Harlan Vaughn's Blog, page 15

May 23, 2019

Earn Points + Cashback With Every Uber & Lyft Ride: The Complete List to Save the Most

I’m always torn between taking Uber and Lyft when it comes to rideshares. I mostly base the decision on which promos I’m chasing at the time. Because both companies let you stack several offers to earn points and cashback rewards every time you ride.

Here’s what you can get with Uber:

200 points (worth $2 in cashback) for each ride when you link your card through Pei – download the app here and enter code “2pur1z” for 500 free points

250 to 500 Freebird points (5,000 points = $10 cashback) when you start your ride through Freebird – download the app here and enter code “OUTANDOUT” for $10 back

1% cashback when you link your card through Hooch – download the app here

$1 in Shop Your Way rewards for every ride, up to $20 per month – link accounts here

Up to 10% back in credits with Visa Local Offers (opt-in through the Uber app)

10 Drop points per $1 for when you link your card with Drop – download the app here

Get to saving every time to rideshare

And here’s what you can do with Lyft:

3X Hilton points per $1 – link accounts

1X Delta mile per $1, and 2X Delta miles on rides to/from the airport – link accounts

30 JetBlue points for rides to/from the airport (up to 1,200 points per year) – link accounts

200 points (worth $2 in cashback) for each ride when you link your card through Pei – download the app here and enter code “2pur1z” for 500 points

250 to 500 Freebird points (5,000 points = $10 cashback) when you start your ride through Freebird – download the app here and enter code “OUTANDOUT“ for $10 back

25 cents for each ride when you tap through Ebates – sign up here (this does NOT stack with Freebird, so choose one or the other – I recommend Freebird!)

10 Drop points per $1 for when you link your card with Drop – download the app here

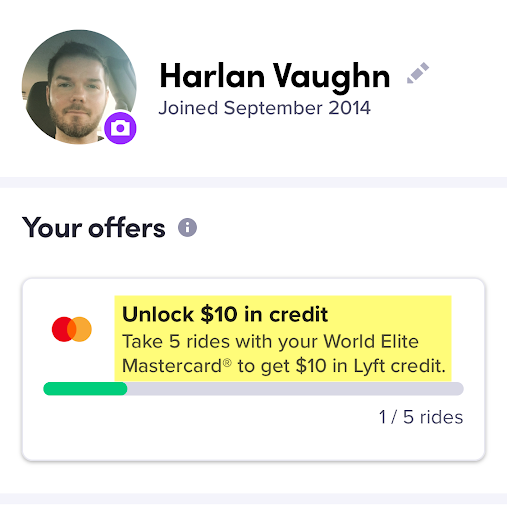

$10 in credit for every 5 rides when you link and pay with a World Elite MasterCard

And that doesn’t count their respective loyalty programs that are slowly rolling out.

It’s kind of incredible you can get all this back from each ride – when you stack multiple opportunities, the rewards amount to a big rebate, particularly if you take a lot of quick rides around town.

So which one is the better choice?

Points & Cashback for Uber & Lyft

Download Uber

Download Lyft

All things told, Uber and Lyft are pretty neck and neck as far the rewards go. I personally give the slight edge to Uber because their loyalty program is available in Dallas and Austin, while Lyft’s isn’t.

I’m already Gold with Uber

That’s a nice edge, because I also earn Uber points on Uber Eats deliveries. And I get $5 in credit for every 500 Uber points I earn.

Plus, the most meaningful rewards, $2 in cashback through Pei, and 250 or 500 Freebird points, are available with both services.

It sounds dorky to say this, but the real tie-breaker for me is the $1 in Shop Your Way rewards from each Uber ride. I save them up and treat myself to a new shirt or pair of pants every once in a while. And that little reward flips the switch toward Uber for me (this partnership is rumored to be ending at the end of May 2019, so if that happens, I’ll prolly go all Lyft all the time).

I LOVE getting $10 in credit after every 5th ride each month

If you have a World Elite Mastercard and link it to your Lyft account, you’ll get $10 in Lyft credit for taking 5 rides in a month. World Elite Mastercards include:

Citi Premier℠ Card

Citi® / AAdvantage® Executive World Elite

Mastercard®

Mastercard®CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Barclaycard Arrival Plus® World Elite Mastercard®

Capital One® Savor® Cash Rewards Credit Card

Even without a rewards program, the $10 credit might be more compelling than a rewards program. I have my Citi AT&T Access More card linked up to Lyft. If I maxed this out every month, that’s $120 in Lyft credits, which easily offset that card’s $95 annual fee.

Because honestly, for a $10 Lyft ride, earning 30 Hilton points and 10 Delta miles isn’t gonna sway me one way or another.

It’s different for everyone, and based on:

If Uber or Lyft has a rewards program where you are

If you get a lot of Uber Eats deliveries

Whether or not you have a World Elite MasterCard

Which rewards you personally find more meaningful

Where Uber & Lyft rewards overlap

There are 3 programs that reward you regardless of which company you ride with:

Pei

Freebird

Drop

First up, Pei has blown me away. You link your cards once, then earn cashback at tons of retailers, including Uber and Lyft.

You can cash out to PayPal once you reach $20 in rewards. And let me tell you – they add up FAST.

Pei currently gets you $2 per Uber or Lyft ride, plus loyalty bonuses

When you download the app and enter code “2pur1z” you’ll get 500 points (worth $5) instantly in your account.

Then there’s Freebird. I am obsessed with this app. Link your rideshare accounts and book through their app to earn points and cashback on your rides – and it adds up quick, too. They also do well with constant Freebird promo codes.

Plus, the points you earn stack with all other promotions, discounts, earnings, etc. There’s literally no downside to using Freebird.

You can get up to $30 cashback if you’re a new user:

Download Freebird

Enter promo codes:

“OUTANDOUT” – $10 cashback ($5 for each of your first 2 rides)

“GO2TEN” – $20 cashback ($10 for each of your first 2 rides)

Finally, there’s Drop. The points add up slower than the others, but once you reach a certain threshold, you can redeem for free gift cards.

Drop is handy for Amazon gift cards every now and again

I added my cards once, and check it every month or so. I’ve redeemed Drop points for Amazon and Whole Foods gift cards in the past. So while not lucrative, hey, I’ll take free merch for spending as I normally would!

No matter which service you prefer, you should definitely be earning rewards through these three avenues – all of them are completely free to use.

Bottom line

Download Uber

Download Lyft

Like I said, I waffle back and forth between Uber and Lyft. Mostly, I toggle between accounts on the Freebird app to check prices on my route. 90% of the time, they’re within 50 cents of each other. In that case, I mostly go with Uber. Those Shop Your Way rewards, they got me!

May 22, 2019

Have You Checked Your Small Business Credit Score Lately? Get It for Free Here.

Nav is a service that’s primarily set up to match small businesses to financing options, loans, and credit cards. And as an added resource, they let you pull your small business credit report for free.

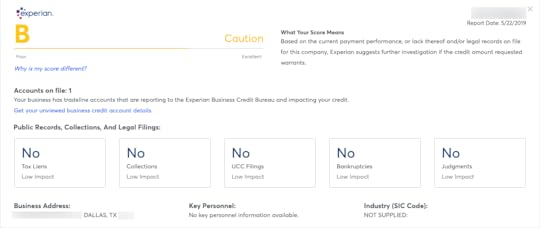

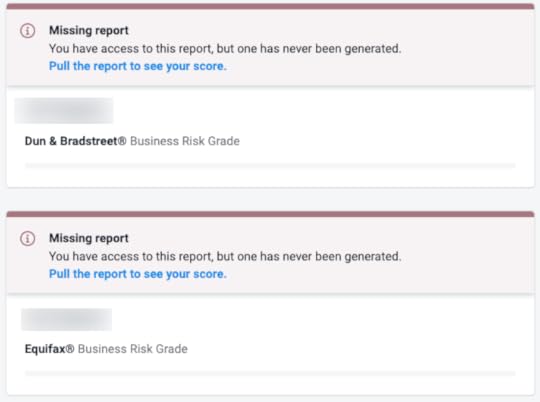

If you’ve ever opened a small business credit card, you probably have a business credit score. Through Nav, you can see your business risk grade from Experian, Equifax, and Dun & Bradstreet.

Experian and Equifax give you a grade of A through F, while Dun & Bradstreet use their own scoring model with a rank between 0 and 100.

But small business credit reporting is still the Wild West, because they match business names and addresses – and these aren’t always unique, so they do a lot of “near matching.” It’s a good idea to check the information that’s out there, particularly if you have a generic business name.

Plus, it’s free to check with Nav, so why not?

I still rent my spare room on Airbnb, and use the income I make to apply for small business credit cards. My Experian credit grade is a B

Here’s more about your business credit score.

Nav credit report – pull it for free

Link: Sign-up for Nav

As mentioned, business credit models can be wonky. In the past, it’s been expensive to get a credit score for your small business.

When I first wrote about Nav in October 2018, they only offered score from 2 sources. Since then, they’re added a third. And all 3 are free to check.

My Experian business risk results

For each, you can check for:

Tax liens

Collections

UCC filings

Bankruptcies

Judgements

While these are specific to your business, if you used your SSN to apply for a business credit card, they could also appear on your personal credit report.

Why to check

The main reason to check your business credit report is that lots of business have similar names – and they’re not always linked by SSN or EIN.

For example, if your business name is “Joe’s Coffee Shop,” you might be mistaken for “Cup of Joe Coffee” or “Joe’s Coffee Stand” or some other similar sounding name – particularly if two near-sounding businesses are in the same city or zip code.

The good thing is you can claim your small business if you’re sure it’s the right one, and link it to your Nav account.

Experian says I only have 1 account on file, and there’s nothing on me with Equifax or Dun & Bradstreet. I find that surprising with as many small business cards as I’ve had – and currently have.

There’s nothing for Equifax or Dun & Bradstreet, which I’m hoping is a good thing

If you find incorrect information, like if your business became intertwined with another one along the way, you can file a dispute to sort it out – just like with personal reports.

If you have a sole proprietorship, your business name is probably your name. Still, it’s worth a peek to see what’s out there.

Bottom line

Key Link: Sign up for Nav to see your business credit score

I’m glad Nav continues to expand their services. My score hasn’t budged since I originally checked ~8 months ago – and that’s a good thing!

Having an A or B with Experian/Equifax, or 80+ with Dun & Bradstreet, is considered a good score. Many credit cards don’t appear on your personal credit report, but they don’t disappear. They go to a separate small business report. And it’s free to check your standing.

I like seeing the metrics and keeping track of things like this, so thought I’d share.

Have you heard of Nav? Did you have a similar experience checking your business credit report?

May 21, 2019

Good Deal: Get a Year of VPN Service for $24 – Secure Your Desktop & Mobile Traffic

I’ve been looking to get a VPN (Virtual Private Network) for a while now. While there are pros and cons to using a VPN, the good stuff far outweighs the bad.

Having a VPN:

Lets you steam content from anywhere (no geoblocks!)

Gives you a new IP address

Protects you when using unsecured public wifi (like in airports)

Secures VOIP phone calls

Prevents your ISP from tracking BitTorrent and other torrent sites

Helps you get around bandwidth throttling tied to your IP address

I primarily use a VPN to stream content from other countries (like when Spotify or YouTube says “this isn’t available in your country” – problem solved), and torrenting. Though when I’m connected to a VPN, I have to go through the whole security routine with bank logins (they want to send a text or email to confirm it’s me – which is a PITA).

That said, I found a deal to get 12 months of NordVPN service for $24 – and so far, I really like it! Particularly because they have apps for every device. So I can secure the traffic on my iPhone. Because I already use Face ID for most apps, the security is actually much easier for mobile.

I’ll show you how to stack the deal to pay $24 for a year of service.

Get a year of NordVPN for $24 – better than a sharp stick in the eye

They also have a 30-day money back guarantee, and make it super easy to cancel auto-payments.

NordVPN coupon + TopCashback = $2 a month for a year of VPN service

NordVPN

There are lots of VPNs out there, and many opinions on which is the best. I chose NordVPN because they’re based in Panama, which doesn’t have mandatory data retention laws – so they are able to keep a strict no logs policy. You definitely want a VPN that is NOT based in the US.

They also have:

5,000+ servers in 60+ locations

Excellent speeds with little loss

Great encryption

Plus, when you sign-up, you can add up to 6 devices to your account. I really like having it on my iPhone.

Yay for secure wifi on mobile phones

It makes me feel better about using public networks in coffee shops, hotels, airports, etc. I consume a lot of content – and do a lot of banking – on my phone, so it’s great to have a VPN app that I can switch on and off.

The service usually costs $84 for a year subscription. But I got it down to just $24 AKA $2 a month.

Stack 60% cashback with a special NordVPN coupon from TopCashback

Here’s how:

Navigate to TopCashback – you can set up an account or login, then search for “NordVPN“

Click through where it says “Get Cashback Now” (like in the image above)

On the NordVPN website, click “Get It Now“

Where it says “Got Coupon?” enter “ EXTRA1YOFF “

Complete your purchase – the total should be $60

After you enter the NordVPN coupon, your total will look like this:

You’ll pay $60 upfront, and get $36 back later

Then, you’ll get $36 back (60%) from TopCashback:

TopCashback will give you $36 back on your purchase – mine is already pending

That brings the price down to $24 for the year ($60 – $36). Pretty good deal for 12 months of VPN service on 6 devices.

Cancel autopay!

After you get the deal, you can go into your account and make sure it doesn’t auto-renew at a higher price.

Click the 3 dots next to “Change Plan” and select “Cancel automatic payments.”

Turn that ish off

Because there will likely be another deal in the future – and the normal price is much higher.

Download the apps

NordVPN has an app for pretty much any device:

Make sure to get the apps or browser extensions, as they’re an integral part of the service

Once you get the ones you need, you can easily toggle the VPN on and off. There’s a quick connect feature that assigns you the best VPN. Or you can choose your own from the list of server locations.

I’ve been using quick connect and it’s been working just fine. Easy to turn on and off with one tap.

Bottom line

NordVPN

TopCashback

I’ve been using NordVPN for a couple weeks now, and thought I’d share how I stacked deals to get a year of service for $24. There are lots of VPNS out there, so if you hate it, you can cancel within 30 days and get your money back.

The gist is to click through TopCashback to get 60% cashback, and apply a NordVPN coupon found there (“EXTRA1YOFF“) to pay $60 for 12 months – then get $36 cashback. The good thing about TopCashback is there’s NO minimum to withdraw, and you can transfer the cash directly to your bank account. And my purchase showed up with an hour or two.

Hope some of y’all find this useful!

Do you have a fave VPN? What do you mostly use it for?

May 19, 2019

Using Points for Emergency Travel: Why Having a Stash Is a Huge Relief for Same-Day Flights

What a week. Just got back from Memphis. Last Friday, I got one of those phone calls. One of those drop everything and fly home right this minute phone calls.

My dad was in the ICU with a brain lesion near his optical nerve – and no one knew why. Doctors thought it could be anything from a simple infection all the up to brain cancer. He had to have biopsy surgery to find out.

Tickets home were $659 round-trip, or $329 each way. I didn’t want to spend the cash, so I went to my usual tricks: using miles and points to fly cheap or free.

I threw clothes in a bag and headed to the airport. This was the first time I’d ever had to fly back so quickly. It was a bizarre experience I don’t want to repeat any time soon.

And it showed me why having a stash of points ready to use at all times is so important for these situations.

I hate hospitals. Using points got me home the same day my dad went to the ICU

Here’s the series of quick steps I used to fly home right away.

When you have to fly immediately, having points for emergency travel can help so much

I’ve booked so many trips by now, the process is automatic.

1. Google Flights

First, a search on Google Flights to check prices and routings. This is also useful for any trip to get an idea of:

What nonstops are available

Which airlines fly the route

Where you could connect if needed

Not a perfect tool, but a helpful place to start

If you see flights are cheap, it’s usually best to go ahead and pay cash rather than dip into your transferable points.

In Dallas, I see lots of flights on American. Typically, flights to Memphis are cheap, but for whatever reason, were selling out for days on end from Dallas (and still are!).

So American has the most nonstops, or I could connect with Delta or United.

2. Run award searches

With a flight in mind on American, I ran through the list of partners and how I could get the points. I can book an American Airlines award flights with:

American Airlines miles

Alaska Airlines miles

Cathay Pacific miles (transfer from Citi ThankYou points or Capital One, but not instant)

British Airways Avios points (instant transfer from Chase Ultimate Rewards points or Amex Membership Rewards points)

Qantas miles (transfer from Citi ThankYou points, but takes a few days)

Business Extra points

I actually had some Qantas miles and/or British Airways Avios points I was willing to burn. The best place to check AA award space is right on their website.

Ugh, of course

But AA had that route on lockdown until later in the month. Not helpful.

Keep checking

Of course, you can check award flights on other airlines – in this case United and Delta, albeit with a connection.

This is why knowing which points program you can use – and the partners within each program – is so important for situations like this.

For example, I can access United flights with:

Aeroplan miles (instant transfer from Amex Membership Rewards points or Capital One)

ANA miles (instant transfer from Amex Membership Rewards points)

Avianca miles (instant transfer from Amex Membership Rewards points or Citi ThankYou points)

Singapore miles (instant transfer from Chase Ultimate Rewards points, Amex Membership Rewards points, Citi ThankYou points, or Capital One)

United miles (instant transfer from Chase Ultimate Rewards points)

Or Delta award flights with:

Delta miles (instant transfer from Amex Membership Rewards points)

Flying Blue miles (instant transfer from Chase Ultimate Rewards points, Amex Membership Rewards points, Citi ThankYou points, or Capital One)

Virgin Atlantic miles (instant transfer from Chase Ultimate Rewards points, Amex Membership Rewards points, or Citi ThankYou points)

3. Decide between a points & miles award or paying cash

If award space is open and the cash price is expensive, definitely transfer your points and book right away!

(This is the beauty of instant transfers – and a huge setback for the Citi ThankYou points program and certain partners that don’t have instant transfers.)

But if there isn’t an award seat open and cash prices are high (like what happened to me), you can decide between:

Paying cash to the airline

Using points anyway by booking through the bank portal

I bit the bullet and used Chase points for my last-minute flight

I have the Chase Sapphire Reserve, so each point is worth 1.5 cents toward travel. For a ~$329 flight, I could use 21,953 Chase Ultimate Rewards points to completely cover the cost.

Is that a good deal? It really depends.

I have plenty of points spread around several programs right now. I felt confident that if I wanted to take a future award trip, my current stash would be enough to cover this flight, and any others I want to book.

Plus, isn’t this what points are for? To use for travel when you don’t want to (or can’t) pay cash?

I didn’t waste time deliberating. My dad was waiting in the hospital. Instead, I booked the flight, plugged in the confirmation number, checked in online, and headed to the airport. While this isn’t a great deal on paper, having my travel covered was a huge weight I didn’t have to deal with on top of everything else going on.

So while this will always be case-by-case, this time I went with the free option and used points to travel home.

It doesn’t take long – and why you should learn

This whole little process took maybe 5 minutes with 3 tabs open (Google Flights, AA.com, and the Ultimate Rewards portal).

Once I found the route, saw there wasn’t space, and used Chase points to book, I was on my way.

Granted, I’ve had practice. And if you have points, you should definitely check and know:

The best routes to your family from your home airport

How many points is typical for an award ticket

Which programs transfer directly to your airline, or partner with that airline

If those programs have instant transfers

How to book a ticket through Chase, Amex, or Citi on the fly

That way you aren’t learning in a heated moment – kinda like a fire drill. Once you have it down, you’re good to (literally) go!

Bottom line

What a whirlwind week. This was the first time I thought I might lose one of my parents and it did not feel great. I’m glad I went. Though I’m emotionally drained.

In this case, I used Chase Ultimate Rewards points. The Chase Sapphire Preferred and Chase Sapphire Reserve cards are invaluable for emergency travel. And yet another reason why the Chase Sapphire Preferred is such a good card for beginners.

I’m grateful for friends to watch my dog, and work colleagues that told me not to worry about anything. Hospital beds make people look so… small. Seeing someone you love in one of those rooms, with all the machines and bloop sounds and tubes is just such a terrible feeling.

Dad’s surgery went well – and he’s gonna make it. There will be a couple of months of recovery. I’m glad I made it home so fast.

As many trips as I’ve taken for fun, the other side of the points hobby is being able to show up when it matters. And not having to consider the cost was a huge, huge relief on an already harried travel day.

Have you used points to travel for an emergency? Was it as easy to book as my last-minute trip home?

May 6, 2019

The Top Card for Beginners? Yeah, the Chase Sapphire Preferred

I’m sure it’s happened to you at some point. A friend asks, “How do you do it?” Take all these trips to places like Hawaii, Tokyo and Osaka, Dublin, Barcelona, and more. How do you get free hotel rooms that cost hundreds of dollars a night?

“I want to travel like you do,” they say. “Where do I start?”

And you have that moment where you’re thinking, “Well for starters, using that debit card for everything you buy isn’t helping anything.” *cough*

You ask about their spending habits. “Do you shop online?” Definitely use a shopping portal – get free miles for clicking a link.

You can stay at the Hyatt Ziva Puerto Vallarta for FREE with Chase Ultimate Rewards points

And sign up for dining rewards while you’re at it because you never know when you’ll get some extra miles in your account – especially if you live in a mid-sized to large city.

But as far as cards go… where to begin?

Chase Sapphire Preferred

Chase Sapphire Preferred 60,000 Chase Ultimate Rewards points

• 2X Chase Ultimate Rewards points per $1 spent on travel & dining

• 2X Chase Ultimate Rewards points per $1 spent on travel & dining• 1X Chase Ultimate Rewards points per $1 spent on all other purchases

• $95 annual fee• $4,000 on purchases in the first 3 months from account opening

• The best card for beginners• Compare it here

Part of me is tempted to say, Discover It ’cause it’s so easy to earn cashback.

Getting Chase Freedom is kind of pointless without the Sapphire Preferred… so I always trace my steps back to the same place.

Had a good 5 years with this bad boy

Dang it, the best card to start with really is the Chase Sapphire Preferred.

Why I recommend the Chase Sapphire Preferred

Here’s what it comes down to:

Easy, daily bonus categories (2X points per $1 spent on travel and dining)

Great sign-up bonus

Easy to rack up points with ongoing spending

Excellent shopping portal (and only one of its kind – Amex, Citi, and Starwood don’t have one)

Useful transfer partners with instant transfers – *this is KEY*

Pair Chase cards to earn even more points

About those travel transfer partners:

60,000 Chase Ultimate Rewards points are worth ~$840 toward Southwest flights

Lots of United award flights are easily bookable on United.com

Booking a Hyatt award night couldn’t be easier – just tick “Hyatt Gold Passport” to see how many points you need for a free night, then transfer

British Airways is a great level 2

From there, you can learn Flying Blue and Singapore when you’re ready to expand

Basically, this card is good for peeps who know nothing and need to have it easy. AND for those who don’t mind really geeking out and digging around in award charts.

I flew to Dublin in Business Class by transferring my points to British Airways

Southwest, United, and British Airways and more than enough if you want to travel domestically.

Important: Don’t even bother applying for this card if you’ve opened for than 5 other cards in the previous 2 years. If you’re a beginner, this shouldn’t be an issue – and it’s a good place to start.

That first transfer

My friends ask, “So I just transfer the points? And they show up on the other side?”

Ah, I remember my first award booking with points. Still so unsure and skeptical it would actually work.

Then, when I booked the flights, I felt somehow the flights weren’t “real” – that I’d be found out and have them taken away. How could that be possible? Free flights? Yeah right. Where’s the scam?

I stayed in Boston with Hyatt points – then flew back to New York on a free American Airlines flight with British Airways points – all transferred from Chase

It wasn’t until the 3rd or 4th award trip that I started to gain confidence in booking awards.

And having instant transfers is really so nice. You transfer to United, refresh the page, they’re in the account. Same for Hyatt, British Airways, Southwest, and the whole lot.

You can even call to book the award and transfer while you have someone helping you on the other end.

If you want “points training wheels,” this is an excellent place to begin – with a lot of power left over for advanced players.

Extra points for everyday spending

Most of my friends eat out too much and frequent too many bars. Sound like your friends? For the love of god, earn bonus points on it! (There’s nothing worse than seeing a debit card in a restaurant.)

The travel category is broad and includes airline tickets, hotel stays, tolls, train passes, bus fare, parking, and lots of other incidentals.

Plus you’ll earn 1X point per $1 spent on other stuff. It’s not a lot, but it’s also a lot better than what you’ll earn with a debit card: nothing.

New Orleans is dead cheap with Chase points – getting there and finding a hotel is easy, and the hotels are lovely

The biggest objection I hear is: $4,000?!?! I can’t possibly spend that in 3 months (to meet the minimum spending requirement). So that’s $1,333 per month for 3 months.

How much is your rent? Put it on a card and eat a small fee once or twice.

Use it when you have a big purchase coming up, like a new appliance, upcoming move, or big party to plan. I even paid my car down payment with a credit card.

Or, take your friends out, pocket their cash, and run the bill through your card. Or they can pay you through an app like Venmo, PayPal, or Cash.

There are plenty of ways to hit the minimum spending requirement, I promise ya.

Bottom line

Chase Sapphire Preferred

Does this help texplain why I like this card so much for beginners?

The other thing I hear is “Oh, it’s all too much to keep track of.” Is it? In my view, I don’t mind “keeping track of it” because I know what it gets me – free travel! That’s really what it comes down to.

Travel is my life’s passion, my ultimate dangling carrot. So yeah, I will track the crap out of some points and miles.

I promise redeeming the points with travel partners isn’t too difficult. Just sign up for a loyalty account, copy and paste the number, and press “Transfer.” It will feel awkward the first time – but it’s easier the second time. (And effortless beyond that.)

And doing that over and over is the answer to the question of, “How do you do it?” That’s how I do it, since day one and up through to now.

And to my regular peeps, what card do you recommend when someone asks, “How do I travel like you do?” CSP, yeah?

May 5, 2019

Get the Capital One Savor $500 Sign-Up Offer While You Can (Dropping to $300?)

Right now, the sign-up bonus for the Capital One Savor card is showing as a $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening on the Capital One website.

But through affiliates like CardRatings, it’s shown with a $500 cash bonus upon meeting the same minimum spending. There’s some speculation it’ll drop to $300 across all channels, although nothing’s confirmed. So if you’ve been thinking about this card, I’d recommend getting the higher bonus while it’s still up, as these links can be pulled at any time.

You’ll also earn:

4% cashback on dining and entertainment

2% cashback at grocery stores

1% cashback everywhere else

Free Postmates Unlimited membership through December 2019 (as a statement credit)

Learn more here

The $95 annual fee is waived the first year. If you spend even moderately on dining or entertainment, this is a great card to consider with a really generous $500 cash bonus.

If I weren’t trying to stay under 5/24, I’d get this in a heartbeat. Keep in mind Capital One pulls from all 3 credit bureaus when you apply for a new card.

How about $500 smackaroos right back in your pocket? Hit up this offer sooner rather than later if you’re interested

And I’ll remind you about those bonus categories!

Capital One Savor $500 Bonus

Capital One Savor – Learn more at CardRatings

The best public offer for the Capital One Savor card right now is:

Capital One Savor$500 Cash

• 4% cashback on dining and entertainment

• 4% cashback on dining and entertainment• 2% cashback at grocery stores

• Free Postmates membership through December 2019

• No limit to how much you can earn

• $95 annual fee, waived the first year• $3,000 on purchases within 3 months from account opening

• Learn more here

4% cashback on dining is straightforward enough, but 4% cashback on entertainment could be surprisingly lucrative. That’s because it’s a broader category than you might think.

Capital One says it’s:

Ticket purchases made at movie theaters, sports promoters (professional and semi-professional live events), theatrical promoters, amusement parks, tourist attractions, aquariums, zoos, dance halls, record stores, pool halls or bowling alleys.

So that could include:

Season passes for sporting events [image error]

The 8 Best Chase Credit Cards & 3 Paths to Choose From (Or Mix and Match)

In a couple more months, I’ll be mercifully under 5/24, which means I’m looking at the best Chase credit cards and wondering what I’ll open, as if ordering off a menu. Chase hasn’t been a possibility for so long, it feels a bit like starting over.

It kinda is. I’ll get to retool my card arsenal – and that got me thinking about what’s worth getting – and what to skip (or cancel if it comes to that).

Upon reflection, I realized there are 3 ways to approach Chase cards:

Focus on personal cards (especially Ultimate Rewards cards)

Focus on small business cards

Go for the Southwest Companion Pass

Not to say any of these paths is absolute. I find that generally, peeps have certain travel goals in mind before they start applying, myself included.

And of course, you can mix and match. Here are the ones to start with.

I’ve got the Chase Freedom – and soon I can expand my entire Chase card strategy

Then you can fill-in around the edges with cards from other banks.

8 best Chase credit cards

Chase currently issues ~27 credit cards. And a solid 2/3 of them are caca.

May 2, 2019

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/23/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $1 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes – use code “OUTANDOUT“)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/23/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $1 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes – use code “OUTANDOUT“)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/23/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $1 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes – use code “OUTANDOUT“)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?