Harlan Vaughn's Blog, page 9

January 24, 2021

Up $8K, starting a new 401k, and possibly switching brokerages? – January 2021 Freedom update

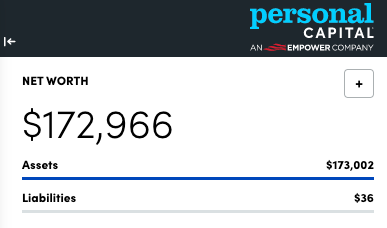

Since last month, I went from 33% of the way toward my $500,000 net worth goal to 35% of the way there. Once I reach $200,000, I’ll be 40% of the way. I find that breaking it up into little steps is a lot more manageable than thinking about the entire goal all at once.

This month finds me sitting at ~$173K, so I’m focused on ways to reach that next milestone. The stock market has been kind, and I’m back to rebuilding my savings after paying off all my credit cards and car note last month. All told, I’m up ~$8,000 this month. And in a few days, I should be getting the first deposit into my new 401k from the job I started a few weeks ago.

Cute dog alert! He was napping right before I took this pic of us

Now that I have no liabilities and only assets to think about, my finances have gotten a bit… routine? So of course I have to rock the boat.

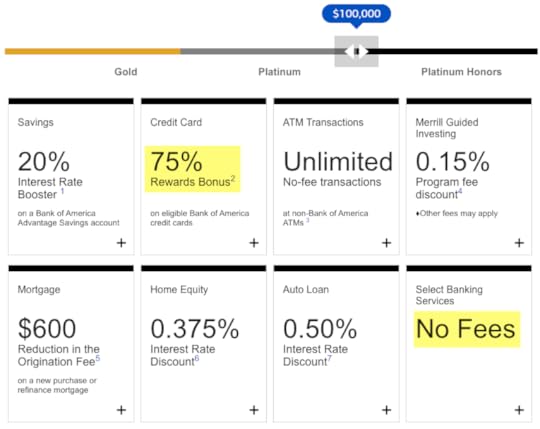

I’m seriously thinking of moving some assets to Bank of America – enough to qualify for the Platinum Honors tier in the Preferred Rewards program – and opening a couple of new cards and a checking account with them. But the thought of switching from Fidelity to Bank of America and from earning points to cashback is giving me heartburn.

Thus are the thoughts that find me on this cool, rainy evening in north Texas.

January 2021 Freedom updateSo I think I set up my new 401k correctly and hoping the first contribution hits next week. I have roughly $1,700 going in every month to hit the $19,500 maximum this year. My new company doesn’t offer a 401k match, so it’s all me. I’ve already maxed out my Roth IRA for 2021, so this is purely for the tax and investment benefits – and to get closer to my Freedom goal.

Last year, there were ups and down, but I was up $60,000 once the dust settled. If that holds true again this year, I will be nearly 50% of the way toward my goal when 2022 rolls around. Now that the first $100K is behind me, I’m hoping things will speed up thanks to compound interest and time in the market.

I’m trying not to read too much about the stock market, but there’s talk of another bubble. Staying the course has gotten me this far, so I’m gonna stick to the plan and roll with it.

Rebuilding savingsI’d like to get $30,000 in a savings account as an emergency fund and to be in a cash-heavy position. So for the next few months, I’ll be putting any extra funds into savings. Then I’ll think about investing the rest in a brokerage account – or maybe continue to save in case a good deal comes up on a house.

Although I don’t know where I’d live yet. I recently submitted applications to two Studio Art programs to get my MFA in Painting. So I’ll see what happens and let that direct my course. I’m hoping to be out of Dallas in the next few months.

Another thing is the computer I’m typing this on is from 2013. It’s still going strong, but has moments where it’s slow or glitches out. I’ve been thinking about getting a new one. But this time, I want all the software and upgrades and extra memory and accessories and all the rest. I’d earmark $3,000 for a new device. If I have it for seven years like I’ve had this one, it’ll be worth it. I was a poor college kid when I got my current basic model computer. It’s been great, but I want to really treat myself next time.

I mention this because it would affect how quickly I’m able to meet this savings goal.

Should I leave Fidelity for Bank of America?Everybody knows I love Fidelity and have been fidelitous to them since forever. But ever since I rolled over my old 401k into my traditional IRA, I find myself with a ~$100,000 account.

Should I?

Through April 15, 2021, there’s a bonus offer for opening a new Merrill Edge account. I could roll over that IRA and get a $375 bonus while also qualifying for the Platinum Honors tier in the Preferred Rewards program.

The highest level in one shot

That would get me a free checking account and a 75% bonus on the rewards from Bank of America credit cards. Which would also mean I could earn a couple more credit card bonuses in the process and add new cards to my rotation.

It would be easy enough to move some funds to Merrill Edge and earn a few bonuses. So I’m considering making a jump for it. I’m just not sure if it’s worth it.

I definitely prefer to earn points as opposed to cashback. But it couldn’t hurt to mix things up a little – could it?

If you have Platinum Honors status with Bank of America, is it worth it? I have until April to think it over. But if a checking account bonus pops up before then, I might not be able to resist.

Marking this as “Highly Interesting.” Because I can’t leave well enough alone.

So I’m 35% of the way toward my goal. That’s pretty rad.

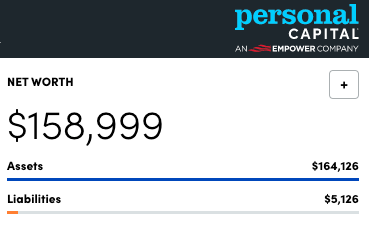

CurrentLast MonthChange2021 Goal ASSETS 401k xxxxxx$19,500 Overall investments$143,742$137,248+$6,494As much as possible Savings$19,916$16,775+$3,141$30,000 Net worth in Personal Capital $172,966$165,033+$7,933$500,000 Track your net worth with Personal Capital

I don’t get out much these days

All told, my investments are sitting around $144K.

On the way to $200K invested

And like last month, this month presents another highest-ever net worth.

The trend continues

Everything I get – side income, another stimulus check, extra money after monthly expenses – I plan to aggressively save. If I can get to $200,000 net worth in a few months, that would be so encouraging. Gonna keep plugging away at it. Every day.

January 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardAnd if I could reach 50% of my overall goal by the end of 2021, my momentum would be unstoppable. Now that I’m getting closer, I’m all the more encouraged to save and invest. It’s almost a game now – a really fun one. Especially now that I have no liabilities acting as inertia.

But because I’m me, I’m considering switching to Bank of America to see what their cards and accounts are about. I’ve been with Fidelity forever but if there’s more to gain, I’m all for trying – especially if I can pick up a few bonuses along the way. If you have any experiences, recommendations, or inside scoop please let me know in the comments!

And thank you for reading and following. Starting now, it’s on to the next $100K milestone! Hope to have more to report for the next update. Things are surely on the go. Stay safe out there!

January 11, 2021

FoundersCard Review 2021: Benefits, Updates, Cost – And Is It Worth It?

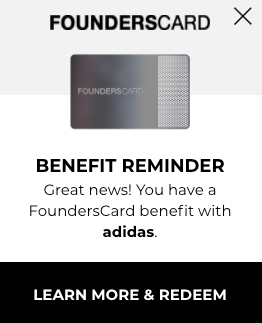

Time to update my FoundersCard review for 2021! I’ve been a member for 7 years by now. Each year, they add more (and more useful) benefits, keep the best ones, and refine their partnerships based on member demand and use.

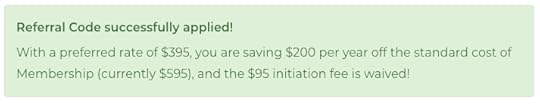

The upshot is making the most of even ONE perk can outweigh the $395 membership – and the rest is gravy. And when you sign up with my link, your rate will never go up.

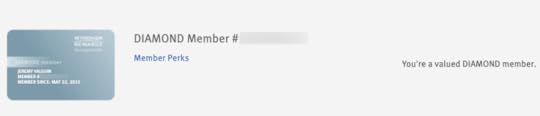

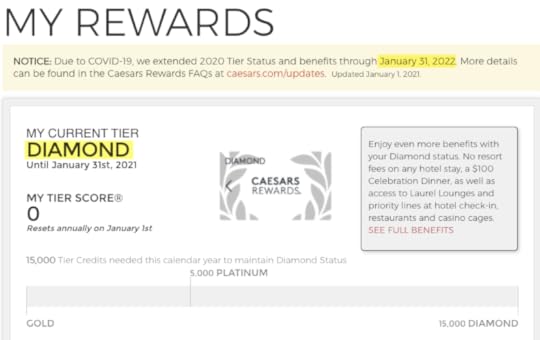

I’ve used the 15% AT&T discount, Hilton Gold elite status, and Caesars Total Rewards Diamond elite status (which is back this year through January 2022!) to cover and exceed the membership cost.

And there are new benefits for 2021, mostly focused on business and lifestyle. A couple of the travel benefits have gone away, but I believe that’s reflective of where we currently are with Covid-19 and that they’ll return. Until then, what’s left is still a long list of benefits.

Has it really been 7 years? Just renewed my FoundersCard membership again as a Charter Member

Here’s everything to know before you apply for membership.

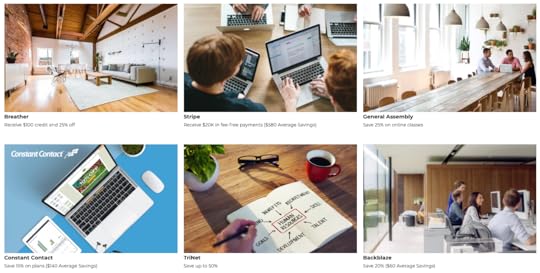

FoundersCard Review 2021Link: Apply for FoundersCard and lock in the $395 annual rateFoundersCard is a membership built for small business owners and entrepreneurs. And the benefits reflect that – especially in 2021.

But many of them, particularly travel and lifestyle benefits, would be useful to most people. Definitely if you’re a frequent traveler. And if you’re not traveling this year, a fresh crop of small business benefits can easily make up for it. It just depends on what you personally find useful.

FoundersCard breaks down their perks into 4 categories:

Travel BusinessLifestyle HotelsOver the years, I’ve saved with from discounts with AT&T, elite status and offers for travel, a cheap trip to the Bahamas, and perks like free magazine subscriptions, free TripIt Pro for a year, access to a free private jet flight, and an event in Dallas with drinks and gifts.

Basically, if you can find 2 or 3 perks that make sense, you can do well with a FoundersCard membership.

With that, here are popular benefits in each category.

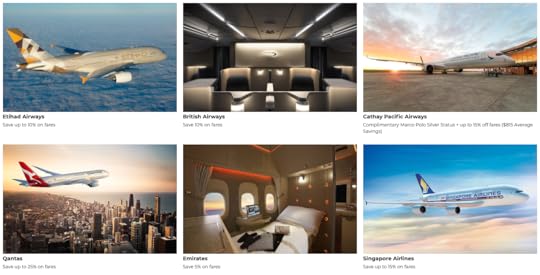

1. TravelAirlinesBritish Airways – Up to 10% off most fares between the US/Canada and the UK (this is also a perk of the Chase British Airways card)Cathay Pacific – 5 to 15% off flights and Marco Polo Club Silver elite statusEmirates – 5% off fares from the USEtihad – Up to 10% off coach and Business class fares for certain destinations departing the USQantas – Up to 25% off fares between the US and Australia/NZ, depending on flight directionSingapore Airlines – Up to 15% off select flights from the USSurf Air – Round-trip trial flight for $650 and two round-trip guest flights when buy an All-You-Can-Fly membershipUnited – Up to 6% off select flights booked directly through United.com

If you pay for flights with partner airlines, these are easy savings

These aren’t huge discounts in most cases, but they’re certainly nice when you can use them. Especially if you get travel reimbursed or fly those airlines a lot.

Again, these aren’t as bountiful as they once were. Notably absent in 2021 is the American Airlines partnership, which has been around for as long as I can remember. I really hope they get back on board soon.

HotelsCaesars – Free Diamond elite status through January 2022 (waived resort fees on any hotel stay, VIP lines, $100 Celebration dinner, 20% off select room rates, free parking at most hotels)Hilton – Free Gold elite status through March 2022 (free breakfast, upgrades when available, late check-out, 25% extra points on paid rates)Omni – Up to 20% off best available rate and flexible cancellation privileges

Hilton Gold elite status is the best of all chain hotels for free breakfast

I love Hilton Gold status for the free breakfast. And if you stay at Hilton hotels often, you can get:

Bonus pointsFree breakfastLate checkoutRoom upgradesPossible lounge access, if you score a Club floor roomCaesars Diamond is back for 2021This year, Caesars Total Rewards Diamond elite status is back, which gets you:

$100 celebration dinnerTier status match to Wyndham Diamond elite statusNO resort fees15% off best available room ratesOccasional free nights at Caesars hotels4 free nights at the Atlantis hotel in the BahamasI just had my $100 Celebration Dinner at the Horseshoe Casino in Tunica, Mississippi, over Thanksgiving break.

If you like Caesars hotels, FoundersCard membership can pay for itself with one trip to Vegas

And when you go to Caesars casinos, you can skip most lines – and you never pay resort fees. In places like Las Vegas, that can save you a ton of time and money. Plus, if you like Wyndham hotels, you can match your status to top-tier elite status with them.

If you stay at Wyndham hotels, you can check in as a Diamond member there, too

I’ve always found a fun way to use my Caesars status, whether it’s just popping into one of their hotels for a free dinner, or trying my luck getting into the lounges (which is not guaranteed to work any more, and you may have to pay). But if they’re slow, they might just let you in. Never hurts to try – I’ve gotten in a time or two despite their official policy.

This is by far one of FoundersCard’s most popular perks

Car rentalsAvis – Free Avis Preferred Plus Membership and up to 25% off rentalsSilvercar – 20% off rentals (this discounts also comes with the Chase Sapphire Reserve card)Sixt – Platinum status and 15% off rentals

Save on your car rentals and get status that lets you walk right to a car and drive away

Again, these are all perks of certain cards. I usually rent through Priceline/Costco/Chase Ultimate Rewards. But it’s worth checking every time for the best deal (and I always do – I sometimes find cheaper rates with Hertz status than I find anywhere else, FWIW).

Other travel savingsCouple extra lil bennies.

ZipCar – Waived setup fees for small business owners, $30 toward your first drive, $35 annual membership fee, and 10% off standard rates Monday through FridayTripIt Pro – Free year of Pro, then $39 annual rate for three years

TripIt Pro has become a must for me. Try it free for a year

I had a Zipcar membership when I lived in New York and loved saving on the initiation fees. Plus you get $30 in credit and 10% off during the week.

I’ve also gotten hooked on TripIt Pro. It’s become part of my travel organization and flow thanks to alerts for gate changes, delays, and connecting flights – often before the airline itself will ping you.

2. BusinessShipping, phones, and data backupAT&T – 15% off most wireless plans OR up to $10 off per line, per month on the AT&T Unlimited Elite planBackblaze – 20% off 1- or 2-year subscriptions (something like this is a MUST for small businesses, or anyone with a computer – I personally use Backblaze!)Phone.com – 1 free yearUPS – Big discounts on shipping (up to 47% off)Zoom – 20% off Zoom services (10 license minimum), one free Zoom Rooms license, 10% off Zoom phoneDropbox – 40% off Business or Plus annual subscription

If you don’t already back up your computers, you need a service like Backblaze (which is what I use)

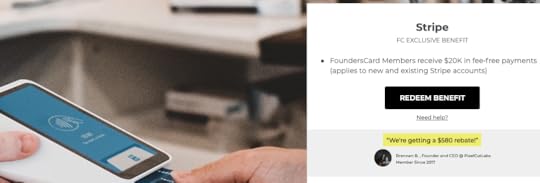

Promotion and documentationMoo – 20% off business printingConstant Contact – 15% off marketing tools and emails and a 60-day free trialShopify – 20% off for a year after a 14-day trial, to have your own e-shopBizFilings – 25% off servicesHarvest – 15% off online invoice and time tracking services and a 30-day free trialStripe – $20,000 in fee-free payments (!!!)Salesforce – Free 14-day trial and 50% off first annual subscription of EssentialsDocusign – 15% off annual plans for the first year for a minimum of 5 seatsHelloSign – 30% off first year of an annual Essentials or Business subscriptionSquarespace – 20% off first annual website planHubspot – 30% off software and a free CRM – 20% off services (domain registration and web hosting)

Save on promotional materials, email services, and business filings – indispensable. And the Stripe $20K deal is pretty sweet

I’ve personally used these combined discounts several times. It really does add up. I’ve incorporated LLCs, written a will, and gotten business cards for the blog with the participating companies.

And the $20K in fee-free Stripe payments can pay for a FoundersCard membership all on its own, considering the fee is 2.9% 30 cents per transaction. On $20,000 in payments, that’s $580 saved – at least.

These benefits are super-focused for where we are in 2021. Discounts on electronic signature services like Docusign and HelloSign, cheap domain registration through Namecheap, personal websites through Squarespace, and email marketing through Constant Contact. These are big, recognizable names and discounts many businesses and entrepreneurs can actually use.

Other business savingsDell – Up to 40% off Dell branded productsMicrosoft – 10% off Microsoft 365 Business StandardAdobe – 15% off Creative Cloud apps for one year (!)Lenovo – Up to 40% off select Lenovo and Think productsOffice Depot – Preferred pricing up to 55% off in-store and online, and free next-day shipping of orders of $50 1Password – 40% off Teams serviceZendesk – 6 months free of sales and support service

I’ve gotten unexpected heavy usage from FoundersCard’s business discounts

You’ll find most of the discounts and offers, especially this year, in the business category – and there are lots more. You can poke around with a preview to see them all.

3. LifestyleThere are lots of discounts in this category, too:

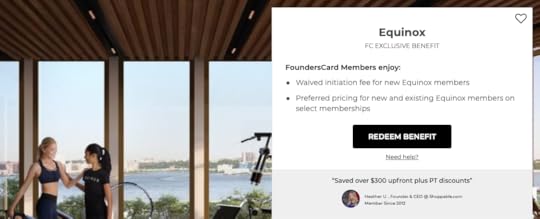

Mr Porter – $200 off your first $500 order, free next-day shippingEntrepreneur magazine – Free 1-year subscriptionAdidas.com – 30% off most itemsSpafinder Wellness 365 – 15% off gift certificatesShopRunner – Free membership (although this comes with many credit cards, including all Amex personal cards and some Citi cards)Bliss Spa – 20% off select treatmentsMany gyms, including Crunch, Equinox, CorePower Yoga, and Pure Yoga – Preferred ratesSoulCycle – 1 free class when you purchase a 10-packMost of them are for online shopping at upscale clothing stores. But there’s also gyms, spas, flower shops, and lots more.

The lifestyle benefits are full of savings on gym memberships, clothes, and much more

I’ve used them here and there (like Mr Porter and an Equinox gym membership). And the free magazines were handy to toss in a bag to read during a flight or layover.

Everything here is a “nice to have” – not crucial, but a fun extra. And again, it adds up if you shop often at a few of the merchants.

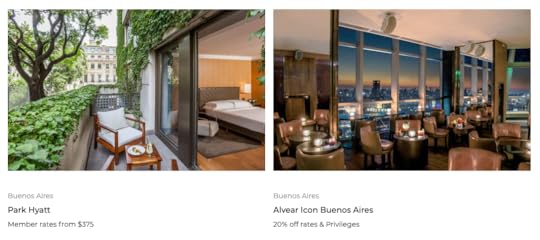

4. HotelsFoundersCard has relationships with hotel chains and independent/boutique hotels around the world. At 300 hotels, you can get:

Exclusive members-only ratesUpgrades and extra perksMore flexible cancellation policiesNo travel agent/booking feesFor example, at certain Marriott hotels, perks include:

Complimentary welcome drinksMore flexible cancellation privilegesSpa discountsFree breakfastDiscounts off the standard room rateYou get similar treatment at Park Hyatt hotels – although the specific perks are unique to each hotel.

Even better, you can book directly. So you’ll still earn credit toward elite status and enjoy your elite status benefits. The caveat is that only:

16 Marriott hotels participate (9 W hotels and 7 Ritz-Carlton hotels)5 Park Hyatts participate15 Omni hotels participateBut there are many boutique hotels, including Arlo NoMad, Standard High Line, Ace, and YOTEL in NYC. And lots all over the world.

It’s aightWhile this is a cool benefit, it’s certainly not all-encompassing. But if you have paid cash stays in a FoundersCard hotel city, you can get a few extras at places that don’t partner with Amex or Chase and their respective upscale hotel programs (Fine Hotels & Resorts and Luxury Hotel Collection).

The selection in Buenos Aires leaves a lot to be desired

I ran a search in Buenos Aires and turned up 2 hotels in the FoundersCard program. New York has 14. Hong Kong has 4. Tokyo has 4.

I don’t consider this a huge money-saver as it’s so limited, but nice to have in your back pocket. And worth checking the prices for paid stays at upscale hotels.

What’s it all worth?As of writing, FoundersCard is $395 a year with waived initiation fees for Out and Out readers.

Boom

If you can make good use of 2 or 3 benefits, it can easily save you that much – and often more.

FoundersCard has a Chrome extension so you won’t miss savings online

For example, my AT&T phone bill is ~$110 per month for 2 lines. I save $15 per month with the FoundersCard discount (applied before taxes). That’s $180 saved per year on something I need anyway – and brings the net cost of membership down to $215.

I have easily saved that much with the:

TripIt Pro discount (free for a year, then $10 cheaper for 3 years)Total Rewards Diamond elite status with $100 Celebration dinners and trip to the Bahamas (huge discounts with this perk alone)Backblaze cloud backup for my computer, which I use every dayAlso, if you value hotel elite status, you can get Gold elite status with Hilton.

FoundersCard has become an invaluable part of my life, travels, and blogging business

The airfare discounts are also handy to save, if you fly those airlines often.

Using the deals = savings, not using them = not savingIt’s easy to completely cover the cost of the annual membership. But the real value is when you can use the benefits. If you do, you come out way ahead – $1,000s ahead, in some cases.

And if you don’t find the discounts useful, then skip it.

December 28, 2020

New job, no credit card debt, car paid off, and IRA maxed out – December 2020 Freedom update

Happy Holidays!

December 13, 2020

Amazon bank points deals: Save big by using 1 Amex, Capital One, Chase, or Citi point (YMMV)

I’ve been using bank points of all kinds to save on Amazon purchases recently and wanted to share. This next week is the last dash to purchase gifts before the holidays, and in many cases you save big bucks by adding these promotions to your account and redeeming a single bank point.

These deals come and go frequently. Sometimes I’m targeted, other times not. Still, I always check to see if I’m targeted and add the promotions to my account.

I didn’t need anything the last time I got an offer, so I stocked up on dog food and called it a day. In that way, it’s great to save on basics or things you absolutely know you’ll need in the future. And of course, gifts!

December 4, 2020

One year of tracking later, my net worth is up $60K – November 2020 Freedom update

About a year ago, I started seriously tracking my net worth. And every month, I’ve posted what I call Freedom updates. Obviously, 2020 has been a wild ride and a lot has happened. I’ve had months where I’ve been way up and way down. Sometimes by tens of thousands from month to month.

After bouts of whiplash, I want to look back at where I started – before I sold my condo in Dallas and Covid-19 hit – and compare where I am now. As of today, my net worth in Personal Capital is $158,999 (darn that extra dollar lol). I’m up over $60,000 from the end of last year. And currently at 31.8% of my goal of a $500,000 net worth.

“They” say investing your first $100K is the hardest. And now my investments are sitting at $127,353. I’m contributing 30% of my paychecks to my 401k. And come January 2021, I’ll dip into my savings account to max out the $6,000 Roth IRA contribution early in the year.

This sure ain’t where I began. Ain’t where I end, either!

But before I get into all that, I just want to celebrate my overall progress. Despite everything, I averaged $5,000 per month in net worth gains over the last year. And now that I have momentum built, I’m hoping it’s just a short jump to the next $100K. Onward!

November 2020 Freedom update

Last year, my goals for the following five years were to:

Buy as many investment properties as I can (probably two) – $TBD

Max out my 401k every year – $95,000 ($19K x 5)

Max out my Roth IRA every year – $30,000 ($6K x 5)

Save $20,000 in a savings account

Pay aggressively toward my mortgage and build more equity – $50,000

Pay off my car loan – $10,000 (my car is holding its value really well)

Hope for continued appreciation on my condo and returns on my investments – $???

Save and/or invest my bonuses, any blog income, and tax refunds – $???

Wow, a lot has already changed (but we knew that the entire time, eh?). I no longer have any interest in buying property, I’ve hit my first savings goal, and sold my condo (and therefore have no more equity). I’ve also paid my car loan down to ~$3,400.

This image is here to give your eyes a small break

I’ve tried to catalogue the evolution, but for 2021, my goals are to:

Max out my 401k – $19,500

Max out my Roth IRA – $6,000

Save $30,000 in a savings account (I want to be cash heavy and currently have $20,000, so $10,000 more)

Finish paying off my car loan – $3,400

Put any extra income into a taxable brokerage account – $???

I find it fascinating how goals evolve. I’m also proud of myself for letting my goals evolve and not being so rigid as to prevent that from happening. The calibrations are clearly working, and compound interest is starting to double down and work in my favor.

As good as reaching ~32% of my goal feels, I can already imagine how good reaching 50% of it will feel. And it’s so within reach!

Where I’m at

Last month, I declared I was at my best-ever net worth.

Boom shaka laka

This month, it’s true again. As long as I can maintain, I’ll expect each month to be better than the previous one, so I’ll retire that “best-ever” phrase and just keep rolling. If 2020 was any indication, that won’t always be true. But at least I can be less surprised and butt-hurt about it.

Up and up, out and out

Of my overall net worth, over $127,000 of that is tied up in index funds. This is where the compound interest gets to work its magic, and where I’ll be focusing most of my efforts in the upcoming year.

Yassss, it’s shrinking so fast

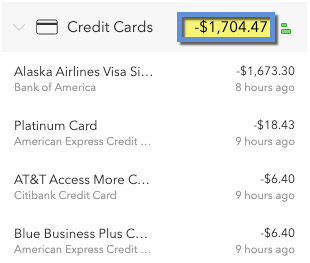

This time last year, I had $20,000 in credit card debt. But I bucked up and paid so much of it down. Now I’m so close to being done with it. I can’t tell you how relieved I am about this.

Even though I’m interest-free until September 2021, the psychological benefit is worth it to see this number at $0. Finally. One less liability causing friction to my momentum.

What. A Year.

Finally, wow – what a ride 2020 was. The big dip in March, all the smaller dips, then increases felt like a rollercoaster. If you can imagine riding up and down all those bumps and peaks and dips. As mentioned, most of my cash is invested in index funds and I try, god do I try, to keep my eyes off my portfolio. But where I was a year ago and where I am now – that difference – I mean…

I’m glad I stayed the course and forded the rivers or whatever. It wasn’t easy. I’m still learning to keep my emotions out of my investments. It’s a lesson well worth learning, and a slow one. Maybe the biggest one I learned from such a volatile year.

December 2, 2020

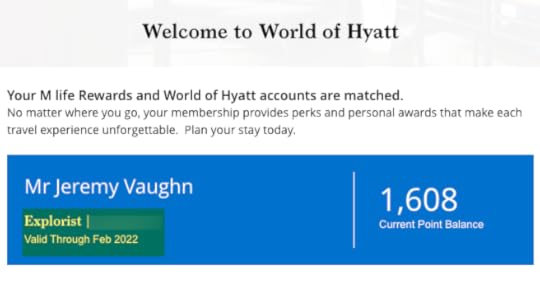

Easy Status Match: Caesars Diamond to M Life Gold to Hyatt Explorist through December 31, 2020

This is rather niche, but it works! Through December 31, 2020, if you have Caesars Diamond elite status, you can match it to M Life Gold, and from there, to Hyatt Explorist. I just did it this past weekend.

The only hitch is you must do the Caesars to M Life match in person. And of course, have Caesars Diamond status to start with, which is a free perk you get from FoundersCard membership. You can also get it from matching your Wyndham Platinum or Diamond status, which you can get from having a Wyndham credit card.

If you’re in a place where there are Caesars and MGM casinos or hotels, like Las Vegas, Atlantic City, or Tunica, it takes just a few minutes to get it done. I was at the Horseshoe Casino in Tunica, Mississippi, and walked over to the Gold Strike Casino. From there, I matched from M Life Gold to Hyatt Explorist online in under a minute.

Easy way to get Hyatt Explorist if you can work it out

Within Hyatt’s program, Explorist – the middle tier – isn’t all that different from Discoverist – the lowest tier – which also comes with having the Chase World of Hyatt card. But this is an easy way to get it for free and without completing a single stay.

Caesars M Life status match to Hyatt Explorist

Conversely, you could match these backwards. If you have Hyatt elite status, you could match to M Life online, then walk to a Caesars (and then match to Wyndham status – this also still works).

Just in case I ever stay at a Wyndham hotel

Why bother matching to Caesars or M Life status? If you ever want to stay at their properties, you’ll get free parking, faster lines throughout, waived resort fees, and potential room upgrades. There are also usually generous room discounts that come with status.

And if you don’t have Hyatt elite status, but you can get the Caesars or M Life status, you can match to their middle tier without having to complete a single stay.

Yay, my newly match Hyatt status

Hyatt Explorist status gets you:

Premium internet

Bottled water

Late checkout and elite check-in

Guaranteed room availability within 72 hours

Bonus American Airlines miles on every paid Hyatt stay, and bonus Hyatt points on every paid American Airlines flight

So nothing too exciting. But if it’s free, why not? Hyatt has some amazing promotions going on right now, so if you can make use of those, you could potentially start out at a higher status from the get-go. Explorist members are also eligible for room upgrades at check-in. You never know on that front – I’ve gotten some nice upgrades as a mid-tier member in the past.

Betting on uncertainty

If this year has taught me anything, it’s to expect the unexpected. I didn’t do these matches to collect random hotel status, but just in case other status match opportunities pop up later. Plus, there might be promotions that convince me to book with a certain chain and it would be nice to have status already if that happens.

Plus, in the case of Caesars and M Life, I’ve found random promotions in my account for cheap rooms. Like really cheap. Combine that with a cheap flight, and you have a recipe for a pretty fun time post-Covid.

I know a lot of people aren’t traveling right now, but when the pandemic is under control, it’ll be nice to have options.

Caesars M Life status match bottom line

I popped in and out (masked) to grab my Caesars Diamond card and then to match to M Life Gold status. You might feel differently about the in-person component of this deal. If you find yourself around an MGM hotel, this is a pretty easy match and unlocks a few different opportunities – including mid-tier Hyatt Explorist status.

Again, it’s niche and the opportunity ends at the end of December 2020, but thought I’d do a quick write-up in case someone finds it helpful. Loving these little opportunities that are popping up.

I’m pleased this post is under 1,000 words. See, I *can* be brief! Hope everyone is having a good holiday season. Stay safe out there.

November 12, 2020

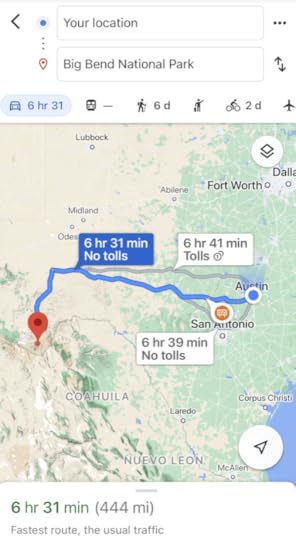

Trip Report: My Texas-sized road trip to Austin, Big Bend National Park & Marfa

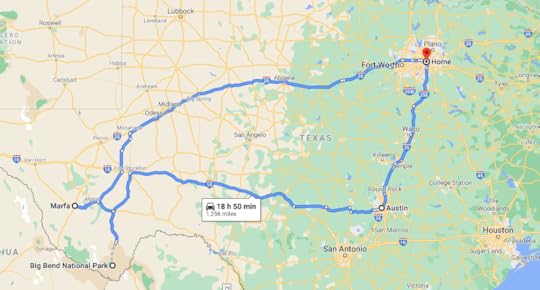

I spent most of last week partying in Austin, hiking in Big Bend National Park, and driving. Lots of driving. I drove over 1,000 miles last week. But let me tell you: West Texas is insanely gorgeous. I had no idea. I kept thinking, “This is Texas?!” as I hiked and drove around the Big Bend area, very much in the middle of nowhere.

I was also able to squeeze in the River Road drive between Lajitas and Presidio (on my way to Marfa), 67 miles of pure twisty mountainous highway considered to be the most scenic drive in Texas and one of the most beautiful in the country.

All the hiking and driving made me feel, at times, that I was perhaps the last person on Earth. It’s such beautiful nature out there. And at night, you can see thousands and millions of stars and glimpses of the Milky Way, which make you feel like you’re on the fringes of the galaxy – which you actually are. Absolutely cosmic.

At the terminus of Lost Mine trail, on the mountains… in Texas!

I wasn’t expecting so many mountains. Or to experience such biodiversity in Big Bend. For example, did you know there are bears in Texas? I sure didn’t. But sure enough, the park is populated with thriving black bears, along with mountain lions, deer, rattlesnakes, and lots of other critters that move between scorched desert to canyon to near-jungle, from cactus flowers to alpines.

Here’s more from the trip.

Big Bend trip report

Austin

I took a week off work to do this trip. Clocked out Friday afternoon, then woke up early Saturday and boogied down to Austin.

I reserved two nights at the Hyatt Place Austin-North Central with Hyatt points for Halloween and the night after. This was purely just for fun. I hadn’t seen my Austin friends in an age and spent two full days brunching, going to the park, and hanging out with them.

I’ve been mostly cooped all for most of the year so I was beyond ready for some socializing. The time flew by, as it does. And then I hopped in my car and drove west – all the way west and a little south, almost to Mexico.

Texas is big

Terlingua

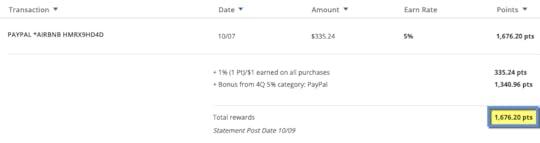

And after driving all day, I found the little cabin I’d rented off Airbnb. For the stay, I paid with my Chase Freedom Flex via PayPal because that’s a 5X bonus category this quarter – so I was able to earn 5X Chase Ultimate Rewards points. Sweet deal!

My adorable Airbnb cabin outside the entrance to Big Bend

The cabin was located about 5 miles outside the West entrance to Big Bend, which was so convenient. And it was only ~10 minutes to the little town of Terlingua, Texas, where there’s a ghost town, a few cute restaurants, and… not much else.

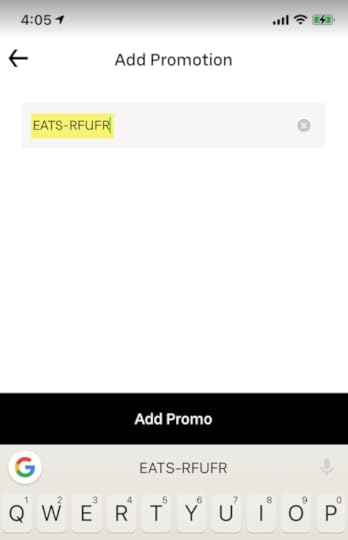

Free Food! Get $20 off your first meal with Uber Eats promo code “EATS-RFUFR”

Sharing an easy win for $20 off $25+ a meal with this Uber Eats promo code: “EATS-RFUFR”

Easy $20 discount with Uber Eats

If you’re in a city where UberEATS participates (and there are many – here’s the full list), you can get $20 off your first $25+ order when you use an existing user’s promo code after you download the app for iOS or Android.

It only takes a few minutes and you can get a nice discount out of it. I’ll show you how easy it is.

$20 off Uber Eats promo code

Link: Uber Eats

Uber partners with restaurants in major cities all around the US and Canada (and around the world). Here’s a very abbreviated list:

Atlanta

Austin

Brooklyn

Chicago

Dallas

Edmonton

Houston

London

Los Angeles

Melbourne

Miami

New York

Ottawa

Paris

Phoenix

San Diego

San Francisco

Seattle

Singapore

Toronto

Washington, D.C.

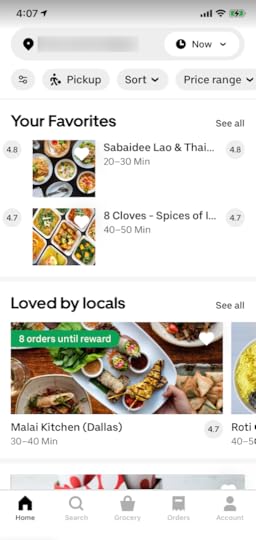

An Uber driver will deliver the restaurant’s food to you after you order via the app. To make it interesting, they rotate the selection every so often, so there’s always something new to try.

Come to meeee

And in my city of Dallas, there’s always a selection of restaurants with a $0 or $1 delivery fee – and it changes every five minutes.

You can only order through the Uber Eats app (not on the website) – so you need a smartphone to access the service (and live in a participating city).

Free food!

Now for the fun part. You can get $20 off your first order of $25+ – and you can use it toward the delivery fee (if there is one).

After downloading the app, click the “Account” tab and enter an existing user’s promo code where it says “Promotions.” Mine is “EATS-RFUFR” if you want to use it. This will give you $20 to use toward your first order of $25 or more. You should see it automatically listed after you enter it.

Enter in the promo code under the “Account” tab

Now you’re ready to start browsing the food options.

Om nom nom

Select whatever you want.

You can use the $20 toward the $25+ worth of food.

Once you find something you wanna gobble, hit “Place Order” and get ready to chow down.

You can share your promo code with others, too. Then they can get free food and so can you.

Bottom line

This should make for a nice lunch break.

I do not know if this promotion is in limited quantities, or if it has an expiration date.

So if you’re interested, I’d go ahead and download the Uber Eats app and apply a promotion code sooner rather than later. As a reminder, my code is “EATS-RFUFR” – that’ll give you $20 to spend toward $25+ worth of food. You can apply it toward taxes and the delivery fee, too.

Uber Eats purchases code as “restaurants,” so your best bet is to use a card that includes dining as a bonus category, like the Chase Sapphire Preferred or Wells Fargo Propel. And if you have Uber credits through the Amex Platinum Card, this promotion will stack with that as well.

Share with your inner circle to keep the free food coming in.

Remember to tip though!

Have you had an experience with Uber Eats?

October 23, 2020

A Bounce Back to a ~$150K Best-Ever Net Worth – October 2020 Freedom Update

Last month sure felt dismal. Felt like throwing money into a fire pit, like I wasn’t catching up to my effort. There have been so many ups and down this year that I should’ve known better. But sometimes doubt gets the best of us and it’s hard to keep riding the wave.

October was much better. I am putting 30% of my paychecks into my 401k and aggressively paying down my credit cards. As of this month, I only have $3,000 to go! I’m challenging myself to pay them off completely by the end of 2020.

So I’m saving heavily and getting into excellent financial shape – as of right now, the best of my entire life. My net worth is currently $148,641. That’s 30% of the way toward my $500,000 goal!

I hope the next couple of months treat me as favorably, though that might be tough with the election coming up in a couple of weeks. We will see how the stock market reacts. I kind of expect it to dip, no matter the outcome.

Sign o’ the times

But I’m keeping myself occupied. Working, writing, talking to friends. Looking forward to my Big Bend trip next weekend. Being present has emerged as a major theme for me lately. That and connection.

October 2020 Freedom Update

When I wrote the last Freedom update post, I was going through it.

Big ouch

See that arrow in the picture? I was down there. Then last week I briefly hit over $150,000 net worth. That was pretty cool. But the next day, the market fell again and I’ve been at ~$149,000, give or take. Which is still great. It’s the highest net worth I’ve ever had.

I’ll likely leave Dallas in the next few months, and would love to preserve my $30,000 savings. Hitting $250,000 net worth is going to feel so good. That’s 50% of my target – and I just hit 30%. It’s starting to look like my goal is attainable. Net worth might fluctuate depending on if I buy another house or not wherever I land.

I’ve tentatively been looking at relocating to Knoxville, TN.

Booked: A Texas Road Trip to Austin & Big Bend National Park

I don’t post industry news – and as most of the world remains closed to Americans, I’ve withdrawn inward. Instead of planes, I’ve found solace in my car during the pandemic. My last trip was to Arkansas, and that was back in July.

I’ve been mostly shut-in, but am venturing out again, feeling more empowered and eager to explore. A wandering soul needs to wander.

My next trip is to Big Bend National Park via Austin at the end of this month. Two nights in Austin at the Hyatt Place Austin-North Central, then three nights in Terlingua, TX at this cute Airbnb cabin outside the entrance to Big Bend. Then back to Dallas through Midland and Abilene.

The lil cabin I booked in Terlingua, TX

I used Hyatt points and a free night credit from my Chase World of Hyatt card for the two nights in Austin, so they were completely free. And paid for the Airbnb with my Chase Freedom Flex via PayPal, which is a 5X Chase Ultimate Rewards points category in Q4 2020.

That Freedom Flex is a beast, I’m tellin’ ya

The only expenses I’ll have on the trip are gas, food, and pet fees at the Hyatt hotel. I’ve been wanting to visit Big Bend for as long as I’ve lived in Texas.

I took election week off to spend in nature and take a break from all the media and craziness. Coincidentally, I’ll be in Big Bend for Day of the Dead this year.

Texas road trip 2020

It’s also sort of my goodbye to Texas. My lease expires in February 2021 and I don’t plan to renew it. I don’t know where I’ll go, but I think I’m done here. I have no idea what that means for my FIRE journey, but I’ll figure it out. A wandering soul needs to wander.

I also want to get to Palo Duro Canyon in my final months in Dallas and by extension, Texas.

To jumpstart my travels (which will probably be domestic), I got an America the Beautiful Parks Pass, which, for only $80, gets you access to every national park and many state parks across the country for a full year. It costs $30 to access Big Bend for one week. So I figured I’d rather have full access to every park – using it two or three times would fully cover the cost. Plus when you buy from REI, they’ll donate 10% to the National Park Foundation.

Can’t wait to break in this bad boy

Like many, I’m turning to outdoor exploration to satisfy my travel whims. And relying on my car to get me around. Good ol’ Nissan Versa Note.

Saturnalia

In a broader sense, reflecting on lots of stuff and wondering what it is I really want to do with this one wild and precious life. I’ve been looking for my why. It’s a big ask!

This will be mental fodder as I drive for hours and hours.

A road trip the size of Texas