Harlan Vaughn's Blog, page 10

September 23, 2020

Down $4,000 & feeling nervous this month – September 2020 Freedom Update

September is drifting past; Virgo season is over. Summer grass to fall leaves. I feel like I’ve been plugging away – and then I look at the numbers and I’ve actually slipped.

This month, I’m reminding myself that progress is slow and steady and every month won’t have big eye-popping gains. Plus, I’m getting three paychecks in October and anticipate that will help me get caught up. As cash-heavy as I’ve been, this month my stocks took a tumble.

Life was simple in September. It’s OK to feel stuck sometimes

I napped a lot. Continued meditating. Being so heavily invested in the stock market, I feel the fluctuations even more – especially now that I don’t own real estate any more.

And several things caught up with me: a big Costco run, a higher than expected phone bill, and a few nights out with friends now that restaurants are slowly re-opening here in Dallas. So while there wasn’t a lot of growth, I used money for the here-and-now.

With the election so close and headline news affecting the stock market, I didn’t realize any gains. But I’m still putting away 30% of my paycheck into my 401k and getting stocks at a discount. I do wish I’d saved more pure cash, though. That’s why these reflections are so helpful for planning each month.

September 2020 Freedom Update

I’m actually really nervous about the election this year. I’m certainly seeing the stock market react to the constant news cycles. Getting through October is going to require all of my ability. I’m having a hard time reconciling reality from news, and it’s kind of affecting me mentally. So there’s that going on.

But as mentioned, I’ll be getting three paychecks, so I can use two of them to:

Pay down credit cards

Make an additional auto loan payment

Add some cash to savings

I should have an extra $3,000 to work with next month, so that’ll be my focus. I’ll also be adding $3,000 more to my 401k. It’s a bummer though, when you add money to your account and the next day, you’ve already lost some of it. :/

I tell myself: keep plugging away, plugging away. That’ll be my mantra in October.

Side note, is anyone else starting to feel nervous about all the news and November? It’s just this low-level anxiousness running at a baseline all the time these days.

Action items: make gains where possible

Ideally with my money next month, I’ll:

Pay $1,000 toward credit cards

Pay $1,000 toward auto loan

Save $1,000 in “high-yield” savings

Pay rent

And of course, I’ve got my 401k on auto-pay.

Guhhhh

Despite my efforts, market losses make progress seem… less impressive.

And of course, the stuff of like kept on coming. I allowed myself to shop and dine and splurge a little more than usual this month. I guess I figured, if it makes me happy now, go for it. Spending to make things feel better in the moment. Also the way my checks were timed this month was just really funky.

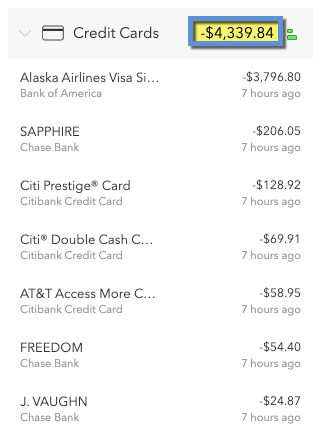

Note: that card with a ~$3,800 balance has a 0% APR until September 2021. So I’m not paying interest even though I’m carrying the balance – and still have a year to pay it off. The others I’ll pay off with my next check in early October.

Other losses

That feeling when you add $1,000 to your investments… and the next day it’s already worth less than that. And then having it lose more value all month. It doesn’t feel great.

I can’t with this year

On September 2, I had ~$114,000 across all my accounts. On September 4 and 18, I added $1,000 each day.

And now, on the 23rd, my overall accounts are at ~$106,000. Aside from keeping head above water financially, I was kinda hoping my stocks would grow, or at least stay the same. I was hoping this would be progress I could measure in the other direction.

Oh god, what’s October gonna be like?

And I don’t expect October to be better. Which is why I’m planning to make gains and increase net worth by paying down debt and saving cash.

I thought for a split second about changing my 401k allocation to 20% to help with this, but then decided… nah. I’m gonna stay the course. Between my 401k, IRA, and what I put into savings, I’m actually saving 40% to 50% of my overall income these days.

At 36, I’m making up for lost time AND trying to get ahead, so that feels like a good level for me now. The dream would be to nudge that closer to a 60% savings rate, but like I said: keep plugging away. Get that debt eliminated, a little at a time.

By the numbers

Let me say, it stung to turn some of those positives into negatives in the table below. I also see stagnation here, what with no progress on my car loan and very little cash saved.

BUT.

I also see several of my goals marked COMPLETE and realize that over the course of this year, I’ve actually come very far. I really do think this was just a funky month. Trying to find the positives here – there really are a lot when I think of it that way.

That’ll do

Plus, I’m still up ~$40,000 from when I started tracking in November 2019.

CurrentLast monthChangeGoal

Credit cards$4,340$3,853+$487$0

Mortgage$0$0xx$0COMPLETE!

Car$3,888$3,888xx$0

Roth IRA 2019$6,000$6,000xx$6,000COMPLETE!

Roth IRA 2020$6,000$6,000xx$6,000COMPLETE!

401k $18,772$17,206+$1,566As much as possible

Overall investments$106,058$108,491-$2,433As much as possible

Savings$30,126$30,101+$125$20,000COMPLETE!

Net worth in Personal Capital $137,993$141,954-$3,961$500,000 Track your net worth with Personal Capital

Something about seeing it all in black and white is always such a rush/thrill/letdown. But there it is in cold daylight. And as they say: numbers never lie.

September 2020 Freedom update bottom line

This month finds my numbers down, but not for lack of trying. Is it a national mood? Is it just me? Did I try hard enough?

If the news and politics continue to impact the stock market, I don’t see myself making gains though I’ll continue to contribute 30% of my paycheck – three times in October!

Instead, I’ll focus on adding to the bottom line and boost net worth by paying off balances and saving cash.

I do have this sort of lingering nervousness about the election and all that. Paying attention doesn’t help. Neither does ignoring it.

So I’m just gonna keep my head down and keep plugging away.

Did anyone else have a tough month on the financial front? Are you feeling stressy because of the news? Best I can tell, there’s no shaking the feeling. We just have to let it pass – like weather. I’ll take these notes and use them to plan for a stronger report next month.

Take care and be safe out there. Thank you for reading!

Just for a smile

September 18, 2020

Chase Freedom Flex Vs Freedom Unlimited: Which Is Better for Your Spending?

Chase has 2 great no annual fee cards that pair nicely with premium Ultimate Rewards cards: Freedom Flex and Freedom Unlimited.

The Freedom Flex card earns 5X Chase Ultimate Rewards points in rotating quarterly categories on up to $1,500 per quarter in combined spending. The Freedom Unlimited earns 1.5X Chase Ultimate Rewards points on all purchases with no cap.

Really gonna depend on bonus categories and how much you typically spend

Lots of peeps ask which is better. To which I always answer: it depends on how much you like the bonus categories. But there’s a longer answer beyond that: how much to you plan to spend on the card each year?

Let’s talk about the break even point and which is better for your finances.

Chase Freedom Flex Vs Freedom Unlimited

The most important thing to know about the Freedom Flex card is the bonus categories. They rotate every 3 months. And you can earn 5X points on up to $1,500 in spending per quarter across all the categories, when you activate the bonus.

So the question becomes: are the bonus categories useful to you?

Freedom Flex has 5X bonus categories

Link: Chase Freedom Flex

Chase Freedom Flex 20,000 Chase Ultimate Rewards points

• That's worth $200 in cashback rewards

• That's worth $200 in cashback rewards• You'll also earn 5% cashback on grocery store purchases (not including Target or Walmart) on up to $12,000 spent in the first year

• $0 annual fee• $500 on purchases in the first 3 months from account opening

• Excellent rotating 5X categories every quarter

• A great first Chase card• Compare it here

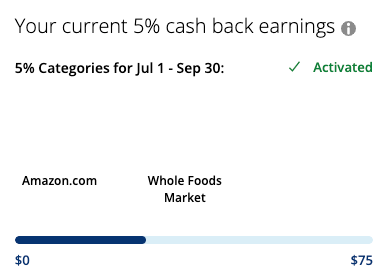

In 2020, Q3 bonus categories were Whole Foods and Amazon. For Q4, they will be Walmart and PayPal.

At Whole Foods, I got 5X last quarter look forward to Q4 for PayPal especially

I took advantage of Q3 by using my Freedom Flex for weekly groceries and for all my Amazon purchases. But – I typically shop at Whole Foods because they have the best produce and their prices are actually comparable to Kroger in my area (Dallas).

I’m a staunch fan of the Freedom cards and the word staunch

Next quarter, I’ll focus on PayPal to check out for online shopping whenever possible.

Chase makes it easy to track your 5X spending

We don’t know what 2021 categories will be yet, but past quarters have included:

Gas stations

Grocery stores

Amazon

Walmart

Department stores

Wholesale clubs

Commuter transportation

Movie theaters

So you never know what’ll pop up! If you spend the full $1,500 each quarter ($500 per month) and activate the bonus, you’d earn 7,500 Chase Ultimate Rewards points (or $75 cashback).

That’s 30,000 Chase Ultimate Rewards points (or $300 cashback) per year. Not a bad return for a card with no annual fee.

The rest

Beyond that, you earn:

5X Chase Ultimate Rewards points on travel booked through Chase

3X Chase Ultimate Rewards points on dining at restaurants

3X Chase Ultimate Rewards points at drugstores

1X Chase Ultimate Rewards points on all other purchases

Earn 3X Chase points on the margarita of your dreams

When you pair the Freedom Flex with a premium Chase card that allows transfers to travel partners (Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred), you can combine all your points – and then book award flights and hotel nights.

This coverage is lackluster compared to other premium cards

I personally wouldn’t book travel through Chase with this card if you have a card that offers better travel protection. If you don’t, then definitely use this one! This is especially true for car rentals. Other cards offer primary rental insurance. This one offers secondary insurance in the US but primary coverage overseas. And booking hotel rooms through a travel portal typically disqualifies you from earning elite status credit and getting elite status benefits – so I wouldn’t book hotels through Chase.

But for dining and drugstores – this card is an easy win! Especially considering there’s NO annual fee. While I’d love to see a category for groceries and/or gas, the bonus categories here are strong and broad enough to keep this card in your wallet full-time – and moreso when there’s a good 5X quarterly bonus category.

Freedom Flex is a World Elite MasterCard

Kinda cool, but Freedom Flex is a World Elite MasterCard. That means you can NOT use it at Costco stores, but can take advantage of other benefits, like:

Ability to make mortgage and car payments via Plastiq (although the new fee makes it usually not worthwhile)

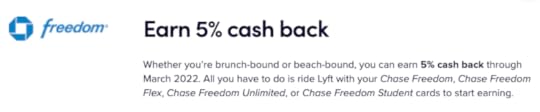

$10 Lyft credit per month for five rides taken in a calendar month

5% rewards at Boxed.com

Free ShopRunner membership for two-day free shipping at many retailers

Cell phone insurance, up to $800 per claim/$1,000 per year in protection from theft or damage when you use the card to pay your bill

Stack stack

I love the Lyft benefit, especially because you can stack it with a promotion to earn 5X points on Lyft rides through March 2022! To be clear, the 5X offer is available on the Freedom Unlimited too, but you wouldn’t get the benefit of the $10 monthly credit from having a World Elite MasterCard.

So these things are minor, but nice to have with a no-annual-fee card.

Freedom Unlimited requires NO thinking

Link: Chase Freedom Unlimited

Chase Freedom Unlimited • $200 bonus (20,000 Chase Ultimate Rewards points)

• 5% cashback on grocery store purchases (not including Target or Walmart) on up to $12,000 spent in the first year

• Spend $500 on purchases in your first three months of account opening

• Spend $500 on purchases in your first three months of account opening• $0 annual feeAfter, earn unlimited 1.5% cashback on all purchases

• Great for everyday spending• Compare it here

This cards earns 1.5X on all purchases. Full stop – that’s it.

If you don’t want to think about bonus categories or activating them, this card might be the way to go.

If you spend more than $20K a year in non-bonus categories, the Freedom Unlimited is better

But if you’re torn whether to get this one or the Freedom Flex, the number to know is $20,000.

That’s how much you’d need to spend to earn 30,000 Chase Ultimate Rewards points with this card ($20,000 X 1.5). And 30,000 points is how many you’d earn if you fully maxed out the Freedom Flex bonus categories every quarter.

It sounds like a lot. But it divides out to ~$1,667 per month in spending.

If you’re using the card for everything, it’s fairly easy to hit that target. Although I personally use other cards for bonus categories and my Blue Business Plus Amex for non-bonus spending.

Realistically, I wouldn’t use the card for that much spending. But you might – especially if it’s your first or only card.

The rest

Like the Freedom Flex, this card also earns:

5X Chase Ultimate Rewards points on travel booked through Chase

3X Chase Ultimate Rewards points on dining at restaurants

3X Chase Ultimate Rewards points at drugstores

And I have the same notes and observations as stated above.

Chase Freedom Flex Vs Freedom Unlimited: which is better for you?

To earn 30,000 Chase Ultimate Rewards points, you’d need to spend:

$6,000 per year with Freedom Flex ($6,000 X 5), or $500 per month

$20,000 per year with Freedom Unlimited (20,000 X 1.5), or ~$1,667 per month

If you like Freedom Flex bonus categories, you get a lot more points for much less spending.

And if you spend a decent amount per month and don’t want to think about bonus categories, go for the Freedom Unlimited.

For this reason, I tell most of my friends to spring for the Freedom Flex. Chase makes it easy to activate the bonus and track your purchases. Plus, when you’re ready, you’ll have a nice stash of Ultimate Rewards points to pair with another card. And that unlocks the ability to transfer your points 1:1 to Chase’s outstanding travel partners, like Southwest, Hyatt, and British Airways (all personal faves).

Pair Chase cards to earn even more points

The Freedom Flex is a good starter card for that reason. Whereas if you had the Freedom Unlimited, you’d have to spend a lot more to earn as many points.

Because the regular bonus categories are the same, the other big distinction is: do you want to earn 1X or 1.5X points per $1 spent? With Freedom Flex, you earn 1X point outside of the quarterly categories. And with Freedom Unlimited, that 1.5X points earning is… unlimited.

So, quarterly 5X categories – yes or no? And 1X or 1.5X points on regular spending?

If cashback is your goal, choose neither

Link: Compare multiple cashback cards

Both cards are advertised as cashback cards. But their power lies in pairing them with another Chase card to access travel partners. Which, yes, requires you to get another Chase card. It’s a good points ecosystem to get associated with.

Some peeps don’t want 2 cards or to think about combining points and transferring them. And for them, I’d say there are better cashback cards if you’re not interested in pairing.

And multiple 2% cashback cards are better than Freedom Unlimited’s 1.5%.

Both cards are part of a long-term strategy

The Freedom Flex and Freedom Unlimited cards are stepping stones toward a bigger points strategy: that you’ll eventually pair them with a premium Ultimate Rewards card.

And both are an excellent place if you want to:

Ease into the world of miles & points

Avoid annual fees

Earn rewards on all your spending

Build your credit profile

Begin a relationship with Chase

Chase Freedom Flex is one of my oldest cards. And I’ll keep it forever

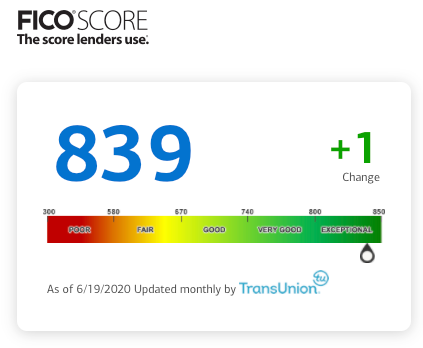

I’ve had my Chase Freedom for 18+ years by now. And I’ll keep it forever because it has no annual fee. It’s literally a free way to age all the other accounts on my credit profile, which helps boost my credit score.

These cards are also relatively easier to get approved for if you have a limited credit profile. Plus, once you have a card with Chase, it gives you leverage for another one in the future.

For all these reasons, either card is a great place to start building your credit and travel goals. Plus, you can always switch from one to the other after a year.

I used Hyatt points to spend 3 nights for free in San Francisco

I use Chase Ultimate Rewards points for free or cheap travel constantly (or I used to pre-Covid, sigh). I spent 3 nights in San Francisco for free thanks to Chase points transferred to Hyatt – which I earned across all my Chase cards. So it’s good to get your points balance growing while starting your other goals at the same time.

Keep in mind, you can NOT get most Chase cards (including these), if you’ve opened 5+ cards in the last 24 months – this is called the 5/24 rule. If you’re starting out, that shouldn’t be an issue. But something to note.

Chase Freedom Flex Vs Freedom Unlimited bottom line

Link: Chase Freedom Flex

Link: Chase Freedom Unlimited

The number to know is $20,000. If you spend more than that per year, the Freedom Unlimited would earn you more points – that’s also assuming you’ll activate and max out Freedom Flex’s bonus categories each quarter.

The Freedom Flex requires much less spending for the most possible bonus points: only $500 per month compared with ~$1,667 on the Freedom Unlimited.

But ultimately, the best one for you depends how much you like the quarterly bonus categories. Typically, they’re super useful and easy to use. Past quarters included grocery stores, Amazon, wholesale clubs, and restaurants.

And both cards should be part of a longer-term goal for credit building or cheap travel. Obviously, both of those are great!

Finally, if your goal is just cashback, choose neither. There are better cashback cards in the world.

Lower spending and a good introduction to points is why I typically steer my friends and family to Chase Freedom Flex. But considering both cards don’t have an annual fee, you really can’t go wrong either way.

Which card do you like better? Do you find Freedom Flex’s bonus categories easy to use?

August 25, 2020

Progress & setbacks, but up $18K anyway – August 2020 Freedom Update

It’s been a weird month. Financially, things have been great. But I’m getting antsy about the next life phase and been doing a lot of “hanging in there” recently.

I had the idea to buy a little house in the Memphis area and move closer to family. But waiting for things to reopen. And keeping an eye on the upcoming election. And hoping to keep my job for a bit longer.

If I can make it through September, October will be a lost month (2020 is already a lost year, so it’s almost moot). There’s going to be so much election stuff that I wonder if anything will get done. And then the results will be explosive no matter what happens. Then holidays. And my lease in Dallas is up in February 2021.

Meditating until 2021

I’m over Dallas. I’m only here to live in an apartment and drive to an office one or two days a week. If anything, this pandemic has shown me what I want – and don’t want.

There’s a lot of wait and see going on from every angle. But time passes, as it does. Despite everything, I’ve been socking funds away for my near- and long-term future. So I’ll be prepared for whatever that might mean for this Freedom journey I put myself on.

And tomorrow’s my birthday. 36 years on planet Earth!

August 6, 2020

5 Easy Ways to Earn Points for Airbnb Stays (Updated 2020)

My friend Meghan asked if I knew of any ways to save on an Airbnb booking. I gave the obvious one – get up to $35 off a booking with a new account.

New to Airbnb? Save $20 off your first $200+ stay, plus get $15 off your first $50+ experience booking

Most everyone has an Airbnb account by now. But if you don’t, here’s my link if you’d like to sign up (and I’ll get a $10 travel credit as well).

That’s honestly the biggest savings. Still, there are other ways to get a return on your Airbnb stay: earn points or miles for it. Depending how you like to redeem them, you can get big value by stacking a few of the methods I’ll tell you about.

Lezz begin, shall ve?

5 ways to earn points and miles for Airbnb stays

These tricks are so easy that you’re literally leaving points on the table if you don’t use them. A couple of them require certain credit cards – but a couple are total freebies.

1. Get 1X Delta miles

Link: Delta + Airbnb

Do I like Delta miles? Not my fave. But I certainly won’t say no to them if it’s as simple as clicking a link.

Earn Delta miles every time you stay with Airbnb

All you have to do is start your booking at the link above.

Considering Delta miles never expire, there’s no reason not to scoop this up. A little here and there can add up over time. And Delta does have some flash sales that are worth a look.

You can transfer Amex Membership Rewards points to Delta instantly at a 1:1 ratio. But it’d be nice if you already have some miles in there so you can save your points for other award flights.

July 25, 2020

What’s your credit card and points strategy these days? (The 3 cards I want now)

I’ve always said, “earn and burn.” Meaning earn your points and miles, then burn them in short order. I keep my points balances low – having 100,000 points is a good enough minimum cushion for me.

Because with that amount, I can get to most places in business class one-way (and to a few in business class round-trip). It’s also enough for me to begin planning a trip. And if I need more, I can start earning what I’ll need. Usually, the easiest way is to open a new credit card.

I’m accumulating points but have no idea how to use them

These days I can earn, but there’s no way to burn. I have a few cards I want, but keep waiting to apply for them. It feels pointless to have a storehouse of points and miles when most places are closed to Americans and there’s uncertainty about when we can travel again.

But my wanderlust is kicking up big time and I know when I’m able, I’ll be off like a rocket.

July 24, 2020

Allbirds: The perfect travel shoes? (Updated 2020)

It’s weird to write about travel shoes in the middle of a pandemic. But I wanted to refresh this article since it’s been up for a while and I have more experience to reflect on.

My first encounter with Allbirds was an article with the kinda clickbait-y title, “The Most Comfortable Shoes in the World.” I rolled my eyes a bit but definitely clicked on it. Because I like to take one pair of shoes with me when I travel: the ones on my feet. So I was curious what had been singled out as “the one.”

Before Allbirds, my go-to was New Balance. They have that appearance of “casual athletic” – and of course the big reflective “N” logo – so I’m comfort-over-style.

For the last three years, I’ve been wearing Allbirds more often than not.

Hanging in my Allbirds

The idea of a comfortable and attractive shoe lured me in. They come in basic colors, they’re $95 a pop, and the founders are committed to design, sustainability, and ethical standards.

What began as a six-month test evolved into a brand preference. And I still get comments about them all the time.

Each pair lasts me ~9 months. I’m on my third or fourth pair by now. Safe to say I’m now a fan.

My Allbirds review, three years later

Link: Get some Allbirds

Firstly, the tops of their most popular shoe (wool runners) are made of wool. That doesn’t mean they’re hot – it means they’re reactive and durable. If you’ve ever hiked in SmartWool socks, it’s a similar idea. The rest is made from all-natural materials.

Material list

I’ve primarily been wearing mine in Texas and can attest to their ability to remain both cool in summer and warm in winter.

A simple, comfortable, logo-free shoe

The colors are neutral and practical. There’s nothing flashy about them. You can wear them with pretty much any outfit. And the heel is thick with plenty of cushion.

Here’s what the heel and bottoms look like

Front profile

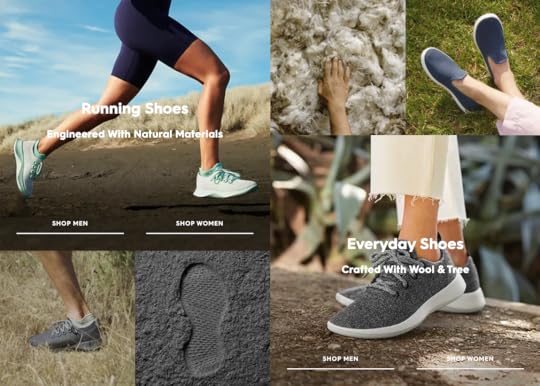

What you see in these pics isn’t their only offering. Allbirds come in a variety of styles, shapes, and colors.

A few of Allbirds’ product lineup

For men and women, you can purchase:

Running shoes (tree dashers)

Everyday sneakers (tree runners and wool runners, which are displayed in this post)

Slip-ons (tree loungers and wool loungers)

Boat shoes (tree skippers)

High tops (tree toppers)

Weather repellent shoes (runner mizzles and runner-up mizzles, which is more of a high top)

They also sell flats for women (tree breezers)

More about Allbirds shoes

Wool runners are your basic day-to-day shoe, with laces. Loungers are slip-on and def have a more casual vibe. The “tree” shoes are made of eucalyptus instead of wool, so they’re even cooler (as in temperature) and more suited for hot weather or athletic use.

I originally ordered a pair of gray runners for my first Allbirds experiment. Three years later, I still order them – although I’ve been tempted by the other styles a time or two. For shoes to wear to work and around town, they are easy to wear and comfortable.

And when I do travel again, I know I can walk miles a day without my feet hurting – like I’ve been able to do before in these shoes.

Forgive the mirror spots, but here’s how Allbirds look as part of an outfit

You can wear them with or without socks. They’re breathable. Water-resistant. And hold up well past the 6-month mark.

Here are a few other resources I consulted before I purchased a pair:

Review: AllBirds Wool Runners (Wired)

There’s a new version of the ‘world’s most comfortable shoes’ that Silicon Valley loves — here’s our verdict (Business Insider)

Allbirds Wool Runners Mini-Review (Pics) (Reddit)

Travel Gear Review: Allbirds – the most comfortable shoes in the world (The Global Couple)

They even ship in a box that uses less cardboard.

Detail down to the shipping box

What I like about them

They’re like walking on a cushiony cloud.

The bottoms are mostly flat, but have little grooves (you can see in pics above. The flatness is good because they don’t track in much dirt from outside. And the wool does great to “repel” the elements.

When I wear them in the rain, I don’t notice water getting down to my socks. I expect it would eventually if you stay out in it for a while but 1.) that sucks and 2.) that’s any shoe. The wool does dry much quicker than what I’m used to, though.

Guess where I was

At this point, I’ve made a lot of memories while wearing a pair of Allbirds, so I’ve formed an emotional attachment to the brand – and it’s a good one to be attached to. I like their corporate ethics and the way they’ve expanded mindfully and responsibly.

They’re the one pair I take on my travels: comfy enough to wear on a plane, walk around new places, and look good throughout. I can’t wait to explore out in the world again.

Allbirds review bottom line

Link: Get a pair of Allbirds

Comfortable shoes were an essential part of my travel experience (and hopefully will be again soon). Until then, I’m staying local.

In the past, when I wore cute shoes I’d get blisters, foot pain, and the feeling of not wanting to walk any more. Which sucks when you’re in a new place (this happened to me in Osaka).

So when I heard about Allbirds In 2017, I spent $95 on a stylish-looking and comfortable pair of wool runners. Since then, they’re my go-to and staple. Easy, no fuss, and they just work.

Points were made

Have you heard of Allbirds? If you have a pair, what do you like about them?

Also see:

Allbirds 6-Month Review: How Are These Travel Shoes Holding Up?

Allbirds Alternative for Guys: Try These Stylish Travel Shoes for Only $40

July 23, 2020

Inventory: The 23 credit cards I currently have – and why

Dang, the last time I did a full credit card inventory was three years ago. Can you believe?

Back then, I had 29 cards. These days I have 23, and currently have my eye on three more (ironically, all cards I’ve had before: Chase Sapphire Preferred, Citi Premier, and US Bank Altitude Reserve).

Of the 29 I had, some I closed, some were discontinued, and others were canceled for me. And I still have a lot of them today. Let’s hop to it!

Recent mainstays

I set up each section with:

Name of card – annual fee amount – # of years I’ve had it – keep or cancel

Amex

I used to be jamming with several Amex cards. But these daze, I’m down to just three. I just can’t with the airline and other goofy credits they used as justification to jack up their annual fees.

I am semi-interested in the Amex Gold card because of its strong category bonuses, but with that $250 annual fee? No thanks.

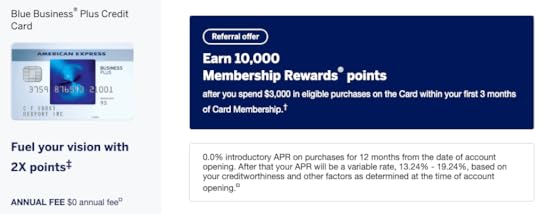

1. Blue Business Plus – $0 – 4 years – Keep

Link: Amex Blue Business Plus 10,000 point offer

No annual fee, 2X Amex Membership Rewards points on up to $50,000 in purchases per calendar year, AND the ability to transfer points to travel partners? Whaaat? This card is an absolute forever keeper.

Plus, thanks to Amex Offers, I actually make money from keeping this card.

What you waiting for?

There’s no official welcome offer, but you can use my referral link to earn 10,000 Amex Membership Rewards points after spending $3,000 on purchases within your first three months. This card doesn’t show up on your personal credit report because it’s a small business card. If you’ve never had it, I highly recommend it.

2. Hilton Aspire – $450 – 4 years – Keep

Link: Hilton Aspire

Amex has kept this card stacked with benefits and has never raised the $450 annual fee since it came out, including:

14X Hilton points on purchases at Hilton

7X Hilton points on flights booked directly with airlines on on Amex Travel

7X Hilton points at US restaurants

3X Hilton points for all other purchases

Up to $250 in Hilton resort credits per year

A free weekend reward night upon renewal each year

Up to $250 in annual airline fee credits

Diamond elite status , which gets you upgrades, free breakfast, bonus points at Hilton, and access to club lounges on every stay

Priority Pass Select membership

Terms Apply

If you like Hilton hotels, this card is an absolute keeper. The annual fee easily pays for itself.

Outside the Hilton Austin a year ago

I prefer Hilton hotels, and will keep this card for as long as the benefits remain this generous.

3. Hilton no annual fee – $0 – 5 years – Keep

Link: Amex Hilton card

I downgraded an old Hilton Surpass to this no annual fee card. It’s basic, but there’s no annual fee so I’ll keep it.

Barclays

4. AAdvantage Aviator no annual fee – $0 – 3 years – Keep

I downgraded my AAdvantage Aviator Red card (which has a $95 annual fee) to this one because there’s no annual fee. Barclays like to keep relationships with customers, so it’s helpful if I ever want another of their cards in the future.

Chase

I currently have eight Chase cards – the most of any bank!

5. Ink Business Preferred – $95 – 2 years – Cancel

I mostly got this card for the stellar welcome offer, but find myself not using it much. Can go in the bin next time the fee is due.

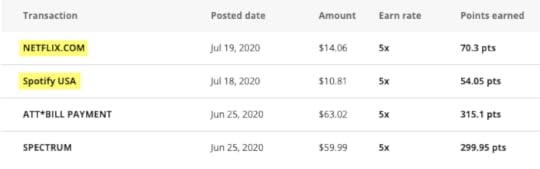

6. Ink Plus – $95 – 6 years – Keep

This card is no longer available to new applicants and offers 5X Chase Ultimate Rewards points on office supply purchases, cable, internet, phone bills, and oddly enough – streaming services.

It’s a bit niche, but 5X for my streaming stuff is nice

I keep it for the bonus categories and also to preserver the ability to transfer my Chase Ultimate Rewards points to travel partners – mostly Hyatt. The airline partners are all a bit crappy tbh.

7. British Airways no annual fee – $0 – 3 years – Likely cancel

Yes, there’s a no fee version of the British Airways card. I was surprised too. When a representative offered it to me, I said sure.

What will mostly likely end up happening is I’ll offer to close this card when I get ready to open a new Chase Sapphire Preferred card, as I don’t think Chase would let me have nine cards. So I’ll keep this one as leverage for that time.

8. Freedom – $0 – 18 years – Keep

My oldest card. I got it when I was 18. And I’ll be 36 next month. Crazy!

This card keeps my accounts aged nicely and my credit score high.

My Chase Freedom helps my AAoA pretty high

Plus, I use the card often thanks to rotating quarterly bonus categories. Which reminds me, I need to activate the bonus for this quarter.

9. Freedom Unlimited – $0 – 8 years – Keep

This was my old Sapphire Preferred, but I downgraded it to this. I use it at Costco and that’s about it – and only because Costco only accepts Visa. It doesn’t get much love otherwise. :/

10. Hyatt (old version) – $75 – 7 years – Keep

I’ve always found a creative use for the Hyatt free night, except for maybe this year. Even if I can’t redeem it because of coronavirus, I’ll hang onto it because:

Coronavirus won’t last forever (right?!)

It’s a slightly older card, so it helps boost my overall credit

I do love Hyatt though, and hope to be back in their hotels soon.

11. IHG Select (old version) – $49 – 5 years – Keep

Same deal at the Hyatt card above. I like the annual free night, but don’t encounter many IHG hotels otherwise.

My IHG stay earlier this month was my first and likely last for a while

12. United Explorer – $95 – 4 years – Keep

I was keeping this card to:

Get more United award space

Use the two lounge passes per year

Keep my United miles alive

Now that I’m not traveling and United miles no longer expire, keeping this card is a bit… dubious.

But like the hotel cards, I’m mostly keeping it out of hope at this point. It would be second on the chopping block after the British Airways card if I do end up canceling. I just paid the annual fee right when coronavirus started bearing down, so I’ll give it until next year to see what happens.

Citi

Now Citi… we love. I use their cards more than any others and have six in total. Their bonus categories, earning structures, and the way the card benefits stack across cards works great for my spending patterns.

Plus, there’s a huge overlap in airline transfer partners with both Chase and Amex. I love my ThankYou points!

13. CitiBusiness AAdvantage Platinum Select – $95 – 3 years? – Cancel

I was keeping this card for the American Airlines benefits. Living in Dallas and having no desire to earn any type of airline elite status, I found myself on American Airlines more often than not.

The enhanced boarding and free checked bag was worthwhile, but I’ll likely cancel when the fee comes due and just get another one later because they’re easy enough to get. Probably from Barclays so I can keep my Citi slots open.

14. AAdvantage MileUp – $0 – 8 years – Keep

Free to have, downgraded from an old AA card. Never use it though. Maybe I should after my recent incident.

My first $100K: How to start investing

You know how bloggers say they started their site because their friends kept asking for pointers? This post on how to start investing is exactly that.

I posted on Insta and Facebook about my first $100K invested in the stock market for my retirement – separate from the cash I’m setting aside.

This milestone happened yesterday! For the first time in my life, seeing six digits when looking at my accounts – finally – was exciting.

It didn’t happen fast for me. But once I buckled down, momentum built and I nearly doubled what I had in just the past year.

This pandemic, horrible as it is, has been an advantage for saving. I’m not traveling any time soon after my weird vacation earlier this month, can’t go to happy hour because bars are closed, and have most meals at home. So my “fun slash going out” and travel budgets are going directly to savings.

If you’re in a similar spot, this is an excellent time to begin investing for your future.

Money Alley is a great place to be

So here’s my mini-guide. Written especially for my friends and those looking for direction.

July 21, 2020

Reminder: Put a charge on all your credit cards every so often (Oops!)

There are a lot of promotions out there right now. Due to coronavirus, many banks added bonus categories to their cards to encourage more use – which is great! The downside is it becomes easy to forget your other cards.

I often recommend downgrading cards with annual fees to their no-fee counterparts to preserve the credit line and history. Older accounts in particular can age your overall credit and lower your utilization rate, which can help your credit score.

But! Because these cards are free to keep, it’s easy to stick ’em in a drawer and forget about them. Like I just did with my US Bank Radisson Rewards Visa.

July 20, 2020

My first vacation during coronavirus was really weird

I had to get out. My last trip was to Cabo San Lucas in early March. So for the July 4 “holiday weekend,” I met my mom and stepdad in Heber Springs, AR. It’s a cute mountain town ~45 minutes north of Little Rock.

We booked two nights at the Holiday Inn Express & Suites Heber Springs. I had plenty of IHG points – and they’re the only pet-friendly place in town for a road trip with the pup.

After being home for 4 months and only leaving to get groceries, I was ready to be anywhere.

What a unique name for a sandy beach

I started out by taking photos of the hotel room as if I was going to do a review and trip report like old times. Well that lasted about two seconds before I realized traveling during this pandemic is just a really weird experience.

From what I saw, about half were taking the virus seriously. And the other half were carrying on like nothing was happening. It was a really strange vibe to reconcile in my mind.

Now that I struck out and traveled, I don’t think I can enjoy trips the way I used to. It wasn’t the same. Maybe I’m not ready for the new normal?

Heber Springs, AR: The site of my first coronavirus vacation

I’m not sure what I was expecting and don’t know if I ultimately have a point. I thought this trip would be different.

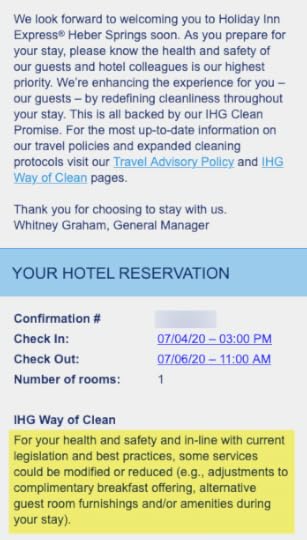

IHG made sure to let me know that when I booked.

So clean.. so clean

They emphasized how clean everything would be and gave me a heads up there probably wasn’t going to be a breakfast. They also emailed their Covid-19 travel advisory policy.

On July 4, I woke up early in Dallas and drove 6 hours to the hotel.

Ouchies Mr. Sun

It was like, really hot in my car. Then was pouring down ran as I got into Heber Springs.

I didn’t take any photos of the check-in experience. I didn’t want to touch anything and then handle my phone without wiping or sanitizing first (phones are among the most bacteria-laden places on the planet). Plus I wasn’t sure what to expect anyway.

For one, this particular hotel took the opportunity to remodel their lobby and dining area during the pandemic – good for them. So there were old, wet carpets rolled up in the outside entrance, slabs of wood and countertop and workers milling about everywhere. Not to mention guests coming and going – most of them without masks.

Make yourself comfortable

I haven’t been out in “the world” since the pandemic started and masks are mandated everywhere in Dallas County lest you risk a fine. So I hadn’t seen anyone maskless in a few months.

Wearing a mask outside has, I guess, become engrained for me. It felt “wrong” somehow being there, breaking quarantine. And I’ve developed this really graphic visualization of particles and droplets flying and spreading everywhere. Has mainstream media gotten to me?

So while processing these thoughts and trying to distance, I looked around and compared this check-in to the entrances of yore when I’d stroll in, photograph the lobby, and not worry about packaged breakfast and droplets and touching surfaces. What a weird new world.

What was different this time

This was one hotel and one experience, but here’s what they had going on and the Holiday Inn Express in rural Arkansas:

Plexiglass on the counter with a small slot at the bottom to pass cards, room keys, and papers – used about half the time

Desk agent alternating between wearing mask and not (below the nose counts as NOT wearing a mask because duh)

No breakfast in the dining room

Breakfast was packaged and had to be consumed in your room

No coffee in the lobby, but you could ask for K-cups

Hand sanitizer mounted to walls throughout the hotel and in elevator area

A few signs recommending social distancing

How did that play out in reality?

Breakfast was a choice of a sausage biscuit, Nutrigrain bar, apple, banana, or orange.

If you wanted the biscuit, you had to microwave it in your room. I don’t eat pork, so I asked for the fruit and a Nutrigrain bar (strawberry or raspberry). It was a sad little spread.

The bananas were a little green and sweating from being refrigerated overnight. And the orange – hard as a little rock. The desk agent used gloves to hand me the items, but then went back to touch other things behind the counter.

Other than that, and some lip service to how clean everything was, it was business as usual. So basically: reduced service, a piece of plexiglass, and some hand sanitizer. Cool cool cool.

People were not taking it seriously

I’d say 80% of the people I saw were not wearing a mask nor making an effort to social distance. I watched several people – not family members – pile into an elevator then motion me in saying there was more room. Not one wearing a mask. I was like… nah.

It seemed like Arkansas had some rule to wear a mask and IHG had initiatives or whatever – but no one wanted to bother with them.

I guess this is new and improved somehow?

As for the “IHG Way of Clean”? I didn’t notice any updates in the room.

Aside from the service things mentioned above, it was like any other hotel stay. The room was a nice size. My dog was fine. There was a pet area with poop bags and a dumpster. I was on the fourth floor and had to use the elevator to take him up and down. But yeah, it was like nothing was different. Same ol’.

View from my room of the sloping foothills in north central Arkansas

What about outside the hotel?

OK so all that was about IHG and what the hotel was doing. The local businesses required masks upon entry. And the restaurants had tables blocked off. But once inside, it was like old times. No one was social distancing. Most servers didn’t bother with masks.

We went to the beach where I spotted nary a mask the entire time. That said, families did a good job of staying distant.

But I think mostly because everyone wants their own little piece of beach – I don’t think it was done consciously for the sake of others, but rather, selfishly to take up as much space as possible.

Me and mama about to walk into a restaurant

Life was going on as usual. I did what I could, but it’s hard to be the only person who cares among a sea of people who don’t.

Darling

We ate at a cute little Mexican restaurant about a mile from the beach.

Forest floor

And I found mushrooms growing in the woods before we watched the July 4 fireworks. When it started to get dark, all the lightning bugs came out and all the cicadas.

A normal week in Mississippi

After two days in Arkansas, I spent a week at home in Mississippi. We went to the farmers market, drove to Tupelo to see my aunt and played bingo, watched live music, went out to dinner, and grilled out between rounds of cornhole, cigars, and bourbon. It was really fun – and really normal.

Mississippi isn’t really “doing” coronavirus, either. And I couldn’t shake the feeling that everything I was doing was somehow wrong when you see all the sanitizer and occasional masks and distancing signs.

On the drive back to Dallas – 500 miles of singing in my car

Nothing had changed. Despite the warnings and news coverage, it was all just another day – except with stimulus payments, unemployment, and a near total ban on international travel. What is going on? I don’t want to stay home forever – but I don’t think I’m ready to leave again, either.

Coronavirus vacation bottom line

I’m having a hard time parsing what’s real and what’s hype. Is the news making coronavirus worse than it is? Are local governments suppressing cases to make it seem better than it is?

Are we being effective? Did I just contribute to normalizing the idea of “ignore it and it will go away” by getting out of town for a while? “They” said it would be OK. We could reopen if we just took a few precautions.

From what I saw and heard, coronavirus is not a concern in the Deep South. There are a few mask-wearers here and there, but people are talking and touching and getting on like everything is fine. And of course, politicizing the situation.

In Dallas, there’s a chaotic energy about the whole thing now that we’re a hot spot. I hadn’t been outside my apartment except to go to work and the grocery store for about four months. Upon emerging, it was the same as ever out in the world. I thought it would be… different. And it wasn’t.

I won’t try to take another trip for a while. I don’t want to fly if everything worth seeing and doing is closed. So while I’m glad I got out of Texas for a bit, I’m also ready to stay in for a while longer even though my wanderlust is bursting at the seams.

And I’m writing off 2020 as a lost year. I’m just going to work and save up money to get closer to FIRE while I still have a job. Maybe 2021 will be better and we can travel freely again.

If you’ve taken a trip recently, how’d your experience compare? Did it feel safe to travel where you went?