Harlan Vaughn's Blog, page 14

August 24, 2019

Why I’m Moving (Even More) to Citi ThankYou Points – And Away From Chase

Like most points fanatics, I held Chase Ultimate Rewards points in the highest regard. It was my primary points program for years. At a recent Meetup, I asked everyone to include their favorite points program on their name tag. Literally everyone put Chase Ultimate Rewards points.

I was the odd one out. I proudly put Citi ThankYou points – which spurred interesting conversation. Because I haven’t really used my Chase cards since January 2019, when Citi Prestige unveiled 5X points earning for flights and dining with the Citi Prestige card.

Chase’s nearest competitor to Citi Prestige, the famed Sapphire Reserve, slid to ye olde sock drawer. Then, when the $450 annual fee came due, I downgraded it to the Freedom Unlimited, which I’ve used exactly never.

Why? Well, for my spending patterns, ThankYou points are much easier to earn. Combine that with the fact that Ultimate Rewards points aren’t as shiny as they once were and you have a recipe for saying “Chase Ultimate… who?”

Sorry, Chase. It’s not me, it’s you.

One’s in, one’s out – which is which?

I say this as someone who is soon to be 2/24 (did I hear you gasp just then?). I mean sure, I’ll prolly get a couple more Chase cards for the sign-up bonuses. But I doubt it’ll change my long-term spending strategy.

Here’s my reasoning.

Chase No-Longer-Ultimate Rewards points

How did we get here? To borrow from the new Taylor Swift album (I promise I’m not a #Swiftie, but rather a #ToriBoy forever), it was death by a thousand cuts. It happened in near slo-mo:

Chase:

Lost Korean Air as a transfer partner

Had to deal with Marriott’s “Bonvoy” program turning into a verb rather than anything useful #StarwoodRIP #Bonvoyed

Has United moving to dynamic pricing in November and I’m SURE that’ll be a bleep-show

Has had minor devaluations with other programs recently, including IHG, British Airways, Singapore Airlines, and Flying Blue

Only has Hyatt to lean on as the best transfer partner

Hasn’t refreshed the Sapphire cards since launching them (! – Compete, Chase!)

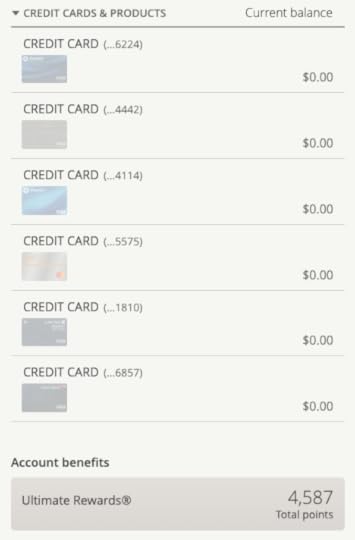

Ain’t spent a dime on any of my Chase cards, and drained my UR balance

I currently have seven Chase cards (the six above and an old Ink Plus), and have transitioned all my spending away from them.

For one, the Freedom’s 5X categories have been mostly uninspiring lately. I’ll use it here and there, but unless it’s groceries, Amazon, Uber/Lyft, or dining – meh.

Then there’s the curious case of the Freedom Unlimited, which earns 1.5X Chase Ultimate Rewards per $1 spent, with no cap. The argument goes that when you combine it with the Chase Sapphire Reserve, where points are worth 1.5 cents each toward travel booked through Chase, that’s a 2.25% return for the Freedom Unlimited, which has no annual fee (1.5 X 1.5).

If/when Hyatt ever devalues, Chase points are trash. This is me in Houston

Sure, it’s a step up from most 2% cashback cards – but the catch is you have to tie it to the Chase Sapphire Reserve, which has a $450 annual fee.

And that was fine for a long time, because when it launched, the Chase Sapphire Reserve was the best all-around travel card out there. But it’s simply not any more.

Prestige redemptions are devaluing too, but it doesn’t matter

Link: The 5 Best Citi ThankYou Transfer Partners Are…

The Citi ThankYou points you earn with Citi Prestige are worth 1 cent each toward travel. Assuming you only spend in the bonus categories and earn 5X points per $1 spent, that’s a 5% return.

Compare that to spending in the Sapphire Reserve’s bonus categories to earn 3X points with points worth 1.5 cents toward travel. That’s still only 4.5% back toward travel (3 X 1.5).

Of course, this only matters if you book travel through the respective bank portals. I’m mostly interested in the transfer partners. And considering Chase’s recent losses, I can do everything I want to do with Citi’s selection of transfer partners:

Avianca

Asia Miles (Cathay Pacific)

EVA Air

Etihad Guest

Flying Blue (Air France / KLM)

Jet Airways

JetBlue

Malaysia Airlines

Qantas

Qatar Airways

Singapore Airlines

Thai Airways

Turkish Airlines

Virgin Atlantic

Especially the most valuable five of the lot.

I’m not too concerned with the minor difference in the premium cards’ annual fees – $450 a year for the Sapphire Reserve vs. $495 a year for Prestige. That $45 isn’t going to sway me either way all that much.

The power is still in the pairing – and it’s better for Citi ThankYou points

Lots of peeps have a “Chase trifecta,” usually the:

Sapphire Reserve or Preferred

Freedom Unlimited

Freedom

AND/OR

Ink Business Preferred or Cash

I personally have an Ink Plus, Freedom, and Freedom Unlimited (right now).

This is because you can combine all the points you earn into the highest-value card account – and supercharge all the points you earn across every card.

For example, you can earn 5X points with Chase Freedom’s rotating quarterly categories, then bounce those points to the Sapphire Reserve. From there, they’re like all other Sapphire Reserve points. You can:

Transfer them to travel partners or

Book travel at a rate of 1.5 cents per point

At a minimum, you want at least one Chase card with an annual fee, because then your points become transferrable to travel partners. Useful for so many situations.

If you have a few Chase cards, the theory is you can maximize every purchase – and then reap the benefits of the best Chase card in your bunch.

Now, Citi ThankYou points

But, it’s even better with Citi. Mmmmhmmmm!

That’s because your points inherit all the best qualities of each card when you combine them into the same account.

The cards look the same, but have wildly different characteristics

Por ejemplo, say you have Citi Prestige, ThankYou Premier, and Rewards+. ALL your points:

Are worth 1.25 cents each toward travel from having ThankYou Premier

Are transferrable to partners from having Prestige/ThankYou Premier

Earn 10% back to your account from having Rewards+

Plus, you can stack the fantastic bonus categories:

5X points on air travel and dining from Prestige

3X points on all travel with ThankYou Premier

3X points on gas with ThankYou premier

2X points on entertainment with ThankYou Premier

2X points at supermarkets with Rewards+

IMO, these are better reward categories than what’s offered with any of the Chase Ultimate Rewards cards. Now THAT’S a “Citi trifecta.”

Make sure not to discount that 10% rebate with the Rewards+ card. You can get up to 100,000 points per year back to your account. That amps up the earning on all your Citi cards!

“But Citi is cutting benefits”

Have to address this.

I’m *super* disappointed Citi is cutting all their travel insurance and many other benefits:

Effective September 22, 2019, Worldwide Car Rental Insurance, Trip Cancellation & Interruption Protection, Worldwide Travel Accident Insurance, Trip Delay Protection, Baggage Delay Protection, Lost Baggage Protection, Medical Evacuation, Citi® Price Rewind, 90 Day Return Protection, and Missed Event Ticket Protection will be discontinued and will no longer be provided for purchases made on or after that date. Coverage for purchases made before that date will continue to be available, and you may continue to file for benefits in accordance with the current benefit terms. Roadside Assistance Dispatch Service and Travel & Emergency Assistance will be discontinued and will not be available on or after September 22, 2019.

Honestly, eff you, Citi. Those are huge ancillary benefits. I used Citi Price Rewind constantly, but nearly every card issuer has cut price and return protection recently. I’d love for them to keep trip delay and interruption, and lost baggage and delay insurance – at a bare minimum.

But then again, Amex doesn’t offer much in the way of travel insurance either. And this mostly affects flights. So while I hate they’re doing this, I’m not sure it’s worth keeping a Chase card just for these benefits. I did take a lot of comfort in knowing they were there – so yeah, this one definitely stings. What do you think about this issue?

You still need a card with primary rental car insurance, though

That is, if you ever rent cars. The Chase Sapphire Reserve and Chase Sapphire Preferred both offer primary rental car insurance both domestically and abroad. Lucky for me, I still have my Chase United Explorer card, which also offers this benefit. In practical terms, this is the one benefit that makes or breaks a proper premium rewards card. Make sure you have one. Chase is still the best for this.

Bottom line

Chase Ultimate Rewards hasn’t kept up in terms of bonus categories, points earning, or transfer partners – all things that are amply available with Citi ThankYou cards.

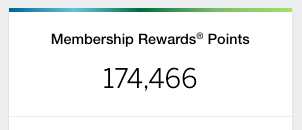

Because of this, I’ve switched my loyalty and spending to Citi ThankYou points cards. And for the odd non-bonus purchase, I use my Amex Blue Business Plus because it earns a flat 2X Amex Membership Rewards points per $1 spent, on up to $50,000 in spending per calendar year. Basically, I want every dollar I spend to have a meaningful return, and I no longer find that happening with Chase cards. I haven’t spent anything on my Chase cards recently.

One more thought: Chase’s best transfer partner is now Hyatt. But since I got my Amex Hilton Aspire card, I’m going full Hilton fanboy – a place I’ve always occupied anyway. So while I still like Hyatt hotels, I personally don’t see myself using them all that much in the near-term.

And just to give a bird’s eye view: I simply don’t think Chase as many useful bonus categories as Citi cards do.

Over to you – what do you think regarding UR vs TY points at this moment in time? Are you still #TeamChase like so many of my compadres? Why are you sticking around? Why not utilize Citi?

Free Food! Get $7 Toward Your First Meal With Uber Eats Promo Code “EATS-RFUFR”

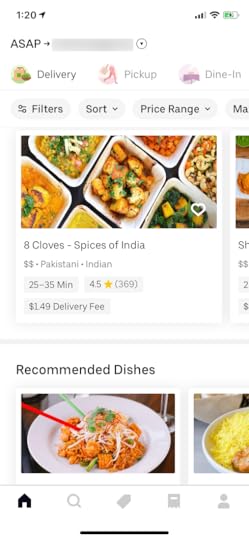

Sharing an easy win for $7 off a meal with this Uber Eats promo code: “EATS-RFUFR”

Easy $7 discount with Uber Eats

If you’re in a city where UberEATS participates (and there are many – here’s the full list), you can get $7 off your first order when you use an existing user’s promo code after you download the app for iOS or Android.

It only takes a few minutes and you can get a nice discount out of it. I’ll show you how easy it is.

$7 off Uber Eats promo code

Link: Uber Eats

Uber partners with restaurants in major cities all around the US and Canada (and around the world). Here’s a very abbreviated list:

Atlanta

Austin

Brooklyn

Chicago

Dallas

Edmonton

Houston

London

Los Angeles

Melbourne

Miami

New York

Ottawa

Paris

Phoenix

San Diego

San Francisco

San Francisco – East Bay

Seattle

Singapore

Toronto

Washington, D.C.

An Uber driver will deliver the restaurant’s food to you after you order via the app. To make it interesting, they rotate the selection every so often, so there’s always something new to try.

Come to meeee

And in my city of Dallas, there’s always a selection of restaurants with a $0 delivery fee if I share my order with another courier – and it changes every five minutes.

You can only order through the Uber Eats app (not on the website) – so you need a smartphone to access the service (and live in a participating city).

Free food!

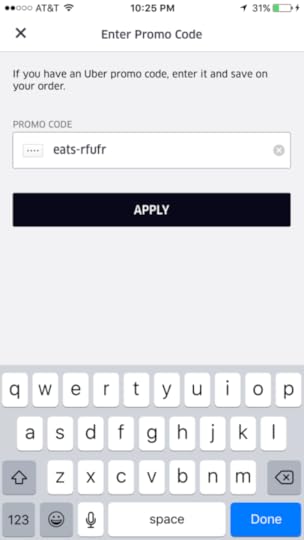

Now for the fun part. You can get $7 off your first order with no minimum – and you can use it toward the delivery fee (if there is one).

After downloading the app, click the “Promotions” tab and enter an existing user’s promo code. Mine is “eats-rfufr” if you want to use it. This will give you $7 to use toward your first order. You should see it automatically listed after you enter it.

Enter in the promo code under the “Promotions” tab

Now you’re ready to start browsing the food options.

Om nom nom

Select whatever you want.

You can use the $7 toward the food price and delivery fees. So in my case, a $14 burger and fries ends up being $7 + service charge and taxes.

Once you find something you wanna gobble, hit “Place Order” and get ready to chow down.

You can share your promo code with others, too. Then they can get free food and so can you.

Bottom line

This should make for a nice lunch break.

I do not know if this promotion is in limited quantities, or if it has an expiration date.

So if you’re interested, I’d go ahead and download the Uber Eats app and apply a promotion code sooner rather than later. As a reminder, my code is “eats-rfufr” – that’ll give you $7 to spend on food. And you can apply it toward taxes and the delivery fee, too.

Uber Eats purchases code as “travel,” so your best bet is to use a card that includes travel as a bonus category, like the Chase Sapphire Preferred or Citi ThankYou Premier.

Share with your inner circle to keep the free food coming in.

Remember to tip though!

Have you had an experience with Uber Eats?

August 4, 2019

Mexico City Trip Report: Teotihuacan Ruins, Xochimilco Canals, & Frida Kahlo’s Blue House

This time a month ago, I was headed to Mexico City for Round Two, after a pretty terrible time there in November 2018. I’m happy it turned out to be the quintessential visit, including:

Amazing food

Aztec ruins at Teotihuacan

A boat ride in Xochimilco

Frida Kahlo’s studio home

A walk through Chapultepec Park

Shopping at one of the sprawling street markets

Mexico City is vibrant, welcoming, safe… and brimming with attractions. There are museums galore, amazing restaurants, tons of green spaces, architecture, historical sites, nightlife, and so much more to enjoy. And, it’s easy to get around, considering everything is a ~$10 Uber ride away (Lyft isn’t there as of August 2019). We didn’t even bother with the subways.

I could’ve spent a month there and it wouldn’t have been enough. Considering it’s only a ~2-hour flight from Dallas, I can see myself returning for a quick weekend visit. Plus, temps are in the 70s (with lows in the 50s/60s) all year, because it’s set in the temperate basin of a mountain valley. So coming from Texas, I got a mid-summer cool-down.

July 10, 2019

Trip Report: Endless Ice, Incredible Nature, & Traditions in Qaqortoq, Greenland

Whew! In the 6 days since I’ve been back from Greenland, I moved all my stuff from Austin to Dallas, unpacked, and am now getting ready to head to Mexico City tomorrow for Round Two.

As soon as I arrived to Greenland, I sensed it’s a special and magical place on Earth. And immediately knew I had to go back.

Because it’s the largest island in the world that’s not a continent. The stats are vast. Greenland:

Is 21 times the size of Iceland

Has an ice sheet three times larger than the size of Texas

Is covered in 80% ice, which is over a mile thick in some spots

Has over 27,000 miles of coastline (!!!)

And yet, only 56,000 people live there. At this scale, it would take years to explore the entire country. Though I saw the tiniest sliver, it’s an incredible and challenging environment to explore.

I dare say it’s the most remote place I’ve ever visited.

Yours truly became an Arctic explorer at the base of the massive Greenland ice sheet

Here’s a glimpse of my time there.

Visit Greenland 2019 – Holy wow

Greenland is one of those places that isn’t on the way to anywhere. Plenty of travelers fly over it all the time, but to visit Greenland requires a concentrated effort.

Getting to Qaqortoq

You can fly there from Iceland or Denmark. I flew on Air Iceland from the Reykjavik city airport (which is different from Keflavik – it’s in the city of Reykjavik and much smaller).

My chariot to Narsarsuaq

We wanted to visit Qaqortoq, a town of ~3,000 people, located in Southwest Greenland.

Location of Qaqortoq

But there’s only one airport in that area, in Narsarsuaq, a settlement of ~150 people. Yup, you have to fly to a settlement of 150 people and then take a boat to the town of 3,000 people.

Seems counterintuitive, but you fly to the outpost to visit the largest town in Southwest Greenland

We learned there will be a brand new airport in Qaqortoq by 2024 – which is exciting news for the area. And that’ll be a big upgrade, because it took an hour and 45 minutes on a little boat to get to Qaqortoq (with a stop in Narsaq).

The flight from RVK was a bit over 2 hours. And that’s after you get to the Reykjavik city airport from Keflavik, which takes about an hour.

Even more restrictive is there are only 2 flights per week from Reykjavik to Narsarsuaq, so the timing has to be impeccable – and that’s of course if there are no delays. So you are very much at the mercy of the flight schedule and can’t be flexible with dates.

Larger towns, like Nuuk, have daily flights, which isn’t as much of an issue. But we had to get the timing absolutely right, and padded in a day on either side in case of delays getting into or out of Iceland.

Whether you fly from Iceland or Denmark, I’d recommend giving yourself at least at day to connect. Because any delay could put your connection at risk. And with limited schedules, you won’t wanna miss the only flight of the day (or week!).

Adventures around Qaqortoq

So getting there was a bit harrowing. But I found my zen and gave myself over to the experience of traveling to an extremely remote destination. Once we landed in Greenland, the magnitude of the peace there washed over me. And the beauty begins well before you land.

Stunning views on the descent into Greenland – get a window seat!

The weather was bright and “warm” – around 60 degrees during the day and 50s at night. This is because, in summer, the sun barely sets. Instead, it gets a bit less bright for a few hours and the sun rises all over again. So there’s not a chance to cool down in the evening with sunlight a near-constant factor.

In the winter, though, Greenland gets wicked cold, especially in the North where it’s above the Arctic Circle.

Once there, we set about exploring around the system of long finger-like fjords via boat. And though we only went 20 to 40 miles at a time, it takes a couple of hours to get anywhere. For round-trips of 4+ hours, it actually takes longer to get to and from a place than the time you spend there.

And you must take a boat or helicopter everywhere you go – there are no roads connecting the towns in Greenland. It’s physically impossible because of the ice sheet and extremely rugged terrain.

Staying in Qaqortoq

So there’s actually a 4-star hotel in Qaqortoq… called Hotel Qaqortoq.

It’s actually really nice! They have fast wifi, two on-site restaurants, breakfast in the morning, and house-brewed beers. By all accounts, it’s a clean and modern hotel walking distance to everything.

Not that the town is that big. There’s only one other restaurant, no coffee shops, and the only shopping is at the tourist office. Surprisingly, there are three grocery stores in town, including one with a big floor for clothes and home goods. I was impressed with the selection.

As an autonomous country still under Denmark’s rule, the selection is very Danish (and all prices are in Danish kronur). I learned they adore the King and Queen of Denmark (and keep up closely with the royal family).

Our room at the Hotel Qaqortoq – notice all the sealskin

There’s also a fur outlet in town where you can by seal and sheep products of all kinds. Hunting seal is very much alive here. They eat it and use the skin for all sorts of products. Our hotel room had sealskin blankets and throw pillows, and the hotel had fur-lined chairs and couches. Sealskin is everywhere – in the clothes, accessories, furnishings…

It’s an Inuit tradition. And the Greenlanders very much want to keep their national history alive.

Isn’t Qaqortoq so cute and idyllic?

We hit a patch of resplendent weather. While it rained here and there, we got huge gaps of sunshine and clear weather. And the sunsets were incredible!

Qaqortoq is an adorable maritime town

Our days were packed with things to do. Thankfully, the daylight hours were long.

Kaffemik

We arranged to have coffee and cakes at a local home. We arrived to our host, Sofia, with a translator, David, to partake in kaffemik, which translates to “get me a coffee!” from Danish and is a celebration gathering for any type of good news. It’s when you open your house and invite lots of people over to have a good time.

Traditionally, you’re served coffee, tea, and cakes, and just enjoy hanging out. Which is awesome!

We set up our kaffemik through the tourist office. And were graciously welcomed into a beautiful home in the center of town, full of old photos and artifacts.

At kaffemik with Sofia and David

I love her hands

Homemade orange cake

We talked about the Arctic, the future of Greenland, and modern Inuit life. Our host – and all the Greenlanders we met – were completely gracious.

It was an honor to participate in a local tradition!

Greenlandic ice sheet

All of Greenland’s towns and settlements are situated along the cost, because the interior is uninhabitable. When you visit, you simply must check out the Greenland ice sheet – it’s hard to miss. Along the way, you’ll see huge icebergs calved from the continental glacier.

It’s a humbling experience because the Greenland ice sheet is rapidly melting, There are more icebergs now than ever. Hearing our guide talk about how quickly the ice is receding was a bit of a shock. And while we only saw the tiniest portion, the scale of this change is mind-blowing.

To get there, we took a boat and hiked about an hour to the base.

Gorgeous landscapes along the fjord

Greenland doesn’t have nearly as many waterfalls as Iceland – and it’s not volcanic. The waterfalls we saw were a function of the melting ice sheet draining into the Atlantic. You can clearly see lighter rock right against darker rock where the ice sheet has receded in the past few years. Considering the rock under the ice sheet is between 1.5 and 3 billion years old, it’s literally untouched by humanity.

Seeing the changes written in the landscape is startling. It’s rugged and huge and the nature here is responding powerfully to the environmental effects.

At the base of the Greenland ice sheet

The ice sheet looks like a mountain from a distance – a gigantic mountain. And the water near it is the most beautiful blue-green color from all the minerals running into the water.

A look inside an ice cave

The melting ice forms a network of ice caves that regularly collapse under their own weight. But while they’re intact, they create the most brilliant shades of blue.

Just a few iceberg friends. They come in all sorts of interesting shapes and colors

And of course, being so close to the action, you get plenty of close-up views of iceberg friends. I imagine living here and watching them float in and out is such a meditative practice.

Uunartoq hot spring

Two hours by boat from Qaqortoq, you’ll find the Uunartoq hot spring nestled on its own island (!).

How cool is that

It’s the only hot spring in Greenland, and forms two small round pools constantly heated to bathwater temperature year-round.

You get stunning 360 views and a bay full of icebergs

The reason for this hot spring is a mystery as there are no tectonic plates here, or anything else that would seemingly cause it. In the 1500s, it was the best Viking spa in town!

June 18, 2019

Tomorrow: Heading to Iceland + Greenland! Plus, Some Life Updates

Tomorrow, I’m flying AUS-DFW-KEF, with a looong layover in Dallas. Then flying to Iceland in a… coach middle seat on American Airlines.

June 11, 2019

Announcing the Next DALLAS Meetup on July 11 – Meet Fellow Points & Travel Peeps!

We’ll have our next Out for Miles frequent flyer meetup in Addison, very close to North Dallas and near the Tollway, I-635, and PGBT.

This one will be Thursday, July 11, at 5:30pm – just in time for Blue Mesa’s reasonably priced happy hour. We’ll plan to hang out for a couple of hours the week after the long 4th of July holiday.

If you’re in the Dallas area, feel free to join!

The next Out for Miles meetup will be 7/11 @ Blue Mesa in Addison/Dallas

Out for Miles July event details

Link: Join Out for Miles

Link: RSVP here

We’ll be at the big table in front of the bar – you’ll see it right when you walk in. Grab a marg or beer and let’s discuss:

Recent Amex Hilton Aspire upgrades

Your holiday weekend adventures

The fate of the Chase Sapphire Reserve

How Amex Membership Rewards points are coming back into relevance

Getting so, so #Bonvoyed

Anything else about travel, points, or miles

Feel free to RSVP via the links or simply show up!

What: Out for Miles – Dallas Meetup

When: Thursday, July 11, from 5:30 to 7:30pm

Where: Blue Mesa, 4152 Cole Ave, Dallas, TX – Google Maps directions and location

Links: Join the group and RSVP on Meetup or RSVP on Facebook

The happy hour is until 7pm with:

Yarm

Here’s the full menu. Parking is all around the restaurant and there’s a big lot behind it, too.

Feel free to bring friends or plus ones!

(If you can’t make this one, join the official group to get updates on future events!)

Looking forward to seeing everyone!

June 10, 2019

Review: 3 Ways the Amex Platinum Card Is Worth the $550 Annual Fee

If you can’t tell, I’ve been thinking about ultra-premium cards a lot lately. Which ones to keep and pick up… and my overall card strategy.

All roads lead back to the Amex Platinum Card (learn more here) – the original, and a current stronghold.

Several years ago, it was my first card that had a big annual fee. Lots has changed in the industry since, but it’s held up remarkably well. It’s still the card to have if you’re seeking lounge access (though admittedly denigrated a bit in the past few years).

Among ultra-premium cards, it holds its own – especially if you can get maximum value from the long list of benefits.

There are three main ways to approach recouping the cost of the $550 annual fee: through lounge access, with statement credits, or from ancillary bennies.

In each case, the card earns its keep – making the rest of the perks gravy.

June 9, 2019

PSA: Don’t Make This Mistake With US Bank Altitude Reserve Travel Credits

Upon logging into my US Bank online account, I noticed something weird.

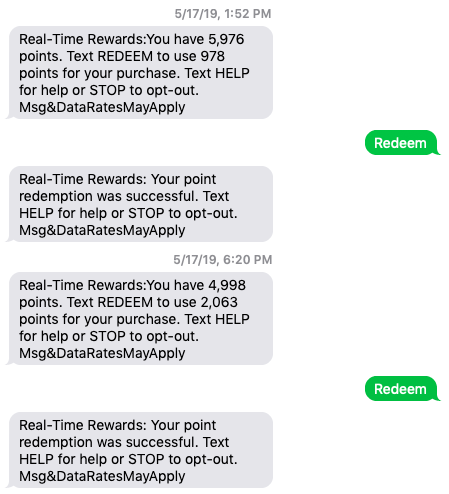

I have a decent amount of points from using mobile pay at Costco for 3X points (a 4.5% return because each point is worth 1.5 cents toward travel). And I have my Real-time Rewards threshold set to $10.

So when I make a travel charge over $10, I get a text asking if I’d like to redeem points to “erase” it.

Just say the magic word and your charge is gone. (The magic word is “Redeem”)

I used this for a few Uber rides recently. Great, great, love it.

But then… I noticed my $325 annual travel credit had recently reset – and doubly covered the charges.

~$82 of charges got double credited – one from Real-time Rewards, the other from my travel credits

Not only did I redeem points for those charges, but somehow it ate up ~$82 worth of my travel credits, too. If I’d known this would happen, I would’ve saved my points.

So when your travel credits reset, DO NOT use Real-time Rewards to erase your charges. You’ll end up paying double!

Oh, and US Bank was beyond lame when I alerted them to what happened. So lame that I’m thinking of dumping this card altogether – after I drain the remaining credits and points, of course.

US Bank Altitude Reserve travel credits don’t play well with Real-time Rewards redemptions

I called to explain what happened. The phone agent didn’t pick up what I was layin’ down. I was like… basically, I used points AND my travel credits on a single purchase. I “paid” twice.

“Can you either put the points back in my account, or reverse the travel credit?”

Either would’ve been fine. Instead, they submitted a request to “research” it. And said they’d send a letter within 5 to 7 business days. Why should I wait a week to correct an obvious error? Whatever. Sure, that’s fine.

A week later, I got the letter. (Yes, a paper letter in the mailbox.)

It said they could not put the points back because I authorized the redemption, and there was no way to reverse the automatic travel credits. I should’ve kept it, but I was so miffed, I threw it in the dumpster next to the mail area.

I don’t understand why I had to wait a week, or why it wasn’t obvious to them I was double-credited.

While it’s only ~$82, it got me thinking about my overall card strategy. And something’s gotta give.

Smell ya later, sucka

Because I recently pondered if I had too many ultra-premium rewards cards with big annual fees. And also:

I just upgraded to the Amex Hilton Aspire with 150,000 Hilton points and I’m so freaking excited because

My Chase 5/24 status gives me a new Chase slot to play with next month

I’m thinking about downgrading my Chase Sapphire Reserve and getting a new Ink Business Preferred

And maybe one more personal card

Sayonara, it was real

I could probably push US Bank a little harder. But you know what? Nah.

I recently paid the annual fee on May 24, so I have time to use the remaining credits and points.

Then I’m gonna close it.

While I firmly believe:

This is the best card for Costco shopping (and mobile payments)

Its perks completely cover the annual fee

Real-time Rewards are revolutionary

I don’t use it much beyond Costco. And if I have a Chase Freedom Unlimited, well, I can just use that to earn 1.5X Chase Ultimate Rewards points when I shop there.

Plus, yeah, I just got that Amex Hilton Aspire (click here, then “View all cards with a referral offer), so that’ll keep me occupied in ultra-premium card land. Thanks to Frequent Miler for spelling out the upgrade deets (no hard pull, same account information, and won’t affect 5/24!).

Also, what a lame response from US Bank. I was an early adopter of this card and never had an issue with it until now. This was the first time I asked for help – and they told me to scram. So I’m walking out on my lil feets… and shifting my overall points strategy to:

Citi ThankYou points and Amex Membership Rewards points for award flights

Hilton points for hotel stays

Chase Ultimate Rewards points for Hyatt stays here and there – I find myself moving away from UR points these daze (!), but that’s another post…

Bottom line

Def not happy that ~$82 bucks worth of my travel credit were wasted for nothing. If you have this card, be careful to avoid using Real-time Rewards until your travel credit is used up – otherwise you’ll use your travel credit AND your points for a single purchase.

I’ll prolly get Uber gift cards via MIleagePlus X to quickly eat up my remaining travel credit and points balance, and call it a day on this card.

I’m about to fall under 5/24 and can get new Chase cards, plus I just got an Amex Hilton Aspire card. If US Bank is gonna make it hard for me to use my rewards, I’ll take my business elsewhere.

Just a heads up so the same thing doesn’t happen to you!

I am also entertaining any thoughts about the “state of the game,” random travel observations, and bank customer service in general (

June 4, 2019

Does Your Biz Spend $6,000+ a Month? Get 95,000 Points, $700+ in Credits, Lounge Access, Elite Status…

Who’s never had the small business version of the Amex Platinum Card? *raises hand*

This card doesn’t count against your Chase 5/24 status. But I didn’t include it on my list of 6 best cards if you’re over 5/24 because:

It will only appeal to a small segment of people

The minimum spending requirement to earn the welcome offer is $20,000 (!) in the first 3 months of account opening

But there are several huge reasons to get this card, namely 75,000 Amex Membership Rewards points as a welcome bonus. Plus it comes with a long list of benefits – like $200 in airline credits, 5x points on flights, and 35% points rebate on an airline of your coach (for coach flights, and any airline for Business or First Class).

You can learn more about the card here.

I always make sure to eat full meals and enjoy a couple free cocktails at Amex Centurion Lounges

The annual fee is NOT waived the 1st year. But man, if you make good use of the lounge access and annual statement credits… it’s a total GOAT.

Amex Platinum business 75K card offer

Link: Amex Platinum small business card – learn more here

The Business Platinum® Card from American ExpressEarn up to 75,000 Amex Membership Rewards points

• $595 annual fee• Earn 50,000 points after you spend $10,000 within your first 3 months of Card Membership

• Earn an extra 25,000 points after you spend an additional $10,000 all on qualifying purchases within your first 3 months of Card Membership

• Get 35% of your redeemed points back from an airline of your choosing, and any First of Business Class flights you redeem points for

• $200 annual airline incidental credit

• 5X points on flights and travel booked through Amex

• Access to the fantastic Centurion Lounges, Delta SkyClubs, and Priority Pass network

• Learn more here

Elephant in the room comes first. You get so much with this card. But to unlock the full welcome bonus, you need to spend $20,000 on purchases within the first 3 months of account opening. It breaks down to:

Earn 50,000 Amex Membership Rewards points after you spend $10,000 AND

Earn an extra 25,000 points after you spend an additional $10,000 all on qualifying purchases within your first 3 months of Card Membership

I like having a lil stash of Amex points

While the spending requirement sounds huge, it breaks down to ~$6,667 per month to earn the full 75,000 Amex Membership Rewards points. Plus, you’ll end up with at least 95,000 points when you factor in the spending (and more if you spend in bonus categories).

Amex has some valuable airline transfer partners (I’ve highlighted my faves)

Link: Amex Membership Rewards transfer partners

When you transfer your points to partners, you can get with the current bonus:

Business Class flights to Europe, Asia, South Africa, or New Zealand (depends on how far and where)

Dozens of short-haul flights around the world – 15, to be exact @ 6,000 British Airways Avios points for flights under 651 miles outside the US

2 round-trip coach flights to Hawaii on United via Singapore Airlines (at 35,000 Singapore miles each)

Round-the-world in Business Class via ANA

I love using points to fly for free in metal tubes

Any of them could be worth $1,000s of dollars on their own, which already makes it worth paying the annual fee the 1st year.

So. Many. Bennies.

I’ll do a cross-section. This card comes with:

$200 in airline fee credits per calendar year (so you can get it in 2019 and again in 2020 – $400 total)

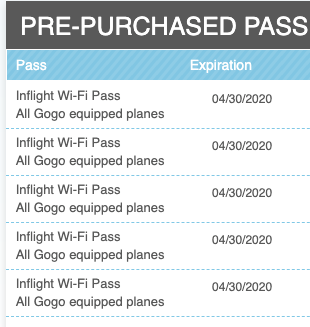

10 Gogo passes to use in-flight per calendar year (10 in 2019 and 10 in 2020 – worth $320 total)

The credits are useful if you’ll, well, use them

That’s $700+ in credits right there – without counting the Global Entry credit for $100, which would add even more if you need/want to use it.

Of course, these credits are only valuable if you’ll use them! I used my airline credits for $400 in Southwest gift cards.

All fun extras to have.

You also get:

Access to unlimited Boingo Wireless

Gold elite status with Hilton and Marriott

Access to Fine Hotels & Resorts

Plus, you can access Amex Centurion Lounges. I go to the one at DFW all the time (the best one!). For me, this alone is easily worth the price of admission. Not only that, but you can use the card to enter Delta SkyClubs and Priority Pass lounges.

I knowwww… every premium card comes with a Priority Pass these days. But the Centurion Lounges are really a special treat – and you can only access them with an Amex Platinum (or Black

May 28, 2019

Today Only (5/28): Get $10 When You Download the Pei App & Link a Card

Hope you had a good holiday weekend! Wanted to share this one day only promotion for the best cashback app out there right out – Pei.

Get a free $10 in your account when you:

Download the app

Link a credit or debit card

Enter promotion code “2pur1z” to get 1,000 points worth $10

That’s it!

Of all the cashback and card-linked apps, Pei is by far the most rewarding and easiest to use. The normal bonus for getting the app is 200 points ($2), so this is an easy win.

Plus, you can get $2 in points for every Uber and Lyft ride you take.

On May 28, 2019, you can get $10 for downloading the Pei app instead of the usual $2

I’ve been impressed with how easily the cashback rolls in for my normal spending. And whereas other cashback apps have gone downhill, Pei is holding strong. Get in on the good stuff while you can, especially with this today-only increased bonus!

Have a great week!