market, last month was good to me. I got to visit Dallas and Austin to see two concerts from the Tori Amos tour. She was magical, and it was good to get away for a few days.

I have a work trip to Knoxville coming up soon, and heading to Memphis to visit family in June – that should be, um, fun with 7+ hours in a car with a toddler.

My little guy is getting so big

Speaking of which, I opened an UTMA account for him with Fidelity. There’s nothing in there yet, but it’ll be a valuable resource for us as he begins to learn about money and finances. If I put $1,000 and never add another cent, with a 10% return, he’ll have $348,912 in 60 years. Compound interest is amazing when it works in your favor.

But of course, I will add more to it and show him how to grow his funds with the simple investing techniques I’ve learned. I’m excited to get that going for him.

Sweet, sweet baby

Last month was also just a lean month in general. I kept thinking I’d have extra funds but things popped up. I was still able to put over $1,000 into savings, and my house continues to appreciate well – plus I’m accruing a little more equity each month.

It felt insignificant with the backdrop of the free falling stock market, though. Every day it sank and sank. I was on a high from reaching half of my net worth goal (I briefly touched almost $258K on April 18), but then the last half of April was just a straight dive back to where I was last month.

Fits and starts, or a bear rally?

May 2022 should be better for me financially. I’m hoping to add more to savings, start building Warren’s UTMA account, and get some outstanding expenses paid down.

Now to the good stuff!

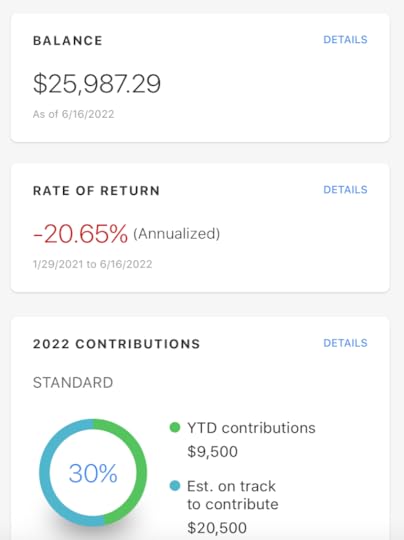

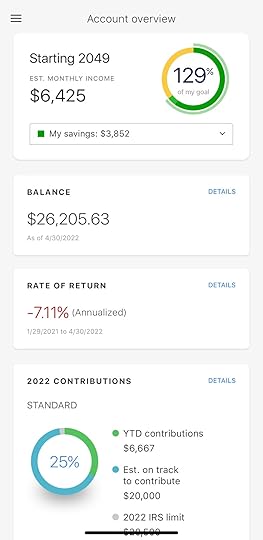

StablegainsLink: Start saving with Stablegains and get $25So looking at my 401k and seeing this was a bummer:

That red text is not the kind of return I wanna see

Since January 2021, my total return is -7.11%. Negative. Despite maxing it out last year and adding another nearly $7K so far this year. I know it’ll bounce back over time, but it’s also demoralizing. Both things are true.

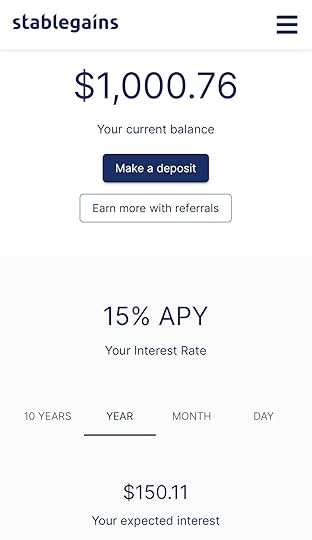

So I was poking around online and ran into Stablegains, a DeFi app based on the Anchor protocol with a 15% APY that accrues daily.

15% interest beats the pants off -7% loss for the year in my 401k

I downloaded the app and did the onboarding after thinking it over for a few days. They had me scan my ID and wanted me to prove I live in Oklahoma (which is one of the 20 states available for this product). After that, I linked my account and sent $1,000 over with ACH. And I’m already earning interest!

Woot woot!

According to the app, I’ll make:

$0.38 per day$11.56 per month$150.11 per year$3,047.89 per 10 yearsAnd that’s if I don’t add any more cash. Stablegains is NOT insured by the FDIC, so if they go under, I’m holding the bag. But I feel comfortable with the Anchor protocol and the way the app works. There are thousands of positive app reviews, and even the folks on Reddit seem to like it.

Most importantly, earning 15% interest just feels like a huge win psychologically, especially on days when my stock portfolio is tanking.

So far, Stablegains is available in:

CaliforniaColoradoDelawareIdahoIllinoisKansasMarylandMassachusettsMontanaNew HampshireNorth DakotaOklahomaPennsylvaniaSouth CarolinaTennesseeUtahVirginiaWest VirginiaWisconsinWyomingIf you’re interested and want to sign-up with my link, you’ll get $25 when you deposit $1,000 for 30 days – on top of the 15% interest you’ll earn.

I’m going to add a bit more and see how it goes but so far, it’s been amazing!

By the numbersHere’s the part where I’d usually say something about how painful it is to turn pluses into minuses, but I remember how the earnings calls for Q2 are for Q1 earnings, when the Omnicron variant was raging, along with supply chain issues. What’s happening today won’t be fully reflected until next quarter.

But the market looks forward and reacts quickly. I believe it’s already priced in the interest rate hike. The ongoing war in Ukraine could have more impact as it keeps going on (and god, I feel terrible for Ukraine!).

On the Colorado River in Austin

But mostly, if this is a recession or a bear market, that’s fine – because I have a long investing horizon. I’m investing for 20+ years out. Even though my portfolio is suffering now, I understand that it’s important to raise interest rates and get inflation under control.

So while it’s challenging, it’s an opportunity to build my portfolio at a much lower cost basis. I dollar-cost average a portion of my paycheck into my 401k every time I’m paid, and I’ll continue to build out my savings, too.

CurrentLast monthChange2022 Goal ASSETS Overall investments$195,980$211,622-$15,642As much as possible 401k (contributions only)$6,667$5,000+$1,667$20,500 401k (overall balance)$26,482$27,095-$613As much as possible Traditional IRA$106,261$116,374-$10,113xx (can't contribute) Roth IRA$48,300$52,719-$4,419$6,000 (in contributions)COMPLETE! Taxable brokerage$8,955$9,769-$814$25,000 (total invested) Savings$8,170$7,119+$1,051$30,000 Primary home equity + appreciation$29,665$27,170+$2,495$20,000COMPLETE! Net worth in Personal Capital $239,425$254,041-$14,616$500,000 (overall goal) Track your net worth with Personal CapitalAnd one more thing. If you’re investing in low-cost index funds that track either the S&P 500 or total market, you’ll be fine because of the broad diversification.

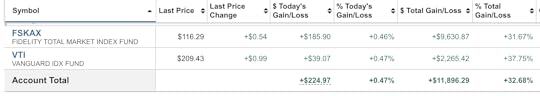

The numbers don’t lie

Even with the recent dips, I’m still up 32+% overall in my Roth IRA with FSKAX and VTI (two of my faves). With a long timeline, index funds are the way to go – the exposure to numerous sectors helps to even things out across all your investments and provides stability during downturns like what we’re seeing now.

May 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30ish days, I:

Started an UTMA account for Warren and can’t wait to teach him about moneyStarted saving with Stablegains to get 15% interest and mitigate the recent stock market dipsKept investing every single pay periodDidn’t save as much as I wanted, but I think May will turn that aroundGot a bit more equity + appreciation on my houseLots of headwinds in the stock market. Historically, we know moments like what we saw last month are a great time to buy – and a great time for new investors to come into the market at a low cost basis. I’m gonna keep investing and stay the course.

I will say though – I had high hopes for last month. April tends to end on an upswing, but this April was only the second with losses in the last 17 years.

My investments (and net worth) slid back again, but onward and upward. This is a blip in the big picture. Curious to see how the next couple of months perform!

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

April 3, 2022

Officially to $254K net worth, over halfway to my $500K goal! – April 2022 Freedom update

! It finally happened! With 876 days left to reach my $500,000 net worth goal, I’m officially at the halfway mark.

! It finally happened! With 876 days left to reach my $500,000 net worth goal, I’m officially at the halfway mark.

Currently at $254,041 with ~$212,000 of that invested in low-cost index funds (mostly FSKAX and VTI). The market’s been hemming and hawing, but it seems like things are on an upswing.

As of this week, it’s on to the second half of my journey!

Historically, April is a good month for earnings. The last 15 out of 16 Aprils have had gains. And I have a feeling that Q1 earnings will reveal the positive effects of inflation.

It’s been a rough quarter, so I’m glad things are finally starting to shift. That losing streak was tough to get through, but I stuck to my plan: regular investing in index funds, automated every two weeks. I’m always amazed at how simple it is and how it just works. It hasn’t failed me yet.

April 2022 Freedom updateLink: Track your net worth with Personal CapitalMarch was a mostly fun month. We got more snow and many sunny days that made it feel like spring. Flowers and dandelions are blooming in the yard and I’ve taken to having my morning coffee outside on the deck as I ponder my days. Life is simple, and we’re all doing well.

Getting to the halfway point in my goal feels like a big mental win that I really needed. Now the first half is officially done. Now it’s just getting over the $300K hump (which I’ll likely accomplish this year), and building toward $500K. I want to make sure to celebrate this each step of the way.

As of now, I plan to put away everything I can toward savings. I still want to rebuild my account to $30,000 this year, and then put any excess into my taxable brokerage account.

Our springy back yard

Warren, my son, continues to grow like a weed. His verbal and physical development was astounding this month. As soon as I can, I’m going to open up a custodial account for him and start him on the investing path early and often. Something like that would’ve completely changed my life. I hope I can change his.

We still have a few more things to pay for, but I feel like I’m getting somewhere even with upcoming big expenses.

Professionally, I’m working with NextAdvisor to provide ongoing commentary about the stock market every week at this dedicated page. The first entry went live last week, and I’m excited to keep working on it every week.

Sweet baby

I also have a couple of small trips coming up. Maybe I’ll write about those. I used free night certificates and credits from my Capital One Venture X card to book them.

Life’s been peachy keen with lots to look forward to. So, so very glad I reached the halfway point! I was really starting to wonder if it would happen this year.

EquityThe bulk of my progress has come from my house appreciating faster than anticipated. Some people don’t include their primary home in their net worth. I likely won’t live in this house forever. When I move, I’ll buy another place and convert it to a rental. Right now I’m my own “tenant.” Seeing it that way helps it make more sense for me.

Happy. Unbothered. Moisturized. In my lane.

It would be pretty easy to sell this place, I think, but I’d like to one day give it to Warren. For now, the value keeps increasing. I view that as future growth, and include it in my calculations.

By the numbersAs mentioned, the equity and appreciation on my house are now at ~$27,000, which is incredible.

I think I’ll be able to add a little more to savings this month and next. And I’ll keep adding to my 401k all year. So far this year, I’ve thrown $5,000 in there – in addition to the $6,000 I put into my Roth IRA already.

My sweet son in the snow

I’m now excited to see what the stock market will do in Q2 and have a feeling we’re about to catch another big upswing.

I just need to clear a few personal hurdles and then will have plenty of news to share as we get into summer. All good stuff, I promise.

So there it is, all written out. Hopefully those pluses stay that way for a while. I’d love to have some meaningful progress before another backslide (if there’s gonna be one).

April 2022 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardIn the last 30ish days, I:

Got to the halfway mark of my $500,000 goal!Continued to invest in my 401k every pay periodFelt the effects of positive market movementSaw my home equity and appreciation make some big jumpsQ1 was difficult to get through, because of the market and also things going on in my life. But March had a lot of good news. I still have a few big things coming up in April and then I’m looking forward to sharing some huge news when I’m able to (not to #vaguepost too much). I know these updates have been rather simple for a while, but they’ve really kept me going and given me a touchstone along my way, which has been very meaningful and given me the strength to keep going.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there!

-H.

March 16, 2022

New coin deal for ~$5,300 in spending and $162 in profit – tomorrow, 3/17 @ 12pm ET!

Just a heads up for a new PFS Buyers Club coin deal in case you want to get in on over $5,000 in spending. Tomorrow, March 17, the US Mint is releasing a new set of coins at exactly 12pm ET. The coins will cost ~$5,337 and all cards except US Bank/Elan (Fidelity) cards should work to earn miles, points, or cashback.

There’s some speculation that Amex cards *might* charge a cash advance fee. Incidentally, I just got the Amex Gold card in the mail yesterday and need to meet the minimum spending requirement. But I think I’ll use my BofA Premium Rewards card for 2.62% cashback (~$140) instead.

Here are the coins that go on sale tomorrow

Aside from minimum spending, you could also gain traction toward spend bonuses like free hotel nights (Hyatt, Hilton), elite status (AA cards), or any other promotions you’ve signed up for.

PFS Buyers Club coin dealLink: Join PFS Buyers ClubIf you haven’t already, sign up for PFS Buyers Club. Then opt-in to the deal. Only opt-in if you can purchase the coins at exactly 12pm ET tomorrow, 3/17 – these coins FLY within seconds and you have to be ready.

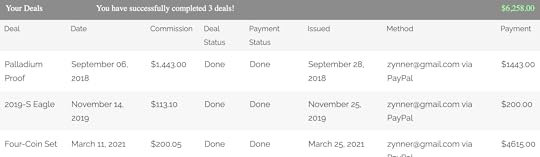

So far, I’ve done 3 deals

I’ve successfully completed three deals, the last one a year ago almost to the day. I’ve opted into others, but don’t always make it to the purchase page. It’s an adrenaline rush to get the coins bought!

But I mention this to say that I’ve personally done these deals before, plan to do this one, and recommend PFS Buyers Club as a reputable reseller with fast payments. And for this deal, you also get an extra ~$162 in profit. Not bad for receiving a box and then dropping it off at a FedEx store.

The coins will cost $5,332.50, plus $4.95 shipping, for a total of ~$5,337.50 in spending.

They’re expected to ship shortly after 3/17, but if it goes on back order or the shipment is delayed, you might need to float the money. I’ve never had to float anything with past coin deals, but mentioning it on the off-chance this happens. I fully intend to do the deal.

Between the $162 in commission and $140 in cashback, that’s $300 for a trip to FedEx. If you have an AA card, that’s 5,000+ Loyalty Points – pretty good if you’re gunning for elite status with American!

PFS Buyers Club coin deal bottom lineLink: Join PFS Buyers ClubGo forth and prosper! You can sign up for PFS Buyers Club to get updates on future deals, even if you can’t do this one. Only opt-in if you’re confident you’ll be around to receive the box when it arrives (or send it to someone you trust, like a family member nearby).

PFS does a great job of laying out the instructions. This is an easy way to generate some spending toward rewards, especially if you currently have minimum spending to complete.

Feel free to share data points in the comments! Would love to hear from people using Amex or Barclays cards before tomorrow!

Do you plan on doing this coin deal? How were your experiences in the past if you did them?

March 13, 2022

Last call for the Capital One Venture X 100K + $200 welcome offer – the BEST premium card!

Today is the last day to get the newly-launched Capital One Venture X card’s incredible early spend bonus! After many rejections from Capital One, I finally got approved for this one – here’s my tip on how to check your approval odds.

For most people wanting a premium travel rewards card, it doesn’t get much better than this one.

The welcome offer is incredibly strong, the rewards earning rates are excellent, and the card’s ongoing benefits justify the $395 annual fee year after year.

Capital One is building their own network of airport lounges and doing great things with their transfer partners. And their version of the Priority Pass includes restaurants in airports (something the Amex version of Priority Pass does NOT).

The Capital One Venture X 100K offer is one of the best in recent memory

I love earning a flat 2x miles on all purchases without having to think about category bonuses. But the Capital One Venture X does earn 10x miles on hotels and rental cars and 5x miles on flights booked through Capital One.

If you’ve had your eye on this one, this is the last call. We don’t know what the new offer will be, but it’ll likely be inferior.

Capital One Venture X 100K detailsLink: Capital One Venture X Rewards card Capital One Venture X100,000 Venture miles (Worth $1,000 toward travel) • Earn unlimited 2x miles on every purchase

• Earn unlimited 2x miles on every purchase• Transfer your miles to 15+ travel loyalty programs

• Enjoy free access to Capital One lounges for you and two guests

• Limited time: Get up to $200 back in statement credits for vacation rentals (Airbnb and VRBO) charged to your card in the first year

• Get 10,000 miles very anniversary year (worth $100)

• Get an annual $300 credit for bookings through Capital One Travel (flights, hotels, and more)

• $395 annual fee• $10,000 on purchases within 6 months from account opening It doesn't get much simpler to earn and redeem points than this• Learn more here

Every year, you’ll get an annual $300 travel credit plus 10,000 anniversary bonus miles (worth $100 toward travel) that easily cover the card’s annual fee. Then there’s:

Huge 100,000-mile welcome offer – worth $1,000 toward travel$200 to use toward vacation rentals (like Airbnb or VRBO) the first year10x miles on hotels and rental cars booked through Capital One5x miles on flights booked through Capital One2x miles on all other purchasesLounge access to Capital One and Priority Pass lounges

I used the $300 travel credit to book flights through Capital One

The card also comes with primary rental car insurance, travel interruption, trip delay, and lost baggage insurance, cell phone protection, no foreign transaction fees, and so much more. I suppose it’s worth mentioning that you also get a $100 credit toward Global Entry or TSA PreCheck every four years, too (it seems like every premium card has that these days).

You have six months to meet the $10,000 minimum spending requirement, which should be attainable for most households (that’s ~$1,666 per month). This is also *the* card I use at Costco, since they only accept Visa cards now. I will happily earn 2x transferable miles on purchases there – and consider this the best card for Costco spending.

A note about the $200 vacation rental creditIf you don’t like Airbnbs, consider using the $200 credit to book a room in Ukraine to help hosts there. You won’t check in, but the money will go to support someone trying to evacuate. It’s a fantastic way to help for no additional cost to you.

Capital One transfer partnersYou can use the miles you earn toward travel purchases, where they’re worth 1 cent each – making the Capital One Venture X is an elevated 2% cashback card.

Or…

you can transfer them to airline and hotel transfer partners, including:

Aeromexico (1:1)Air Canada Aeroplan (1:1)Air France/KLM Flying Blue (1:1)Accor Live Limitless (2:1)Asia Miles (1:1)Avianca LifeMiles (1:1)British Airways (1:1)Choice Privileges (1:1)Emirates Skywards (1:1)EVA Air (1:1)Finnair Plus (1:1)Qantas (1:1)Singapore Airlines (1:1)TAP Miles&Go (1:1)Turkish Airlines Miles&Smiles (1:1)Wyndham Rewards (1:1)Capital One has been rapidly improving their mileage transfer partners, including both the offerings and transfer ratios (most are now 1:1 except for Accor, which – no loss there). There are also transfer bonuses! I’m excited to see what else they add in the future.

When the early spend bonus hits

With minimum spending included, you’ll have at least 120,000 miles after you earn the welcome offer.

Plenty to play with

That’s enough to get some seriously fun travel with Capital One’s transfer partners. It’s also worth at least $1,200 toward travel – but can easily be worth much, much more when you transfer your points for flights instead.

My faves and where I’ll likely send my points are in bold in the list above.

Capital One Venture X 100K bottom lineLink: Capital One Venture X Rewards cardI’m loving my new Capital One Venture X card! I already earned the welcome bonus and spent the $300 travel credit. As of now, I still have my $200 vacation rental credit and am strongly considering booking an Airbnb in Ukraine to help a host there.

Next month, I’m flying through DFW and scheduled an extra long layover to properly explore the new Capital One lounge. Sure beats the socks off the crowded Centurion lounges.

I plan to keep this card long-term because of the annual $300 travel credit an annual 10,000-mile bonus that cover the card’s annual fee, and also to access Capital One lounges when I fly and for Costco shopping.

One more note: you can add authorized users for no additional cost – and they get their own Priority Pass membership! I added a user and her credit score has already gone up ~60 points, which is also pretty rad.

Today is the last day to hop on this fantastic offer and potentially open yourself up to a new points ecosystem with a great welcome package. If you’ve been holding out, give it a spin even if you’ve been denied before. Again, here’s how I figured out I was likely to get approved after many previous denials.

Thank you for using my links to apply! You’ll definitely be supporting an independent blogger and it’s very much noticed and appreciated.

Stay safe and scrappy out there!

Will you be taking advantage of the Capital One Venture X 100K + $200 welcome offer?