Harlan Vaughn's Blog, page 11

July 14, 2020

Condo sold, net worth return to form, & up $35K – July 2020 Freedom Update

Big news first: I closed on my condo on June 29! It hit the market April 22, and I got the offer on May 30. As y’all know, I’ve been on veritable pins and needles waiting for this. Now that it’s over, I’m almost embarrassed at the sheer amount of mental and psychic energy I put into it.

It drained me and consumed my thoughts. For the first time since I was little, I got down on my knees at night and prayed (for a smooth, quick sale).

This whole thing started in January when I got a small ceiling leak and morphed into this whole debilitating thing. But it’s done. And I finally feel like I’M BACK.

Now I live in an apartment in Dallas with the goodest boy

I’m always amazed (in a bad way) at how consumed I get with situations to the point where it zaps me so fully. That said, the last couple of weeks before closing were absolutely freaking crazy. In no way would I describe myself as being “calm.”

I didn’t post a June 2020 Freedom update because I knew the sale was pending and that it would shake up my financial situation. It did. And now I’m heading into the best financial shape of my life.

July 2020 Freedom Update

On June 29, I got up early and went to the title office. Within an hour, it was done. Later that day, I got the money from the sale.

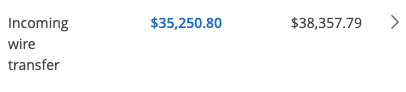

Wowza

All told, I walked away with $35,250.80. Not as much as I wanted or could’ve gotten, but plenty considering I was ready to get rid of the condo for pennies if necessary.

Manna

In the interim, I sat and had a long margarita. Selling that condo was such a relief. Such a weight off. I let the liquor take off even more. It was my first drink in several weeks.

Then I went home and set about distributing the money. I’d thought about it for a while – exactly what I wanted to do with it. After I canceled my homeowner’s insurance and turned off the electricity, I split the proceeds into little pieces – and met a slew of my 2020 financial goals in the process.

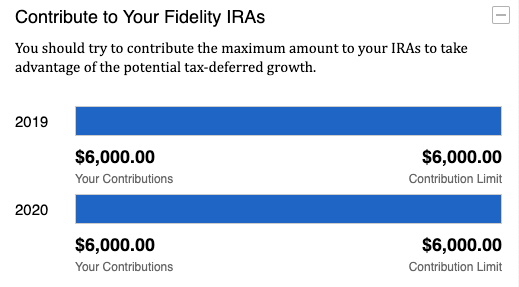

Maxed out my 2020 Roth IRA

First things first, I sent $6,000 to my Roth IRA and maxed it out for 2020 in one fell swoop. When the cash cleared, I bought $6,000 worth of VTI and called it a day. Boring, simple, easy index funds: exactly what I want in my retirement accounts.

VTI is my newest flavor of vanilla. Here’s what’s in my Roth IRA

I have a few different index funds in my Roth IRA. The stocks are total market, with near-equal portions of FSKAX, FZROX, and VTI. I went back and forth about FSKAX vs VTI, but wanted to see how an ETF stacked up to a mutual fund over time. I’m also keeping an eye on FZROX (Fidelity’s completely free to own fund) and will change that up in January 2021 if needed.

This felt so dang good

But they’re all index funds and all roughly the same. I guess I like comparing similar flavors.

June 26, 2020

Plastiq Payments Earn 5X Points (up to 7,500) With Citi Prestige Promotion

If you have a Citi Prestige card, there’s a promotion running through the end of August 2020. You can earn 5X points per $1 spent on “online purchases” – up to 7,500 Citi ThankYou points.

My friend Angie tipped me off that Plastiq payments are working to trigger the bonus points, so I took the opportunity to make a $1,500 auto loan payment. Plastiq is a bill payment service that allows you to pay most bills (and even individuals providing a service) with a credit card.

Details of the Citi Prestige 5X promotion

Sure enough, I earned 7,500 Citi ThankYou points for the payment. So while that’s great, a word of caution. Plastiq is increasing the payment fee from 2.5% to 2.85% on July 1, 2020.

If you wanna get in on this easy win, you only have a few more days!

Citi Prestige Plastiq 5X points

As mentioned, the fee is going up next week. That said, you can still lock in the lower 2.5% fee on payments scheduled through June 30, 2020. And the Citi Prestige 5X promotion runs through August 31, 2020. This is helpful if you don’t want to make a big payment all at once.

Keep in mind, Citi Prestige is a MasterCard, which means you can use it for auto, rent, mortgage, HOA dues, and pretty much any other payment. Other card types (Visa and Amex) don’t cover every category, but the advantage here is you can schedule, say, your mortgage or car payment through August. And as long as you schedule it before the end of June, you’ll get the lower fee AND 5X points on the purchase with Citi Prestige.

Yay-yiss hunty!

I had enough FFDs (fee-free dollars) to cover the payment, and the $1,500 charge earned me 7,500 points, which the max you can earn with this promotion.

The magic number

If you have to pay the 2.5% fee though, and want to hit exactly $1,500, you’ll want your payment amount to be:

$1,463.41

with a $36.59 fee

That’ll ensure you max out the promotion and get all your bonus points. Of course, you can always pay some other amount and finish maxing out the promotion with other online purchases. Citi is vague about what counts (other than groceries and drugstores), but if you want to be sure, Plastiq payments are a dead simple way to do it in seconds.

Is it worth it?

Link: Sign up for Plastiq

7,500 Citi ThankYou points are worth $150 assuming you value them at 2 cents each (and you should – all flexible bank points should be worth at least that much otherwise don’t redeem them).

With this deal, you’re paying ~$37 to get $150 worth of points, which is pretty dang good.

Easy 5X? Yes plz (also: anyone read palms?)

If you’re new to Plastiq, you can sign up and get $50 FFDs after making $500 in payments. It’s not a lot, but you could easily max it out with the Citi Prestige deal and get a few bucks in free payments for later.

I don’t see any downside to this promotion tbh. If you already have a Citi Prestige card, this is an easy way to rack up extra points. And it’s worth it, even with Plastiq’s current 2.5% fee considered. It’s probably still worth it when the fee goes up to 2.85%, but obviously not as good as it is for the next few days. So get it while it’s hot!

May 26, 2020

Hitting a major rough patch & down $35K – May 2020 Freedom Update

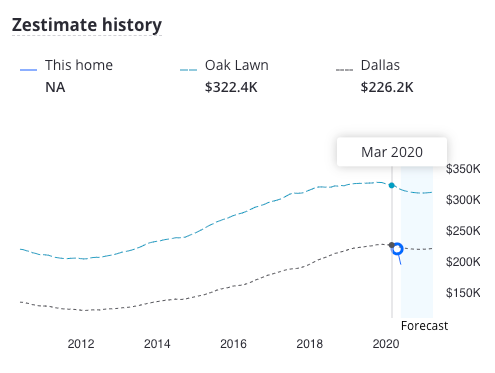

Selling my Dallas condo has consumed most of my energy this month. Every time I check the Zestimate on Zillow, it falls a little more (yeah, I know it’s not reliable, but seeing the number go down gets me in the worst way). The value was above $200K for a few years, and now it’s dipped below that.

I get the resale certificate tomorrow. At this point, I’m seriously considering offloading to a cash for homes place just to get rid of it so I can move on with my life.

Because of Covid-19, I was able to get a 90-day forbearance on the mortgage. So I’m hoping that whatever’s going to happen will work itself out in the next three months. Cuz it’s seriously stressing me out.

What good has come from this situation? I’m meditating again and preparing for life’s next chapter

In the background, I’ve taken time to reconnect to my meditation practice (remember when I did that 10-day meditation retreat when I first got to Dallas?). And I’m seriously considering going full digital nomad when I no longer have a mortgage pinning me down. I want to travel again – this time, for a long time.

I’m also cutting my losses. Mourning in advance, if you will. So while my numbers are down this month, it means I’m going to have to work that much harder (or smarter) to keep my goals on track. Either way, I feel I am winding down my time in Dallas.

May 2020 Freedom Update

It’s wild that I started tracking net worth a few months before a historic pandemic.

Right now, I’m having to pay for a mortgage and rent while my condo is for sale – so things are mostly steady, although my overall net worth is down again. With all the ups and downs in the market and selling, I wondered if it’s even worth it to keep tracking every month. But I want to. Because I know where I am right now won’t always be this way, and I’d like to have the document to reflect on later.

I desperately want to get rid of my condo

And I will never ever live anywhere with an HOA ever again as long as I live. I have been so soured on this whole experience. We’ll see what happens, but I’m nearly to the point where I’ll do whatever I have to do to finish this thing off.

It was such a great home for so long… and then it wasn’t. I just hope that, despite all the HOA problems, someone will still want to buy it.

With the Zestimate down (which is what Personal Capital uses to estimate value and project net worth), I’m at the lowest I’ve been so far on my journey.

Projected value history and forecast

I considered NOT including my home’s value in net worth calculations But there is always some value in a home. I’ve heard both sides and decided to include it mostly because, for a while, it seemed Dallas real estate would go up (or at least hold steady) long-term. I need to think this over more, but the pandemic has certainly changed that last sentence. That’s for sure.

My stocks are surging back

I’m glad something’s going well.

Even small wins feel uncertain

At my peak, I had $87K in stocks. As of today, I’m back at $84K. All this time, I’ve continued to sock away 10% of my salary in my 401k.

Would love to see this hold steady for a while

After I sell this condo and get my credit cards paid down, I’ll amp this number up and finish maxing out my 2020 Roth IRA. And add to my savings account. I’ll likely take a hybrid approach and work on them all a little at a time. #babysteps

But overall, the drop in property value has tanked me

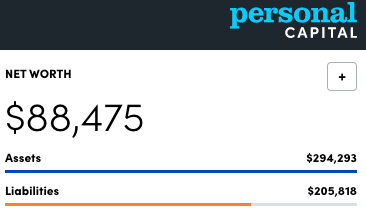

When I started tracking my net worth, it was ~$95K. And now it’s $88K. Even though my stocks are around the same level, cards and mortgage are paid down more, and I have more savings, I’m lower.

What happened?

Did I lean too much on my primary residence’s value?

Well, back in November, my place was “worth” around $230K. Now it’s “worth” around $194K. That’s a difference of $30,000 to $40,000 dollars, depending.

And even though estimates aren’t entirely accurate, it’s true property values are falling in Dallas. Some say a new housing crisis with a flood of delinquencies and foreclosures is about to ensue nationwide.

So was I wrong to include my primary residence in my net worth calculations? A few months ago, I had an asset – now I have a liability.

I guess it goes to show how fast things can change/are changing. If I wanted to stay in Dallas through this correction, I’d keep the place and ride it out. Maybe even refi with rates so low right now. All’s I know is I’m ready to sell now.

If I buy a single-family home in the future, will I include it in my net worth? Even if the value decreases and I go underwater on the mortgage? I think I will.

Net worth is always asset vs. liability – and homes are an example of both in one vehicle. On one hand, your property value could shoot up. On the other, you may get a bigger tax bill or have to make a huge, expensive repair. Either way, it’s going to affect your net worth. It’s the line we walk with homeownership.

I know a home is harder to liquidate than stocks, but the fact remains that you can. You can always get something for a house if you have to. That’s also why I include my car. I can always sell it and get some sort of cash. It might be less than ideal, but it’s still an asset I have that’s worth real cash. The level of liquidity doesn’t matter so much as your own personal risk tolerance.

The cold numbers

Numbers never lie. And while I don’t like this big of a dip, it’s only temporary. With so much in flux, this can look radically different this time next month. In the past, it’s gone up $20K in a month and dropped $25K in a month.

I’ll just have to do everything I can to offload that condo and stay focused on the final goal: get my net worth up to $500,000.

Considering stocks are $80K+ of that number right now, I can still get there if things continue upward. Though with everything going on right now, that’s anyone’s guess. That’s why we must do our best and forget the rest. Running so many mental models will only make a person go crazy.

CurrentLast monthChangeGoal

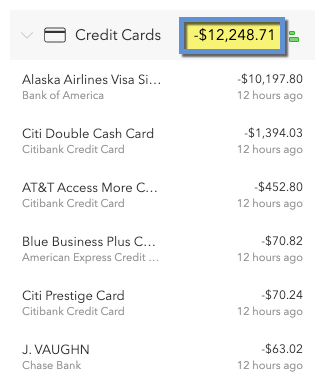

Credit cards$12,042$12,149-$107$0

Mortgage$141,782$142,091-$309$0

Car$5,526$5,595-$69$0

Roth IRA 2019$6,000$6,000xx$6,000COMPLETE!

Roth IRA 2020$0$0xx$6,000

401k $9,515$7,907+$1,608As much as possible

Overall investments$83,912$76,983+$6,929As much as possible

Savings$1,535$1,534+$1$20,000

Net worth in Personal Capital $88,475$123,560-$35,085$500,000 Track your net worth with Personal Capital

In a month, and in a year, everything will certainly be different. I just have to keep making these entries and plotting the course. Slow and steady wins the race.

April 26, 2020

Up $11K, condo for sale, moved, and uncertain – April 2020 Freedom Update

What a month for my April 2020 Freedom update. My condo is on the market now (!). COVID-19. I moved into an apartment around the corner. And I’m still employed – for now.

I’m concerned my property value is going to drop like a stone, and worried if I can even sell, given all the problems with the HOA (pending lawsuit, no reserves, many members delinquent on dues).

I always thought I was doing the right thing by investing in property. I had no idea how much control an HOA would have and how much they can affect your asset. I just want to offload this thing as quickly as possible – and I’m willing to give somebody the deal of a lifetime if it means I can get out.

Would anyone like to buy a perfectly good condo in Dallas?

This experience has soured me on condos (specifically HOAs), and to some extent, Dallas. I’m just ready move on with my life.

I will never buy property with an HOA ever again. And this whole thing really makes me wonder if I really want to deal with owning property at all. I love my new apartment – everything works and I’m not responsible for anything. I can cancel my lease and be out of here with a 60-day notice. It’s so… unattached. So freeing.

Although with COVID-19 happening, I definitely see the value of living in a paid-off house, especially with money being uncertain.

So a lot has happened in these last four weeks. And I really hope even more happens in the next four.

For starters, my investments have started to recover. But the idea of “normality” still seems very far away.

April 2020 Freedom update

The gyrations continue. Hopefully I can get cash from selling soon. I don’t want this thing to sit on the market forever. Been feeling nervous about that.

If I can’t sell, perhaps it can be an Airbnb or I could rent it. But I’d rather just sell it because I no longer want to be attached to it.

I moved into my apartment last Friday and with the way time is moving these daze, it feels like forever ago. So yup, I now have a mortgage and rent. I don’t expect to get ahead until the sale is done or I can figure something out.

But we have a special meeting coming up to remove the current board and I’m confident things will change at the complex. I have already mentally detached and am ready for the next chapter in my life.

I am free associating like crazy so thanks if you’ve made it this far. On to the money stuff. And maybe more stream of consciousness.

Cash is everything rn

I did a balance transfer and have my credit card debt sitting with a 0% APR rate until September 2021. So hopefully I can sell before then lol.

Because of that, I’m trying to stay head above water with a mortgage AND rent, so any extra cash I get is going directly to my savings account. I’m going to try my best not to touch it. But until the threat of this pandemic wanes, cash is absolutely king.

My credit card debt has gone up a bit because of the move

Because of the move and sale, I had to buy materials to make repairs and pay movers. So that cost a fair bit. But I get three paychecks in May, so I think I can catch up and make progress next month.

Investments are recovering

Last month was a huge jolt to my portfolio. But in April, it started to come back.

Thank gods

This is really just a loss “on paper” but pretty soon these investments will be all of my net worth. Very soon, I hope.

This is $16K higher than last month

I’m still contributing 10% of my salary toward my 401k. I figure I should get it in there while I have it. Because yes, I’m low-key worried about getting laid off. My company is struggling for business. But we’re OK… for now.

I haven’t filed taxes yet (I owe), and haven’t started contributing to my 2020 Roth IRA. Those things will have to wait until later this summer.

I’m up $11,000

Despite everything, I’m getting closer to my best-ever net worth. That’s no doubt going to change once I no longer have a mortgage in the mix. And the pandemic will affect the value of my property. So I expect this number to fall, then swoop up again over the next few months. But whatever, I just have to roll with it.

CurrentLast monthChangeGoal

Credit cards$12,149$11,868+$281$0

Mortgage$142,091$142,556-$465$0

Car$5,595$5,780-$185$0

Roth IRA 2019$6,000$6,000xx$6,000COMPLETE!

Roth IRA 2020$0$0xx$6,000

401k $7,907$5,155+$2,752As much as possible

Overall investments$76,983$60,924+$16,059As much as possible

Savings$1,534$533+$1,001$20,000

Net worth in Personal Capital $123,560$112,682+$10,878$500,000 Track your net worth with Personal Capital

The most notable thing this month is the recovery of my investments and the fact that I was finally able to sock $1,000 into my savings account. I’m actually really proud about that.

I’m not going to get too attached to outcomes here because the numbers are about to fly all over the place. But as long as I’m generally trending up, I can still meet my goal.

Which is this: in 1,583 days, I’ll be 40. That’s when I’d like my net worth to be $500,000. In the end, this pandemic will be a blip on the radar. But living through the blip, right now – it’s a wild ride, man.

April 2020 Freedom update bottom line

Things are all up in the air now because of:

My pending condo sale (pray I can sell it)

Job uncertainty

April 5, 2020

Ways to support Out and Out during the COVID-19 pandemic

What a strange time to be a travel blogger. And what an especially strange time to be a travel blogger who’s also interested in personal finance topics. I can’t travel, and the economy is going through one of the rockiest, decline-iest, bear market-yist times in a generation – or a lifetime. #iquit #not

There’s no question page views and blog revenues are declining right now. There’s simply lack of interest and people are more preoccupied with daily existence rather than aspirational trips and points balances. I’m still here and ready to get back those types of reports. Trust me, I’m ready to book an epic trip the second things return to normal (in my cabin fever haze).

But what really rattled me was when my company slashed everyone’s salary and started cutting expenses left and right. So now I’m low-key worried about my future and thought – well, there’s no harm in asking for support. Plus, many readers might not know there are so many ways to support the blogs they enjoy. Including mine.

It’s always been hard for me to ask for support. But I figure nothing ventured, nothing gained. And oh, how I’d like to venture right now!

Cheers to the many years this blog has been around

Many of the ways you can support are super simple – by clicking a link at no cost to you. Affiliate links are free for you and directly support the blogger of your choice – including me.

And most links have a benefit to you in the form of promotions for services we’re mutually interested in.

I encourage everyone to support the blogs, little guys, small businesses, and local joints they love – we need you more than ever during this pandemic. So please please please use our links!

I will also go ahead and say thank you for the first of many times throughout this post. Thank you for your support!

Ways to support Out and Out

When I started this blog in March 2013, I had no real plan or goal for it. I threw out ideas I had about banks, card, points, miles, and general travel – and what do ya know? People responded. Those people formed my tribe of followers.

That was seven years ago. Over time, I’ve leaned into the craft of blogging and use this forum as a way to hone my writing and personal interests. Along the way, I’ve made many friends, attended conferences, hosted meetups, and consistently written about my journeys throughout the points and miles world.

What I’ve come to learn is that travel is my biggest passion. So the thought of being locked away without being able to step on a plane whenever I want is kind of crazy. I’m grateful for all the trips I’ve taken – I couldn’t name a favorite if I tried – and hope to take more again soon. It’s best that we stay inside until this virus subsides. But as a born traveler, it’s taking a different kind of toll on me.

For now, we all have to get through the next few months. Myself included.

First pass at designing the Out and Out logo

If any of these things below can benefit you and you want to directly support the blog, please use my links and codes. I appreciate the support as I try to sell my Dallas place and hold on to my job for as long as I can.

Looking forward to the next evolution… whatever that’s going to look like. Grateful for any support right now.

Earn and burn

Right now is an excellent time to:

Accumulate miles and points

Run test searches for routes your interested in

Recalibrate your cards and loyalty programs

Dream about new trips

Look for new travel opportunities

Earn cashback on your daily supplies

So while we can’t redeem points right now, we can certainly start collecting miles to get ready for the time comes when can redeem them.

And as crappy as hotels and airlines have been over the past decade, I think we’ll see a time when they’ll have to soften their requirements – especially as travel slowly ramps back up in a post-virus world. We might even already be in another recession. Remember 2010 and how they threw the world at us?

With that, here are ways you can support Out and Out directly.

Sign up for new credit cards

Many banks have pulled their credit cards from affiliate relationships. But there are still some cards that remain, like:

Select Chase cards (personal and small business)

Amex personal cards

Wells Fargo Propel Amex – my review

A few US Bank cards

And a few others I can’t mention because of compliance

Here are my links if you want to explore:

Travel rewards credit cards

Airline credit cards

Hotel credit cards

Cashback credit cards

Small business credit cards

If there’s a card you find that you’ve been meaning to apply for and it’s the best available public offer, thank you for using my link!

I get my links through CardRatings, and they have been an amazing partner with me for a couple of years by now. So when you see CardRatings, just know you’re in the right place.

Review of My $100 Stay at the Hyatt Ziva Los Cabos

Writing this now is so weird because my last trip was exactly a month go today. In early March, I headed to Cabo San Lucas to enjoy a 4-night stay at the Hyatt Ziva Los Cabos. Read about how I booked it for $100 per person – including flights – for what would’ve been a $2,600 trip.

And now I’m reminiscing because I don’t know when my next trip will be, which would’ve seemed unthinkable just a few weeks ago. I have FinCon set up in Long Beach in early October. Sure hope I can still get to that. But no jet-setting or hopping around the globe for a while. I’m craving a nice long trip to Europe.

March 30, 2020

10 ways to make the most of self-isolation (Quarantine and chill edition)

We’re all staying at home during this pandemic. Because self-isolation is a must. It’s weird to not have the option to go out for a meal or grab a drink. And I miss hanging out with friends.

But, I’m dealing like everyone else. Washing my hands, staying inside, and taking long (socially-distanced) walks with the pupper. He really is my best friend right now. We quarantine and chill.

And we are staying worked out and hydrated throughout this thing, ok?

Here are 10 things getting me through this lockdown.

May the lord open.

10 things to do during quarantine and chill

I’m not sure what today is or how long I’ve been here, but March 2020 is shaping up to be the longest year of my life. I’m actually enjoying the chance to slow down for a bit and reconnect to myself.

Here’s what I’ve been up to.

1. Order Uber Eats/local delivery

The service industry is taking a beating right now. No movies, concerts, sports… or restaurants. As much as I love cooking at home, I still want to support the eateries my area.

I use Uber Eats to get food delivered. They have no contact delivery options. And they’re waiving all delivery fees if you order local. How cool is that?

No delivery fees with Uber Eats

If you use my code, you can also get $7 off your first order with no minimum. After downloading the app, click the “Promotions” tab and enter an existing user’s promo code.

Mine is “eats-rfufr” if you want to use it. This will give you $7 to use toward your first order.

Or if you’re in Dallas like me (or Austin), order directly from the restaurants because now you can get cocktails delivered. Yes, you can have a margarita delivered right to your door.

Lord knows restaurants need all the business they can get right now. Order local – no chains!

2. Get groceries delivered

I can’t order in every day because that gets expensive. And tbh, my company is trimming their budget left and right and I’m low-key worried about my job. Thank gods I have Amazon Prime, because 2-hour delivery from Whole Foods is free (and I mostly eat fruits and veggies at home, so that’s perf).

Instacart will send a driver to shop for you and deliver groceries to your door

If you prefer other stores, definitely checkout out Instacart because they have most stores available on there. My mom is obsessed with getting Aldi groceries delivered via Instacart.

With both services, you can schedule a window of time to get your items delivered – and both offer no contact delivery.

Don’t even have to go out and practice my social distancing

The good thing about Amazon Prime is you can verify store availability before checkout, which is helpful for items that have been selling out quickly, like TP, tissues, hand soap, etc. It’s not a perfect system, but at least you don’t have to get out and check for yourself.

3. Try new recipes

What do we do with these delivered groceries? Get to munchin’.

Now’s your chance to bake, sautee, air fry, Instapot, slow cook, and generally experiment to your heart’s content.

Salad game strong

I for one have been making some bomb-ass salads. They’re little masterpieces, each one.

#omgyum

And baking delish homemade crisps, steaming veggies, and trying new combinations in my morning smoothies. Viewing this extended stay-at-home retreat as a culinary cornucopia is a much better way of thinking of it than a “lockdown.”

My wanderings to the kitchen fill me with wonder whereas before it would be a rushed fumbling to “get it done.” It really is the little things.

I’ve also been telling my food thank you and pondering their long journey to my kitchen before eating. I haven’t lost my marbles – it’s a small but powerful act of mindfulness I’d encourage you to try. Again – little things.

4. Catch up on movies

I love firing up Netflix and Hulu knowing I got all night, baby. Just me and you. I rewatched The First Wive’s Club, started Little Fires Everywhere (no one plays an uptight suburban housewife like Reese Witherspoon), and added Tiger King next to my queue (can’t wait!).

Now that film productions are suspended, it makes me grateful to all the actors and artists that made these films and shows over the years. I finally feel like I can catch up a little – although there’s soooo much content out there, it’s nigh on impossible to ever really get caught up.

5. Read books

I am loving my mountain of unread books right now. I have a few paperbacks and loaded up several to my Kindle. There’s nothing like grabbing a beer and swaddling under covers with a book and consuming words and ideas, conjuring images in my mind, and being transported by another’s descriptions. Things I ordinarily wouldn’t notice or describe are laid out so differently than I’d perceive. That’s the magic of reading, ain’t it?

This book is exquisitely kinky

Right now, I’m reading Existential Kink, which is a delightfully kinky way of uniting your unconscious desires with your ego and transmuting them into a glorious alchemical marriage. It’s about making the unconscious conscious and taking delight in the adorable, quirky, mess of life and realizing you’re the context on which the content is based.

It’s heady stuff, and perfect for ruminating with a cold beer in hand on a quiet evening at home.

March 24, 2020

Taking a $25,000 beating & dealing with panic in a bear market – March 2020 Freedom Update

This year has already been difficult in many ways. So I’ll have to unleash a whole lot of not great news. Of course, everything is down right now. And I’m fighting my HOA about a roof repair and thinking about renting an apartment nearby and trying to sell my current place.

All that’s been going on in the background as everything I’ve worked to save in the past year or two has been wiped out in the stock market. I’m hoping I can sell before my property value suffers too much. I will never, NEVER live in a place with an HOA EVER again.

That said, I’m grateful to have a job that’s allowing us to work from home. But this – all of this – moving, renting, selling, and making repairs to my current place (including the roof and ceiling!) are going to cost me everything I have. Like, everything.

But I have to try.

I few weeks ago, we lived in a different world and I was in Cabo. How quickly things change

For a second, my finances are going to spin out of control. And oddly enough, it’ll all be OK.

March 2020 Freedom update

It’s totally unreal everything that’s happened since my last Freedom update. Things were on the up and up. And now… who knows what’s going on.

While I’m still contributing to my 401k, I’ve resorted to paying the minimums on my credit cards until some dust settles.

You see, I’m trying to rent an apartment nearby, repair and sell my condo, and move. And contractors and movers want cash. But once I sell my condo, I *should* have enough to pay it all back and then some.

I’ve been fighting my HOA since January about a ceiling leak. They refuse to repair the roof because they are basically insolvent and the board president is a literal lunatic. I want out of here ASAP. But trying selling a condo with a ceiling leak and a broke HOA right now is a herculean task. All I know to do is try. But man, it’s breaking me.

I’ve missed writing here. Most days and nights, I’m consumed with thoughts about money and my living situation, and of course… the pandemic. I oscillate between living in fear, wanting to fight back, and a slough of despond. But I bucked up and:

Started a petition to impeach the entire board

February 24, 2020

One IRA maxed, a return to credit cards & up $10,000 – February 2020 Freedom Update

Hello my droogs. How quickly things change in a day.

I started this post with such excellent news to report: big gains, strong performance, and hard work paying off. As I write this, I fear I’m about to go into battle with my HOA over repairs that haven’t been made for a month – right before my (nearly free) Cabo trip. So I’ll try to put myself back into my previous headspace and vent about the rest later. Because I need to vent.

The good news is a continuous upward trend. Though I fear coronavirus is about to give my stocks a hell of a beating, I’ll have to see it as an opportunity to buy more at a discount. Because it’ll pass and that’s what it is.

This month finds me almost done maxing out my 2019 Roth IRA. Then I can finish paying my credit cards and turn attention to the 2020 Roth IRA. All according to plan.

I’ll be back in Mexico at the end of this week, a lot further ahead than I was before – even if it doesn’t feel that way right now

The HOA stuff might throw a wrench in my progress soon, and I hate that. But life, right?

Sigh – going back to previous headspace again. As it stands now, my overall net worth is up to $137,885 – 28% of the way toward my $500,000 goal. Baby steps feel so good.

February 2020 Freedom update

I’ll keep this one brief. April 15th is creeping up which means:

I have to file (and pay) my 2019 taxes

The last day to max out 2019 IRAs is approaching

I wasn’t in a great place for a lot of 2019, and certainly didn’t max out my Roth IRA during the year. But I’m making up for it in a big way – and making tons of other progress, too.

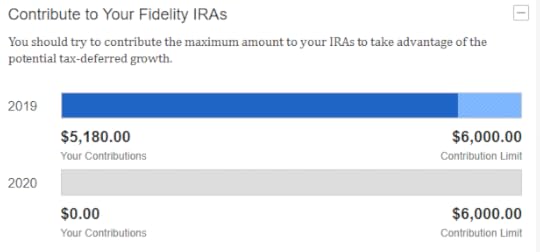

Almost there for 2019 Roth IRA!

Of the $6,000 maximum, I’m $5,180 into the 2019 contribution limit.

Only $820 to go!

No matter what, I’ll focus on filling out the final $820 that’s allowed and sink it all into no-fee Fidelity index funds (FZROX is my fave).

I accomplished this by taking a break from paying down my credit cards. There’s no interest right now, but as soon as I’m done with the Roth IRA, I have to catch up in a hurry because my 0% promo rate expires in April 2020. That, or roll it over one last time with a new balance transfer offer. And my god, that’ll be the last one I ever do. (I swear!)

All this to say, I’m almost there. You know how they say, “Save till it hurts?” I’m officially hurting. Getting this far required every spare scrap I had. But almost there. And I don’t want to ease up.

It’s true that once you realize how far you can extend, you can always find a little more to squeeze (like an anaconda). That said, I don’t want to get so obsessed with saving that I forget to have fun – and this Mexico trip will put that back into focus. I have some things to say about that mentality too. (This is becoming a scratch pad for all the future things I want to write. Lord grant me more energy to pour into writing!)

February 13, 2020

Citi retention offer: A quick call got me 3X ThankYou points everywhere (up to 35K)

I’ve written how everyone with a Citi card should call at least once a year and check for a Citi retention offer – particularly if the card has an annual fee.

My Citi Prestige annual fee recently posted. I called, and no joy. This week, the fee on my beloved AT&T Access More card posted, so I called again.

This time, I got my favorite retention offer so far: an extra 2X Citi ThankYou points on all spending, with a max of 35,000 points.

That breaks down to 3X points per $1 spent on up to $17,500 spent in non-bonus categories. And 5X points per $1 spent for online purchases (which are a bonus category with this card). Wow.

Gosh I love this card

I immediately queued up mortgage, HOA, and car payments with Plastiq (because it’s a MasterCard, which you can use for those payments) and moved the card into my wallet – a place it hasn’t been for a looong time.

3X Citi ThankYou points for everyday spending is an awesome return. I value that at 6% assuming each point is worth 2 cents each.

Morever, earning an extra 35,000 ThankYou points is worth $700 to me by that same metric. AND this card earns an extra 10,000 Citi ThankYou points when you spend at least $10,000 in a cardmember year. Because this offer will also trigger that bonus, I value it for an additional $200.

So yes, this quick call recouped the card’s $95 annual fee nearly 10 times over. And is a great reminder why you should always always call Citi about retention offers.

Note: The Citi AT&T Access More card is no longer available. Nope, not even for product changes.

Citi retention offer details

I noticed a few new things with this call, which was very similar to Middle Age Miles’ call on their Citi Premier card.

For one, I’d heard you could accidentally close a card through the automated system if you say “close card” so I said “representative” and got an agent pretty fast.

I explained the fee had just posted on my card and I wasn’t using it as much (which is true now that I’m using the Citi Double Cash for mortgage payments through Plastiq). The agent asked, “Do you want to close it?”

So I said, “Well, I’m thinking about it… do you have any bonus offers available if I keep it?”

She replied, “I can only transfer you to check if you say YES, you want to cancel.”

That kinda gave me pause. My thought is too many cards were canceled through the automated system so now they need verbal confirmation before they do it. I didn’t want to say it. But I did. “Yes, close the card.”