Why I’m Moving (Even More) to Citi ThankYou Points – And Away From Chase

Like most points fanatics, I held Chase Ultimate Rewards points in the highest regard. It was my primary points program for years. At a recent Meetup, I asked everyone to include their favorite points program on their name tag. Literally everyone put Chase Ultimate Rewards points.

I was the odd one out. I proudly put Citi ThankYou points – which spurred interesting conversation. Because I haven’t really used my Chase cards since January 2019, when Citi Prestige unveiled 5X points earning for flights and dining with the Citi Prestige card.

Chase’s nearest competitor to Citi Prestige, the famed Sapphire Reserve, slid to ye olde sock drawer. Then, when the $450 annual fee came due, I downgraded it to the Freedom Unlimited, which I’ve used exactly never.

Why? Well, for my spending patterns, ThankYou points are much easier to earn. Combine that with the fact that Ultimate Rewards points aren’t as shiny as they once were and you have a recipe for saying “Chase Ultimate… who?”

Sorry, Chase. It’s not me, it’s you.

One’s in, one’s out – which is which?

I say this as someone who is soon to be 2/24 (did I hear you gasp just then?). I mean sure, I’ll prolly get a couple more Chase cards for the sign-up bonuses. But I doubt it’ll change my long-term spending strategy.

Here’s my reasoning.

Chase No-Longer-Ultimate Rewards points

How did we get here? To borrow from the new Taylor Swift album (I promise I’m not a #Swiftie, but rather a #ToriBoy forever), it was death by a thousand cuts. It happened in near slo-mo:

Chase:

Lost Korean Air as a transfer partner

Had to deal with Marriott’s “Bonvoy” program turning into a verb rather than anything useful #StarwoodRIP #Bonvoyed

Has United moving to dynamic pricing in November and I’m SURE that’ll be a bleep-show

Has had minor devaluations with other programs recently, including IHG, British Airways, Singapore Airlines, and Flying Blue

Only has Hyatt to lean on as the best transfer partner

Hasn’t refreshed the Sapphire cards since launching them (! – Compete, Chase!)

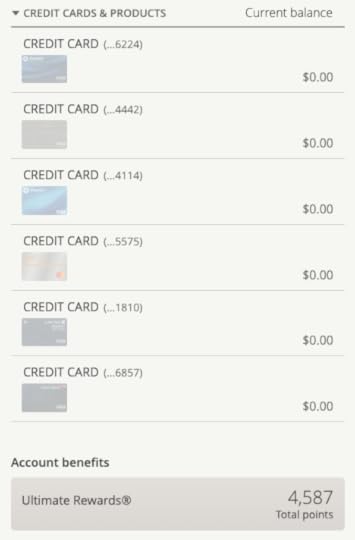

Ain’t spent a dime on any of my Chase cards, and drained my UR balance

I currently have seven Chase cards (the six above and an old Ink Plus), and have transitioned all my spending away from them.

For one, the Freedom’s 5X categories have been mostly uninspiring lately. I’ll use it here and there, but unless it’s groceries, Amazon, Uber/Lyft, or dining – meh.

Then there’s the curious case of the Freedom Unlimited, which earns 1.5X Chase Ultimate Rewards per $1 spent, with no cap. The argument goes that when you combine it with the Chase Sapphire Reserve, where points are worth 1.5 cents each toward travel booked through Chase, that’s a 2.25% return for the Freedom Unlimited, which has no annual fee (1.5 X 1.5).

If/when Hyatt ever devalues, Chase points are trash. This is me in Houston

Sure, it’s a step up from most 2% cashback cards – but the catch is you have to tie it to the Chase Sapphire Reserve, which has a $450 annual fee.

And that was fine for a long time, because when it launched, the Chase Sapphire Reserve was the best all-around travel card out there. But it’s simply not any more.

Prestige redemptions are devaluing too, but it doesn’t matter

Link: The 5 Best Citi ThankYou Transfer Partners Are…

The Citi ThankYou points you earn with Citi Prestige are worth 1 cent each toward travel. Assuming you only spend in the bonus categories and earn 5X points per $1 spent, that’s a 5% return.

Compare that to spending in the Sapphire Reserve’s bonus categories to earn 3X points with points worth 1.5 cents toward travel. That’s still only 4.5% back toward travel (3 X 1.5).

Of course, this only matters if you book travel through the respective bank portals. I’m mostly interested in the transfer partners. And considering Chase’s recent losses, I can do everything I want to do with Citi’s selection of transfer partners:

Avianca

Asia Miles (Cathay Pacific)

EVA Air

Etihad Guest

Flying Blue (Air France / KLM)

Jet Airways

JetBlue

Malaysia Airlines

Qantas

Qatar Airways

Singapore Airlines

Thai Airways

Turkish Airlines

Virgin Atlantic

Especially the most valuable five of the lot.

I’m not too concerned with the minor difference in the premium cards’ annual fees – $450 a year for the Sapphire Reserve vs. $495 a year for Prestige. That $45 isn’t going to sway me either way all that much.

The power is still in the pairing – and it’s better for Citi ThankYou points

Lots of peeps have a “Chase trifecta,” usually the:

Sapphire Reserve or Preferred

Freedom Unlimited

Freedom

AND/OR

Ink Business Preferred or Cash

I personally have an Ink Plus, Freedom, and Freedom Unlimited (right now).

This is because you can combine all the points you earn into the highest-value card account – and supercharge all the points you earn across every card.

For example, you can earn 5X points with Chase Freedom’s rotating quarterly categories, then bounce those points to the Sapphire Reserve. From there, they’re like all other Sapphire Reserve points. You can:

Transfer them to travel partners or

Book travel at a rate of 1.5 cents per point

At a minimum, you want at least one Chase card with an annual fee, because then your points become transferrable to travel partners. Useful for so many situations.

If you have a few Chase cards, the theory is you can maximize every purchase – and then reap the benefits of the best Chase card in your bunch.

Now, Citi ThankYou points

But, it’s even better with Citi. Mmmmhmmmm!

That’s because your points inherit all the best qualities of each card when you combine them into the same account.

The cards look the same, but have wildly different characteristics

Por ejemplo, say you have Citi Prestige, ThankYou Premier, and Rewards+. ALL your points:

Are worth 1.25 cents each toward travel from having ThankYou Premier

Are transferrable to partners from having Prestige/ThankYou Premier

Earn 10% back to your account from having Rewards+

Plus, you can stack the fantastic bonus categories:

5X points on air travel and dining from Prestige

3X points on all travel with ThankYou Premier

3X points on gas with ThankYou premier

2X points on entertainment with ThankYou Premier

2X points at supermarkets with Rewards+

IMO, these are better reward categories than what’s offered with any of the Chase Ultimate Rewards cards. Now THAT’S a “Citi trifecta.”

Make sure not to discount that 10% rebate with the Rewards+ card. You can get up to 100,000 points per year back to your account. That amps up the earning on all your Citi cards!

“But Citi is cutting benefits”

Have to address this.

I’m *super* disappointed Citi is cutting all their travel insurance and many other benefits:

Effective September 22, 2019, Worldwide Car Rental Insurance, Trip Cancellation & Interruption Protection, Worldwide Travel Accident Insurance, Trip Delay Protection, Baggage Delay Protection, Lost Baggage Protection, Medical Evacuation, Citi® Price Rewind, 90 Day Return Protection, and Missed Event Ticket Protection will be discontinued and will no longer be provided for purchases made on or after that date. Coverage for purchases made before that date will continue to be available, and you may continue to file for benefits in accordance with the current benefit terms. Roadside Assistance Dispatch Service and Travel & Emergency Assistance will be discontinued and will not be available on or after September 22, 2019.

Honestly, eff you, Citi. Those are huge ancillary benefits. I used Citi Price Rewind constantly, but nearly every card issuer has cut price and return protection recently. I’d love for them to keep trip delay and interruption, and lost baggage and delay insurance – at a bare minimum.

But then again, Amex doesn’t offer much in the way of travel insurance either. And this mostly affects flights. So while I hate they’re doing this, I’m not sure it’s worth keeping a Chase card just for these benefits. I did take a lot of comfort in knowing they were there – so yeah, this one definitely stings. What do you think about this issue?

You still need a card with primary rental car insurance, though

That is, if you ever rent cars. The Chase Sapphire Reserve and Chase Sapphire Preferred both offer primary rental car insurance both domestically and abroad. Lucky for me, I still have my Chase United Explorer card, which also offers this benefit. In practical terms, this is the one benefit that makes or breaks a proper premium rewards card. Make sure you have one. Chase is still the best for this.

Bottom line

Chase Ultimate Rewards hasn’t kept up in terms of bonus categories, points earning, or transfer partners – all things that are amply available with Citi ThankYou cards.

Because of this, I’ve switched my loyalty and spending to Citi ThankYou points cards. And for the odd non-bonus purchase, I use my Amex Blue Business Plus because it earns a flat 2X Amex Membership Rewards points per $1 spent, on up to $50,000 in spending per calendar year. Basically, I want every dollar I spend to have a meaningful return, and I no longer find that happening with Chase cards. I haven’t spent anything on my Chase cards recently.

One more thought: Chase’s best transfer partner is now Hyatt. But since I got my Amex Hilton Aspire card, I’m going full Hilton fanboy – a place I’ve always occupied anyway. So while I still like Hyatt hotels, I personally don’t see myself using them all that much in the near-term.

And just to give a bird’s eye view: I simply don’t think Chase as many useful bonus categories as Citi cards do.

Over to you – what do you think regarding UR vs TY points at this moment in time? Are you still #TeamChase like so many of my compadres? Why are you sticking around? Why not utilize Citi?