Harlan Vaughn's Blog, page 12

February 9, 2020

FoundersCard Review 2020: Benefits, Updates, Cost – And Is It Worth It?

Time to update my FoundersCard review for 2020! I’ve been a member for 6 years by now. Each year, they add more (and more useful) benefits, keep the best ones, and refine their partnerships based on member demand and use.

The upshot is making the most of even ONE perk can outweigh the $395 membership – and the rest is gravy. And when you sign up with my link, your rate will never go up.

I’ve used the 15% AT&T discount, Hilton Gold elite status, and Caesars Total Rewards Diamond elite status (which is back this year through January 2021!) to cover and exceed the membership cost.

And there are new benefits for 2020!

Wow, has it really been 6 years? Just renewed my FoundersCard membership again as a Charter Member and yes that’s a really old picture

Here’s everything to know before you apply for membership.

FoundersCard Review 2020

Link: Apply for FoundersCard

FoundersCard is a membership built for small business owners and entrepreneurs. And the benefits reflect that.

But many of them, particularly travel and lifestyle benefits, would be useful to most peeps. Especially if you’re a frequent traveler.

FoundersCard breaks down their perks into 4 categories:

Travel

Business

Lifestyle

Hotels

You can still get free nights at Atlantis in the Bahamas

Over the years, I’ve saved with from discounts with AT&T, elite status and offers for travel, a cheap trip to the Bahamas, and perks like free magazine subscriptions, free TripIt Pro for a year, access to a free private jet flight, and an event in Dallas with drinks and gifts.

Basically, if you can find 2 or 3 perks that make sense, you can do well with a FoundersCard membership.

With that, here are popular benefits in each category.

1. Travel

Airlines

American – Rotating quarterly benefit. Past quarters included free Platinum or Gold elite status challenges, a percentage off fares, and Business Extra points

British Airways – Up to 10% off most fares between the US/Canada and the UK (this is also a perk of the Chase British Airways card)

Cathay Pacific – 5 to 15% off flights

Emirates – 5% off fares from the US

Etihad – Up to 10% off Business and coach class fares

Qantas – 8% to 25% off fares between the US and Australia/NZ, depending on flight direction

Singapore Airlines – Up to 15% off select flights from the US

United – Up to 6% off select flights booked directly through United.com

If you pay for flights with partner airlines, these are easy savings

I’ve made excellent use of the American Airlines benefits. And saved money on paid flights, earned elite status from free challenges, and bonus Business Extra points (which I redeemed for lounge access again this year).

I help myself to any Admirals Club whenever I fly AA, thanks you Business Extra points earned through FoundersCard promotions throughout the year

These aren’t huge discounts in most cases, but they’re certain nice when you can use them. Especially if you get travel reimbursed or fly those airlines a lot.

Hotels

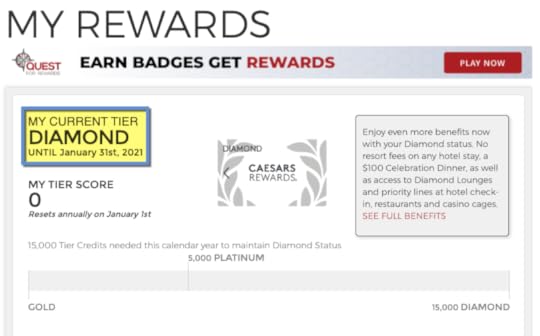

Caesars – Free Diamond elite status through January 2021 (waived resort fees on any hotel stay, VIP lines, $100 Celebration dinner, 20% off select room rates, free parking at most hotels)

Hilton – Free Gold elite status through March 2021 (free breakfast, upgrades when available, late check-out, 25% extra points on paid rates)

Marriott Bonvoy – Platinum elite status challenge – stay 15 nights with 3 months of enrolling in the challenge, get Platinum elite status for up to one year

Omni – Free Select Guess Platinum status (upgrades, late check-out, double credit toward free nights, free water nightly)

Hilton Gold elite status is the best of all chain hotels for free breakfast

I love Hilton Gold status for the free breakfast. And if you stay at Hilton hotels often, you can get:

Bonus points

Free breakfast

Late checkout

Room upgrades

Possible lounge access, if you score a Club floor room

Caesars Diamond is back for 2020

This year, Caesars Total Rewards Diamond elite status is back, which gets you:

4 free nights at the Atlantis hotel in the Bahamas

$100 celebration dinner

Tier status match to Wyndham Diamond elite status

NO resort fees

15% off best available room rates

Occasional free nights at Caesars hotels

If you like Caesars hotels, FoundersCard membership can pay for itself with one trip to Vegas

And when you go to Caesars casinos, you can skip most lines – and you never pay resort fees. In places like Las Vegas, that can save you a ton of time and money. Plus, if you like Wyndham hotels, you can match your status to top-tier elite status with them.

If you stay at Wyndham hotels, you can check in as a Diamond member there, too

I’ve always found a fun way to use my Caesars status, whether it’s just popping into one of their hotels for a free dinner, or trying my luck getting into the lounges.

Rolling up to the Horseshoe Tunica with my Total Rewards Diamond elite status

It’s not guaranteed to work any more, and you may have to pay. But if they’re slow, they might just let you in. Never hurts to try – I’ve gotten in a time or two.

This is by far one of FoundersCard’s most popular perks

Car rentals

Avis – Free Avis Preferred Plus Membership and up to 25% off rentals

Getaround – $50 off your firs rental

Groundlink – $30 credit and 15% off all rides

Hertz – Free Gold Plus Rewards or FIVE STAR membership and rental discounts up to 20%

Silvercar – 20% off rentals (this discounts also comes with the Chase Sapphire Reserve card)

Sixt – Platinum status and 15% off rentals

Save on your car rentals and get status that lets you walk right to a car and drive away

Again, these are all perks of certain cards. I usually rent through Priceline/Costco/Chase Ultimate Rewards. But it’s worth checking every time for the best deal (and I always do – I sometimes find cheaper rates with Hertz status than I find anywhere else, FWIW).

Other travel savings

Couple extra lil bennies.

ZipCar – Waived setup fees for small business owners, $20 toward your first drive, and 20% off standard rates Monday through Friday

TripIt Pro – Free year of Pro, then $39 annual rate for three years

TripIt Pro has become a must for me

I had a Zipcar membership when I lived in New York and loved saving on the initiation fees. Plus you get $20 in credit and 20% off during the week.

I’m also gotten hooked on TripIt Pro. It’s become part of my travel organization and flow thanks to alerts for gate changes, delays, and connecting flights – often before the airline itself will ping you.

There are a few other extras, like 15% off with Carey (a chauffeur service), and $100 off a Sanctifly membership to work out at/near airports. They’ve done a good job adding new travel perks this past year!

2. Business

Shipping, phones, and data backup

AT&T – 15% off most voice and data plans $30+, not including unlimited voice and iPad plans

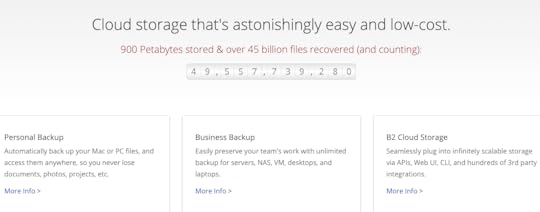

Backblaze – 20% off 1- or 2-year subscriptions (something like this is a MUST for small businesses, or anyone with a computer – I personally use Backblaze!)

Phone.com – 1 free year

UPS – Big discounts on shipping (up to 47% off)

If you don’t already back up your computers, you need a service like Backblaze (which is what I use)

Promotion and documentation

MOO – 20% off business printing

Constant Contact – 15% off marketing tools and emails and a 60-day free trial

Shopify – 20% off for a year after a 14-day trial, to have your own e-shop

LegalZoom – 20% off (I’ve used this a few times)

BizFilings – 25% off services

Harvest – 15% off

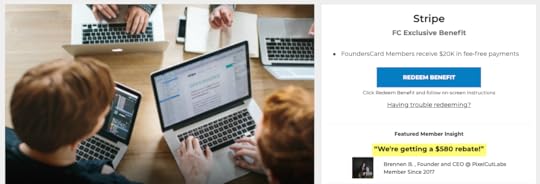

Stripe – $20,000 in fee-free payments (!!!)

Salesforce – Free 14-day trial and 50% off first annual subscription of Essentials

Hubspot – 30% off software and a free CRM

Crowdspring – $124 off a service, which is a $25 discount and free Advanced Promotion Package ($99 value)

Save on promotional materials, email services, and business filings – indispensable. And the Stripe $20K deal is pretty sweet

I’ve personally used these combined discounts several times. It really does add up. I’ve incorporated LLCs, written a will, and gotten business cards for the blog with the participating companies.

And the $20K in fee-free Stripe payments can pay for a FoundersCard membership all on its own, considering the fee is 2.9% + 30 cents per transaction. On $20,000 in payments, that’s $580 saved – at least.

Other business savings

Dell – Up to 40% off Dell branded products

Lenovo – Up to 40% off select Lenovo and Think products

Apple – Preferred Business relationship pricing, based on your annual spending for your business

Office Depot – Preferred pricing up to 55% off in-store and online, and free next-day shipping of orders of $50+

I’ve got unexpected heavy usage from FoundersCard’s business discounts

These are all geared toward building your small business. In that sense, saving cash definitely helps the bottom line.

You’ll find most of the discounts and offers in the business category – and there are lots more. You can poke around with a preview to see them all.

3. Lifestyle

There are lots of discounts in this category, too:

Mr Porter – $200 off your first $500+ order, free next-day shipping

Entrepreneur magazine – Free 1-year subscription

Inc. magazine – Free 1-year subscription

Dollar Shave Club – $18 in credits toward a razor subscription

Adidas.com – 30% off most items

Rent the Runway – 20% off

Spafinder Wellness 365 – 15% off gift certificates

ShopRunner – Free membership (although this comes with many credit cards, including all Amex personal cards and some Citi cards)

SXSW – Preferred badge pricing

Bliss Spa – 20% off select treatments

Many gyms, including Crunch, Equinox, and SoulCycle – Preferred rates

Big savings on SXSW passes this year

Most of them are for online shopping at upscale clothing stores. But there’s also gyms, spas, flower shops, coffee, and lots more (68 lifestyle benefits currently).

The lifestyle benefits are full of savings on gym memberships, clothes, and much more

I’ve used them here and there (like Dollar Shave Club and a gym membership). And the free magazines were handy to toss in a bag to read during a flight or layover.

Everything here is a “nice to have” – not crucial, but a fun extra. And again, it adds up if you shop often at a few of the merchants.

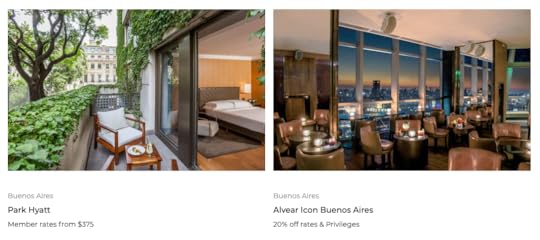

4. Hotels

FoundersCard has relationships with hotel chains and independent/boutique hotels around the world. At 300+ hotels, can get:

Exclusive members-only rates

Upgrades and extra perks

More flexible cancellation policies

No travel agent/booking fees

For example, at certain Marriott hotels, perks include:

Complimentary welcome drinks

More flexible cancellation privileges

Spa discounts

Free breakfast

Discounts off the standard room rate

You get similar treatment at Park Hyatt hotels – although the specific perks are unique to each hotel.

Even better, you can book directly. So you’ll still earn credit toward elite status and enjoy your elite status benefits. The caveat is that only:

16 Marriott hotels participate (9 W hotels and 7 Ritz-Carlton hotels)

5 Park Hyatts participate

15 Omni hotels participate

But there are many boutique hotels, including NoMad, Standard High Line, Ace, and YOTEL in NYC. And lots all over the world.

It’s aight

While this is a cool benefit, it’s certainly not all-encompassing. But if you have paid cash stays in a FoundersCard hotel city, you can get a few extras at places that don’t partner with Amex or Chase and their respective upscale hotel programs (Fine Hotels & Resorts and Luxury Hotel Collection).

The selection in Buenos Aires leaves a lot to be desired

I ran a search in Buenos Aires and turned up 2 hotels in the FoundersCard program. New York has 16. Hong Kong has 4. Tokyo has 3.

I don’t consider this a huge money-saver as it’s so limited, but nice to have in your back pocket. And worth checking the prices for paid stays at upscale hotels.

What’s it all worth?

As of writing, FoundersCard is $395 a year with waived initiation fees for Out and Out readers.

If you can make good use of 2 or 3 benefits, it can easily save you that much – and often more.

FoundersCard has a Chrome extension so you won’t miss savings online

For example, my AT&T phone bill is ~$110 per month for 2 lines. I save $15 per month with the FoundersCard discount (applied before taxes). That’s $180 saved per year on something I need anyway – and brings the net cost of membership down to $215.

I have easily saved that much with the:

TripIt Pro discount (free for a year, then $10 cheaper for 3 years)

American Airlines lounge membership from FoundersCard promotions for Business Extra points (I go in all the time for snacks and drinks)

LegalZoom 20% discount ($50+ in savings)

Total Rewards Diamond elite status with $100 Celebration dinner and trip to the Bahamas (huge discounts with this perk alone)

Dollar Shave Club credits ($18 to start)

Backblaze cloud backup for my computer

Also, if you value hotel elite status, you can get Gold elite status with Hilton.

FoundersCard has become an invaluable part of my life, travels, and blogging business

The airfare discounts are also handy to save, if you fly those airlines often.

Using the deals = savings, not using them = not saving

It’s easy to completely cover the cost of the annual membership. But the real value is when you can use the benefits. If you do, you come out way ahead – $1,000s ahead, in some cases.

And if you don’t find the discounts useful, then skip it.

February 3, 2020

Booked: How I used points to save $2,000+ on five days at FinCon 2020

Dang, conferences are expensive these days! Especially if you’re paying for it yourself and not getting reimbursed from a job. But FinCon is one I’m happy to self-finance.

I’m genuinely interested in the content, meeting like-minded peeps, and immersing myself in a world of ideas about money. Now that I’m FIRE-ing up my efforts more than ever and missed last year in DC, I simply had to go. But I didn’t want to pay the piper.

So I burned a batch of old Marriott points for a five-night stay only four minutes from the conference hall, plus a few Amex Membership Rewards points. And used Citi ThankYou points and statement credits to fly there and back. The only thing I’ll pay for is food, rideshares to/from the airports, and dog boarding.

Booked: Four all-inclusive nights in Cabo worth $2,600 for $202 + 145K points (1.8 cpp)

For the third year in a row, I’m heading to a Hyatt all-inclusive vacation in Mexico with an old friend from Chicago. The past two years, we’ve gone to the Hyatt Ziva Puerto Vallarta.

This year, we’re switching it up and visiting the Hyatt Ziva Los Cabos! I’ve never been to Cabo – and a look at all the restaurants at the hotel was all the convincing I needed.

We could’ve booked PVR again – it all lined up with points – but said nah, let’s visit a new property. After this trip, I will have been to all the Hyatt all-inclusives in Mexico with the exception of the Hyatt Ziva Cancun. And if it’s anything like the past two years, it’s going to be an amazing beach chill-out.

Y’all know I can’t pay out-of-pocket for this rn

But I have aggressive financial goals to raise my net worth to $500,000 in the next five years. So there was no way I’d remotely consider paying for this experience.

Instead, I used my points arsenal for flights on Alaska, American, Southwest, and United – and the Hyatt stay itself – with help from Chase Ultimate Rewards points and Amex Membership Rewards points.

Here’s how I saved $2,637 and paid a cool $202 out-of-pocket. A much better price!

Los Cabos with points 2020

Here’s the puzzle I’ve encountered three years running:

Get one person from Dallas and one from Chicago

To the same airport within an hour or so

With a return flight within an hour or so

For an all-inclusive hotel stay

That are ALL available with points

And happen to line up with a weekend to maximize days off

In a two-week span of late February to early March

It requires all my spreadsheet and points acumen to cobble together.

Hyatt has all-inclusives in:

Cancun (Zilara and Ziva)

Los Cabos (Ziva)

Puerto Vallarta (Ziva)

Zilara is adults-only and 25,000 points a night, and Ziva is family-friendly and 20,000 points a night. The Ziva I’ve stayed has been amazing – I haven’t even really noticed the kids.

Can’t wait to see how this one compares to the others

Of all the locations, the Zivas were all available. But the only award flights I could find were to Cabo or Puerto Vallarta. The past two years, Puerto Vallarta has been the only thing available, so we jumped at the chance to try a new place.

Checking points prices

It’s easy to see which Hyatt locations are available with points: run a search and click the “Use Points” box. Once you know which dates are available and how many you’ll need, you can arrange your flights around the hotel schedule.

When I book award flights, I always start with Google Flights and the Southwest website for two reasons:

If flights are cheap, just pay for them

See the most direct routes and best times for your home airport

Southwest has tons of flights from both Dallas and Chicago, and of course Dallas has American and Chicago has United.

For the American flights, I checked:

AA website (ugh, the new pricing is awful. RIP AA miles for AA flights)

British Airways to see what’s actually low-level

Qantas to verify/double-check and also compare prices because they’re both distance-based with different zone bands

For United flights, look at:

United’s site

Lifemiles (Avianca’s program)

Aeroplan

And Southwest shows you everything directly on their website.

Booking Los Cabos with points

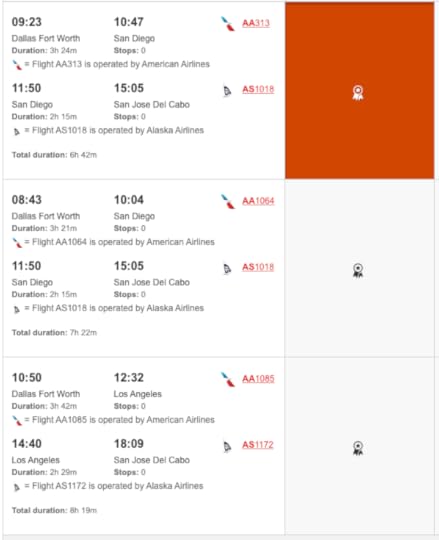

I had leftover Qantas points from a recent transfer bonus and wanted to use them for my flight to Cabo (DFW-SAN on American, SAN-SJD on Alaska). You can access Qantas with Amex Membership Rewards points instantly, or Capital One miles and Citi ThankYou points within a few business days.

So I burned what was in my account and topped it off instantly with a transfer from Amex.

Well how bout that – instant booking with British Airways points topped up from Amex

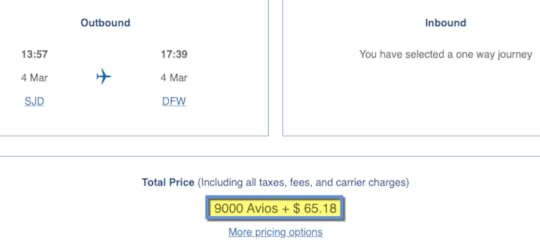

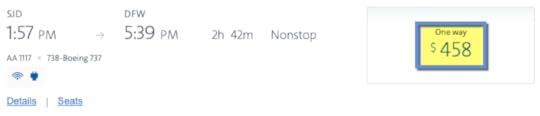

And to get home, I used 9,000 British Airways points also instantly topped off from Amex points.

That flight would’ve been $458 had I paid cash!

Nope nope nope

My friend had Southwest points and used 12,870 of them to book her own nonstop flight to Cabo. And try though I might, I could only find a nonstop flight back on United using United miles. Why?

This is one of the reasons I keep the Chase United Explorer card

United has hogging the best-priced award flight (which was also nonstop) for elites and Chase cardholders.

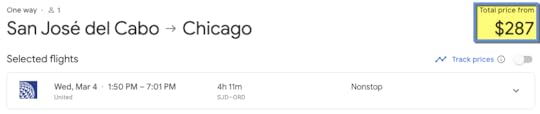

Or you can pay $287

The retail cost for this flight was $287. But I have lots of United miles from various promotions and bonuses, so I was happy to snap it up at that award price.

Finally, the hotel cost 80,000 Hyatt points. I had some in my account and transferred the rest from Chase Ultimate Rewards points. Remember when I got the Chase Ink Business Preferred a few months ago to earn 80,000 more Chase points?

Chase Ink Business Preferred 80,000 Chase Ultimate Rewards points

• 3 Chase Ultimate Rewards points per $1 on the first $150,000 spent on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines each account anniversary year

• 3 Chase Ultimate Rewards points per $1 on the first $150,000 spent on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines each account anniversary year• 1 Chase Ultimate Rewards point per $1 on all other purchases

• Bonus is worth $1,000 toward travel booked through Chase

• $95 annual fee• The minimum spending requirement is $5,000 on purchases in the first 3 months from account opening

• Amazing small biz card with best-ever offer right now• Compare it here

I saved $1,585 on the hotel stay with the points I already had plus what I transferred.

How about $0?

That comes to 2 cents per point in value, which is what I always strive for with Chase points. Plus I won’t have to pay for food or drinks for five days and four nights, and that’s pretty dang sweet.

Los Cabos with points – by the numbers

Here’s how it worked out:

DFW-SAN-SJD: 26,000 Qantas miles + $36 / Retail: $265

MDW-SJD: 12,870 Southwest points + $36 / Retail: $244

SJD-DFW: 9,000 British Airways points + $65 / Retail: $458

SJD-ORD: 17,500 United miles + $65 / Retail: $287

4-night stay at Hyatt Ziva Los Cabos: 80,000 Hyatt points / Retail: $1,585

Totals:

145,370 points/miles from Amex, Chase, Southwest, United, Hyatt

Retail price: $2,637

Out-of-pocket cash copays for flight taxes and fees: $202

Final cpp value: 1.8 cents per point ($2,537 – $202 / 145,370)

Some thoughts. Even though it doesn’t look like an amazing points value on the surface, it is to me.

I was able to make use of a double transfer bonus (Citi and Qantas were both offering bonuses on points transferred to Qantas). So if you’re thinking, yeeesh, 26,000 Qantas miles for those cheap flights? Yes – I actually got a great deal to get them. Easy come, easy go.

I had British Airways points let over from a bonus too. And the Hyatt points in my account were from work trips, so I didn’t have to pay for or earn them in any way.

Lastly, I was happy to use a perk of my Chase United Explorer card and snag a great nonstop flight for my friend that wasn’t available anywhere else. So with that considered, it’s like another little bonus.

Another reason to check AA flights on Qantas

My flights to Cabo are DFW-SAN on AA and SAN-SJD on Alaska. You can technically book Alaska flights with British Airways points but can NOT search award space on their site (and you must call to book).

This isn’t the case with Qantas. You can see AA and Alaska award flights already linked as an itinerary and you can book directly on the Qantas site. Actually, I didn’t even see this routing option on the AA site either. So it’s worth checking in a few different places to see:

What’s actually available

How you can string them together for an award

Routings you wouldn’t otherwise be aware of

If award space is phantom or verify it in a couple of spots

From the Qantas website – all bookable. Pretty cool

In particular, AA, BA, and Qantas can all book Alaska flights (and so can Singapore). So if there’s an Alaska flight that can help you out, I thought it was cool that you could see it laid out so nicely on the Qantas website. Just little tips from one award booker to another.

Bottom line

So excited for third Mexican vacation in as many years. They have been so good to ease burnout and soothe my heart post-breakup. This year, I’m in a great place mentally and emotionally – I just want to save money and still experience that salty air and crashing waves on the beach.

The total cash outlay was only $202 – so I paid a cool $101 for my half (we went dutch). I had points and miles tucked into so many little pockets that I was able to patch this trip together and still have plenty left over for more trips later this year (I also booked an award trip to this year’s FinCon in Long Beach!).

In some ways, miles are getting more expensive to use but easier to earn. Booking this trip made me reflect on all the bonuses I’ve taken advantage of and promos along the way. Also AA’s dynamic award pricing is such garbage. I hate it.

January 27, 2020

Invest Vs Pay Down Credit Card Debt & Up $11,000 – January 2020 Freedom Update

Most of my thoughts recently have been on money instead of travel. Now that I have aggressive financial goals, I want to meet at least a few milestones before I take another big trip.

I’m seeing the juncture of points & miles with personal finance so clearly. I’m understanding how much you can really save on travel by accumulating credit card rewards – and sinking the extra funds into investment accounts.

Of course, I’ve always known how awesome points are if you’re passionate about travel. And you bet your bottom dollar I’m gonna treat myself to a nice big award (!) trip to celebrate soon enough.

Travel will always be my #1 passion. Now I’m wondering: where is the intersection of traveling cheap and living frugally?

This month, I was waiting for the right time to post this update. But there is no perfect time and things will always be in flux.

With that in mind, let’s dive into what happened in January!

January 2020 Freedom update

Link: My First Month of Diligent Saving & Net Worth Is up $20,000 – December 2019 Freedom Update

There’s no magical time to post these updates. I was waiting for that time when:

All credit card payments have posted

Direct deposits are in

Transfers are in and done

401k contributions have posted

Mortgage is paid for the month

All balances are updated to reflect activity

I managed to kinda sorta catch it for previous updates, but it wasn’t happening this month. But that’s OK, because it’s also given me time to ponder my overall strategy as I inch ever closer to my goals.

Switching focus to Roth IRA instead of credit cards

Link: Did Fidelity Just Become the Best Investment Bank? 4 New FREE Funds!

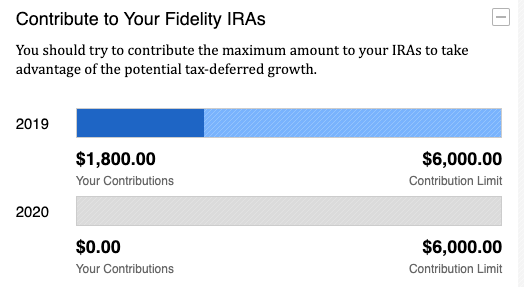

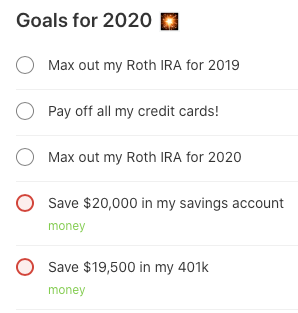

Even though I still have a balance on my 0% APR card, the cutoff to contribute to 2019 Roth IRAs is April 15 – less than three months away!

My 0% rate also expires in April, but you know what? I get those balance transfer offers all the diddy dang time. And I don’t want to lose the opportunity to invest in my Roth IRA. It’s an important retirement vehicle.

Gotta get those 2019 contributions in NOW

With that thought, I’m hitting the pause button on paying down my credit cards until after I max this out for 2019. Then I’ll go back to paying them (once and for all!). Afterward, I’ll max out my 2020 Roth IRA. Then I can focus on padding out my emergency fund of $20,000.

This isn’t the end. But it sure ain’t where I began

The stock market has been doing so well. I don’t want to miss getting in on this historic bull run. But even with the recent slight downturns, I wouldn’t want to miss the chance to buy more stocks at a discount – the other side of the coin. Whichever way it flips, I don’t want to miss my shot. I’m putting every penny into my 2019 Roth IRA until it’s maxed. Here’s the fee-free Fidelity fund I’m investing in.

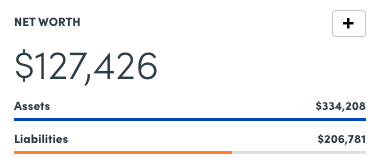

I’m up over $11,000 toward net worth!

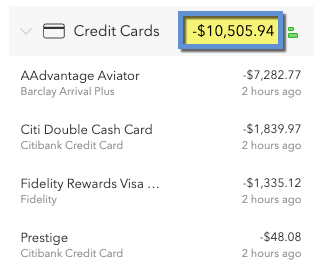

Yussss! I have to remind myself that paying off my credit cards *is* building my net worth. Because losing debt cuts down liability, even though if feels like stalling progress.

Assets up, liabilities down. Ebb, flow

My ultimate goal is to reach a $500,000 net worth. And I don’t think the way there is to focus on one thing at a time. Rather, a hybrid model of saving, investing, and paying down debt – a little all at once – seems to keep things chugging along nicely.

For all the times I feel like I’m stalling out or not progressing quickly enough, I…

I think of all the (literal) mountains I’ve climbed. Those moments when you can’t see much in front of you because of all the switchbacks. Am I getting anywhere? How many miles have I climbed by now? But then you turn around and…

Climbing more mountains

…I’ve really gotten so, so far.

So here’s where I’m at:

CurrentLast monthChangeGoal

Credit cards$10,506$14,836-$4,330$0

Mortgage$143,481$143,941-$460$0

Car$6,147$6,511-$364$0

Roth IRA 2019$1,800$0+$1,800$6,000

Roth IRA 2020$0$0xx$6,000

401k $5,425$3,331+$2,094As much as possible

Overall investments$82,212$74,169+$8,043As much as possible

Savings$532$530+$2$20,000

Net worth in Personal Capital $127,320$115,806+$11,514$500,000 Track your net worth with Personal Capital

I’m so excited to get started on my Roth IRAs, even if it means dialing back the credit card progress for a sec. I’m just gonna go down the list:

Can’t wait to check these off, one at a time

After all this is done, I will ramp up my 401k contributions to the max. And treat myself to an award trip as a reward for coming so very far.

Next steps

I’ve been thinking of picking up another Citi Premier card to add 60,000 more ThankYou points to my balance. Between Chase Ultimate Rewards points, Amex Membership Rewards points, Citi ThankYou points, and all my Hilton points I should have pleeeenty saved up to do something epic. Like bucket list epic. Already so excited thinking about it!

Can’t wait to get this to triple digits

Eventually, the bulk of my savings will be in stocks as opposed to property or cash – and I guess it already is. I just never want my value to be locked up in my primary residence, or one stock account. Again, I think a hybrid approach is best. Lil of this, lil of that.

It’s also cool to think of my stockpile of points as an investment of sorts – one with a very high risk and constantly declining, but also with the potential for big payoff. Especially if I think of it as supplanting/replacing my cash travel budget.

I’m so over HOAs and thinking of leaving Dallas

Yeah. Dealing with a property management company and a BOARD has been hell recently. I currently have two leaks in my bedroom that need repair and getting it done is through a COMMITTEE of people and bureaucracy. My whole complex needs basic shit done that’s constantly neglected. And I’m soooo over it, dude. If I had a single family home, I could do whatever I wanted to with it. Instead, I can’t even rent out my place without PERMISSION.

This whole condo thing has done wonders to show me what I don’t want. I sure as hell don’t want this any more. Freaking stupid.

Thank you, Dallas

Which leads me to… life. I’ve been in Dallas for 5 years by now. I feel like I grew into my final adult form here. It’s been a great chill down after leaving New York. If I sell this place, I’d probably rent for a while. And I can rent anywhere. I’d basically just be in Dallas to work at a job.

My current job is fine. But if I’m gonna go rogue, I wanna go really rogue. And explore every option.

But nothing is going to happen any time soon. I have too many financial goals keeping me in place here. Head down, go to work, pay down cards, save save save. That’s prolly gonna be my life for another year or so.

In that time, hopefully my property value will rise even more than it already has. If I can cut and run with at least $50,000 tax-free dollars, I’ll consider Dallas a success.

Until then, I’m dreaming of meeting my goals, that next award trip, and the next iteration of the funniest, weirdest, twistiest-turniest thing I’ve ever experienced: ya know, life.

January 2020 Freedom update bottom line

I’m that benign office worker with lofty goals and big dreams. I daydream about being in mountains while I’m in my cubicle. Music transports me to other worlds. My energy goes into living, mostly. And sometimes creating. Writing. I love writing here so much and always want to approach it with humble energy.

I started this blog back in New York, and it’s been with me through extreme profit, depressive episodes, adrenal fatigue, multiple jobs, burnout from said jobs, and countless trips (I guess I could technically count ’em, but suffice it to say a LOT of trips). What’s happening to me now is both a settling down and a growth period all at once.

I’m finding my WHY. As long as I stay grateful and gentle, it’s gonna be pretty cool. For now, plugging away.

January 8, 2020

Balance transfer cards 2020: A godsend when you need more time (but don’t fail the test)

Hi lil lovies. The holidays were wild, eh? I’m writing this in a medicated haze with flu-like symptoms. But I wanted to write. And I’ve been meaning to talk about is how I’m using balance transfer cards to:

Meet my current financial goals (which I need to update)

Smooth out large, unexpected expenses (like when my AC quit in July and I had to get a new HVAC system)

Give myself a jump-start to purchase big items when I want them (I bought myself a rowing machine because I really really wanted one and I’ve been using it regularly)

This is because I didn’t have enough in a savings account, which will change this year. So hopefully I won’t have to rely on them in the future.

But for now, they’ve helped me consolidate a lot of balances spread over several cards with big interest rates. I paid a one-time balance transfer fee, and have a 0% APR rate through April 2020. So I haven’t paid a dime of interest since. And honestly? It’s been the one thing that’s given me time to get caught up.

Balance transfer cards aren’t a perfect solution. But they’ve bought me time and helped me avoid a ton of interest while I got my plans together

The test, of course, is paying them back before the 0% promotional rate expires. If you don’t, you’re right back to where you started.

December 26, 2019

Freebird Promo Code for $10 Cashback: “OUTANDOUT”

Here’s the latest Freebird promo code you can stack for up to $10 cashback on Uber and Lyft rides booked through Freebird.

Here’s how to do it. After you download Freebird, enter this.

Freebird promo code:

“OUTANDOUT” – $10 cashback ($5 for each of your first 2 rides)

Freebird lets you book Uber and Lyft rides through their app – and you’ll earn points on each ride. Once you earn 5,000 points, you can cash it out for $10. So you can potentially do even better when you add points to the mix.

I love using the Freebird app for Uber and Lyft rides

Plus, any Uber and Lyft credits and promos stack with Freebird!

Freebird promo code powers up your Uber and Lyft apps

Key link: Download Freebird

Link: Up to $10 Back for Uber & Lyft Rides + Earn Points Every Time With Freebird

If you ride Uber or Lyft with any regularity, I’ve found Freebird to be a nice “power up” for those bookings. The prices are the same – as it pulls the quote from those apps directly – and I’ve also had my Uber/Lyft credits and promos applied even when booking through Freebird.

With Freebird, you earn points + cashback for ordering rides through the app. Here’s my full writeup on Freebird with more information.

I took Lyft rides all around San Antonio recently, including to the River Walk

You can get an extra $10 cashback with my promo code “OUTANDOUT.”

I am all over this as it’s literally free cashback for doing something you’re already planning to do.

I have no idea how Freebird is making money (presumably through sponsorships from local businesses and liquor companies), but take it while the getting is good – especially if you have trips coming up soon. They’ve also got a deal going with Don Julio for $5 cashback or 500 points when you responsibly take a ride home from a bar (the reward depends on availability that night). So the cash and points add up fast.

It will stack with any Uber/Lyft credits or promotions already attached to your accounts – and trigger any travel statement credits from cards like Chase Sapphire Reserve, Citi Prestige, or US Bank Altitude Reserve. So there’s a potential triple/quadruple stack in here (you know I love a good stack):

Uber/Lyft rewards + credits

Credit card statement credits

Freebird cashback

Miles/points (not with CSR and travel credit, though)

World Elite Mastercard benefits with Lyft

Bottom line

What’s also cool is you can toggle between Uber and Lyft within the Freebird app if you want to check prices with both services. That way, you can pick the cheaper option and still earn the Freebird points and cashback credits.

I’ve been using Freebird for months and haven’t had any issues. Receipts and charges still come directly from Uber or Lyft – just note they pull your default payment method from the respective service, so be sure to change it directly within the correct app if you so desire.

And again, I dunno how Freebird will be profitable with all these promotions going on but… get it while you can. I’ve already initiated a few transfers to my bank account and gotten cash money directly in hand – so I can personally confirm it works.

Happy riding!

December 2, 2019

My First Month of Diligent Saving & Net Worth Is up $20,000 – December 2019 Freedom Update

November was the first month I got down and dirty with my new financial goals. Having them in mind gave the month shape and purpose – I felt for the first time in a while that I was working toward something urgent and real and palpable that I could measure.

If naming things is empowering, creating a plan is getting superpowers. I watched as each dollar flowed into and out of my accounts.

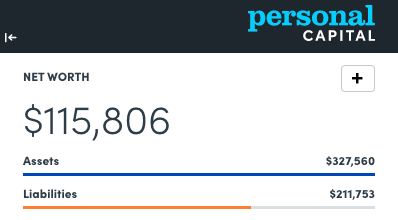

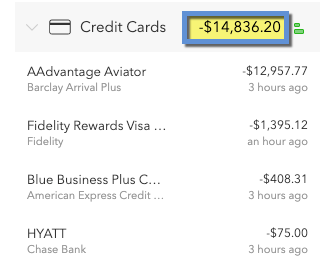

Slow and steady wins the race, but I have an out-of-control, flaming emergency! I have GOT to pay off my credit cards by April 2020 before the 0% APR rate expires. And I’ve got over $14,000 left to go.

Last month, a combination of strong market and aggressive payments boosted my overall net worth to $115,806 – a full $20,000+ increase.

And while it’s nowhere near the $500,000 goal I want to hit, it’s an awesome start. And to that end, this is my first Freedom update (Freedom is what I call money). I hope I look back on these posts and marvel at my progress. One day…

Getting started on my FIRE in a big way – getting rid of credit card debt is my #1 prerogative right now

I know “never say never” buuuut… I will NEVER have credit card debit ever again as long as I live. In the future, I’ll dip into my healthy savings account. Because this hurdle really freaking sucks.

December 2019 Freedom update

Like most peeps, I’m hard on myself. While I can clearly track and see my progress, the little voice always says, “You could’ve done better.”

That’s not something I would say to a friend. Instead I’d say, “Your progress was amazing! Keep it up and you’ll reach your goal faster than you ever dreamed!”

I’m already at 23% of my $500,000 goal

So I’m not going to admonish myself because I did a fantastic job. I’m replacing negative self-talk with:

My progress was amazing

Keep it up

I’ll reach my goals faster than I think

Because really, fear about money is what got me here in the first place. Thoughts like:

All it takes is a bad market, and you’re back to square one

Your assets might not appreciate as much as you think they will

You can’t always save – some expense will pop up eventually and then what?

Owning a home is too expensive

Your goals are too high. You might save a little, but $500,000? *laugh track*

All my investments gained value in November 2019 (though today they took a loss). It will always be up and down like this

And all these things might happen. I’ve never experienced a recession with investments, so I don’t know how my temperament would be. And my home could lose value, or end up costing me. But that’s fear talking. And I had a great month.

Let’s dig in.

A $20,000+ net worth increase in 30 days!

Holy wow, how’d that happen?

I got three paychecks in November (usually only get two)

Therefore, had more 401k deposits with company match

And the stock market did really well.

Reducing debt make my net worth go up

Zillow says my home gained value

I was hoping to crack $100K net work, so this result surpassed all my expectations.

CurrentLast monthChangeGoal

Credit cardsxx$21,945-$$0

Mortgage$143,941$144,952-$1,011$0

Car$6,511$6,688-$177$0

Roth IRA 2019$0$0xx$6,000

Roth IRA 2020$0$0xx$6,000

401k xx$2,333+$As much as possible

Overall investmentsxx$70,962+$As much as possible

Savings$530$529+$1$20,000

Net worth in Personal Capital xx$95,246+$$500,000Track your net worth with Personal Capital

A few thoughts.

The stock market is a fickle thing. A 1% change can add or deduct $1,000s from my balances. Luckily, it was mostly additive as I begin this trek.

And I usually only get two paychecks in a month, so while this is great, I don’t expect my progress to be this great in December 2019.

Holy crap, I am slaughtering my credit card debt! It kills me that I can’t max out my 401k this year until I knock this out.

But I descended to this point over a long time. Each month, there was a little more. I barely noticed it until one day, I couldn’t believe how far I’d spiraled out. But I’m climbing out faster than I got in. I am so grateful to really clobber this thing.

Once I hit single digit $1,000s, it’s full speed ahead

I don’t fully trust Zillow’s “Zestimate“ of home worth. I’d expect it to be off by ~$20,000 give or take. But I’ve found it to be pretty close, so I’m comfortable using it for my net worth projections.

I can’t wait to build out my savings account, increase my 401k deduction to 25% (it’s currently set at 10%), and max out my Roth IRA.

I’m impressed that my mortgage dips so much each month – I honestly thought it was much less than that.

And man, I really do fear the next recession. If it happens while I’m in my tracking phase, it’s going to make me feel really behind and get to me. I need to develop mental resources to withstand that for a couple years or more. Because it could happen.

Having a big savings account is going to be my saving grace throughout this journey, so I can let myself breathe. I’m also afraid I won’t let myself ever use it. Because of that “back to square one” way of thinking.

Heard

As soon as I can settle these things in mind, I think I’ll feel more confident. So this is me baby-stepping into owning the goals I set for myself. I still keep turning around to see where I came from – not far enough down the path for the beginning to look distant. Yet.

Bottom line

I’m pleased with how last month went, and how I’m starting December. My progress won’t always be this strong, and any little fluctuation could erase a lot of my progress.

It’s amazing how money (freedom) has this energy, don’t you think? How we let it into our thoughts, injecting itself into our fearscapes. And the concept of “net worth” as if a number can ever really define that?

Starting this plan and turning my thoughts to freedom are bringing up mixed emotions of enthusiasm, lack of control, security, motivation, and honestly, primal freaking fear about losing the stuff.

It’s also an exercise in moderating my energy, doing my best, and letting the chips fall where they may. And also this sensation of… wow, I gained so much this month. Now I have that much more to think about losing. Isn’t that effed up?

What is this thing, this entity – and all these conflicting emotions somehow miscible when discussing a single topic?

Another thought that unsettles me: I don’t have a solid WHY yet about this plan other than – I just want to. I want to be able to take care of myself for a long, long time. (Is that my why?)

But for now, “I exist as I am, and that is enough.” – Walt Whitman

And that’ll have to do. So I’ve started the journey – but it’ll be a while until I feel like I’m cruisin’ along.

Does thinking about money stir up these things in you, too? I can’t be only one both amazed and petrified at the same time? Thank you for following me through this!

November 24, 2019

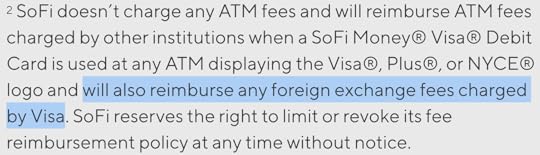

It’s Official: SoFi Money Will Reimburse All ATM Fees Worldwide, Even Visa 1% Forex Charges

Welp, that’s it. Now that all SoFi Money ATM fees are gone, SoFi Money is officially the best checking account available today. It’s great right out of the gate, requires no futzing or maintenance, and now, they’ll even reimburse Visa’s 1% forex fee internationally – so you get free withdrawals with absolutely zero fees worldwide.

They’ve tried hard to overcome any hurdle to be the best checking account around. You get:

Free, unlimited, and INSTANT ATM withdrawals worldwide. Even if Visa charges you a forex fee, they’ll reimburse that too

1.6% APY on any balance you carry

Zero fees, no minimums

Easy to use app and website

$50 bonus when you open an account and fund it with at least $100 – bonus appears in a day or two and it takes 2 to 3 minutes to set up

I’m proud of their efforts. And I’m switching to make this my full-time checking account after my next pay cycle.

Well how ’bout that?

Yes, I’ve had a Chase checking account for over a decade. And I’ll keep it because it’s free, and for the incredibly rare times I need to do something in a branch. But for everyday banking, bill payments, and my financial clearing house, I’m going all-in with SoFi Money. #officiallyconverted

SoFi Money ATM fees – nothing to see here!

Link: Open a SoFi Money account and get $50

Link: My SoFi Money checking account review

One of the biggest bones of contention for these types of fully free checking accounts has been the 1% foreign exchange fee when withdrawing funds overseas. Schwab explicitly says they don’t charge them, Fidelity doesn’t charge them in practice, and now SoFi is making the official claim to reimburse them.

But unlike Schwab and Fidelity, SoFi also has a generous 1.6% APY on any balance you carry. In practice, that’s not a lot – but considering the others provide nothing, it’s better by default.

Also, it takes Fidelity a few days to reimburse your ATM fees, and Schwab an entire billing cycle. But not the case with SoFi Money – fees are reimbursed instantly. These features, combined with no fees, and a debit card, are all I need in a checking account.

And now for what I want in a checking account:

Transactions that post fast

A nice app and website – make it intuitive

Fully integrate with Mint and Personal Capital cuz that’s where I track my net worth

Integrate with Venmo/PayPal

Everything I want AND need

SoFi seems to’ve fixed their Mint connection recently because it now updates fast and flawlessly. No issues on any of those things in the few weeks I’ve been using SoFi. Now I’m ready to make the leap and switch my direct deposits over. I even added the debit card to my wallet’s “permanent” slot.

It doesn’t get more real than this

OK, so is like, anything missing from SoFi Money?

Before I make it sound like the best thing since sliced bread, there are a few limitations you should know:

SoFi Money doesn’t support Zelle payments. I’ve used it a few times in the past with other account and really liked the ease of instant payments

You can’t deposit cash into the account – so it’s NOT good for cash heavy users

You can’t deposit money orders

SoFi Money supports Apple Pay and Samsung Pay but the debit card is not contactless, if that matters to you

There are no physical branches. It’s all online, baby!

There are no wire transfers, although they say this is coming soon

SoFi isn’t FDIC-insured. This means if they went bottoms up, you wouldn’t qualify for government insurance. However, once the balance is transferred to a partner bank you ARE FDIC-insured, but it’s that middle ground that’s murky. This doesn’t matter to me because I keep my checking account balances low, but it’s certainly something to be aware of.

Get even more from your SoFi Money account

There are a couple of other promotions you can stack with the $50 opening bonus.

When you set-up a recurring direct deposit of at least $500, you’ll get a $100 bonus when the second one hits – and the first one needs to hit by January 31, 2020.

How ’bout another free $100 on top of no SoFi Money ATM fees?

AFAIK, everyone who opens the account is targeted for this deal. I know I’m gonna get my extra $100 – and as a bonus, I genuinely like the account. Total win-win.

Use this to pay for Lyft rides, get 20% back through February 18, 2020

Then there’s the promotion going on Lyft rides. When you pay with your SoFi debit card, you’ll get 20% back – up to $1,000 – on rides you take through February 18, 2020.

This is obvi excellent on longer rides, or if you can’t take advantage of the $10 credit for five rides when you pay with a World Elite Mastercard. 20% is a nice offer!

If you can make use of either of these promotions, opening a SoFi money account is a super good deal because you can stack them all. And you know I love a good stack.

November 23, 2019

Roundup of Targeted Amazon Offers With 1 Amex, Chase, Citi, or Discover Point – Save on Holiday Shopping!

There are lots of targeted Amazon promotions out there now. Which is awesome, because Black Friday are Cyber Monday are next week! When you combine these deals with inevitable sale prices, you stand to save buku bucks this holiday season. Or you can do like I did, and stock up on dog food.

November 10, 2019

Need a Checking Account With NO Fees, Minimums, or ATM Charges EVER? Try These.

It’s been over 4 years since I first professed my love for the Fidelity Cash Management account – one of the best no fee checking accounts. And about the same amount of time since I wrote about the Aspiration Summit account.

But that was before SoFi Money came on the scene. That account has no fees – but also free unlimited ATM withdrawals worldwide AND 1.6% APY on any balance you carry. It’s now the one I recommend most if you’re looking to dump your brick-and-mortar bank (and you probably should).

There’s a new sheriff in town, and it’s SoFI Money

All are fantastic checking account options because there are no fees, no minimum balances, and no direct deposit requirements. Essentially they’re free to open and keep forever, even if you never use them. Even better, these accounts reimburse ATM fees from ANY ATM in the world. And there are no hard credit pulls to open.

There are a couple of key differences. But, bottom line, you should have at least one of these accounts!

Best no fee checking accounts

1. SoFi Money

Link: Open a SoFi Money account and get $50

This one is new to the list – it launched in 2019. And if you only get one of these accounts, open this one because you get:

Unlimited, instant ATM reimbursements worldwide allowing you to use any ATM that accepts Visa – an amazing perk for travelers

1.6% APY on your balance – comparable to many high-interest savings accounts

No fees, no minimums

Sub-accounts to save for your goals, and joint accounts for your S.O.

Blazing fast sign-up – I had an account open in 2 to 3 minutes

$50 bonus when you open an account with $100+ – and it posts within a day or two

It’s basically a traveler’s dream checking account. And the $50 bonus when you open it is one of the easiest to earn. Just open and fund it and your bonus appears within a day or two. Easiest money I ever made!

King of free checking accounts and perfect for traveling

I really can’t say enough good things about this checking account. It’s simple to use, travels well, and is even good enough to be your main checking account. Plus it’s the only one that earns interest on your balance.

Here’s my full SoFi Money review.

2. Fidelity Cash Management Account

Link: Open a Fidelity Cash Management account

This was my go-to for a long time. You can use it anywhere without ATM fees. When you withdraw from a fee-bearing ATM, the fee is reimbursed the same day the charge clears your account.

Boom #donewiththose

It’s also an amazing tool for overseas travel. I transfer some cash into this account a few days before a trip. In the past, I’ve paid nasty interchange charges each time I’ve needed to access my cash. With this card, there is a 1% fee built-in by Visa but there are no additional fees. I don’t mind the 1% because it’s $1 per $100 – which is a small price, in my opinion, for all the convenience I get from this account. I love it.

I also used this account for my Airbnb business as a de facto business checking account. I let the balance build every month. Then paid the rents and bills. And transferred the rest to pay down my student loans. Rinse and repeat each month.

It’s an easy way to keep all that separate from my (other) main Chase checking account – which I wouldn’t recommend these days. I got it forever ago and don’t pay fees to have it. If I did though, I’d have zero issue dumping it for this account. Now, I like how it keeps things apart per the envelope method.

What to know before you get a Schwab checking account

The inevitable question is, “How does it compare to the Schwab Bank High Yield Investor Checking Account?”

They’re essentially the same. BUT:

Schwab uses a hard pull when you open their account

Fidelity uses a soft pull

Schwab requires you to open an investment account, although you do NOT have to use it – ever – if you don’t want to

Fidelity doesn’t require any other accounts

AND:

Both have no fees

Both reimburse all ATM fees (yes, worldwide)

Both have free bill pay

Both are great if you invest with the respective firms

I didn’t want the hard pull or an account I’d never use. Between them, the Fidelity account was better for me. And I’ve just stuck with it.

Here’s my full Fidelity Cash Management account review.

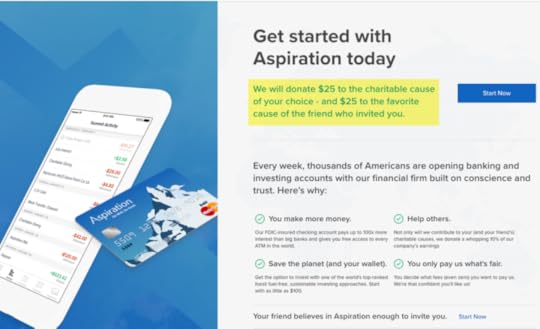

3. Aspiration Summit

Link: Open an Aspiration Summit account

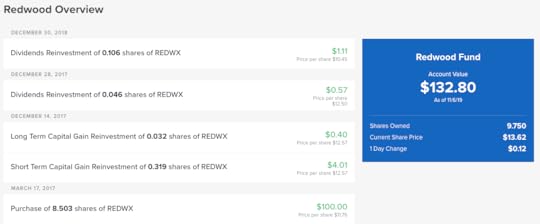

So this account has several of the same features as the Fidelity account. And, it has a savings component.

I also bought $100 of stock in Aspiration’s Redwood Fund just to see how it would perform

When you direct deposit at least $1,000 in the account each month or have $10,000+ saved, you’ll earn 1% interest on the balance, which compounds monthly. So if you’re interested in saving too, this is a great account for an emergency fund. But be aware, you can get much better rates elsewhere and without the requirements. It’s really only good for the free ATM withdrawals.

Get $25 to donate to charity – and I’ll get $25 to donate, too

You’ll also get $25 to donate to charity when you sign-up.

There are no fees, no minimums, and no requirements to keep the account free. But there’s one important difference in how ATM fees are reimbursed: it happens when your monthly statement closes instead of when the charge clears, like you get with SoFi or Fidelity. And you’re limited to 5 withdrawals per month. If you withdraw sporadically, this shouldn’t be an issue, though.

If you’re interested in a no-fee checking account with global ATM access, this one is another contender. Especially because they’re committed to helping and protecting the environment with their profits.

Here’s my full Aspiration checking account review.

Which one is best for you?

Definitely SoFi Money because you earn a little interest on your balance and ATM reimbursements are instant. By far, this one will serve the needs of most peeps just fine. Plus, the app and user experience is top-notch.

Although I personally like Fidelity for being able to link my IRA accounts. And an edge to Aspiration Summit for its versatility as a savings account and commitment to the planet. Net-net, all are excellent options.

I’d go with the Fidelity account if you:

Already have other Fidelity accounts

Want your ATM rebates back within a day or two

Have a Fidelity Visa

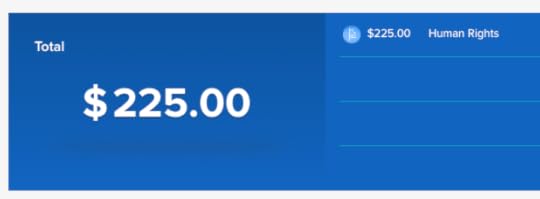

I’ve donated $225 to human rights so far because of Out and Out readers!

And recommend the Aspiration Summit account if you:

Don’t mind waiting for the ATM fee reimbursement

Like the charitable giving option

Like what the company stands for

All these accounts a stellar choice for completely free banking. I’ve used them all extensively and never had an issue. So I recommend them wholeheartedly.

And if you are paying fees to have a checking account, to keep a minimum balance, or to access your money… stop that immediately! There’s no need to pay anything.

Bottom line

Link: Open a SoFi Money account and get $50

Link: Open a Fidelity Cash Management account

Link: Open an Aspiration Summit account and get $25

I know we get caught up on credit cards in this hobby of ours. But we all need checking accounts to make our payments. There’s simply no need to pay fees to have your money in an account or to access it – no matter where you are in the world.

I’ve withdrawn cash from my Fidelity account in Ireland, Japan, Germany, Chile… and occasionally withdrawn money when I couldn’t use a credit card.

I can personally vouch for it. Although with SoFi Money on the scene, there’s a new show in town – and it’s now the best no fee checking account option.

It mainly comes down to how quickly you want your ATM fees reimbursed. And if you want a hybrid savings option.

Even if you already have a checking account you like, consider the envelope method – all are great free options for this.

Even if you only use them for international ATM withdrawals, that’s reason enough.

So now I’m curious – what’s your favorite checking account? Are there any better than these?